Tax-Free Compounding – Accumulating vs. Distributing ETFs

The Definitive Guide to Slashing ETF Costs and Taxes - PART 5

This article is Part 5 of our Definitive Guide to Slashing ETF Costs and Taxes.

Compounding is a money-making machine. But taxes and fees can sabotage your plan.

Typically, up to 2-3% of the 7% average annual total return from Global Stocks comes in the form of dividends. But what happens to compounding if your ETF distributes them?

Today, let’s look at how to optimise your ETF selection for the compounding magic to work without leaking too much in unnecessary taxes.

KEY TAKEAWAYS

- It’s the same ETF but a different share class. In most cases, distributing and accumulating share classes belong to the same ETF.

- The return is the same. Excluding taxes and transaction costs, if dividends were reinvested by the investor, the return would be the same for both share classes.

- The choice usually doesn’t impact ETF costs. iShares and Xtrackers ETFs tracking MSCI World are rare exceptions.

- Saving for retirement? Accumulating ETFs boost compounding. Taxes on dividends are deferred until retirement, and there are no transaction fees for reinvesting.

- Some countries are exceptions. In Germany, distributing share classes may be preferable up to a threshold. In the Netherlands, the UK, or Switzerland, tax paperwork or cash flow to pay ongoing taxes can also play a role.

- Living off your portfolio? Distributing ETFs are more convenient. It’s mainly due to lower transaction costs.

- Switching later in life is costly. It’s rarely possible without triggering tax events unless held in tax wrappers. In practice, holding accumulating ETFs is still preferable, as compounding of deferred taxes outweighs transaction costs later in life.

Here is the full analysis

How to know which share class I'm buying?

Example of Vanguard FTSE All-World ETF

In a previous guide, we explained how to read ETF names. Today, let’s take again the same popular ETF that we looked at – the Vanguard FTSE All-World UCITS. As you remember, it has two share classes:

- Dividend Accumulating Share Class

- Dividend Distributing Share Class

Does it apply to all investors?

Only Europeans. US Investors don't face this issue.

It’s one of those European ETF Investing quirks that doesn’t apply to US Funds, where regulations require distributing at least 90% of its income to shareholders.

How are the share classes different?

It's the same ETF, but cash from dividends is handled differently.

Accumulating share class ETFs automatically reinvest dividends, boosting the share price and harnessing the power of compounding for growth over time, ideal for investors not needing immediate income. Distributing share classes, on the other hand, hand dividends straight to investors, providing a regular cash flow and suiting those who rely on investment income.

Tax implications differ: accumulating may defer taxes, whereas distributing could lead to immediate tax liabilities on dividends received.

Key differences

| Feature | Accumulating Share Class | Distributing Share Class |

|---|---|---|

| Dividend Reinvestment | Automatically reinvested into the fund. | Paid out to shareholders as cash dividends. |

| ETF Price | Increases as result of reinvested dividends. | Doesn't increase to the same extent due payouts. |

| Tax Implications | May defer tax liabilities (depends on jurisdiction). | May incur immediate tax on dividends. |

| Compounding Effect | Benefits from compounding. | No dividend compounding unless reinvested manually. |

| Investor's Cash Flow | No direct cash flow from dividends. | Regular cash flow from dividend payments. |

| Long-term Growth Focus | Better suited for accumulating phase investors. | Suited for retired investors. |

How does an accumulating ETF work?

Same return, different dividend distribution.

Imagine investing €10,000 into two share classes. Both start with a net asset value (NAV) of €10 per share and are expected to yield a 7% annual return.

- With the Accumulating Share Class: It reinvests all its earnings, so after one year, the NAV would increase to €10.70 per share (that’s the initial €10 NAV with a 7% increase). You wouldn’t receive any cash distributions, as all the income generated is reinvested into the ETF.

- With a Distributing Share Class: This one pays out its earnings to investors. Assuming it has an annual dividend yield of 3%, you would receive €0.30 per share in dividends. After a year, despite the same 7% growth, the NAV would be €10.40 per share (initial €10 NAV plus 7% return, minus the €0.30 dividend paid out). This means you’d get €300 in dividends, but the NAV of your ETF would be lower than that of the accumulating ETF due to the dividend payments.

Comparing two different funds can quickly become complicated if one has a distributing and the other an accumulating share class. The best way is to compare the same share classes on a Total Return basis (re-invested dividends).

