Sustainable ETFs X-Ray – Comparison Of Holdings

THE DEFINITIVE GUIDE TO SUSTAINABLE INVESTING - PART 5

This article is part 5 of Bankeronwheels.com definitive guide to Sustainable Investing.

Today, let’s look at what investments you will be exposed to because that’s going to be a significant driver of ETFs’ performance. Spoiler – I hope you like the taste of Coke. And Pepsi, too.

KEY TAKEAWAYS

- Popular ESG Funds can be up to 75% less diversified than non-ESG Funds.

- They tend to be more exposed to Techs and Telecoms and underweight Energy, Utilities or Industrials. They also have a large cap bias.

- But the more ESG ratings impact the screening process, the more concentration problems it may pose. Composition may become unintuitive. A lot of iShares ETFs fall into this category.

- Conversely, pure SRI Funds, like the Vanguard ESG Global All Cap UCITS ETF, are more diversified. Diversification reduction is usually only up to 15% compared to traditional ETFs. The sectoral mix of pure SRI funds that don’t rely on ESG ratings is also more intuitive.

- Pay special attention to the way the ETFs work, rather than their names. While we follow academic conventions related to use of words like ‘ESG’ or ‘SRI’, both iShares and Vanguard have different definitions.

Here is the full analysis

We previously established a framework on how to think about Sustainability. Now, let’s focus on ESG & SRI blend ETFs.

Our Framework - Spectrum and Focus of this Section

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Popular IShares ETFs

On paper, the ESG + SRI Blend ETF proposition sounds excellent. Why not exclude weapons, tobacco or gambling and at the same time also only include the highest-rated ESG companies? The best part? These funds have outperformed their parent benchmark over the past three years! But this may not be the best idea. Here is why.

Comparing the most popular iShares ETFs

We have compared the performance since June 2019 of some of the three largest ESG + SRI Blend ETFs. These funds all track U.S. companies (but the same logic applies to iShares MSCI World ETFs):

- iShares MSCI USA SRI UCITS ETF

- iShares ESG MSCI USA Leaders ETF

- iShares MSCI USA ESG Enhanced UCITS ETF (tracks the ESG Focus Index)

What are the SRI Screens applied?

