DO I NEED A CREDIT CARD IN EUROPE AND THE UK?

If you were to believe everything that the folks in the personal finance industry say, using credit cards is pretty much a no-brainer.

After all, you get free money for a month since the interest is only paid after the bill is due, which would be a month later.

You get reward points that you can redeem for real-world items, and some credit card issuers will even pay you simply for signing up for their card.

There are entire communities dedicated to analyzing and optimizing the best way to sign up, and eventually discontinue, credit cards, and extract the maximum cash from the Credit Card companies.

But most of the advice given is US-centric.

Does the same advice also apply to European residents?

Let us first find out why location even matters for credit cards.

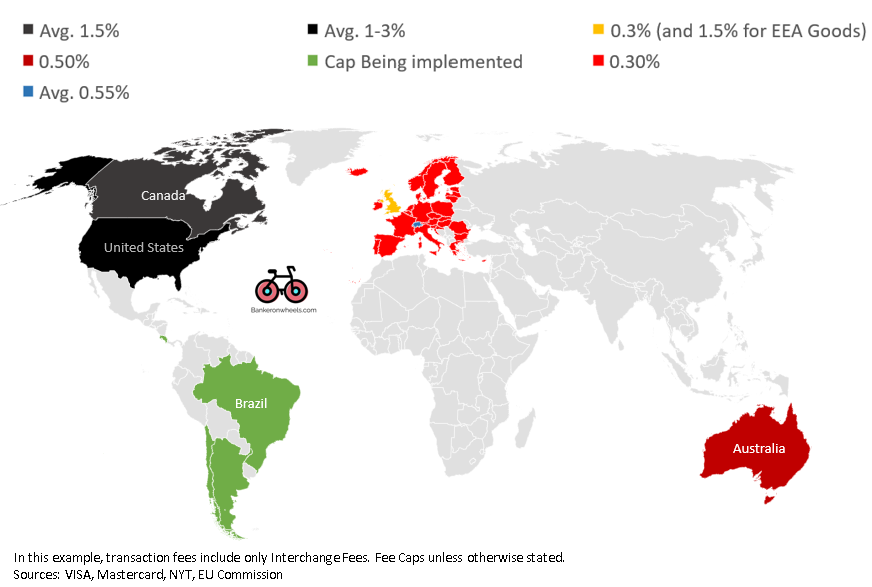

European Credit Card Companies will never compete in the same realm as their US counterparts. To protect consumers, the EU capped transaction fees that Credit Card Issuers charge to retailers at 0.3%. The UK, until recently, also had the same cap, being a part of the EU. This is now changing.

STATE OF PLAY

Why do credit cards in Europe not give great rewards?

How can Credit Card companies offer consumer rewards? You probably guessed it. Mainly through transaction fees.

For example, if you don’t pay on time, the Credit Card companies charge you interest and penalties.

But if everyone always pays on time, the companies still make money by charging retailers for every transaction that’s done using their Credit Card.

That’s the cash cow of the business. And this transaction fee is called interchange fee.

Transaction fee caps Are set To Protect Consumers

Rewards In Europe Are capped

In the US, it is simply a matter of shopping around to find a Credit Card that not only gives great benefits, but also doesn’t charge an arm and a leg simply for the privilege of holding the card.

That’s because US consumers indirectly pay for them through 1-3% average fees.

This is not the case in Europe.

Some Credit Cards in Europe may charge an annual fee for holding a card and they also give paltry returns when it comes to cashback.

It’s simply because European regulators are more protective when it comes to credit card charges.

In 2015, the EU capped transaction fees at 0.3%. This has already been effectively implemented in certain countries like France and other countries will follow.

With their revenue from transaction fees capped out, Credit Card companies have little room to offer more than slim pickings in terms of cashback and rewards.

Even debit cards felt the pinch since they were also covered by the legislation (EU cap of 0.2%).

For example, the Revolut Metal cashback card offers 1% for purchases outside Europe, but only 0.1% for purchases inside the EU.

In short, European Credit Card Issuers will never compete in the same realm as their US counterparts.

UK May Play by different rules

The UK, until recently, also had the same cap, being a part of the EU.

However, since the Brexit, the Credit Card companies have started to push up certain transaction fees again.

While most of the transactions remain within 0.3%, interchange fees on online purchases from the European Economic Area increased to 1.5% for both VISA and Mastercard.

It may mean a re-appearance of some cashback and rewards in the UK in the future. But for the rest of the EU, the situation is expected to continue.

What we now have to evaluate is whether, despite not providing such incentives to consumers, is it still desirable to hold credit cards if you’re a European resident?

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

WHO CAN BENEFIT FROM A CREDIT CARD?

