The Reason Why Sustainable Investing Will Underperform

THE DEFINITIVE GUIDE TO SUSTAINABLE INVESTING - PART 6

This article is part of Bankeronwheels.com definitive guide to Sustainable Investing.

We previously busted the first myth surrounding ESG. Wall Street didn’t want you to know that ESG Ratings are not about protecting the planet. And yet, over the past few years, ESG investments have, sometimes significantly, outperformed.

Today, let’s bust the second myth by looking at academic research. Despite all you read on this topic, this outperformance will not last.

KEY TAKEAWAYS

- Over the past century, Sustainable Investments did not outperform. Sin Stocks did, because they are riskier. In investing, returns come with additional risks.

- But Sustainable funds may temporarily outperform, as they’ve done from 2018 to 2022.

- This outperformance is due to two reasons. First, they are over-exposed to large-cap and growth risk factors. Second, ESG was, until recently, very trendy. Investors developed a taste for sustainability, that inflated valuations.

- This taste is the very reason why ESG ETFs are poised to underperform on a risk-adjusted basis. More flows mean higher valuations today and lower expected returns tomorrow.

- Sustainable investing is like a luxury good. Flows tend to be higher in good times and lower in recessions because investors cannot always afford it.

- Higher fees will also contribute to underperformance.

Here is the full analysis

I'll tell you why I like the cigarette business. It costs a penny to make. Sell it for a dollar. It's addictive. And there's fantastic brand loyalty.

Warren Buffett (1987)

A rewarding Investment

There is broad consensus from academics around the historical outperformance of Sin Stocks:

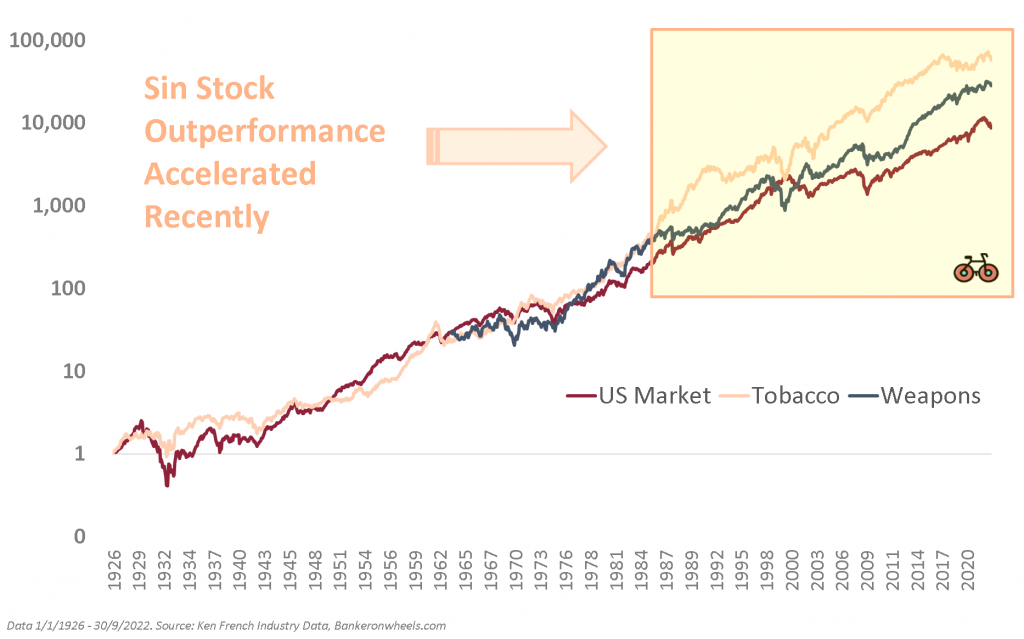

- US Sin Stocks have outperformed the market by 3-4%, and International Sin Stocks by 2.5% – based on 100-year data in a study called The Price of Sin: The Effects of Social Norms on Market.

- US Tobacco outperformed by 4.6%, UK Alcohol by 2.2% – Tobacco was 14.2% against 9.6% for the overall US Market, based on the paper Exclusionary Screening covering the last 120 years.

- The most impressive outperformance came from Gaming (26.4%) and Weapons (24.6%) – concluded Frank Fabozzi in his study Sin Stock Returns based on more recent data.