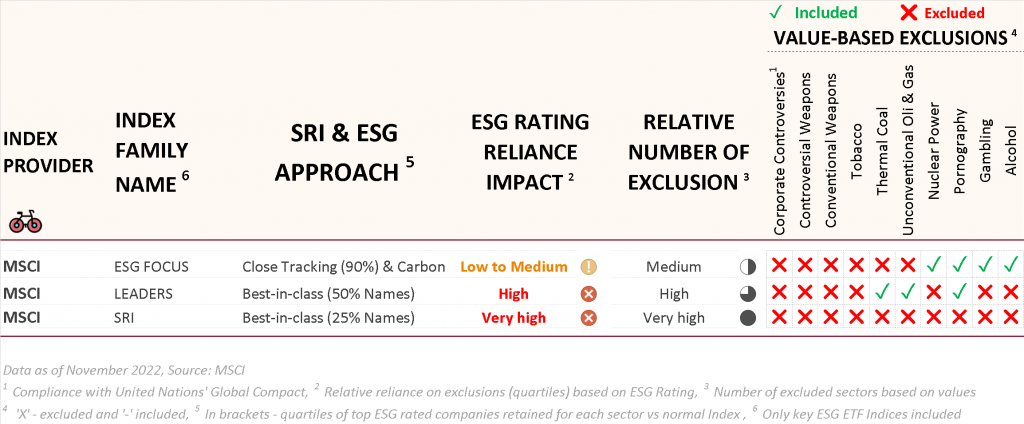

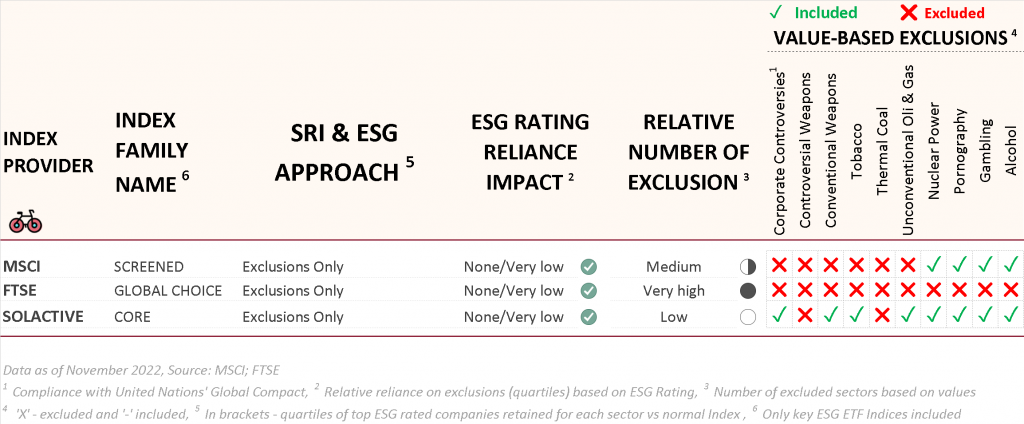

We use the same table we covered in the Sustainable ETFs Benchmark analysis. However, this one is focused on benchmarks for our three popular funds.

List of benchmarks with value-based and eSG rating exclusions

As shown in the above table, The MSCI SRI Index includes the most SRI or value-based restrictions. In addition, value-based screening is also heavily applied to the MSCI Leaders Index. On the other hand, the MSCI ESG Enhanced Focus Index includes Nuclear Power. To illustrate the above table, let’s look at the exclusions for one of the benchmarks.

What are the ESG Rating-based exclusions applied?

As shown in the table above, the MSCI SRI Index is the most heavily influenced by ESG Rating selection.

- MSCI SRI – the Index provider only targets to include up to 25% of the best-rated names from its parent index

- MSCI Leaders – is also quite restrictive. It includes up to 50% of the best-rated names

- MSCI ESG Focus – that is used by iShares ESG Enhanced ETF includes 90% of names, excluding the bottom 10% of worst-rated companies

To confuse things, MSCI named its most restrictive ESG+SRI Blend Index the “MSCI USA SRI Index”. Remember, it’s not a pure SRI Index. In fact, it only retains c. 25% of the highest-rated ESG names on top of the SRI screening.

How do ESG + SRI Screenings impact iShares Sectoral composition?

- The composition can be significantly impacted by the screening process.

- Usually, as it’s the case for ESG Leaders and ESG Focus funds, it goes into an intuitive direction: a bit more Tech, less Energy stocks.

- But the more best-in-class we go (e.g. retaining only 25% of the highest ESG-rated companies) the further the sector composition changes.

- That’s also because for the SRI fund, MSCI has included a 5% cap per company to avoid excessive concentration risk.

When the Index Provider has an extremely selective ESG Rating methodology, and on top of that there are additional caps, the result becomes very unintuitive. Have a look at the SRI ETF below.

Sectoral Comparison of iShares MSCI USA ETFs

How do ESG + SRI Screenings impact TOP iShares Holdings?

