Menu

Diversify Your Portfolio To Make It Antifragile To All Market Environments But Most Importantly To Your Own Emotions

Banker on Wheels’ Easy Ride to Factor Investing – Part 1 Welcome to Part 1 of Bankeronhweels.com Guide to Factor Investing. My first job on Wall

The Stock Market is a powerful money-making machine that can make you rich and financially independent

But how much can you lose? And how

Bankers are a rational bunch unless you talk to them about Football or Gold.

Gold is a controversial topic, and there are a lot of

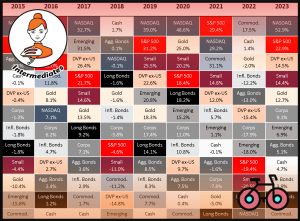

2022 reminded us that trees don’t grow to the sky. But, for equities, 2022 losses meant 2023 gains. Over the past decade, Global Equities

Expats face unique challenges – financial regulations of both their home country and the host country, different taxation regimes or currency risk. Offshore investment giants like Zurich or Generali International are there to benefit

Are you a Retriever, a Cyclist or a Banker?

Free PDF when you subscribe to our Newsletter

The Simplest Equity Portfolio

2023 Summary of 10 Year Returns and Risk considerations

Don't Fall For Wall Street's Traps

Understand what drives its price. It's not inflation.

How to decide on allocation

How To Invest In The Short Term

(PREMIUM Content)

How To Make the Most in the Long Run

(PREMIUM Content)

Are You Prepared for the Next Market Crash?

Should You Have A 100% Equity Portfolio?

How To Maintain Your Risk Profile

What you can learn from Cylcing

How to be Wiser Than Wall Street

How easy is it to pick stocks?

Copyright © 2020-2024 Bankeronwheels.com. All rights reserved.

Sitemap |Privacy Policy | Terms and Conditions | Coaching Terms and Conditions | Contact | About | Transparency| Cookies