How to ride a bull in 8 steps

You only live Twice

At a double digit daily average return, it took a few weeks for compounding to work its magic. He became rich overnight. If you don’t have such close friends, lucky you to be able to stay the course.

But for some, FOMO may be hard to resist and forces us to take calculated risks. Not only because the last epic bull market was two decades ago and such accelerating (late) stage phase of a bull market is rare.

By actively participating, you learn how euphoric markets work (assuming this lasts). You may feel what it’s like to be a 12-year old Korean Warren Buffett.

But one needs to be reminded to stay wise, especially now. Potentially compromising your life goals was the real trigger for this post (see rule #7). While this market may feel exciting, the stakes are rising.

And my goal with this website, through hard work over the past months, is to help you make your life a little bit easier. Hopefully by creating long term wealth.

Here are 8 common sense investing rules I follow to Live Twice:

- 4 rules for a life with a bit of thrill (Active bets)

- 4 for long term dreams (Passive portfolio)

One for the THRILL (Active)

If you decide to go for active investing, separate play money and goal-based portfolios.

A Golden Retriever really dislikes Japanese Shiba Inus, if only because it reminds him of the 1980s in Japan. Can’t blame him, Doge, ironic as he may be, is probably the worst bet out there.

You don’t want to jeopardize your long term dreams.

Odds are stacked against you, the moment you start making active bets.

If you really need to make them, keep active bets small (I don’t exceed 10% of my assets).

If you are lucky, small stakes will compound, like they did for my friend. You could even make your portfolio barbell by combining all your assets through a Retriever Portfolio and separating from active bets.

Timing an euphoric market is impossible. Gradually cash-in the winners.

What made my friend successful is discipline around taking money off the table when his stock was on its way to the moon. Make a simulation – e.g. selling 15-20% at each pre-defined stage can make all the difference. Open Excel – have rules, simply relying on ‘gut feeling’ and keeping things in your head in not enough. Hold yourself accountable.

In a bull market, profit is what’s booked; all else is just potential gains.

#3 Don't be naïve about diversification

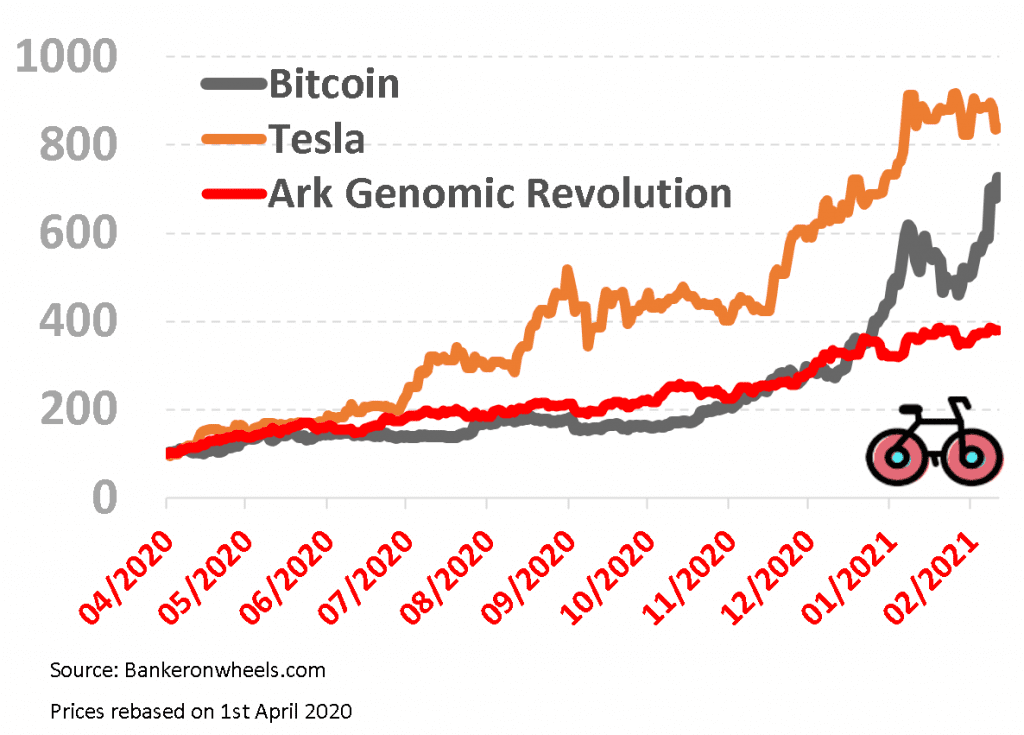

Most risky assets are highly correlated.

