AN ALTERNATIVE TO FIRE. BECOMING FREE - FINANCIALLY RELIEVED AND ENTIRELY ENGAGED.

Bankeronwheels.com is dedicated to making you Financially Independent.

Some of our readers are also part, or interested in, the Financial Independence, Retire Early Movement (also known as “FIRE”).

Romain Tancré recently joined Bankeronwheels.com to share his extensive experience. As a Banker, a Management Consultant, and of course, a Cyclist.

But perhaps even more important is his involvement in the community. Romain can provide you with a fresh perspective on Early Retirement, the challenges in reaching it and ways to make the ride more enjoyable.

Here is Romain’s story. We hope it makes your journey easier.

The first time I came across the concept of FIRE, I was thrilled. It opened up a world of possibilities, very far from the usual narratives surrounding me for most of my life. But as I started digging into the topic, a couple of things were puzzling me.

My Journey To An Alternative Life Path

My First Aha Moment

We all know the usual path – slowly climb the professional ladder, buy a big house and die rich.

The first time I came across the concept of FIRE, I was thrilled. It opened up a world of possibilities, very far from the usual narratives surrounding me for most of my life.

FIRE allowed me, and many other people, to both dream and plan, using hard data and not wishful thinking.

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Define Your Own Freedom

The usual FIRE journey can be pretty long, and might not address some important questions.

As I started digging into the topic, a couple of things were puzzling me.

I deconstructed its underlying assumptions and twisted them so that they fit my life philosophy, values, and personal situation.

Eventually, I came up with an approach making more sense for me, and I hope for many other aspiring FIRE people as well.

I suggest a journey that is shorter and more pleasant and ultimately more meaningful.

In this article, I’ll briefly recap the basics of FIRE, then I’ll point out what annoys me about it, and will suggest an alternative path, which I called becoming FREE – Financially Relived and Entirely Engaged.

My objective is not to convince you to blindly replicate this approach. But rather to broaden your perspective on what your financial journey could be.

As always, do your research and calculations, and think carefully before executing any large and often irreversible decision.

Your FIRE amount typically ranges from 20x to 33x of your targeted yearly expenses.

Work Hard, Save More, Retire in Your 40s

Let’s use FIRE’s Wikipedia page as a starting point to define what the FIRE Movement is, and what it implies:

Those seeking to attain FIRE intentionally maximize their savings rate by finding ways to increase income and/or decrease expenses, along with aggressive investments that again increases their wealth and/or income. The objective is to accumulate assets until the resulting passive income provides enough money for living expenses throughout one's retirement years. (...) Many proponents of the FIRE movement suggest the 4% rule as a rough annual withdrawal guideline, thus setting a goal of at least 25 times one's estimated annual living expenses. Upon reaching financial independence, paid work becomes optional, allowing for retirement from traditional work decades earlier than the standard retirement age.

