Bankeronwheels.com TOP 10 in 2020

2020 marked the launch of Bankeronwheels.com

While the content is still relatively new, a few pieces have generated significant interest and were shared across networks. I have tried to select the TOP 10 amongst them.

I broadly bucketed my work into three categories:

- Investment Guides – are high level overviews of some key Investment topics including concepts like portfolio protection, long term portfolio construction or asset classes

- Technical Deep Dives – topics that are slightly more hands-on and perhaps more interesting from a DIY investors’ perspective that want to have a better grasp of e.g. ETF or Broker selection but also how the Index landscape looks like

- Blog Posts – are my personal insights into the Investment World. A Banker turned World Cyclist shares his perspectives, thoughts related to personal values and Investment Principles that may help you achieve your goals

Enjoy the reading. Wishing you again all the best in 2021.

TOP INVESTMENT GUIDES

How to build an investment portfolio for Long Term Returns

This article is only available to our PREMIUM Members (Rollers). Read how it works. Login

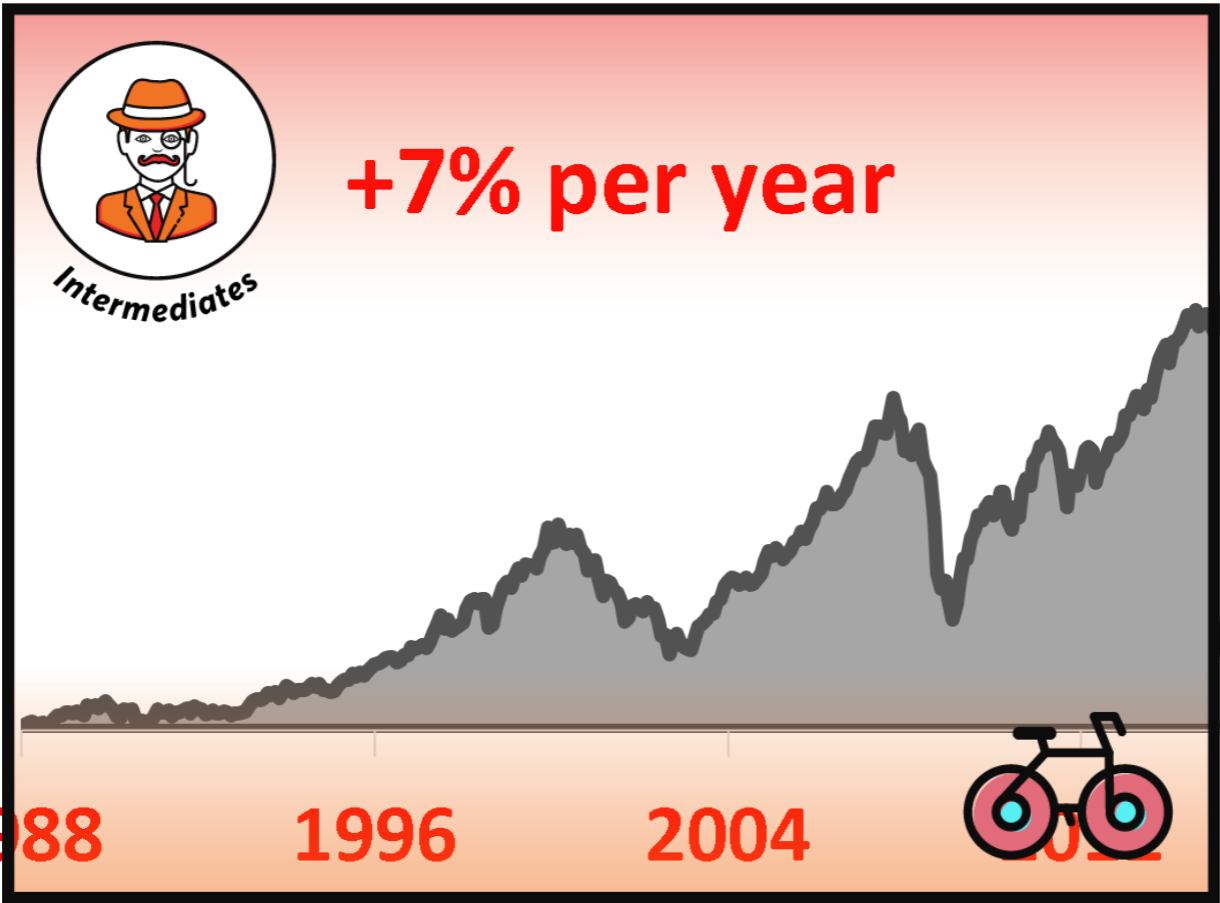

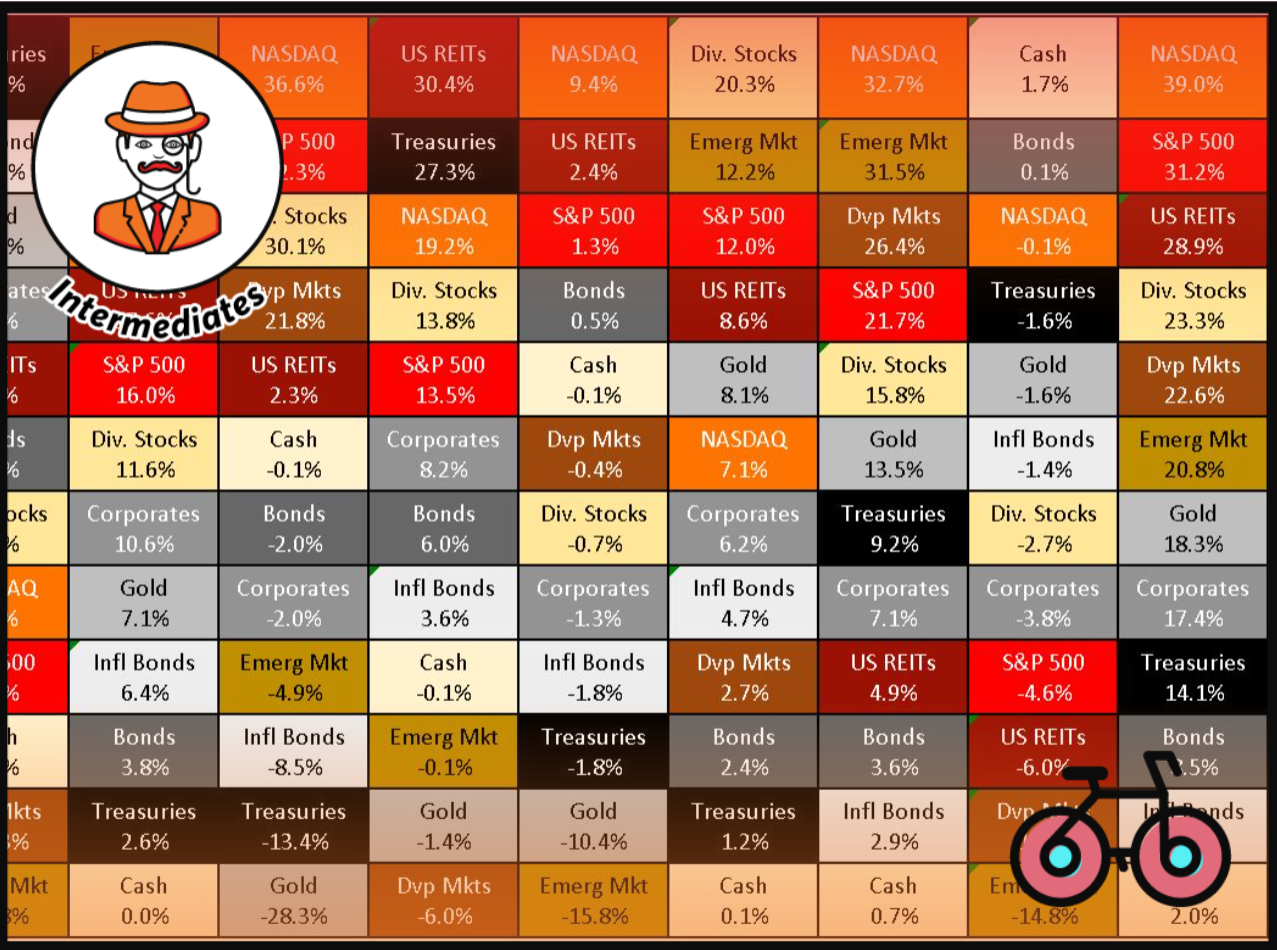

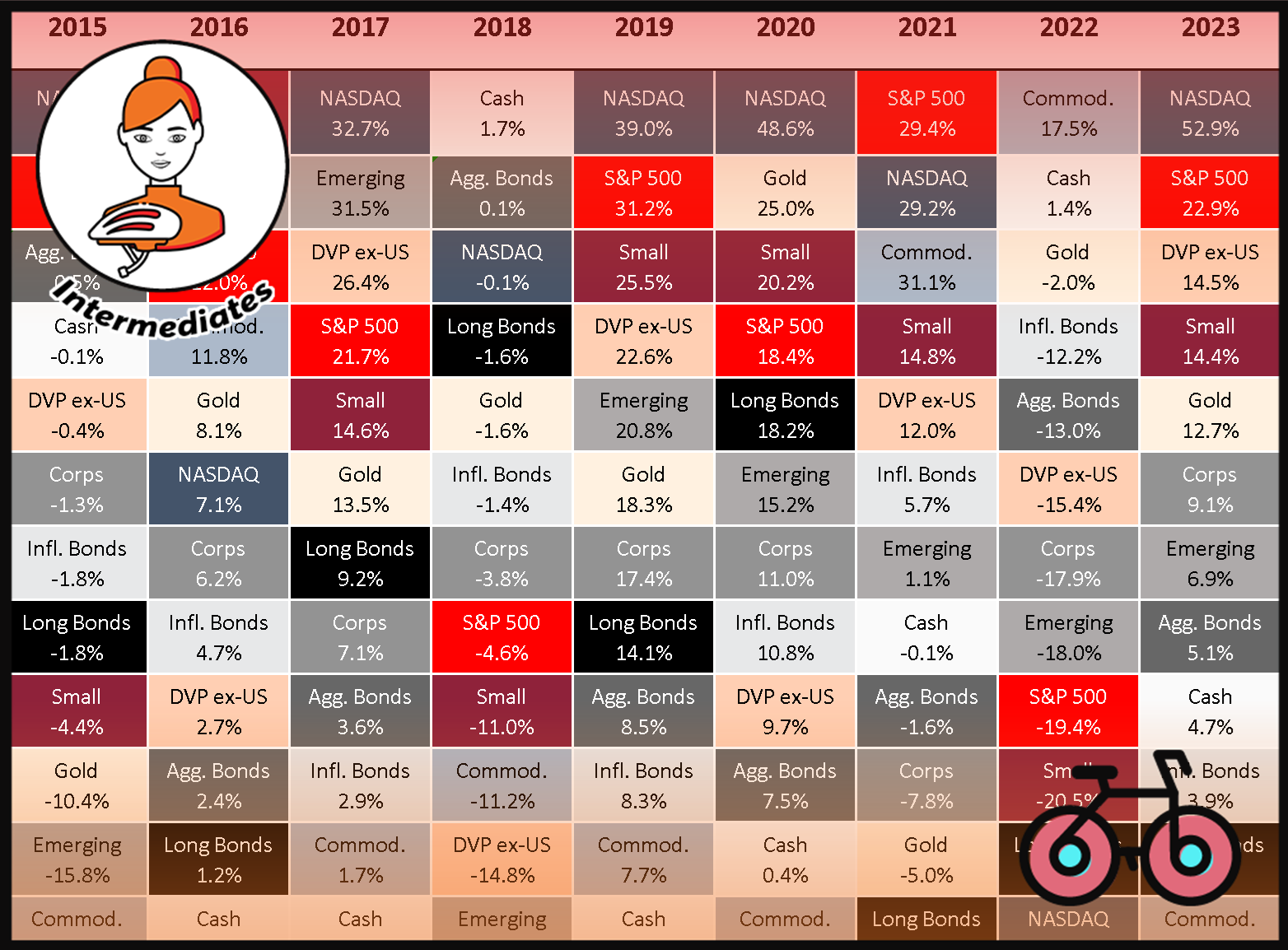

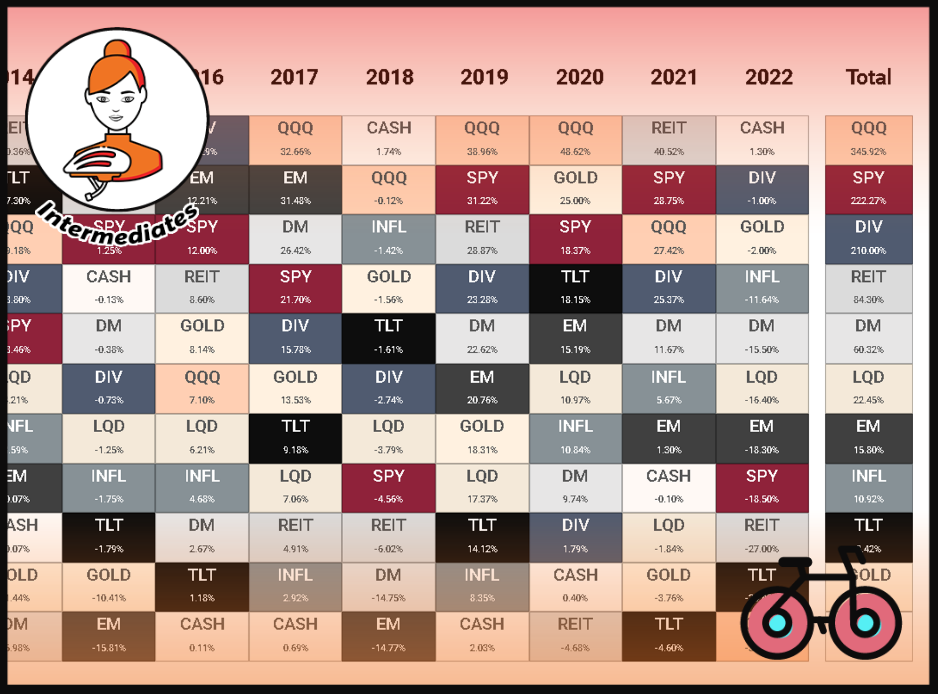

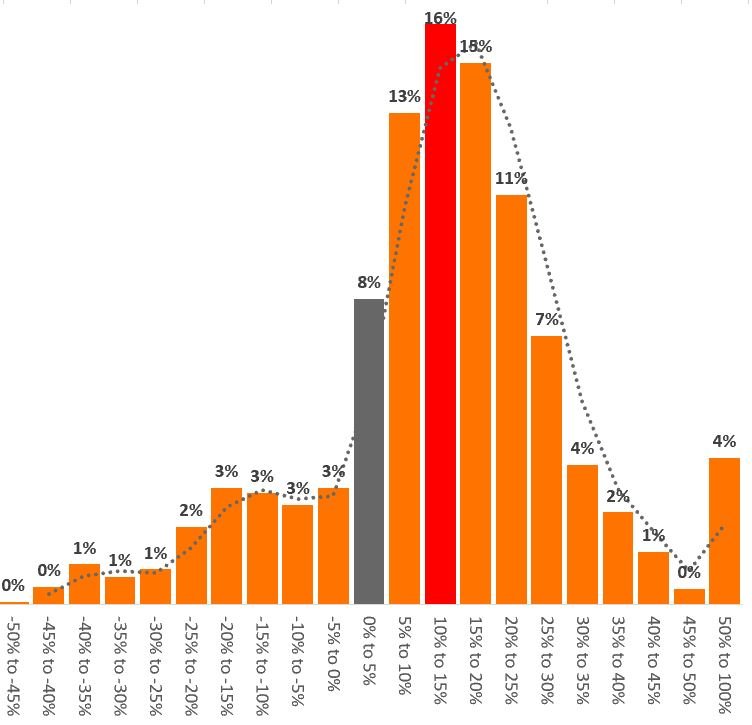

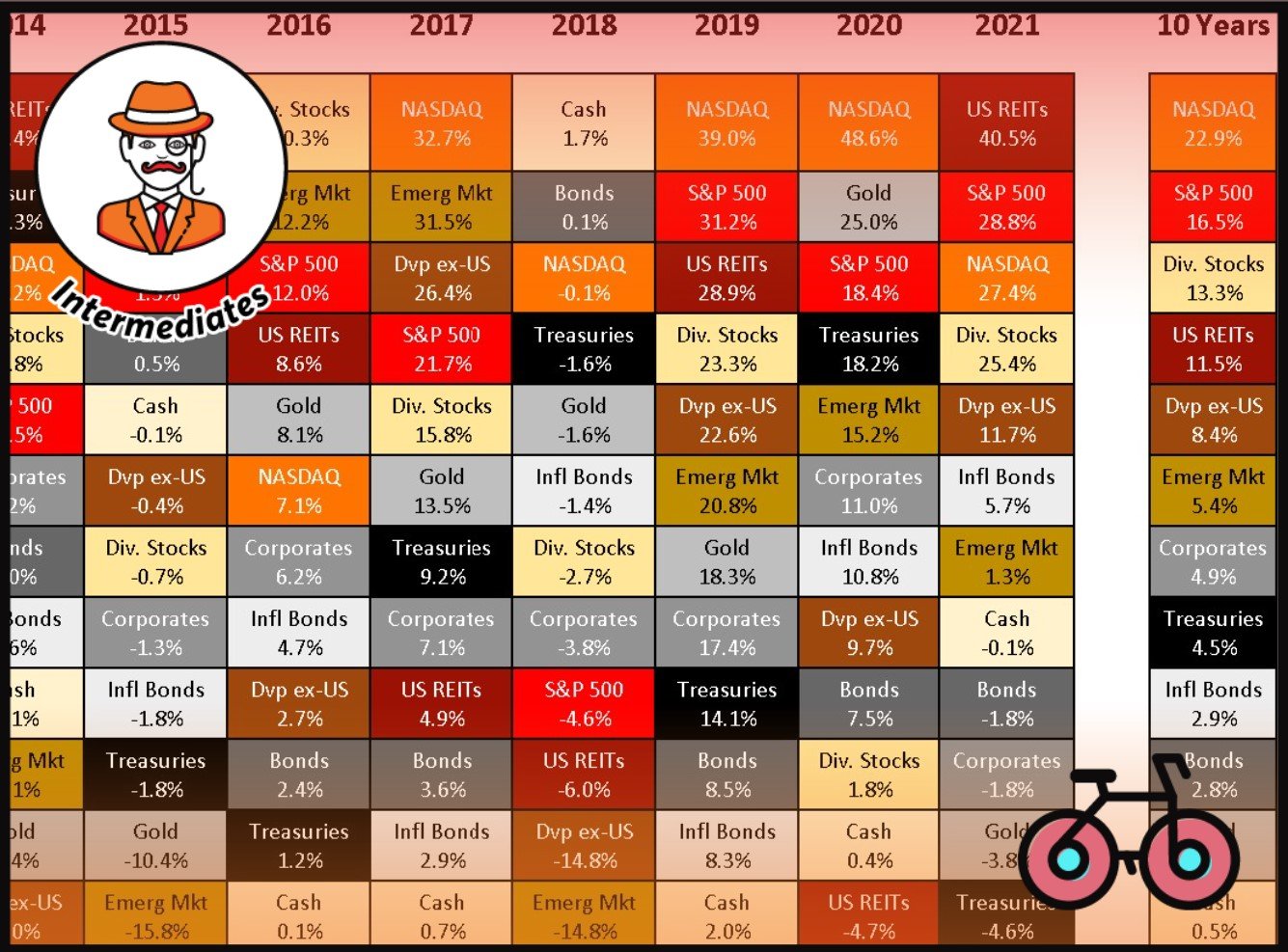

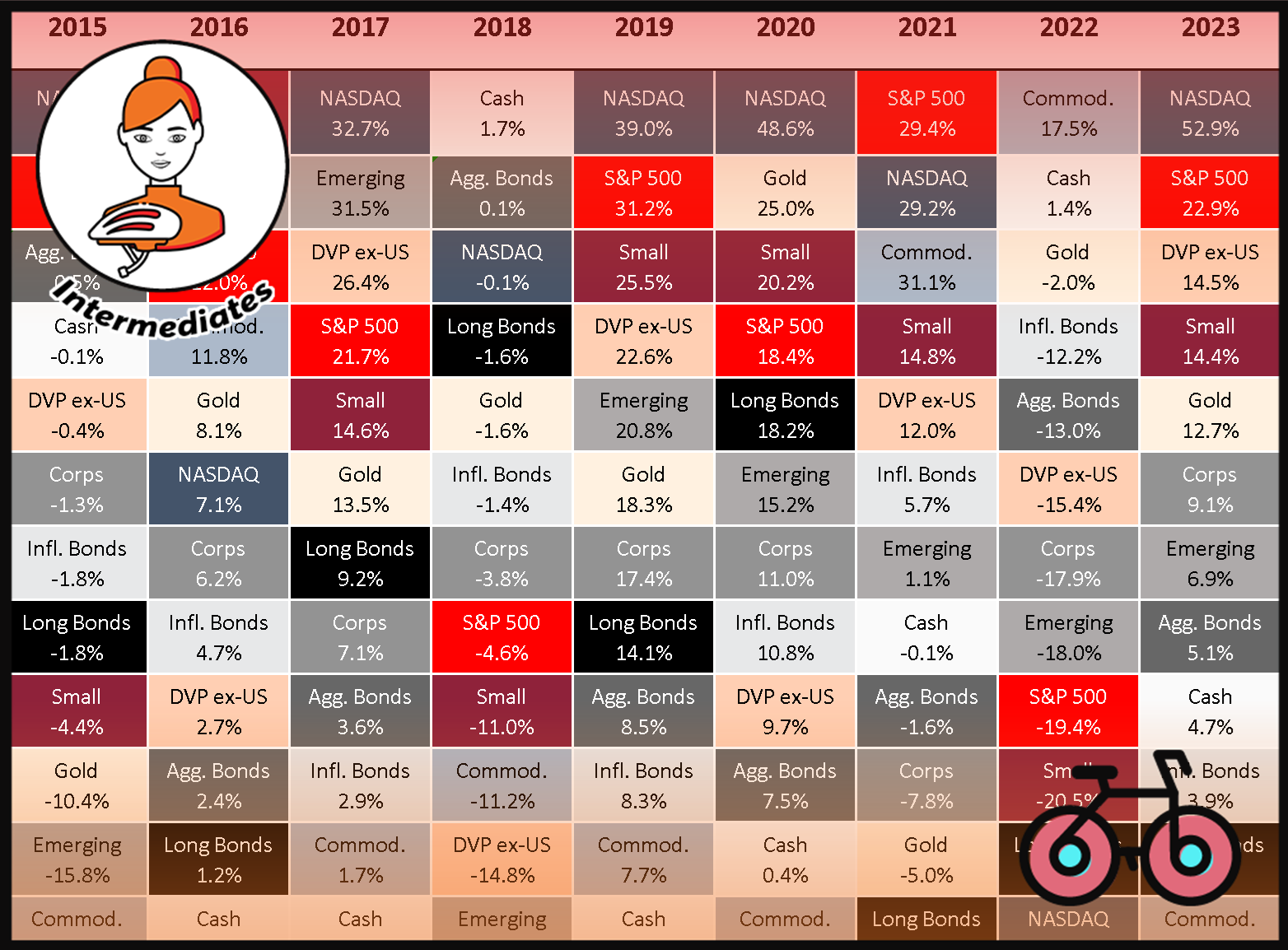

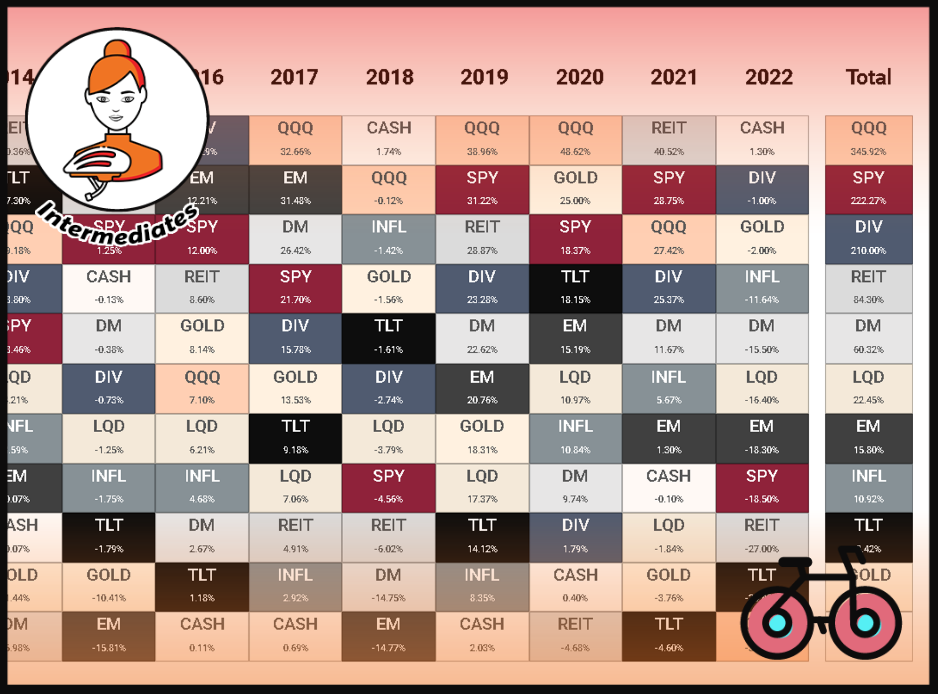

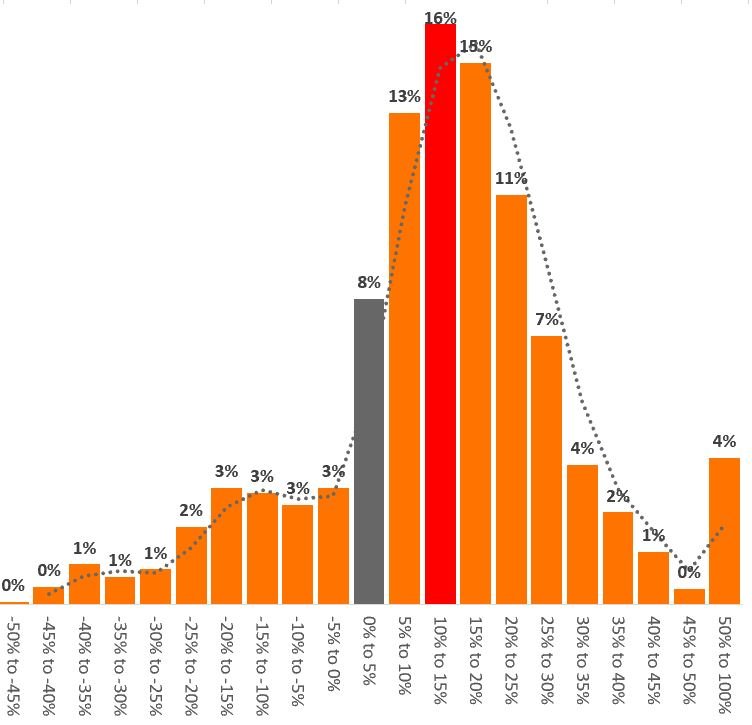

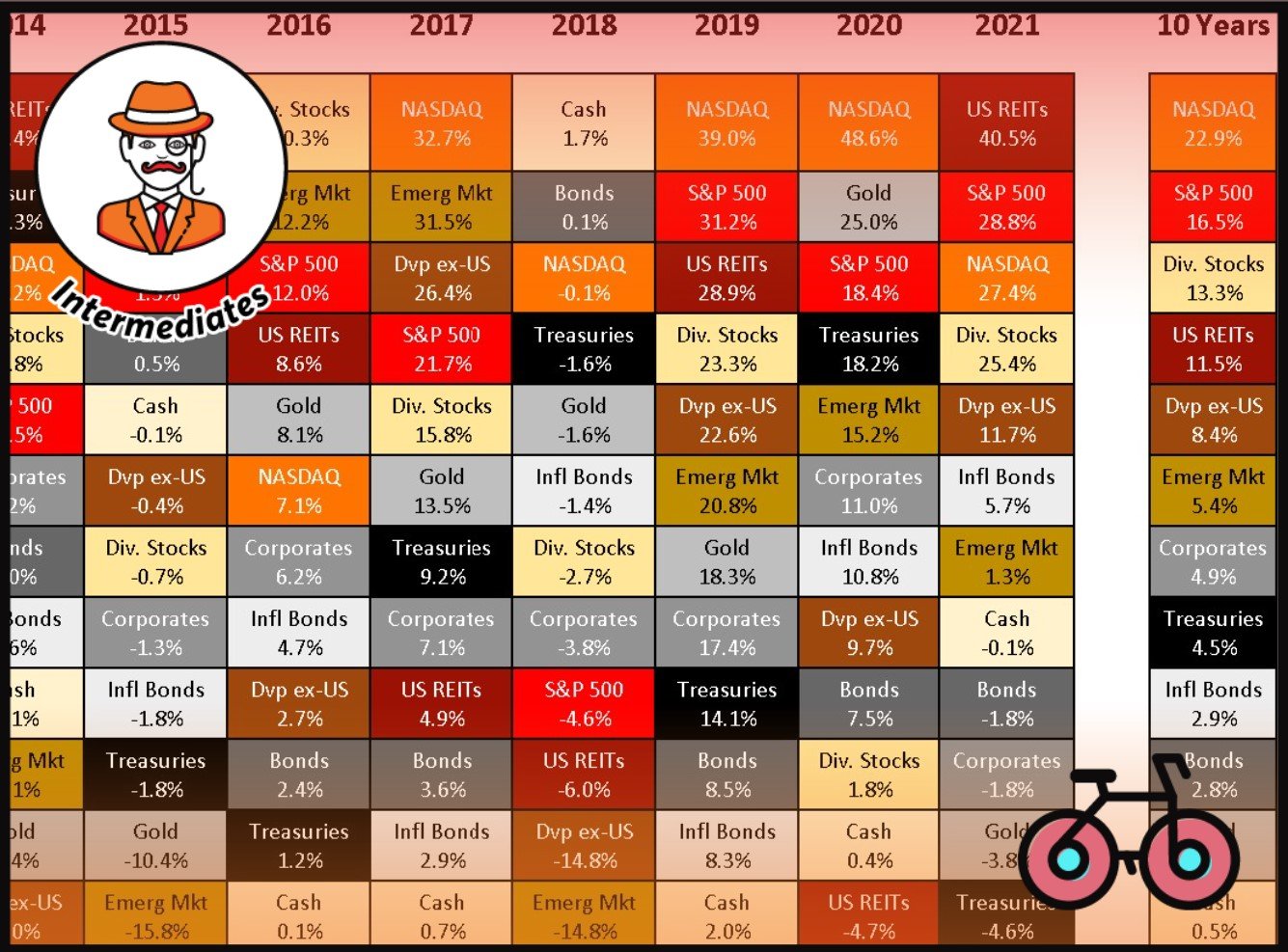

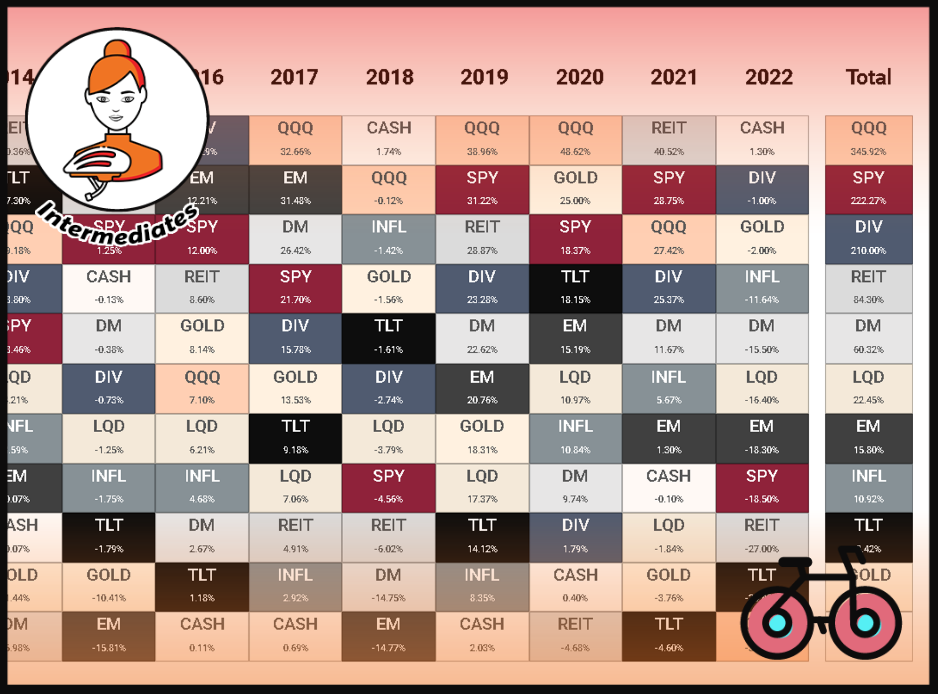

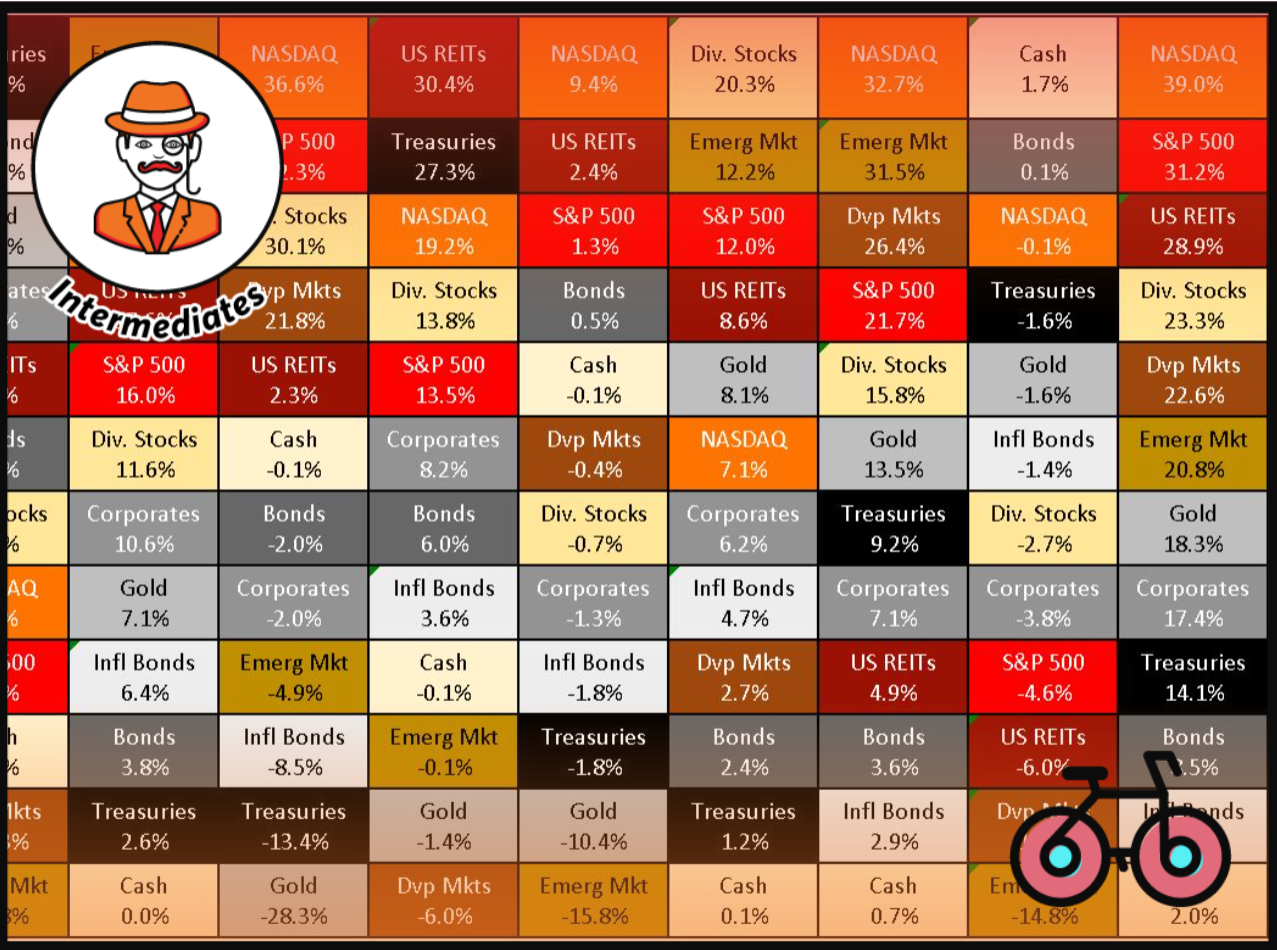

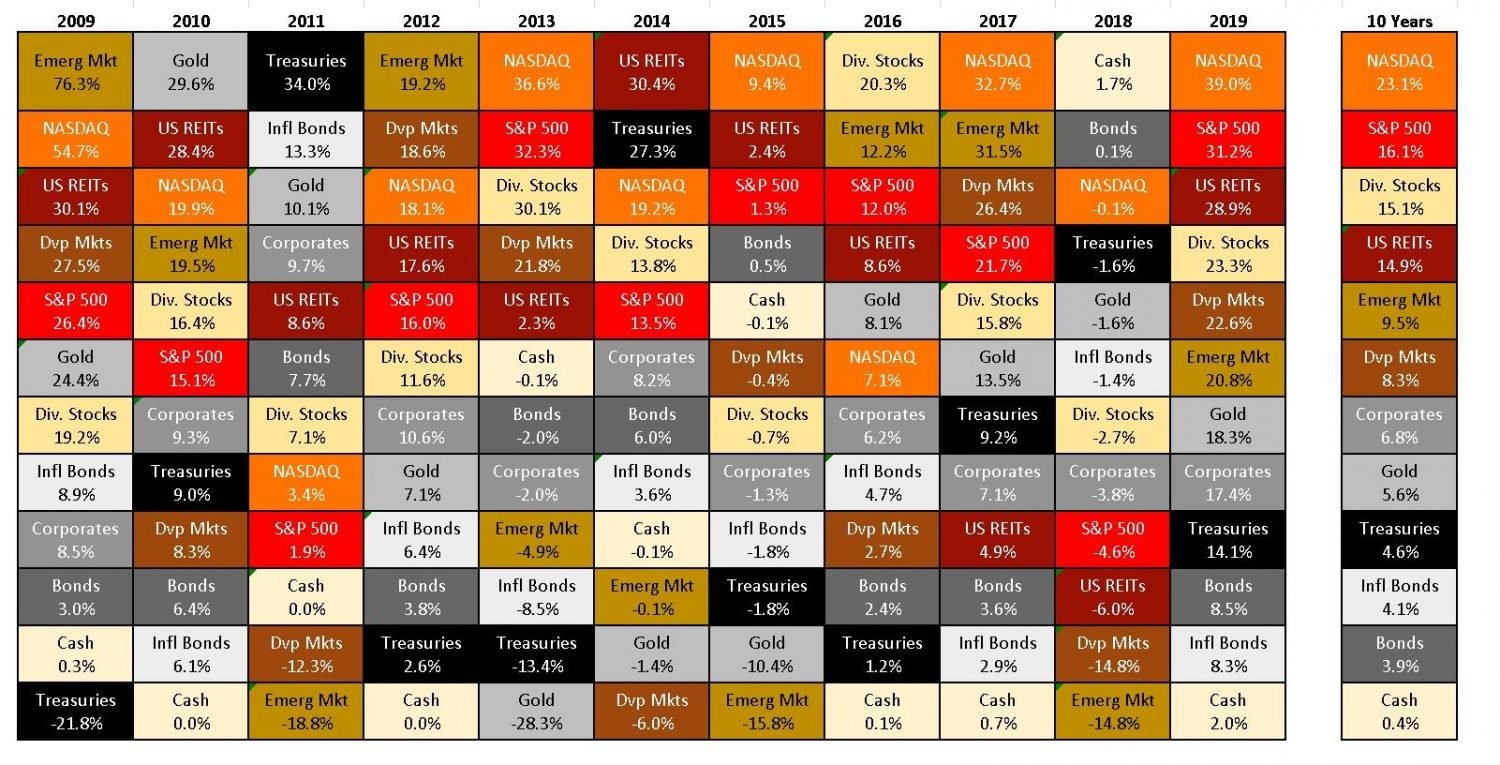

The Long Game – Historical Market Returns & 2021 Expectations

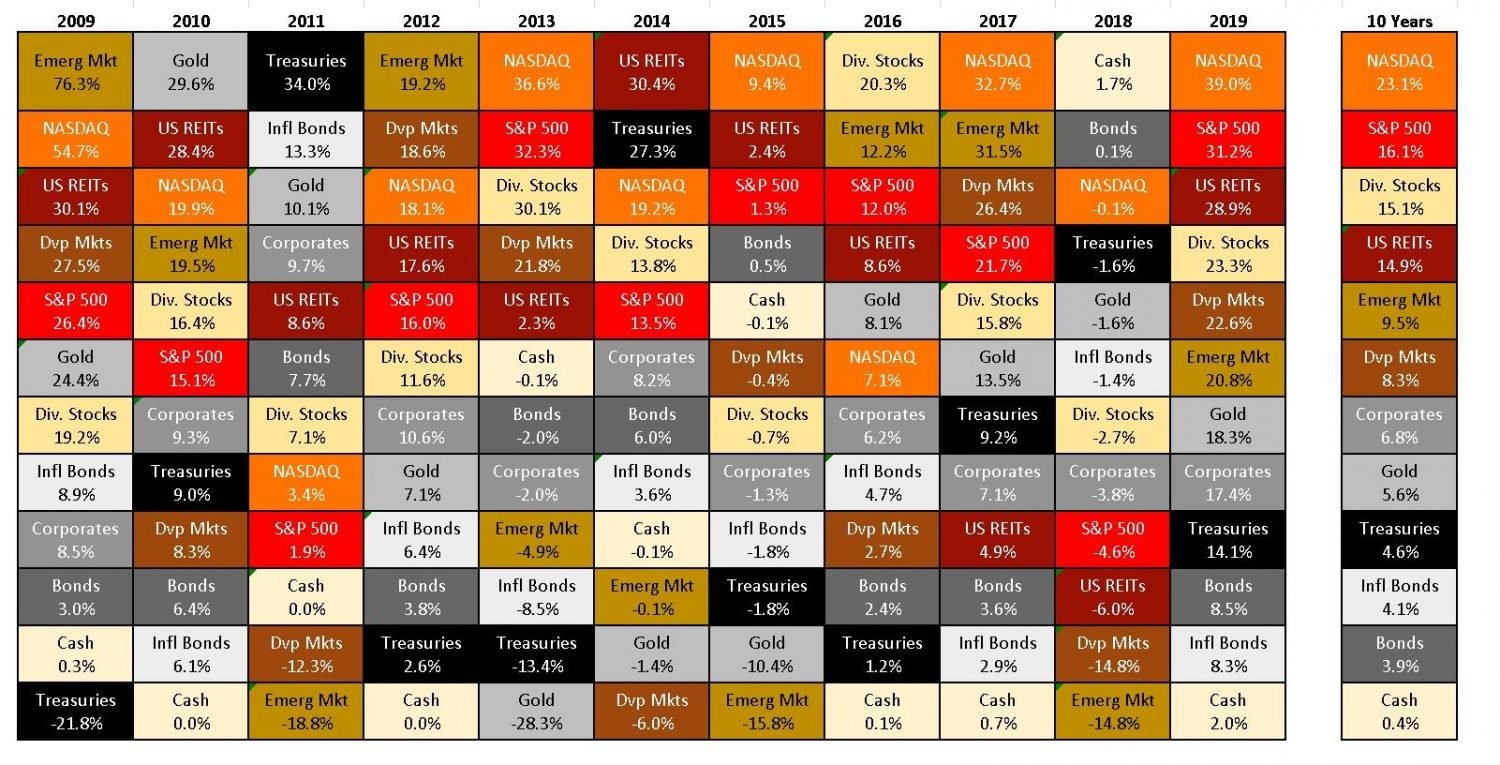

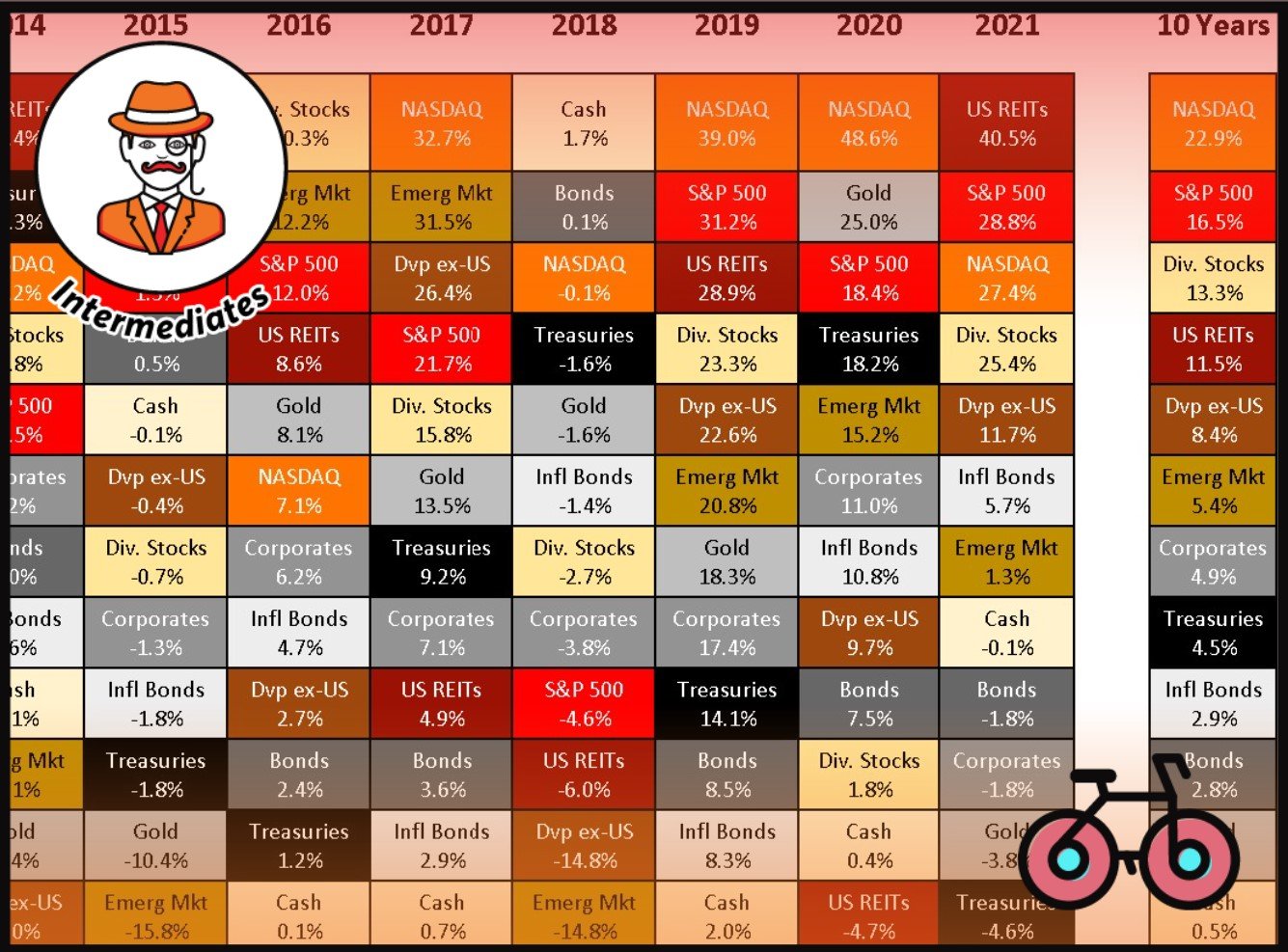

2020 Asset Class Returns Review and 10 and 20 year perspective.

Winners rotated but Tech didn’t.

Developed Markets ex-US are pretty much only returning dividends.

European Investors – optically lower gains but overall wealthier.

Broker Safety: Should You Rely On Broker Insurance?

