My Baby Steps Into Crypto (Movie Review)

Cryptocurrencies have been around for over 10 years, and they have weathered several significant downturns.However, regular people like me don’t really understand how the technology works. What is blockchain, and why are cryptocurrencies so valuable?

I watched three films and read one blog post to find out what crypto is all about.

- But How Does Bitcoin Actually Work?

- WTF is the Blockchain?

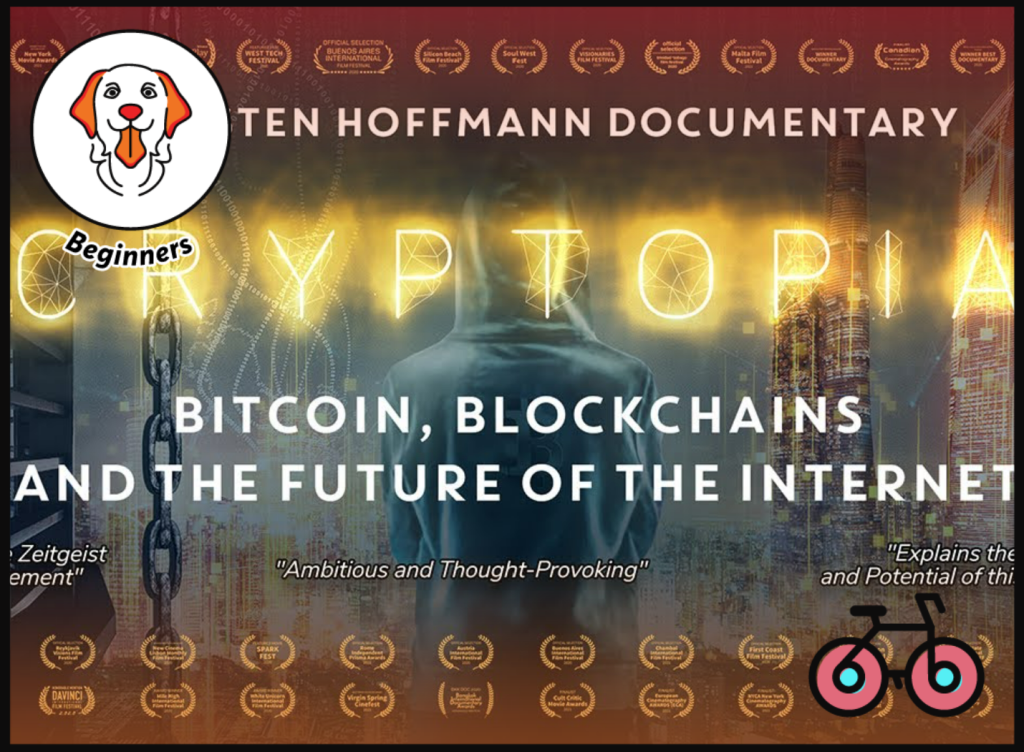

- Cryptopia – Bitcoin, Blockchains and the future of the internet

- Trust No One: The Hunt for the Crypto King

In today’s article, I’ll share my learning journey and discuss whether my perception of blockchain and cryptocurrencies has changed as I have learned more.

KEY TAKEAWAYS

- But How Does Bitcoin Actually Work is a film that was very well-made and short enough that it doesn’t get tedious or overwhelming. It gives a good overview of crypto and blockchain, and it is created entertainingly.

- WTF is The blockchain goes a step beyond. It’s risky to rely on a middle man because they could make a mistake, they might cheat you, or the record could be destroyed. In the case of Blockchain, the risk is much smaller because the ledger is stored on countless devices.

- Cryptopia is more balanced. We learn that some big banks and companies already use blockchain technology to track supply chains and secure transportation. However, the film also examines the negative aspects of crypto.

- Trust no one, The Hunt For the Crypto King, shows the risks. It is the story of QuadrigaCX, the biggest cryptocurrency exchange in Canada, that was a scam.

Here is the full analysis

But How Does Bitcoin Actually Work? A Short Film

But how does bitcoin actually work? | Available for free on YouTube

The Maths Behind Crypto

The first source I consulted was a short film on Youtube, called “But How Does Bitcoin Actually Work?” This was put together by Grant Sanderson’s math-focused channel, 3Blue1Brown, which has over 4.5 million subscribers.

If you’ve never studied computers or higher math, it can be hard to understand exactly how cryptocurrencies work.

The film explains them as a ledger, where everyone can add lines and everyone has access to all the information.

As the video progresses, more complicated elements are added to this ledger. The concept of encryption is explained, and Sanderson demonstrates the reason why nobody can copy or alter the information contained in the ledger.

He explains how a new signature is made every time you access the ledger to prevent lines from being copied.

Sanderson also explains that there is a limit to the number of transactions that can be made because only one block, containing a bit more than 2,700 transactions, can be mined every ten minutes.

Therefore, only around 4.6 Bitcoin transactions can be made per second. This is one of the main reasons why Bitcoin is problematic.

How Did the Film Help ME?

This film was very well-made and short enough that it doesn’t get tedious or overwhelming.

