How To Choose A Safe Stock Broker?

Definitive guide to choosing a stock broker - Part 3

This is part 3 of Bankeronwheels.com Definitive Guide to choosing a Stock Broker.

Imagine discovering your broker has gone belly-up overnight, leaving your hard-earned investments in the balance. In a market where investors tirelessly chase after low fees, the often-ignored specter of broker failure lurks in the shadows.

The collapse of a broker isn’t just a plot twist in a Hollywood blockbuster—it’s a stark reality that has left many investors stranded and panicking.

Could your broker be next? What safeguards do you have in place?

Here is what you need to know to protect your savings.

KEY TAKEAWAYS

- It is unlikely that you will incur losses—on ETFs or other securities—following a Broker bankruptcy. For your investments to be at risk, three conditions must happen simultaneously: fraud, inadequate broker capital, and an insufficient Compensation Scheme.

- But your assets could be frozen for months – if the resolution process is complex or if locating securities is delayed due to, for example, accounting issues. In times of significant market stress—when it’s crucial to have control over your assets—you may face opportunity costs.

- Some accounts are at higher risk – This is particularly true for brokers in countries with weak regulators, or those with complex business models involving derivatives and leverage. There’s a risk with accounts that allow security lending, especially if the brokers do not adequately manage counterparty risk.

- To mitigate these risks – consider choosing brokers that are transparent, listed on a stock exchange, issuing rated debt, systemically important – increasing the likelihood of state support – and are regulated in jurisdictions known for robust guarantee schemes.

- Securities and Cash have a combined Investor Guarantee Scheme – ranging from €20k in countries like Italy or Belgium to €100k in Spain. An additional safeguard exists if cash is held in your name with a bank, potentially benefitting from an extra €100k guarantee.

- Interactive Brokers – the largest retail broker announced a merger of its Hungarian and Irish operations in Sept’23. All EU customers will fall under the supervision of the Central Bank of Ireland.

Here is the full analysis

Can my Broker Go Bust?

It happens more often than you think

In the UK alone, a number of retail brokers went bust just over the past few years:

- SVS Securities folded in 2019 after UK regulators uncovered questionable commission arrangements.

- Beaufort Securities, previously listed among the “UK’s 1,000 Companies to Inspire in 2017” by the London Stock Exchange, ultimately collapsed. This downfall followed a scandal involving and resale of Picasso’s ‘Personages’, which was part of a larger money laundering scheme.

- Worldspreads, Fyshe Horton Finney, and Pritchard Stockbrokers, also met their demise due to various financial ‘irregularities’.

In Theory, one Rogue Trader can take it down

For Some the Market May Be One Giant Casino

The most notorious tale from Hollywood involves Nick Leeson, who gambled away clients’ funds and covered his losses, ultimately leading to the fall of Barings, one of Britain’s oldest banks. However, Leeson’s story isn’t unique in the annals of banking history. Other individuals, such as Kerviel and Adoboli, have also left indelible marks with their rogue actions. This raises a critical question: Could brokers potentially face similar systemic failures due to individuals going rogue?

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

What Makes It more likely?

