Easy, But Boring Money – How to Reduce Withholding Tax?

The Definitive Guide to Slashing ETF Costs and Taxes - PART 4

This article is Part 4 of our Definitive Guide to Slashing ETF Costs and Taxes.

One of the advantages of DIY Investing is that you can optimise for your personal circumstances, including reducing your tax bill. ETFs are simple, transparent and efficient.

But the devil is in the details. Often invisible taxes affect returns from dividends, especially, when money flows beyond borders.

KEY TAKEAWAYS

- There are three levels at which ETFs are taxed.

- By investing through tax-wrappers, such as an ISA in the UK or PEA in France, you can eliminate taxes owed to your government. However, you might still be subject to withholding taxes from other countries where dividends originate.

- Most Equity ETFs are affected, particularly Global Funds where U.S. Stocks represent over 60% of market value.

- To reduce Withholding Taxes paid to the U.S. Government from 30% to 15%, choose an Irish-domiciled ETF. But there are two ways to reduce Withholding Taxes even further.

- First, Synthetic ETFs do not pay any withholding taxes to the U.S. Government at all.

- Second, U.S. ETFs can reduce the overall tax bill to both the U.S. and your Government due to tax offsets. But before investing is U.S. ETFs be sure that your country, like the UK or Switzerland, has a good Estate Tax Treaty with the U.S.

- There are no Withholding Taxes on US Bonds, so Bond ETFs are less problematic.

Here is the full analysis

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

how taxes can get out of control

Why do we have to deal with withholding taxES?

A withholding tax is a tax imposed by a country on outflow of dividends, interest or capital payments from that country. This is done because generally, governments are concerned about money outflows from their jurisdiction.

The tax is paid to the Government by the payer of the income (ETF) rather than the recipient of the income (you, the Investor). It gets worse. It is not a one-off tax. Each time there is an outflow outside any impacted country’s borders, there is potential for an additional withholding tax.