Average Annual Sin Stock Outperformance

Sin Stock Outperformance only Accelerated

One may think that this is an old trend and things are changing. The data points to the opposite conclusion. Recently, the Sin Stock outperformance trend only accelerated.The studies above and our analysis below, with data until September 2022, confirm that the vast majority of the Tobacco outperformance came after the 80s.

US Sin Stocks Have Outperformed over the past century (1926-2022)

There are two explanations for the outperformance of Sin Stocks and the underperformance of ESG – Taste and Risk.

It's Not Something You want to mention over Christmas dinner

You may think that the markets follow rational pricing models, but in a 2005 paper, Fama and French demonstrated that taste could be a driver of asset values. When some investors receive a consumptive good benefit (e.g. social or psychological reward) for investing in a certain kind of asset, then the price of that asset will be higher than a comparable asset that carries no such personal benefit.

Investors overpay to sleep better, knowing that their portfolio is greener. Such stocks trade at a premium to earnings, resulting in a higher P/E ratio and lower expected returns. The opposite is true for Tobacco. Investors wouldn’t be comfortable mentioning such investment over Christmas dinner. There is less taste for it, so it trades at a lower P/E and ensures higher expected returns.

Sin Stocks Are Potentially Riskier

But there is also the other side of the coin. Risk. A few years after praising Tobacco as a sound business model, Warren Buffet changed his mind:

“It is fraught with questions that relate to societal attitudes and those of the present administration. I would not like to have a significant percentage of my net worth invested in tobacco businesses. The economy of the business may be fine, but that doesn’t mean it has a bright future”.

Tobacco investors earn higher returns because they bear higher risks. Some well-informed investors are ready to ride out the ‘ESG hype’ and bear those higher risks. The same applies to other industries, for example, regulatory risk for gambling.

Do Sin Stocks Generate Alpha?

No, Companies Producing Sin Products Are Just Better Managed

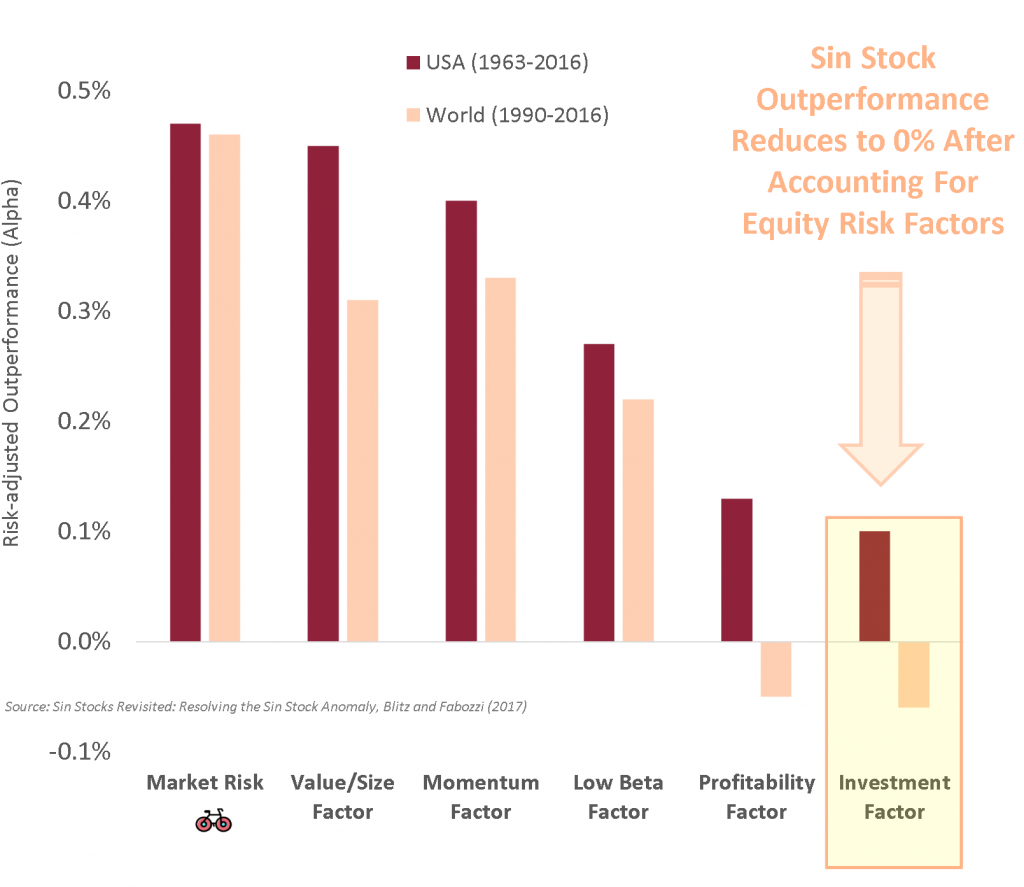

In the 2017 paper Sin Stocks Revisited: Resolving the Sin Stock Anomaly, Blitz and Fabozzi ran regressions to understand whether there is a risk-adjusted outperformance:

