No Time to Risk: How To Pick a Bond ETF For the Long Run

The Definitive Guide to Bond Index Investing - PART 4

Welcome to Part 4 of our Definitive Guide to Bond Index Investing.

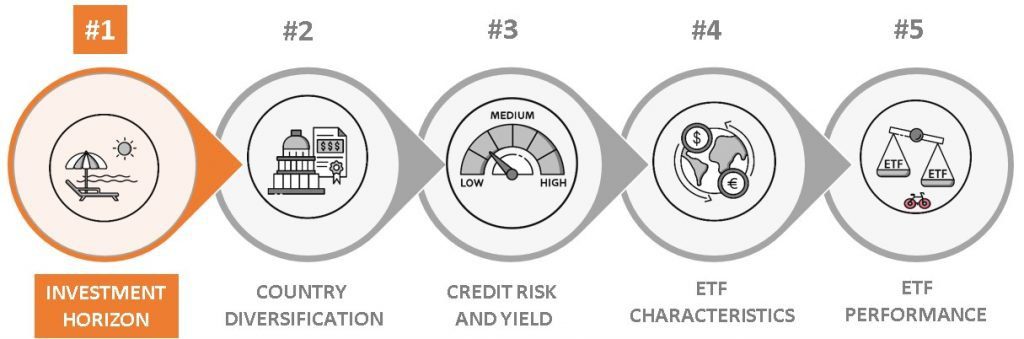

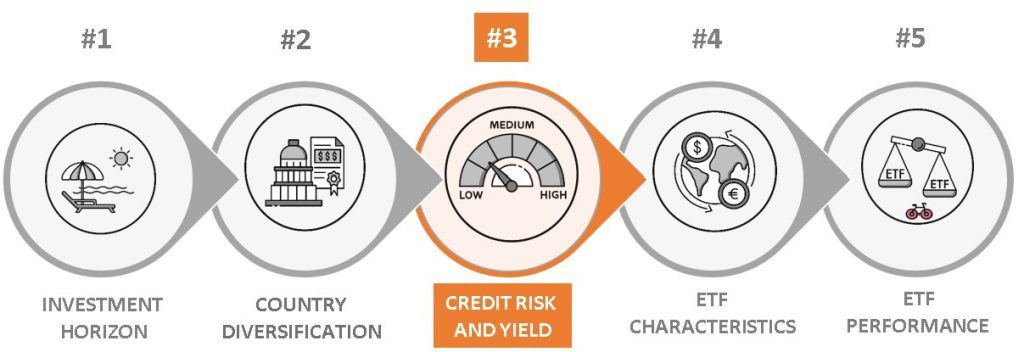

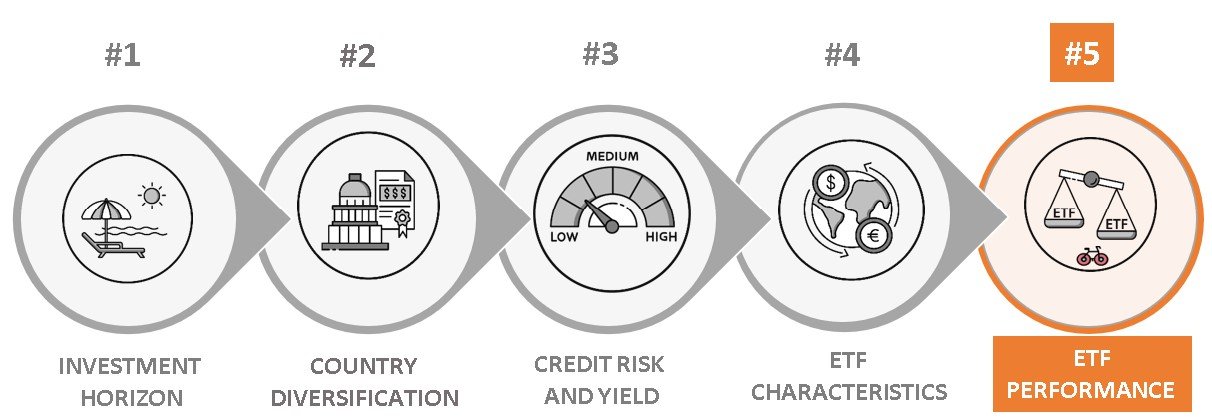

Bonds are a shield for your medium and long-term portfolios, including when deflation strikes. Ready to select a long term Bond ETF? Let’s break it down in 5 steps.