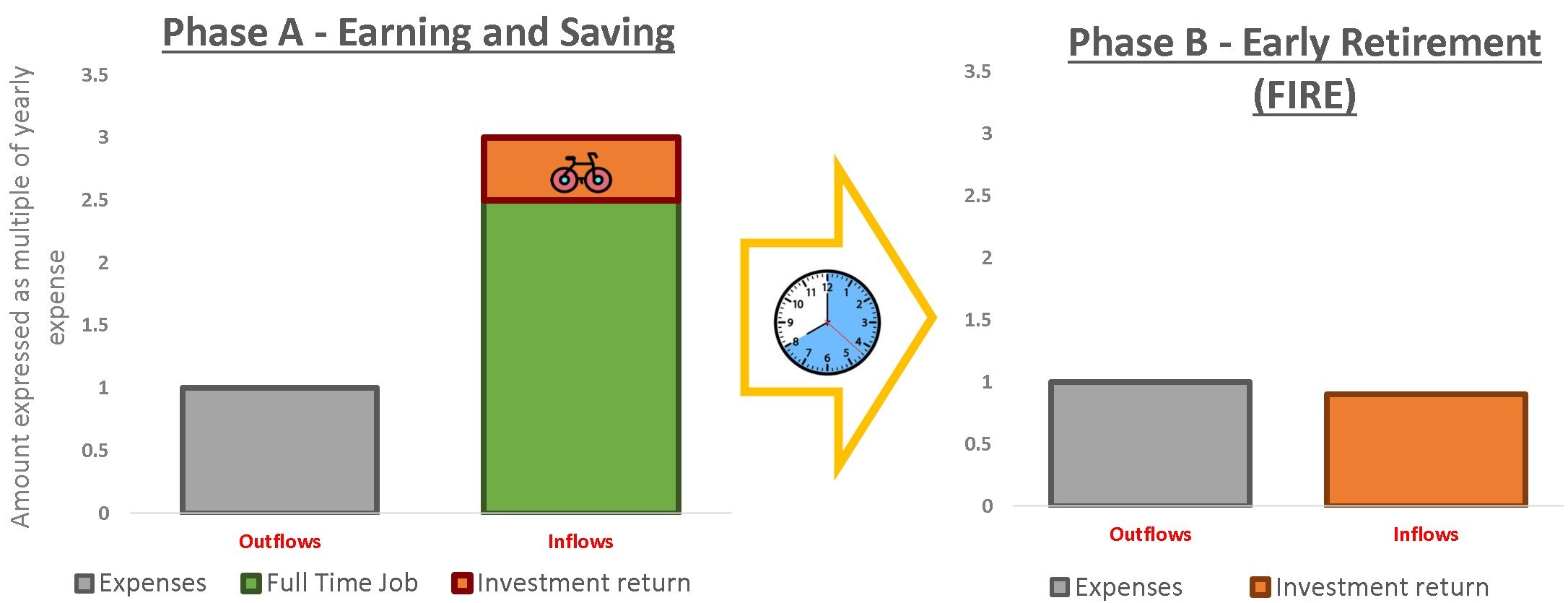

Here we see the two basic phases of FIRE, which I’ll call Phase A and Phase B.

- Phase A: Working and Saving Aggressively – It usually means working long hours in a single occupation, typically a corporate job. Somehow implied is that this activity is not your life’s calling or true passion, hence the search for an alternative lifestyle enabled by FIRE. Saving rate is usually aggressive, and money smartly deployed across products fitting your unique situation.

- Phase B: Retire And Live Off Accumulated Savings – No further cash is needed from work (you become “Financially Independent”). You can finally enjoy cocktails on the beach all year long (that’s the “Retire” piece), or do what you do want (e.g., arts, taking care of the family, hobbies, etc). Outside of the cocktails, FIRE is not addressing what you’ll do during phase B.

Reaching your magic number

The game for the people aspiring to go FIRE is to retire as early as possible, usually targeting a “FIRE amount”.

This can be done by maximizing cash inflow from their work.

In most instances it means pursuing high paid professions, minimizing expenses and maximizing risk-adjusted investment returns.

The FIRE amount varies from one person to the other but is mostly tied to the desired lifestyle during retirement.

FIRE adepts will further differentiate themselves into Lean FIRE, Fat Fire or even Barista FIRE.

The lifestyle also depends on your risk appetite, your age, health and what you like your kids to inherit.

For the math lovers out there, the amount is supposed to keep the Probability of Ruin (expenses > wealth) under a certain threshold, for a given time horizon.

Or if you prefer graphical representations (I do)

Technical note: charts show expected value for readability. All those items are stochastic and not deterministic. For example, your financial portfolio return will hover around the expected value during “regular years”, but also be quite negative and way above your expenses during bad and good years respectively. Expenses are uncertain too (see challenge 2 below).

Typically, in Phase B, expenses are similar to your expected investment return, or slightly higher.

As a side note, it’s OK to withdraw part of your principal, as long you die before your wealth reaches $0.

But the key assumption is that no money is generated nor needed from work-related activities during this phase.

The remembering self will sign you up for a high paid profession so that the FIRE day comes a little quicker. The experiencing self will work her a** off 80 hours a week to realize the plans of her monomaniac brain-mate.

FIRE - THE CHALLENGES

Challenge #1 - Reaching Phase B Can Take A very Long Time

While the “Time to FIRE” depends on multiple individual parameters, I bet that for most people it is not going to happen in the short term.