in practice, certain Business Models can be a trigger

Wannabe Goldman Sachs

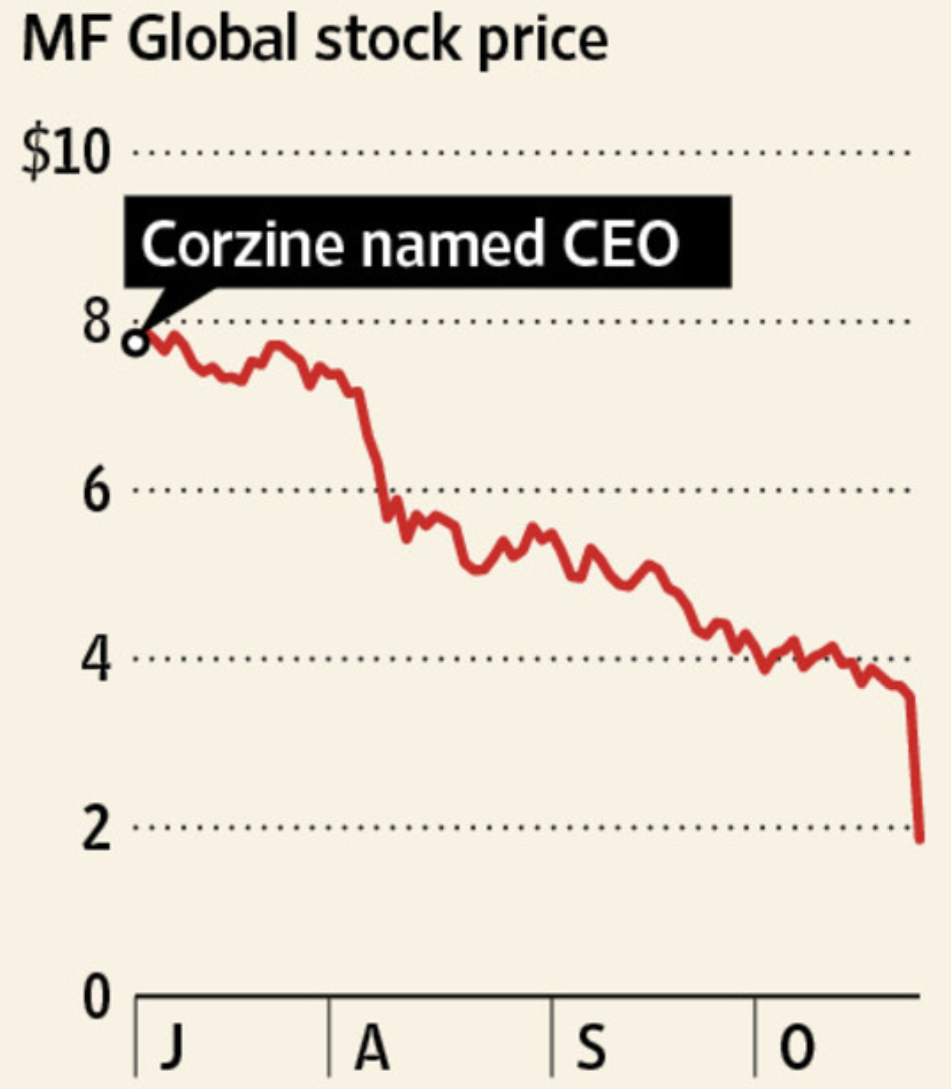

For instance, look at MF Global. A broker with ambitions. From serving retail investors and derivatives customers like farmers and financial advisors, it aimed to morph from a mundane execution shop into a powerhouse akin to Goldman Sachs.

Enter Jon Corzine, the CEO with a vision. Corzine took aggressive stabs at European Sovereign Debt amidst the tumultuous European Debt Crisis of 2011. The result? A liquidity crunch, relentless margin calls from Wall Street, and an eventual, dramatic collapse into bankruptcy.

But there’s more. In a desperate bid to stay afloat, MF Global didn’t hesitate to dip into client funds, for entire weeks. Dipping into client money, like for Nick Leeson, happened not as a premeditated action but rather as a consequence of a risky business model.

What increases the risks?

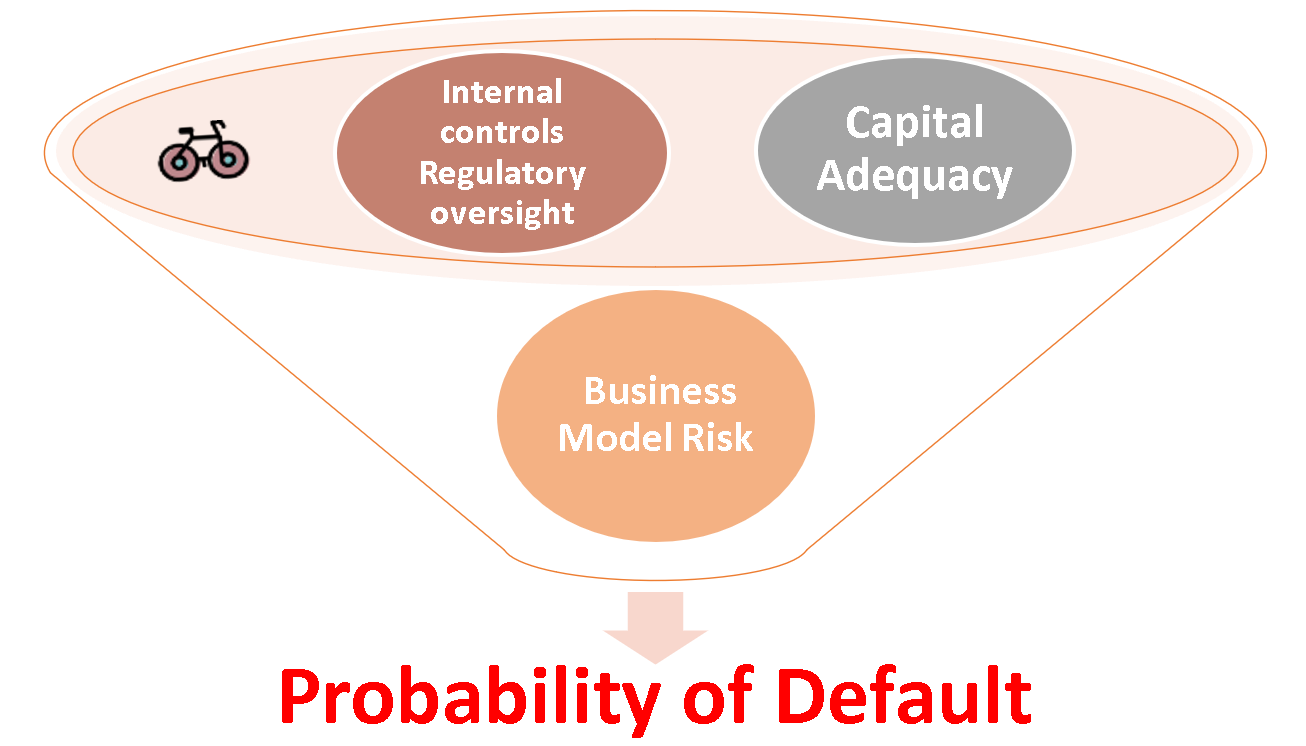

Grasping the likelihood of broker bankruptcy is no simple feat for retail investors, primarily due to limited access to relevant data and a lack of expertise to accurately gauge the probability of default. Nonetheless, certain warning signs can serve as valuable indicators. Notably, there are three red flags to keep an eye on: a Risky Business Model, a Weak Regulator, and a Lack of Capital.

