Weekend Reading – When Taiwan Falls & Vanguard: Personalised Inflation Hedging

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web.

We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process.

Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance.

As usual, everything is to be used at your own risk.

TYPE OF CONTENT

- Youtube

- Reading

- Podcast

- Academic

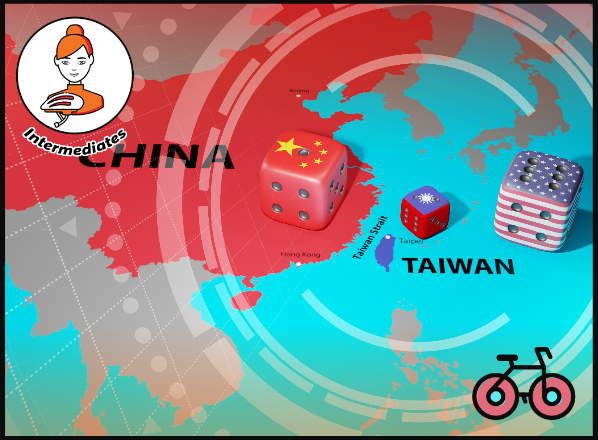

- Twitter Thread

The United States and China are now in a trade war, a technology war, a geopolitical influence war, and a capital/economic war, and they are now dangerously close to a military war.

Ray Dalio

INVEST WISELY

This section is dedicated to research on how to invest for the Long Run using Passive Investment Strategies. Read Topics related to (i) Portfolio Construction and Asset Allocation (ii) Acting wisely by avoiding behavioural traps and also (iii) publications that help understand how financial markets work.

CONSTRUCT YOUR PORTFOLIO

Japanese people love minimalism and simplicity. In a lot of fields, as Steve Jobs said, building Simple products is Hard. Making a product like the iPhone certainly was. Yet, in investing, building Efficient portfolios is simple.

Your complicated strategy will ultimately be tested by the market, like the 2008 value of Subprime Bonds was for German investors. That’s when most investors bail out.

- Personalized Inflation Heding To Unique Investor Circumstances (Vanguard)

- Short Duration ETFs as Defensive Asset In An Uncertain Time (Morgan Stanley)

- Retirement Income: Six Strategies (CFA Institute)

- How to create an income stream by selling non dividend paying stocks (Rational Walk)

- How closely do index funds track their benchmarks? (Morningstar)

- 4 Key Investing Concepts and How to Apply Them (Humble Dollar)

How to Review Your Portfolio Performance (Peter Lazaroff - 11 min)

Measuring the success of your portfolio is important for several reasons, but most people don’t know how to properly measure the success of their portfolios. What are the differences between Portfolio-Based Benchmarks and Goals-Based Benchmarks & meaningful questions to ask when evaluating performance.

HOW TO INVEST

In conversation with Myron Scholes on How To Invest Your Money (What Happens Next? - 44 min)

UNDERSTAND FINANCIAL MARKETS

- When Taiwan Falls - Geopolitical Consequences Of A Potential Fall (Pacific Forum)

- The Active Comeback As A Consequence of Peak Passive May Never Arrive (The Evidence Based Investor)

- Europe's Stubborn Inflation Problem (Bridgewater Associates)

- The Strengthening US$ Is Not Bad News For Everyone (Morningstar)

- Could UK house prices fall 30% by next year? (Bloomberg, Paywall)

- The Pros and Cons of Using Volatility As A Measure of Risk (Verdad)

ACTIVE INVESTING

This section relates to improving your knowledge about active investing. If you decide to sin, then sin only a little. Given ample evidence, combined active bets should be ideally a relatively small fraction of your portfolio.

FACTOR & Thematic investing

King of Quants Cliff Asness on how to keep your cool (The Economist - 40 min)

Quantitative investors are known for their cool, mathematical approach to investing. They build models which search for patterns across huge data sets to discern where they should invest. The frenzied “bubble in everything” wrongfooted many quants in 2020–but the stock markets return to Earth, which crippled many traditional funds, generated huge returns for the quants in 2022. Nowhere was this clearer than in the performance of AQR Capital Management, a quant fund run by Cliff Asness. Its long-running strategy returned 43.5% last year, net of fees.