- If only Market Risk is considered, Sin Stocks show around 0.45% Alpha for US and World Stocks

- By adding value, size, momentum and low beta risk factors, the alpha reduces to 0.2-0.25%

- By accounting for the Fama French five-factor model, including profitability and investment, the alpha virtually disappears.

Returns of vice stocks occurred because these companies are more profitable and less wasteful than the average corporation.

Sin Stock 'Alpha' Becomes Insignificant after accounting for Risk Factors

Do You Need Invest In Sin Stocks To Outperform?

No. Sin Stocks outperform because they are exposed to different risk factors. In summary, Sin Stocks’ performance can be replicated by a factor investing strategy by investing in equities with similar risk profiles, e.g. more profitable value stocks.

ESG Stocks May Be Less Risky

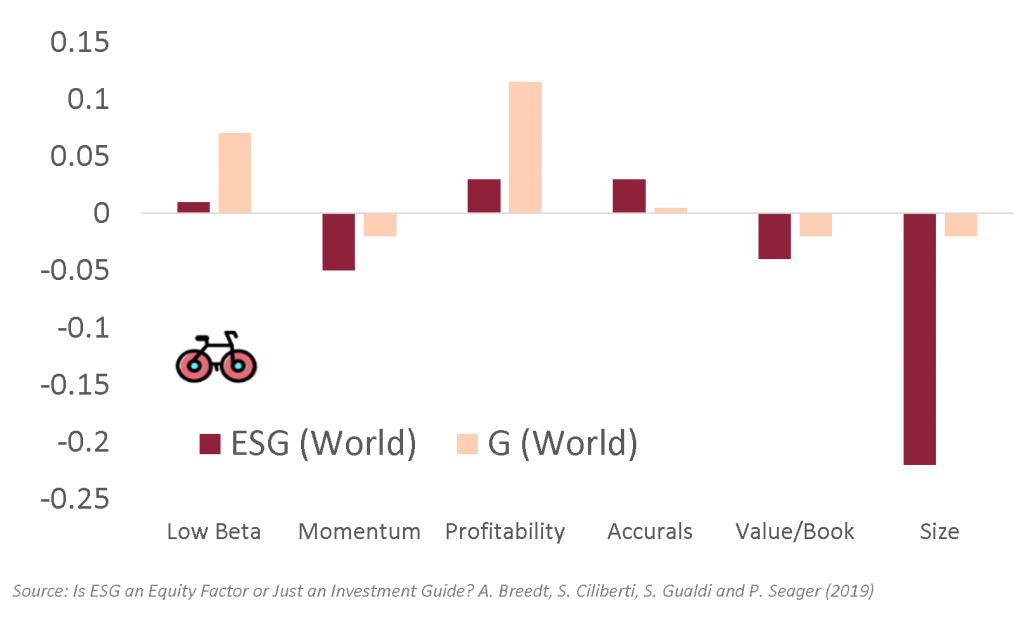

Now, think of ESG as the exact opposite of Sin Stocks. To explain investment performance based on ESG Ratings, let’s start with the risk story. As we’ve seen in our X-ray of ESG Funds – these funds have biases. In 2019, the paper Is ESG an Equity Factor or Just an Investment Guide? authors concluded that ESG Investors take less risk by e.g. avoiding small stocks and having less exposure to the market.

ESG ETFs have less market Risk and larger, more profitable stocks (2007-2017)

What Explains Most ESG Fund Returns?

Other academic papers reach similar conclusions:

- ESG Portfolios have growth/tech and large cap biases – These Investments have higher ratings but are also more expensive, leading to lower future returns.

- ESG Portfolios have Europe/Pacific biases – Higher scores result from more stringent regulations in those regions.