Let’s assume it’s going to take 12 years for the sake of the example (which corresponds to an already pretty aggressive 60% savings rate).

On paper, considering the full expected remaining duration of your life, those 12 years look relatively short and bearable.

In reality, it means c. 3,100 days waking up and knowing that today you won’t enjoy life to its fullest.

You project yourself into the future during this whole period. You’ll suffer from the “I’ll be happy when” syndrome.

Again, The underlying assumption here is that your current Full-Time job, while bearable and sometimes even enjoyable, is not your true life’s calling.

Hence the search for something else and your interest in FIRE.

Before signing up for a journey exceeding 10 years, consider some of the following two lessons.

Lesson 1: You Are Likely To Be Wrong About Your Future Self

In a 2010 TED talk, Daniel Kahneman talks about how the “remembering self” differs from the experiencing self.

- The remembering self is the one deciding to pay the yearly subscription fee of an expensive gym club, comfortably seated on his sofa on January 1st.

- The experiencing self is the one required to go to the gym 5x a week to make the investment worth it.

In the context of FIRE:

- The remembering self will sign you up for a high paid profession so that the FIRE day comes a little quicker.

- The experiencing self will work her a** off 80 hours a week to realize the plans of her monomaniac brain-mate.

Importantly, the longer your plan (e.g. a 10+ year phase A), the more likely you are to be wrong about your future self.

Lesson 2: We are bad at guessing our future desires

In another 2014 TED talk, this one from Dan Gilbert, we learn that most of us are pretty bad at guessing our future desires and needs.

Committing to a multi-decade plan based on what you think is right today is therefore pretty risky.

There should be a better balance between the present and the future, and between your two selves, one which paves the way for the future while enjoying the process along the way.

Challenge #2 - Working And Making Money Aren’t Inherently Bad

If retiring and not working were the ultimate and universal goals, you wouldn’t see billionaires working 100+ hours/week.

Something else must be at play that is not reflected in the traditional FIRE model. I think it comes down to what people call Work (who doesn’t hate Mondays?), and their belief about Working for money (who likes to sell his/her soul?).

First, I think everyone will agree that “doing nothing” (drinking cocktails on the beach all day long) is fun for one week, maybe one month if you really are into it, but not much beyond that.

Humans need to be driven by something, projects larger than themselves, projects that fully engaged them, otherwise they will be bored to death.

Those projects are what should be called Work, not those rigid boxes called Job Descriptions created one century ago.

Everyone should have his/her definition of what Work means, and I invite those who haven’t thought about it to have a look at the exercise of the inspiring website/book Design your life.

Personally, I define “Work” as my contribution to the planet and the human species, of the present and the future. And I surely want to continue to contribute in phase B. Once you have clarified what Work is, my guess is that you will want to have at least some of “it” in your life.

Of course, even your Work is extremely valuable to you, it won’t valuable to others all the time, and shouldn’t be.

But if you create something valuable, there is no reason to give it away for free. There is a big gap between selling your soul to Evil Corp and making money thanks to your life’s calling.

Some people don’t appreciate this difference, and simply consider that making money is always a sin. But fundamentally, when people pay for your craft, it means that they appreciate what you do, and encourage you to continue. It’s a positive, and healthy, feedback loop.

That is what markets should be about, in their most basic sense. Homo economicus prefer free stuff when they are the buyer, and a huge pile of money when they are the seller.

I would argue that real Humans like to express their gratitude towards others, and one way of doing that is through sharing their time and money (which is essentially time stored) for things they appreciate, paying (and receiving) the fair price.

This one was the big “aha moment” for me, which unlocked this whole discussion.

I realized that I wanted to continue to contribute to the world, by sharing my best self with others and capturing part of that value along the way.

Challenge #3 - Depletion Of Human Capital And Full Reliance On Financial Portfolio Create Risks

While the previous point discussed the well-being impact of not working, there is also a financial impact well worth digging into.

One of the most useful things I’ve learned studying Finance was the concept of Human capital. Basically, it is your ability to turn your time into money. It depends on internal factors such as your skills, education, etc. but also external factors such as the state of the economy or your location.

Most people consider their financial capital and their human capital separately, optimizing for each of them individually, aiming to reach two local maxima. By considering your human capital and financial capital together you can achieve a global maximum.