#1 risky activities

Derivatives and Leverage

Does your broker operate with a risky business model? Engaging in proprietary trading, though infrequent nowadays, is a major red flag. When a broker trades on behalf of clients while also managing its own account, it may lead to conflicts of interest. There are additional risks, like market making on exotic products—including options. The cessation of such risky activities often receives positive acknowledgment from rating agencies, as evidenced by the upgraded rating of Interactive Brokers by S&P. Offering an array of leveraged products and re-hypothecating securities are other warning signs to note, as witnessed by the disappearance of client assets in the case of MF Global.

👉 Action Step: Opt for a broker with a straightforward and simple business model. If the model seems complex, demand transparency to understand the inherent risks better.

#2 Security lending

How is counterparty risk managed?

Security Lending increases the probability of not recovering all your assets. Lending securities is a common way for brokers to generate revenue. For instance, clients of DEGIRO or Trading212 engage in this practice. Other brokers, like Interactive Brokers, offer clients the option to participate. It’s crucial to review your client agreement to understand your involvement. In this process, brokers lend out securities to short-sellers, and receive interest payments in return. However, this approach carries risks: in the event of a market crisis, if liquidity for your security evaporates, brokers may struggle to recover your shares. Consequently, the management of collateral and counterparty risk becomes a matter of trust.

👉 Action Step: Avoid participating in security lending unless you are comfortable with the associated risks.

#3 An inexperienced Regulator

Cyprus is not the same as the UK

Let’s clarify something important – massive frauds are never uncovered by internal auditors, which underscores the importance of having an adept regulator. The competency and experience of regulators play a crucial role here. Take the GameStop fiasco, for instance; even the SEC faced criticism, accused of increasing the likelihood of market collapses. Smaller European regulators lack the sophistication seen in their larger counterparts. From my professional encounters with regulators, it’s evident that those in economies with deep capital markets, such as the UK and the Netherlands, tend to exhibit greater expertise and sophistication.

👉 Action Step: Always review your Client Agreement to identify which regulatory body has oversight over your broker, ensuring they are both competent and experienced.

#4 inadequate Capital

Why to Choose a Transparent Broker

Does your broker maintain sufficient capital to offset the risks they’re undertaking? Adequate reserves are vital as they need to cover potential losses, which inherently rise with the complexity of business models. For individual investors, scrutinising business models, assessing profitability, and ensuring adequate capital can be challenging tasks.

👉 Action Step: Since direct control over this aspect is typically beyond reach, demand transparency to leverage indirect oversight.

How To Choose A More Transparent Broker?

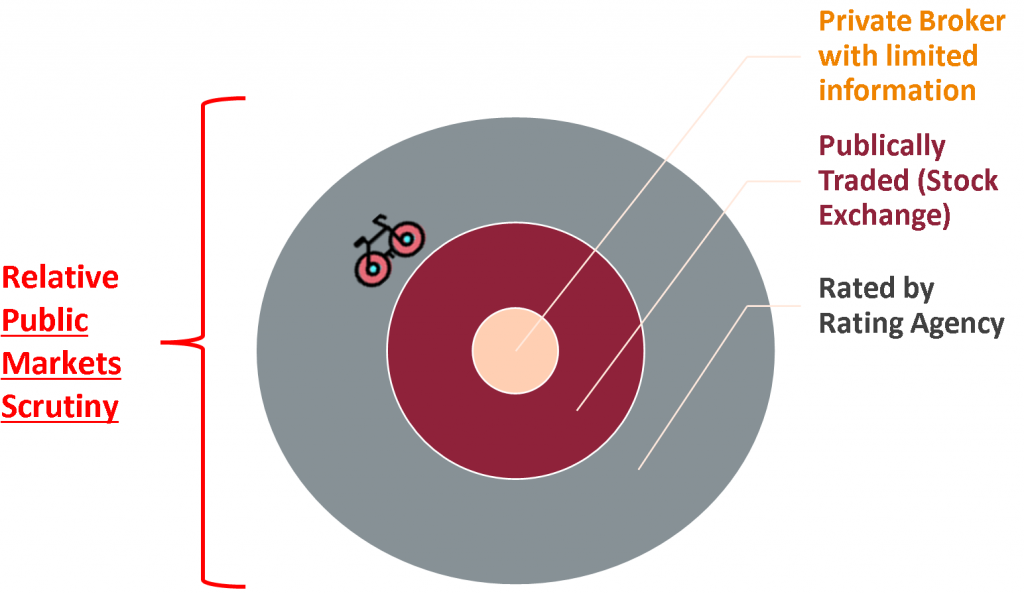

Get Wall Street to monitor your Broker

One approach to ensuring your broker is under pressure to maintain adequate capital is through the scrutiny of entities equipped with more data and expertise—such as Credit Rating Agencies or Investment Banking Research Analysts. So, how can you verify if these experts are actively monitoring your broker?

👉 Action Step: Stay proactive in seeking out analyses and reports from these specialized entities to ascertain they are keeping a close watch on your broker’s financial health and stability.

Checks To Perform

- Does IT have a Credit Rating?

- Is It listed on a Stock Exchange? What is its Market Cap?

- Or is My Broker just A Small Private Entity?

HOW TRANSPARENT IS YOUR BROKER?