But Do ESG Ratings Generate Alpha?

No. According to the same study, if we account for risk factors, ESG as an equity factor “has returns compatible with noise“. There is no ESG risk-adjusted outperformance. Governance (“G” in the graph above) was the most promising. But its alpha also disappears after adjusting for the profitability (quality) risk factor.

Do You Need Invest In ESG To Lower Risks in Your Portfolio?

In summary, Academic research shows that while ESG Stocks may be less risky, ESG Ratings are not capturing anything we haven’t previously accounted for. ESG strategies offer no additional downside risk protection beyond the known factors like quality companies, which tend to be large, profitable and invest conservatively.

And this is very problematic for the ESG Industry. Not only do financially material ESG Ratings have no impact on the planet, but they may also not be a useful risk measure for portfolio managers (la raison d’être of ESG integration?)

A lot of media outlets, and ESG Rating providers want you to buy this story.There was in fact, an outperformance. But highlighting this to imply it will continue is intellectually dishonest.

The Inevitable Underperformance

What the Media and ESG Providers Want You To Believe

Now, I see what you may be thinking. Empirical evidence shows that, after accounting for risk factors, e.g. the 2018-2021 Tech run, ESG ETFs still generated incremental outperformance. A lot of media outlets, and ESG Rating providers, want you to buy this story. And in fact, there was an outperformance. But highlighting this to imply it will continue is intellectually dishonest.

What Happened from 2018 to 2021?

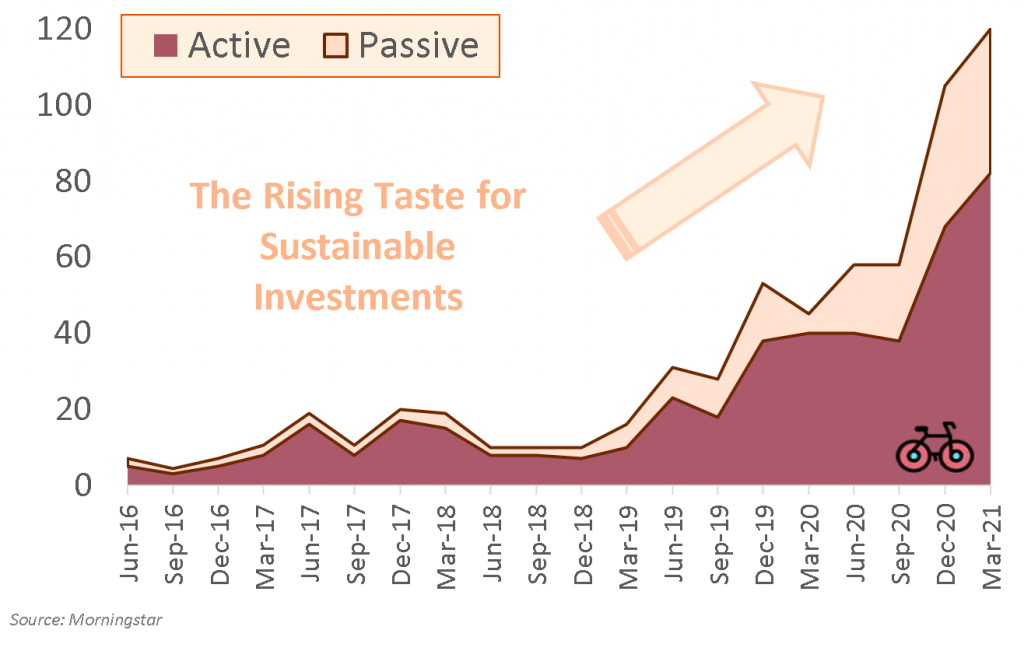

Remember – most ESG studies covered 2007-2017 data. Before the ESG movement took off. First, let’s look at the flows in Sustainable funds:

- Until Q4’18 the inflows were insignificant.

- From 2019 quarterly inflows increased x6 to reach 120€ bn in Q1’21.

Quarterly European Sustainable Fund Flows (in €bn)

Why did ESG Outperform from 2018 to 2021?

Remember how we mentioned Sin Stocks outperforming because it’s hard to talk about this type of investment over Christmas Dinner? Well, that’s also why ESG outperformed. A high taste for Sustainability has driven up valuations.