Investment Projection Schemes In The EU Are Inadequate. Could An Independent Insurance Be A Solution?

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

While the older brother AJBell strides with clear direction, Dodl seems a bit lost, wandering without a map. And let’s be real—no other broker in its league hits you with a 0.15% custody fee.

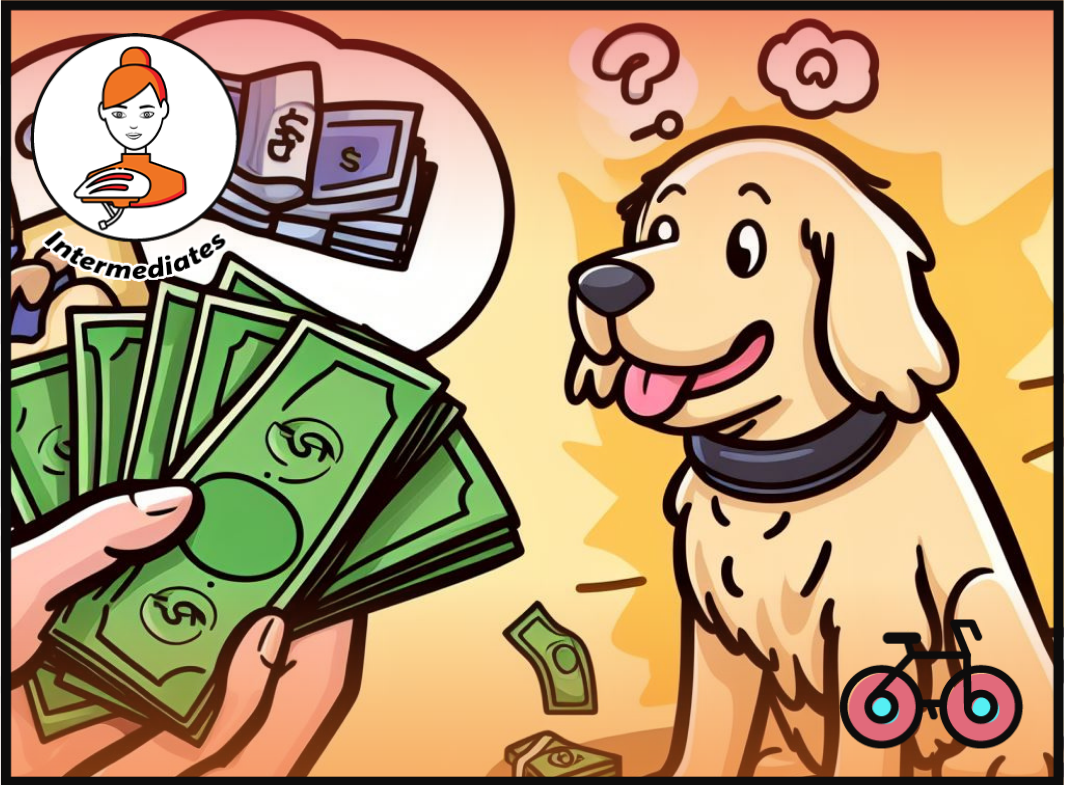

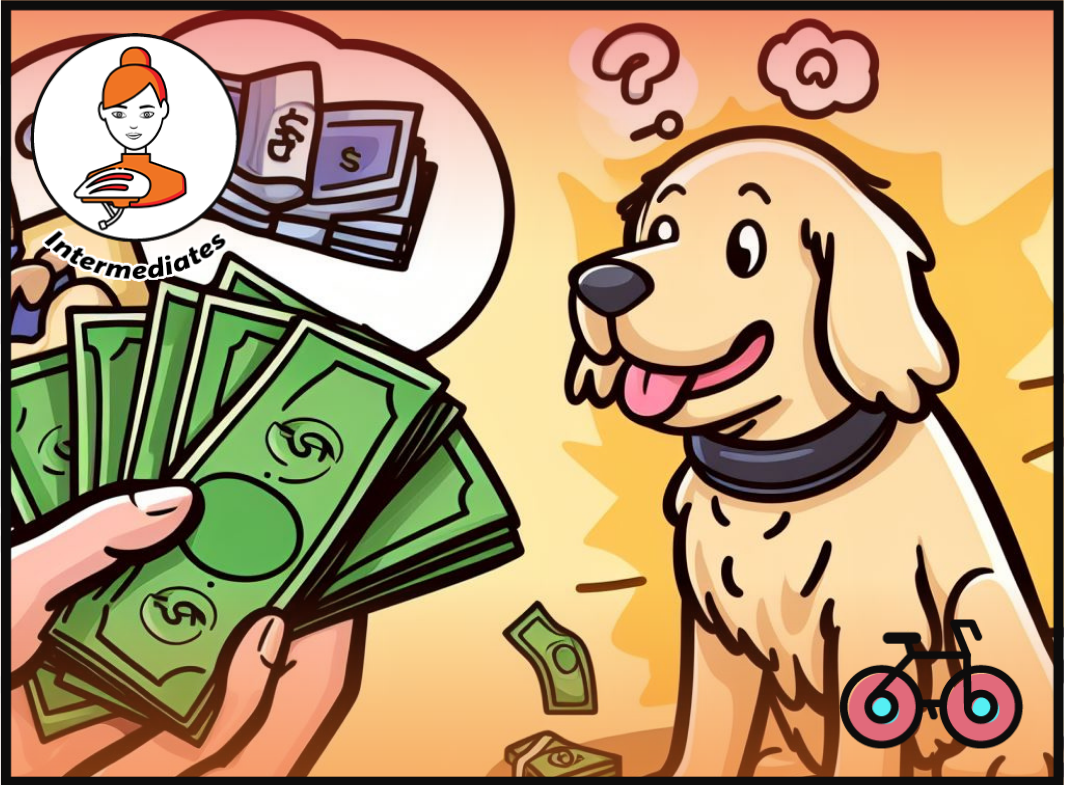

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Your friend’s stock first skyrocketed, then hit a plateau, and ultimately lagged behind the market. Sound familiar? That’s because it’s a tale as old as time. He’s now so attached to it, he can’t bear to sell. Imagine a world where he didn’t agonise over every buy or sell.

A world without the balancing act of portfolio rebalancing.

He probably hasn’t even heard of Vanguard LifeStrategy. And with the hefty fees his financial advisor charges, that’s hardly surprising.

Enter a quasi Golden Retriever Portfolio in a single fund.

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

Banker on Wheels’ Easy Ride to Factor Investing – Part 1 Welcome to Part 1 of Bankeronhweels.com Guide to Factor Investing. My first job on Wall

Money Market Funds: Are ETFs The Best Bang For Your Buck Or A Risky Ride?

Some ETFs track the same benchmarks as well-known Money Market Mutual Funds.

The advantage? There is no minimum ticket, and ETFs are much cheaper. However, the allure comes with its twists. As always in finance, higher returns can mean more risks.

4 Things I Learned In 4 Years Of Running A Finance Blog

SHOULD YOU START A FINANCIAL BLOG IN 2024? When I launched Bankeronwheels.com four years ago, my ambition was to spread knowledge to a diverse audience

Weekend Reading – JP Morgan Guide To Retirement

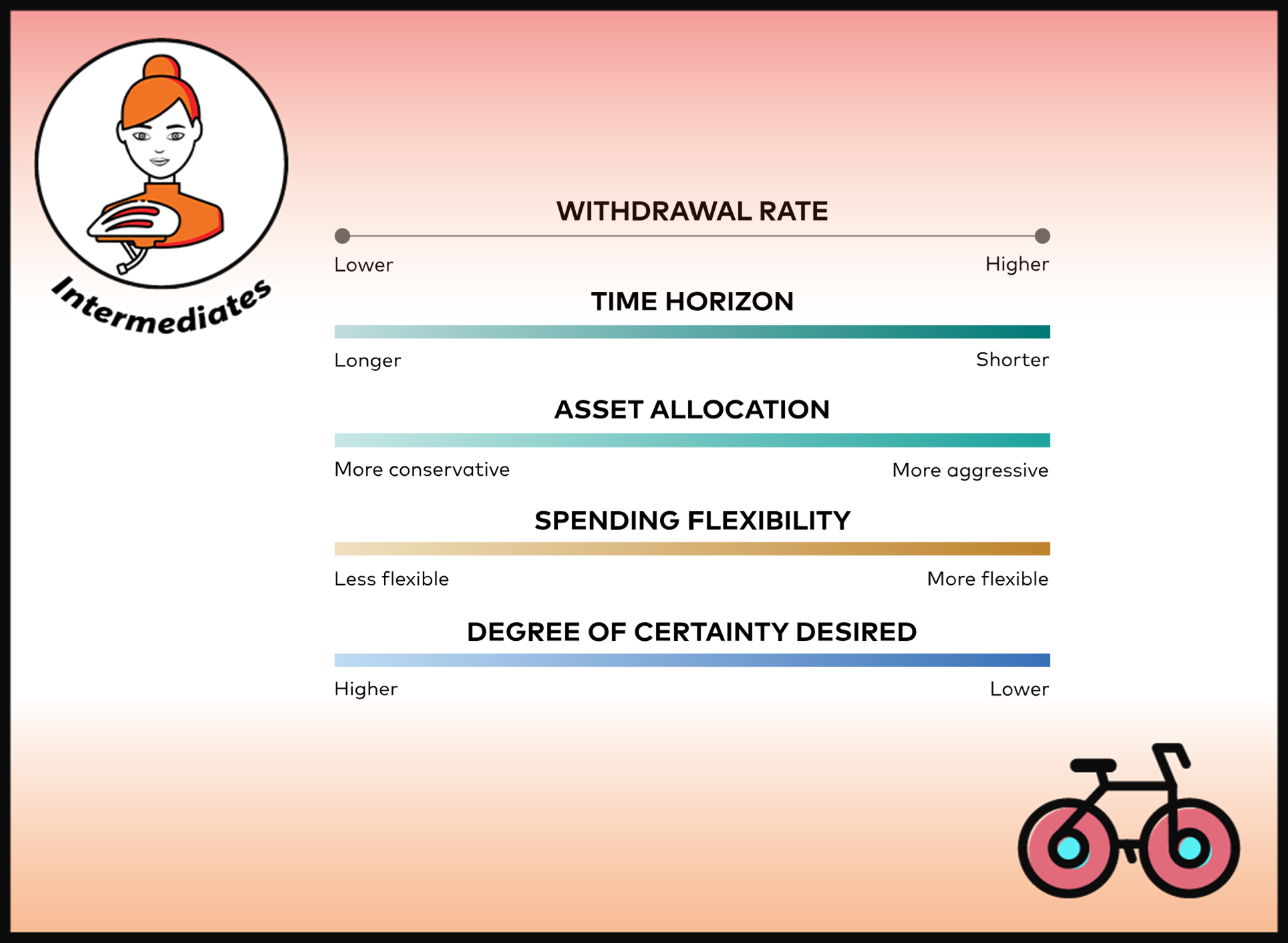

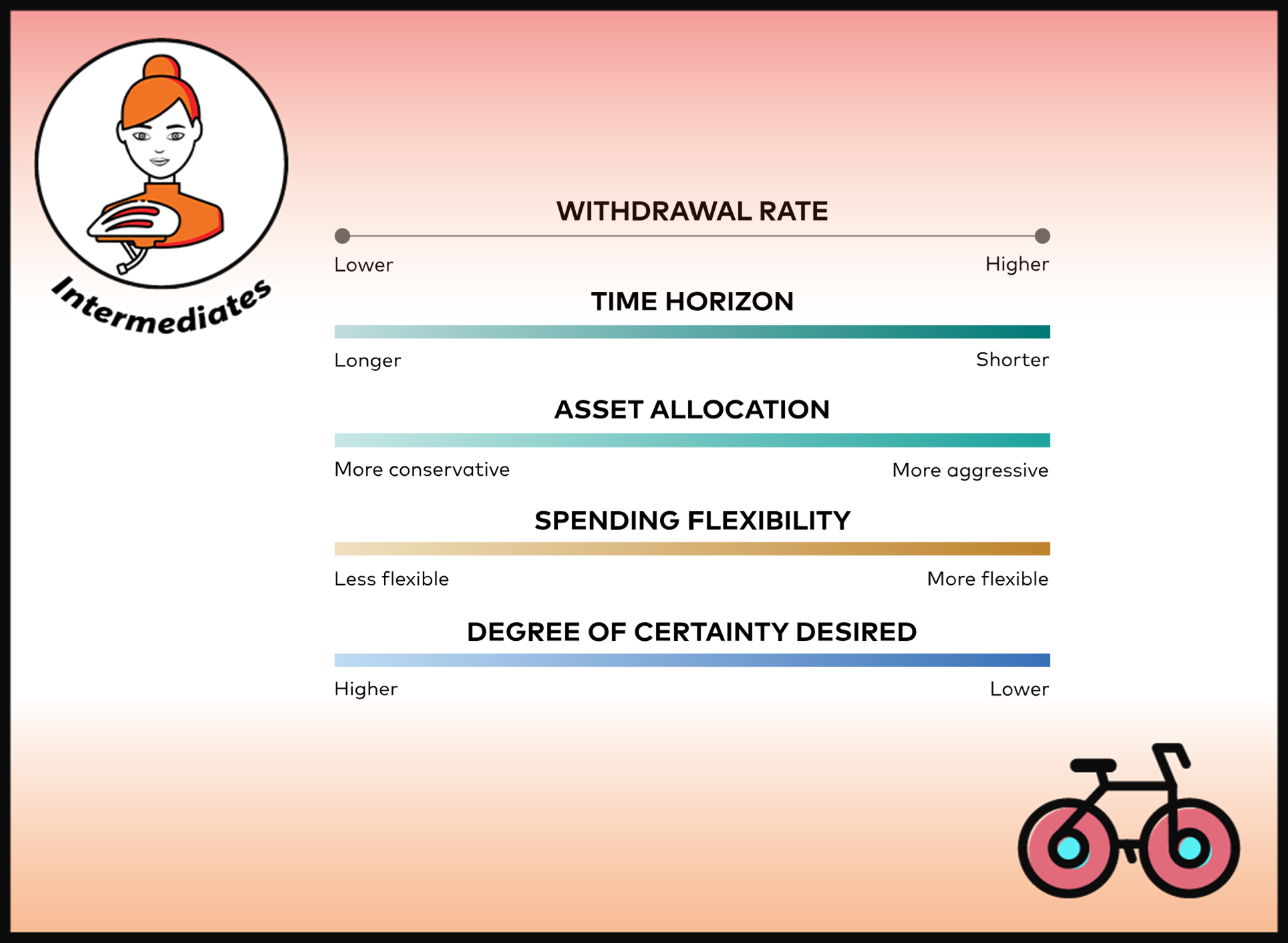

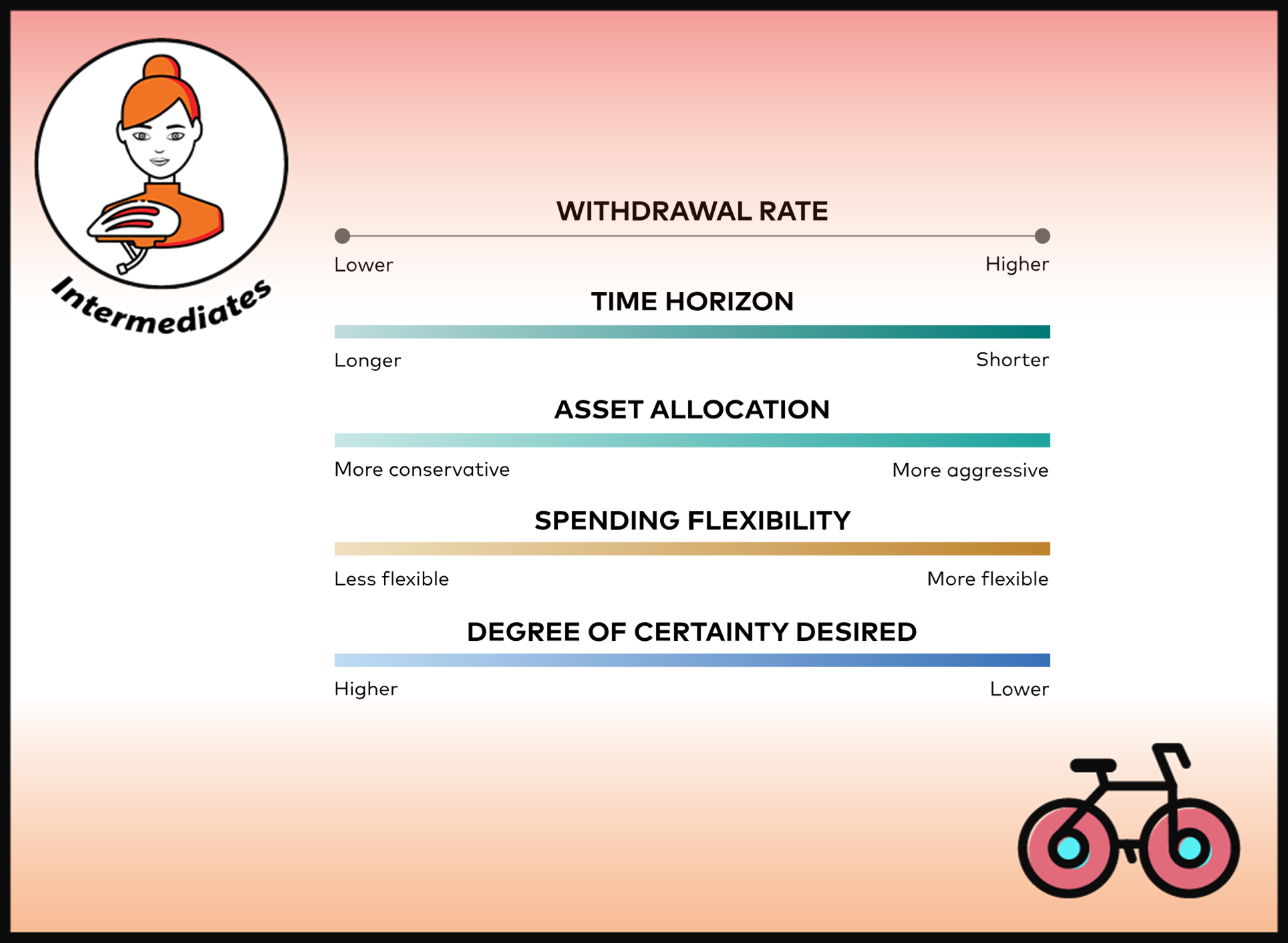

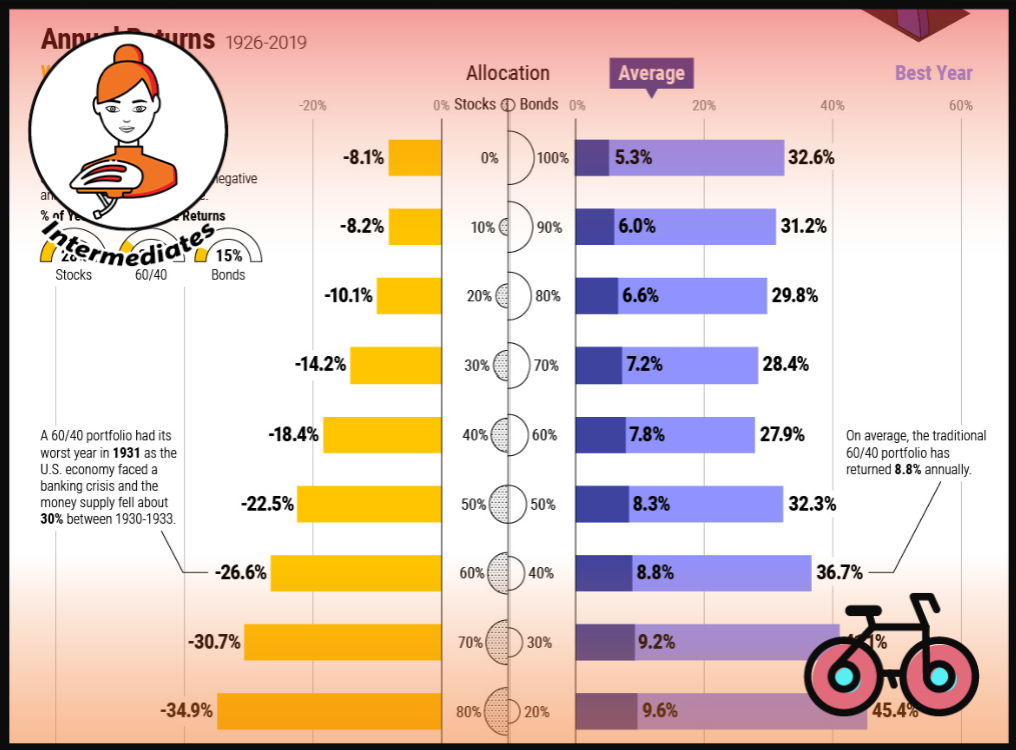

The 4% rule is the maximum initial withdrawal percentage that has a high likelihood of not running out of money after 30 years. With current life expectancies, a 35-year view is more appropriate.