For example, if you are a stockbroker (high-risk profession), you should probably take less risk with your money (more bonds, fewer stocks). If you are a librarian, go for the opposite (more stocks, fewer bonds).

The issue is the following: in the traditional FIRE model, you typically rely 100% on “financial” capital once you reach “FIRE day”.

In some situations (e.g. someone who cannot physically work anymore), this could make sense.

However, for most of the FIRE demographics, it is actually undesirable:

- First, the marketable knowledge and skills (“Human capital”) you created during phase A will deplete quickly. Human capital is an asset, and every CEO knows that maintaining the value of an asset is important. It doesn’t imply working in the same field/industry, but rather continuing to be an active member of society and using your brain to solve real-world problems (which are usually paid, see challenge #2).

- Second, if anything happens to the financial portfolio, you’re in trouble if that’s your only line of defence (i.e. your only way of covering your expenses). Think of a market crash, a broker bankruptcy, or simply some bad modelling assumptions.

- Third, the ‘expenses’ part of the equation can also go out of control. In this situation, you will not be able to “scale” your financial portfolio to cover those extra needs – and you’re likely to rely on your human capital (hence the need for maintenance described above)

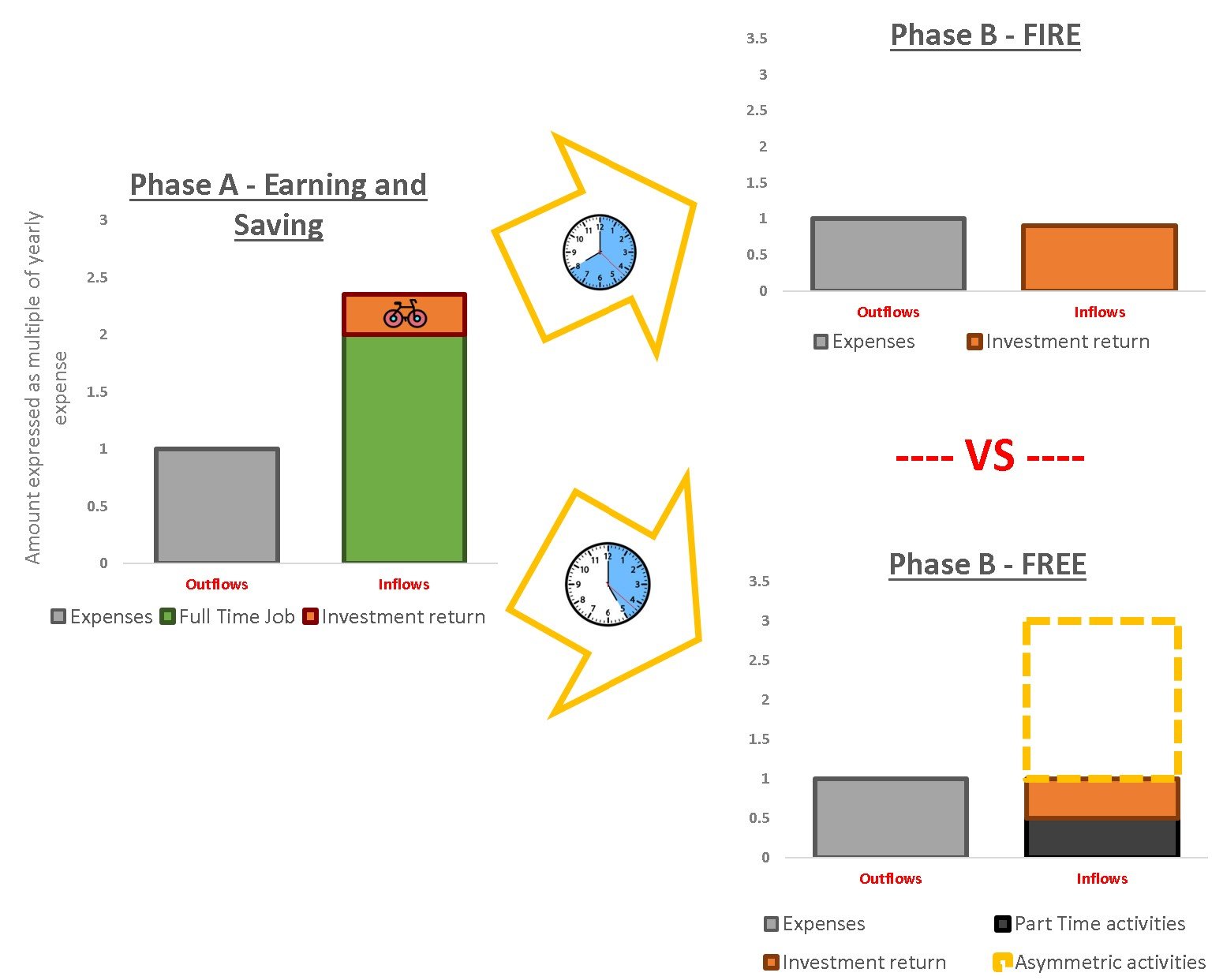

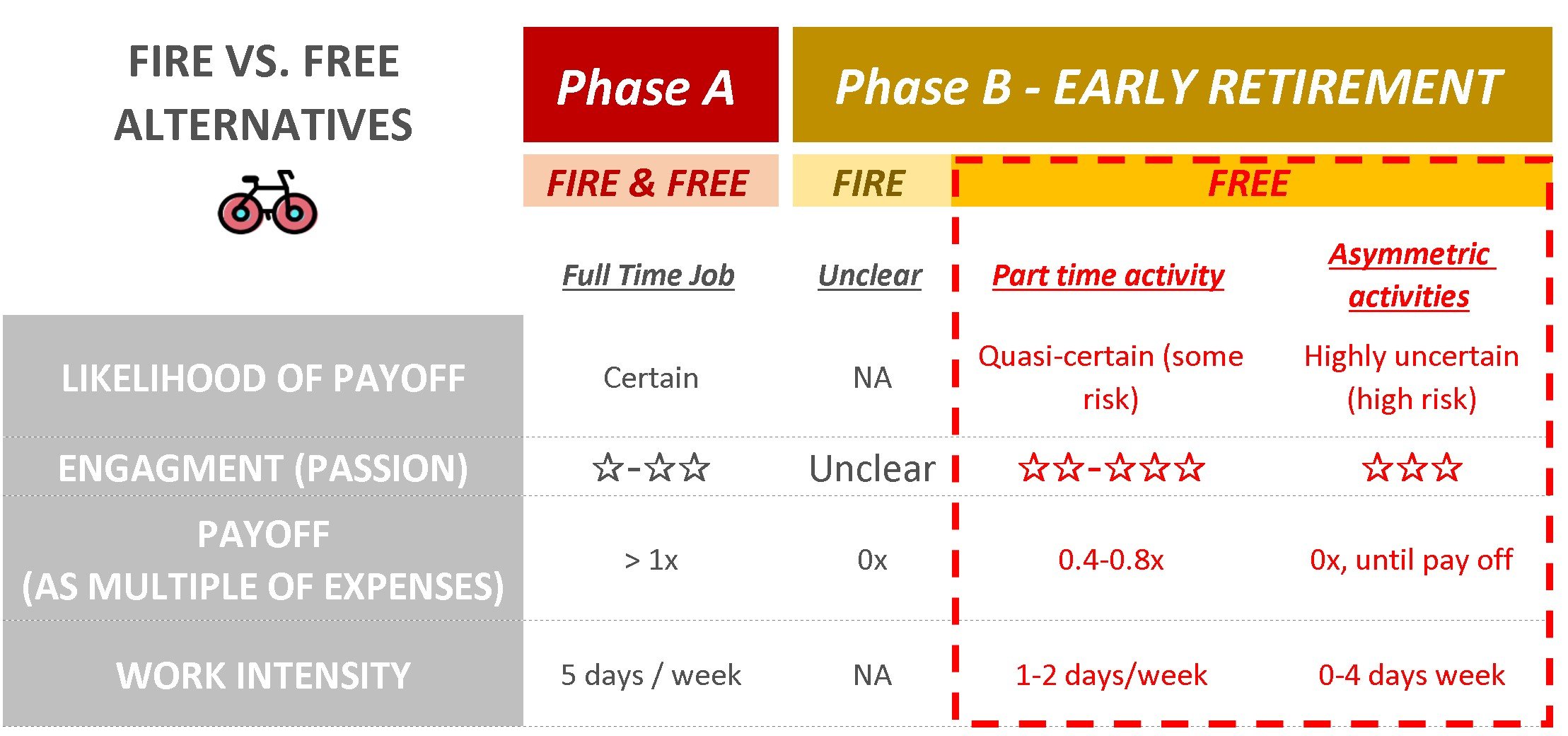

MY ALTERNATIVE - Instead of saving enough money to go from "Full-time job" to "Fully Retired", target a lower savings amount, and go "Partially Retired", working part-time on something you deem meaningful, while also pursuing asymmetric (high risk and high rewards) activities.

THE ALTERNATIVE - BECOMING FREE. FINANCIALLY RELIEVED AND ENTIRELY ENGAGED.

Here is my alternative.

