How To Choose A Sustainable ETF Benchmark?

THE DEFINITIVE GUIDE TO SUSTAINABLE INVESTING - PART 4

This article is part of Bankeronwheels.com definitive guide to Sustainable Investing.

Despite the irrelevance of ESG Ratings, there are still ways to invest sustainably. Suppose that you want to express your values but limit the impact of ESG Ratings. How would you go about selecting an ETF? First, let’s dive into benchmarks that ETFs track.

KEY TAKEAWAYS

- Pure SRI Funds are the most intuitive choice for an Investor willing to exclude investments based on moral grounds.

- You can exclude up to ten different categories of businesses based on your ethical values. For example Weapons or Tobacco.

- However, sometimes pure SRI Funds reflecting your values are not available. In that case, you need to select an ESG & SRI blend ETF. They represent the vast majority of the investment universe.

- But ESG Ratings for funds in this blend category produce a wide range of, sometimes undesired, outcomes.

- If you decide to invest in a blend ETF, exclude the investments based on the values you feel strongly about, then minimize the impact of ESG Ratings.

Here is the full analysis

We previously established a framework on how to think about Sustainability. Today, let’s focus on ESG&SRI blend ETFs and SRI Funds.

Our Framework - Spectrum and Focus of this Article

There are hundreds of ESG ETFs from dozens of Index providers. But let’s face it, only a few matter:

- MSCI ESG dominates this space – with a market share of 60%. Most providers use its methodologies, including BlackRock’s iShares.

- FTSE ESG benchmarks – are used by Vanguard.

- S&P ESG methodologies – have their quirks. For example, kicking out Tesla from the S&P ESG 500 Index was quite controversial. We will analyze this later in this guide.

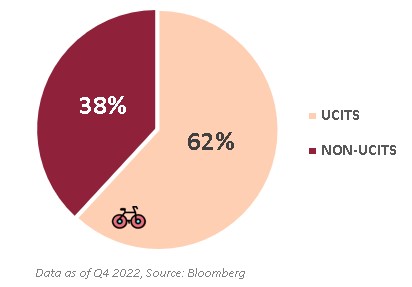

Overall, there are plenty of UCITS ETFs to choose from. However, compared to other market segments, in ESG Europe is a leader.

Who matters in the ESG Space?

How much control do you want to give to the index provider?

Before diving into return considerations, let’s reiterate the critical fact. Both SRI and ESG Rating exclusion filters (as explained here) reduce portfolio diversification.

Here, at Bankeronwheels.com, we emphasize that diversification is key to long-term investing success. But while SRI is investor-driven, ESG rating filtering depends only on the Index Provider.