Surviving The Next Bear – Strategies To Profit From The Next Market Crash

The Stock Market is a powerful money-making machine that can make you rich and financially independent

But how much can you lose? And how do you take advantage of market crashes?

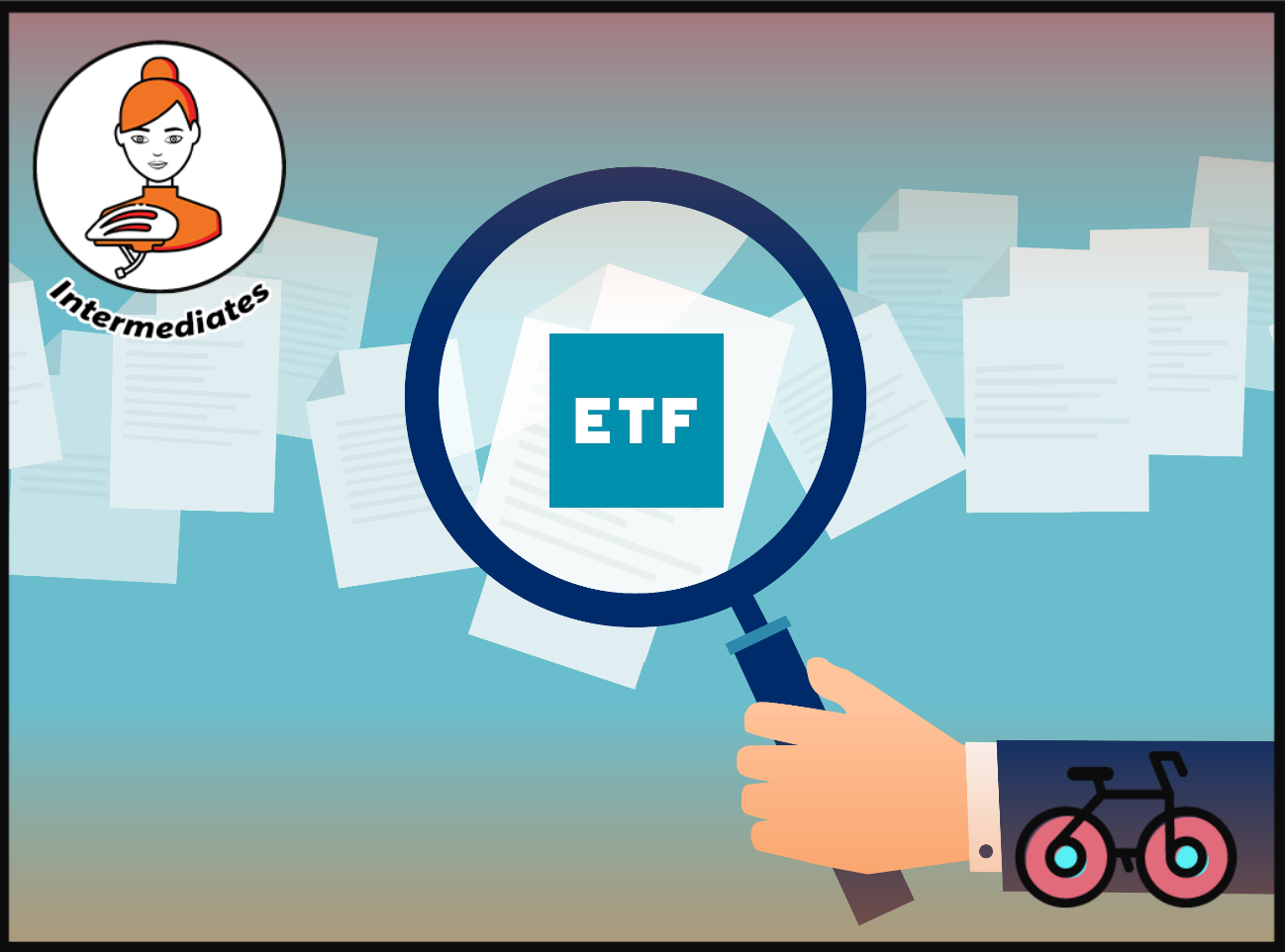

Cracking the Code: Decoding ETF Names & Discovering Tools To Find Them

If you read about Investing from a US source you know how easy it is to invest in North America

And yet in Europe and the UK, selecting an Equity ETF can be a bit of a different ballgame.

Not only is Europe more fragmented. For instance, the second-largest ETF provider in the US, Vanguard, doesn’t even cover 5% of the market in Europe. There are also oaspects like currencies or dividends.

But it’s also never been easier to buy ETFs. By doing some initial research you can avoid life-long fees charged by Robo and Human Advisors.

It will make you substantially wealthier.

Broker Review Methodology

When choosing a broker, investors face a myriad of considerations, from safety measures to fee structures and beyond. Bankeronwheels.com takes a unique approach to broker comparison, designed with the discerning investor in mind. Here’s how we guide you through making an informed decision.

iWeb Share Dealing Review – Great For Inactive Investors

iWeb Share Dealing is the typical boring, but cost-efficient platform with good ETF availability. But make no mistake, it is an excellent option for investors seeking a reputable platform who don’t invest frequently, as there are no custody charges. However, advanced investors might encounter limitations based on their sophistication and needs.

AJBell Review – Leading Broker & Low-Fee SIPP Provider

AJBell is a Tier 1 broker with a good reputation, long track record and competitive fees. Only the most advanced investments are beyond the scope of the platform for many UK based investors it will be a top choice.

Weekend Reading – Interactive Brokers Fees: Are You Overpaying?

France Has A New PEA World ETF.

UCITS vs U.S. ETFs – Pros and Cons for Non-US Investors

ETF Domicile is not very glamour. And something that most new investors won’t pay attention to. While fees and index tracking frequently steal the spotlight, the domicile’s pivotal role in portfolio performance cannot be overstated.

Some of our readers from Latin America, Asia and Middle East know how to optimise their tax bill.

But here is what most investors ignore, and may pay a heavy price for it.

Should You Invest In Gold In 2024?

Bankers are a rational bunch unless you talk to them about Football or Gold.

Gold is a controversial topic, and there are a lot of misconceptions about it and facts that may surprise you. Some investors avoid it, since it does not generate any yield. But, portfolio managers and traders, including prominent ones, allocate personal savings to Gold.

If we don’t subscribe to the doom predictions of gold bugs and take emotions out of the equation, is buying Gold a wise choice?

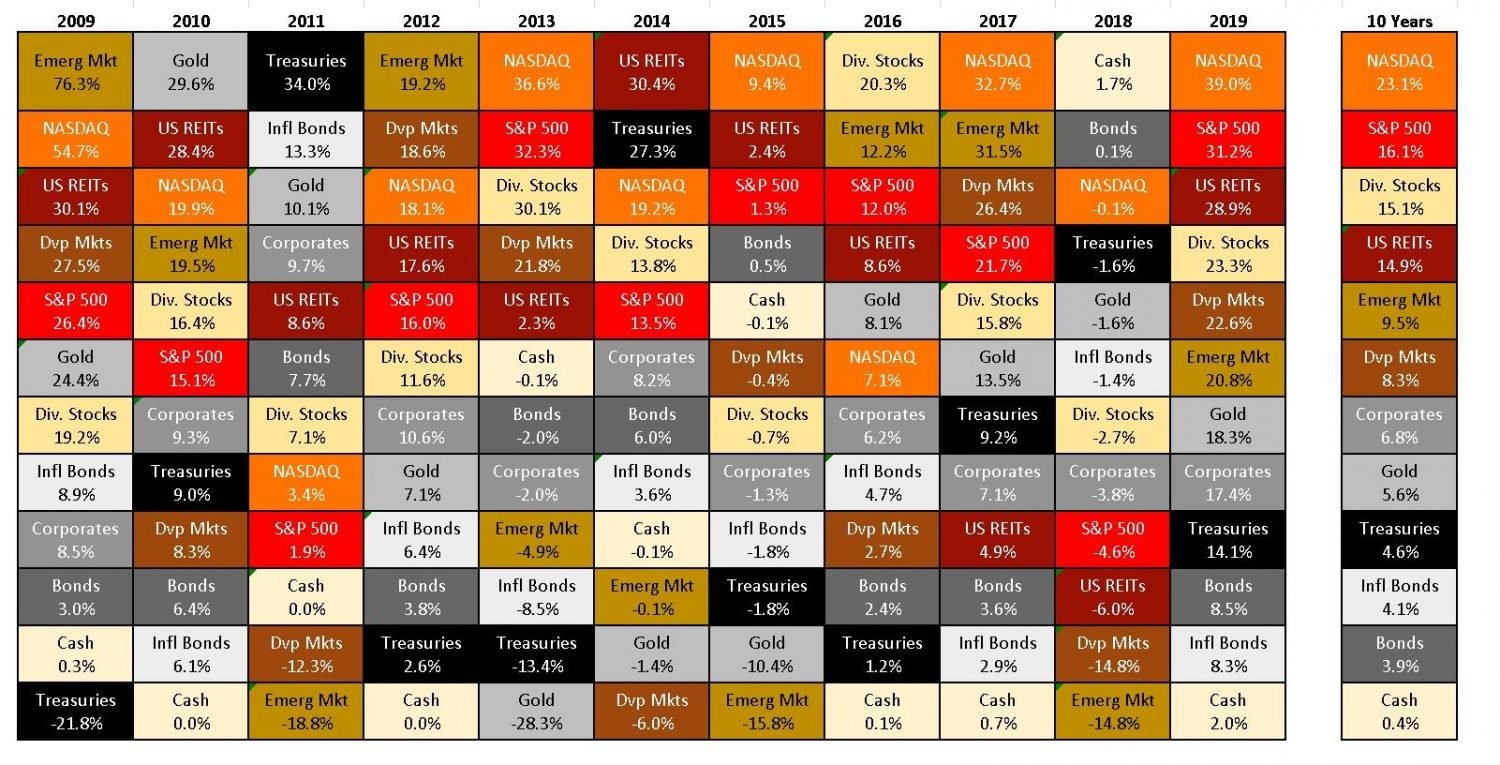

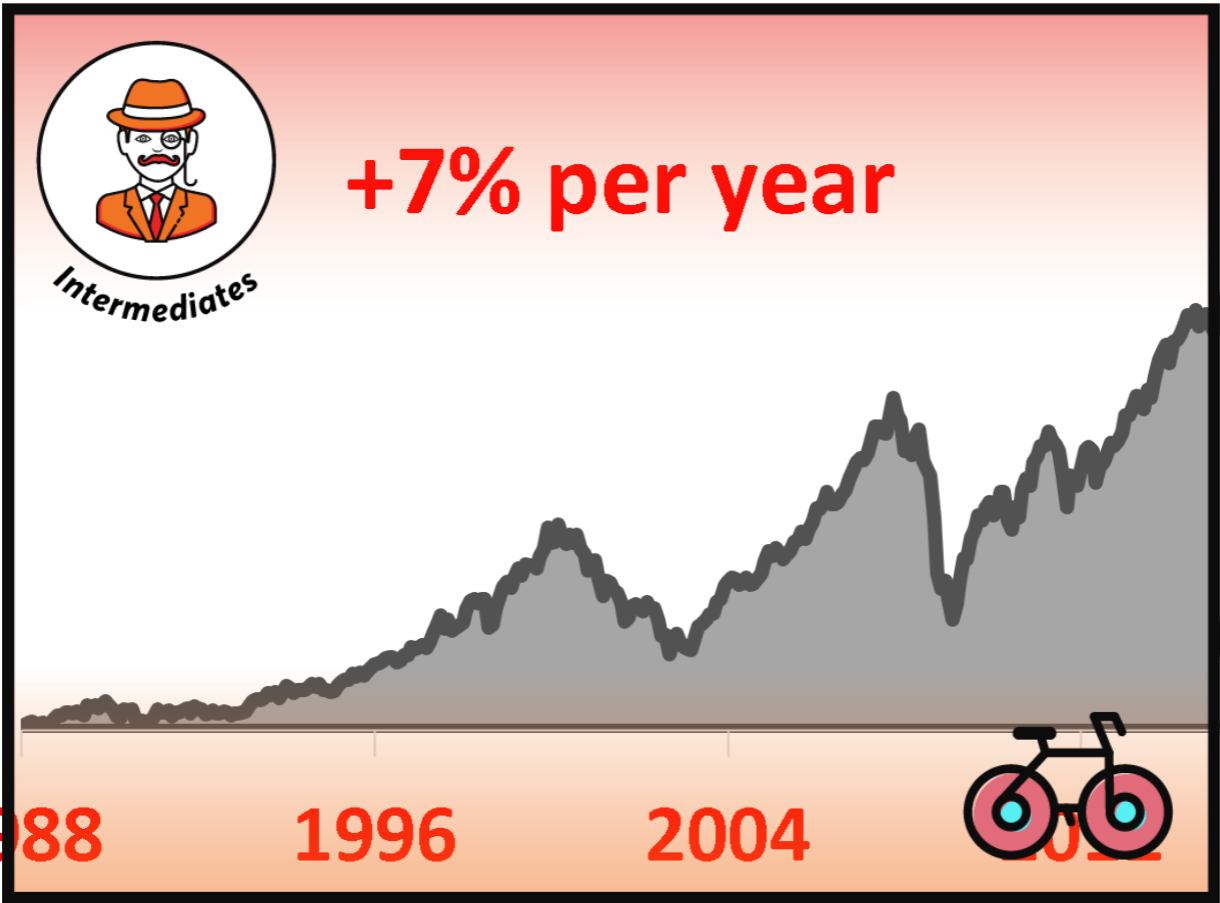

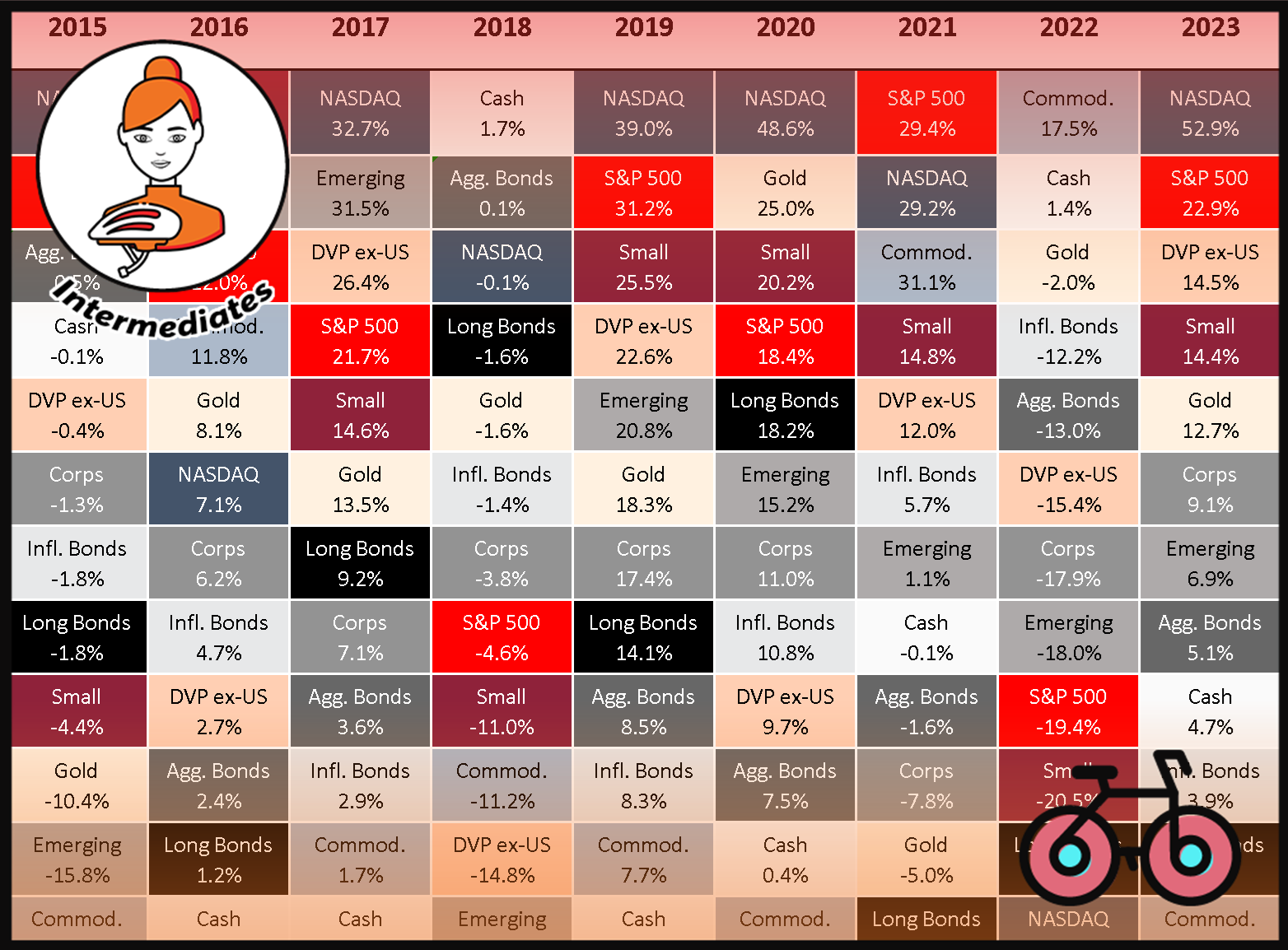

The Long Game – 2024 Guide To Asset Class Returns

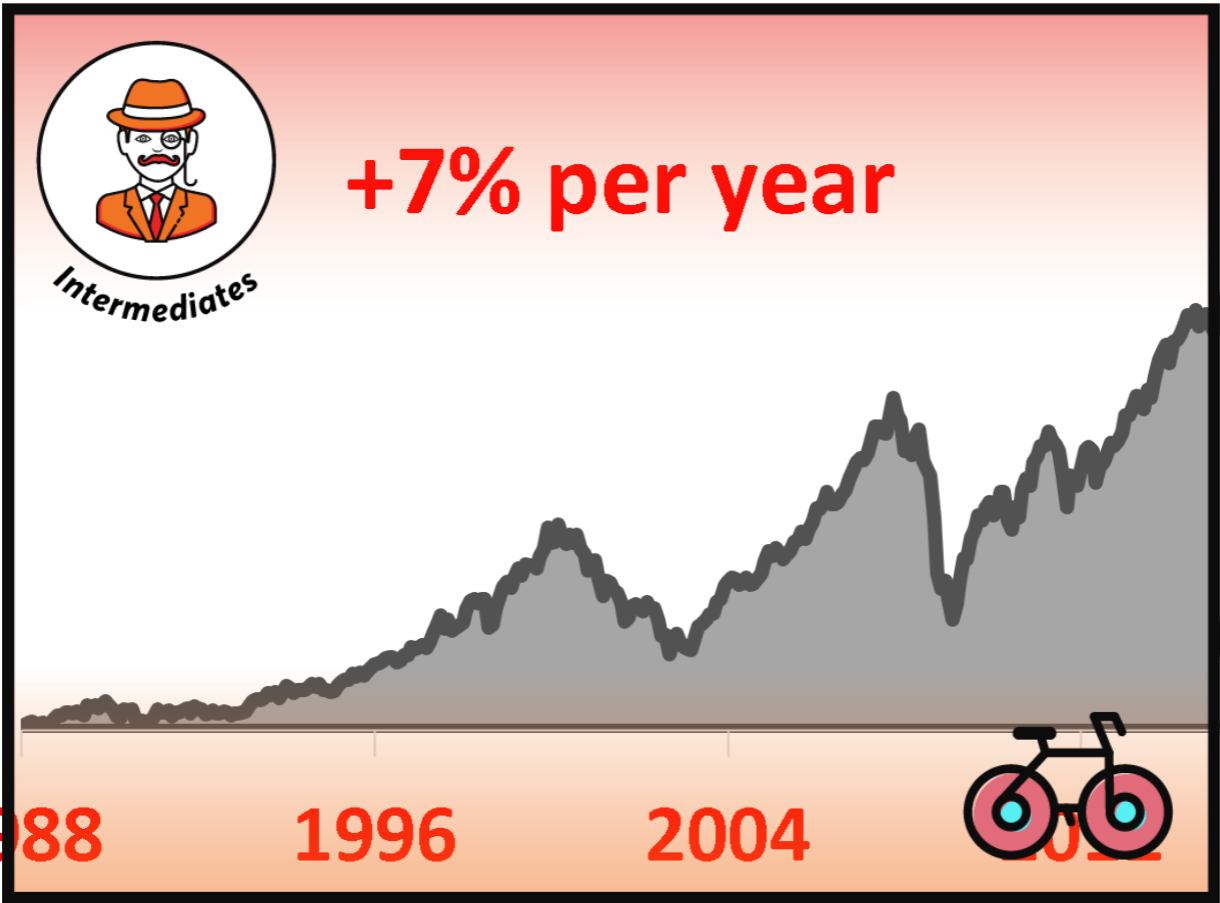

2022 reminded us that trees don’t grow to the sky. But, for equities, 2022 losses meant 2023 gains. Over the past decade, Global Equities have gained over 215% and returned 7.9% annually.

Today, it’s time to rebalance your portfolio – maybe buy some losers (I look at you – Bonds and Value Stocks), and revisit your plans for 2024 and beyond.

Interactive Brokers Fixed vs Tiered Plan – Which Is The Best For ETFs?

What Is IBKR Fixed Vs Tiered Pricing? Fixed pricing is easier to understand. Tiered pricing formula is more complex and exchange-dependent.

Millionaire Expat: How To Build Wealth Overseas (Book Review)

Expats face unique challenges – financial regulations of both their home country and the host country, different taxation regimes or currency risk. Offshore investment giants like Zurich or Generali International are there to benefit from this lack of knowledge.

Hallam uncovers their predatory behaviour, as high fees and hidden costs rob expatriates blind. A story reveals the stark reality: paying a $19k penalty was smarter than enduring daylight robbery, echoing a widespread financial deception faced by many.

Freetrade Review – An ETF-Friendly Platform

Freetrade markets itself as an ETF-friendly platform with very competitive pricing for SIPPs and General accounts. It caters well to investors who want a simple portfolio as well as investors that may be interested in trading on European and U.S. exchanges. More advanced investors may find limitations depending on their sophistication and needs.

Finding Your Broker Tribe: Our Broker Classification System

Brokers are usually bucketed together by comparison sites, that don’t have an in-depth knowledge of trade-offs related to fees, transparency and counterparty exposure. Most of the websites are also conflicted, often promoting brokers with the highest-earning commissions.

We take a more rigorous angle. How would a wise long-term investor categorise them?

Here is what you need to know about the 5 Key Broker Categories in Europe and the UK. These categories give you a mental model of how to think about brokers, but some of them may not fit in neatly, and availability in your country may also impact your choice.