KEY TAKEAWAYS

- Your Investment Horizon: The longer your horizon, the higher the duration. Most ETFs have a duration between 6 and 8 years.

- Geographical Diversification: You may choose Issuers in the EU or the UK, or diversify globally. Some ETFs, like the Vanguard Global Aggregate Bond UCITS ETF, exclude China, while the iShares and SPDR Global Agg ETFs include it.

- Risk Vs Yield Trade Off: Today, Aggregate Bond ETFs provide between 0.5% to 1.5% of incremental yield, compared to Government Bonds. But, a higher proportion of US Treasuries within a Bond ETF helps during a crisis, like COVID-19.

- ETF Characteristics: Fees matter less, as UCITS funds are quite competitive. ETF jurisdiction has also low impact, but Broker Availability, Size, Dividend Distribution, and currency hedging are key.

Here is the full analysis

STEP 1 - INVESTMENT HORIZON

By far, Your most important decision.

First, you need to account for your investment horizon. The higher the duration, the better it is suited for long term investing:

- For Bonds – the duration, in years, should broadly match the investment horizon.

- For Bond ETFs – the horizon may be somewhere between duration and two times duration. In the previous article we explained why.

Duration is the risk you take but also the protection you may get in case of an economic downturn, particularly deflationary. It comes with a rebalancing benefit. For example, if your Investment Horizon is 15 years, selecting a Bond with a similar term/duration is reasonable. However, if you select a Bond ETF, a duration of 8+ years could be a good starting point. In practice, the choice for a long term investor is somewhat limited.

Today, most ETFs have durations around 6 to 8 years, which is adequate for a medium to long term investment horizon.

STEP 2 - COUNTRY DIVERSIFICATION

More Diversification, Similar Yield

With respect to issuing countries, Bond ETFs may be of two types:

- Local Bonds, e.g. UK Bonds or European Bonds

- Global Bonds (also called International) – Diversified Developed Markets, or concentrated in G7 Countries.

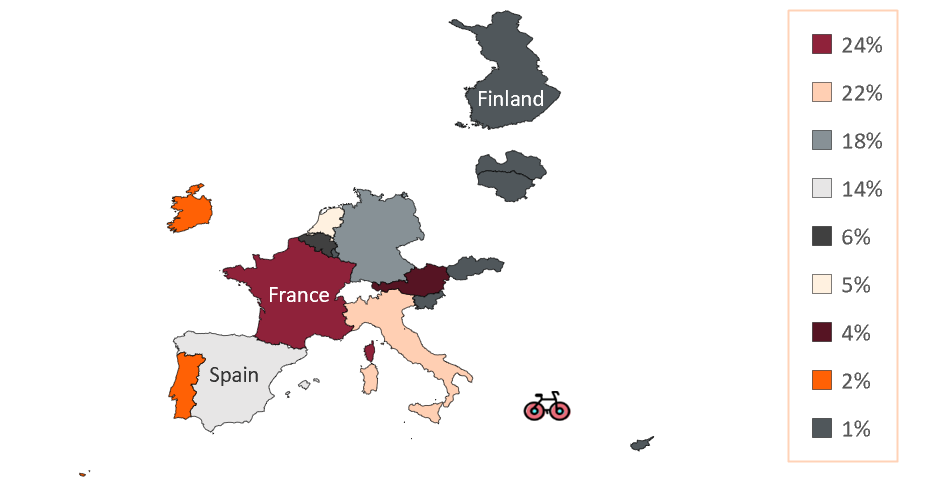

Which countries will you be exposed to in a European ETF?

EUROPEAN Government BOND ETF

Which Index Do Global Government Bond ETFs Track?

