Slashing FX costs! In which currency should I buy ETFs?

The Definitive Guide to Slashing ETF Costs and Taxes - PART 6

This article is Part 6 of our Definitive Guide to Slashing ETF Costs and Taxes.

One of the most confusing aspects of UCITS ETFs is currencies. Pay special attention. Not only can they affect the long term performance of the Stocks and Bonds, but they also impact the FX conversion fees you pay your Broker.

Today, let’s look at the best practices and what you can do to reduce FX fees.

KEY TAKEAWAYS

- There are four currency types when looking at an ETF (i) the Underlying Assets’ Currencies (ii) the Hedging Currency (iii) the Trading Currency, and (iv) the Fund Base Currency.

- The first two are strategically important. You can hedge the Underlying Assets’ currencies if you’re uncomfortable with currency risk.

- The last two are tactically important, as they may trigger broker FX conversion fees.

- If the Trading Currency differs from your currency, the broker charges a one-off FX fee when you buy or sell the ETF. If available, buy a share class denominated in your home currency.

- Any dividends are paid in the Fund Base currency. Your broker charges a quarterly FX fee if the currency differs from yours, but only if you hold a distributing share class.

- However, unlike the Trading Currency, the Fund Base Currency can be rarely influenced, as tax reasons often override the choice of distributing vs accumulating share class.

Here is the full analysis

Some currencies are relevant to the entire ETF, while others are specific to your chosen Share Class. Remember, an ETF share class refers to different types of shares within the same ETF that may have varying fee structures, currencies, or distribution policies.

Are FundS or Share Classes Impacted?

Let’s go through them one by one:

- Underlying Assets’ Currencies – Apply at Fund level. They relate to the currencies Stocks or Bonds held in the ETF are denominated in.

- Currency hedging – Applies at the ETF Class level. You often have the option to hedge the underlying currencies. There are hundreds of currency-hedged ETFs.

- Trading Currency – Applies at the ETF Class level. You can choose in which currency to settle the transaction. E.g. Vanguard FTSE All-World UCITS ETF share classes can be bought in EUR, CHF, GBP or USD.

- Fund Base Currency – Applies at Fund level. The ETF aggregates all reporting and pays dividend in the base currency.

Fund vs Share Class Level Impact

| Currency Type | Impact |

|---|---|

| 1. Underlying Assets' Currencies | ETF |

| 2. Currency Hedging | Share Class |

| 3. Trading Currency | Share Class |

| 4. Fund Currency | ETF |

How to Find them?

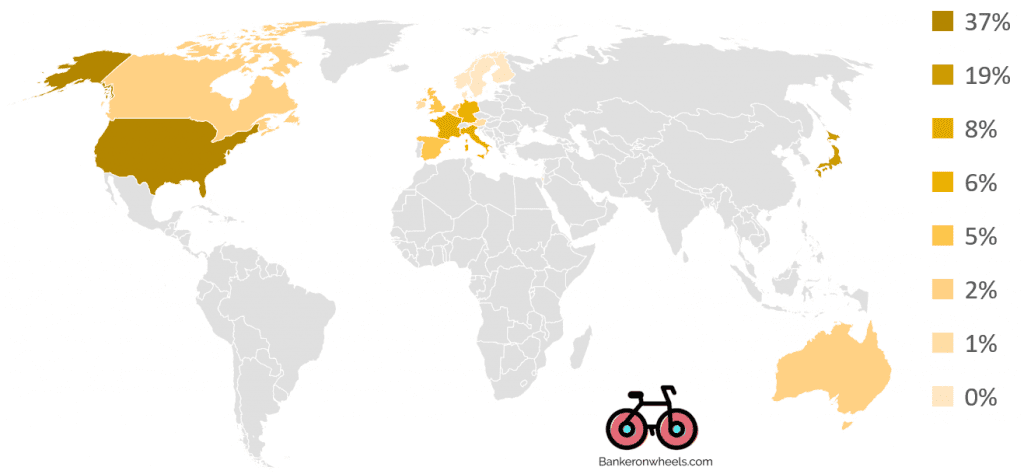

- Underlying currencies – A breakdown of currency exposure can be found in the ETF Factsheet. Here is an example for Vanguard FTSE All-World ETF (page 3, Market Allocation is a good proxy for currency risk e.g. Japanese Stocks will be denominated in Yen). For this ETF, the vast majority of currency risk in USD.

