Bankeronwheels.com Guide Methodology

Banker, cyclist or retriever? Choose your investing style!

We have divided our guides into easily digestible chunks to make your journey more enjoyable.

KEY TAKEAWAYS

- Three Characters – We’ve designed three distinct characters to guide you through your investment journey. Choose the one that aligns with your investment goals, the amount of time you’re willing to dedicate to managing your portfolio, and your eagerness to deepen your understanding of financial markets.

- Three Main Sections – Our content is organized into three primary sections to cater to different levels of expertise and interest: A beginner’s guide for those new to investing. An in-depth look at ETF selection and best practices, tailored for informed decision-making, and a section dedicated to investment strategies.

- For Investors From All Around The World – Our resources, including the beginner’s guide and investment strategies, are designed to be universally applicable, benefiting investors worldwide. The ETF section is an exception. It caters to non-US investors by focusing on UCITS ETFs, which offer tax advantages for these investors.

Here is the full analysis

How Do I See If An Article Is for me?

Look at the TOP left corner of our articles

Resource Guidance on the website

Each resource on this website is tagged according to the path you want to choose.

The Icon reflects your Investing Style. From Simple Passive Portfolios (Golden Retrievers), through semi-passive (Cyclists) to Advanced Investing (Bankers).

How Do I Use This Site?

Meet Our three characters

The Golden Retriever, The Cyclist and The Banker!

We have created three characters to help you on your investing journey. Pick one of them depending on your objectives, time you want to spend managing your portfolio and willingness to increase your knowledge about financial markets.

The Golden Retriever, aka Wise Passive Investor – has the simplest and easiest to understand portfolio with minimum maintenance, as he assumes – probably correctly – that a dog is just as likely to beat the market in the long run as a professional investor. The Golden Retriever follows the bone (aka money) in the most fee-efficient and transparent way. Simplicity often wins.

The Cyclist, aka Semi-Passive DIY Investor – Accepts that markets are mostly efficient, but given her experience in travelling across the globe, she has the desire to incorporate a couple of active bets, and high-level tweaks (e.g. optimising taxes or offsetting job risks) to her predominately index portfolio. She also won’t bother overdoing this because, after accounting for costs and time doing research, trying to beat the market can’t compete with real life experiences like cycling the world.

The Banker, aka Evidence-Based Investor – Has a good grasp of the markets, and wants to squeeze out all the returns based on academic research, for example using Factor Investing or Risk Parity Strategies. But, Equity Risk Factors underperform over long periods of time, and sticking to his guns will be challenging. Strategies with leverage also have their own risks. Implementation is not straightforward, and outcome – far from guaranteed.

The Golden Retriever, aka Wise Passive Investor – has the simplest and easiest to understand portfolio with minimum maintenance, as he assumes – probably correctly – that a dog is just as likely to beat the market in the long run as a professional investor. The Golden Retriever follows the bone (aka money) in the most fee-efficient and transparent way. Simplicity often wins.

The Cyclist, aka Semi-Passive DIY Investor – Accepts that markets are mostly efficient, but given her experience in travelling across the globe, she has the desire to incorporate a couple of active bets, and high-level tweaks (e.g. optimising taxes or offsetting job risks) to her predominately index portfolio. She also won’t bother overdoing this because, after accounting for costs and time doing research, trying to beat the market can’t compete with real life experiences like cycling the world.

The Banker, aka Evidence-Based Investor – Has a good grasp of the markets, and wants to squeeze out all the returns based on academic research, for example using Factor Investing or Risk Parity Strategies. But, Equity Risk Factors underperform over long periods of time, and sticking to his guns will be challenging. Strategies with leverage also have their own risks. Implementation is not straightforward, and outcome – far from guaranteed.

What does it take to be one of them?

Initial setup varies from a few weeks to a few months

You can become a Golden Retriever in just a few weeks. Your portfolio will be almost on autopilot. Customising your portfolio as a cyclists can take a bit longer, and maintenance is usually simple. To become a Banker, you need to acquire some portfolio management knowledge.

Types of Resources

| CHARACTER | MINIMUM LEVEL | TYPE | INITIAL READING | PORTFOLIO MAINTENANCE |

|---|---|---|---|---|

| Golden Retriever | Beginners | Passive Investing | 4-8 weeks | Few Hours per Year |

| Cyclist | Intermediate | Semi-Passive | 2-3 months | Couple of days per quarter |

| Banker | Advanced | Advanced (Factors, Risk Parity) | 3+ months | Couple of days per quarter |

Is a retriever portfolio less profitable?

Not necessarily. But it's easier to manage and understand.

The big misconception in investing is that a complex and sophisticated portfolio guarantees superior performance, as compared to a simpler one. Risks and Returns don’t necessarily depend on the complexity of your portfolio or your knowledge. The portfolio risk, whether it’s as straightforward as a Golden Retriever’s or as intricate as a Banker’s, varies based on how it’s built and the way assets are allocated.