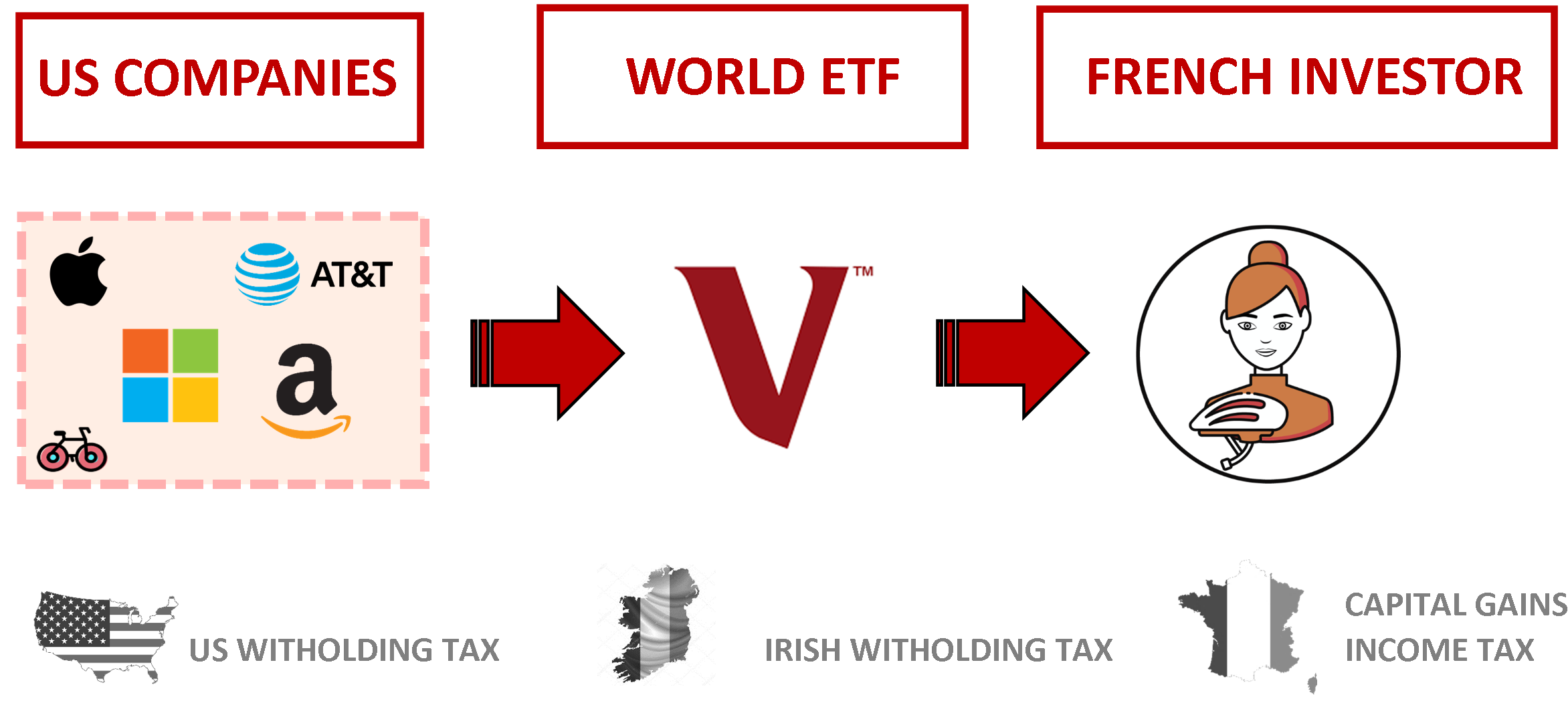

Typical Dividend Flow - from the US to France via Ireland

If you don’t pay close attention and optimise taxes, each country in the chain – where your Global Stocks are located, the ETF domicile-country and your home country – will claim its part. Without you noticing it.

In the example above:

- Dividends flow out of the US (Level 1 Tax) – They are paid by US companies to an ETF outside the US (in Ireland) and thus US authorities charge a US withholding tax (Level 1 Tax is 15% since the ETF domicile is Ireland. It’s paid to U.S. Authorities.)

- Dividends flow out of Ireland (Level 2 Tax) – But Irish ETF dividends are paid to an investor outside Ireland (France). So, normally, another withholding tax would be charged (however, Ireland does not charge anything for European Investors, so what’s called Level 2 Tax is 0%.)

- Dividends taxed in home country (Level 3 Tax) – The nightmare is not over just yet. The French Investors pay income and capital gains taxes in France for dividends and when selling the ETF (These are called Level 3 Taxes and are individual. In France, they are 30% unless investing through French PEA tax wrapper.)

What Can you Do About it?

When buying an ETF, pay attention to what’s called ETF Domicile. This will not only determine the Level 1 taxes that I described above, because of the arrangement of the country where the ETF is domiciled with the U.S., but sometimes even also Level 2 taxes because of the arrangement of the country where the ETF is domiciled with the Investor’s home country.

Which Taxes Can be Optimised?

Usually, Level 2 taxes in the EU are 0%, so the key ones to watch out for are Level 1 and Level 3 taxes. Let’s see first how to reduce Level 1 taxes.

Why the rest of Europe is irrelevant

The popular belief is that the reason why some UCITS ETFs’ Domicile is not beneficial from a tax perspective relates to the lack of a tax treaty and that Ireland has a special deal with the US.The reality is that all European countries, including Luxembourg, Germany or France have treaties with the US but the quirk is that ETFs are legally structured in a way that they often can’t access these treaties.

In Ireland, ETFs are structured like corporations, thus can benefit from the bilateral agreements between the US and Ireland. In Germany, is depends whether the fund is a KAG that faces 30% US withholding tax or InvAG with 15% tax. French and Luxembourg ETFs face a 30% tax charge.

Level 1 Tax Rates ON U.S. DIVIDENDS DEPEND ON ETF Domicile

| Key Consideration | IRELAND | LUXEMBOURG | GERMANY | FRANCE | US ETFs |

|---|---|---|---|---|---|

| Does the country have a tax treaty with the US? | Yes | Yes | Yes | Yes | - |

| Can ETF access bilateral tax treaty with US? | Yes | No | Yes / No | No | - |

| Are Equity dividends received at lower treaty level? | Yes | No | Yes / No | No | - |

| What is the withholding tax level applied to Equities? | 15% | 30% | 15% or 26.375% | 30% | 15% (less OFFSET) |

| Is interest on Bonds subject to withholding tax? | No | No | No | No | No |

| What is the withholding tax level applied to Bonds? | 0% | 0% | 0% | 0% | 0% |

For ETF domiciled in Germany, the rate depends on the structure of the Fund (KAGs or InvAGs). US ETFs are taxed at 15% if claimed back with W8BEN Form. Offset depends on country's tax code.