They shouldn’t, if they belong to the same fund. But remember, each ETF website can calculate the performance differently. A Total Return approach should in theory yield the same return for both share classes, but an assumption can be made on the dividend tax and that’s why it may create the appearance that results are different.

Are the ETF fees the same?

The TER is usually the same.

Distributing and accumulating share classes should have exactly the same TER/OCF. Some of BlackRock’s ETFs are the exception to this rule. And the exception only applies to very isolated iShares cases.

Some of BlackRock’s ETFs are the exception to this rule. And the exception only applies to very isolated iShares cases.

The story starts sometime in 2012, a couple of years after Barclays had to sell to BlackRock its jewel crown (iShares) in the middle of the Global Financial Crisis.

At that point, given the competition from cheaper Vanguard’s ETFs, BlackRock have expanded their iShares Range. To compete with Vanguard it launched cheaper products aka ‘CORE’ ETFs.

That’s why you can still see rare legacy BlackRock ‘non-core’ funds that are more expensive than CORE ETFs. The CORE products were initially designed for Long Term Investors.

A popular misconception is that these are the same Fund, since they follow the same benchmark. But in these rare cases, it’s actually not only different share classes but also different Funds.

- iShares Core MSCI World UCITS ETF (USD, Accumulating) has a TER of 0.2%

- iShares MSCI World UCITS ETF (USD, Distributing) is more expensive with a TER of 0.5%

The accumulating one is cheaper. You guessed who’s the potential Investor!

Still, these Funds are managed by the same team.

As it happens, I know the portfolio manager who at one point was running $100bn of these ETFs at BlackRock including the two above, who confirmed that this only applies to quite rare BlackRock ETFs – most iShares still follow the rule that TER/OCF is the same for Accumulating and Distributing Classes.

For example, around 2010, BlackRock unveiled its ‘core’ S&P 500 and FTSE 100 ETFs with TERs of 0.07% and initially kept the legacy equivalent product fees at 0.40% but then reduced them to be in line.

Expect the remaining few discrepancies in fees to disappear in the future.

If the Total Expense Ratio you are seeing on distributing and accumulating funds is different, there almost always may be more fundamental reasons for it:

- A more fundamental difference in the share class – e.g. currency hedging.

- A different ETF tracking the same index: with different Fund Domicile, replication type (synthetic vs. physical) etc.

- Accumulating Fee: 0.19% p.a.

- Distributing Fee: 0.12% p.a.

Why Is The choice personal?

What matters in determining what's best for you?