- Currency Hedging – Can be found in the share class description. e.g. iShares Core MSCI World UCITS ETF EUR Hedged (Dist). This share class hedges all Developed Countries’ currencies, so that you are only exposed to the EUR.

- Trading currency – Will be available in the factsheet and when you look up the share class with your broker. Page 1 of the Vanguard FTSE All-World UCITS ETF factsheet shows it can be bought it USD, EUR, GBP or CHF.

- Fund Base Currency – Available either in the factsheet (top section) and ETF’s name, e.g. Vanguard FTSE All-World (USD).

Asset Returns vs. Broker FX fee impact

The Underlying currencies and the choice of hedging them is strategic. The trading currency and fund base currency won’t have a major impact, but will nevertheless trigger one-off FX fees.

Strategic Importance (Asset Returns)

- Underlying currencies - Your Real Currency Exposure

- Hedging Currency - Removing Currency Risk

Tactical Importance (FX fee savings)

- Trading Currency - Currency in which you buy an ETF

- Fund Currency - Currency is which dividends are paid

Here is a summary of the importance of the different currencies.

Importance OF currency types

| Currency Type | ETF Share Class | Strategic Impact | Quarterly FX Impact | One Time FX Impact |

|---|---|---|---|---|

| 1. Underlying Assets' Currencies | Both | ⚠ HIGH | - | - |

| 2. Currency Hedging | Both | ⚠ HIGH | - | - |

| 3. Trading Currency | Both | - | - | ⚠ MEDIUM |

| 4A. Fund Currency | Accumulating | - | - | - |

| 4B. Fund Currency | Distributing | - | ⚠ MEDIUM | - |

Now, let’s look at them individually.

1. Underlying Assets' Currencies

Why Should You care about it?

The Underlying Assets’ currencies have a major impact on the ETF’s return. It is the most important currency set to consider, since you will be exposed to the fluctuation of the underlying currencies versus your own home currency.

However, the ETF currency risk you are taking is more complex than just looking at the currencies of the underlying ETF Stocks. While equities are denominated in a certain currency in which they trade on a Stock Exchange, they also may have business models relying on global sales.

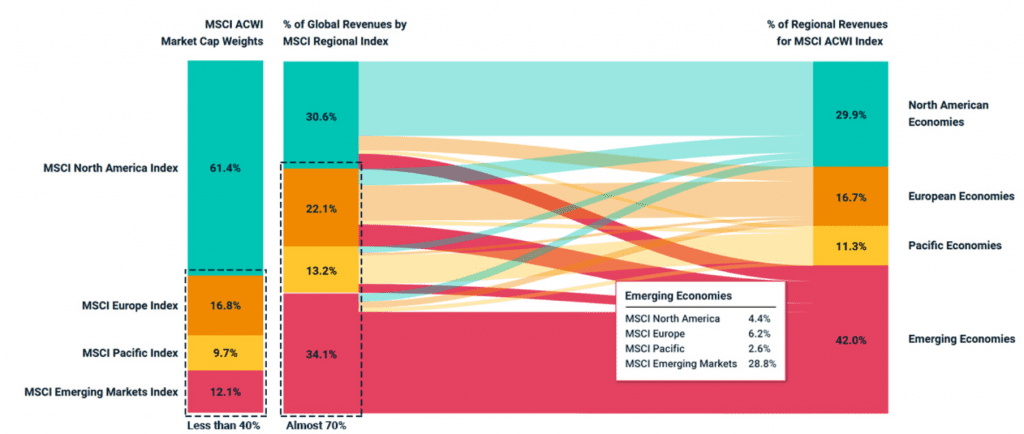

For example, let’s take the MSCI AWCI Index, a benchmark very close to the FTSE index tracked by Vanguard FTSE All-World ETF. 61.4% of its Market Capitalization is denominated in USD. However, only 29.9% of all revenues from North America, due to globalisation. That’s the true economic, or revenue currency risk, you’re taking.