#1 Best case - The Broker is Rated

Rating Agencies are on your side

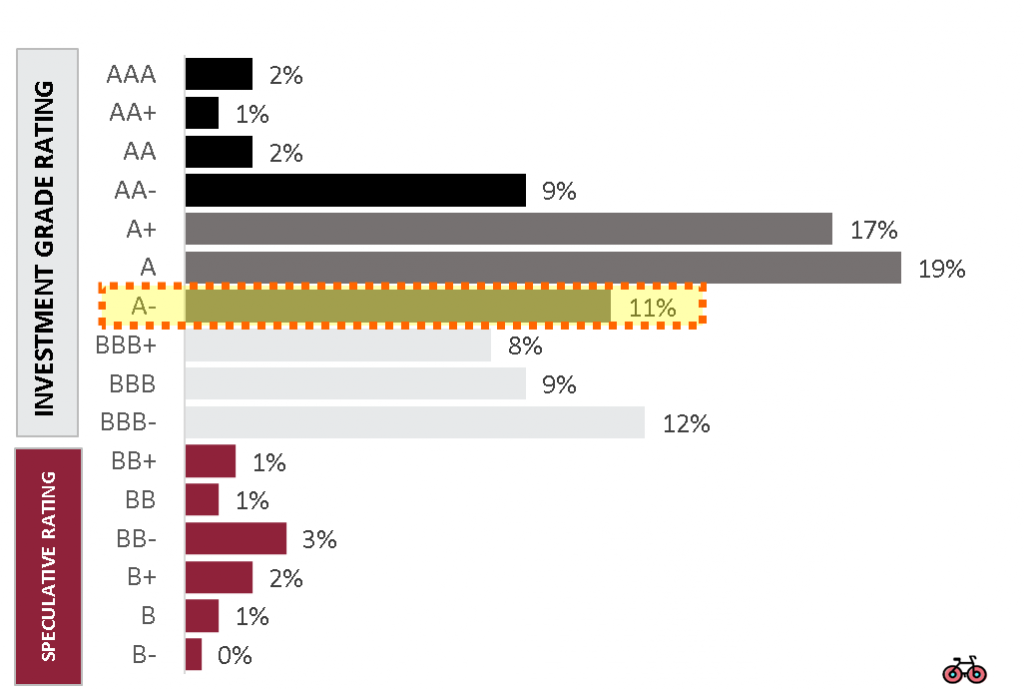

The optimal situation would be to engage with a broker that is evaluated by a credit rating agency, though such instances are quite rare. The uniqueness of this scenario lies in the rating agency’s perspective, which is highly sensitive to the risk of default—a viewpoint that directly aligns with your interests as a customer. As a retail investor, this allows you to monitor your broker’s credit rating actively and understand the rationale behind any downgrades that occur.

Rating Agencies Wore Blinders, But increase transparency Today

While Rating Agencies faced substantial criticism during the Global Financial Crisis—and rightfully so—their approach to rating ABS deals in 2008 significantly differs from how they rate banks. So, what exactly do the ratings provided by these agencies reflect?

Primarily, these agencies evaluate the probability of default (PD). In rare cases, they may also assess recovery levels (which are the inverse of Loss Given Default or LGD). This analysis is conducted for unsecured creditors who, like you, are concerned about the potential bankruptcy of the institution in question. The assessment ranges from quantitative models to qualitative scorecards that take into account profitability, debt levels, and business models.

When a broker starts facing financial issues, there might be early warning signs. While there is no guarantee that investors and rating agencies will identify these signs promptly, having expert oversight offers a clearer insight compared to navigating the situation blindly.

How are Financial Institutions rated?

How does Interactive Brokers compare?

Good quality ratings range from AAA (Best) to BBB-. Anything below is called Junk Debt, and speculative. Most Brokers don’t have Credit Ratings. One of the largest that does have a rating is Interactive Brokers (IBKR). The parent entity is rated BBB+ but the Broker Business is rated A-.

Compared to banks, IBKR ranks in the middle of the pack, which is a solid performance given that Rating Agencies penalise brokers due to less stringent regulations. 11% of Banks are rated A-. 50% are rated above A- while 39% are below.

S&P Ratings FOR Top 200 Global Banks

If there were 100 Interactive Brokers, One of Them would go out of business in the next 10 years

What does it mean in reality? Based on past observations data, the proportion of ‘A’ Financial issuers that defaulted on their obligations was:

- 0.1% within a year

- 0.3% within 3 years

- 0.6% within 5 years

- 0.9% within 7 years

- 1.2% within 10 years

Default Rates by Rating Category

| Rating/Time Horizon | 1 Year | 3 Years | 5 Years | 7 Years | 10 Years |

|---|---|---|---|---|---|

| AAA | 0.0% | 0.2% | 0.6% | 0.8% | 1.0% |

| AA | 0.0% | 0.2% | 0.5% | 0.7% | 1.0% |

| A | 0.1% | 0.3% | 0.6% | 0.9% | 1.2% |

| BBB | 0.2% | 1.0% | 1.7% | 2.2% | 3.0% |

| BB | 0.6% | 2.3% | 3.8% | 5.1% | 6.0% |

| B | 2.5% | 7.1% | 9.8% | 11.6% | 13.8% |

| CCC/C | 17.2% | 25.1% | 28.4% | 30.0% | 32.5% |

👉 Action Step: When selecting a broker, consider their credit rating, if available. A rating up to BBB- is usually relatively solid. For brokers without credit ratings, it’s crucial to conduct additional research and due diligence to assess their financial stability and risk level.

#2 Second Best - Listed on a Stock Exchange

Size increases the chances of state intervention

A small private broker has much lower requirements to disclose data about its business model, profitability and debt than a public entity. For a lot of investors, it’s a red flag.