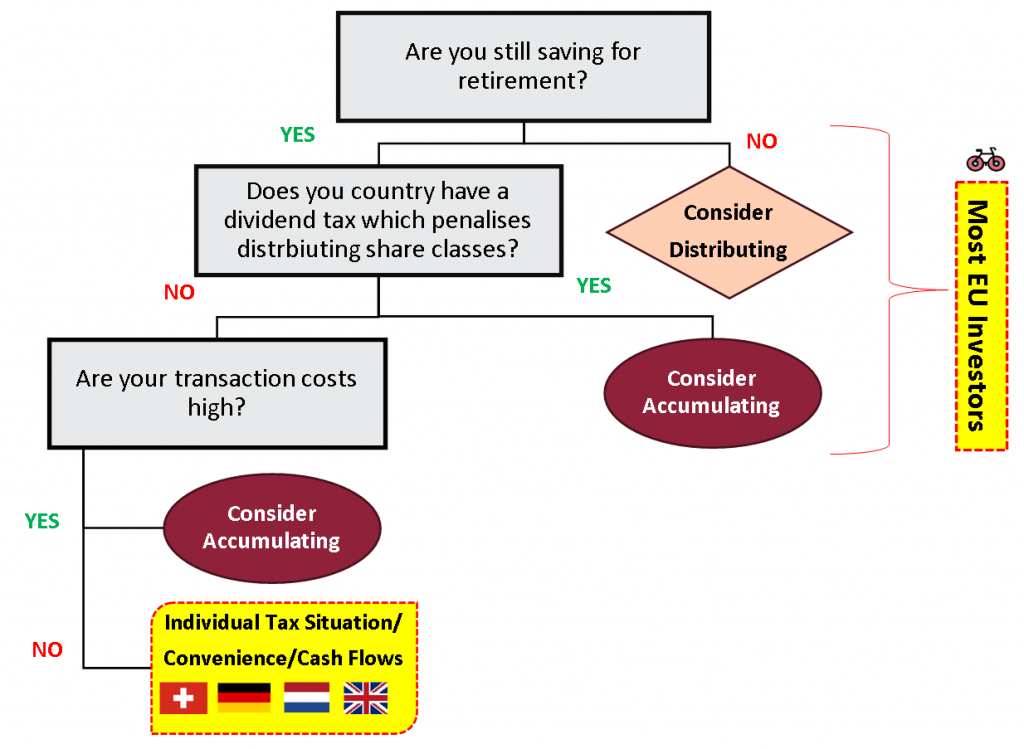

Start by asking yourself Four Questions.

Choosing a distributing vs accumulating share class comes down to your:

- GOAL - Are you saving for retirement or already retired?

- Tax Treatment - Does your country tax dividend payments?

- Transaction costs - Are your Broker's Trading Costs High?

- Convenience - CAN YOU AVOID TAX PAPERWORK? DO YOU NEED CASH TO PAY TAXES?

What is the most important?

It's mainly about taxes in your country.

The key aspect in accumulating vs distributing share class selection relates to taxes.

In Europe, it is generally beneficial to choose an Accumulating Share Class over a Distributing Share Class given that dividends are taxed when paid, with some exceptions, e.g. the UK or Switzerland, where this choice is tax-neutral.

The table below summarises the current tax treatment in Europe.

Distributing vs Accumulating ETF Flowchart

Do Accumulating etfs have a Tax advantage?

Yes, They Avoid dividend taxes.

Accumulating share classes reinvest all income into new shares increasing your wealth exponentially over time – exactly like a rolling snowball!

- Countries With Accumulating Advantage – Delayed taxation, that will come in the form of Capital Gain Tax at the moment of sale, provides for a compounding effect that will have a significant advantage over time in Belgium, Portugal, Spain, Italy, France, Poland, Czechia or Slovenia. In Ireland, Investors may still achieve higher returns by using Accumulating Share Classes, despite taxation every 8 years.

Does it apply to all countries?

To the vast majority. But some are exceptions.

There are two groups of European countries where it’s less obvious:

- Tax Neutral Countries – The UK or Switzerland have a deemed tax. Think of if as if the country was taxing all virtual dividends, even though they are reinvested. In the Netherlands, the choice is also tax neutral. But distributing ETFs are more cumbersome. You need to pay taxes on the dividends you receive when investing in a distributive fund. You can get that back, but you must explicitly ask for it in your yearly tax declaration.

- Partial Distributing Advantage – Germany is the EU’s the most cumbersome case, where distributing share classes can provide you with benefits, but only up to a threshold.

For Tax-Neutral Countries what else plays a role?

Dividend cash can serve to pay taxes

There are two advantages that can offset the convenience of not having to reinvest with accumulating ETFs:

- Distributing Can Provide Cash Flows To Pay Taxes – In case you hold accumulating ETFs, you will need to come up with cash to pay deemed taxes every year, which can add up once the portfolio grows.

- Distributing Can Reduce Paperwork – For accumulating ETFs, you will have to track the dividends that were reinvested and get taxed on them annually. ETF providers have to comply with these regulations, and you will get a multiplier to calculate the exact amount. You also have to record how many units were reinvested throughout the lifetime of your holding in order to avoid being double-taxed when paying capital gains taxes.

Accumulating vs Distributing Tax Advantage

| Your Tax Residency | Tax Advantage | Dividend Tax |

|---|---|---|

| Portugal, Belgium, Spain, Italy, France. | ACCUMULATING | Tax on distributed dividends only. |

| Czechia, Slovenia, Poland, Bulgaria, Croatia, Latvia, Estonia, Hungary. | ACCUMULATING | Tax on distributed dividends only. |

| Ireland | ACCUMULATING | Tax on asset growth every 8 years. |

| United Kingdom, Switzerland, Austria | NEUTRAL | Tax on reinvested dividends. |

| Netherlands | NEUTRAL | Wealth tax. A 15% flat rate applies to dividends and can be claimed back. |

| Germany | DISTRIBUTING | Distributing preferred up to Sparerpauschbetrag threshold is reached. |

For educational purposes only. Bankeronwheels.com does not provide tax advice. Taxes are subject to changes. If you see any inaccurate information above or want to add your country for the benefit of other investors, please send us a message. Annual Tax Allowances in some countries, e.g. UK or Germany, may incentivise Distributing Funds up to a limit. Above that limit, it may be beneficial to hold both share classes.