Once we have the quick wins (or rather lack of them) out of the way, we come to actual, practical reasons why it would make sense to hold a Credit Card in Europe.

In essence, there are three types of people that can benefit from having a Credit Card in Europe and the UK:

- The Extensive Traveller – With perks such as insurance, air miles or convenience using it with car rental companies

- The Personal Finance Optimizer – Through chasing some cashback deals, optimizing liquidity or even marginally improving a credit score. Premium Credit Card benefits could also outweigh annual fees.

- The Online Shopper – Credit Cards may provide better protection than Debit Cards in Europe

If you shop online, from smaller retailers or websites, and happen to be scammed, or don’t receive the promised product, a chargeback on a credit card is child’s play.Whereas if the same situation occurs on a debit card, you would have already fronted the money, making you bear the liability until the issue is sorted out.

Can credit cards protect me from fraud?

safer in the US

Did you know that debit cards in the US are a major source of defrauding consumers?

The US has just recently moved from magnetic stripe cards to chip-and-sign cards. Magnetic stripes are simple to counterfeit, and even chip-and-sign only have a single factor authorization (the card itself) and not a pin.

Chip-and-pin cards present in Europe that have a microchip embedded, and also require a one-time code called a pin for authorizing a transaction, are all but universal.

So, using debit cards is a huge risk for US consumers, which added to the amazing rewards on Credit Card, results in a country that rarely uses debit or charge cards.

More Convenient in europe

Europe doesn’t have that issue.

However, just because chip-and-pin cards are more secure, doesn’t mean they are foolproof.

Especially if you shop online, from smaller retailers or websites, and happen to be scammed, or don’t receive the promised product, a chargeback on a credit card is child’s play.

Whereas if the same situation occurs on a debit card, you would have already fronted the money, making you bear the liability until the issue is sorted out.

Since all of us have limited cash flow at any point in time, it can lead to a tricky situation if you end up having substantial money blocked, even if you end up having it refunded later.

If you’ve ever rented out a car, you know how insistent they are on you using a credit card.

Even if some do agree on any other mode of payment, they will then insist on keeping a sizable deposit to protect against loss of or damage to their car.

This is actual money going out of your account, which will only be returned to you once the car is returned undamaged.

Whereas on a credit card, they simply block the same amount of money. Since the money gets unblocked as soon as you return the car, you will not get impacted in the slightest because of it.

The same goes for booking some hotels.

Can a credit card help me in budgeting better?

Other than all the tangible benefits of a credit card, there are some organizational reasons to hold one too.

With a debit card, you need to have the money in your account to spend it. While that is a good thing, for someone whose expenses may vary month-to-month, it may be an issue when the income doesn’t exactly match the expenses.

With a credit card, on the other hand, you spend first.

Then, by the time you’re supposed to pay the bill off, you know exactly how much you’ve spent, and can divert your income accordingly.

For example, suppose you have an income of about €5,000, out of which you invest €500 and spend the remaining. If you end up having expenses in December totalling up to more than €4,500 however, you are going to have to either borrow from someone or not pay some bills.

But if the same thing happened to a credit card user, they could just put the expenses on the card, and then have a month until January to figure out how to pay the difference.

That could be by reducing their January investments, selling off something, picking up extra shifts, and so on.

So, while Credit Cards cannot help you reduce your spending, they certainly give you breathing space to figure out how to meet your expenses.

On the flip side, they can also help you invest more and sooner. Since you already know how much you’ve spent last month and that you’ll be expected to pay this month, you can safely invest anything leftover without worrying about unexpected expenses.

REAL ADVANTAGE #2 - FREQUENT TRAVEL

How can a credit card benefit me if I travel frequently?

If you travel frequently, consider getting a travel-specific Credit Card.

Some of them offer great benefits like earning miles on all your transactions, even the non-travel ones, and companion vouchers that you can use to fly a loved one along with you, for no charge of course.

For example, the British Airways American Express Credit Card earns you 1 Avios per euro spent – on absolutely anything.

Some specific travel-oriented Credit Cards also offer travel insurance with the card. If you were anyway planning on getting such insurance, it might be cheaper to get the one with the card.

Similarly, most Credit Cards also offer rental car insurance.

Finally, some car rental companies still do not accept debit cards.

In the EU, if the consumer has purchased goods on the internet and does not receive the goods, she should first complain to the trader. If the trader does not deliver the goods or does not reimburse the payment made, the consumer can turn to the Credit Card Issuer.

REAL ADVANTAGE #3 - BANKRUPT RETAILER OR FAULTY PRODUCT

Making large purchases or shopping at a relatively new retailer?

Credit Cards may provide this extra protection.