To choose a portfolio, consider the following: Will you fulfil your life objectives with this portfolio? And crucially, will you remain level-headed and avoid rash decisions when (not if) its performance inevitably derails?

Are retrievers less knowledgeable?

Sometimes they may be the smartest.

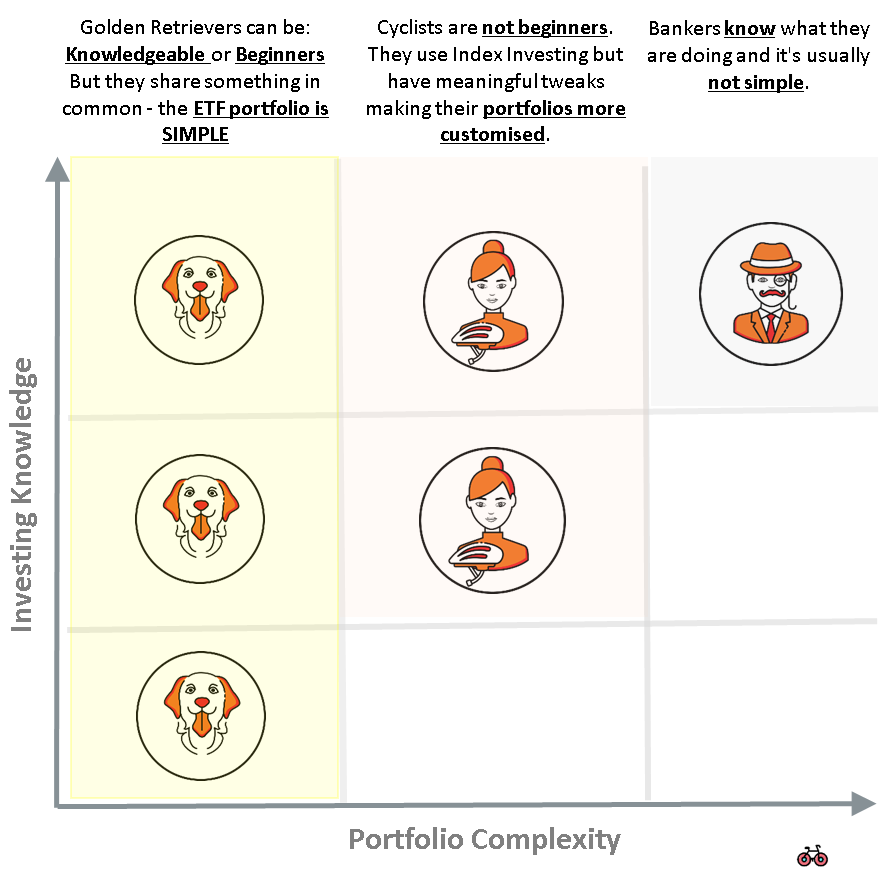

We divide our guides based on the desired complexity of your portfolio and willingness to learn more. So, if you see:

- A Golden Retriever – It suits two types of audiences. First, Individuals who aim to learn just enough to maintain an efficient portfolio, allowing them to focus on other important aspects of life. Second, it may also be ideal for those who value knowledge but prefer to keep their investing strategy straightforward. That’s because a lot of smart Golden Retrievers are aware of investment pitfalls, including behavioural, tax and cost implications of active investing.

- A Cyclist – Seeks customization in her investment approach, akin to a cyclist making precise adjustments for optimal performance. It’s particularly beneficial for those looking to enhance tax efficiency or balance specific risks, including perhaps job-related uncertainties (human capital).

- A Banker – Has sophisticated investment needs. You must be comfortable navigating complex financial landscapes and looking for advanced portfolio strategies.

Which investor are you?

How To choose a character

1. The Golden Retriever

Should You be Chewy - the Golden Retriever?

Here are some of the practicalities of being a Golden Retriever:

- For whom: All Investors can set up this type of portfolio, including very beginners.

- Why To Be A Dog: Investing requires minimal effort. You can live your life to the fullest without spending time managing your portfolio, but still following best market practices.

- Initial Time Required: You will need 4–8 weeks to become familiar with the materials to set up a portfolio and implement it.

- Ongoing Portfolio Maintenance: You only need a day or two per year to rebalance a portfolio.

- Main Challenges: Sticking to your strategy can be challenging during market crashes, and when certain markets that your friends are invested in outperform.

- Number of ETFs: You won’t need more than a couple of ETFs.

- Examples of Funds: Global Equity ETFs or with the addition of bonds Vanguard Lifestrategy ETFs

- Bankeronwheels.com Resources: A significant part of our guides are targeting Golden Retrievers.