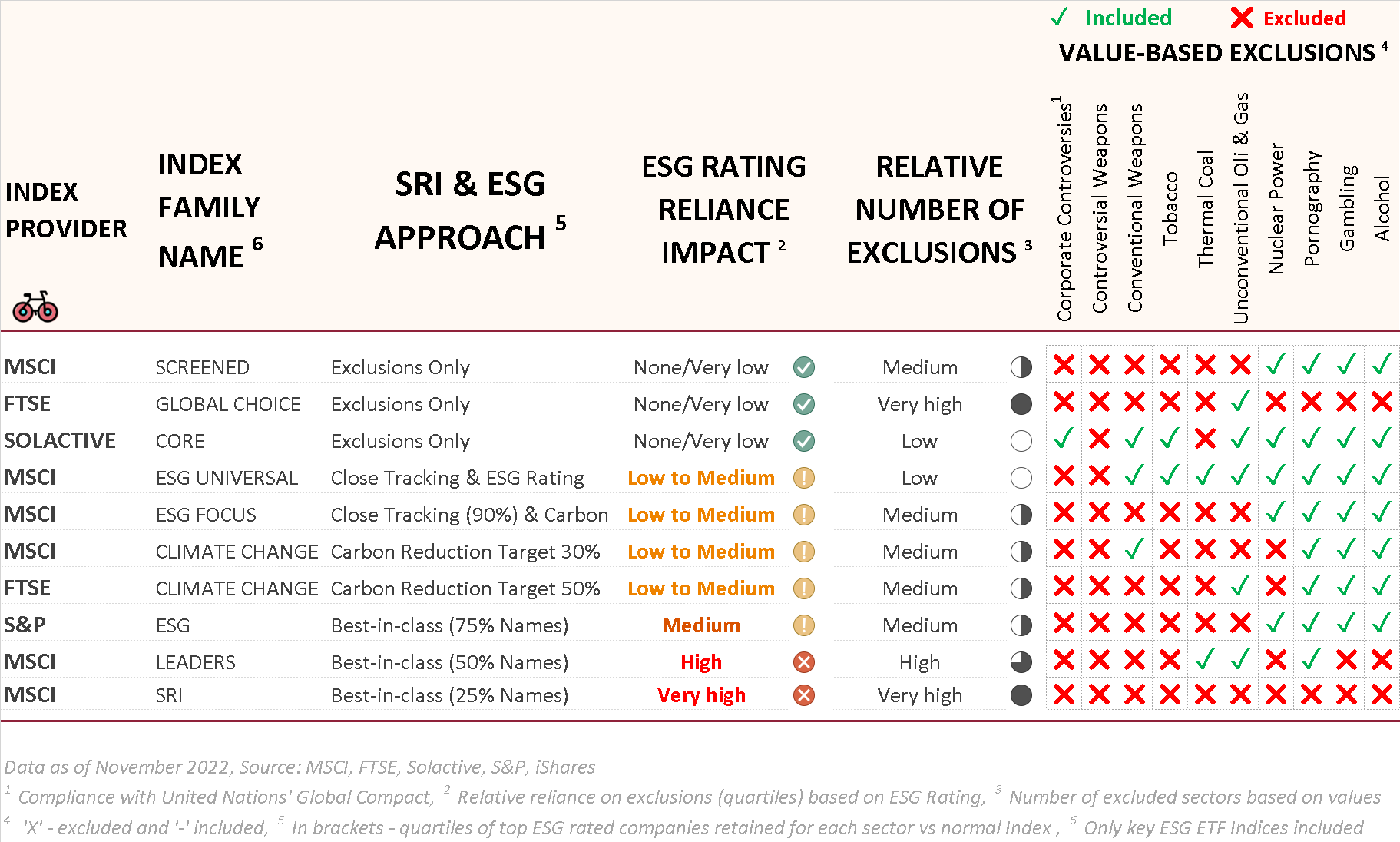

HOW TO SELECT THE RIGHT BENCHMARK

- First - Eliminate benchmarks Based on your Value Screens (last few columns below)

- Second, choose the Index that minimizes the ESG Rating Reliance Impact.

This methodology will allow you to filter the investments that are not aligned with your values, but at the same time, maintain the highest diversification of your portfolio otherwise. Below this table, we explain how the approaches work in practice.

List of benchmarks with value-based and eSG rating exclusions

Provider & Index Family

- We have only listed key benchmarks – the table removes unnecessary indices that large UCITS SRI & ESG ETFs do not use.

- Index name – While it’s not always self-explanatory, it sometimes includes the Index objective. For example, Climate change benchmarks focus partially on carbon reduction metrics.

SRI & ESG Approach & ESG Rating Reliance

This is my interpretation of the Index objective. It is a crucial consideration. It often reduces diversification based on the provider’s often irrelevant to protecting the planet ESG Ratings (and not your values):

- Exclusion only – does not take any ESG Ratings into consideration (prioritize these benchmarks)

- Close Tracking & Carbon Reduction – Selection based on ESG Ratings may influence exclusions but can, in rare cases, have some benefits – selecting based on carbon reduction targets (this is marginally negative)

- Highest ESG Rated Only – The provider operates a selection (retains from 75% to only 25% of names in each sector) based on their ESG Rating (the lower the retention, the more damaging this aspect)

Number & nature of Value-Based Exclusions

These exclusions reduce diversification but are based on your values. Since this is your personal trade-off, there is no wrong/correct answer here:

- Corporate controversies – removes companies based on non-compliance with United Nations Global Compact (UNGC)

- Controversial Weapons – such as cluster bombs, anti-personnel mines, chemical or biological weapons

- Conventional Weapons – encompass a wide range of equipment not limited to armoured combat vehicles, combat helicopters, combat aircraft, warships etc.

- Thermal Coal – Is linked to the mining, processing or sale of this fossil fuel.

- Unconventional Gas & Oil – all activities that extract natural gas and oil from rock formations

- Other more obvious exclusions – Tobacco, Alcohol, Nuclear Power, Pornography or Gambling

Are all ESG Rating Providers Similar?

Seeing a few benchmarks that are not from MSCI, you may wonder whether other providers took a different approach to ESG rating. The short answer, backed by extensive academic research, is that ESG Rating Providers differ widely in their rating approaches.

However, MSCI is the most relevant one for Equities. FTSE does not use them for the Global Choice Indices. S&P has a rating approach different from MSCI or Morningstar (Sustainalytics), but it is severely flawed in its own right. We will address this issue in a later article of this series.

FIXED INCOME

Unless you select individual Green Bonds, chances are that you will be restricted to a handful of index series: Bloomberg MSCI Indices, FTSE ESG Select Indices, JP Morgan ESG Indices or Solactive Indices, including Green Bonds. The choice is primarily driven by your strategy and the credit risk you want to take.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

WHAT ABOUT OUTPERFORMING TILTS?

We know already that ESG Ratings are flawed. Hence, the need to minimize their impact. But what is really within the ESG & SRI ETFs? Would some sectoral tilt convince you to change your mind? Especially if these funds have a track record of significant outperformance. Now, let’s have a look at that what popular iShares and Vanguard ETFs hold.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – JP Morgan Guide To Retirement

Surviving The Next Bear – Strategies To Profit From The Next Market Crash

Weekend Reading – Asset Class Returns since 1970 & Trend Following Strategies

Cracking the Code: Decoding ETF Names & Discovering Tools To Find Them

Broker Review Methodology

iWeb Share Dealing Review – Great For Inactive Investors

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🎁 Taking advantage of our affiliate links when setting up a broker account. This doesn’t increase your costs, and we often secure exclusive bonuses for our audience.

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.