If your Broker is listed on a Stock Exchange, Institutional Investors will analyse the company, produce reports and scrutinise profitability vs competitors. As a retail investor, you can access your Broker’s annual report to understand its business, too. The larger the broker, the more eyes will potentially watch it. And the more systemic the risk becomes. It’s not a guarantee, but the State will have more skin in the game when things go wrong.

Price action may also draw attention, especially if it’s a long trend related to things like profitability, not necessarily a quick way down like MF Global back in 2011.

👉 Action Step: For brokers listed on stock exchanges, regularly review analysis from institutional investors, if available, and the broker’s annual report. Pay attention to long-term price actions and trends, as they may offer valuable insights into the broker’s financial stability and future prospects. Be aware that while larger brokers may offer a sense of security, they also carry risks.

Best case - Significant Opportunity Costs

The more complex the business, the longer the wait

Even if your funds are eventually recovered, significant opportunity costs can occur. The duration of the bankruptcy process is unpredictable, during which you cannot access, sell, or rebalance your investments. Since the bankruptcy proceedings tend to be prolonged (lawyers are paid by the hour, after all), the opportunity costs can be substantial.

For instance, in the UK, the FSCS guarantees investors’ funds in the event of insolvency but must first identify and quantify any shortfall before compensating investors. This duration is dependent on the administrators, who are tasked with reconciling accounts to verify the availability of cash and assets, a process that can be time-consuming and varies with the complexity of the task. The more intricate the business model, the longer this takes.

With no formal timeframe for returning funds to investors, even simple cases can take months, as evidenced by Beaufort Securities: it failed in March 2018, and the first transfer occurred at the end of September 2018.

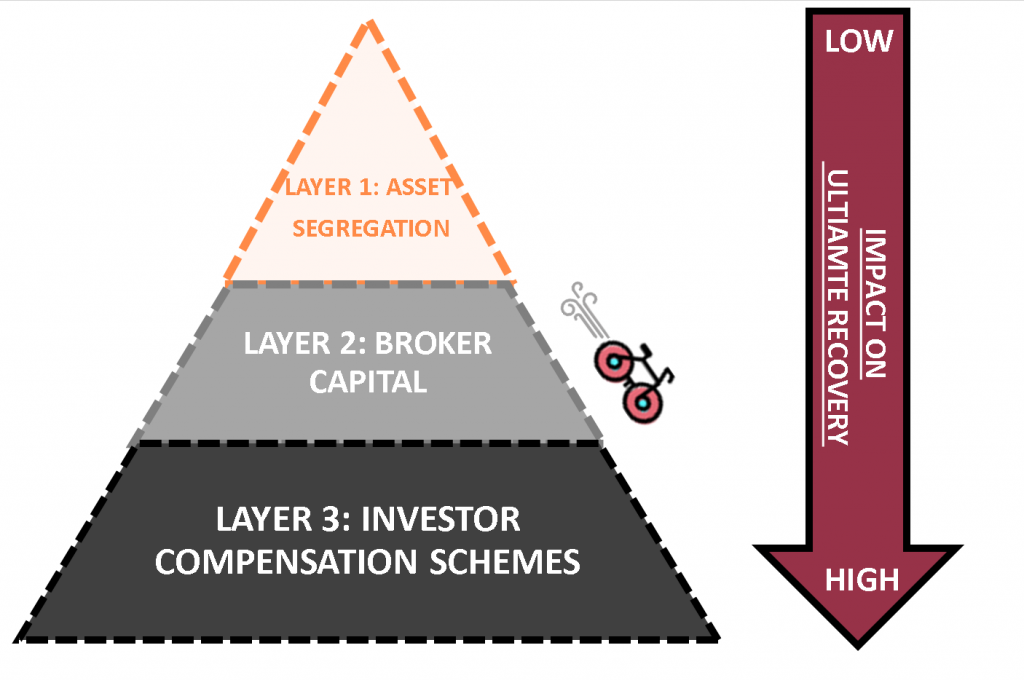

Can you lose Your Assets?

Your Three layers of protection would all need fail

Losing assets would require two simultaneous events. First, your broker would have to become insolvent due to liquidity issues, fraud, or other significant events, like a systemic collapse. Following this, all three layers of protection—asset segregation, adequate broker capital, and government compensation schemes—would need to fail in covering the losses. Although this scenario is unlikely, it is crucial to understand how to minimize these risks further.

But An Administrator can Dip into your assets

However, it’s important to note that administrators can access your assets under one of two circumstances:

- Fraud and Insufficient Capital: A very unlikely Nick Leeson case and/or

- Costly Workout Exceeding Broker Capital: For instance, if a broker holds illiquid securities and the administration process requires their valuation. In jurisdictions like the UK, regulators can impose administrative fees on investors. While other broker creditors can’t access your investments, an administrator isn’t a broker’s creditor. Administrative fees can be steep—for Beaufort Securities, PwC billed £100m. Regulators might cover these fees, but it is at their discretion.

How To Protect Your Investments AND YOUR CASH?

Investment Compensation Schemes

Asset segregation may not protect you

It’s crucial to distinguish between your Investments and your Cash. Let’s begin with the Investments. The potential losses on investments hinge on three layers of protection. However, the first two layers are largely theoretical and might not offer much help in distressing situations, especially those involving fraud and accounting discrepancies. The most straightforward and impactful precaution you can take is to verify the limits of the compensation scheme in place.