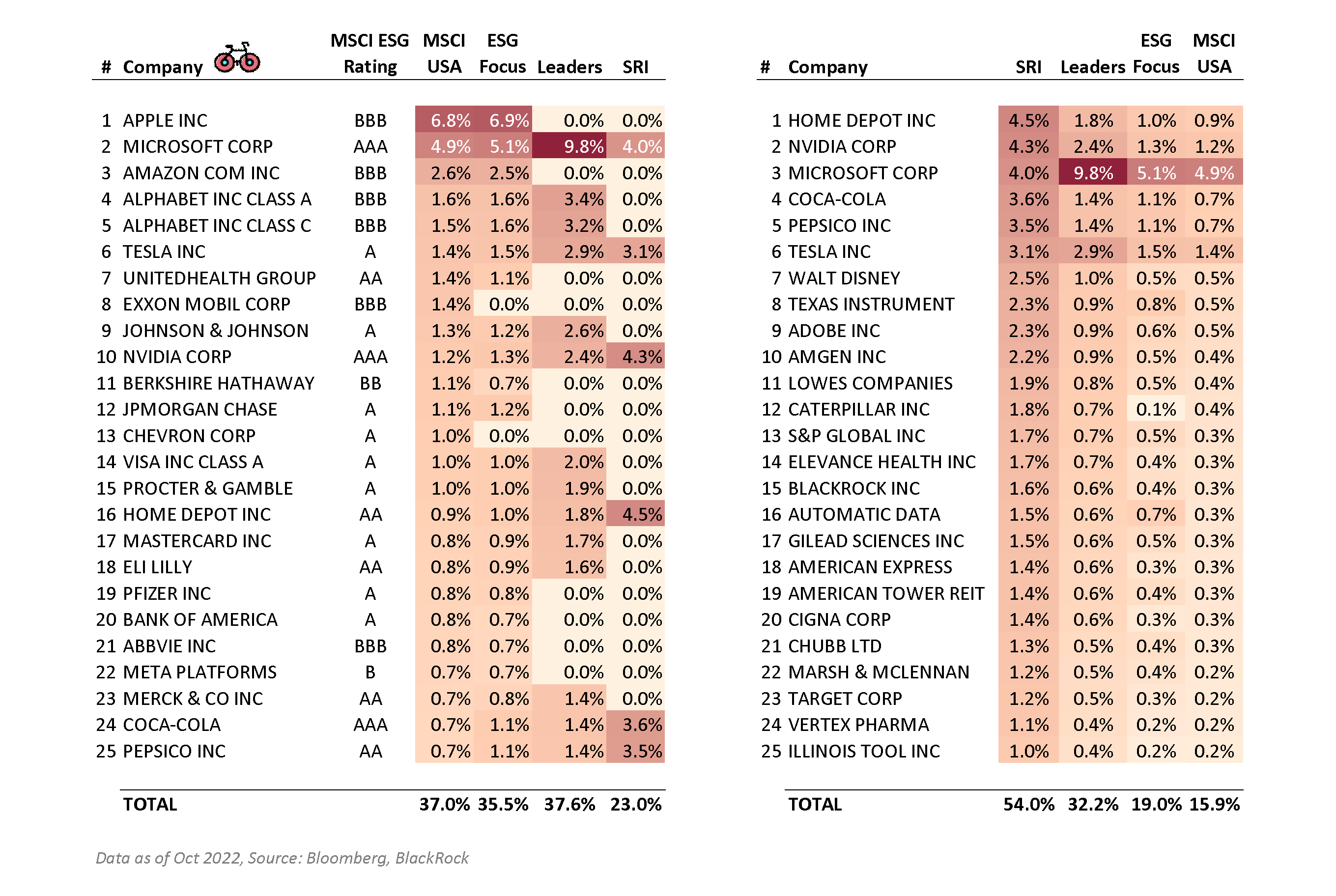

Now, let’s have a look at two tables:

- The one on the left uses MSCI USA as a reference. It also shows MSCI ESG Ratings for the TOP 25 Names in the Index. And then gradually how much names are dropped once ESG + SRI screenings come into play.

- The one on the right shows the TOP 25 names in the most restrictive ETF based on the MSCI SRI Index. It then compares the other ETFs to it.

TOP 25 Names Retention rate

The individual names vary a lot:

- iShares MSCI SRI – Excludes names such as Apple, Amazon, Google or Meta. Not what you’d expect, right? The highest concentration is in names like Home Depot or Nvidia. But I hope you like the taste of Coca-Cola and Pepsi, if you select this fund.

- iShares MSCI Leaders – Excludes Apple, Amazon or Meta but includes Google. Very high concentration to Microsoft or Tesla. It does that to maintain close replication of sectoral composition with the parent index but at the expense of being over-exposed to these companies.