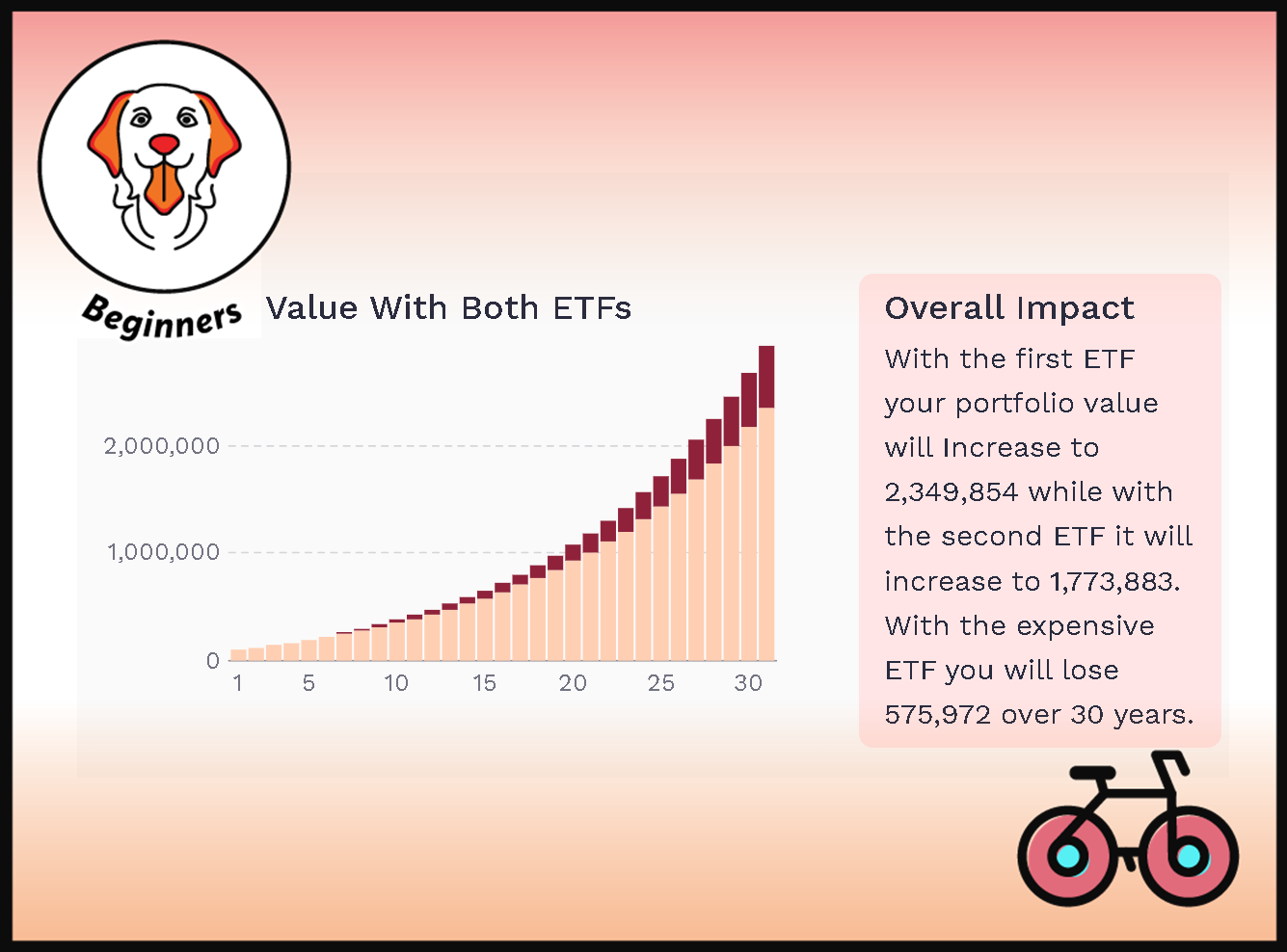

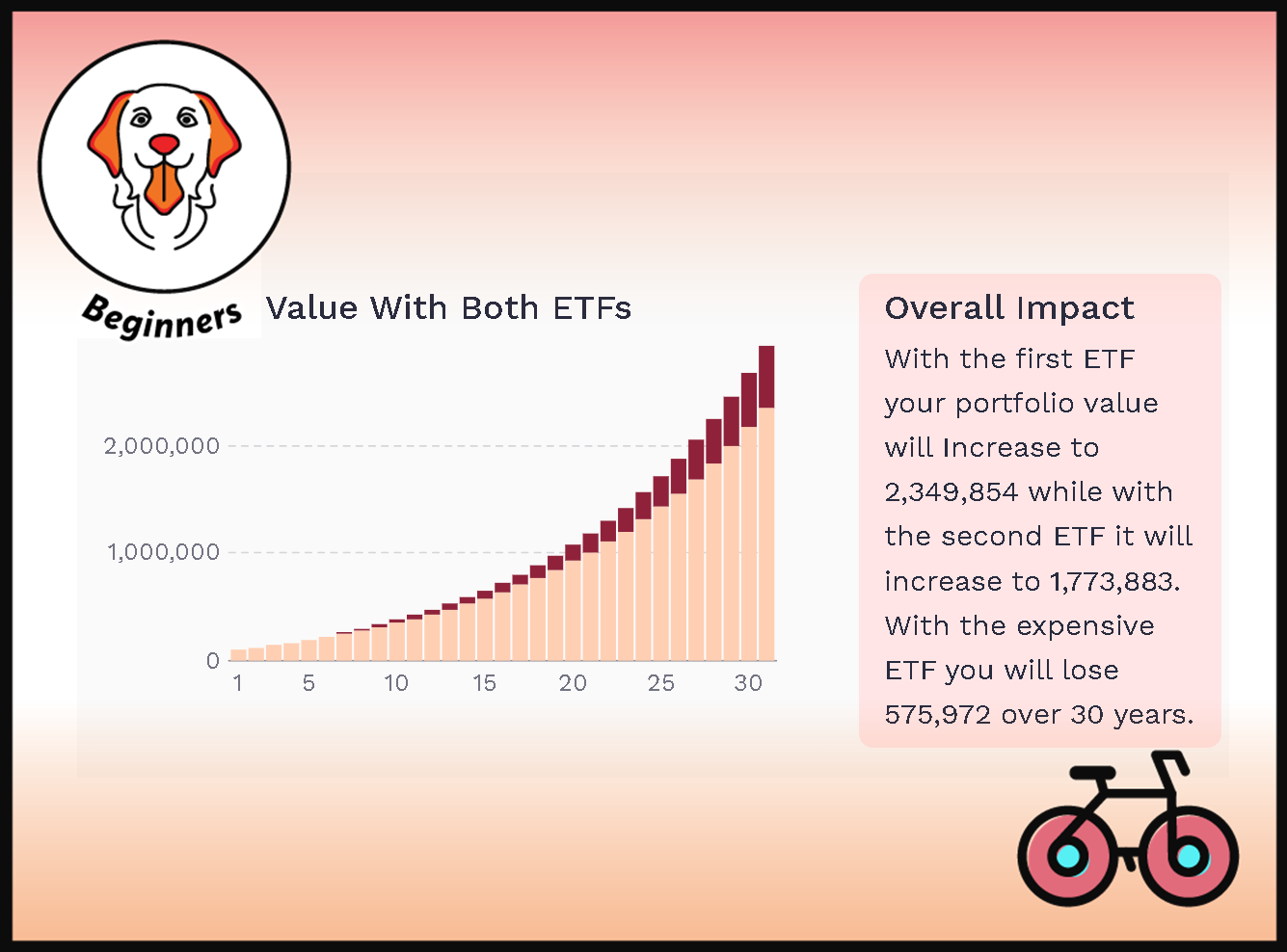

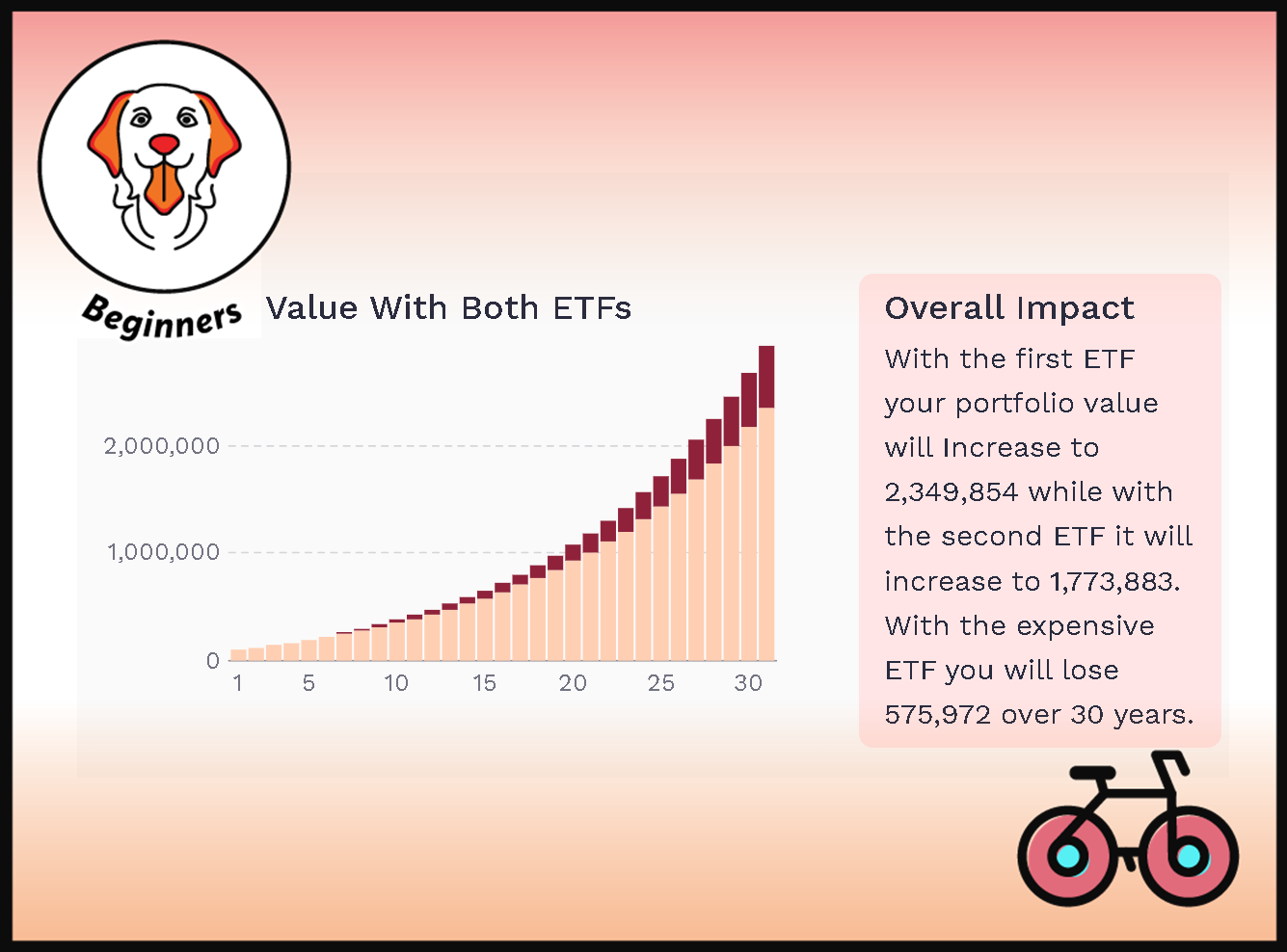

Tools: ETF Fee Calculator

Compare the portfolio impact of two ETFs: an expensive ETF (high TER) and a cheap ETF (low TER)

Interactive Brokers Review: Insights From Hundreds Of Investors

For most individual investors, Interactive Brokers is simply one of the best platforms. While beginners might find its interface and features complex, the platform is a treasure trove for those willing to scale the learning curve. It is suitable for most passive investors. Very competitive ETF trading commissions and FX rates, no ongoing platform fees along with family subaccounts and monthly standing orders largely justify opening an account.

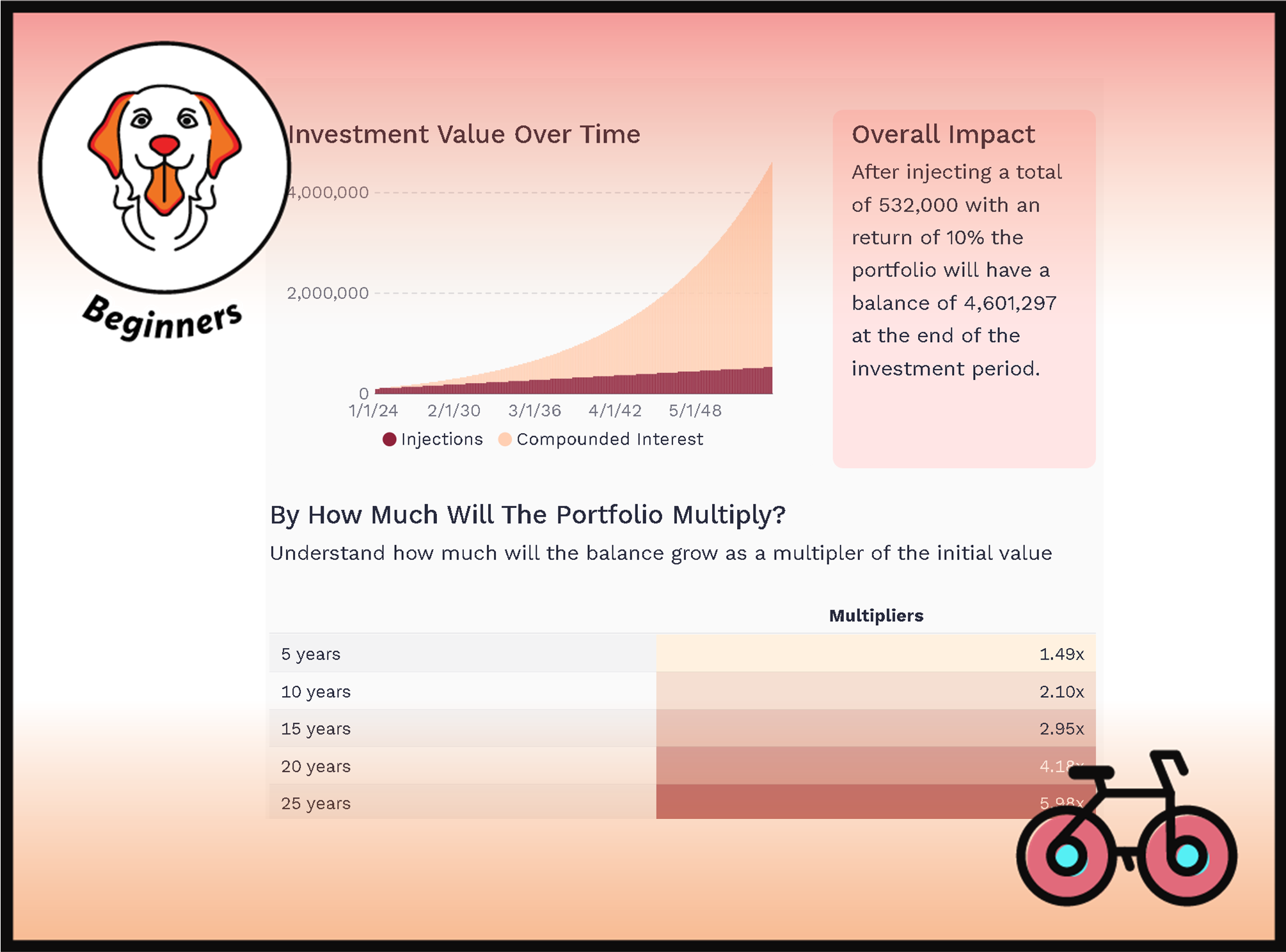

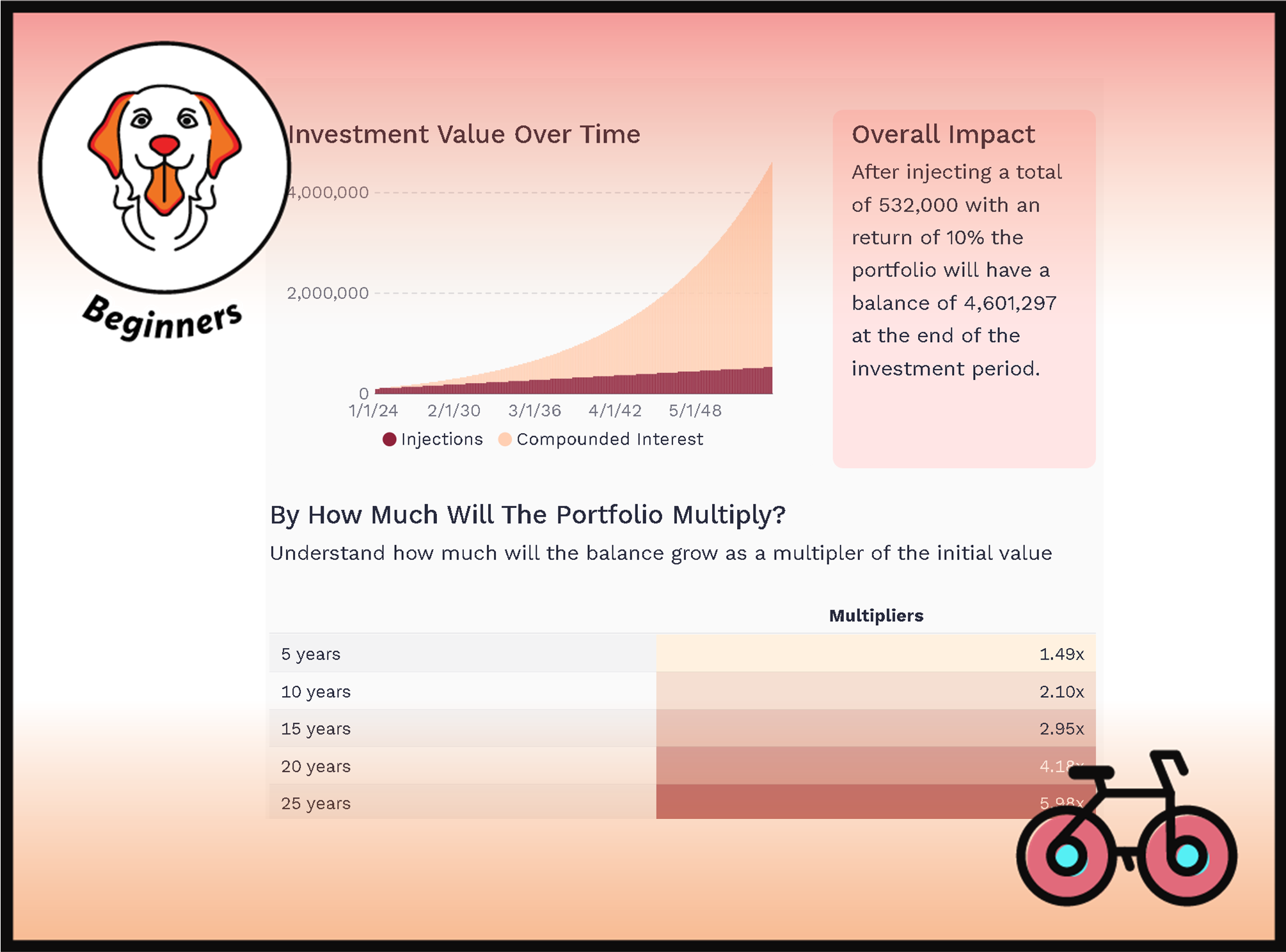

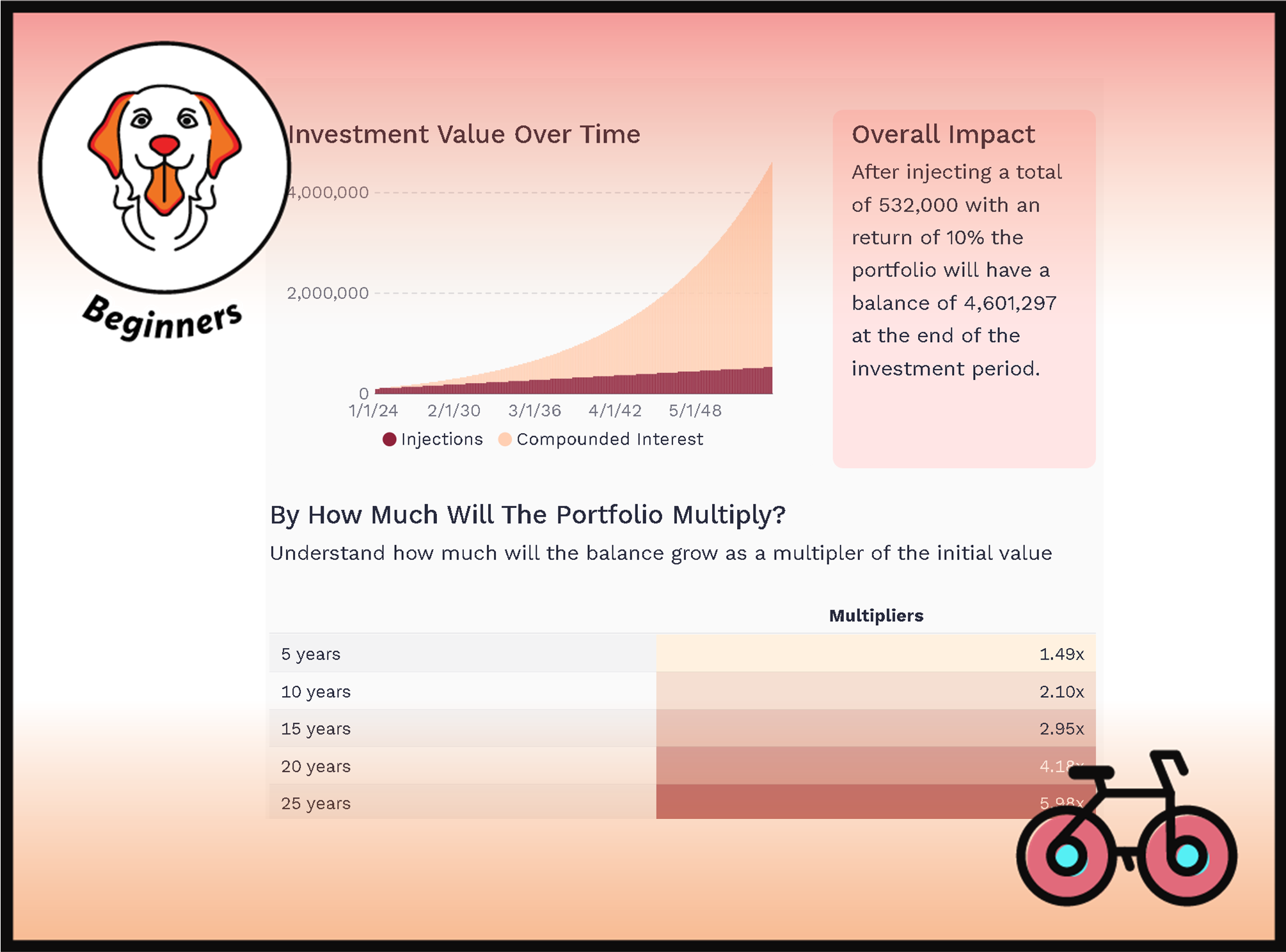

Tools: Compound Interest Calculator

Understand the impact of compound interest over time and as a multiplier of the invested value. Compare different compounding frequencies.

Weekend Reading – Invesco Lowers Small Cap ETF Fee To Become The Lowest In Europe

Small Cap ETFs Got Cheaper. Which Bonds Are Best Diversifiers?

Should You Invest 100% In Equities?

We live in extraordinary times. Just a decade ago, the mere idea of launching a website like ours, rooted in evidence-based investing, would seem far-fetched due to a general disinterest. Today, academic insights like the recent paper ‘Beyond the Status Quo: A Critical Assessment of Lifecycle Investment Advice’ by Scott Cederburg, Michael O’Doherty, and Aizhan Anarkulova, which challenges traditional asset allocation are not just noted – they’re often implemented by individual investors.

Beyond The Hype – Bitcoin’s Potential Role In A Portfolio

With the first wave of U.S. Spot Bitcoin ETFs and the SEC approval, Bitcoin is taking a new place in some portfolios.

The topic is contentious amongst our readers. According to our survey, only half of you have an allocation. That’s the way it should be – the best strategy is the one you understand and can stick to. So, while it may be worth exploring for the adventurous investor profiles, it’s not a fetch for the Golden Retrievers.

Investment Mistakes Even Smart Investors Make and How to Avoid Them (Book Review)

Einstein once said that common sense is the collection of prejudices acquired by the age of eighteen. Similarly, much of what is conventional wisdom on investing is wrong.

Most people can get by just fine without knowing anything about, say, rocket science. It is substantially more difficult to get through life without being knowledgeable about finances.

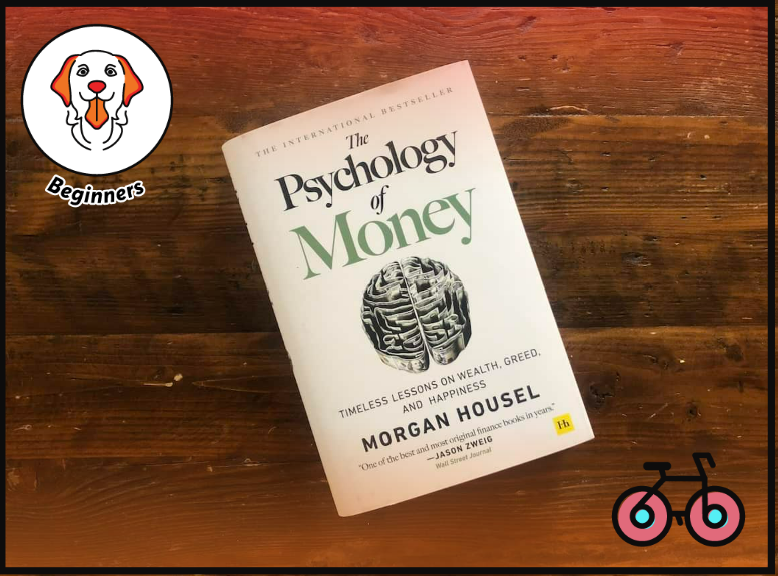

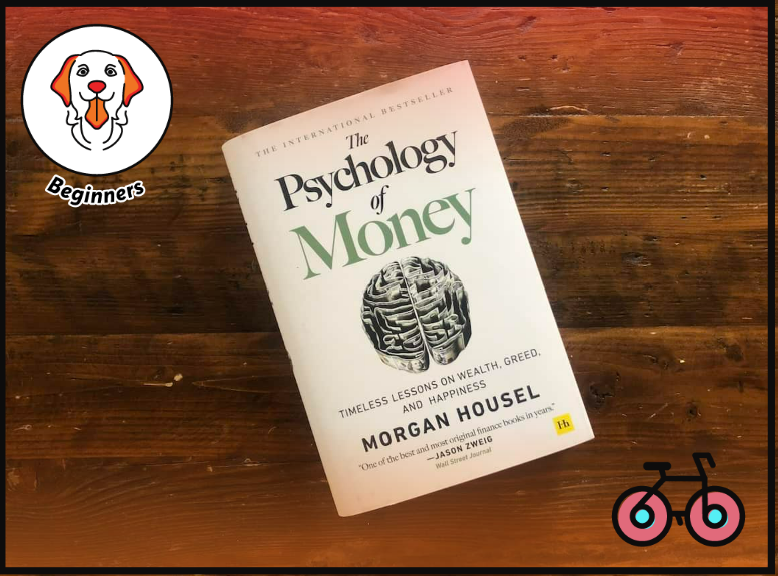

The Psychology of Money – Timeless Lessons on Wealth, Greed, and Happiness (Book Review)

The author is an expert in behavioural finance and history and an avid proponent of financial independence.

In his book, he takes us through some of the most important lessons he’s learned about why we act the way we do and how to think positively about wealth and investing.

Currency Royale – Should You Hedge Your Bonds?

Navigating the world of bonds can be a treacherous journey, especially when it comes to currency hedging.

Can your strategy change based on your home currency? Does it matter if you invest in Euros, or Swiss Francs? Is the British Pound any different? What about other currencies?

Is the decision to hedge impacted by your life situation and goals?

From Tibet To California – 8 Investing Lessons From Cycling The World

You may think that spending over a decade on Wall Street would teach me more about successful investing than cycling.

Surpringly, successful investing is more about perspective and wisdom than technicals.

From Tibet to California, here are 8 Investing lessons I learned from Cycling the World.

InvestEngine Review – Decent Choice (For Beginners)

InvestEngine offers competitive trading for ISA and General accounts, as well as a good range of ETFs. It caters well to buy-and-hold investors who want a simple portfolio. More advanced investors will quickly be very limited in their choices, as they can only trade LSE-listed ETFs.

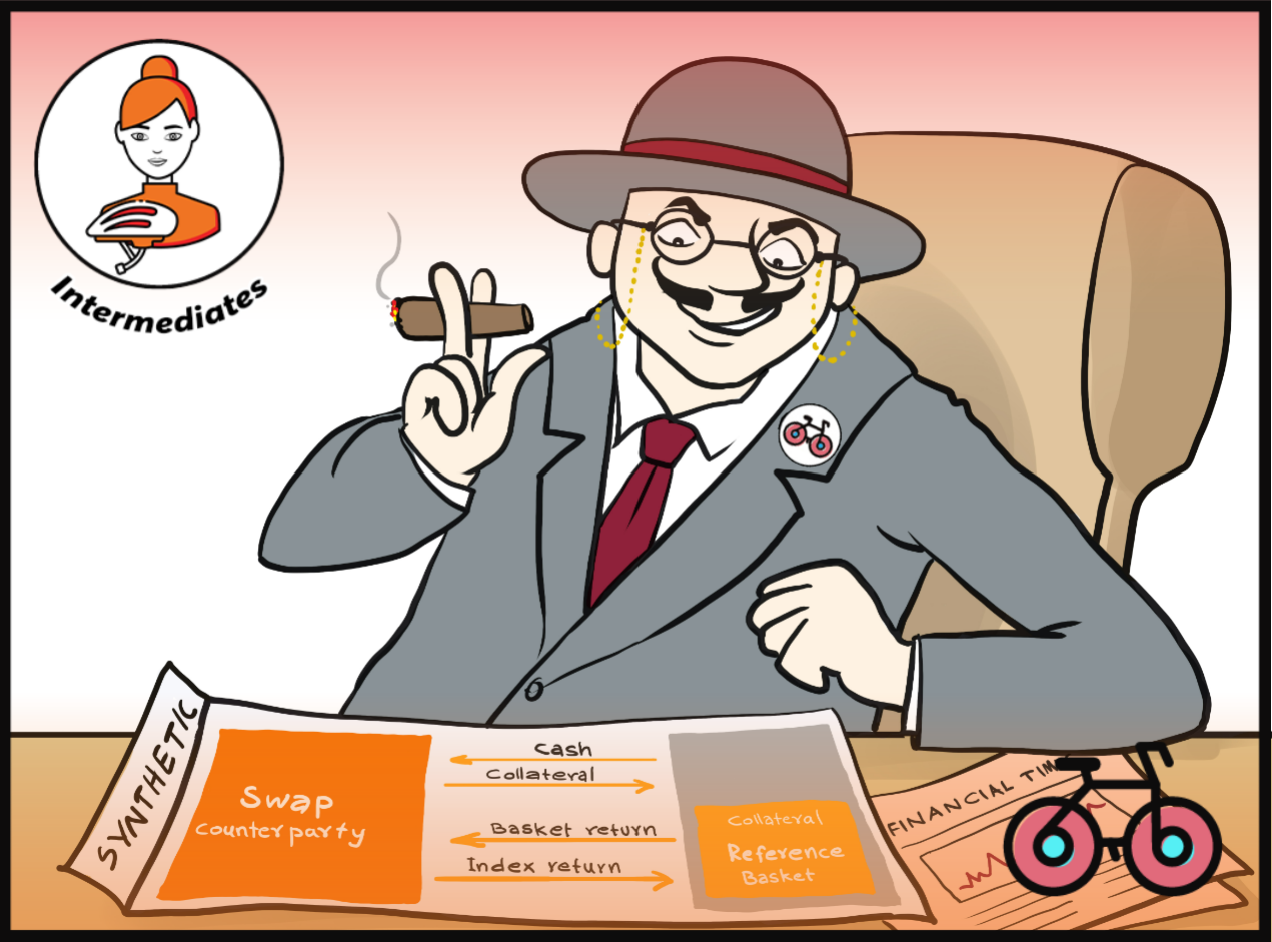

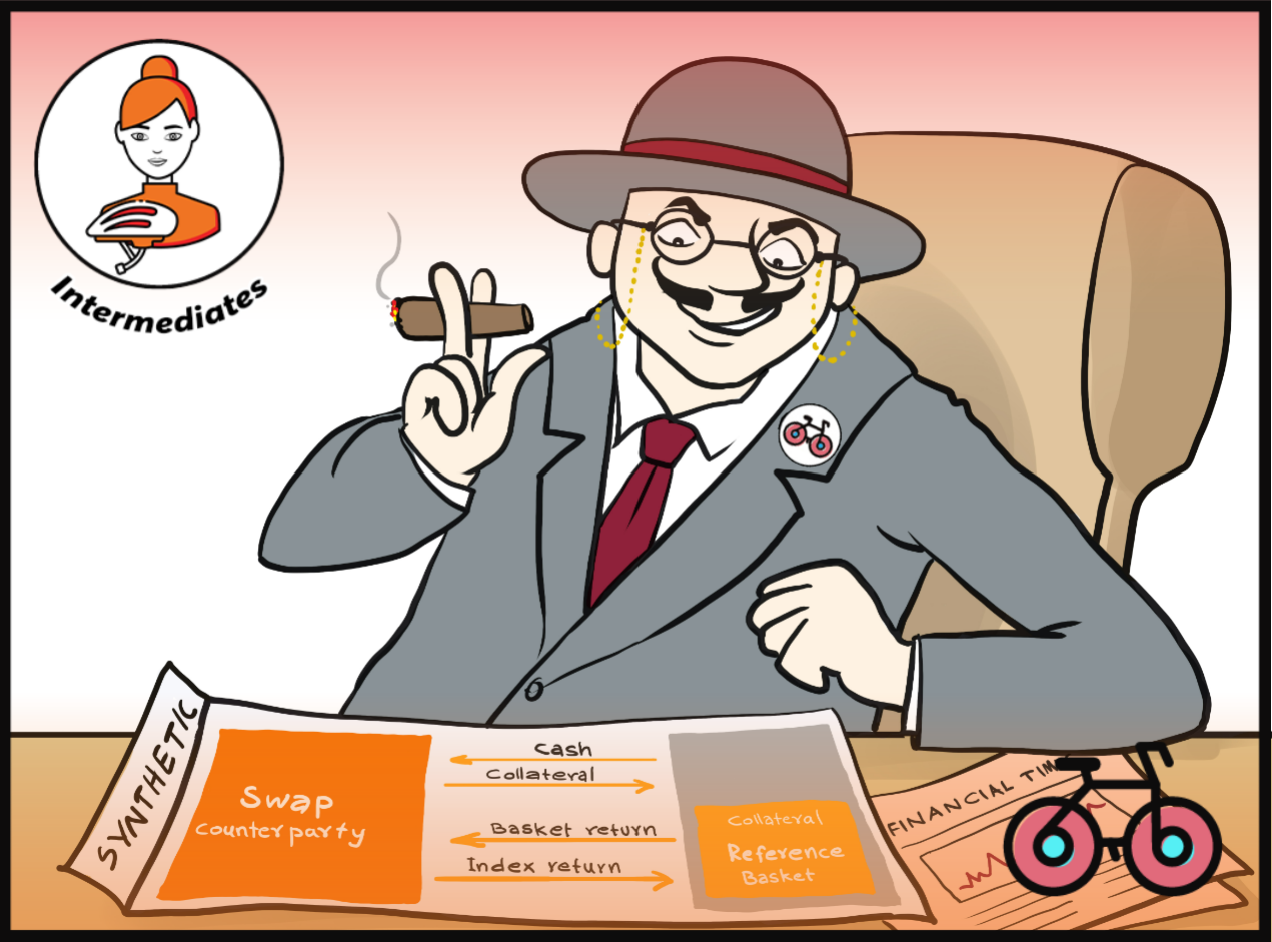

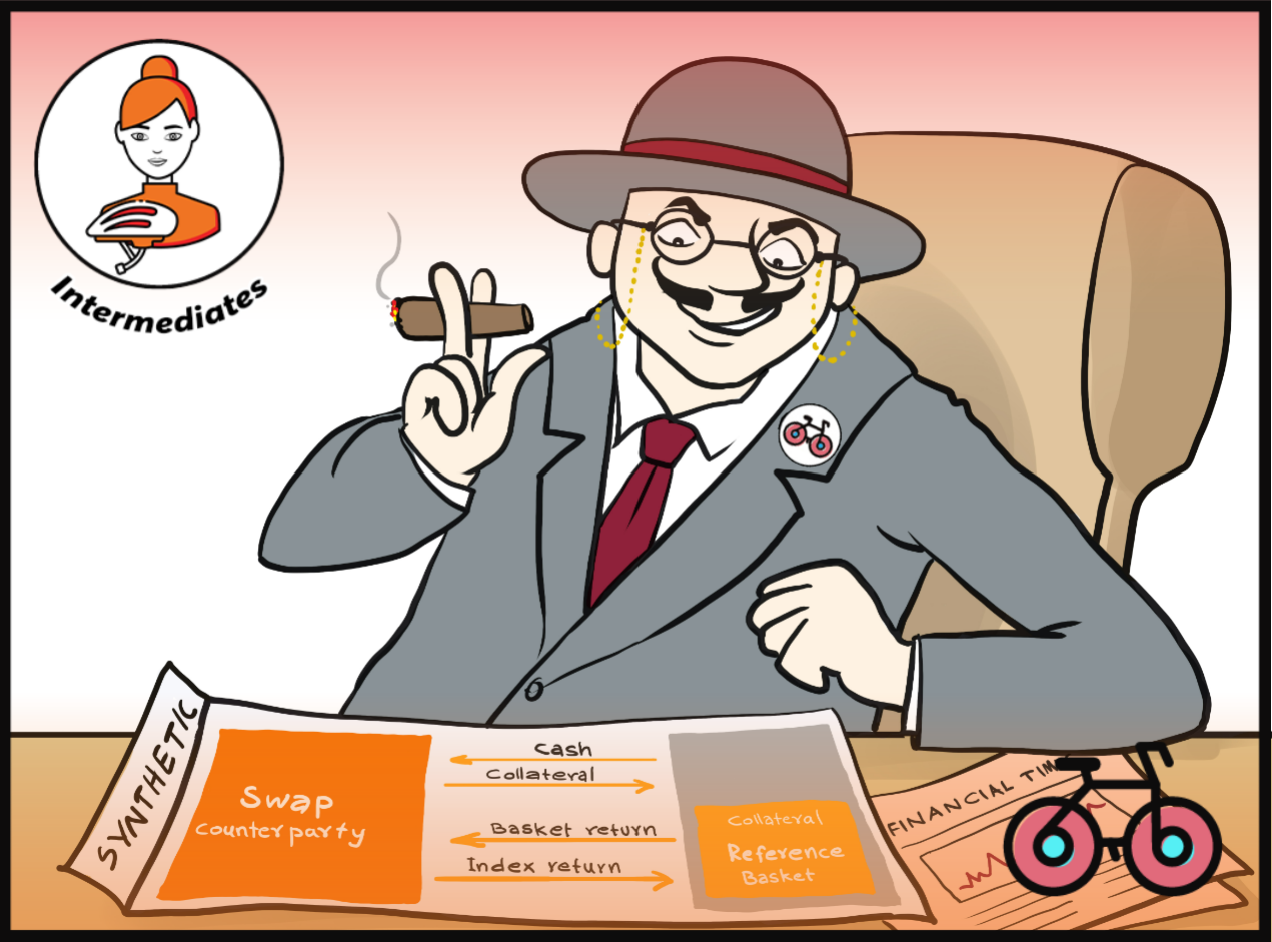

Weekend Reading – BlackRock Launches A Synthetic World ETF

BlackRock has expanded its synthetic range with the launch of a World Equity ETF. The iShares MSCI World Swap UCITS ETF (IWDS) is listed on Euronext Amsterdam with a total expense ratio (TER) of 0.20%. IWDS tracks the MSCI World Net TR Index, which offers exposure to 1,480 equities across 23 developed market countries.