- Good Asset segregation can provide for quick Asset Transfer

- Broker Capital can Mitigate The Risk Of Losses in case of fraud

- A Compensation scheme is the ultimate safety

The Three Layers of Protection For YOUR INVESTMENTS

What Are Investment Compensation Schemes?

EU Countries need to apply a guarantee of at least €20k

Investment Compensation Schemes (ICS) in the EU are protective frameworks established to shield investors’ assets and funds. These safeguards come into play when investment firms are unable to return investors’ assets due to insolvency or misconduct. The ICS offers a predefined level of compensation to investors. While each EU member state operates its own unique scheme, all are aligned with an EU directive that mandates a minimum coverage per investor. This coverage is typically €20,000 or higher, depending on the specific regulations of each nation.

Why do these Scheme exist?

To protect investors from fraud and accounting issues

The European Commission notes on its website: “Investor Compensation Schemes protect investors using investment services by providing compensation in cases where an investment firm is unable to return assets belonging to an investor. This might occur for example where there is fraud or negligence at a firm or where there are errors or problems in the firm’s systems”.

What is guaranteed?

The ICS is a combined protection on both Investments and cash

Investor Compensation Schemes exist because of the risk of fraud, and that’s why it’s the ultimate safety net. According to the EU Directive, the compensation arises when the broker is unable to:

- Repay money – owed to or belonging to investors and held on their behalf.

- Return any securities – belonging to investors and held, administered or managed on their behalf.

How can I check the compensation Amount?

Ensure you know which agency regulates your Broker. European Brokers often operate through multiple entities, and the specific entity overseeing your broker determines the limit of the compensation scheme available to you. This is not necessarily determined by your country of residence.

👉 Action step: Verify the EU country in which the broker entity handling your investments is regulated. This information is typically found in the Client Agreement. Be sure to review this document to understand the regulatory framework and compensation limits that apply to your investments.

What is the compensation Amount?

How is it calculated?

The guarantee is per eligible person, per broker. So, if you have multiple accounts with one broker you only benefit from the guarantee once.

It varies a lot within the EU

Depending on where the broker is regulated, you may check the relevant amount:

- In the US, the limit is $500,000. It also includes a cash component of up to $250,000.

- In the UK, your limit is £85,000, with an additional £85,000 for cash.

- The EU directive ensures a minimum of €20,000. The implementation of this directive varies a lot. Certain member states go well beyond that, e.g. Spain with €100,000 or France with €70,000, but it drops to €25,000 in Portugal and €20,000 in Poland or Germany.

Will I get 100% of the claimed amount back?

No, in certain countries 10% will be lost

The compensation may be 100% or 90% of the loss, depending on the member state. The EU gave member states the flexibility to make investors share some losses.

In a nutshell, some countries want you to do your homework and assess how risky your broker is. Examples of countries with this limit include Germany or Ireland which only guarantee 90% of your losses up to a maximum of €20k. In these instances:

- If the loss is €30k, you will recover the minimum of 90% of 30k and 20k, so in this case €20k.

- If the loss is €16k, the recovery is 90% of the amount which is €14,4k.

Does Cash have an additional guarantee?

Usually cash doesn't have an additional guarantee

Typically, it will be combined with the guarantee on your investments.

Where Is My Cash Held?

It's usually commingled with other customers' cash

As investment brokers, firms are not allowed to keep your cash. Under EU law, investment firms must hold the client money, including any dividends or interest paid, in a safe, protected way. If you are not fully invested, it is either:

- Commingled customer cash account – with a custodian Bank, that is sometimes disclosed by the broker. A combined guarantee applies.

- A Money market fund – Broker can park the cash in short term Bond holdings, but they do not fall under the European Deposit Guarantee Scheme like Bank accounts. The combined guarantee applies.

- A Bank Account in Your Name – If you have a segregated bank account in your name arranged by your broker. An additional guarantee applies.

👉 Action step: Check the broker’s policies or your client agreement to clarify how your cash is managed. Is it held in a commingled bank account, or in your name?

What happens to my Cash when my Broker goes bust?

It's part of the ICS, unless you have a bank account in your name

Depending on the above arrangement, different scenarios may apply. The best case is, if a separate Bank account is opened in your name. All cash benefits from the dedicated European Deposit Guarantee Scheme up to €100,000.

Some broker-bank arrangements fall into this category, e.g. DEGIRO has launched this after merging with FLATEX, or your country may have some additional provisions for such situations, e.g. France usually gets brokers to open a Bank account in your name.

But most don’t have such arrangements, and your cash is commingled with other investors, so you don’t have an additional guarantee.

Summary of Compensation Schemes

| Country | Investment Guarantee | Coverage Level | Cash Guarantee | Guarantor |

|---|---|---|---|---|

| US | $500k | 100% | Combined up to 250k | SIPC |

| UK | £85k | 100% | Additional £85k | FSCS |

| Spain | €100k | 100% | Combined | FOGAIN |

| Hungary | €100k | 100% | Combined | BVA |

| France | €70k | 100% | Combined | FGD |

| Portugal | €25k | 100% | Combined | SII |

| Poland | €22k | up to €3k - 100%, €3-22k - 90% | Combined | KDPW |

| Netherlands | €20k | 100% | Combined | ICS |

| Belgium | €20k | 100% | Combined | GF |

| Italy | €20k | 100% | Combined | FNG |

| Denmark | DKK 150,000 | 100% | Combined | FS |

| Germany | €20k | 90% | Combined | EDW |

| Ireland | €20k | 90% | Combined | ICC |

Same Broker CAN have Different Protection Schemes

In Sept'23, Interactive Brokers Merged its operations

Below are some examples of how you may analyse your broker. To make the example more relevant, I considered investors from the UK, France and Poland for the same broker – Interactive Brokers.