- iShares MSCI ESG Enhanced (ESG Focus Index)– Includes all of them but excludes Exxon Mobil or Chevron, which is probably the most intuitive outcome.

Diversification Is Impacted. a Lot. Out of the total 623 names in the MSCI USA, the iShares based on MSCI ESG Focus Index holds 571 names (diversification reduction of c.8%), MSCI Leaders 277 (diversification reduction of c. 52%) and MSCI SRI only 151 (diversification reduction of 76%).

Now, let’s focus on a typical SRI ETF.

Our Framework - Spectrum and Focus of this Section

Again, we use the same table we covered in the Sustainable ETFs Benchmark analysis. However, this one is centred around the benchmarks for SRI-only Funds.

List of benchmarks with value-based and eSG rating exclusions

Deep Dive into Vanguard ESG Global All Cap UCITS ETF

Now, let’s have a quick look at a fund tracking one of the 3 SRI benchmarks above – the Vanguard ESG Global All Cap UCITS ETF. It tracks the FTSE Global Choice Index.

Again, given that there are no naming conventions and probably because the word ‘ESG’ is trendy, Vanguard named its SRI-only Fund “ESG Global All Cap”. Despite what its name may imply, it is not an ESG Fund. Based on the documentation, there is no ESG rating selection. It’s a pure SRI Fund.

What are the SRI Screens applied?

Vanguard applies the same rigorous screening as the MSCI SRI Fund we have previously reviewed.

What are the ESG Rating-based exclusions applied?

Vanguard doesn’t apply any ESG-rating exclusions.

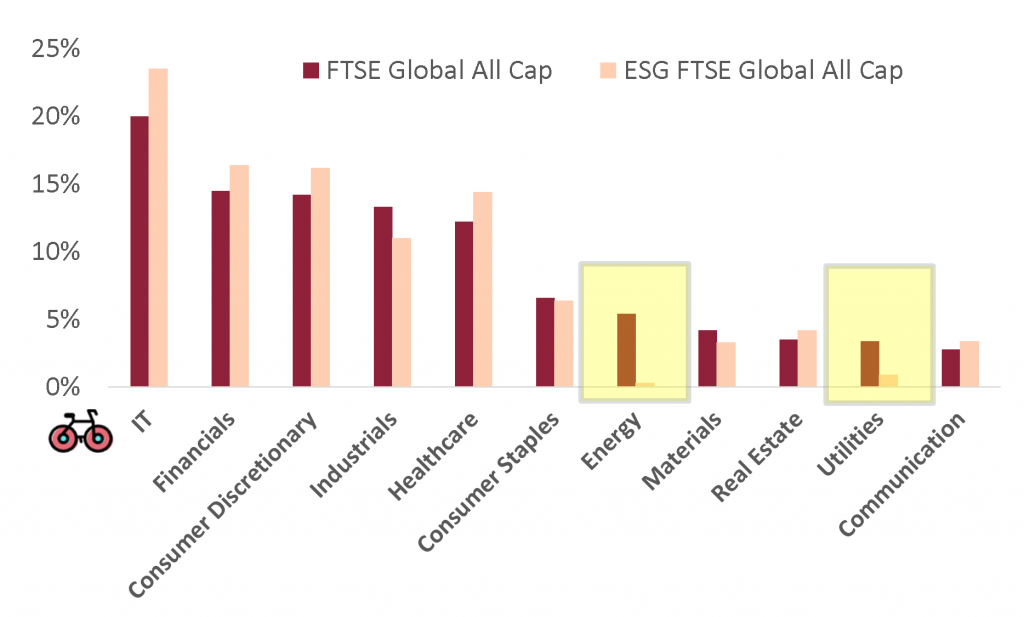

How do SRI Screenings impact Vanguard ETF Sectoral composition?