STOCKS

- US Listed Entities & Their China Exposure (China Charts)

- In conversation with Columbia Professor Doron Nissim on Earnings Quality (Excess Returns - 1 hr 7 min)

- The essence of business is not growing revenues but growing profits (Aswath Damodaran)

- Tools for measuring stock sentiment (Validea)

- What ails Google and what it can do to redress (Praveen Seshadari)

- The Most Shorted Stocks on FTSE (Morningstar)

A data-driven approach to picking growth stocks and thematic baskets (Flirting With Models - 14 Min )

It’s no secret that high flying growth stocks were hammered in 2022, so here is a revisit of a conversation with Jason Thomson.

Jason is a portfolio manager at O’Neil Global Advisors, where he manages highly concentrated portfolios of growth stocks.

SUSTAINABLE investing

This section is about Sustainable Investing. You can invest in a Socially Responsible way but there are many ESG traps. Learn how to invest sustainably, and what it means for expected returns, with the our definitve guide to sustainable investing.

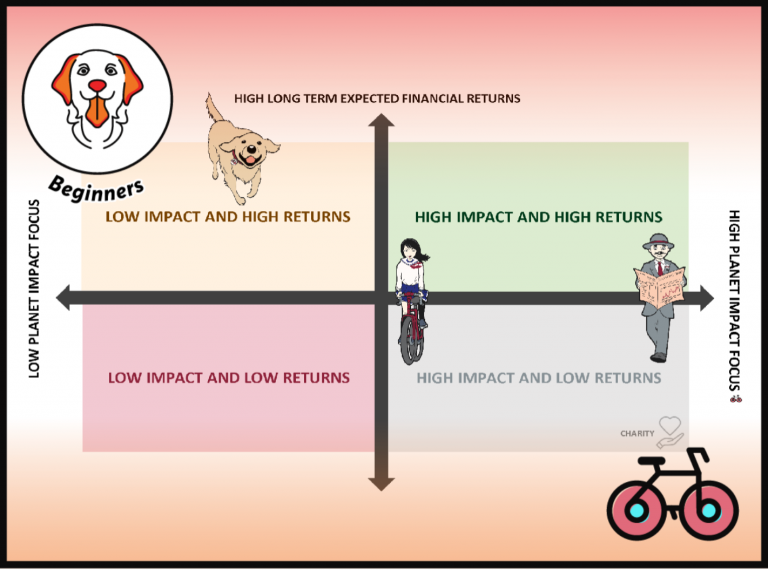

There are at least three proven sustainable investing strategies.

To keep it simple, you may hold a non-screened portfolio and, use the incremental profits for philanthropy.

If you want to avoid investing in certain types of industries, e.g. Tobacco companies, you may select cost-efficient and well-diversified SRI Funds. The most active sustainable strategy is Impact Investing.

ALTERNATIVE ASSET CLASSES

FROM WALL STREET

Charlie Munger On Tesla, Alibaba and Bitcoin (CNBC - 2 hr 35 min)

Choice Architecture & Role in Financial Decision Making (Rational Reminder - 51 Min)

The decisions we make may be further out of our control than we’d like to imagine. Today we are joined by Professor Eric J. Johnson to discuss choice architecture and its role in financial decision-making. Eric is a decision science expert and the author of the book, The Elements of Choice: Why the Way We Decide Matters. In this episode, we learn about the various factors that impact not only decision-making but the effort required to make a decision. Eric shares his philosophy on free will and shares advice for making important decisions and guiding clients to find the right choice as a financial advisor. Tune in to discover how to minimize the influence of the choice architect and take charge of your decisions!

crypto & blockchain

REMINDERS TO PUNT RESPONSIBLY

In conversation with Madoff Trader & Investor Andrew Cohen (Excess Returns - 51 min )

With the recent release of the Netflix documentary “Madoff: The Monster of Wall Street,” many of us have been learning more of the details behind the scandal. Andrew Cohen, participated in the documentary and was both a trader on the legitimate side of Madoff’s business and a victim of the Ponzi scheme. Andrew gives us an inside look at what it was like to work in the Madoff organization and takes us through the timeline of events from when he started there to when the Ponzi scheme was uncovered.

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

DIVE DEEPER - BOOKS & MOVIES

In the Book review section we rate some of the most relevant resources related to Financial Independence, Personal Finance and Investing. Browse All Book and Video Reviews.

The 2023 Netflix docuseries Madoff: The Monster of Wall Street dives into the largest Ponzi scheme in history, worth $64.8 billion.

Although the Madoff madness stopped in late 2008, today’s investors still fall for the very same tricks.

What exactly can we learn from this series?

Let’s have a closer look.

This section is dedicated to UK and European Products. It can also touch on other European jurisdictions outside the Euro-zone.