Depending on your location, you will be signing the client agreement with a different entity, benefit from a different Investor Compensation Scheme and have a more or less sophisticated regulator:

- The UK Investor – falls under her local regulatory supervision with its £85 investor protection scheme.

- The French Investor – signs an agreement with the Irish Entity (IBIE), that services most Western European Clients, and has a €20k compensation scheme.

- The Polish Investor – historically signed an agreement with the Hungarian Entity (IBCE), that services most Eastern European Clients. It benefited from the Hungarian €100k protection scheme. However, since in Sept’23 IBKR announced moving all its EU operation to Ireland, so going forward a €20k scheme will apply.

Hungary will no longer have a double taxation treaty with the US from 1st January 2024. In Sept’23 Interactive Brokers announced moving its Hungarian operations to Ireland. Read more about the impact.

Illustrative examples of European Brokers

| Investor Country | Broker | ICS | Local Regulator | Parent | Inception | Listed | Rated | Size | Rating | Cash Arrangement | Securities Lending |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UK | Interactive Brokers | £85k | UK | USA | 1977 | ✓ | ✓ | $34 bn | A-/BBB+ | 14 IG rated large U.S. Banks | Optional |

| France | Interactive Brokers | €20k | Ireland | USA | 1977 | ✓ | ✓ | $34 bn | A-/BBB+ | 14 IG rated large U.S. Banks | Optional |

| UK | Vanguard UK | £85k | UK | USA | 1975 | ✘ | ✘ | Large | - | Banks | No |

| Germany | DEGIRO | €20k | Germany | Germany | 2013 | ✓ | ✘ | $1 bn | - | Flatex Bank | Yes |

| Belgium | Saxo | €20k | Danemark | China | 1992 | ✘ | ✘ | Medium | - | Saxo Bank | Unk |

| France | Trading 212 | €20k | Cyprus | Bulgaria | 2013 | ✘ | ✘ | Small | - | Barclays | Yes |

How does it work in practice?

what happens if a stock broker goes bust

Typical Chain of events and process

If a stockbroker goes bust:

- Liquidation Process: The failed firm usually goes through a liquidation process, where customer claims are addressed. The trustee or relevant authority will work to return assets to the customers.

- Transfer to Another Broker: Customer accounts might be transferred to another solvent broker. This helps in resuming trading and investment activities.

- Losses: Any trading losses or decline in investment value are not covered by protection schemes. Missing assets and cash due to broker failure are then addressed.

- Investment Compensation Schemes Kick in: For example, in the U.S., the Securities Investor Protection Corporation (SIPC) may cover up to $500,000 (including a $250,000 limit for cash) per customer when assets are not fully recovered. In the UK, it’s £85k.

This is a general outline, and the exact process can vary based on jurisdiction and specific circumstances of broker failure. Always check with the relevant authorities and regulators for the most accurate and current information.

Common misconceptions About Broker safety

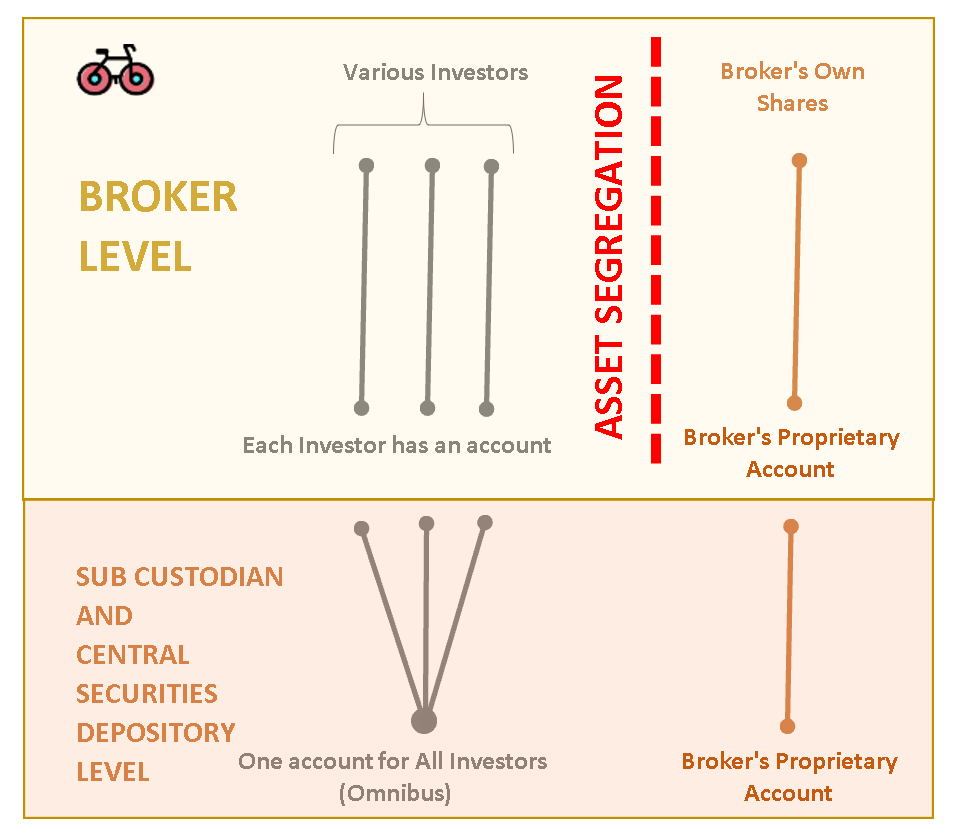

The broker does not hold shares in your name with the custodian.