Fidelity International Review: A Golden Retriever-Friendly Platform

Fidelity International stands out as a great choice for investors with families, and looking for a reputable and competitive choice. However, advanced investors may find limitations depending on their sophistication and needs.

Interactive Brokers – How To Identify Stock Exchanges In Europe?

Interactive Brokers (IBKR) is one of the largest and most sophisticated brokers in the world.

However, understanding how to identify a Stock Exchange may not always be the easiest. Here is how it works.

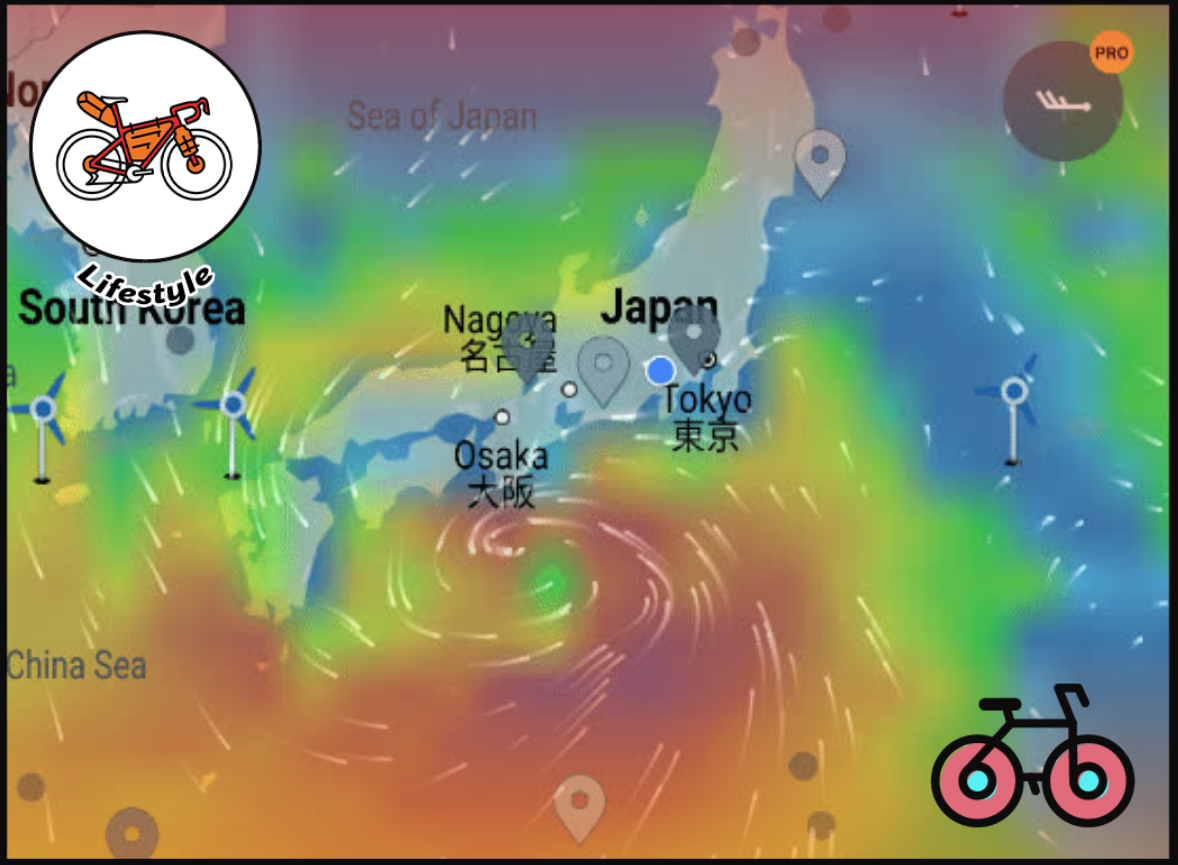

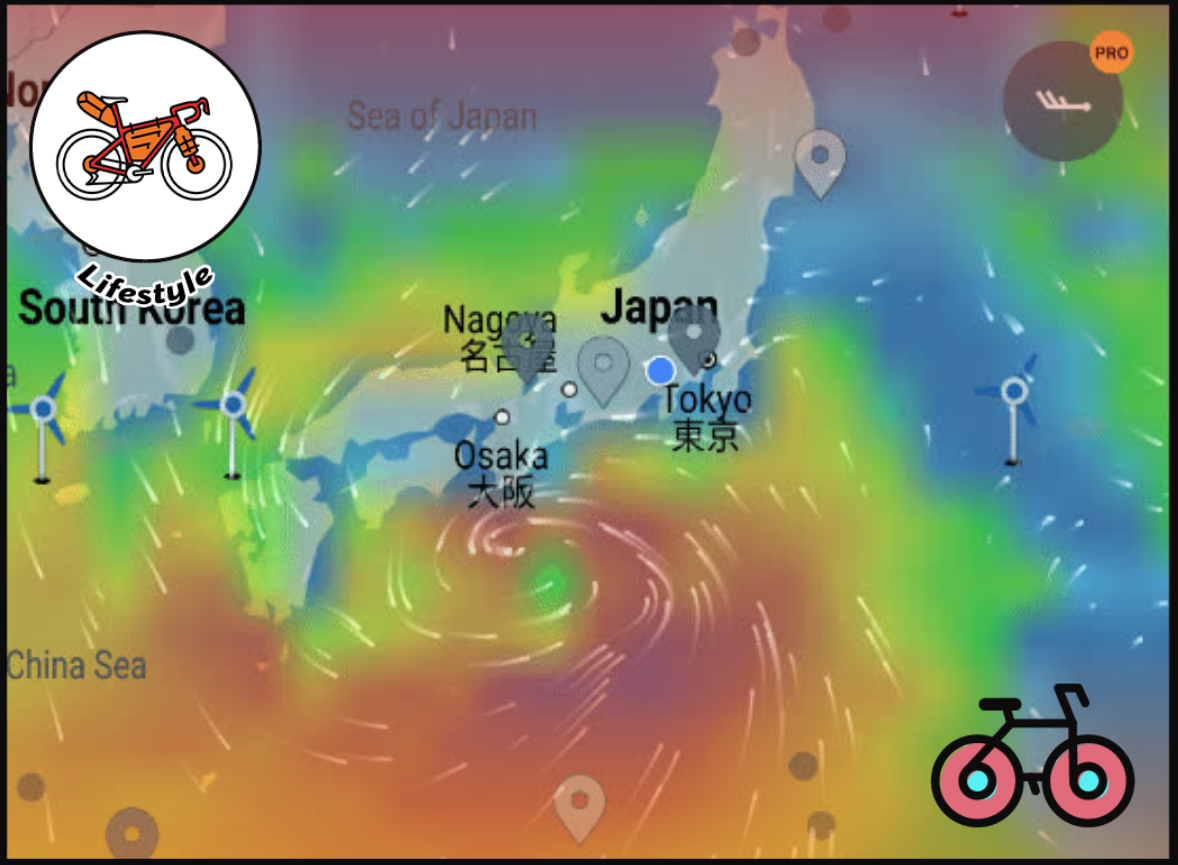

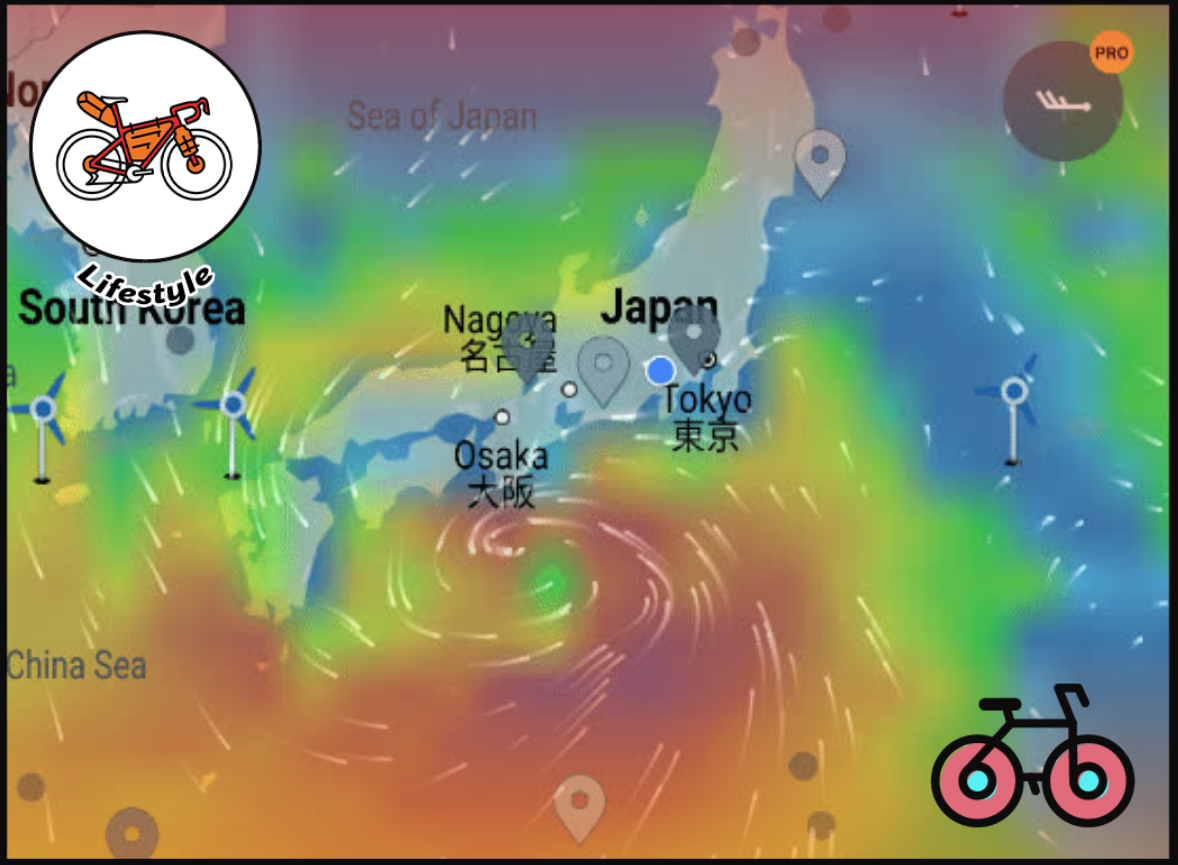

Cycling In Japan – 2 Secret Maps, Best Islands and Seasons.

Between 2019 and 2023, I spent close to a year in Japan. I cycled over 4,000 km from Hokkaido to Okinawa. Here are some tips on how you can make the best of your trip to the country of the rising sun.

Developed Markets ex-US: How To Control Your Allocation To U.S. Stocks

From March 2024, Xtrackers MSCI World ex USA UCITS ETF allows you to control exposure to the US Markets.

Weekend Reading – Amundi Launches The Cheapest UCITS World ETF

SAXO Review, Trend Following, Are We in stock market bubble?

SAXO Review: Pros & Cons For EU & UK Investors

A few years ago, SAXO wouldn’t be on our radar. It was a fairly expensive platform built mainly for traders. However, since their acquisition of the Dutch Bank BinckBank, part of the focus has shifted towards long-term investors. In January 2024, SAXO also reduced certain fees, making it an interesting Broker for investors in Europe. But, the fees still look prohibitive in the UK.

7 Ways To Park Your Cash: Risk-Return Tradeoffs

Bank Deposits have their merits, but let’s face it, they provide you with a tiny fraction of the market yields. What are all your short-term investing options ? Today, let’s look at the trade-offs.

Real-Life Portfolios: Thoughts On Challenging Academic Papers

The worlds of physics and investing are hardly comparable. But, what does it take to challenge the status quo? Why didn’t the recent paper ‘Beyond the Status Quo: A Critical Assessment of Lifecycle Investment Advice’ achieve it?

Vanguard Investor UK Review – Leader in Hands-Off Investing

Vanguard Investor UK stands out as a great choice for hold and buy investors that are looking for a simple platform managed by a very reputable global asset manager. However, more sophisticated investors may find limitations on both investment choice and advanced features.

Review of BlackRock ICS: The Rolls-Royce of Money Market Funds

You’re now rolling with the big dogs! BlackRock Institutional Cash Series are Mutual Funds that a predominately used by professional investors, but can also be bought by individual investors.

Hargreaves Lansdown Review – Cheapest Big 3 Broker For UK Buy & Hold Investors

Hargreaves Lansdown projects an image of a premium, dependable service where no corners have been cut. In cycling terms it’s pitching you Trek or Specialized – big brand, high production quality. HL has everything you need to conduct a wide range of basic to fairly complex investing activities, but you’ll need to be smart to manage costs carefully, since these can be high versus competitors.

Weekend Reading – 100% Equities For Non-US Investors? Pay Attention To Details.

100% Equities: Raph’s View, 100% Equities: The Economist’s Criticism, What happens when you invest right before a bear market? Mike Green about how the growth in passive has changed markets, The Trillion Dollar Equation, Financial Literacy and Financial Resilience: Evidence from Italy.

Interactive Investor Review – A Leading UK Broker

Interactive Investor stands out as a great choice for investors with families, and looking for multicurrency accounts to reduce FX-fee frictions. However, advanced investors may find limitations depending on their sophistication and needs.

Weekend Reading – Do you need real estate in your portfolio?

Do you need a separate allocation to real estate in your portfolio? MSCI Index rebalance brings India-China weight gap to record low Inflation-protected bonds: justified backlash? Bond Ladders Gain Traction in Direct Indexing.

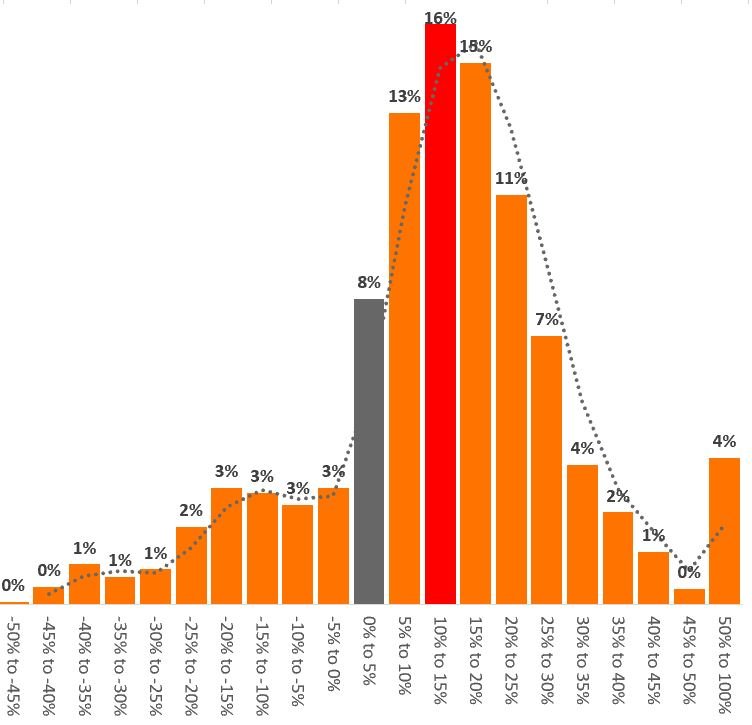

9 Charts That Spell Disaster for Your Cousin’s Stocks

Trying to beat the market is an entertaining activity.

Consider this: from 2013 to 2024, the top 10 U.S. stocks, largely dominated by Big Tech, eclipsed the rest of the S&P 500 pack by a whopping 4.9% annually.

But, you’re getting yourself into an investing minefield. What’s the potential damage if you pick a loser? Especially if you do it in an overheated market?

Sure, your stock-picking friends may get lucky in the short term. But, here are nine charts showing why – in the long run – you will outperform.

Weekend Reading – AQR Destroys The 100% Equity Case: It’s Silly.

DEGIRO Review: A Leader In Low-Cost Investing. Is the U.S. Stock Market Too Concentrated? Emerging Market ETFs: BlackRock vs Vanguard. Real estate: REITs, public vs private real estate. Japan’s Nikkei hits 34-year high on weak yen. Ranking Of Largest Brokerage Firms by Assets. The cost of raising a child.

DEGIRO Review: A Transparent Leader In Low-Cost Investing

If you’re looking for a low-cost broker, and don’t mind paying marginally more than with its competitors, DEGIRO is a very good choice. The advantage? You invest your money with a more transparent broker than most VC-funded direct competitors that have just a few years of track record.

Live and Let Buy: Which Bonds For Your Objectives?

Whether you are investing for the Short or Long Term, Bonds are a key component in a portfolio.

Today, we’ll cut through the noise and spotlight the bond categories we’ll unravel in this guide. We also go through bonds you may want to avoid to accomplish your goals. Let’s dive in!

Weekend Reading – Confused About Brokers? Here is how to categorise them.

Safe vs Cheap: Finding Your Broker Tribe Stocks are STILL a great long-run investment! When to prefer bonds over stocks Is Elon Musk Right To Worry About Passive Investing? India vs China ETF Performance. Investing in Stocks All-Time High.

Ranking Of Largest Brokerage Firms by Assets in 2024

Brokers can have a staggering range of Assets Under Administration with a large diversity and sometimes – mammoth scales – at play in this space.

But pay attention to the nuances. A lot of websites compare brokers using the AUM metric, which is misleading. Some brokers are also asset managers, and play different roles.

Weekend Reading – Should You Invest in Stocks at All-Time Highs?

Should You Invest in Stocks at All-Time Highs? Can You Live On Dividends From Your Portfolio? Equity for the long run? With Alan Dunne How to Start Investing in 10 Steps. Monte Carlo Simulations: Forecasting Folly?

Come Along For A Hike With Francesca: How to Start Investing In 10 Steps.

Last weekend I was on a hike with some local friends and after talking about some exciting topics like cycling the world the conversation ended up drifting towards investing.

Francesca recently discovered ETFs while Joanna heard about Tracking Funds from her friends.

Both were relucatant to deploy money in the Stock Market. While Francesca held significant amounts of cash for a number of years, Joanna thought there was no better investment than her home.

Weekend Reading – Should Your Job Determine How You Invest?

We Reviewed Interactive Brokers. 100% Equities? No, according to Antti Ilmanen.

Should Your Job Determine How You Invest? Overview of the US and European ETF markets by leading Issuers. It’s Official: Passive Funds Overtake Active Funds.

Weekend Reading – Going 100% Equities? Maybe You Shouldn’t.

Stocks Have Not Always Beaten Bonds. Should You Care? Lifecycle Investment Advice – 100% Equities or Not? Live And Let Buy: Which Bonds For Your Objectives? The U.S. dollar is unlikely to continue defying gravity. Visualizing the Top Global Risks in 2024.

What’s the Future for Bankeronwheels.com? 2023 Year-End Survey Results.

Bankeronwheels.com, born during the COVID pandemic, began as a personal blog blending cycling with investing insights.

With limited ways to assist others during the pandemic, Raph, inspired by the kindness experienced during his global cycling journeys, aimed to share his financial knowledge and cycling wisdom. His goal – to teach readers how to efficiently earn in a relatively passive way, enabling them to focus on more important aspects of life – like sustainable travel on a bike. By 2023, the blog had exceeded expectations in growth.

Weekend Reading – Is Your Age in Bonds a Good Investing Rule?

Historical Performance of Popular Portfolios, UBS – Global Family Office Report including Asset Allocation, Vanguard 2023 TOP Reading list: From 60/40 to securities lending, Visualizing 60 Years of Stock Market Cycles, Bankeronwheels.com TOP 10 Reads from 2023.

How To Choose A Cheap Stock Broker?

Over the past months, as we developed our Broker Fee Comparison Tool, we looked into the different fees in Europe and the UK.

You probably won’t be surprised to hear that the fee structures are very confusing! But, the portfolios of our readers are often relatively simple, so coming up with a lifetime accumulation phase simulation of all fee components to choose the cheapest broker is not only feasible, but necessary.

Certain fees – like custody fees – eat into investors’ wealth in the same dramatic way as high Total Expense Ratios charged by Fund Managers.

Ready to choose the cheapest broker for your portfolio? Let’s dive in!

Genki vs SafetyWing: Best Insurance For Nomads

We spent 2023 travelling across Asia, the Middle East and Europe meeting a variety of nomads.

To assess which policy is the best we came up with five traveller profiles: Remote Worker/Entrepreneurs, Gap Year Adventurers, Family Nomad Travellers, Long-Term Bikepackers and Retiree Travellers.

In this article, we aim to guide you through this often-overlooked aspect of long-term travel, helping you make the best choice for your own adventures.

How To Choose The Best Stock Broker?

Why Is Our Guide Different? This guide is Bankeronwheels.com’s deep dive into European and UK Brokers. We approach Brokers by: ETF Focus – We are long-term

Weekend Reading – What Worked? Returns Of Popular Portfolios.

Historical Performance of Popular Portfolios, UBS – Global Family Office Report including Asset Allocation, Vanguard 2023 TOP Reading list: From 60/40 to securities lending, Visualizing 60 Years of Stock Market Cycles, Bankeronwheels.com TOP 10 Reads from 2023.

Our 2023 Unmissable TOP 10 – Did You Catch Them All?

As we prepare our pipeline of articles and ideas for 2024 it’s time to summarise what you liked in the prior 12 months.

Here are some of our most-read posts of the past 12 months.

Shape The Future Of Bankeronwheels.com

2023 marked the third full calendar year of Bankeronwheels.com.

We truly appreciate all support received and will work hard to make 2024 more impactful!

Year-End Reading – Wise Money Got It Right. Again.

Bankeronwheels.com 2024 Guide to Long-Term Asset Class Returns, Why You Probably Need to Rebalance Your Portfolio Now, Why Investors Benefit From the Return Of Sound Money, Mapped: How Houthi Attacks in the Red Sea Impact the Global Economy, Confessions of an Analyst: My Five Investing Mistakes.

Weekend Reading – Vanguard’s Outlook For 2024 And Beyond

Vanguard’s Outlook for Markets, Bitcoin in a Portfolio and Quants’ Winter.

15 Best Investing Book Gifts To Choose From This Christmas

The holiday season is just around the corner, and with it comes the challenge of finding a great gift for your loved ones.

Why not opt for a personal finance book this year?

We have compiled reviews of some of the most helpful works on managing money effectively.

There is a range of content, appropriate for readers of different ages, in different situations, and living in various parts of the world.

Commission-Free Brokers: Are You Trading Or Being Traded?

Definitive guide to choosing a stock broker – Part 6 This is part 6 of Bankeronwheels.com Definitive Guide to choosing a Stock Broker. ‘Free trading’ often

Weekend Reading – 15 Investment Books Wall Street Doesn’t Want You to Read This Christmas

More returns for your family, less for bankers: 15 book gifts this Christmas, US Equities: Repeat of the previous decade? Visualizing Return Expectations by Country . What’s Really Driving Inflation and Bond Yields?

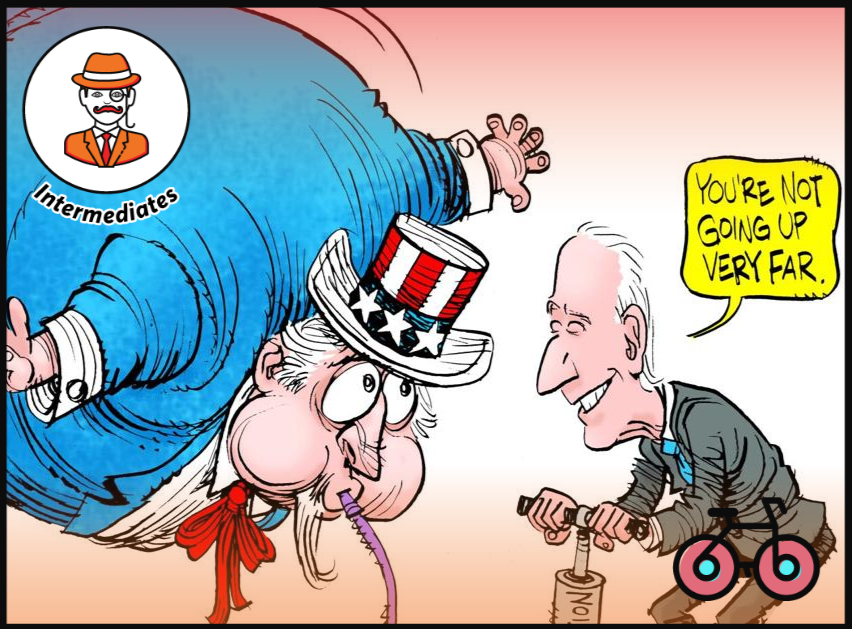

▶ Visualizing $97 Trillion of Global Debt in 2023

Weekend Reading – How Much Are You Losing? The Hidden Costs Of Commission-Free Trading.

EU Bans Payment for Order Flow – Less Transparent Exchanges Remain.

Is now a good time to buy bonds?

Improving the odds of meeting a portfolio return target.

Weekend Reading – Buying a House? New Xtrackers ETFs for Medium-Term Life Goals

New Medium Term fixed-maturity Euro Corporate Bond ETFs from Xtrackers,

What’s a Safe Retirement Spending Rate Today? Insurances – when to take it and when not. Wise pauses taking on European business customers

Broker Cost Comparison Tool

European and UK Brokers tend to have complex fee structures, making them hard to compare. However, most of our readers have simple portfolios that makes it possible to run illustrative scenarios and compare the overall cost in an accumulation phase. Here is how it works.

Weekend Reading – Vanguard’s Strategies to Live Off Your Portfolio Without Draining It

Vanguard’s comprehensive guide to various retirement withdrawal strategies, This is a Wonderful Market for Dollar Cost Averaging, Credit Ratings of Major Economies.

Investing Is Simple, Like Riding A Bike (Book Review – Italian)

As we find ourselves just a few weeks away from Christmas, I am both thrilled and humbled to present to you a foreword I had the immense honour of writing for a book that is as unique as it is insightful.

Weekend Reading – Escape the Tax Man: Tax-Free Compounding & Top 12 Countries with Zero Taxes!

A deep dive into credit investing, Compounding with no taxes -Accumulating Vs Distributing ETFs, Asset Allocation Isn’t Magic, Asset Class 5-Year Sharpe Ratios. How Time Horizon Affects the Odds of Equity Investing. The 20 Most Common Investing Mistakes in One Chart.

Tax-Free Compounding – Accumulating vs. Distributing ETFs

Compounding is a powerful wealth-creation tool. But taxes and fees can sabotage your plan.

Typically, up to 2-3% of the 7% average annual total return from Global Stocks comes in the form of dividends. But what happens to compounding if we distribute them?

Today, let’s look at how to optimise your ETF selection for the compounding magic to work without leaking too much in unnecessary taxes.

Weekend Reading – Saving On Dividend Taxes with S&P 500 ETFs

How to save money on Dividend Taxes with S&P 500 ETFs, Dr. William Bernstein on Asset Allocation, Four Deep Risks & Inflation Linked Bonds, Why the stock market usually goes up?, Why Aren’t Stocks Down More? Index Funds, How To Build Wealth & Financial Independence Wisdom, Gaining edge by forecasting volatility and correlations.

Can You Trust The Banker? How To Choose The Best S&P 500 ETF.

I was initially sceptical towards Synthetic ETFs. Back in 2009, I analysed client portfolios of CDO and CDOs-Squared – some of the most complex, and toxic, financial instruments ever assembled by Wall Street Banks. After working-out structured finance portfolios, synthetics raised my eyebrows.

Weekend Reading – 0.03% Fee SPDR S&P 500 ETF Becomes Europe’s Cheapest

Should you invest in Gold in 2024?, Two Fund vs Three Fund Portfolio, Bonds as Diversifiers Aren’t Dead–Just Dormant, All Weather Investing, Have you outperfomed? Which index to benchmark your portfolio against?Making Sense of the market with Aswath Damodaran, The Largest Stock Exchanges in the World.

Weekend Reading – Safe Withdrawal Rates Based On Inflation & Valuations

UCITS vs U.S. ETFs – Pros and Cons for Non-US Investors, Small Cap Index Funds: Expectations vs. Reality, Why people like to hold individual stocks instead of funds, Mapped: Investment Risk, by Country, We usually think about what to buy. But “When should I sell?” At Long Last, Bonds Once Again Matter, Recap of UK Tax wrappers.

ETF Fees – How They Work & How to Minimise Them!

Over the past two decades, Index Investing became attractive, partly due to low ETF fees.

While you can’t avoid fees altogether, minimizing them is vital for maximizing your long-term returns. What are the different costs, and how do they compare to single Stocks or old school Mutual Funds?

Ready to safeguard your returns from unexpected fees? Let’s dive in!

Weekend Reading – Is Your City’s Real Estate In A Bubble?

UCITS vs U.S. ETFs – Pros and Cons for Non-US Investors, Small Cap Index Funds: Expectations vs. Reality, Why people like to hold individual stocks instead of funds, Mapped: Investment Risk, by Country, We usually think about what to buy. But “When should I sell?” At Long Last, Bonds Once Again Matter, Recap of UK Tax wrappers.

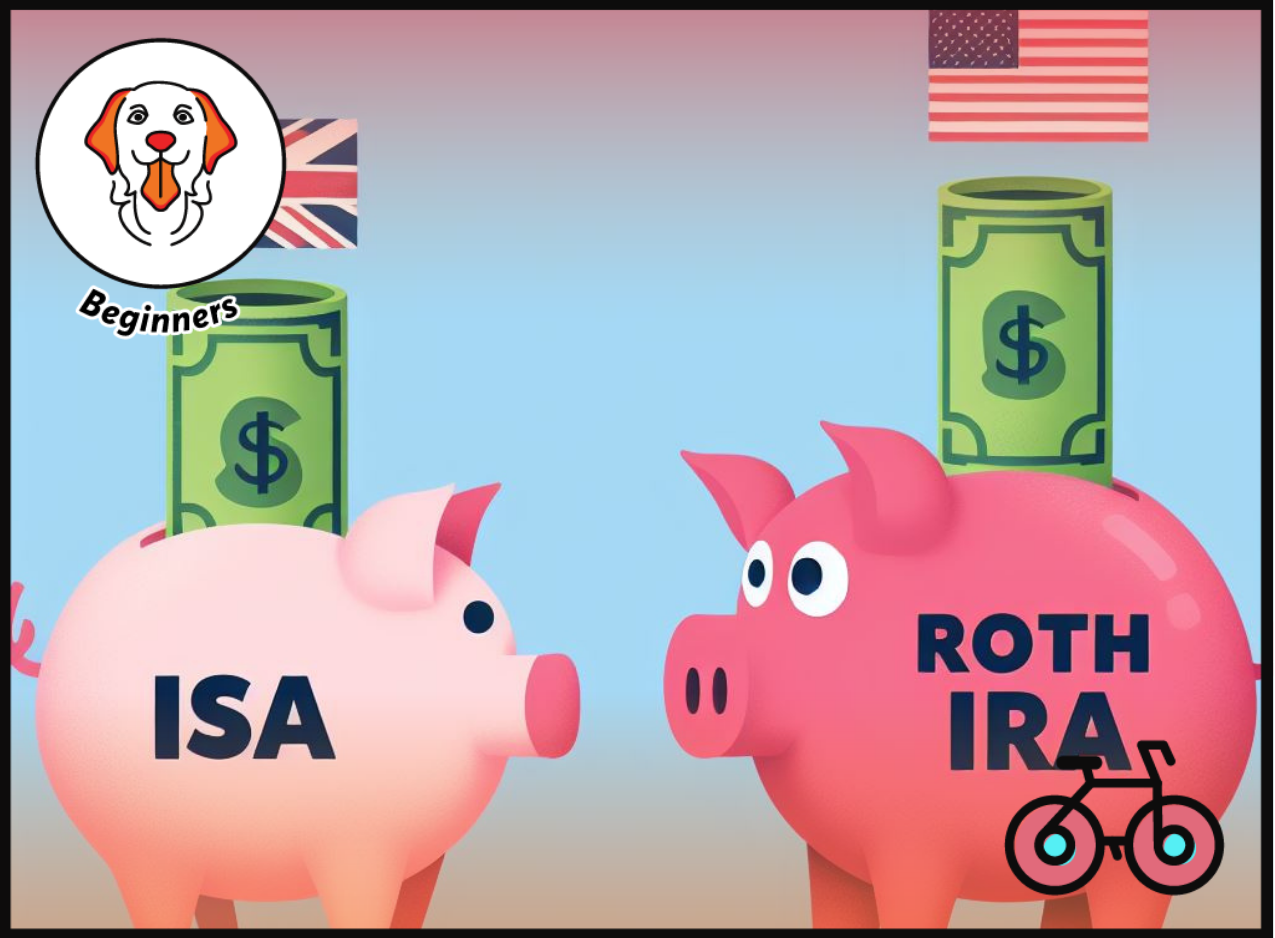

Discover 2 Powerful Roth IRA Equivalents for UK Investors

You’ve likely heard the buzz about the Roth IRA from US investing circles, tantalizing savers with its tax-free growth and withdrawal benefits.