Instead of saving enough money to go from “Full-time job” to “Fully Retired”, target a lower savings amount, and go “Partially Retired”, working part-time on something you deem meaningful, while also pursuing asymmetric (high risk and high rewards) activities.

What it means, is the following:

- You’ll be “Relieved” from your most pressing expenses (housing or food). You won’t be fully Independent, as you’ll still have to cover part of your expenses (maybe those more related to leisure) with your part-time activity

- You’ll be able to pursue activities deemed meaningful earlier, which will make you much more Engaged. Those activities will be both paid (your Part-Time activity, where you exchange a bit of little engagement for money) and unpaid (your asymmetric activities, where you don’t care about the money but realize that it can massively pay off in the long term)

Graphically, this looks like the following:

The Math Behind It (Illustrative Example)

- Imagine you save 60% of your income with the salary of your FT job in phase A. This means you’re earning 2.5x your expenses [1/(1-60%)], against 5 days of work per week. In other words, 1 workday covers 0.5x of your expenses

- If you decide to go “FREE” once you reach 50% of the FIRE amount (~covering 0.5x of your expenses with your financial portfolio), this means you only have to work 1 day per week to cover the remaining 50%. That’s all very theoretical of course. It should be adjusted for your unique situation. E.g. Are you able to charge less/more per day for your Part-time activity vs FT job? You get the idea.

- Why not go directly for 2.5 days of part-time, and not save any money? Because you won’t have any slack/cushion, constraining your opportunity set of part-time activities. You’ll seek steadiness of income before passion, which is missing the goal of FREE. You won’t be “Relieved”. Building a financial portfolio of a significant size (to cover >0.4x your expenses) is important.