Although old terms such as ‘deposit’ or ‘safekeeping’ are still used, shares have not been held in paper form for many years.

Your shares are commingled with other investors in a Central Securities Depository that tracks the ownership of shares. Because Omnibus accounts are used in most cases, your name won’t be listed on this depository, but rather your broker or another executing broker that executed the order for them as the ‘Nominee’, as illustrated below.

But remember, at the Central Securities Depository level, all of these client assets are held together. So, a chain of rights is in place, in which you, the investor, are the ultimate beneficiary. But, this assumes the broker’s accounting system, at the moment of bankruptcy, has all the relevant information, which is not a guarantee. Bankruptcies happen for a reason, and accounts can be manipulated.

No. In fact, the scheme was mainly designed to protect securities, not cash, that won’t be returned to investors due to fraud. That’s because Investors are supposed to make money work for them by purchasing securities, and not hold cash. But fortunately, the ICS also happens to cover any remaining cash up to the overall limit.

In the best case, if broker systems are good, and there is no fraud, the transfer of shares to another broker will be much smoother. But unfortunately, asset segregation is not a guarantee and is unlikely to provide protection when you need it most.

Asset segregation is designed to keep client assets separate to avoid the commingling of customer assets with the working capital of the brokerage firm. The process involves having separate legal entities, e.g. an SPV, that is bankruptcy-remote from the Broker and can’t be accessed by broker creditors during an insolvency process.

So yes, all brokers will claim asset segregation, because it’s a regulatory requirement. But the broker is managing all accounts until it collapses. This protection only works if the employees of the broker don’t act in a fraudulent manner by mismanaging, including in the accounts, client assets of the separate entity, including transferring/selling or mismanaging your shares.

But, when the Broker is on the edge of collapse, and needs cash or assets to meet its own liabilities, the temptation to ‘borrow’ client assets, may become appealing.

This is usually not the case. Cash is protected up to the combined amount. That’s because it’s likely that the cash is held by the broker in a commingled custodian account along with other investors.

The reason is simple. Investors shouldn’t hold cash in their broker accounts, but rather money market funds or other short-term instruments.

But there is one exception. Certain brokers are affiliated with banks and if they do open an account in your name, then the EU Deposit Guarantee Scheme will protect you up to an additional €100k.

Indeed, most individual investors don’t have the data nor the experience to estimate the likelihood of default. They may also be missing some key pieces of the puzzle – for example, capital adequacy. But you may somewhat mitigate risks by choosing an entity that has any of the following (i) a more experienced regulator (ii) with a simpler business model (iii) being transparent, (iv) and systemically important.

In theory, brokers have capital requirements designed to cover administration costs if they collapse.

But it is possible that the capital held by the broker isn’t sufficient to cover the administration costs, for example if the broker also manages very illiquid securities that need to be valued by third party consultants. In this case, Investors may, depending on the insolvency regime, bear some administration costs. In the case of Beaufort Securities, this amount was in the hundreds of millions.

That is, unless the State decides to step in and cover the shortfall.

So, while more capital doesn’t always translate into the lower probability of default, brokers with larger market caps are under more scrutiny by regulators as they pose systemic risks, making bail-outs potentially more likely.

Final Thoughts

Should I have accounts with multiple Brokers ?

Diversification is the only free lunch in finance

Today, a lot of brokers pass no fixed costs on clients, so having multiple accounts has limited downsides, mainly lower convenience, but possible upsides. Broker diversification is recommended. Being without the ability to access investments for months can create significant stress. Compensation schemes typically apply the limit across all accounts you have with a Broker – but, of course, not across Brokers. If you have large savings, and you want to improve your protection, the obvious thing to do is to have accounts with more than one broker.

Should I have accounts with Banks?

Banks have tighter regulations

Since the GFC, Banks have been more tightly regulated. In fact, credit rating agencies apply notching for brokers for this reason. Finding a cheap Bank is generally a good idea to diversify counterparty risks.

Apply Common Sense

Things will most likely turn out fine

In terms of safety, the system usually works well in case of a collapse, and you should ultimately receive the investments you legally own promptly and any money, including dividends and interest, back. At a minimum, keep in mind the following:

- Keep records of your holdings

- Be vigilant - A failure of a broker often prompts scammers offering to help investors receive compensation

It's Personal

Investors will have different requirements

Broker selection, like most things in investing is very personal. A young investor in her 20s may prioritise compounding and fee impact, while an investor in his 40s may want safety of a large pool of assets for retirement. There is no one size fits all.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

WHat else you need to consider

Given the low Investment Protection Scheme amounts in the EU certain brokers subscribe to an insurance policy for their customers to increase the limits. Should you rely on these guarantees? Let’s have a look at them in the next part of our guide.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Broker Safety: Should You Rely On Broker Insurance?

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

Money Market Funds: Are ETFs The Best Bang For Your Buck Or A Risky Ride?

4 Things I Learned In 4 Years Of Running A Finance Blog

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.