While this famed investment vehicle is sadly out of reach for UK residents, fret not!

Let’s dive into the Roth IRA Equivalents for UK Investors.

Weekend Reading – IBKR Merger: Are You Affected?

Interactive Brokers Merger – Are you impacted? When It Comes to Passive Bond ETFs, the Devil Is in the Details. Index funds don’t give you average returns. They almost guarantee you’ll be in the decile. Mixing Bitcoin With 60/40 is Like Using Kerosene as Kindling. Why China’s real estate crisis is different. “We’re going to have a debt crisis in this country” – Ray Dalio

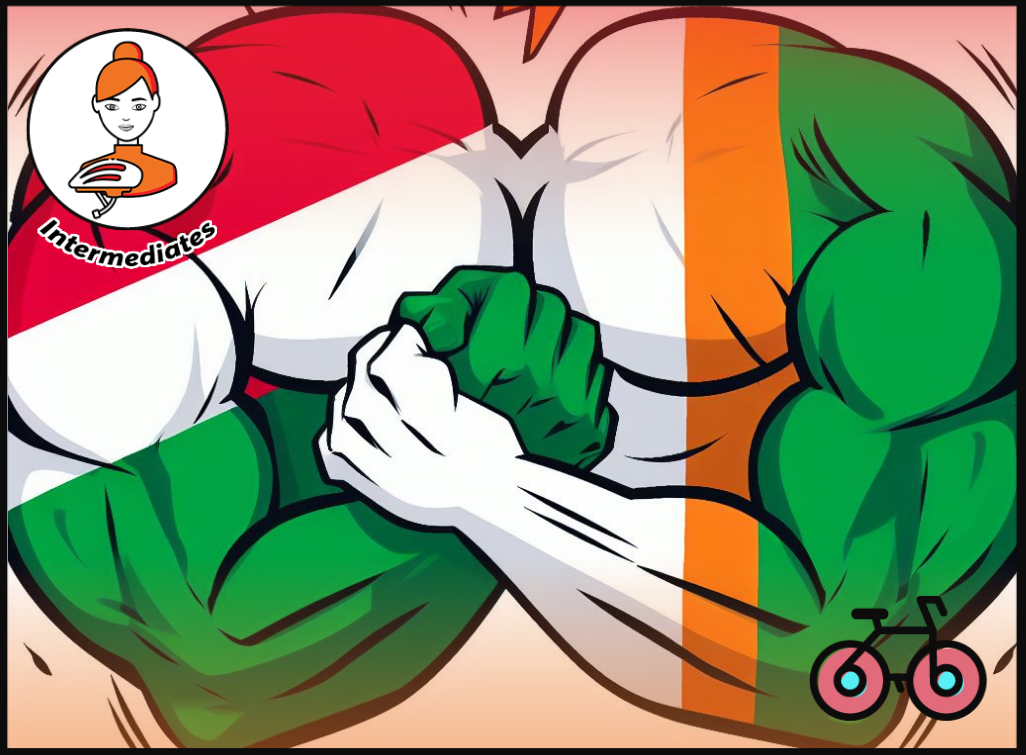

Interactive Brokers Merger – What Does It Mean For Your Portfolio?

Interactive Brokers (IBKR) is one of the largest brokers in the world, with a $37 bn market cap and ‘A-‘ Credit Rating from S&P.

In September 2023, it announced merging its EU operations, and moving all customers to its Irish entity (IBIE).

We don’t know the exact reasons for this move, except the stated efficiencies, but in January 2024, the U.S. ends its double taxation treaty with Hungary, where its second entity was based.

Most of its Central and Eastern European customers were historically assigned to the Hungarian entity (IBCE).

For most IBKR customers, the major difference will be the change of the regulator. IBIE falls under the supervision of the Central Bank of Ireland, whereas IBCE fell under the supervision of Hungarian Central Bank. Both countries have difference Investment Compensation Schemes.

How To Choose A Safe Stock Broker?

Imagine discovering your broker has gone belly-up overnight, leaving your hard-earned investments in the balance. In a market where investors tirelessly chase after low fees, the often-ignored specter of broker failure lurks in the shadows.

The collapse of a broker isn’t just a plot twist in a Hollywood blockbuster—it’s a stark reality that has left many investors stranded and panicking.

Could your broker be next? What safeguards do you have in place?

Here is what you need to know to protect your savings.

Weekend Reading – Is the Fed done raising rates?

How Bankers slice the global pie & why index choices mattes, Is the Fed done raising rates, How Often to Rebalance a Portfolio, A new Index based on business activities rather than domicile, CAPM works across asset classes.

Cracking the Code: How Bankers Slice the Global Pie (2023)

Most investors starting out would be confused to learn that, for example, investing in an MSCI World ETF wouldn’t provide them with a Global exposure.

Equity ETFs can be confusing due to Index Providers’ naming conventions. So, I had a deep dive into how they work, and I hope you can also benefit from it

What Are UCITS Equivalents Of Popular Vanguard Funds?

As a European or UK Investor, you would have to slightly adjust the way to construct a typical two, three or four fund Portfolio using UCITS ETFs.

Weekend Reading – More iBonds & Highest Security Lending Returns

It’s Time to Consider Inflation Adjusted Bonds, Bond ladders with iBonds (Updated with new ETFs), Securities Lending Provides Value. But Is It Enough?, 4 ways to diversify concentrated stock positions, Reports of 60:40’s Death Have Been Greatly Exaggerated, Bill Gross on the End of the Great Bond Bull Market, Visualizing the Future Global Economy by GDP in 2050 and more.

How To Construct a Bond Ladder with iBonds

Have you ever considered matching Bond cash flows with a life event, like buying a house, or kids’ tuition fees, by using an ETF?

iBonds act like regular Bonds. The ETF will mature, and you will be repaid at a predetermined date.

However, they offer several ETF advantages over regular bonds – they trade like stocks, are diversified, and don’t require high investment amounts to get started.

Weekend Reading – What Returns From Vanguard Lifestrategy Can You Expect & New iBonds.

▶ Vanguard LifeStrategy – Updated Return Expectations

▶ Implications of Regime-Shifting Stock-Bond Correlation

▶ Duration matching asset allocations with personal goals

▶ Honey, the Fed Shrunk the Equity Premium

▶ Why is Argentina’s economy such a mess?

▶ On Dividend Investing Strategies

▶ Are Leveraged ETFs Worth the Costs and Risk?

Weekend Reading – How To Park Your Cash: Short-Term Investing Hacks

▶️ Investing for the Short to Medium Term – The new UCITS iBonds ETF

▶️ How to Use Cash in a Portfolio

▶️Dissecting the Investment Factor

▶️Position Sizing: Optimizing for Better Returns

▶️Cheapest destinations for a last-minute holiday this September

▶️Why We Glorify Overwork and Refuse to Rest

Cycling Tibet – Spiritual, Ballistic, Magnificent.

Tibet was the most rewarding part of all my cycling adventures, not only because of physical challenges.

Spiritual Tibet played a big role.

But I quickly realized other aspects that make it a unique place.

This region is the heartland of Nuclear China and a place with extensive minorities including Hui Muslims and Tu Mongols whose ancestors served in Ghenghi Khan’s army.

But China was also the most challenging country I have cycled in.

Weekend Reading – Weak Currencies: How To Avoid Losses

▶ Should You Hedge Currencies?

▶ Should you have commodities in your portfolio?

▶ How Dividends contributed to total returns in different markets

▶ Why China’s economy ran off the rails

▶ Sector composition of the S&P 500 since 1985

▶ If the UK stock market is cheap, why doesn’t it go up?

▶ BRICS is fake

Buying the S&P 500 today? Wait. These 7 Graphs Might Change Your Mind.

As portfolio managers, we are constantly reminded of changes in the world’s economy. This century may not belong to America. And my portfolio needed to reflect it.

15 Years On, We Fall For The Same Tricks – Madoff: The Monster of Wall Street On Netflix (Review)

The 2023 Netflix docuseries dives into the largest Ponzi scheme in history.

Although the scheme was discovered in late 2008, investors are still falling for the same tricks.

Weekend Reading – Bonds Rollercoaster: Fear, Greed, and the Search for Safe Havens

▶ Four Reasons Bond Yields Are Rising

▶ Don’t fret about lower bond prices. Bonds mature at par.

▶ Have Bonds Finally Reached Escape Velocity

▶ Sovereign Bonds: In search of safe havens

▶ The 4 big structural forces holding back China’s economy

▶ Everything & Everyone Underperforms Eventually

Weekend Reading – Best Bond ETFs & 9 Biggest Mistakes Millennials Make

➡️ Market Cap (Weighted) Hated Indexes

➡️ Why Aren’t Investors Selling Stocks to Buy Bonds?

➡️ One of the best ways to build and maintain an investment portfolio is by stress testing different scenarios

➡️ No time to risk- how to pick a bond ETF for the long run

➡️ Visualising the $105 trillion economy in one chart

➡️ Why Aren’t Investors Selling Stocks to Buy Bonds?

➡️ Is Britain really as poor as Mississippi?

No Time to Risk: How To Pick a Bond ETF For the Long Run

Bonds are your shield for medium to long-term portfolios, even when deflation strikes. Ready to master Bond ETFs? Let’s break it down in 5 steps. We have also shortlisted candidates assuming you want to hedge currencies.

Weekend Reading – Millionaire Expat: How To Build Wealth Overseas

➡️Millionaire Expat: How To Build Wealth Overseas

➡️BlackRock launches Fixed Maturity Bond ETFs in Europe

➡️Wall Street Thinks You’re Dumb: The Rise Of Wise Money

➡️How To Determine Your Investment Risk Tolerance

➡️7 Things I Don’t Own in My Portfolio

➡️Vanguard’s perspective on the U.S. credit downgrade

➡️Why does the BlackRock MSCI World ETF exist?

How You Can Cycle The World – A Practical Guide

While you may be here to read about investing, some of you were curious about ways to travel the world on a bike. In 2019, I covered 20k km with a rugged touring setup, favouring it over the sleeker bikepacking style. It let me venture into the wild autonomously for up to a week. Now, I’m into shorter bikepacking adventures.

Here are my key practical insights to get started. But also to lower your cost of travel, in general.

Weekend Reading – Avantis Launches Small Cap International Stock ETF

➡️ Do trend following managed futures impact safe withdrawal rates?

➡️ Is Cash the Best Insurance Asset?

➡️ Investment portfolio examples: asset allocation models for beginners

➡️ Exposing financial charlatans – the YouTube trading course seller

➡️ 7 steps to a better portfolio

➡️ For bond investors, near-term pain but long-term gain

➡️ Avantis Launches Small Cap International Stock ETF

Wall Street Thinks You’re Dumb: The Rise Of Wise Money

Wall Street likes to make a clear distinction between Institutional Investors and Retail Investors. It’s Smart Money versus Dumb Money. But Mass media is largely ignorant of the rise of relatively new two breeds on retail investors.

Exposing Financial Charlatans – The Youtube Trading Course Seller

Financial charlatans pose a significant threat. The danger is twofold: they undermine trust in legitimate financial education and practices, and they may severely impact individual investors’ financial plans and life prospects.

It’s crucial, to expose their practices and keep investors on alert.

Weekend Reading – How To Invest Like The 1%

➡️ The risks of securities lending

➡️The top three misconceptions about the 60/40 portfolio

➡️Buying the S&P 500 today? Wait these 7 charts will change your mind

➡️Replicating Popular Investment Strategies with Equities + Cash

➡️Should you hold cash or bonds rights now?

➡️Dimensional files for Vanguard-style ETF share classes

➡️How to Invest Like the 1%

Weekend Reading – Liquidity vs TER: Vanguard On Real Cost Of ETF Ownership

➡️ Liquidity vs TER: Real cost of ETF ownership

➡️ Planet Boglehead: Vanguard Struggles to Win Over the World

➡️ Live and Let Buy: Which Bond ETF Types For Your Objectives?

➡️ Gold prices – why didn’t they move over the past 2 years?

➡️ Should I Hedge With Non-Traditional Investments?

➡️ How well do commodities hedge against UK inflation?

➡️ Updated equity risk premiums & country premiums

➡️ When are rate hikes going to stop?

Weekend Reading – FAT FIRE: Guide To A Luxurious Early Retirement

➡️ Fat FIRE: The Comprehensive Guide to a Luxurious Early Retirement

➡️How to Spend More in Retirement

➡️Show Us Your Portfolio – A sit-down with Larry Swedroe

➡️How America Saves? Vanguard’s in-depth analysis

➡️Do property prices really double every 10 years?

➡️Why “everything aligns” for Japanese stocks

➡️Congrats, you’ve just survived the longest bitcoin bear market ever

A Banker’s Safari: Navigating The Zoo of Factors with Berkin and Swedroe’s Guide to Factor-Based Investing

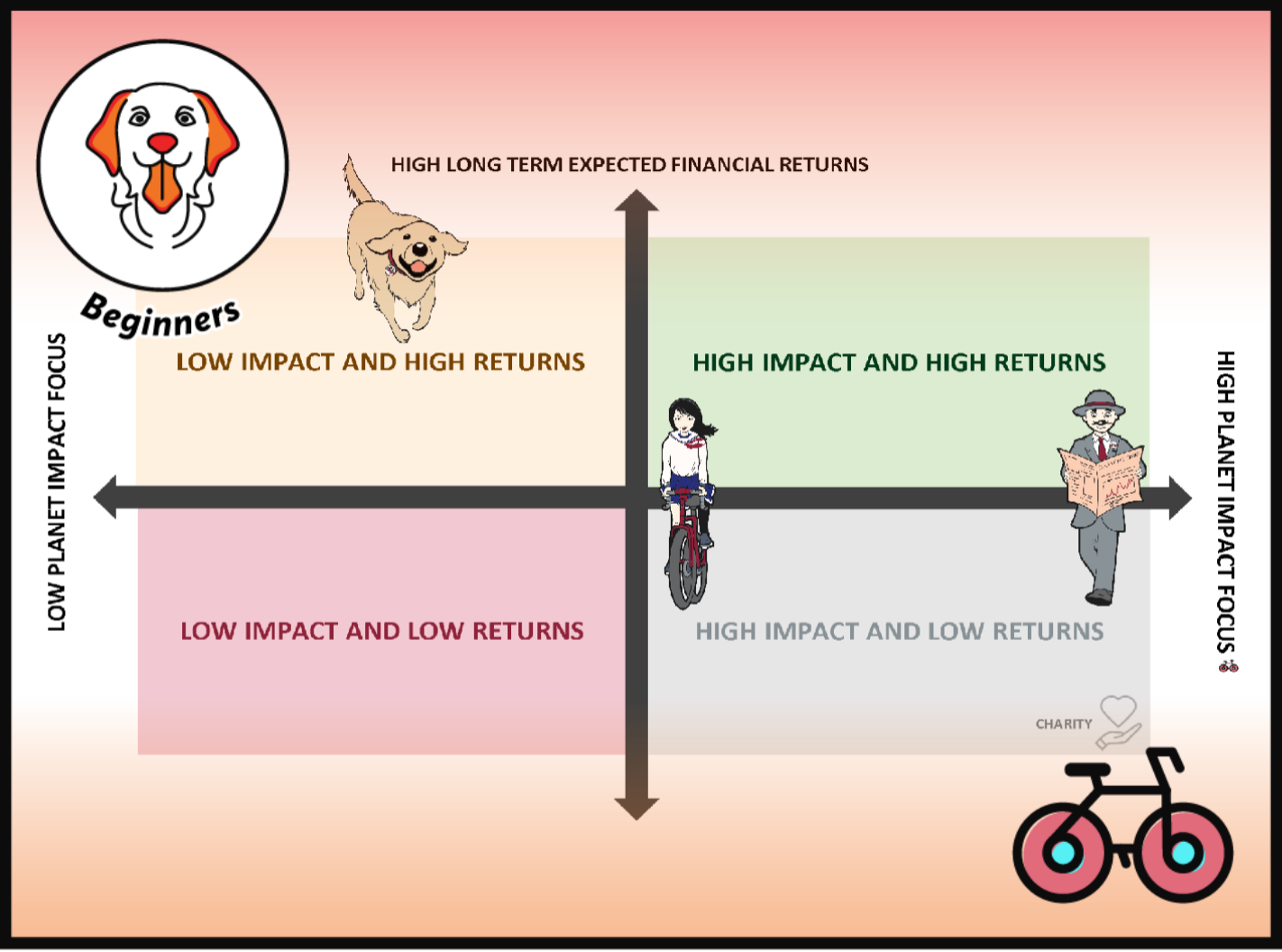

For our readers itching to outdo the average ‘Golden Retriever’ or ‘Cyclist’ portfolio, craving an edge with more diversification and potential for higher-than-average returns, we highly recommend starting with Berkin and Swedroe’s “Your Complete Guide to Factor-Based Investing”. Designed for our ‘Banker’ readers with an advanced grasp on investing.

Weekend Reading – How to survive the next market crash

➡️ Surviving The Next Bear – Strategies to Profit from a market crash

➡️ Fact or Fiction? Test Your Knowledge About Investing During a Recession

Inflation – Cash & Commodities:

➡️ What Role Should Cash Play in Your Portfolio?

➡️ Commodities diversification: Is it worthwhile?

➡️ Correlations and returns: What happens if inflation remains elevated?

➡️ You no longer need access through an approved advisor to access DFA’s brainpower

Weekend Reading – Invesco launches Europe’s Cheapest FTSE ALL-World ETF

Invesco has now the cheapest FTSE All World ETF

Is passive investing better than active investing? A critical review.

What can the CIA teach investors?

How Cheap (or Expensive) is the Stock Market Right Now?

In conversation with Dr. William Sharpe – Capital Asset Pricing Model & More

5 steps to a minimalist portfolio

Warren Buffett explains why passive investing is a winning strategy

Ride Morocco – The California of the Muslim World

In June’21, Morocco reopened after having contained most of the pandemic in an exemplary manner.

Here are the 6 things that I got used to and that I will dearly miss.

And a teaser of what awaits, should you choose Morocco as your next destination!

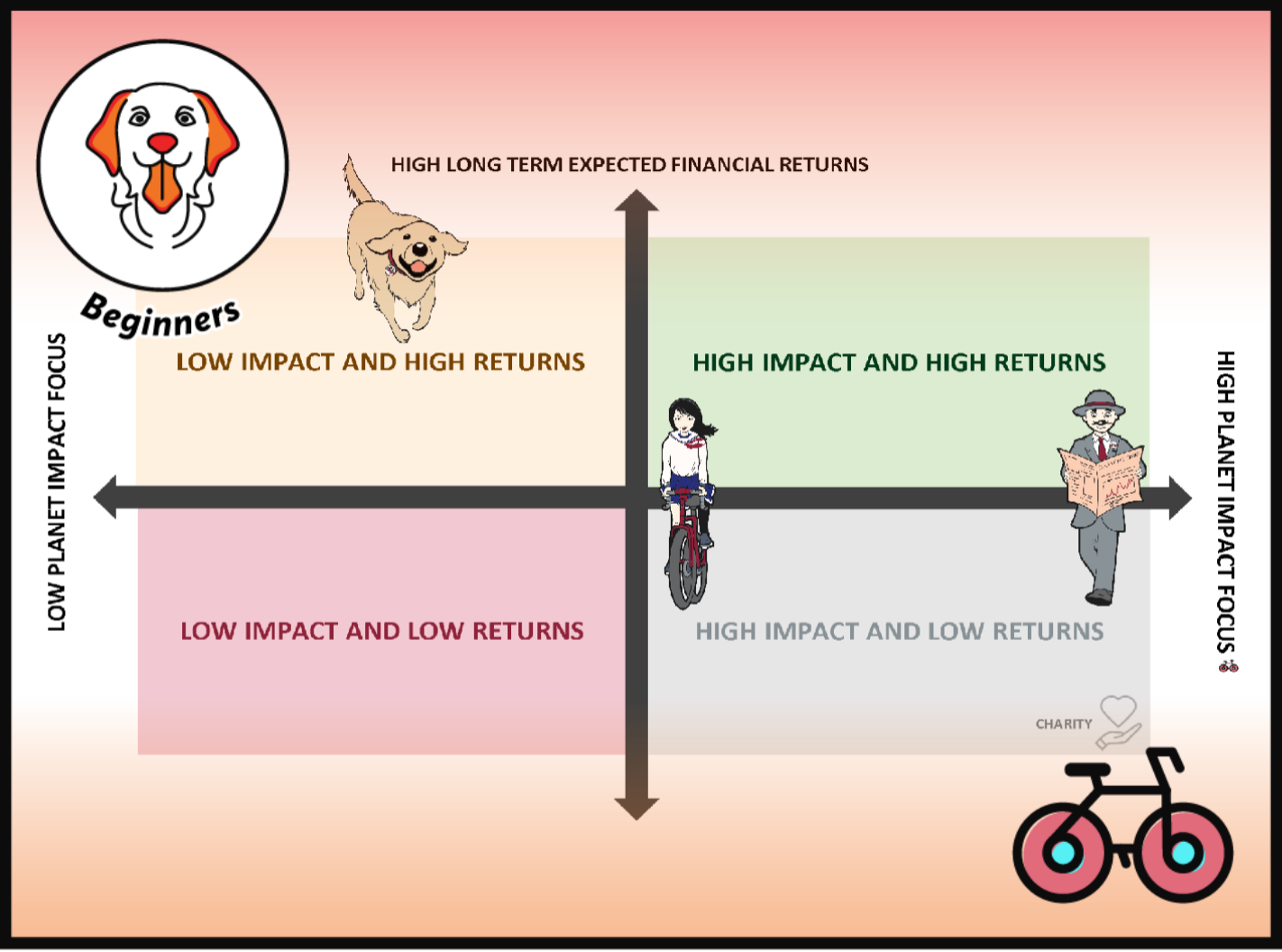

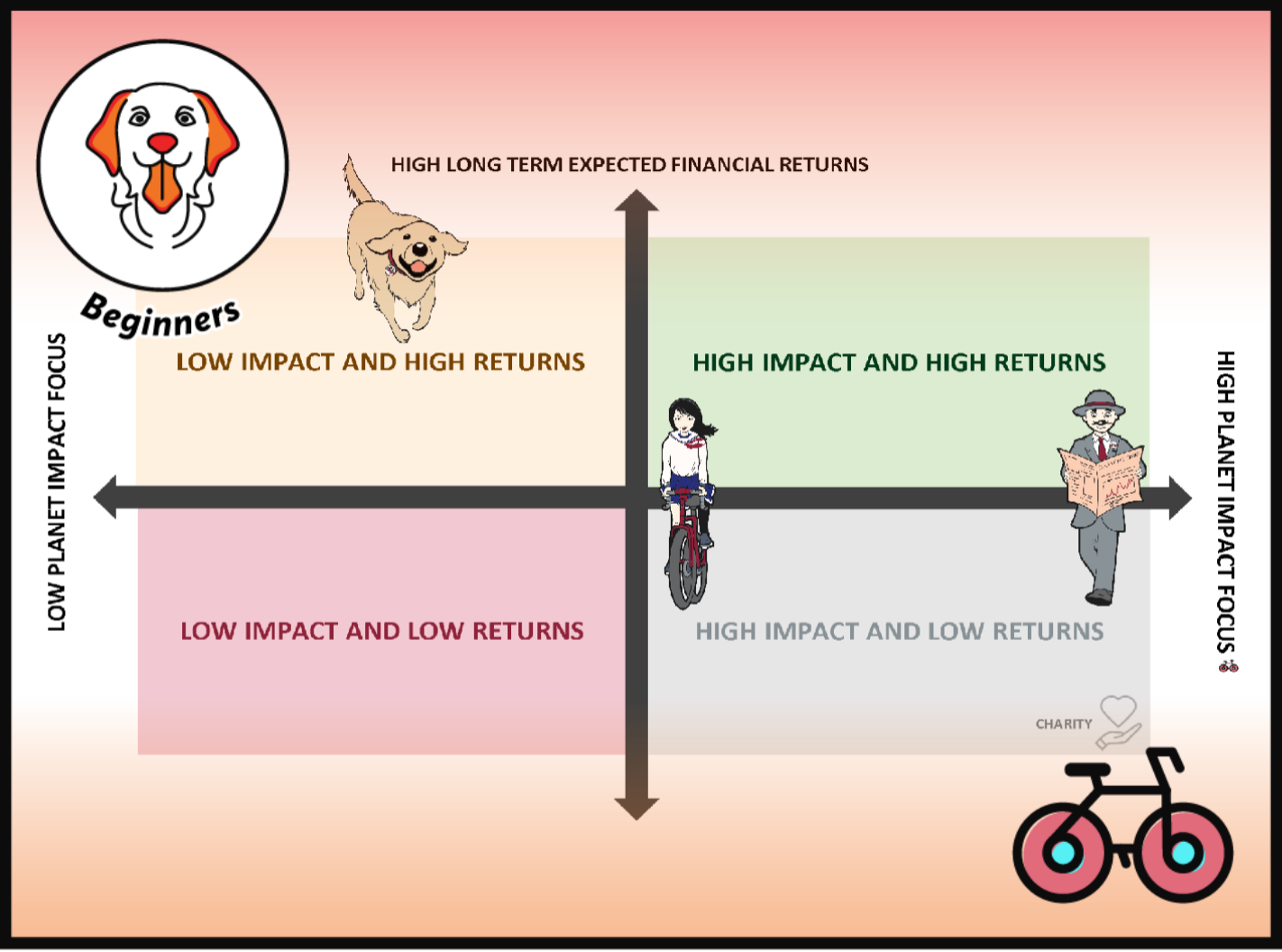

The Reason Why Sustainable Investing Will Underperform

Wall Street doesn’t want you to know that ESG Ratings are not about protecting the planet. And yet, over the past few years, ESG investments have, sometimes significantly, outperformed. Today, let’s bust the second myth. Despite all you read on this topic, this outperformance will not last.

Your Money or Your Life (Book Review)

Your Money or Your Life by Vicki Robin and Joe Dominguez is one of the oldest and most well-known books about financial independence. While it teaches you how to manage your money, it takes a much broader approach than many other personal finance guides.

In fact, the program created by the authors is designed to change almost every aspect of your life. Let’s have a look at whether this classic, first written in 1992 and updated in 2008, is still relevant for readers today.

Weekend Reading – Vanguard On Best Portfolio Rebalancing Frequency

How to rebalance your portfolio including Vanguard study on frequency, The risk of owning equities declines as the time horizon increases, or does it? Become a passive Investing Ninja – the definitive guide to slashing ETF Costs and Taxes, Is the Bear Market Over?

Become A Passive Investing Ninja – The Definitive Guide to Slashing ETF Costs and Taxes

We haven’t come across one definitive guide that allows you to become the Ninja of slashing Investing Cost. Here is where we step in. Slashing them, one by one. Whether they are visible, or not – ETF Costs, Taxes, FX Fees or Invisible Costs – when trading ETFs, including spreads.

Cash Is Not Enough: Why To Hold Bond ETFs Despite Price Rollercoasters.

Everyone has an idea about how the Stock market works. Yet, Bond markets are widely misunderstood. By Retail Investors, they are quite often labelled as ‘uninteresting’, to put it mildly. But Bonds are important for the overall success of your investment strategy.

For instance, most investors are still surprised to hear that Bond ETFs can lose 20%+ of value. Bonds can also ‘pop’ during a crisis when they gain as much in value in a few weeks.

Let’s play with a simplified Bond ETF calculator to get an intuitive sense of what is the upside and downside of Bond ETFs. Is keeping cash is preferable?

Weekend Reading – 10 bad takes on this market, including 5 Stocks Driving It

10 bad takes on this market, including 5 Stocks Driving It,

Investment Mistakes Even Smart Investors Make and How to Avoid Them, Why Down & Sideways Markets are Bullish

Regret optimized portfolios and optimal retirement income.

From Japan’s Alaska to Japan’s Hawaii: 7 Reasons To Cycle Japan

7 things I really miss after leaving the land of the rising sun, and a short summary of over 4,000 kms on the road!

Check out my favorite 3 money-hacks to make the most of your journey including travelling anywhere in Japan for $100!

Weekend Reading – What’s the best long-term investment?

What’s the best long term investment?

Effects of 5-10% Allocation to Gold

What is the optimal level of duration – and does it even matter?

Slashing FX costs. In which currency should I Buy ETFs?

The Problem With Investing In Bond Indexes

Things professional investors should say but cant

Slashing FX costs! In which currency should I buy ETFs?

There are four currency types when looking at an ETF are the underlying assets’ currencies, the hedging currency, the trading currency and the Fund base currency.

However, only the first two of them are really important. But by knowing the other two can save FX fees.

Weekend Reading – How To Protect Your Portfolio: Gold & Bonds

Decoding ETF Names & Discovering Tools To Find Them

Excellent Interview with Prof. John Y. Campbell on Long-term Investing Decisions

What’s the Best-Performing Asset Type During a Recession?