The markets have two modes – Risk On and Risk Off.

While the latest Bitcoin narrative is digital Gold, my instinct tells me that it has a long way to become one. The next crash may verify my assumption about how differently, for the time being, it reacts to Gold (I suspect Institutional Investors that are pilling in are more prone to the Lindy effect)

The wealth of Elon Musk, Cathie Wood, the Tik Tok kids and value of Doge may all plunge at the same time.

It’s also interesting how certain Bitcoin advocates (amongst them some like Value Stocks) see a bubble in Tesla while justifying crypto levels.

On the other hand, Goldbugs don’t mind when Gold is lifted by low rates but when Stocks mechanically follow the same pattern it becomes a dangerous bubble.

The fact is, most of these assets often move because of the same, single factor.

A lot of the prices are shooting up at the same time – IPOs/SPACS or Sectorial ETFs to name a few.

What made my friend successful is lack of trading in and out of stocks, because of fees, tax implications and since most off the jumps happen overnight, which you can’t act upon anyway.

I admit that while we don’t share the same investment philosophy, I’m impressed by how stoic he is, not looking at his brokerage account for entire days as the market value moved by tens, then hundred thousand of dollars. Day trading skills won’t help you – if you really believe in your trade stick with it.

One for the DreamS (passive)

#5 Stick to the plan

Stick to the plan with your long term portfolio.

Don’t let the distinction between play money and investments become blurry.

Having skin in the game is important but even more so is controlling for your risk profile. Think about your risk tolerance.

Keep an eye on asset allocation. Rebalancing is key. You may adopt a threshold-based rebalancing method if your asset allocation gets out of whack. I have written a guide on rebalancing, if this can help.

But if you want to avoid rebalancing altogether, Vanguard recently launched Lifestrategy ETFs in Europe. Alternatively, you may invest though target risk funds like BlackRock’s ESG ETFs.

#6 Keep it simple

If anything, simplify your long term portfolio further. There are only so many things you can focus on.

Asset Allocation is key, but by having “too many irons in the fire”, you may miss the boat on structural changes in the market (e.g. rotation into value or emerging markets) that may take place during a bull market, or even a possible subsequent crash. Remember, some parts of the market are still cheap.

You can also go through the Investor checklist, to make sure you didn’t omit anything in your portfolio.

#7 Don't fall for the ETF trap

If there is one rule that works over the long term in markets, it’s that you either have high prices now or future returns, not both.

I personally feel less confident about sustainability of last decade’s exceptional returns, with each acceleration of the market (World ETFs gained 17% in the last 6 months)

But, it’s the above that really got me worried and inspired this article.