- The first ‘L’ is Living Life. How do you plan around life essentials while reducing unnecessary costs?

- The second ‘L’ is Loving Life. It’s usually the mismanaged L. It’s not only about the destination but also the journey and values that define you today.

- The third ‘L’ is Later Life. How to invest wisely for Early Retirement.

FINANCIAL PRODUCTS

COST OF LIVING

OUR Community

Question of the week

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

DESIGN YOUR LIFESTYLE

This section is dedicated to the ‘Why’ of Investing, trends or career choices.

LIFESTYLE

- Could a shareholder letter offer life advice? Berkshire's does (Neckar)

- The Learning Curve at 30 - what you should know before you're 30s (Morningstar)

- The four day work week movement picks up steam as most firms opt to extend trial (Guardian)

- The young in the developed world are falling out of love with cars (The Economist, Paywall)

- Reduce Wants, Increase Happiness - the formula to achieve things (The daily stoic - 8 min)

Choice Architecture & Role in Financial Decision Making (Rational Reminder - 51 min)

The decisions we make may be further out of our control than we’d like to imagine. Eric is a decision science expert and the author of the book, The Elements of Choice: Why the Way We Decide Matters. In this episode, we learn about the various factors that impact not only decision-making but the effort required to make a decision. Eric shares his philosophy on free will and shares advice for making important decisions.

EARLY RETIREMENT

CAREERS

- The 5 soft skills that could land you your next job (Forbes)

- Decrease in productivity maybe indirectly correlated with return to office (Fortune)

- 20% of Workforce Refuse To Be Coaxed Out of Early Retirement (This is money)

- 75% of London Workers Would Rather Quit Than Return To Office Full Time (This is money)

- Despite Shrinking Economy & Worker Shortage, Britons prefer to continue working part time (Guardian)

TECH & ECONOMY

James Clear, Atomic Habits — Mastering Habits, Growing an Email List to 2M+ People (2hrs)

James Clear (@JamesClear) is a writer and speaker focused on habits and continuous improvement. He is the author of the #1 New York Times bestseller Atomic Habits, which covers easy and proven ways to build good habits and break bad ones.

Travel

miscellaneous

Revisiting Japan's Lost Decade (Konichi-Value - 29 min)

Japan was on its way to surpass the United States as the world’s largest economy, and the supply of infinite growth and prosperity seemed non-stop. Then, the party suddenly stopped.The video & podcast is a detailed depiction of Japan’s lost decade (1991-2001): The tragic tale of the world’s largest economic bubble burst and its consequences.

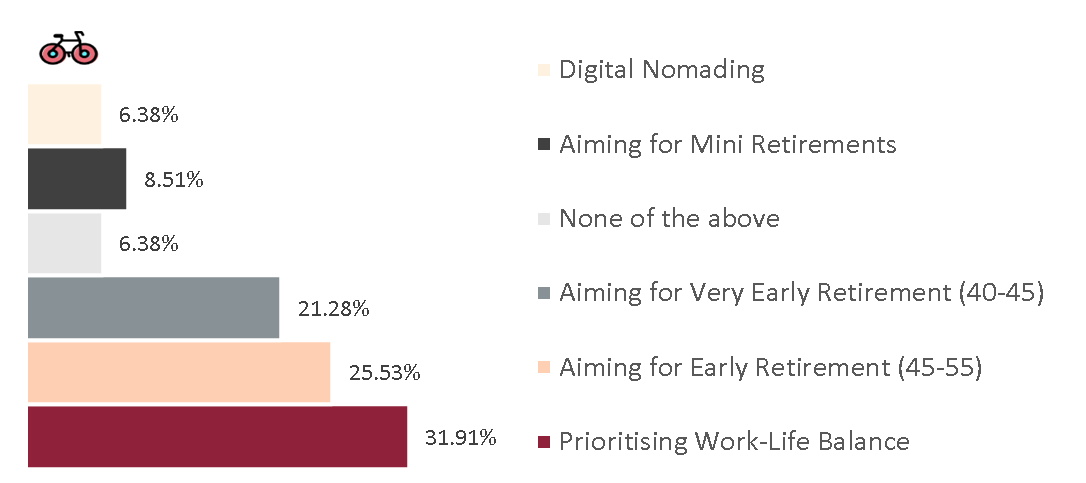

Last Week We asked you

What Lifestyle choice are you currently pursuing? (Multiple Choice Were Possible but most only selected one)

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

Money Market Funds: Are ETFs The Best Bang For Your Buck Or A Risky Ride?

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.