Gold – In six of the last eight recessions, gold outperformed the S&P 500 by 37% on average

Interactive Brokers – Mayday for Margin Lending

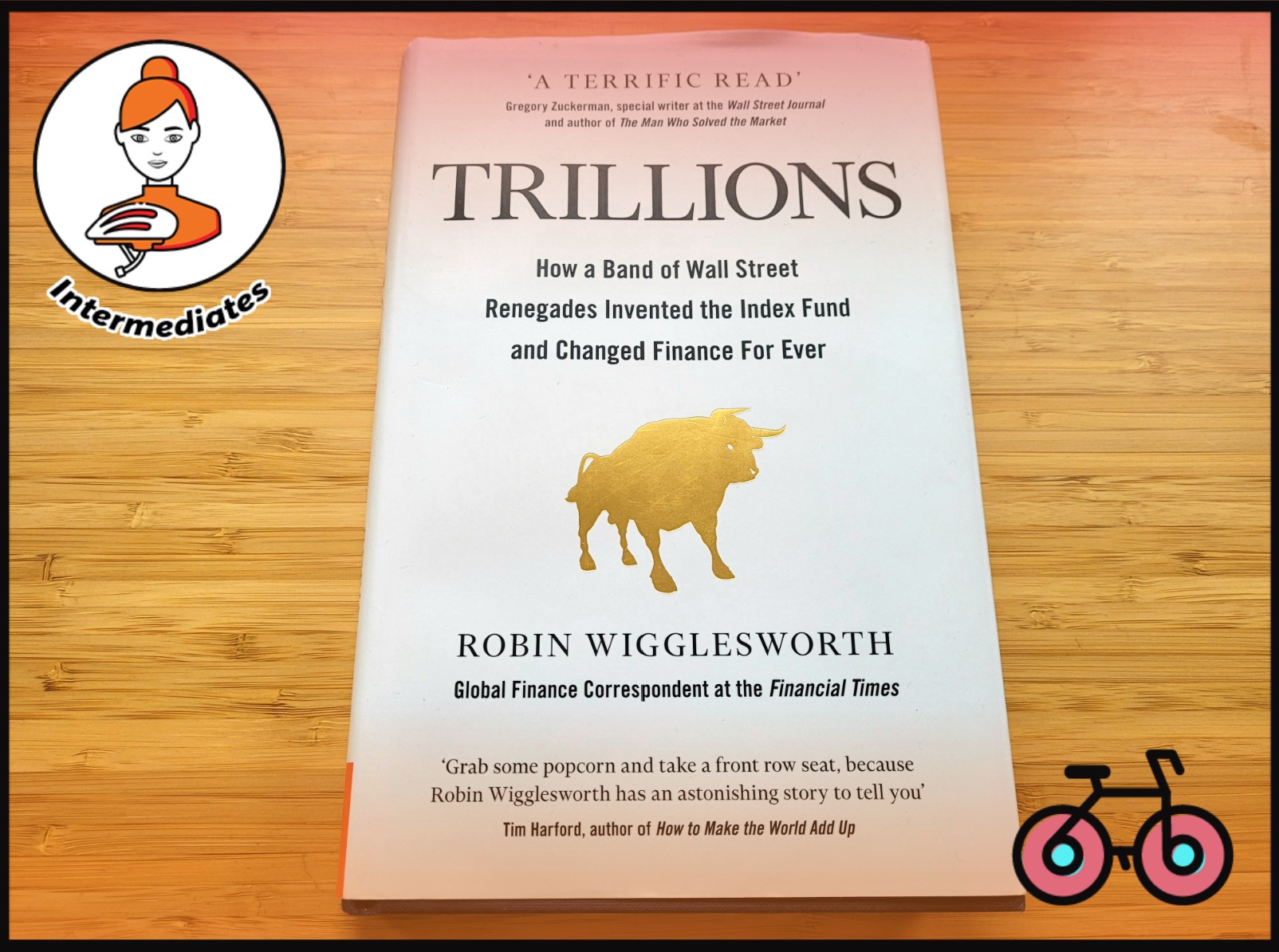

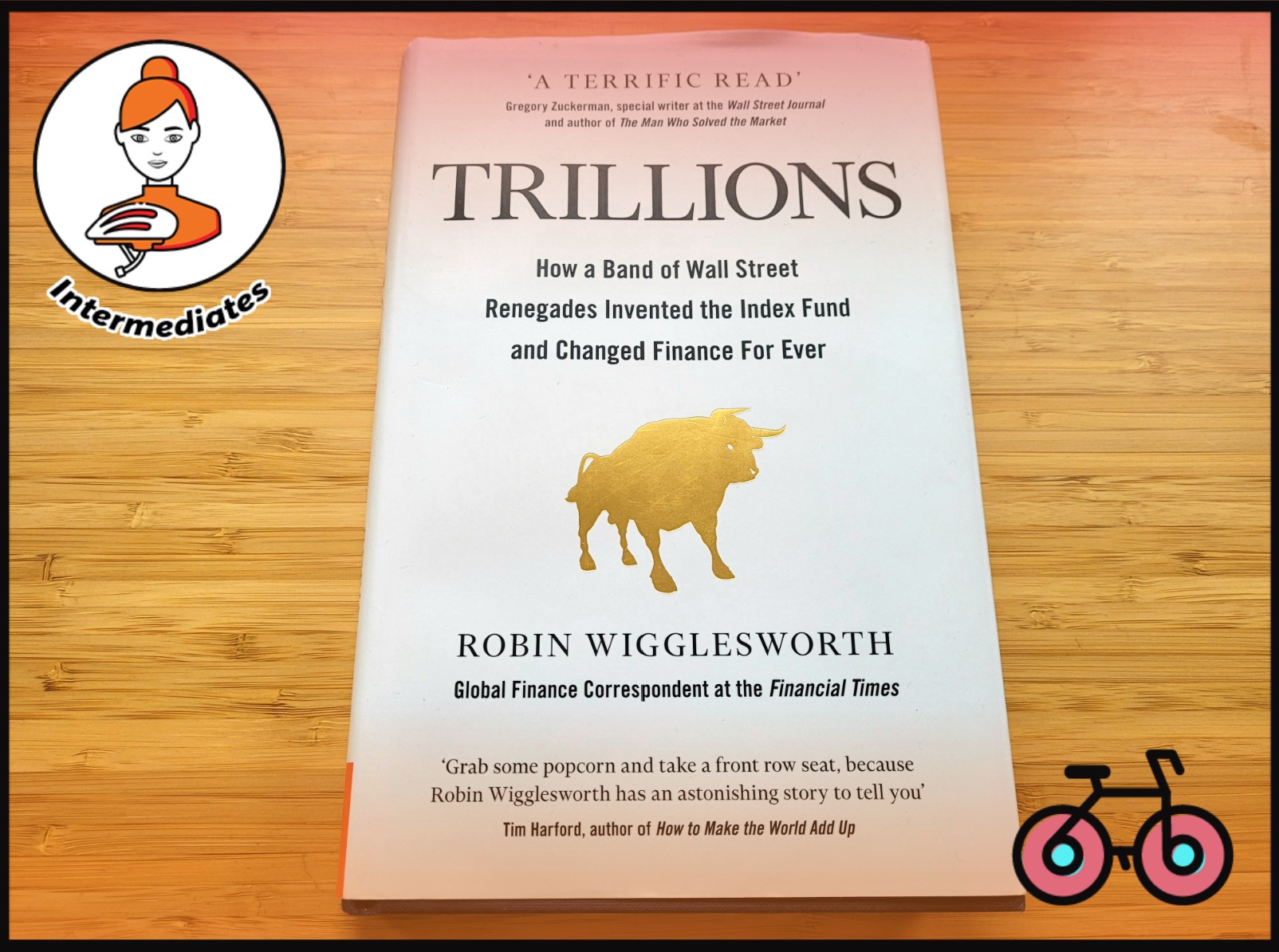

Trillions – The People Behind Your ETFs (Book Review)

The picture from the 5th Solvay Conference held in Brussels in 1927, is probably the finest collection of human brain power in the history of mankind. 17 of the 29 attendees, including Einstein and Curie, were or would go on to become Nobel Laureates. Unfortunately, the world of Finance lacks these selfless figures. Except that the 1970s saw the advent of the low-cost Index Fund.

Invest Your Way to Financial Freedom (Book Review)

Great books on money management and financial freedom investing are hard to find, especially ones with no ulterior motive.

That’s why Invest Your Way to Financial Freedom by Ben Carlson and Robin Powell is an exciting addition to the European personal finance space.

An Apolitical, Data-driven Guide To Sustainable Investing.

Introduction to Sustainable Investing including ESG, SRI or Green Investing. We also cover a summary of articles in this guide and highlight which articles may be useful for you depending on your objective and level of knowledge.

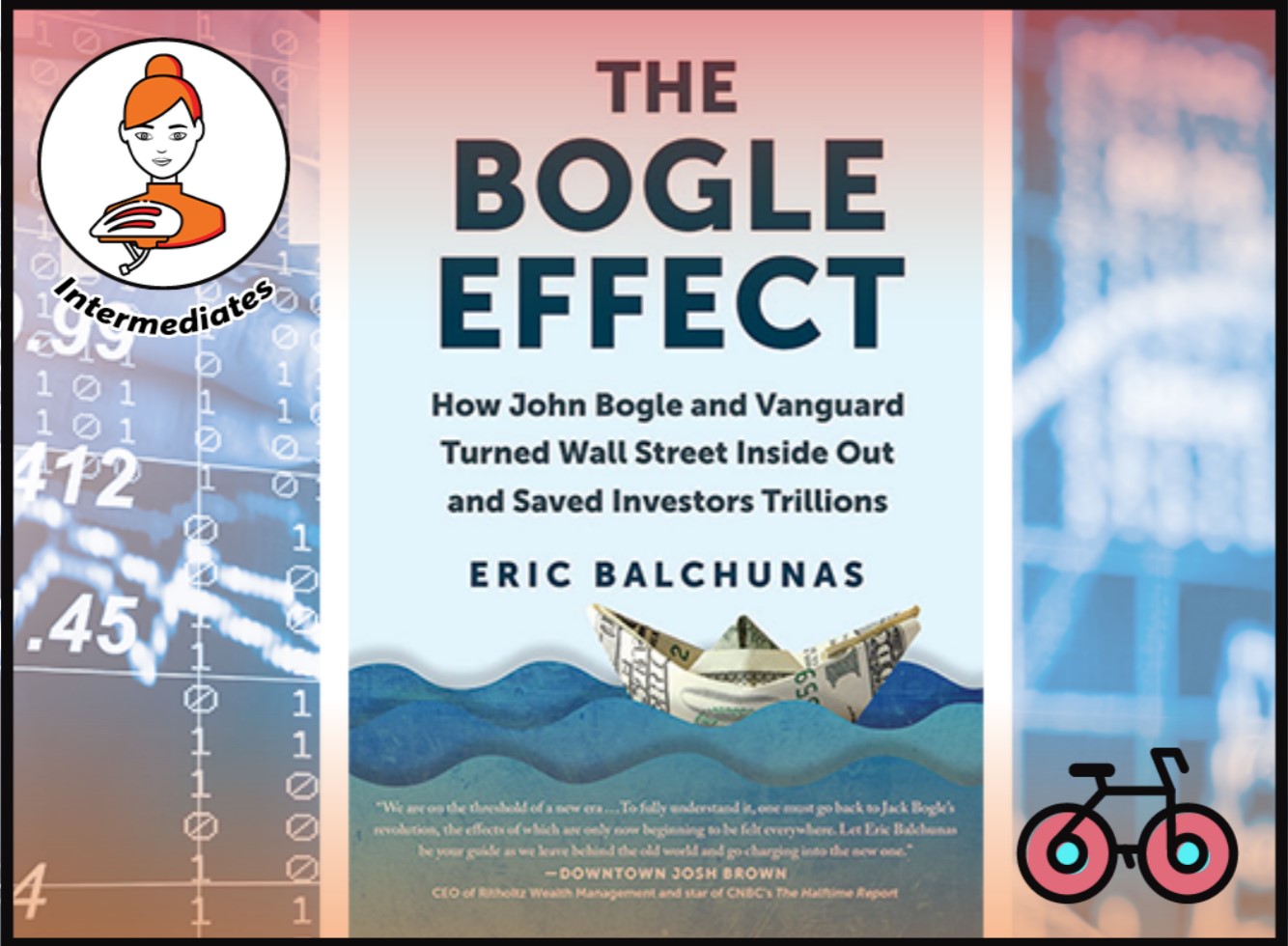

What Is The Bogle Effect? (Book Review)

There are a lot of misconceptions about Bogle, especially amongst his fans and the Bogleheads community.

Eric’s book is not a biography of John Bogle in the conventional sense nor is it an introduction to his claim to fame, that is, index investing.

Instead, the book may be characterized as an attempt to chart the impact the Bogle on the history of the mutual fund industry.

A Random Walk Down Wall Street (Book Review)

A Random Walk Down Wall Street by Burton G. Malkiel is a bestselling personal finance book that takes the reader on a journey through financial history and teaches about past and present investment strategies.

It is extremely well-known and has been sold over 1.5 million times, earning its author great respect in the financial world.

Money Explained on Netflix (Series Review)

The five topics explored are “Get rich quick”-schemes, credit cards, student loans, gambling, and retirement.

There is a strong US focus, but many of these issues are applicable to people around the world, so the series could be worth watching regardless.

It focuses on explaining the issues and the history behind them as well as demonstrating what researchers and policymakers are doing to counteract them.

Understand the Global Financial Crisis (Movie Review)

The 2008 event still impacts all of us nowadays and has changed the world of banking forever.

For this reason, I’ve set out to watch a trilogy of movies covering this time period, in the hopes that they could help me understand why there was a crash, what happened, and what implications the downturn has for us today.

Today, I’ll share my experience of watching The Big Short, Inside Job, and Margin Call.

Raph will also add his perspective as someone who spent a few years on an ABS desk managing some of these Bonds.

Investing Demystified (Video Series & Book Review)

Investing Demystified: How to Create the Best Investment Portfolio Whatever Your Risk Level by Lars Kroijer educates the general population on how to best invest.

The author is a former hedge fund manager, so he has spent years of his life analyzing the markets and learning about portfolio theory. As a result, the information in this 2017 guide is backed by the most current research into how markets work.

Kroijer pays special attention to making his concepts applicable for investors all over the world, and you can implement his rational portfolio no matter where you live.

Three Sustainable Investing Strategies That Work

Despite the expected underperformance, some investors may want to express their Sustainability views in their portfolio.

How can you have an impact on the planet?

Let’s have a look at three ways to invest sustainably.

Sustainable ETFs X-Ray – Comparison Of Holdings

We look at what investments you will be exposed to when investing in iShares and Vanguard ESG ETFs. Investors may be surprised to learn what these ETFs include. These factor tilts are a significant driver of returns.

How To Choose A Sustainable ETF Benchmark?

How much control do you want to give to the Index Provider?

Most of ETFs, including iShares track MSCI Indices. We compare them to FTSE benchmarks used by Vanguard.

What Is Sustainable Investing – the BS Meter

When investors mention Sustainable Investing, confusion and relativism reign. That’s because hardly anyone uses a consistent framework of thinking about this topic. There are four main types of sustainable investing.

ESG Ratings Uncovered – What Wall Street Doesn’t Want You To Know

ESG Industry tricked investors. Greenwashing by companies, you may think? No, there is a more fundamental issue. ESG Ratings are the exact opposite of what you think they are.

Weekend Reading – Who Should NOT Invest in Total Market Index Funds?

Beware of These Fund Red Flags,

Should we be starting to think more about deflation than inflation next year?

Making the case for international equity allocations, How Should NOT invest in Total Market Index Funds?

YTD Global Factor Performance.

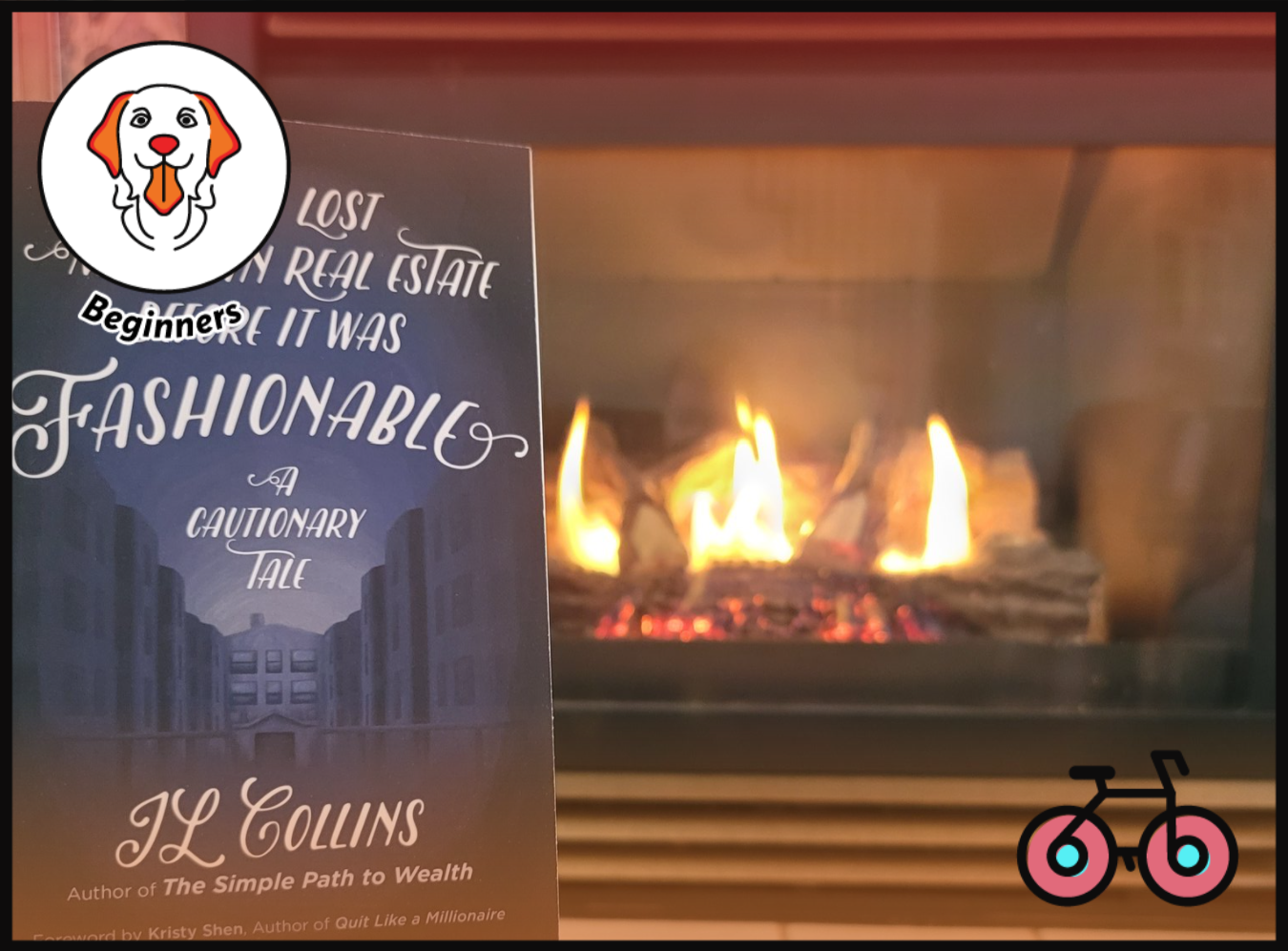

How I Lost Money in Real Estate Before it Was Fashionable (Book Review)

How I Lost Money in Real Estate Before it Was Fashionable by JL Collins tells the story of his disastrous condo purchase in the 1970s and 80s. The short book demonstrates how, contrary to popular opinion, real estate isn’t always an amazing investment and that potential homeowners should be critical before buying.

My Baby Steps Into Crypto (Movie Review)

I watched three films and read one blog post to find out what crypto is all about.

-But How Does Bitcoin Actually Work?

-Cryptopia – Bitcoin, Blockchains and the future of the internet

-Trust No One: The Hunt for the Crypto King

-WTF is the Blockchain?

In today’s article, I’ll share my learning journey and discuss whether my perception of blockchain and cryptocurrencies has changed as I have learned more.

Starting Your Journey to Financial Independence (Movie Review)

Reading 300-page books about financial independence isn’t for everyone. But fortunately, there are countless documentaries and short films out there that aim to help you manage your money more effectively.

Today, we will have a closer look at three: Playing with FIRE, The Minimalists – Less is Now and Early Retirement in One Lesson.

Easy, But Boring Money – How to Reduce Withholding Tax?

To reduce the withholding tax, a global investor must choose an ETF domicile that has an advantageous tax treaty with the US, since US Equities have a weight of over 50% in global Equity Funds.

For European Investors, this domicile is Ireland with a 15% US withholding tax on US dividends.

Money – A User’s Guide (Book Review)

Money: A User’s Guide by Laura Whateley was published in 2018 and aims to educate young people between the ages of 18 and 40 about how to best handle their money.

It provides a good basic overview, the book is not focused on financial independence or investing to create an income.

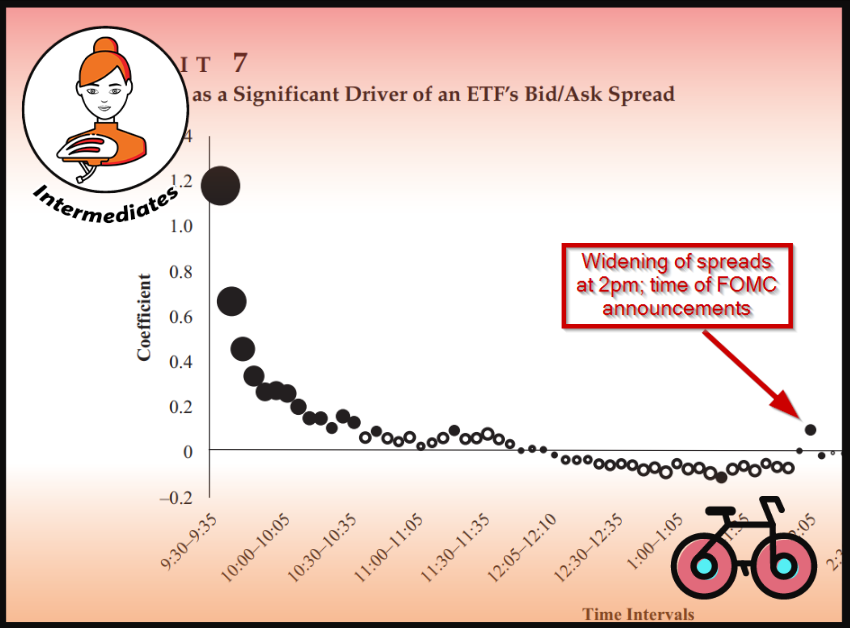

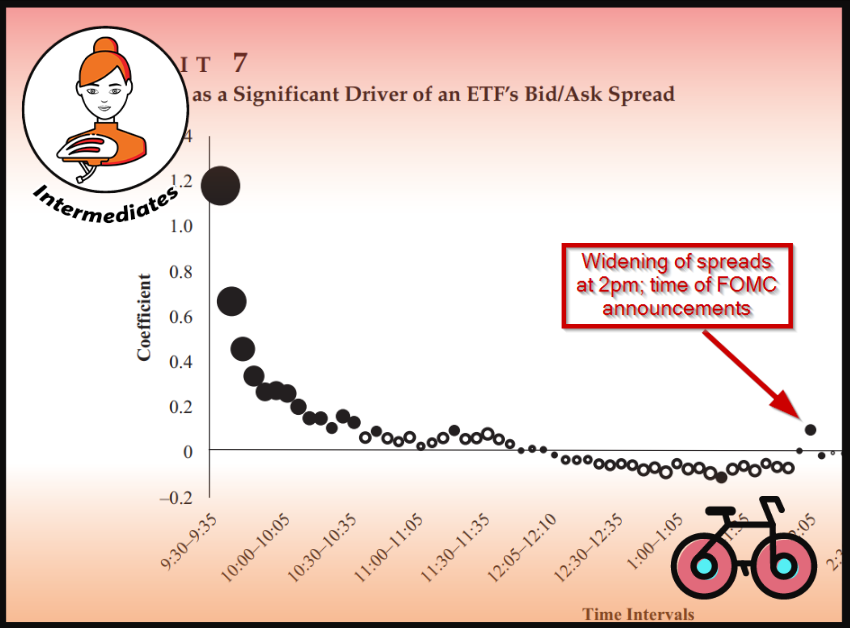

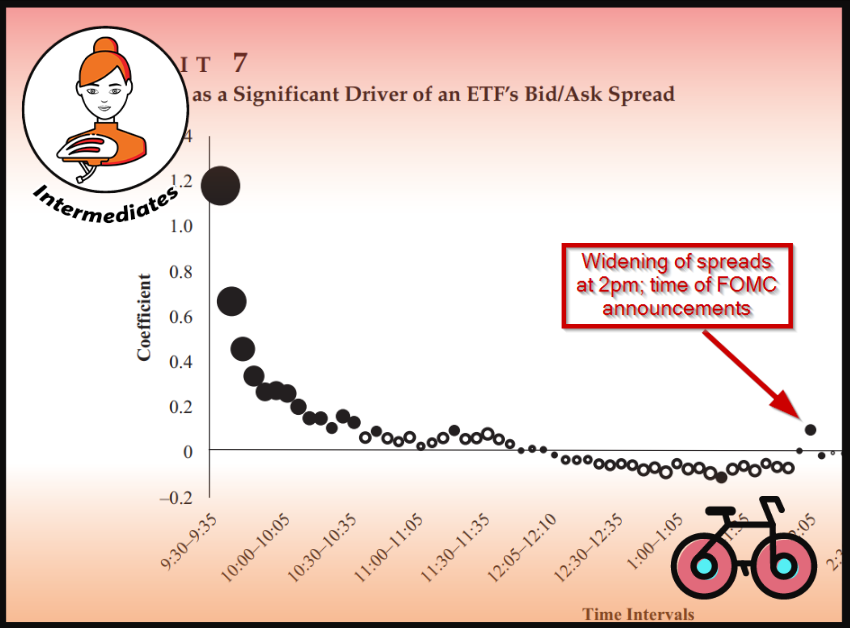

Weekend Reading – Don’t Buy ETFs When The Market Opens

What are the best times of the day for ETF investors to trade? The Top 20 stocks in the S&P 500 contribute the most to its return,

The Berkshire Empire: Hidden truth of Buffet & Munger’s success, How To Get Rich – Netflix Series Review

How to avoid the inheritance disasters seen in US drama Succession

Taking control of your finances while being in a variable income Job and more.

How to Get Rich (Netflix Series Review)

Today, let’s look at why most people are so bad at managing their finances and where you and your loved ones can start to change it. This is a must-watch for those who are new on a journey but also, for those that are just minimising all spending, like some in the FIRE community, to postpone a rich life, that may never come.

Weekend Reading – Are Short-Term Bonds a No-Brainer Right Now?

What Happens After a Bad Year in the Stock Market? The Biggest No-Brainer Investment Right Now? Actually, maybe not. Thoughts on BlackRock’s decision to ditch the traditional 60/40 portfolio About Gold and Tradeoffs and more.

The Millionaire Next Door (Book Review)

This book is a classic in the personal finance space.

In it, the authors detail what they have learned after interviewing countless millionaires and their families.

But are the concepts helpful in today’s world, 25 years later? And can European investors apply the lessons learned from American millionaires?

Just Keep Buying (Book Review)

What makes the book stand out? Our readers won’t be surprised to learn that most of Nick’s work can be found in other books we’ve reviewed. In fact, parts of the book have been published on Nick’s own Of Dollars and Data blog.

But with this new compendium, Nick adds some fresh perspectives.

Most importantly, he organizes the essential knowledge into actionable steps and does it in a pleasant way.

The Little Book of Common Sense Investing (Book Review)

The Little Book of Common Sense Investing by John C. Bogle, published in 2007, is an account of why the author is in favor of using index funds when investing. In essence, the advice is simple: invest in a broad market index fund and hold for the long term.

But Bogle goes into detail about why such a strategy will produce above-average results and what factors affect your investment the most.

The Simple Path to Wealth (Book Review)

The Simple Path to Wealth by JL Collins is designed as a one-stop roadmap to financial freedom.

Since its publication in 2016, it has sold over 400,000 times and been translated into several other languages, including Japanese and German.

Weekend Reading – The Portfolio To Live Longer

How much should you pay for an ETF?

Why to focus on long-term market results,

Investors are still their worst enemy, Ranking real residential property prices in 57 countries from 2010 to 2022, The Portfolio to Live Longer, On mid-career pivots.

Work, Play, and Surf: 5 Beach Getaways for Digital Nomads from Okinawa to Koh Lanta

Over the past year, Raph and I worked remotely from Digital Nomad places in Asia and Europe.

Sometimes illusionary in a corporate environment, work-life balance can also be tricky on the move. We tested different coworking spaces, but sometimes adapted a work-from-home style when options were limited.

Time off while travelling can be incredibly rewarding. We wanted to bring out what each place offers to make your choice easier if you have no family obligations, are in a flexible job like Tech or Digital Marketing and are keen to embark on a new adventure.

Bon voyage!

How Much Should You Pay For An ETF?

Based on Vanguard research, investing through an ETF that has a 0.6% higher fee can lower the chance of a successful early retirement by more than half.

But how should you choose the cheapest ETF? Especially, when one has a better historical performance and the other a better forward-looking expense ratio? Here are some questions, that European and UK Investors frequently ask.

Weekend Reading – DEGIRO Increases Fees, SPDR ETF becomes the cheapest Global Fund . Best Definition of Early Retirement.

The Golden Rule of Investing: Role of Gold in a portfolio, SPDR cuts TER to 0.17% for its ACWI ETF,

DEGIRO adding €1 fee to Core ETF selection, In conversation with Naval Ravikant: 4 life traps you need to get out of now, Value Investing: Solid Approach to Building Wealth? With Wes Gray.

Handpicked Selection of Best Equity ETFs

For someone who is not familiar with ETF benchmarks and criteria, selecting an ETF has become a headache. Comparison websites generally list thousands of ETFs.

Here is where we step in. Investing should be simple. The below selection is the best at what they do and covers most needs well.

Weekend Reading – Visualising 90 years of stock & bond performance

Best Links – 4 bond strategies that matter, Sound Financials Are The Ultimate Deep Value Investment, Sam Altman on GPT 4 & the future of AI, Advice for Anxious Investors, Retiring with Purpose and more.

Weekend Reading – Vanguard: Invest now or temporarily hold your cash?

Best Links – Vanguard on Lump Sum vs. DCA – Why a lump-sum strategy makes sense for most investors, Handpicked selection of the best equity ETFs, Rules of the money game , In conversation with Cliff Asness on Quant Value Investing and more.

Weekend Reading – Second-biggest bank collapse in U.S. history

Best Links -Silicon Valley Bank Collapse, The Inside Story of How Vanguard & Wellington became partners, The Morgan Stanley Chat GPT FAQ, Should Investors be wary of corporate bonds? How Long Does It Take For You To Double Your Wealth and More.

The Definitive Guide To Equity Index Investing

We approach Equity Index Investing by (i) Showing investors what matters when thinking about different asset classes and (ii) Shortlisting the very best ETFs as a starting point for their analysis.

Weekend Reading – Asset Returns since 1900 & Warren Buffett’s Shrinking Alpha

Best Links – Credit Suisse Global Investment Returns Yearbook, Jp Morgan Guide to China, Berkshire Hathaway Shareholder Letter, Microsoft vs. Google, How To Die With Zero, OpenAi founder on AI existential risk, the 8 best spreadsheets to track your net worth.

Weekend Reading – When Taiwan Falls & Vanguard: Personalised Inflation Hedging

Best Links – The United States and China are dangerously close to a military war. Personalised Inflation Hedging by Vanguard, Reviewing portfolio performance, interview with the king of quants, Charlie Munger on Tesla, Alibaba and Bitcoin and more.

Explain it to a Golden Retriever – A Review of World ETFs

In Investing, building a portfolio is simple. If you can’t explain it to a 6 year old your investment portfolio may need revision – Here is all you need to know about World ETFs.

Weekend Reading – Vanguard: The Making Of An $8 Trillion Empire

Best Links – Story of Jack Bogle and Vanguard on Youtube, Why Investing Like a Millionaire Won’t Necessarily Make You a Millionaire, Understanding Country Risk, Dissecting the AI bubble of 2023, Stock buybacks don’t matter and more.

Weekend Reading – How Far Are We From Passive Peak?

Best Links – Vanguard on why Europe’s Energy Crisis is far from over, are we near the peak of passive investing – opinion from Man Group and Martin Schmalz on Bloomberg, How should you Invest your money with Nobel Prize Winner Myron Scholes, International ETFs’ Benchmarks, The Toolkit for the worst case scenario – Job Loss and much more.

Weekend Reading – Vanguard On How To Integrate Commodities Into Your Portfolio

Best Links – Vanguard On How To Protect Your Portfolio With Commodities In The Short And Medium Term, Seven Principles For Successful Investing, Live, Love, Later – The Ultimate Early Retirement Checklists, How To Become The Architect Of Your Life and more.

Financial independence planning in 2023 – The Ultimate Early Retirement Checklists

Our first checklist with will get you started. We also created the 3L checklists to help you organize your life.

The first ‘L’ is Living Life. How do you plan around life essentials while reducing unnecessary costs? The second ‘L’ is Loving Life. Is the usually forgotten L. It’s not only about the destination, but also the journey and what defines you today. The third ‘L’ is Later Life. How to invest wisely for Early Retirement.

Weekend Reading – Vanguard’s Guide to Wellness & Sound Ways to invest Sustainably

Best Links – Effective Strategies to Invest Sustainabily, Vanguard’s guide to designing your life for financial wellness, Commodity Returns, How Much to spend in retirement, all about Sleep.

Vanguard ESG Global All Cap UCITS ETF – ETF Review

Vanguard ESG Global All Cap UCITS ETF – Review: Past and Expected Performance, ESG and SRI Screening, sector composition compared to parent benchmark.

iShares MSCI USA SRI UCITS ETF – ETF Review

iShares MSCI USA SRI UCITS ETF – Review: Past and Expected Performance, ESG and SRI Screening, sector composition compared to parent benchmark.

The Long Game – Historical Market Returns & 2023 Expectations

2022 Asset Class Returns Review and 10-year Long Term Returns Study.

Since 2013, World Equities have gained over 185% and returned 6.4% annually.

It’s probably also time to rebalance your portfolio. Sell some of the winners, buy some losers.

International Stocks and Small Caps look attractive, but while this is great for learning, remember the game’s rules and try to remain forecast-free.

Shape the future of Bankeronwheels.com

2022 marked the second full calendar year of Bankeronwheels.com.

We truly appreciate all support received and will work hard to make 2023 more impactful!

Here are some takeaways from our survey. We also cover in details parts of our plan for next year.

Affiliate Links

We are currently working on a series of methodologies related to broker selection.

In the meantime, if you are comfortable with choosing your broker and want to support our website you can sign up using one of the affiliate links (when available below).

Do I Need A Credit Card in Europe and the UK?

If you were to believe everything that the folks in the personal finance industry say, using credit cards is pretty much a no-brainer. After all, you get free money for a month. But most of the advice given is US-centric. Does the same advice also apply to European residents?

Financial Jargon Explained By Kathrin

Personal finance can be confusing, especially if you’re new to it.