- You can also work on your Part-Time activity for more than 1 day per week, adding some capital along the way, and lowering the risk of depleting your financial portfolio. If the Part-Time activity you found makes you fully engaged. That’s even better and another good reason for scaling up to more than 1 day

This has multiple benefits:

More Meaningful Life

- This one should be pretty straightforward. By lowering your target saving amount, you move phase B forward. Cutting your targeted amount by 50% may cut the “time to phase B” down to 50%, depending on the financial portfolio return and expected salary progression.

- Because FT Jobs are usually rigid and occupy your full mental space and calendar, going earlier to phase B will give to more time to do what you love and find Meaning in your activities, paid and unpaid.

Becoming Financially Relieved

- Thanks to your financial portfolio, your most basic needs (say 50% of your expenses) will be covered, removing some of your strongest fears related to the bottom of the Maslow Pyramid.

- You can then take slightly more risks with your Work, and choose one (or several) Part-Time activities that are more aligned with your passions and values, and still solve real-world problems. By partly removing the money constraint, you expand the opportunity set (things you can do with your time). Regular FIRE goes one step further by almost totally removing the constraint, allowing you to do even more things, but I would argue that opportunities unlocked by going FREE are already a huge expansion vs. the 9-5 life.

- This idea of having enough money to take slightly more risk and be more engaged/explore your passions is one of the most appealing features of the Universal Basic Income (UBI). You can see the FREE journey as a way to create your own (volatile) UBI.