Equities - The true currency risk you are taking

For Bonds, it is more straightforward. The underlying Bonds’ currencies are the true currency risk you are taking.

The Xtrackers Global Developed Government ETF invests in Developed World Government Bonds, and the major countries for those Indices and ETFs are USA, Japan and France. For each of the underlying Bonds currencies are primarily the USD, JPY and EUR, as illustrated below.

Bonds - The true currency risk you are taking

What can you do about it?

You will be exposed to fluctuations of those currencies unless you decide to hedge. Now, how does it work in practice?

Why Should You care about it?

For Bonds - it removes all currency risk

By investing in a hedged ETF share class, you will remove currency risk for Bond ETFs. For example, if you are a European Investor and choose the EUR Hedged Class, you will be earning income in EUR from International Bonds without taking any currency risk. If you hedge the currency, the asset currency performance risk becomes largely irrelevant.

For Equities - Hedging may not remove all currency risk

Even if you do decide to hedge, hedging will not protect you from all currency risk. As we’ve seen, the hedge is sized as it relates to the underlying Stocks’ notional exposure, not the economic risk. The companies you invest in have international operations and may not choose to hedge foreign currency risk, in which case you will be still indirectly exposed to it.

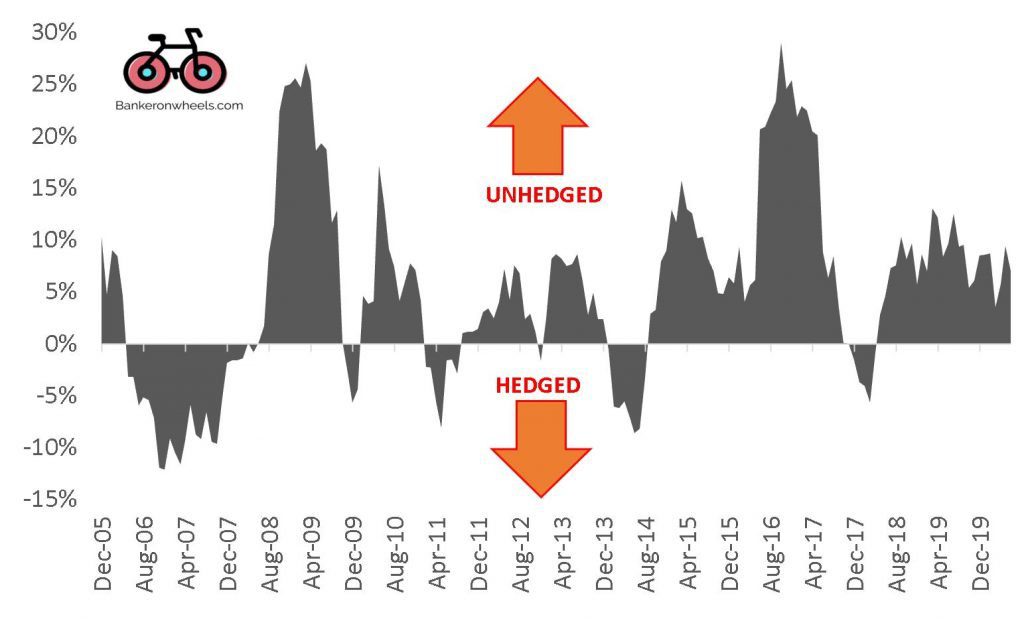

What is the impact of currency hedging on ETF Returns?

As illustrated above, the difference in return can be substantial. Here the annual return can vary as much as 25% depending on your choice of ETF currency hedging.

What can you do about it?

Should I buy a currency hedged ETF share class?

Standard Market Practice - ETF currency hedging decision matrix

| Asset Class | Investment Horizon | Hedged | Optional Hedging | Unhedged |

|---|---|---|---|---|

| Equities | Short Term | ✔ | ||

| Equities | Long Term | ✔ | ||

| Bonds | Short Term | ✔ | ||

| Bonds | Long Term | ✔ |

Another aspect to remember is that you can’t fully hedge all the underlying currency risks in an Equity ETF, so you may as well leave it unhedged.

3. TRADING Currency

Why Should You care about it?

Does the ETF Share class currency expose me to additional currency risk?