UK and Switzerland - Accumulating ETF Paperwork

It’s very important to check the ETF status. If the ETF is not a reporting Fund, then any capital gain you make on that fund is taxed as income rather than capital gains, when you sell. Income tax is much higher for most people than capital gains tax.

Similar to US ETFs, investment funds located within the UK must allocate the income they generate. But, UK Investors can also invest in EU Funds that don’t have such requirement. These UCITS ETFs can choose to become ‘reporting funds’ which necessitates reporting their accrued income annually to HM Revenue and Customs (HMRC). By gaining this status, investments by UK taxpayers in these funds are treated similarly to distributing funds. When a reporting fund accumulates income in a reporting period that isn’t passed on to investors, this is referred to as ‘excess reportable income.’

For more, see Vanguard’s UK Reporting Fund Guide.

- For Accumulating ETFs Listed on ICTax: Check the “Course listings” on ICTax for any “virtual dividends.” Declare the number of shares held at each “virtual dividend” date when doing your taxes.

- For Accumulating ETFs Not Listed on ICTax: The lack of a “virtual dividend” model means capital gains might be taxed as income.

Goal #2: You're Living off your portfolio.

Why are distributing share classes Advantageous?

If you already reached your investment goal, and are an income-seeker, periodically selling shares may involve extra costs while distributing share classes will provide you with income you need, more cost-efficiently, to fund your new lifestyle. A 2-3% distribution rate from a distributing ETF provides for some quarterly needs.

Can I switch to Distributing ETFs when I Retire?

Unfortunately, while technically often being the same ETF, distributing and accumulating share classes are different securities. Switching from accumulating to distributing creates a tax event with potential capital-gains tax consequences and transaction costs.

Is it beneficial to buy a distributing share class when i retire?

You will need to assess your individual situation. The trade-off of immediate capital gains vs. higher transaction costs usually results in investors retaining the accumulating ETF and selling a few percent of it each year to fund their goals.

What if ETFs are in tax wrappers?

Does the choice impact ETFs in Tax Wrappers?

Yes, since no CGT and Dividend taxes are paid.

ETFs in tax wrappers like ISA in the UK or PEA in France are not impacted by dividend taxes and capital gains taxes. It means that you can swap into distributing ETFs without triggering a tax event later in your life, assuming broker commissions are low enough to justify the convenience.

Can Distributing etfs be more efficient in the long run?

They may, for living off your portfolio and helping in rebalancing.

Since no taxes are paid on dividends, you need to consider whether broker commissions today are low enough to be less relevant than the convenience of receiving dividends when living off your portfolio at retirement. Additionally, during the accumulation phase, you can still use the dividends to rebalance your portfolio.

But, most dividends in ETFs are paid more often than in annual intervals, which means that it may increase opportunity costs, and affect compounding, if not reinvested immediately. For example, Vanguard FTSE-All World distributes dividends quarterly. Accumulating ETFs may still be more convenient.

Are Dividend withholding taxes impacting my choice?

Didn't We just address dividend taxes?

Yes, only the ones to your government. But, there is another tax at source.

Unfortunately, that’s not where all the ETF Taxes nightmare stops.

A dividend withholding tax is another tax on money that leaves a certain country.

In many countries, tax services are withholding dividends. This tax is upstream at the company level, e.g. Apple (a US company) paying dividends to an Irish ETF. What the ETF does with the money (reinvests or distributes) doesn’t matter from a withholding tax perspective.

This tax is invisible to most investors, but you can also reduce it if you dig further – and increase tax-efficient compounding.

Here is how:

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Next Steps

In the next article, let’s have a look at ETF Share Classes from a Currency perspective. Which types of currencies impact performance, and how can we save money on broker commissions?

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Surviving The Next Bear – Strategies To Profit From The Next Market Crash

Weekend Reading – Asset Class Returns since 1970 & Trend Following Strategies

Cracking the Code: Decoding ETF Names & Discovering Tools To Find Them

Broker Review Methodology

iWeb Share Dealing Review – Great For Inactive Investors

AJBell Review – Leading Broker & Low-Fee SIPP Provider

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🎁 Taking advantage of our affiliate links when setting up a broker account. This doesn’t increase your costs, and we often secure exclusive bonuses for our audience.

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.