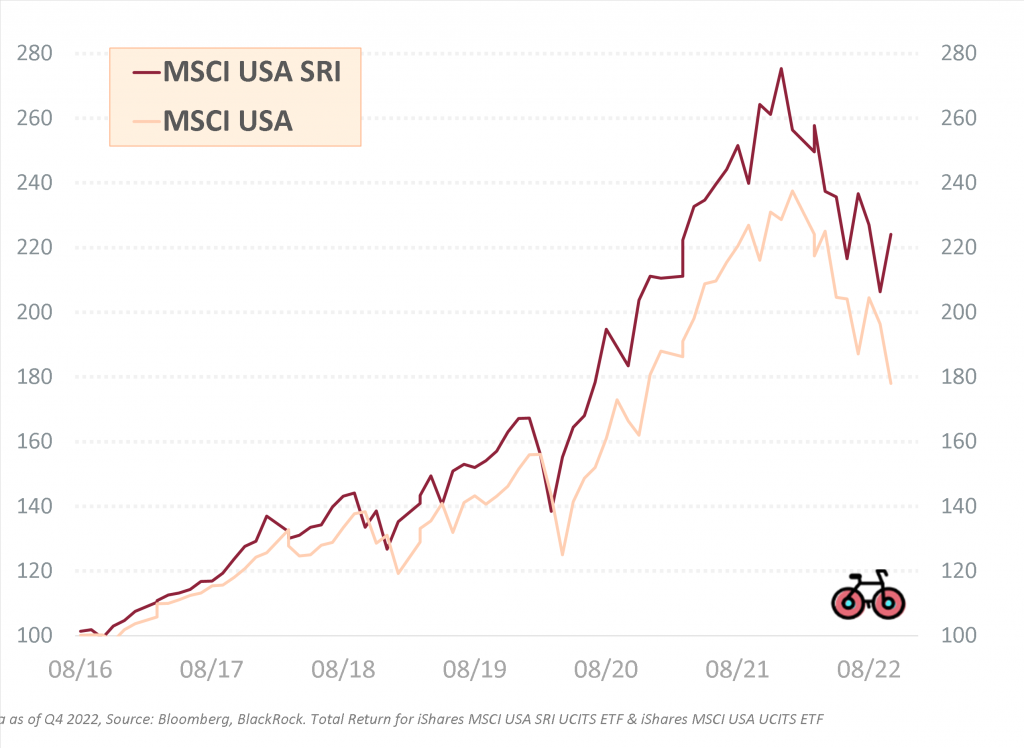

If you look at the past 6.5 years, the iShares MSCI USA SRI UCITS ETF averaged an annual return of 13.8%. An outperformance of 2.7% over its parent benchmark. Partially because of factor exposure, and partially due to taste for sustainability.