At purchase, you exchange your own currency to buy the ETF Trading currency. However, ultimately the Fund buys the underlying Assets in their currencies, so intermediary currencies, like the Trading Currency, don’t matter much.

The ETF Share class currency does not change the currency risk you are taking by investing in the underlying assets and thus, this currency also doesn’t have any influence on the overall ETF performance.

The ETF share class currency is not a key aspect in ETF selection and will not have an influence on the returns. However, if all other criteria are fulfiled, it may be marginally beneficial if the trading currency is your home currency. But remember, it’s not mandatory if you don’t have that option.

What can you do about it?

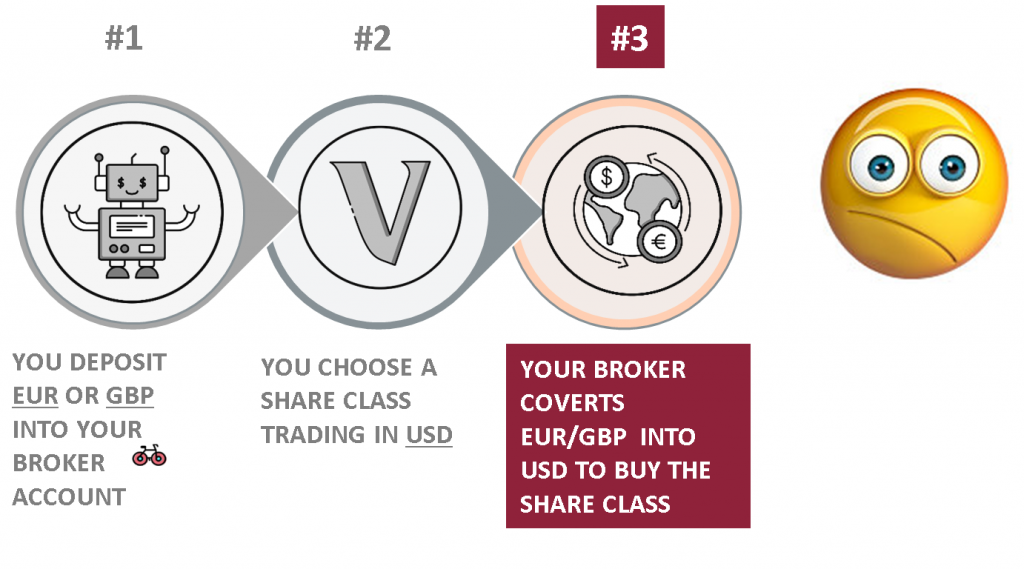

Case 1: You buy Vanguard FTSE All-World in USD.

The reason to pay attention is that you pay an additional FX conversion fee at the time of purchase and sell, if you don’t buy the ETF in your own currency.

Here is the flow of what happens:

- You deposit EUR or GBP into your broker account.

- You instruct the broker to buy an ETF in USD.

- To buy the ETF share class in USD, the broker will convert EUR/GBP to USD. Brokers can charge as much as 1-2% for this service, although for the majority the FX fee is reasonable. As of May 2023, Interactive Brokers charges minimum of $2 or 0.002% and DEGIRO 0.25%.