Now, let’s have a look at the sectoral comparison:

- The most significant effect of SRI screening is, as expected, on Energy and Utilities with hardly any remaining exposure in the ESG Fund

- Materials and Industrials are also marginally impacted

- The other sectors benefit from relative overweight

Sectoral Comparison

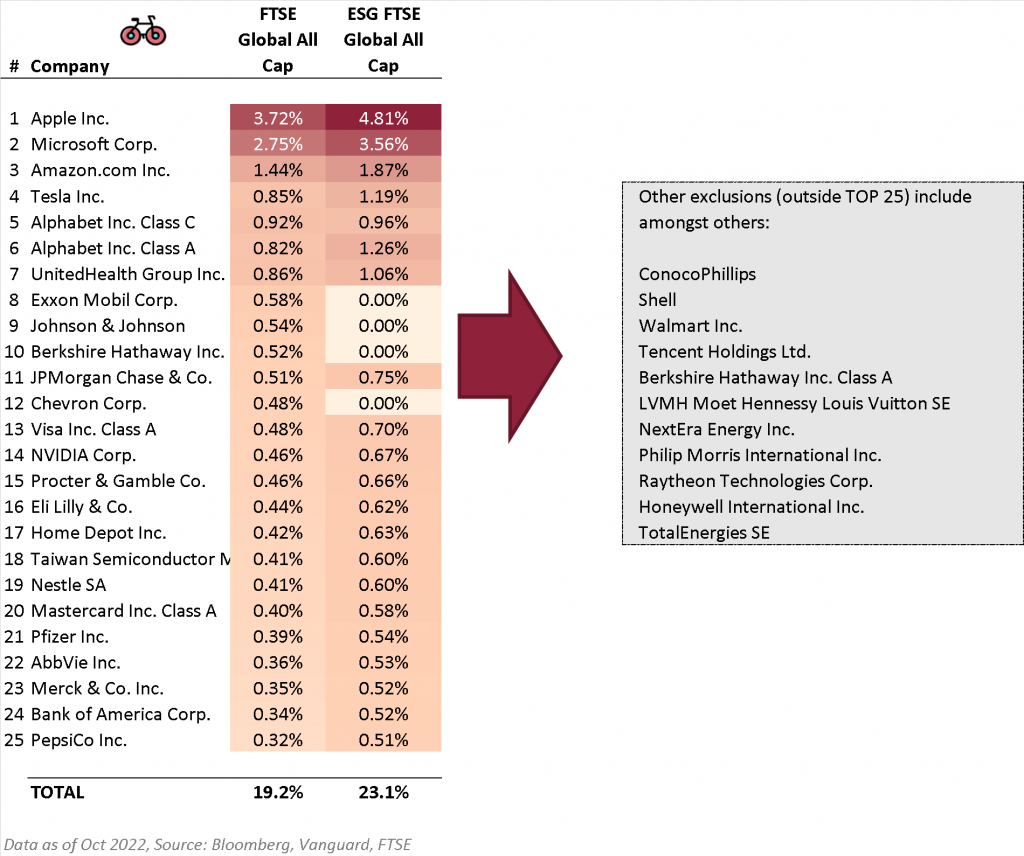

How do SRI Screenings impact TOP Vanguard ETF Holdings?

Out of the total benchmark of 9,523 names in the FTSE Global All Cap, the ESG version is modelled on 8,057 (or a diversification reduction of 15%).

ESG FTSE Global All Cap Top 25 Holdings and Exclusions

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

PERFORMANCE - IS THERE MORE TO IT THAN SECTORS?

To summarize, the benchmarks where ESG Ratings are the most intrusive come up with the least intuitive compositions, also because of additional caps. For example, iShares MSCI USA SRI ETF excludes a lot of names that investors favour, including big tech. There is some good diversification of soft drinks – between Pepsi and Coke, but that’s not the type of diversification you probably had in mind.

Pure SRI funds have more intuitive outcomes – like the Vanguard FTSE ESG Global All Cap ETF. But what about the performance of ESG and SRI Investments? Let’s have a look at this in the next article.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

Money Market Funds: Are ETFs The Best Bang For Your Buck Or A Risky Ride?

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.