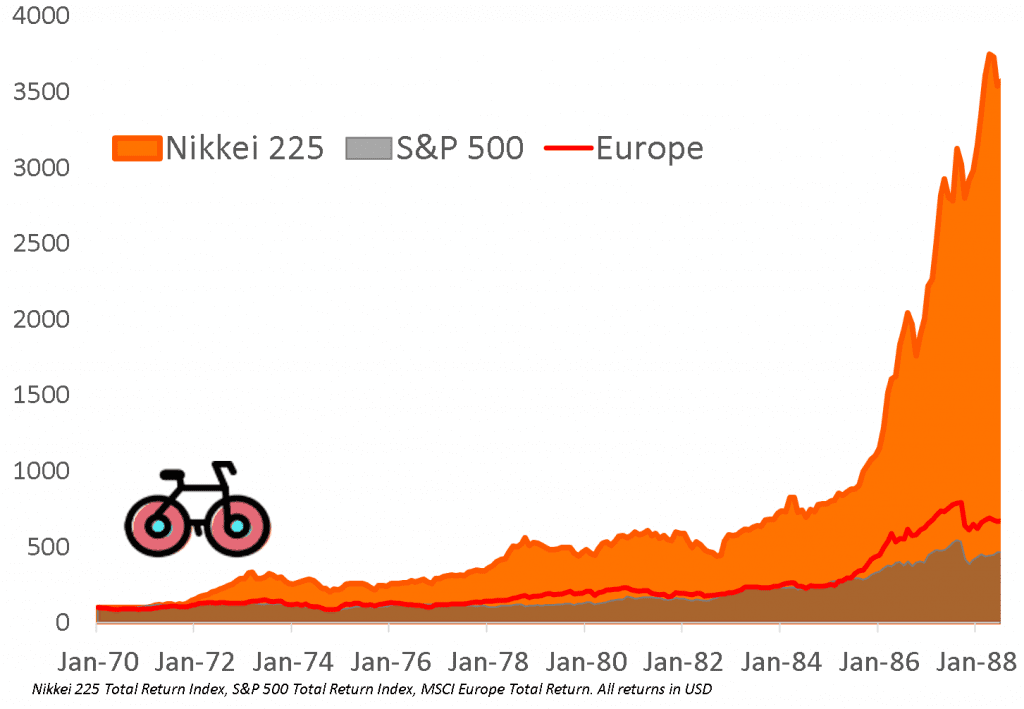

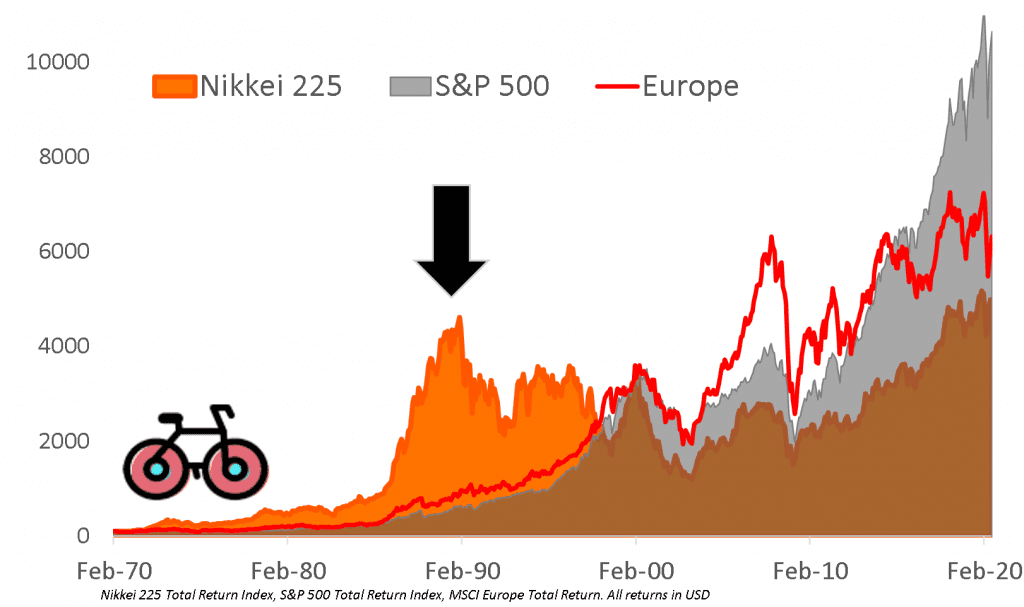

Today’s and Japanese Investors from the 1980s have something in common – a willingness to drop dragging assets, like the S&P 500.

Being a Japanese investor in the 1980s one must have been thinking “The Japanese stock market has been a better investment for many years now. It is reasonable to drop the S&P 500 from my portfolio since it’s a drag on the performance”

The additional issue today is that sectorial ETFs are associated with diversification, giving a false sense of safety.

So was the Nikkei with 225 companies from different industries.

Retirement Portfolio diversification means exposure to different countries, currencies and industries, all at the same time.

One day you may be here

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

#8 Stay vigilant and prepare for a Bear attack

Remember, prices are supported by narratives. And there are strong narratives supporting current market, which may change leaving place to a more fundamental analysis.

Keep track of your active and passive portfolio. Over the long term, my bet is that the return from your long term portfolio will outperform. Especially, when adjusted for fees, taxes but most importantly, for your precious time.

While riding the bull, prepare for a bear attack, now is the time to do so.

Good luck!

Disclosure: I am long Bitcoin, but do not have any other active positions in the above mentioned investments

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Surviving The Next Bear – Strategies To Profit From The Next Market Crash

Weekend Reading – Asset Class Returns since 1970 & Trend Following Strategies

Cracking the Code: Decoding ETF Names & Discovering Tools To Find Them

Broker Review Methodology

iWeb Share Dealing Review – Great For Inactive Investors

AJBell Review – Leading Broker & Low-Fee SIPP Provider

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🎁 Taking advantage of our affiliate links when setting up a broker account. This doesn’t increase your costs, and we often secure exclusive bonuses for our audience.

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.