Case 1: When Trading Currency is NOT the Investor's Currency

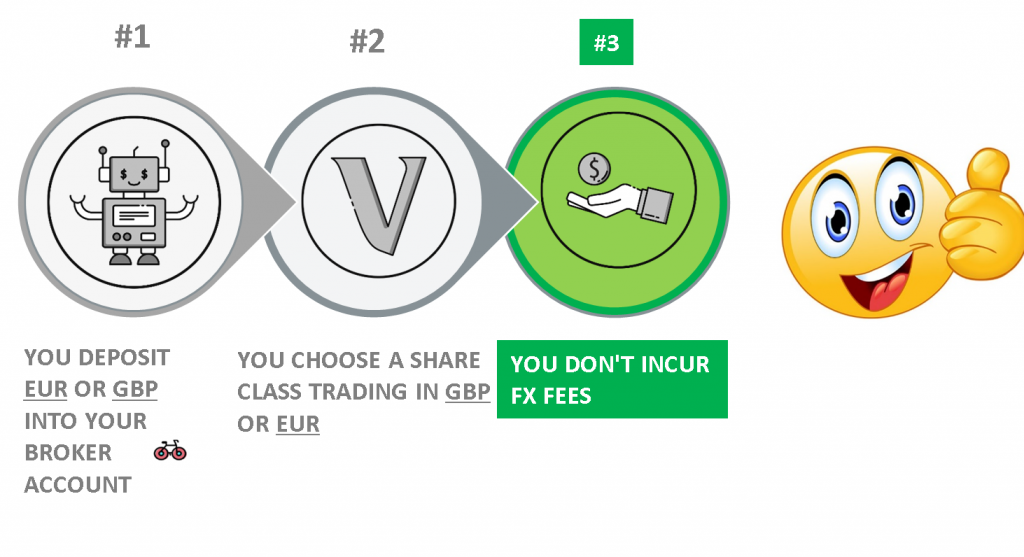

Case 2: You buy Vanguard FTSE All-World in EUR or GBP.

This FX fee is quite easy to avoid. There is ample choice in European currencies for major ETFs, so you will probably have the option to use your own currency as Trading currency. For example, let’s say you want to buy Vanguard FTSE All-World Distributing Share Class:

- If you’re in the UK – you may want to buy VWRL on the London Stock Exchange. You won’t incur any FX fees. But if you buy VWRD, you will incur FX fees!

- If you’re in Europe – You can choose XETRA Exchange (VGWL), Euronext or Borsa Italiana (VWRL) and transact in EUR, avoiding any FX fees.

Trading Currencies for Vanguard FTSE- All-World (USD) Distributing Share Class

| Stock Exchange | Ticker | Trading Currency |

|---|---|---|

| XETRA | VGWL | EUR |

| London Stock Exchange | VWRD | USD |

| London Stock Exchange | VWRL | GBP |

| Euronext Amsterdam | VWRL | EUR |

| Euronext Paris | VWRL | EUR |

| Borsa Italiana | VWRL | EUR |

| SIX Swiss Exchange | VWRL | CHF |

Here is the flow of what happens:

- You deposit EUR or GBP into your broker account.

- You instruct the broker to buy an ETF in your local currency EUR or GBP.

- To buy the ETF share class, the broker won’t need to convert EUR/GBP to USD. You save on FX fees.

CASE 2: When Trading Currency is the Investor's Currency

4. Fund BASE Currency

Why Should You care about it?

Does the Fund Base currency expose me to additional currency risk?

The Fund Base Currency simply refers to the currency that a fund reports in and not the currencies of the underlying securities which you are exposed to. For example, for a Global Government Bond ETF, the Fund will have classes in different currencies and some are distributing dividends while others are reinvesting them there are various available options for investors. However, the Fund Manager must consolidate all information and will report in a unified way.

The fund base currency has marginal importance in ETF selection and will not have an influence on the returns from the ETF.

What can you do about it?

The short answer is not much.

That’s because the choice between accumulating and distributing is primary a tax or cash flow decision, that has a much bigger impact than one-time FX charges, which probably won’t move the needle in this decision.