It gives a good overview over crypto and blockchain, and it is created in an entertaining way.

However, a short 30-minute video isn’t enough for a beginner like me to fully understand how crypto works.

People who don’t have a background in maths might have trouble connecting the explanations and analogies to the real-world example of Bitcoin.

To deepen my understanding, I decided to read an article explaining the same concept in a slightly different way.

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

WTF Is the Blockchain? An Article

The Problem Solved By Crypto

The HackerNoon blog post is designed for complete beginners, and it explains the basics of the blockchain much more quickly than the documentary.

The descriptions are simpler, so they are easier to grasp for a beginner.

Unlike many other sources, the post starts with the problem: every time you want to send someone money, you have to trust a third party, usually a bank.

Blockchain allows us to transfer money between ourselves without a middle man.

The article demonstrates how each transaction is listed on everyone’s ledger and secured with a hash function consisting of three numbers.

It also explains how mining is essentially the process of finding the third number, the proof of work. The first person to find it reaps the reward. In the case of Bitcoin, the current reward is 6.25 BTC.

WHAT DID I LEARN WITH THIS ARTICLE?

I actually read this article twice. The first time was before I’d watched the two other films listed below, and the second time was at the end of my learning journey.

While the post helped me to understand the core concepts, I still didn’t fully connect the dots after my first read-through. The second time, it was much easier because I’d immersed myself in the topic, and I now understood what the author was saying.

To me, the most important takeaway from this post is the purpose of the Blockchain. It’s risky to rely on a middle man because they could make a mistake, they might cheat you, or the record could be destroyed.

In the case of Blockchain, the risk is much smaller because the ledger is stored on countless devices.

Unless more than half of the users are corrupt and trying to cheat the system, blockchain is unlikely to stop working.

CRYPTOPIA: Bitcoin, Blockchains and The Future of the Internet | Available for free on YouTube

The Many Functions of Crypto

“Cryptopia: Bitcoin, Blockchains and the Future of the Internet” was produced in 2020 by Torsten Hoffmann, a filmmaker, media entrepreneur, and consultant.

The film is split up into three sections: Bitcoin, Blockchains, and The Future of the Internet.

This film portrays Bitcoin differently to the other two sources above. It compares it to a giant, endless vault.

The money can only exist and be transferred between individual wallets inside this vault. Each transaction gets recorded, and the individual recordings get put together in a block. Every ten minutes, one block is created, and the transactions stored inside it can never be altered again.

I liked this explanation because it complemented what I had learned previously and explained it in an intuitive way.

How Did the Film Help ME?

This film explains how Bitcoin and the other cryptocurrencies can perform many functions.

Aside from being a store of value and a currency we can use, they also facilitate smart contracts, which enable us to cut out the middle man during business transactions.

We learn that some big banks and companies are already using blockchain technology to track supply chains and secure transportation.

However, Hoffmann also examines the negative aspects of crypto.

For example, initial coin offerings, which introduce new coins to the market, are discussed. Unfortunately, many of them are scams, and people have lost millions.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Trust No One: The Hunt for the Crypto King - A Cautionary Tale

Trust No One: The Hunt for the Crypto King | Official Trailer | Available on Netflix

The Precautions To Take

Unlike the films and article above, which were all about the technical side of crypto and provided an overwhelmingly positive perspective, “The Hunt for the Crypto King” follows an individual example.

It is the story of QuadrigaCX, the biggest cryptocurrency exchange in Canada.

The owner, Gerry Cotten, set up this exchange for his own gain.

Essentially, he was a scammer who slowly transferred customers’ money to other exchanges and then gambled it away.

In late 2018, Cotten died in India, and 110,000 of his customers lost the money they had invested with QuadrigaCX.

The film follows one particular investor, who put all his money, $500,000 into QuadrigaCX.

His story shows how damaging putting all your eggs in one basket can be.

The downfall of QuadrigaCX can teach us several things:

- Always do your due diligence before investing with a platform or exchange. Even though a company might have a good-looking website and many customers, it could still be a scam.

- Don’t put all your eggs in one basket. Split your money between several platforms and asset classes. This is common knowledge, but there are still many people who get caught up in the hype and go all in on a type of asset or platform.

- Remain cautious at first when investing into a relatively new asset class or with a new company. Start by investing a very small portion of your wealth and see how it goes.

WILL I Buy BITCOIN?

After watching all these films and reading a long article, how has my perception of cryptocurrency changed?

Am I going to start investing in it now?

The answer is yes.

Now that I know what crypto is all about, I am planning to invest 0.5-1% of my net worth into cryptocurrencies in the next few weeks.

One of the experts interviewed in “Cryptopia” suggested this strategy.

If the market collapses, I won’t lose a lot of wealth, but if it takes off, that 1% could potentially increase my wealth significantly.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

Money Market Funds: Are ETFs The Best Bang For Your Buck Or A Risky Ride?

4 Things I Learned In 4 Years Of Running A Finance Blog

Weekend Reading – JP Morgan Guide To Retirement

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.