Easiest Choice to reduce Level 1 Taxes - Irish ETFs

Investing in Global or US Equities through an Irish or US ETF brings tax benefits. If you invest through a tax wrapper like an ISA in the UK, the Irish solution is the most convenient choice.

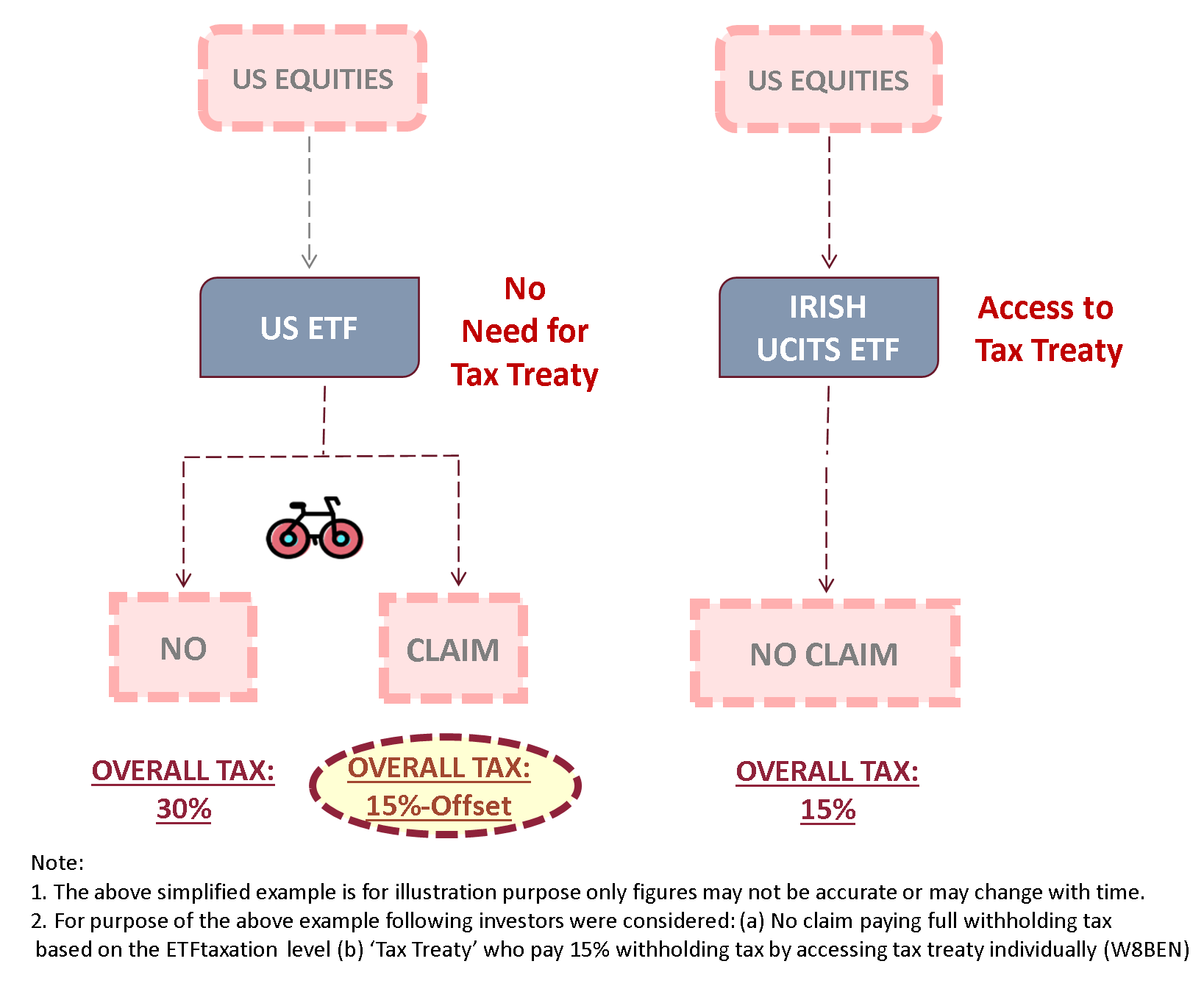

How does the Tax Offset work for U.S. ETFs?