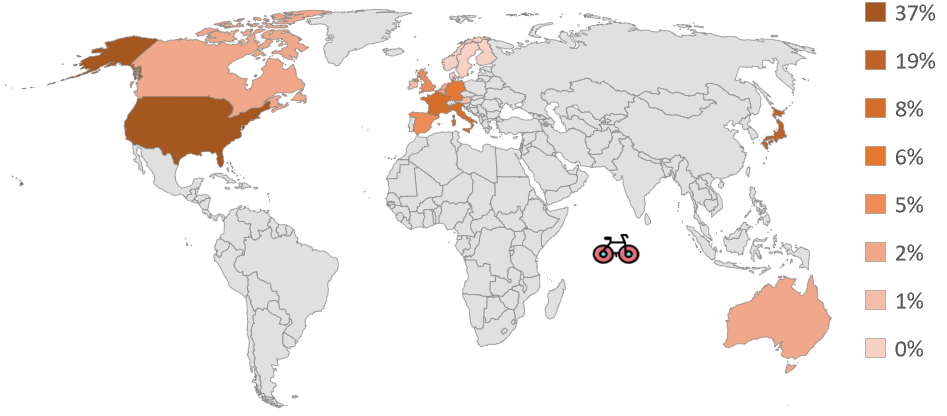

Global Bond ETFs with a focus on Developed Countries track either of two Benchmarks:

- FTSE World Government Bond Index – Developed Markets (illustrated below)

- FTSE Global Group of Seven (G7) Index

GLOBAL Government Bond ETF

Government Bond ETFs vs G7 Countries

- The exposure of a World Government Bond ETF (Developed Markets) is to countries such as the US (35-40%), Japan (approx. 20%) but also various European Union members, the UK, Canada and Australia.

- Bond ETFs with G7 Countries are even more concentrated, particularly as it relates to US Treasuries. These Bond ETFs also include Canada, a couple of key EU states like France, Germany and Italy, Japan, the United Kingdom.

is there a Risk benefit To Global Bond ETFs?

Yes, compared to local Bonds like UK or a single State, Global Bond ETFs provide better diversification without, reducing returns.

Is There a Return Benefit to Global Bond ETFs?

Since you will likely be hedging currencies, the long term return from Global Government Bonds and your local Government Bonds tend to be similar, as far as financial theory goes.

STEP 3 - RISK vs YIELD TRADE-OFF

MORE CORPORATES, MORE YIELD.

When choosing the debt Issuer type, you have the choice between ETFs composed of:

- Government Bonds – Only State Guaranteed Bonds.

- Aggregate Bonds – Include 60% to 70% of Government Bonds. The rest are high-quality corporate or, for global funds, mortgage bonds.

What is an Aggregate Bond ETF?

Aggregate Bond Funds are the broadest Fixed Income ETFs. About two-thirds are government bonds and c. one-third are corporate or highest quality US mortgage bonds (often implicitly guaranteed by the U.S. Government).

What is the Breakdown of Aggregate Bond ETFs?

Global Aggregate Bond ETF will have exposure to the highest quality American Mortgage Securities while the European Aggregate Bond ETFs won’t.

Issuer Exposure

| Exposure | Global Bonds | EU Bonds |

|---|---|---|

| Government | 63% | 68% |

| Financial | 13% | 18% |

| Mortgage Securities | 10% | 0% |

| Consumer & Industrial | 3% | 6% |

| Utilities | 2% | 2% |

| Other | 8% | 6% |

Are Aggregate Bond ETFs lower quality?

Yes, marginally. Government Bond ETFs give you the best protection and will react faster in a downturn. You can see the comparison in the case of Covid-19 Sell-off in the step 5 below.

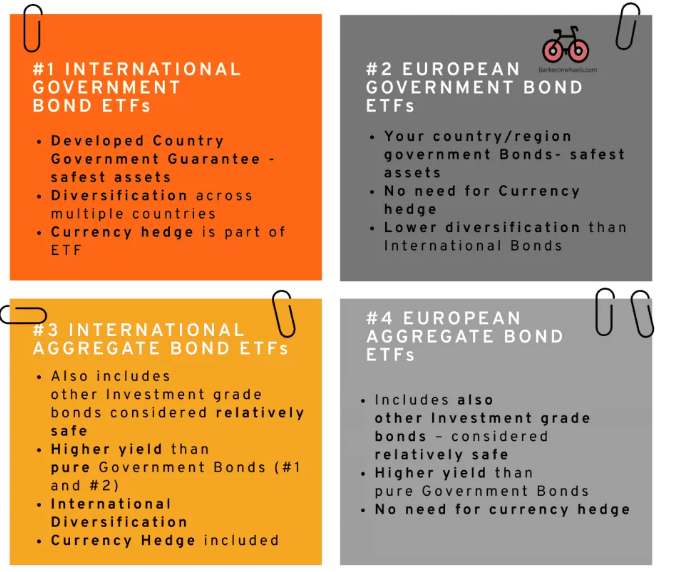

SUMMARY - What are the big 4 Bond ETF Types?

