Weekend Reading – Can Brokers Suffer the Same Fate as Banks?

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk.

TYPE OF CONTENT

- Youtube

- Reading

- Podcast

- Academic

- Twitter Thread

The major difference between a thing that might go wrong and a thing that cannot possibly go wrong is that when a thing that cannot possibly go wrong goes wrong it usually turns out to be impossible to get at or repair

Douglas Adams

INVEST WISELY

This section is dedicated to research on how to invest for the Long Run using Passive Investment Strategies. Read Topics related to (i) Portfolio Construction and Asset Allocation (ii) Acting wisely by avoiding behavioural traps and also (iii) publications that help understand how financial markets work.

CONSTRUCT YOUR PORTFOLIO

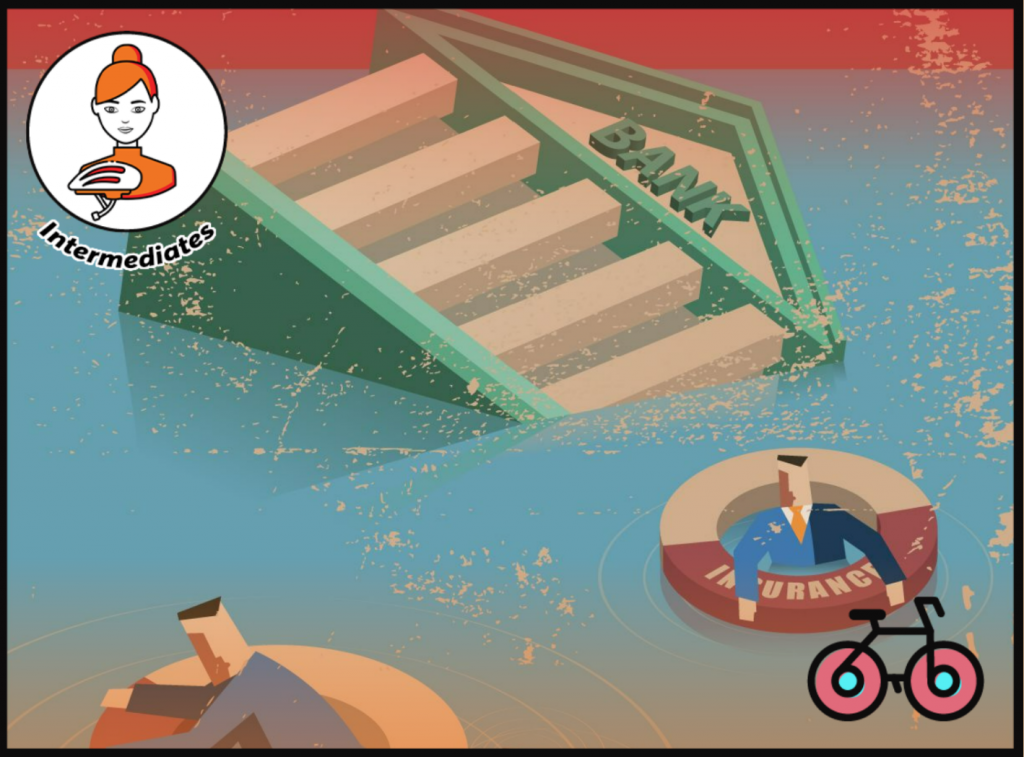

When Brokers Go Bankrupt: What are the Odds & Navigating Investor Compensation Schemes.

Silicon Valley Bank collapsed. Could your broker be next?

Over the past decade, investors focused on fees, and rarely on safety. What happens when a Broker fails? How likely is it? Could it be yours? Here is what you need to know.

The role of debt in financial planning (Rational Reminder - 1 hr 9 min)

Learn about debt in financial planning, consumption smoothing, the mindset and psychology behind debt, the risk that comes with debt, how credit cards impact how people interact with their money, integrated financial planning, and important aspects of mortgages.