On top of the liquidity aspect mentioned earlier, credit card chargeback is also guaranteed when a retailer goes bust or the product you purchased is faulty.

This is because most countries make the Credit Card Issuer as liable as the retailer.

- In the EU, if the consumer has purchased goods on the internet and does not receive the goods, she should first complain to the trader. If the trader does not deliver the goods or does not reimburse the payment made, the consumer can turn to the payment service provider. In terms of a chargeback, EU law only covers credit card chargeback. Purchases, where debit cards are used, are not covered by EU law but can sometimes be covered by national law such as in Denmark and Portugal.

- In the UK, under Section 75 of the Consumer Credit Act 1974, the protection is even higher. The credit card company is jointly liable for any breach of contract or misrepresentation by the retailer or trader.

For most European countries, using a credit card likely has no impact on your ability to get loans, and isn’t a factor for or against holding one.

REASONS TO STAY AWAY FROM CREDIT CARDS

Now that you know of real reasons why one should have a credit card, let us also learn why it may not be the best idea to get one for some people.

Can Using a Credit Card Increase My Spending?

Spending in cash is painful. It is also impossible to spend more than you have. These two factors mean that it is easy to control spending when you’re doing it using cash.

Anecdotally, we know that it is easy to overspend when using a Credit Card.

There is ample research to back this up as well – a study found that shoppers spend up to 100% more when using a Credit Card instead of cash.

Does Using a Credit Card Impact My Credit Score?

Unlike the US, most countries in Europe do not have a credit score that can determine your access to loans and the interest rate charged on them.

Even the ones that do work differently than in the US.

For example, in the UK, where Credit Rating Agencies like Experian track creditworthiness, paying your credit card regularly may help but there are plenty of other factors that play a role, too.

Other countries like the Netherlands and Spain have a blacklist, that only tracks unpaid debts. As long as you’re not on the blacklist, you’re fine.

A few like Germany (Schufa Rating) and Ireland (Central Credit Register) have a more US-like credit score, that is affected by credit card usage.

In a nutshell, for most European countries, using a credit card likely has no positive impact on your ability to get loans, but may penalize you in case you don’t pay on time.

BEST PRACTICES for Using a Credit Card

Now that you’ve decided that it makes sense for you to use a credit card, make sure you follow these best practices to ensure that you don’t become an example of the cons of using credit cards.

The practices are simple but they work brilliantly in keeping you on the right side of Credit Card debt.

- SET YOUR LIMIT

- TRACK YOUR EXPENSES

- KEEP TRACK OF DUE DATE

- PAY IN FULL

#1 Set Your Own Limit

Your Credit Card will usually come with a spending limit.

However, that need not determine your spending. Know how much you can pay off every month, and that should be your credit card limit.

For example, if you know that you can only spend €£2,000 on your Credit Card bill next month after paying off your mortgage and saving a bit, it is up to you to ensure that you don’t spend more than that this month.

#2 Track Your Expenses

Once you know how much you’re ‘allowed’ to spend, the next logical step is to track your expenses to stay within your self-determined limit. You don’t need to track every penny, but at any given point during the month, you should be aware of how much you’ve spent broadly.

#3 Keep Track of the Due Date

Unlike other bills which usually become due on the 1st of every month, credit cards can have wildly varying due dates, depending on when you first got them.

If you forget to pay off the bill before this due date, you will begin to be charged interest – and the interest rates are usurious.

On top of it, you may have to pay a fixed penalty for paying late.

Some providers let you set up a direct debit for the Credit Card bill while others are completely manual.

So, if your provider doesn’t provide for direct debit, or you’re not comfortable with that for any reason, put a recurring reminder on your phone for the date your bill is due, and pay it before that.

#4 Pay off the Entire Bill

When it comes to paying off credit cards, there are two options for paying the bill. You can pay the minimum, or you can pay it in full.

Paying the minimum means that you won’t have defaulted on the debt, but you will be charged interest on the remaining amount. Whereas if you pay the amount in full, there are no charges at all, meaning that it is effectively an interest-free loan.

Given that the benefits of having a Credit Card in Europe are not very attractive, paying interest on the loan would pretty much put you in the red. So, make paying off the entire bill a non-negotiable.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

CONCLUSION

Do you need a credit card in Europe? Absolutely not.

Should you still get one? Only if you can utilize some very specific benefits that so happen to fit your current lifestyle.

But if you do decide to get one for whatever reason, stick to the best practices and you won’t end up in the red for the simple privilege of using a credit card.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Broker Safety: Should You Rely On Broker Insurance?

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

Money Market Funds: Are ETFs The Best Bang For Your Buck Or A Risky Ride?

4 Things I Learned In 4 Years Of Running A Finance Blog

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.