In Step 2, we have covered possible geographical areas (i) International Bonds and (ii) Local Bonds. Now, if we add two more dimensions (i) Government Bonds or (ii) Aggregate Bonds we end up with four possible Bond ETF Types:

- Global + Government (#1 below)

- Local + Government (#2 below)

- Global + Aggregate (#3 below)

- Local + Aggregate (#4 below)

Four Bond ETF Categories

STEP 4 - ETF Characteristics

Make a call on Currency RIsk.

Should you hedge currency risk?

Hedging Bonds will reduce the volatility of your portfolio. In this article, we only selected Bond ETFs that are hedged. But is it always needed? We cover this topic extensively in the next article.

Accumulating or Distributing Share Class?

The bonds that pay interest can be distributed through dividends. Choosing between accumulating or distributing funds is among the first choices investors in Europe make. The appropriate option may influence your taxes.

In most Continental Europe, accumulating funds generally have lower taxes because they fully reinvest dividends without triggering dividend taxes. In the UK’s deemed tax on dividends, taxes all accumulating fund dividends at the same tax rate as normal dividend. Other countries where distributing and accumulating is not clear-cut include Switzerland or Germany. If you’re unsure which to choose, check our dedicated guide.

STEP 5 - ETF Performance

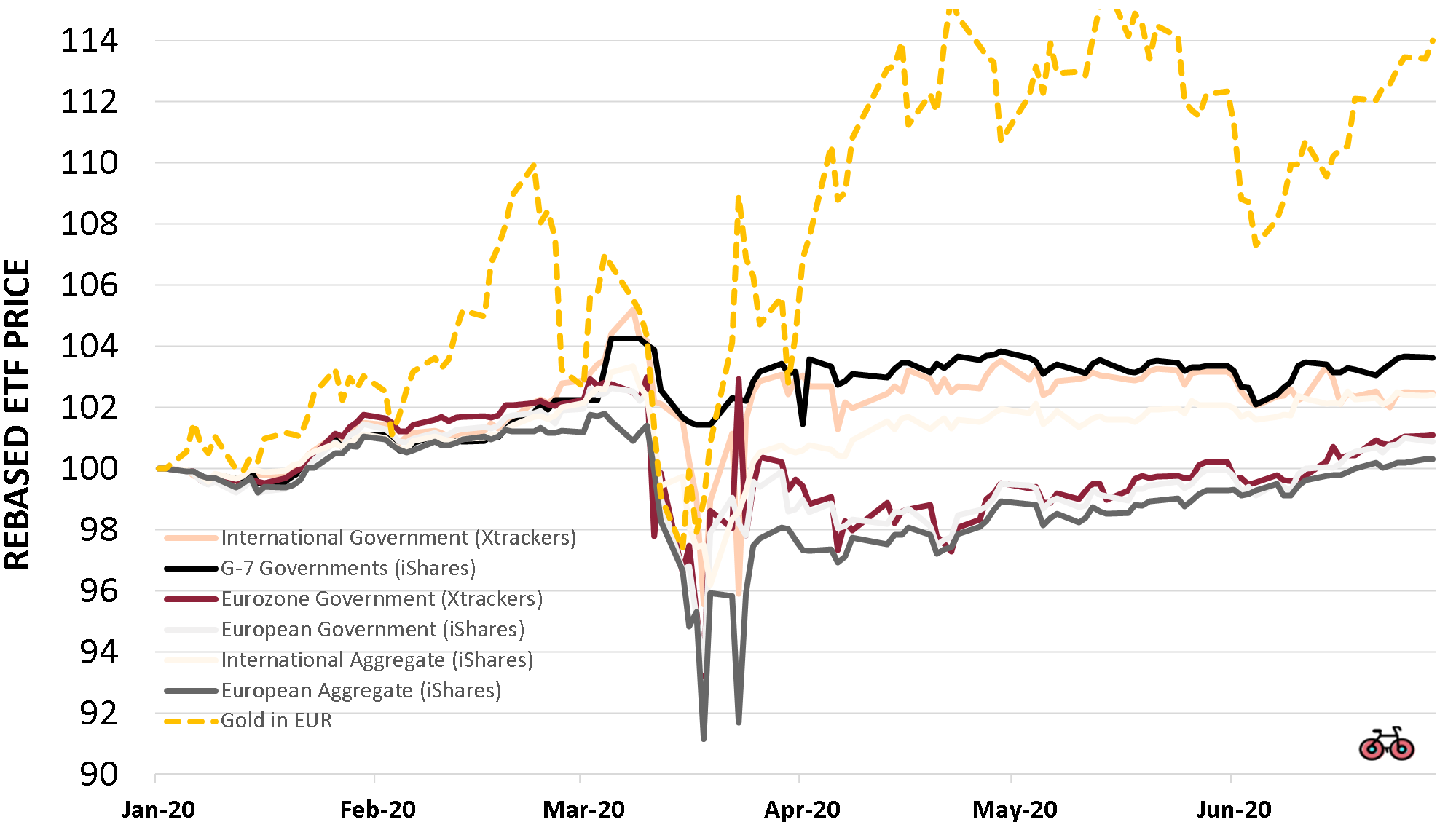

COVID-19 Sell-off

How did funds perform?

Bond ETF Performance in March 2020

The Index Funds that I reviewed had generally performed well in the COVID-19 Sell off:

- Global Government Bonds (G-7) – were the most resilient, with a drawdown of only 3%. It’s perhaps no surprise since US Treasuries are the safest assets and these represented 44% of the Index.

- Global Aggregate Bonds – benefited from exposure to the US and a flight to quality. iShares Global Aggregate ETF marginally outperformed Xtrackers Global Governments, but this could be due to the liquidity of EUR classes, since USD classes had a very similar drawdown at -5%.

- European Government Bonds – had a drawdown between -8 and -9% for a similar duration

- European Aggregate Bonds – had the worst drawdown (-11%). But, they provide incremental yield vs European Government Bond ETFs.