2. The Cyclist

Should You be Kumiko ( 組子)- The Cyclist?

- For whom: Intermediate or Advanced Investors.

- Type: Index portfolio with some active bets.

- Why to be a Cyclist: Allows to (i) Invest in a customised way, improving tax efficiencies, potentially reducing fees, implementing some personal views for example related to sustainability, offsetting human capital and potentially increase risk-adjusted returns.

- Initial Time Required: You will need 2–3 months to become familiar with the materials to set up a portfolio and implement it.

- Ongoing Portfolio Maintenance: You will likely need a day or two per quarter to rebalance a portfolio and optimise it from a tax perspective.

- Main Challenges: May require more research and maintenance. You will be prone to potential behavioural biases, and may find it challenging keeping the active part relatively small and a consistent over time.

- Number of ETFs: Usually involves at least three funds.

- Examples of Funds: Regional tilts to capitalization-weighted indices, adding diversifiers, Socially-responsible Screening or Tax-efficient regional ETFs.

- Bankeronwheels.com Resources: Most of our guides target cyclists.

3. The Banker

Should You be Ethan - The Banker?

Here are some implications of being a Banker:

- For whom: Advanced Investors.

- Type: Investing incorporating Equity Risk Factors or Strategies like Risk Parity.

- Why To Be a Banker: Allows for potential outperformance compared to capitalisation-weighted indices.

- Initial Time Required: You will need at least months to become familiar with academic research related to risk factors, and implement it.

- Ongoing Portfolio Maintenance: You will likely need a day or two per quarter to rebalance a portfolio and optimise it from a tax perspective.

- Main Challenges: Substantial research, maintenance and adequate ETF selection. Potential behavioural biases, keeping the active, underperforming parts consistent over long periods of time. Poor UCITS availability for certain strategies and tax leaks for US ETFs.

- Number of ETFs: Usually involves at least three funds, but multifactor funds can make implementation simpler.

- Examples of Funds: Multi-factor ETFs, Leveraged Portfolios, Risk-Parity ETFs, Small Cap Value, CTAs etc.

- Bankeronwheels.com Resources: Currently, only a few guides target bankers. This will increase over time.

What Guides are available?

Discover the three main sections

Our guides are divided into three sections:

- Beginners’ Guides (All Investors) – These resources are compiled to introduce beginners to investing, including books and movies. Most of these resources are agnostic to your location and can be read by US, European or any other investors.

- ETF Guides (Non-US Investors) – These guides focus predominately on UCITS ETFs covering Equities, Fixed Income, Fund of Funds, Alternatives and Sustainable Investing. These guides are mainly for non-US Investors.

- Investment Strategy Guides (All Investors) – These guides cover portfolio construction, asset allocation, asset classes or risk management. Most of these resources are agnostic to your location and can be read by US, European or any other investors.

Meet Our Community

A lot of cyclists!

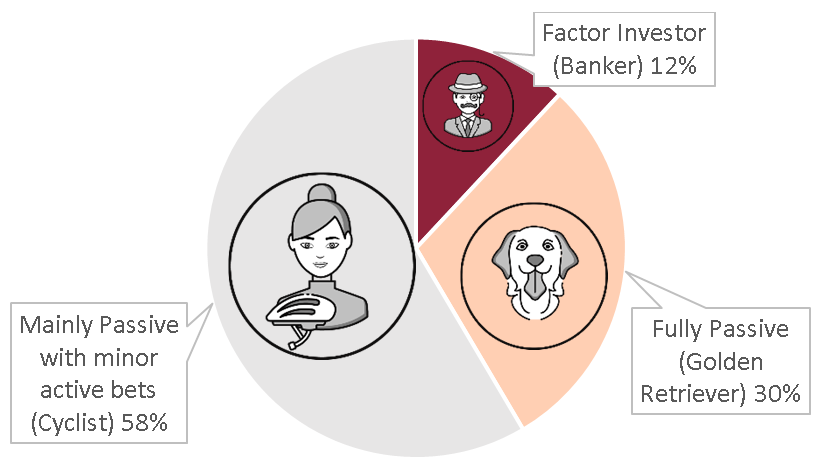

Current Complexity of our Community Members' Portfolios

- Golden Retrievers – About a third of our readers want to keep it extremely simple and efficient by using 1 to 2 ETFs for their entire portfolio.

- Cyclists – 58% of our readers are passive but are experimenting with tweaking their portfolio, including tax optimisation and customisation or sometimes a few active bets.

- Bankers – 12% of our readers are experienced enough to implement factor investing.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Broker Safety: Should You Rely On Broker Insurance?

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

Money Market Funds: Are ETFs The Best Bang For Your Buck Or A Risky Ride?

4 Things I Learned In 4 Years Of Running A Finance Blog

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.