HOW TO INVEST

- 3 Personal Finance Lessons from the Collapse of SVB (Fortunes & Frictions)

- Backtests are Unemotional. Humans are Not (A Wealth of Common Sense)

- Personal Finance: What's Important & Whats Not? (JL Collins)

- Risks Vs Uncertainty & The Illusion of Control (Price Action Lab)

- Don't chase the past: The fallacy of historical returns explaining future expected performance (Creative Planning - 12 min)

UNDERSTAND FINANCIAL MARKETS

- A detailed look at the night effect with Bruce Lavine (Excess Returns - 33 min)

- Is China Practicing Unannounced Capital Controls? (Business Insider)

- The real-life costs of central banks missing their inflation targets (Joachim Klement)

- Can the UK swerve recession? (Morningstar)

- Inflation is Slowing, Not Going. Here's What to Expect. (Morningstar)

- SVB & Implications For Financial Markets (Goldman Sachs)

- There have been 563 bank failures since 2000. (Pranshu Maheshwari)

- No size, it seems, is now too small to fail. (Morningstar)

- 8 Questions on the Banking Panic of 2023 (A Wealth of Common Sense)

Credit Suisse - The Story of Finance Gone Wrong (26 miuntes - FT.com)

Revisiting what went wrong at Credit Suisse

ACTIVE INVESTING

This section relates to improving your knowledge about active investing. If you decide to sin, then sin only a little. Given ample evidence, combined active bets should be ideally a relatively small fraction of your portfolio.

FACTOR & Thematic investing

STOCKS

A data-driven approach to picking growth stocks and thematic baskets (Flirting With Models - 14 Min )

It’s no secret that high flying growth stocks were hammered in 2022, so here is a revisit of a conversation with Jason Thomson.

Jason is a portfolio manager at O’Neil Global Advisors, where he manages highly concentrated portfolios of growth stocks.

SUSTAINABLE investing

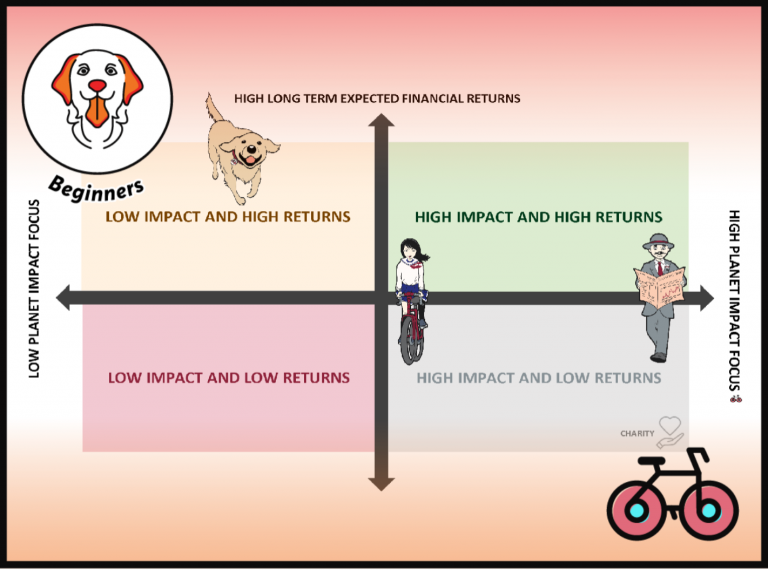

This section is about Sustainable Investing. You can invest in a Socially Responsible way but there are many ESG traps. Learn how to invest sustainably, and what it means for expected returns, with the our definitve guide to sustainable investing.

There are at least three proven sustainable investing strategies.

To keep it simple, you may hold a non-screened portfolio and, use the incremental profits for philanthropy.

If you want to avoid investing in certain types of industries, e.g. Tobacco companies, you may select cost-efficient and well-diversified SRI Funds. The most active sustainable strategy is Impact Investing.