Diversification Of Your Overall Value: Becoming More Robust To External Shocks

- As mentioned above, your financial portfolio is not scalable. Having marketable skills is pretty handy if you need to face unexpected cash outflow. If you have worked on a couple of Part-Time activities in the past, it might be relatively easy to re-activate them, essentially “scaling” your Part-Time activities from 1-2d/week to 3-4d/week for example. Plus, you maintain your human capital, which no one can steal from you.

- By doing this, you ultimately diversify your portfolio (which is composed of money + time, or Financial capital + Human capital)

Asymmetric Financial Opportunities Generated Earlier

- Next to working on your Part-Time activities, you can use some of your remaining available time to pursue high-risk high rewards activities. Those activities have an asymmetric payoff profile: on average, you should expect them to fail, but if you play long enough you may be able to capture the high payoff located in the long tail. See the excellent article from ofdollarsandata on the topic capturing Taleb’s idea of designing your life in an asymmetric way.

- By asymmetric opportunities, I’m thinking of entrepreneurship and anything deemed “creative” (writing/blogging, music, painting, fall in this category).

- While those activities are available in the traditional FIRE journey, they are generated much later, decreasing their likelihood to occur.

- Regardless of the financial success of those activities, you’ll develop new skills along the way, contributing to your skill stack, ultimately increasing the value of your Human capital

If you leave the corporate world too early and without shiny credentials, it might be harder to sell your skills on your own, in the Freelance jungle. Large corporations remain great places to learn hard and soft skills

The RiskS And Key Considerations

This approach is not without risks, and each situation needs to be assessed individually.

Part-Time activities need to exist and pay somehow decently:

- This whole scheme is based on the assumption that you can find Part-Time activities, leverage your skills & passions, and cover ~50% of your expenses.

- This might not be possible for some professions, which are “FT or nothing” in nature. The Part-Time activities also need to pay enough so that you don’t have to work 6 days per week to cover 50% of your expense.

- If you leave the corporate world too early and without shiny credentials, it might be harder to sell your skills on your own, in the Freelance/Part Time jungle. Large corporations remain great places to learn hard and soft skills. Also, large corporations usually offer attractive salary progressions if you stick there long enough, so going FREE means giving up potentially some very lucrative years (first within the corporate, then in the freelance jungle). There is definitely a trade-off there too.

Leaving Your Comfort Zone:

- Having a single occupation, especially through a large corporation, removes the daily volatility present in everyday life. By going out in the wild by yourself, you’ll be exposed to many more small risks. I personally see those small risks as an opportunity to learn

- Searching for Part Time activities and exploring Asymmetric activities require a significant amount of stamina and Human Capital, to begin with, and might not be suited to everyone

Final Considerations:

- How much you like phase A / how badly do you want to go into phase B

- How you define what Work is, and you want to spend your time in phase B. If you’re interested in pure leisure, if you want to focus on your family exclusively, or if you need 100% of your time for your asymmetric/other activities, then the regular FIRE journey light be better suited for you

It only takes 1000 true fans to live off your passion today, whereas 20 years ago you had to face a ton of intermediaries, either stopping you or capturing a huge share of the value you created

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Why today is the best time to do this

Two hundred years ago, investment and work opportunities were limited, so the only way to cover your needs (read: expenses) was to exchange your time, usually by doing what your parents have been doing.

Today, the world is very different.

Buying and selling financial assets can be done on your smartphone by almost everyone on the planet. You can enter into a working relationship with someone on the other side of the planet, and apply a skill you’ve learned a couple of months earlier for free on a MOOC platform.

The Internet has unlocked the long tail: the cost to produce and distribute have never been so low, leading to the emergence of multiple niche markets.

Those niche markets are the opportunities you’ll want to target with your Part-Time and your assymetric activities (and even your FT job if you’re lucky!).

Some say it only takes 1000 true fans to live off your passion today, whereas 20 years ago you had to face a ton of intermediaries, either stopping you or capturing a huge share of the value you created.

In the near future, thanks to WEB3.0, you will not only consume, create but also own a piece of the internet and the content you’ve created.

Refine your journey accordingly.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

Money Market Funds: Are ETFs The Best Bang For Your Buck Or A Risky Ride?

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.