- Gold – fell by 12.6% before quickly rebounding, while the EuroStoxx 50 tumbled 39%.

Is Tacking Difference Important?

By the time you have applied the filters from steps 1 to 4, you should already have a solid candidate. Unlike Equity ETFs, for quite a few European hedged Bond ETFs, Tracking Difference may be misleading. TER could be a good proxy to assess how cheap funds are. You may (or not) look at costs – all these funds are very competitive from an ongoing charges perspective.

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

BOND ETF Comparison Table

How to narrow down your options

The below table is broken down by the categories introduced above:

- Size – Most funds have at least 1 bn Euro of assets under management. This includes all shares classes.

- Duration – For most funds is between 6 and 8 years, making them good candidates for medium-term (MT) to long-term (LT) investment horizons.

- Yield-To-Maturity – The yield below is the unhedged Yield. A currency hedge return needs to be added to estimate the expected total return. How is it calculated? Read the next article.

- Benchmark – In most categories, ETFs track the same benchmarks. The exception is Vanguard Global Aggregate Bond UCITS ETF that tracks the Bloomberg Global Aggregate Float Adjusted and Scaled Index. The Float Adjustment and Scaling does exclude China. Vanguard’s ETF Yield-to-Maturity is around 1% higher than the iShares Core Global Aggregate Bond UCITS ETF and the SPDR Bloomberg Global Aggregate Bond UCITS ETF, due to the exclusion of China and lower weights of e.g. Japan.

- Accumulating and Distributing Share Class Availability – This includes unhedged European and UK ETFs, and hedged Global ETFs.

Best Bond ETFs - Comparison

| Fixed_Income_ETF-Full_Name | Size | Dur. | Yield | TER | MT | LT | Accum. | Distr. | Benchmark | Category | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Xtrackers II Global Government UCITS ETF | 2.0 | 7.60 | 3.50% | 0.25% | ✓ | ✓ | USD,CHF,GBP | EUR,GBP | FTSE World Government Bond - Developed Markets | Global & Government | |

| iShares Global Government Bond UCITS ETF | 2.2 | 7.40 | 3.60% | 0.20% | ✓ | ✓ | USD | EUR,GBP | FTSE G7 Government Bond Index | Global & Government | |