ALTERNATIVE ASSET CLASSES

FROM WALL STREET

In conversation with GMO Co Founder Jeremy Grantham on how the FED has got everything wrong consistently (Bloomberg - 47 min)

Jeremy Grantham blames the US Federal Reserve for creating a bubble in asset prices—one he says has a long way to go before it’s fully deflated. As a result, stock prices may not reach bottom until late next year, he warns. The 84-year-old co-founder of investment firm GMO joined the What Goes Up podcast to explain what he calls the current, “meat grinder” phase of the market, and why he believes the central bank has “hardly gotten anything right.”

crypto & blockchain

REMINDERS TO PUNT RESPONSIBLY

In conversation with Madoff Trader & Investor Andrew Cohen (Excess Returns - 51 min )

With the recent release of the Netflix documentary “Madoff: The Monster of Wall Street,” many of us have been learning more of the details behind the scandal. Andrew Cohen, participated in the documentary and was both a trader on the legitimate side of Madoff’s business and a victim of the Ponzi scheme. Andrew gives us an inside look at what it was like to work in the Madoff organization and takes us through the timeline of events from when he started there to when the Ponzi scheme was uncovered.

In the Book review section we rate some of the most relevant resources related to Financial Independence, Personal Finance and Investing. Browse All Book and Video Reviews.

The 2023 Netflix docuseries Madoff: The Monster of Wall Street dives into the largest Ponzi scheme in history, worth $64.8 billion.

Although the Madoff madness stopped in late 2008, today’s investors still fall for the very same tricks.

What exactly can we learn from this series?

Let’s have a closer look.

This section is dedicated to UK and European Products. It can also touch on other European jurisdictions outside the Euro-zone.

- The first ‘L’ is Living Life. How do you plan around life essentials while reducing unnecessary costs?

- The second ‘L’ is Loving Life. It’s usually the mismanaged L. It’s not only about the destination but also the journey and values that define you today.

- The third ‘L’ is Later Life. How to invest wisely for Early Retirement.

FINANCIAL PRODUCTS

COST OF LIVING

OUR Community

Question of the week

This section is dedicated to the ‘Why’ of Investing, trends or career choices.

LIFESTYLE

Nassim Taleb - 11 Rules for Life (10 mins)

- Get rich in your sleep (or because of it) (Joachim Klement)

- What are Psychological Paths of Least Resistance? (Collab Fund)

- How much money buys happiness? (Ritholtz)

- Happiness Can Buy Money (Believe it or not that's Science Talking) (Five Year FIRE Escape)

- How to stop the mindless scrolling (Business Insider)

- How tiny stresses pile up — and what to do about it (Axios)

The science & art of longevity (The Tim Ferris Show - 2 hr 22 min)

Peter Attia, is the founder of Early Medical, a medical practice that applies the principles of Medicine 3.0 to patients with the goal of lengthening their lifespan and simultaneously improving their healthspan. He is the host of The Drive, one of the most popular podcasts covering the topics of health and medicine. Dr. Attia received his medical degree from the Stanford University School of Medicine and trained for five years at the Johns Hopkins Hospital in general surgery, where he was the recipient of several prestigious awards, including Resident of the Year. He spent two years at the National Institutes of Health as a surgical oncology fellow at the National Cancer Institute, where his research focused on immune-based therapies for melanoma.

EARLY RETIREMENT

- The FIRE Escape Door (Italian Leather Sofa)

- Is there an ideal age to retire? (Physician on FIRE)

- Why Coast FIRE is better than Traditional FIRE (Marriage, Kids & Money)

- Doom & Gloom? Many retirees worry about running out of money. But their spouses might take a rosier view (Wall Street Journal, Paywall)

- The main purpose of FI is to learn and live your life with intention (ChooseFi - 1 hr 14 min)

- The 5 Habits of Financially Responsible People (Darius Foroux)