ETFs, Passive Investing, Permabears or FIRE – what do all the terms financial bloggers use actually mean?

When I first developed an interest in managing my own money, it took me several years to learn about the various concepts and strategies.

Now, I like to think I have a working knowledge of the most important terms.

How much do you know about investing?

How much do you know about Investing? How much do you know about the world of investing? In this quiz, you can test your knowledge

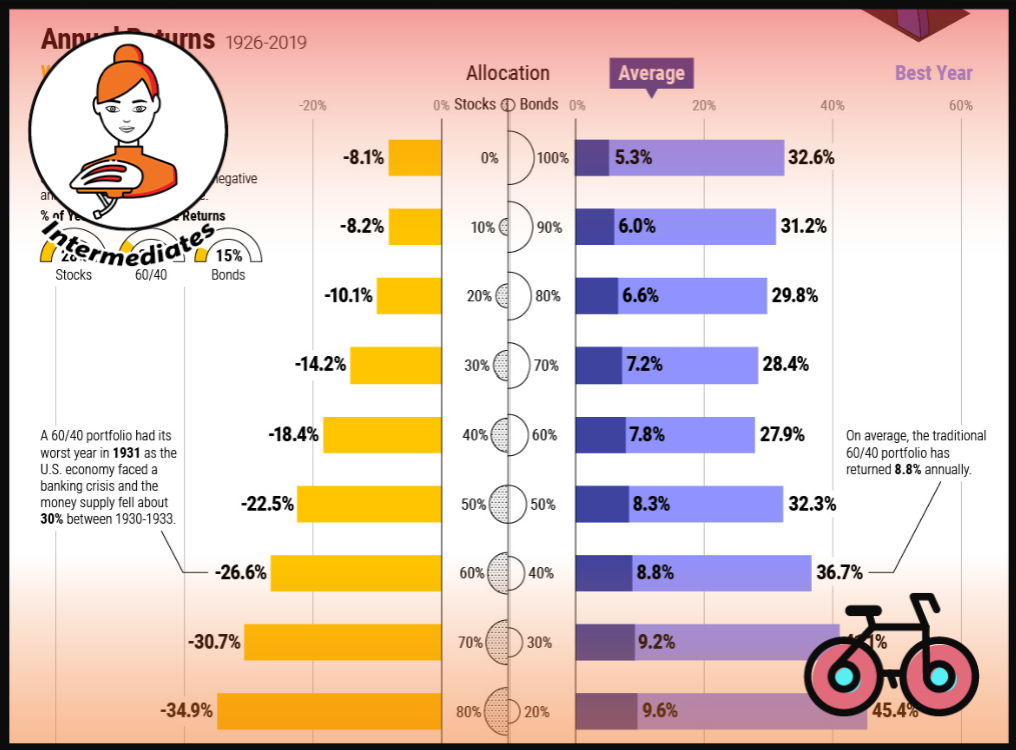

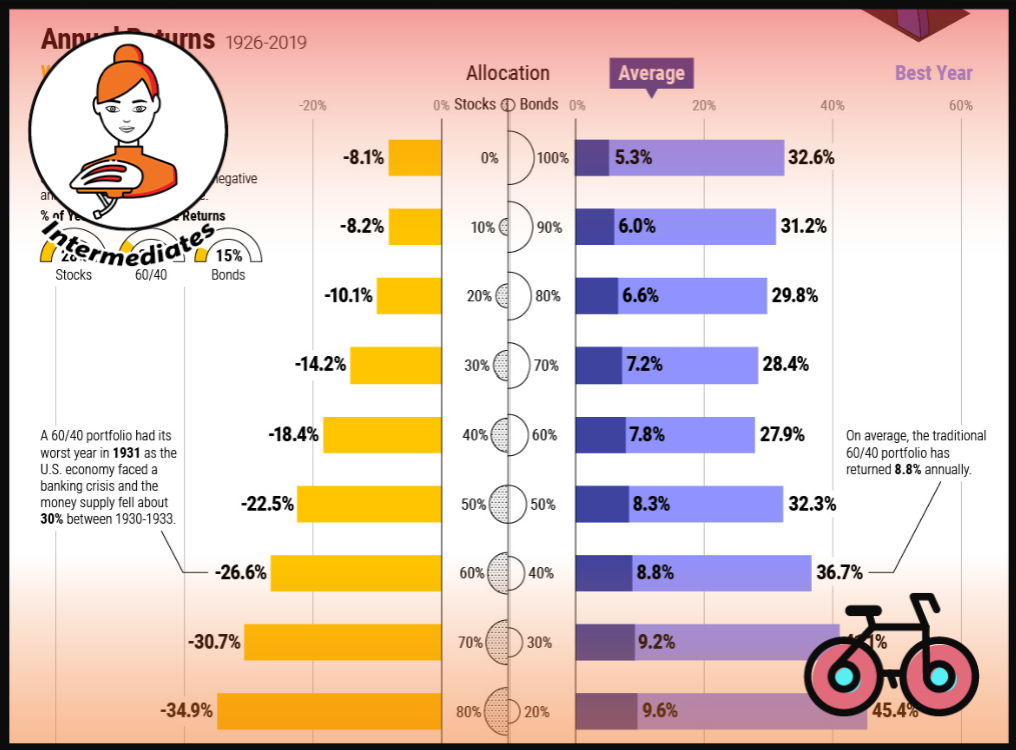

Do I need Bonds in my Portfolio? Understand how Bonds improve the odds of higher returns.

Do you want to buy cheap Equities? Holding Bonds may precisely give you that opportunity through re-balancing. Unless you can put your cash aside for 10+ Years you may want to check how Bond ETFs eg. iShares AGG can increase your returns and reduce risk of high losses.

Here is a simple comparison of 100% S&P 500 Portfolio vs. the most commonly used 60% S&P 500 40% Bonds Portfolio

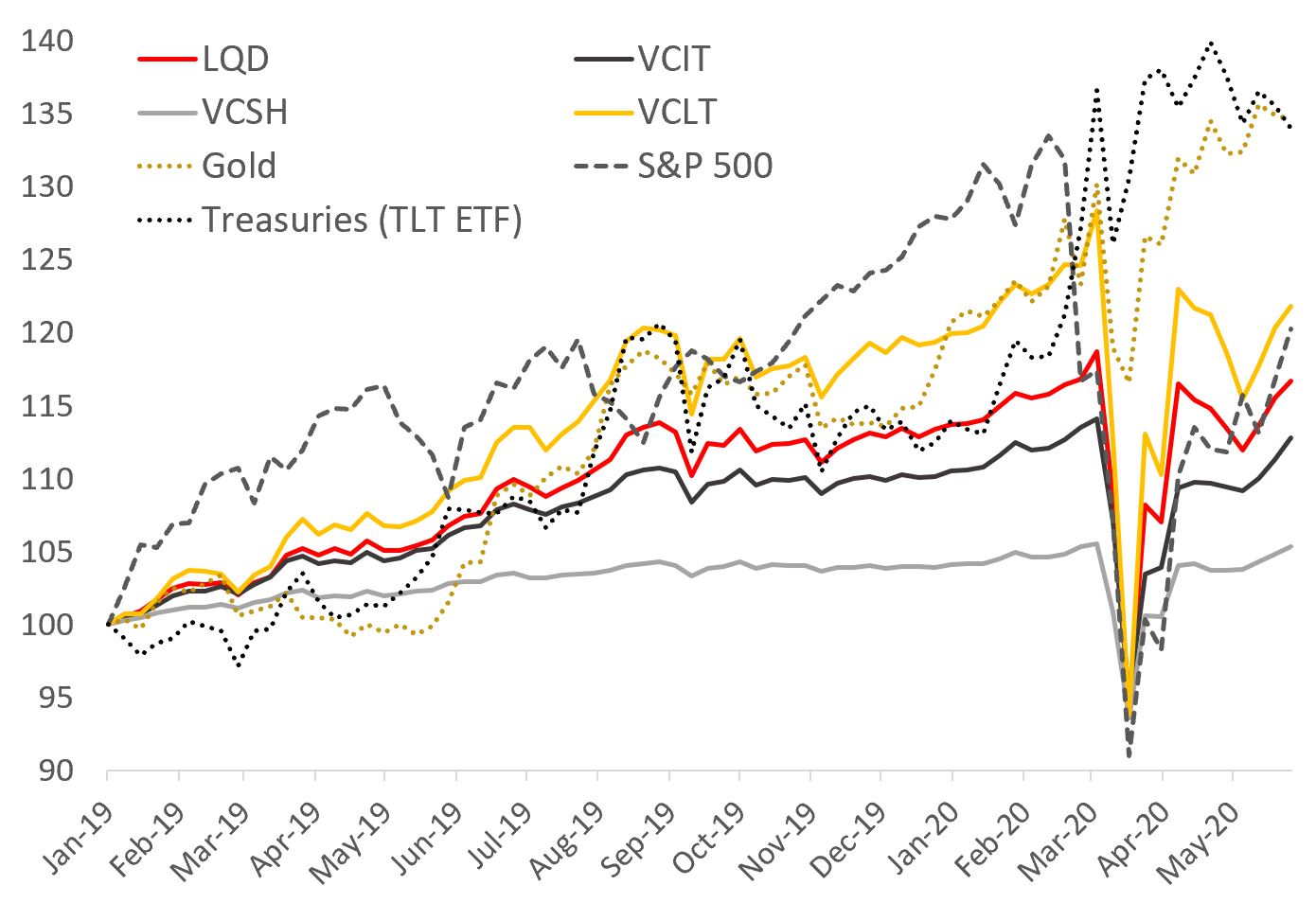

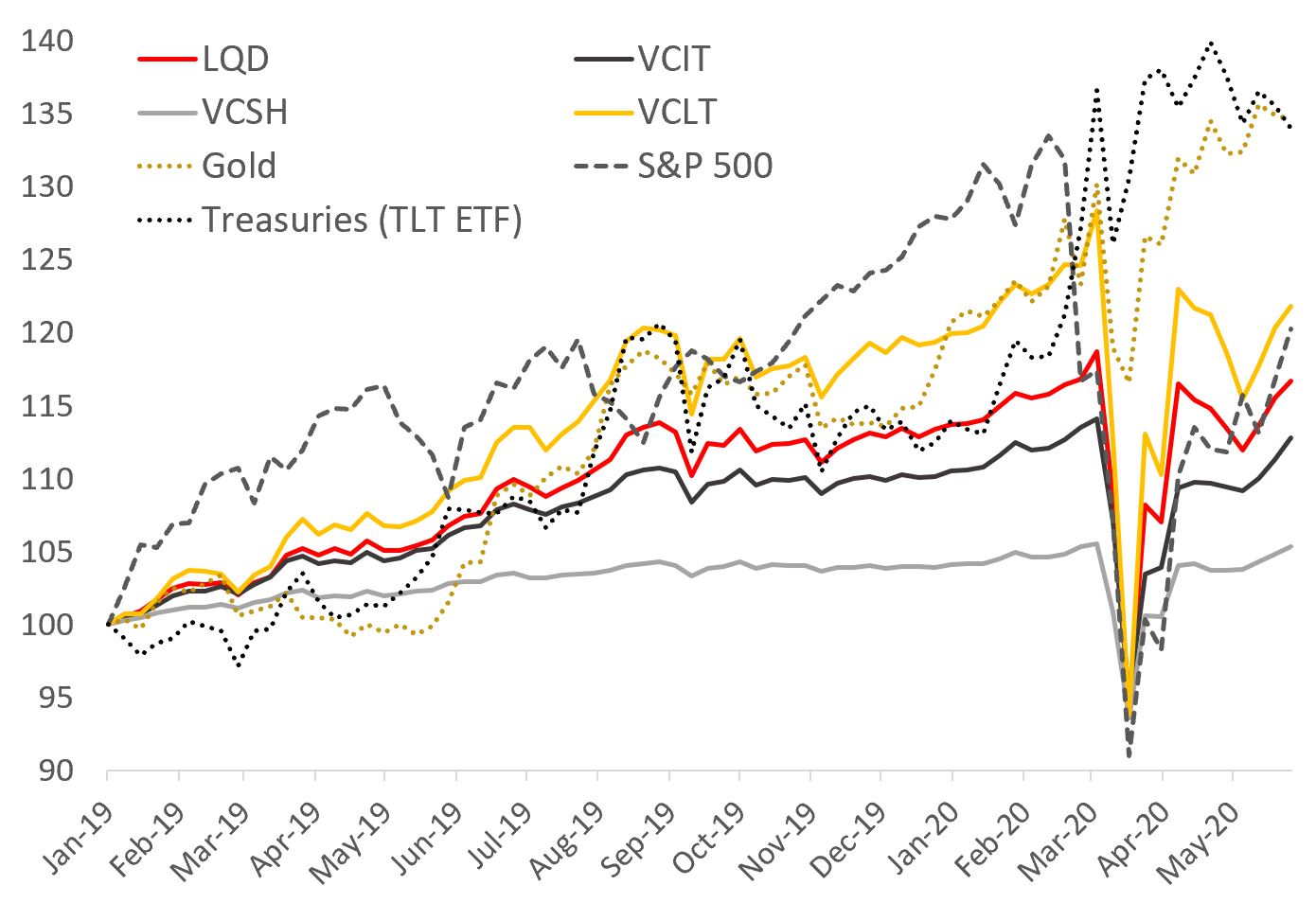

What to expect from US Treasury Bond ETFs in 2020

If you had Treasury ETFs in your portfolio going into 2020, well done! The YTD Returns range from low single digits for Short Term US Treasury ETF to over 30% for long term treasury bond ETF and have performed remarkably well during the Coronavirus Bear Market. However, the current situation is somewhat asymmetric. Read what are the risks.

What Do Tour De France Winners and Your Portfolio Have In Common?

Ah, compounding, the eighth wonder of the world, the solution to all problems, and the hidden secret of life.

But is it really all it is touted to be, or like all cure-alls, something that sounds great only on paper?

Is Vanguard the Best ETF Provider?

In 2008, Warren Buffett, the Oracle of Omaha, threw down the gauntlet to his friends over at the elite hedge funds. The challenge?

He stated that, with all their genius and intellectual firepower, hedge fund returns could not beat the returns given by the humble S&P 500 Index Fund over a nine-year period. The consideration? A mere million dollars.

The Long Game – Historical Market Returns & 2022 Expectations

2021 Asset Class Returns Review and 10-year Long Term Returns Study.

Over the past decade, World Equities gained over 320% and returned 12.4% annually.

It’s probably also time to rebalance your portfolio. Sell some of the winners, buy some losers.

In fact, this is what Vanguard’s model implies.

Can you make 10x with Crypto Tokens? I tried for you

Over the past decade, crypto has grown into a $2 trillion market cap industry and it has been through a few booms and busts.

Chances are it isn’t going away.

It remains a highly speculative asset class but as you can see, it now takes longer for Bitcoin to increase 10x in value.

How about tokens?

I analyzed the risk involved.

A Moment On The Tube. Financial Independence as a Self-Employed – The Discovery.

When financial independence first became popular, most people interested in the concept were engineers or those in stable, high-powered jobs. But in recent years, the movement has attracted more people from all walks of life.

An Alternative to FIRE. Becoming FREE – Financially Relieved and Entirely Engaged.

The first time I came across the concept of FIRE, I was thrilled. It opened up a world of possibilities, very far from the usual narratives surrounding me for most of my life.

But as I started digging into the topic, a couple of things were puzzling me.

Vipassana Meditation And Investing

Humility is usually associated with poverty, for example as it relates to Buddhist Monks. It may sound counterintuitive that humility makes you richer, but it does.

Bankeronwheels.com – TOP 10 in 2021

2021 marked the first full calendar year of Bankeronwheels.com.

While most the content is still relatively new, a few pieces have generated significant interest in 2021.

I have tried to select the TOP 10 amongst them, in case you missed some.

How to protect against Inflation

If your portfolio is already set up to reach your goals and hedge against most risks, returns should offset any inflation in the long run.

But there may also be a chance that central banks won’t get the job done to slow down inflation. If you think that’s the case, extra protection may be worth considering.

Here are the best ways to protect against unexpected inflation.

Going on a green off-piste – BlackRock’s ESG alternatives to LifeStrategy ETFs

Blackrock ESG Multi-Asset ETFs use iShares ETFs to provide access to stocks and bonds according to three risk profiles – conservative (MACV), moderate (MODR) and growth (MAGR) – with the aim of delivering a total return.

Before you Invest – Long Term Investor Checklist

Ready to create your investment portfolio? Is there anything you may have missed? Run through the Investment Checklist before buying ETFs

Bond ETF Calculator – Understand impact of rising Interest Rates

Bond ETF Calculator that helps to understand impact of rising Interest Rates on ETF Total Returns

You only live twice – How to ride a bull market

A few weeks ago, one of my best friends started making life-changing money from the markets.

Best techniques to Rebalance your Portfolio

I must confess I didn’t think much of portfolio rebalancing until I studied it more closely. And from my observations, this applies to a lot of people – even bankers.

Bankeronwheels.com – TOP 10

Bankeronwheels.com TOP 10 in 2020 2020 marked the launch of Bankeronwheels.com While the content is still relatively new, a few pieces have generated significant interest

Crash course to simplify your portfolio – 3 aspects to watch for High Impact Asset Allocation Strategies

Investing is more about following sound principles than knowing all the details – simplify your portfolio with these asset allocation strategies to improve performance and time you need to dedicate to portfolio management. Here is how to clean up your portfolio from asset classes you don’t need

How to invest in stocks during a Market Crash?

These are the 10 Rules they have learned

During the March Stock Market Crash pretty much all my family members and some of my friends asked me how to invest in stocks. Given the current market turmoil, there is an increasing appetite for buying stocks. This is what you need to know should another crash materialize (e.g. should the liquidity problems turn into solvency problems in the wider economy later this year)

Yes, short term investing is more difficult but you can be smart about it (5 year investment plan)

Are you planning on Investing for a few years e.g. house down payment a college fund or a wedding and wondering how to best deploy your savings?

Here are some very simple ways to invest that can also include some of your favourite asset classes without compromising your overall goals

Investing for Financial Independence? Pay attention to Key 12 Asset class returns

Asset allocation is typically the most important driver of portfolio performance (up to 90%). You can learn about the wider markets and the fact that being unfamiliar with an asset class is not always an excuse for not including it in your portolio mix – we tend to have a ‘domestic’ and ‘familiar asset class’ bias and that’s why a lot of investors just focus on domestic Equities

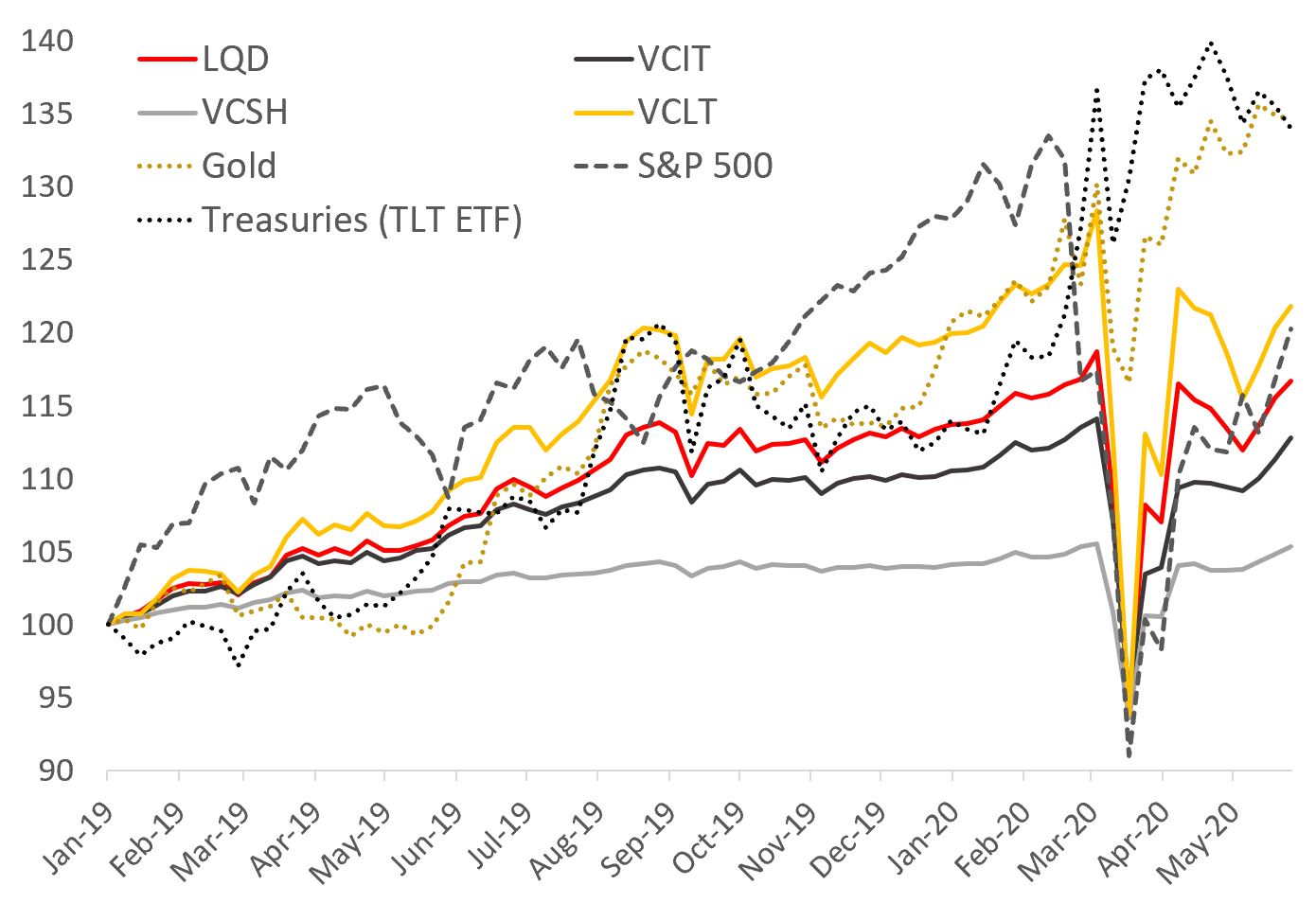

Looking for Safe Income? FED showed the way – TOP 3 Corporate Bond ETFs reviewed (LQD vs VCIT and VCSH)

Looking primarily for Income and diversification rather than portfolio protection? Invest alongside the FED in Investment Grade Corporate Bond ETFs. All you need to know – Coronavirus Risks, Returns, Yields, Price Performance during COVID-19 and GFC

Should I Invest in one go?| Lump Sum Investing vs. Dollar Cost Averaging

2 out of 3x deploying a lump sum of money immediately is better than Dollar Cost Averaging (~2% better returns). Here is what you need to know.

Are Bond ETFs Safe? Here is what happened during Coronavirus Crash to Fixed Income Index funds

Which are the Index Funds that the FED is currently buying? Are Bond ETFs safe? Here is what you should know about ETF price discounts. We analyse what happend to Fixed Income Bond Funds during Coronavirus Crash

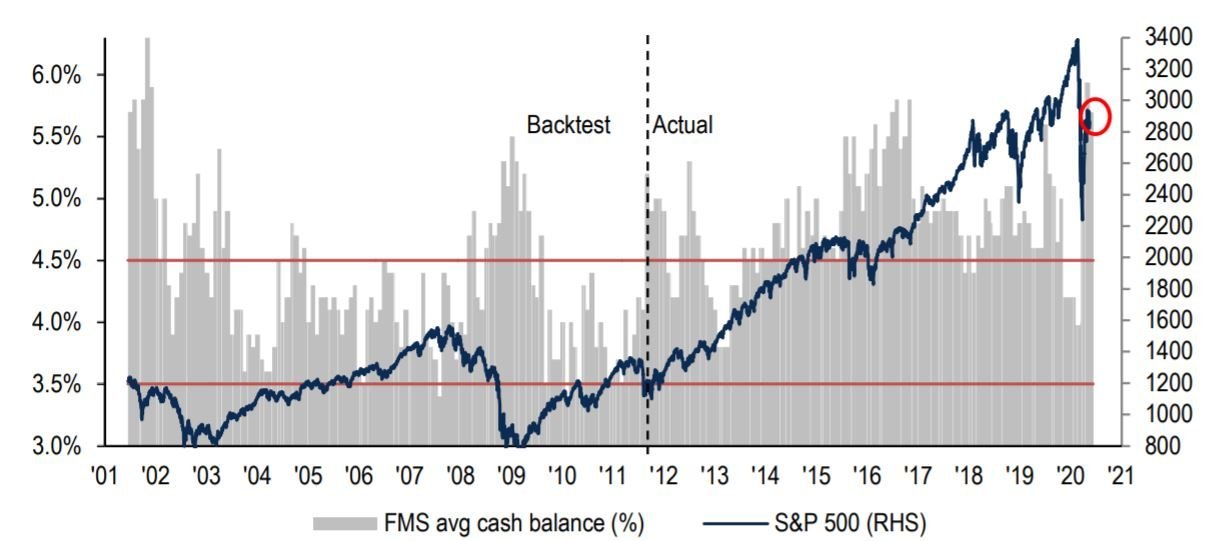

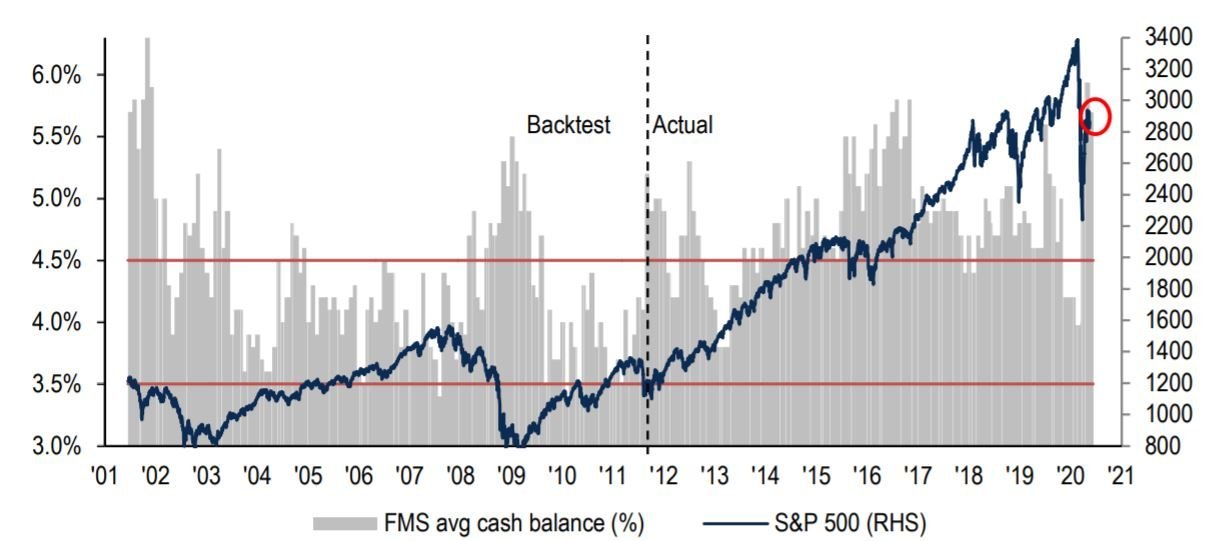

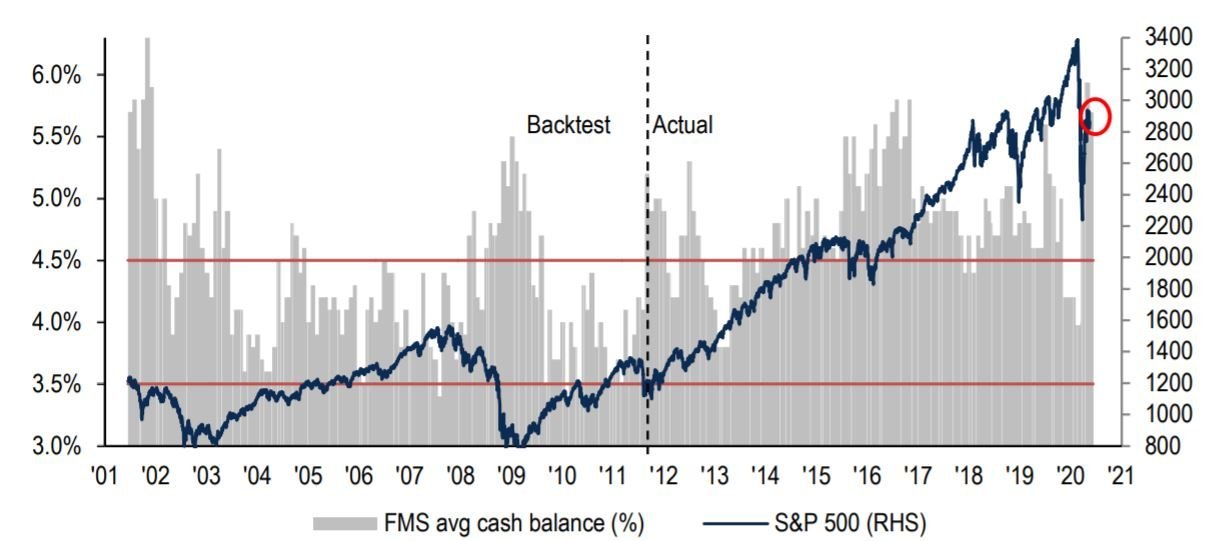

COVID-19 Asset Allocation | Did 68% Fund Managers get it wrong?

Asset Allocation: Bank of America Fund Manager Survey found that 68% think this is a bear market trap – did they get it wrong? Most bought sectors and jurisdictions are…

COVID-19: Keep investing even if your monkey brain wants you to stop

Sometimes we may base our decisions on fear but we need to keep being rational. Earlier last year I was in Hokkaido’s bear land close

10 Investing Mistakes You Should Avoid

10 Investing Mistake You Should Avoid “Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays

Powerful Low Budget Tips – An Adventure Cyclist’s Perspective

Powerful Low Budget Tips – a long distance cyclist’s perspective Having cycled close to 20,000 kms over the past months in different parts of the

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

TOP TECHNICAL DEEP DIVES

Cracking the Code: Decoding ETF Names & Discovering Tools To Find Them

If you read about Investing from a US source you know how easy it is to invest in North America

And yet in Europe and the UK, selecting an Equity ETF can be a bit of a different ballgame.

Not only is Europe more fragmented. For instance, the second-largest ETF provider in the US, Vanguard, doesn’t even cover 5% of the market in Europe. There are also oaspects like currencies or dividends.

But it’s also never been easier to buy ETFs. By doing some initial research you can avoid life-long fees charged by Robo and Human Advisors.

It will make you substantially wealthier.

Cracking the Code: How Bankers Slice the Global Pie (2023)

Most investors starting out would be confused to learn that, for example, investing in an MSCI World ETF wouldn’t provide them with a Global exposure.

Equity ETFs can be confusing due to Index Providers’ naming conventions. So, I had a deep dive into how they work, and I hope you can also benefit from it

How Much Should You Pay For An ETF?

Based on Vanguard research, investing through an ETF that has a 0.6% higher fee can lower the chance of a successful early retirement by more than half.

But how should you choose the cheapest ETF? Especially, when one has a better historical performance and the other a better forward-looking expense ratio? Here are some questions, that European and UK Investors frequently ask.

Explain it to a Golden Retriever – A Review of World ETFs

In Investing, building a portfolio is simple. If you can’t explain it to a 6 year old your investment portfolio may need revision – Here is all you need to know about World ETFs.

Broker Safety: Should You Rely On Broker Insurance?

Investment Projection Schemes In The EU Are Inadequate. Could An Independent Insurance Be A Solution?

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

While the older brother AJBell strides with clear direction, Dodl seems a bit lost, wandering without a map. And let’s be real—no other broker in its league hits you with a 0.15% custody fee.

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Your friend’s stock first skyrocketed, then hit a plateau, and ultimately lagged behind the market. Sound familiar? That’s because it’s a tale as old as time. He’s now so attached to it, he can’t bear to sell. Imagine a world where he didn’t agonise over every buy or sell.

A world without the balancing act of portfolio rebalancing.

He probably hasn’t even heard of Vanguard LifeStrategy. And with the hefty fees his financial advisor charges, that’s hardly surprising.

Enter a quasi Golden Retriever Portfolio in a single fund.

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

Banker on Wheels’ Easy Ride to Factor Investing – Part 1 Welcome to Part 1 of Bankeronhweels.com Guide to Factor Investing. My first job on Wall

Money Market Funds: Are ETFs The Best Bang For Your Buck Or A Risky Ride?

Some ETFs track the same benchmarks as well-known Money Market Mutual Funds.

The advantage? There is no minimum ticket, and ETFs are much cheaper. However, the allure comes with its twists. As always in finance, higher returns can mean more risks.

4 Things I Learned In 4 Years Of Running A Finance Blog