| iShares Core Global Aggregate Bond UCITS ETF | 6.7 | 6.60 | 3.95% | 0.10% | ✓ | ✓ | USD,EUR,SEK | USD,GBP | Bloomberg Global Aggregate Bond Index | Global & Aggregate | |

| SPDR Bloomberg Global Aggregate Bond UCITS ETF | 2.7 | 6.65 | 3.95% | 0.10% | ✓ | ✓ | USD,EUR,CHF | USD,GBP,EUR | Bloomberg Global Aggregate Bond Index | Global & Aggregate | |

| Vanguard Global Aggregate Bond UCITS ETF | 3.3 | 6.90 | 5.00% | 0.10% | ✓ | ✓ | USD,GBP,EUR,CHF | EUR,GBP | Bloomberg Global Aggregate Float Adjusted and Scaled Index | Global & Aggregate | |

| Xtrackers II Eurozone Government Bond UCITS ETF | 2.6 | 7.40 | 3.20% | 0.15% | ✓ | ✓ | USD,EUR | EUR,GBP | IBOXX® € Sovereigns Eurozone Index | European & Government | |

| iShares Core Euro Government Bond UCITS ETF | 4.2 | 7.30 | 3.30% | 0.09% | ✓ | ✓ | CHF | EUR | Bloomberg Barclays Euro Treasury Bond Index | European & Government | |

| Vanguard Eurozone Government Bond UCITS ETF | 1.8 | 7.40 | 3.20% | 0.07% | ✓ | ✓ | EUR | EUR | Bloomberg Euro Aggregate Treasury Index | European & Government | |

| Lyxor Euro Government Bond UCITS ETF | 1.2 | 7.30 | 3.30% | 0.14% | ✓ | ✓ | EUR | EUR | Bloomberg Barclays Euro Treasury | European & Government | |

| iShares Euro Aggregate Bond ESG UCITS ETF | 1.6 | 6.50 | 3.50% | 0.16% | ✓ | ✓ | EUR | EUR | Bloomberg MSCI Euro Aggregate Sustainable and Green Bond SRI Index | European & Aggregate | |

| SPDR Bloomberg Euro Aggregate Bond UCITS ETF | 0.6 | 6.40 | 3.50% | 0.17% | ✓ | ✓ | - | EUR | Bloomberg Euro Aggregate Bond Index | European & Aggregate | |

| iShares Core UK GILTS | 2.3 | 8.50 | 4.65% | 0.07% | ✘ | ✓ | - | GBP,EUR | FTSE Actuaries UK Conventional Gilts All Stocks Index | UK & Government | |

| Lyxor Core FTSE Actuaries UK Gilt | 1 | 8.60 | 4.60% | 0.05% | ✘ | ✓ | - | GBP | FTSE Actuaries UK Conventional Gilts All Stocks Index | UK & Government | |

| Vanguard U.K. Gilt UCITS ETF | 0.3 | 10.00 | 4.70% | 0.07% | ✘ | ✓ | GBP, EUR | GBP | Bloomberg Sterling Gilt Float Adjusted Index | UK & Government |

Which Global Bond ETF should I choose?

After choosing the duration, Bond Types, pick the ETF in your currency to reduce FX Risk. Then, choose between accumulating and distributing based on your personal situation. Finally, you may consider performance, marginal yield differences and costs.

For example, if you consider a Global Bond ETF, some good candidates may include:

- For Best Protection: iShares Global Government Bond UCITS ETF

- For Incremental Yield: When unhedged, the Vanguard Global Aggregate Bond UCITS ETF provides the best yield, due to lower allocation to low yield countries like Japan. It also excludes China, that today risks deflation.

- For Largest Diversification: iShares Core Global Aggregate Bond UCITS ETF, or SPDR Bloomberg Global Aggregate Bond UCITS ETF

These are marginal preferences. The wider conclusion is that, given that I have pre-selected only the most established names for this analysis, any of the above funds are good diversifiers for your portfolio.

But, some of these characteristics, like yield, change when currency hedging is in place. Read my next article to understand how.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Next Steps

In the next article, we will look at whether hedging currencies is a good idea, and why you need to account for Hedge Return when calculating expected returns for Bond ETFs.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

The Truth About €1 Million Broker Guarantees

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

Money Market Funds: Are ETFs The Best Bang For Your Buck Or A Risky Ride?

4 Things I Learned In 4 Years Of Running A Finance Blog

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.