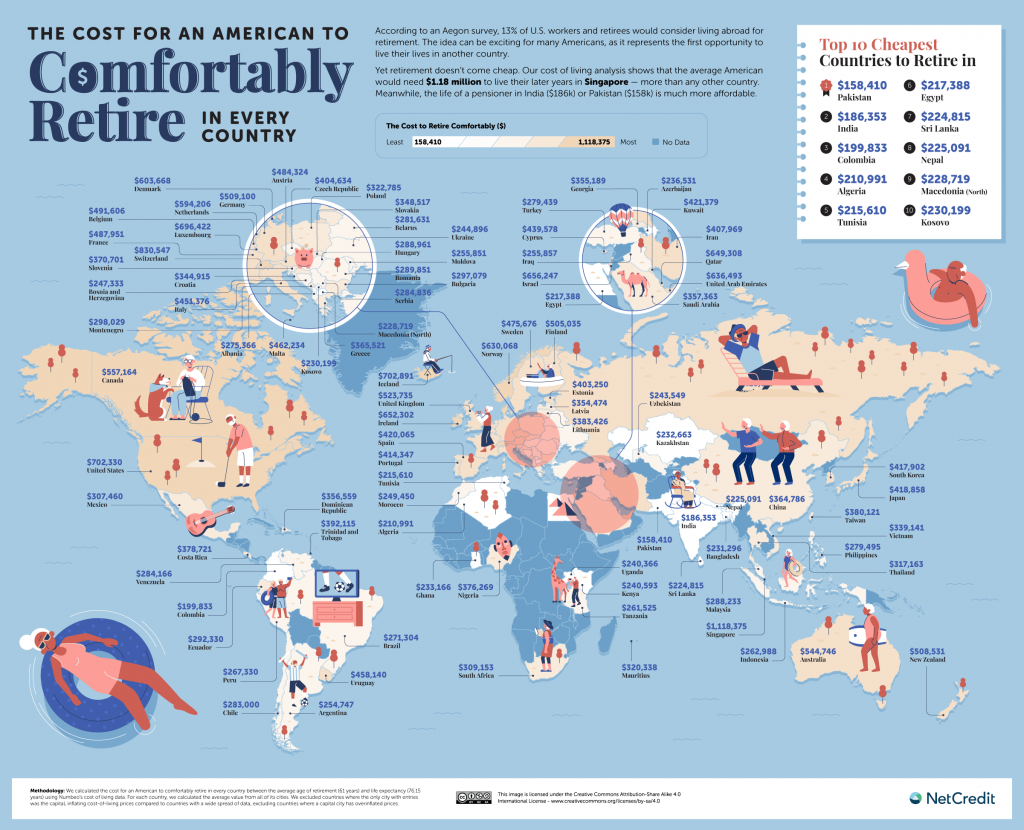

Cheapest Places to Retire Across the World (Source: NetCredit.com)

CAREERS

- The Surprising Effects of Remote Work (The Atlantic)

- Going Remote: The Long-run Effects of Working From Home (Econ Fact - 21 min)

- There’s a Good Chance You’ll Regret Quitting Your Job (The Atlantic)

- Remote workers are adopting a new practice called ‘body doubling,’ in which they watch strangers work online (Fortune, Paywall)

TECH & ECONOMY

- How SpaceX’s Satellites Are Bringing Remote Workers to the Wilderness (The Information)

- 10 breakthrough technologies for 2023 (Technology Review)

- The hottest party in generative AI is productivity apps (Venture Beat)

- Winner Takes All - The Creator Economy Is Growing (Citi Bank)

- Will ChatGPT Improve Financial Literacy? (Morningstar)

James Clear, Atomic Habits — Mastering Habits, Growing an Email List to 2M+ People (2hrs)

James Clear (@JamesClear) is a writer and speaker focused on habits and continuous improvement. He is the author of the #1 New York Times bestseller Atomic Habits, which covers easy and proven ways to build good habits and break bad ones.

Travel

miscellaneous

Revisiting Japan's Lost Decade (Konichi-Value - 29 min)

Japan was on its way to surpass the United States as the world’s largest economy, and the supply of infinite growth and prosperity seemed non-stop. Then, the party suddenly stopped.The video & podcast is a detailed depiction of Japan’s lost decade (1991-2001): The tragic tale of the world’s largest economic bubble burst and its consequences.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – JP Morgan Guide To Retirement

Surviving The Next Bear – Strategies To Profit From The Next Market Crash

Weekend Reading – Asset Class Returns since 1970 & Trend Following Strategies

Cracking the Code: Decoding ETF Names & Discovering Tools To Find Them

Broker Review Methodology

iWeb Share Dealing Review – Great For Inactive Investors

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🎁 Taking advantage of our affiliate links when setting up a broker account. This doesn’t increase your costs, and we often secure exclusive bonuses for our audience.

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.