But, there are cases when U.S ETFs may be even more beneficial than UCITS ETFs. Because they impact Level 3 taxes, reducing the overall tax bill.

You may be able to trade US ETFs. But your broker may have restrictions in place. With MIFID II regulations, you must prove that you meet certain criteria to access US Funds. If you do satisfy them, in order to benefit from tax breaks, make sure to request and fill out the W-8BEN form from your broker.

Here is what you can claim:

- Claim access the tax treaty – that your country has with the US. Similar to a European UCITS ETF you will be charged, 15% not 30%.

- Claim additional domestic tax offset – on your withholding tax paid to the US Government. This depends on the tax rules in your country. E.g. in the UK, where high taxpayers have a 32.5% rate, you can claim back the 15% already paid to US tax authorities. Great tax shield.

Level 3 Tax offset with U.S. ETFs

Two Rules Before You Buy a U.S. ETF

Before you invest through US ETFs make sure you are familiar with two additional rules:

- First, your family may be liable to a 40% estate tax on investments above $60k in case you pass away. Certain countries are exempt below very high thresholds (e.g. $5.45m for the UK, and similar levels in Switzerland)

- Second, the biggest hassle with US ETFs is for UK Investors, that also need to make sure the US ETF has a reporting status with HMRC for tax purposes. Otherwise, you may end up paying income tax on disposal instead of capital gains. If you’re not in the UK, double-check your country doesn’t have a similar requirement.

What's the Damage?

To understand the impact of choosing the wrong ETF, we can calculate the Net Dividends received post all taxes. The below illustrates dividend payments from US companies for a high tax band UK Investor. Even if access to US ETF is not available, the savings of using an Irish ETF are considerable.

Tax Bill for a UK Investor depending on ETF Domicile

| British Investor | Irish ETF | US ETF (with Offset) | Luxembourg ETF |

|---|---|---|---|

| Gross Dividend Received | 100 | 100 | 100 |

| Level 1 (Investment Level) | 15% | 0% | 30% |

| Level 2 (ETF Level) | 0% | 15% | 0% |

| Level 3 (Personal dividend tax) | 32.5% | 32.5% | 32.5% |

| Domicile tax offset | - | -15% | - |

| Overall Tax Rate | 42.6% | 32.5% | 52.8% |

Going a step further - reducing WHT from 30% to 0%

Avoiding all Taxes

There are a couple of exceptions, when you don’t pay any taxes at all, whether Level 1 or Level 3:

- UK’s SIPP – is mentioned in the double taxation agreements between the US and the UK. If you buy a US ETF, the remaining 15% may be claimed back for you, provided that the broker does the necessary paperwork. This is great news as it reduces the overall tax bill to 0%. Magic. Make sure you choose the right broker, though.

- French PEA – Investors usually invest through Synthetic ETFs that also reduce the Level 1 taxes to 0%. Again, no Level 1 and no Level 3 taxes paid. Make sure you choose Synthetic ETFs.

European ETF domiciled outside Ireland may have some merits as well. Here are some considerations when choosing an Irish ETF may not necessarily bring much tax advantage.

- Equity ETFs with Synthetic Replication, since these FUNDS TEND TO AVOID withholding taxes

- Equity ETFs with low exposure to the U.S.

- Bond ETFs

What about Dividends from other countries?

Dividends from other countries than the U.S. are affected too. But they typically represent a much lower proportion in most portfolios.

In order to check the tax rate, you can consult guides from the Big 4 Accounting Firms, including:

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Next Steps

Now, How Do I reduce Level 3 taxes?

An accumulating fund is a fund that reinvests the investor’s dividends within the fund while a distributing fund is a fund that distributes dividends to its investors.

Is any withholding tax paid on accumulating ETFs?

While the ETF will not pay you any dividend at the fund level, the ETF may still have to pay withholding tax on dividends received from stocks in other jurisdictions at the investment level.

For instance, Vanguard All-World UCITS ETF has an accumulating share class. The share class does not distribute dividends to investors, but the dividends received from US stocks get taxed in the US.

Thus, whether you are choosing a distributing or accumulating ETF will not impact the withholding tax you are paying.

In part 4 of this guide, we look at how Level 3 taxes may be impacted by the choice of the share class.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

Money Market Funds: Are ETFs The Best Bang For Your Buck Or A Risky Ride?

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.