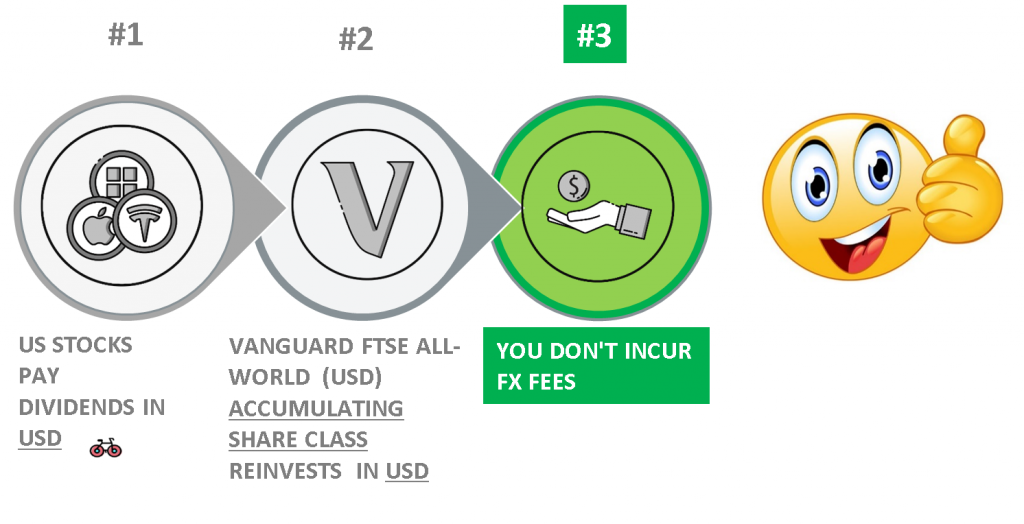

Case 1: You Hold an Accumulating Share class

First, for accumulating share classes, there is nothing you need to do. You won’t incur any FX charges.

Here is the flow of what happens:

- US stocks pay dividends in USD.

- The ETF reinvests them in their currency.

- There is no currency conversion. You save on FX fees.

CASE 1: FUND Currency & ACCUMUATING ETFs: No FX Fees

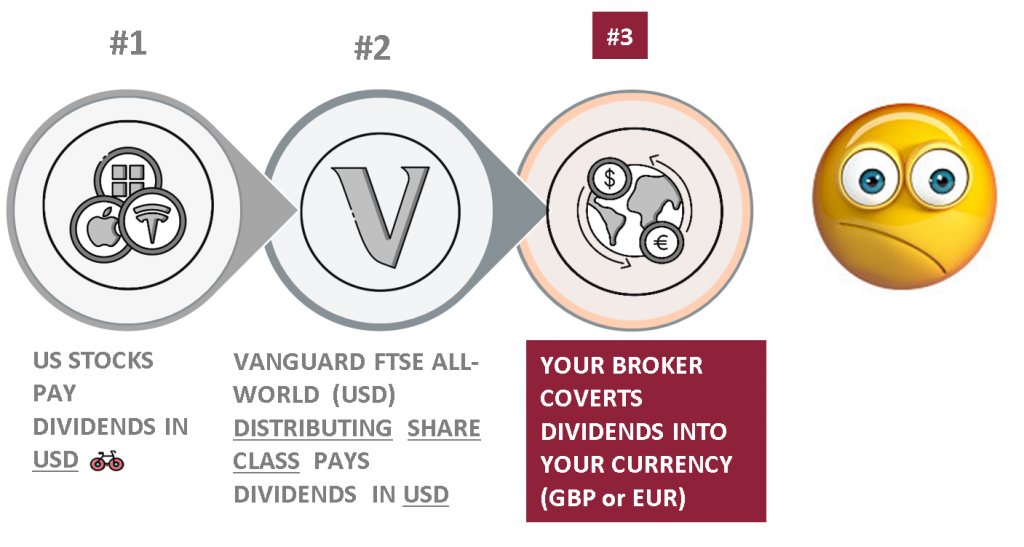

Case 2: You Hold a Distributing Share class

Second, for distributing funds, dividends are distributed in the fund currency. Pay attention to the ETF name. The fund currency is stated there. Your broker will convert the distributed amount into your currency for an additional conversion fee.

Vanguard FTSE All-World UCITS ETF (USD) Distributing

Here is the flow of what happens:

- US stocks pay dividends in USD.

- The ETF distributes them in the Fund Base currency, the USD.

- If your Broker account is in EUR or GBP, the Broker converts the amount to your local currency, triggering FX conversion fees.

CASE 2: FUND Currency & DISTRIBUTING ETFs: Possible FX FEes

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Next Steps

In the next article, we will look at the most invisible cost of all – spread.

How do you choose an Exchange to reduce spreads?

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – JP Morgan Guide To Retirement

Surviving The Next Bear – Strategies To Profit From The Next Market Crash

Weekend Reading – Asset Class Returns since 1970 & Trend Following Strategies

Cracking the Code: Decoding ETF Names & Discovering Tools To Find Them

Broker Review Methodology

iWeb Share Dealing Review – Great For Inactive Investors

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🎁 Taking advantage of our affiliate links when setting up a broker account. This doesn’t increase your costs, and we often secure exclusive bonuses for our audience.

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.