iShares MSCI USA SRI UCITS ETF - ETF Review

Overall Assessment

This ETF is very poorly diversified and impacted by financially material ESG Scores.

While it has recently outperformed, the risk-adjusted performance outlook, given that investors’ taste for sustainability has driven up valuations, is negative.

ETF Snapshot

Below is an ETF Review that was performed by our team.

For each fund characteristic, we link to the correspondent guide to give you more context.

| Characteristic | ETF |

|---|---|

| Asset Manager | BlackRock |

| Accumulating Tickers | SUAS, SUUS, QDVR |

| Distributing Tickers | SRIL, 36B6 |

| Sustainability Strategy | ESG and SRI Blend |

| ESG Rating Screening | Yes |

| Ethical (SRI) Screening | Yes |

| Number of ESG Exclusions | Very High |

| Number of SRI Exclusions | Very High |

| Planet Impact | Moderate (Excludes Sin Stocks) |

| Parent Benchmark | MSCI USA |

| Est. Diversification Reduction | 75% |

| Inception Date | Jul-16 |

| Expected Performance vs. Parent | Long-Term Underperformance |

| Income Distribution Types | Accumulating |

| Domicile | Ireland |

| Currency Risk | Unhedged (Hedged versions also available) |

| Replication | Physical (Full Replication) |

| Settlement Currencies | USD, EUR (Both), GBP (Accumulating Only) |

| Total Expense Ratio | 0.20% |

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

What is iShares MSCI USA SRI UCITS ETF?

- iShares MSCI USA SRI UCITS ETF is the largest ESG + SRI Blend ETF in the World.

- The ETF tracks the MSCI USA SRI Select Reduced Fossil Fuels index.

- iShares MSCI USA SRI UCITS ETF only retains around 25% of the best-in-class ESG-rated stocks.

- iShares MSCI USA SRI UCITS ETF also includes a number of SRI screens.

- The ETF manager applies a cap of 5% to holdings.

- iShares MSCI USA SRI UCITS ETF is managed by BlackRock, the largest Asset Manager in the World.

- The custodian is State Street, the largest custodian bank in the world.

- Commercial risk is limited given that the ETF is one of the largest ESG ETFs in the World with over $7bn of Assets Under Management.

What are iShares MSCI USA SRI ETF Top Holdings?

- iShares MSCI USA SRI UCITS ETF top 5 holdings include Home Depot, Nvidia, Microsoft, Coca-Cola, Pepsi.

- Its holdings diverge materially from its parent benchmark, the MSCI USA Index, which includes amongst its top 5 holdings Apple, Microsoft, Amazon, Alphabet and United Health Group.

- Given its focus on retaining only around 25% of top ESG rated securities and its SRI screening, the ETF excludes a number of Growth Stocks, for example Apple, Alphabet or Meta Platforms.

- The iShares MSCI USA UCITS SRI ETF is not well diversified.

- Out of the total 623 names in the MSCI USA, the iShares based on the MSCI SRI USA Index only retains 151 Equities (diversification reduction of around 76% versus the parent Index).

What are iShares MSCI USA SRI UCITS ETF top sectors?

- iShares MSCI USA SRI UCITS ETF Top 5 sectors include Healthcare, Financials, Information Technology, Consumer Discretionary and Consumer Staples. Healthcare is the largest sector, accounting for around 20% of total market value.

- The composition diverges from its parent benchmark, the MSCI USA Index, which includes Information Technology, Healthcare, Consumer Discretionary, Financials and Consumer Staples. Information Technology is the largest sector, accounting for around 26% of total market value.

What ESG and SRI screenings are being applied?

- iShares MSCI USA SRI UCITS ETF does not include Equities involved in UNGC Controversies, Conventional or Controversial Weapons, Tobacco, Thermal Coal, Unconventional Oil and Gas, Pornography, Gambling or Alcohol.

- iShares MSCI USA SRI ETF retains only around 25% of the top ESG rated Equities, based on the MSCI financially material ESG Ratings.

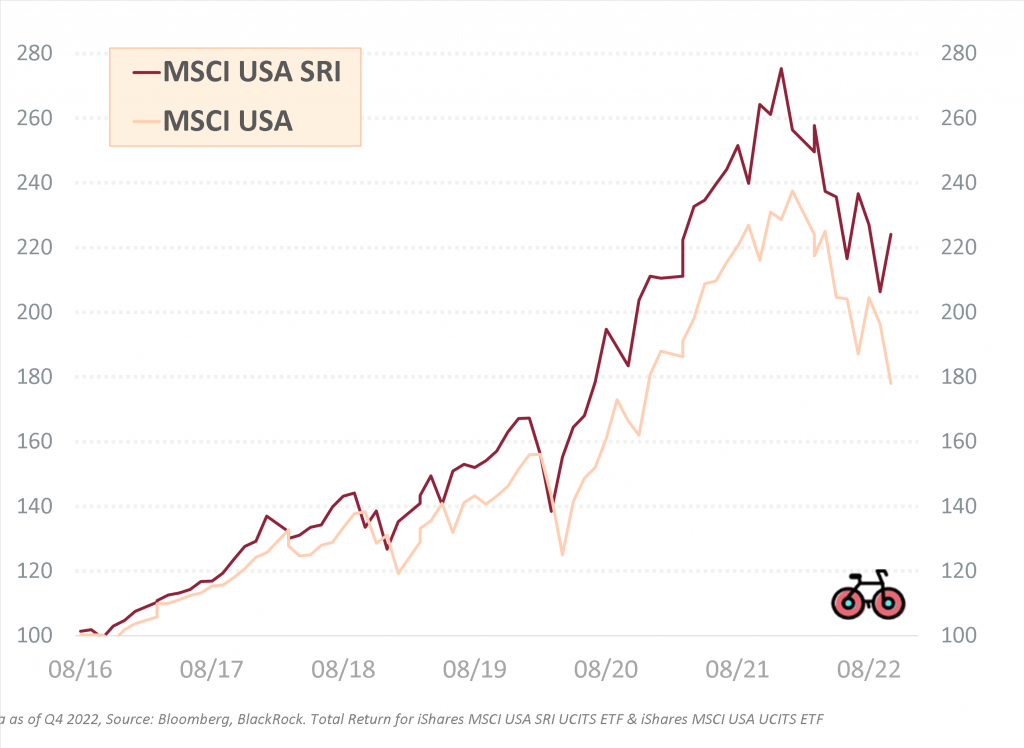

What is iShares MSCI USA SRI UCITS ETF Index performance?

- As of December 2022, the ETF’s benchmark, the MSCI USA SRI Select Reduced

Fossil Fuels Index, as well as MSCI USA SRI Index, have both outperformed the parent benchmark, the MSCI USA Index, over 3-year, 5-year and 10-year periods. - For example, its 5-year total return is 10.95% versus 8.75% for the parent index.

In which currencies is iShares MSCI USA SRI UCITS ETF available?

- iShares MSCI USA SRI UCITS ETF is available in UCITS format in the following currencies: USD, EUR, GBP, MXN and COP. Currency hedged versions are also available.

- iShares MSCI USA SRI ETF includes accumulating and distributing share classes.

Similar Questions

How does iShares MSCI USA SRI UCITS ETF composition compare to iShares ESG MSCI USA Leaders UCITS ETF and iShares MSCI USA ESG Enhanced UCITS ETF?

All three Funds are some of the largest ESG ETFs from BlackRock. Read how their holdings differ.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

What will impact iShares MSCI USA SRI UCITS ETF future returns?

Based on Economic Theory, expected returns will be impacted by both the fund’s factor exposure and investors’ taste for sustainability. Read how both of these factors may impact future returns.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

Money Market Funds: Are ETFs The Best Bang For Your Buck Or A Risky Ride?

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.