Performance of iShares ESG+SRI Blend ETFs

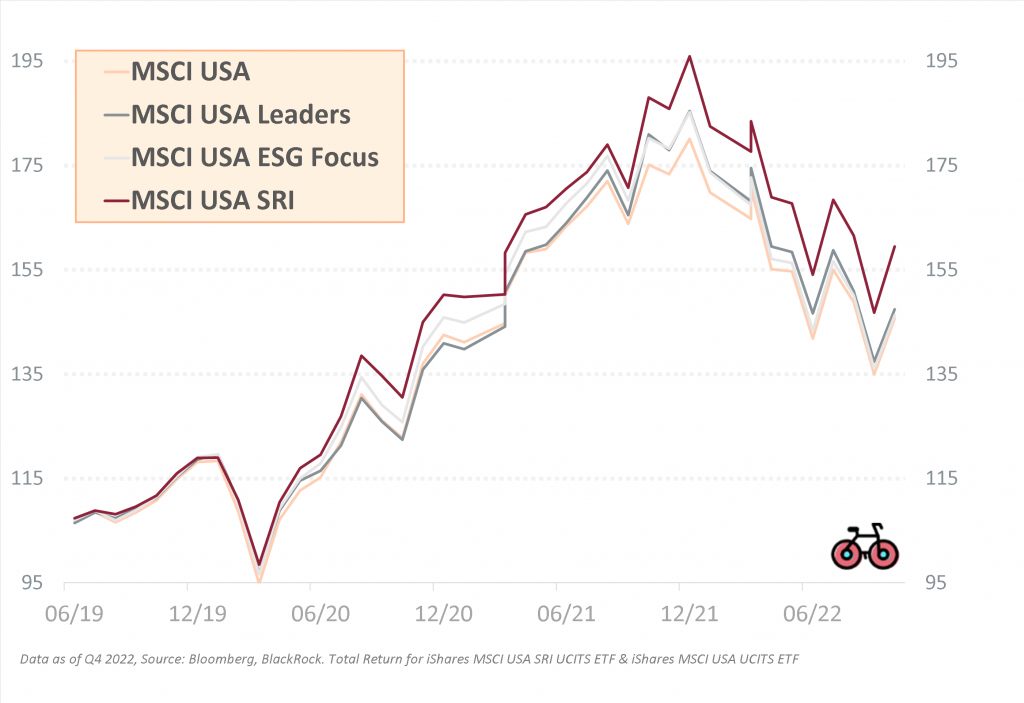

In fact, the more intrusive ESG Rating get, as explained in our previous article, the better the performance.

Since June 2019:

- iShares MSCI USA SRI UCITS ETF (retains only TOP 25% ESG names) gained 14.3% annually

- iShares ESG MSCI USA Leaders ETF (TOP 50% ESG names) gained 11.7% annually

- iShares MSCI USA ESG Enhanced UCITS ETF (TOP 75% ESG Names) gained 11.5% annually

- iShares MSCI USA ETF only gained 11.3% annually

When Will ESG Start Underperforming?

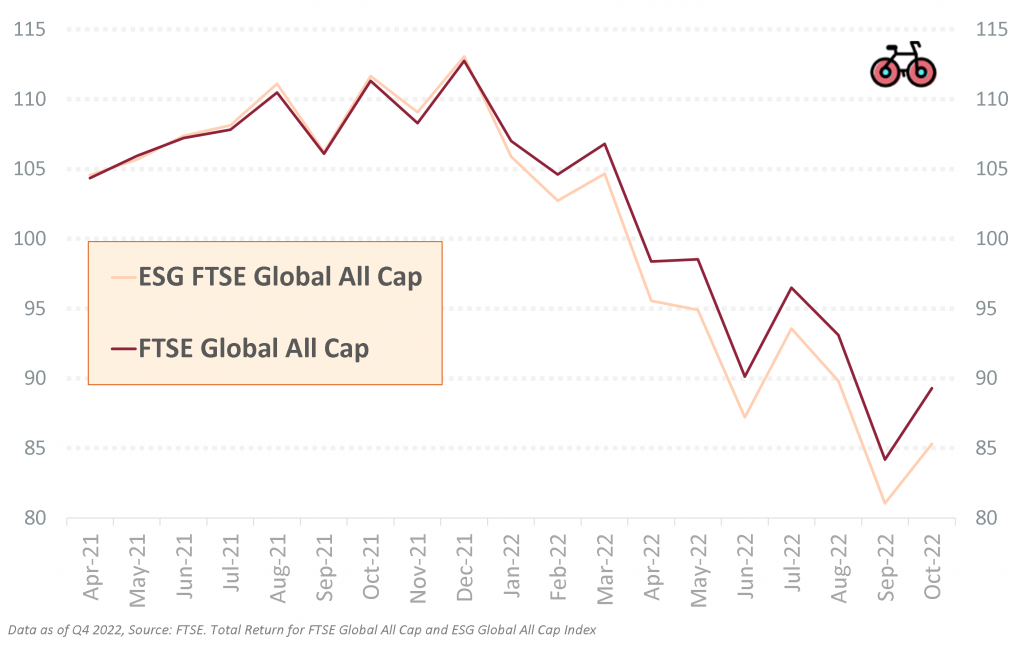

It’s hard to say. If the ESG consumption good is a luxury good, as the 2019 study Is Socially Responsible Investing a Luxury Good? would indicate, then green stocks may outperform brown stocks in good times but underperform in recessionary times.

The recent underperformance of certain funds, including the Vanguard ESG Global All Cap UCITS ETF would imply this trend has already started. Factors and taste for Sustainability can explain this.

FTSE Global All Cap vs. ESG Global All Cap Index Performance (April 2021 - Oct 2022)

What If I Invest For the Long Term?

But, we may also see a continued medium-term ESG outperformance if the market stabilizes, and there are more flows into sustainability funds. This trend can last for years. However, based on academic research, given that taste was driving up valuations, long-term ESG underperformance is almost certain on a risk-adjusted basis.

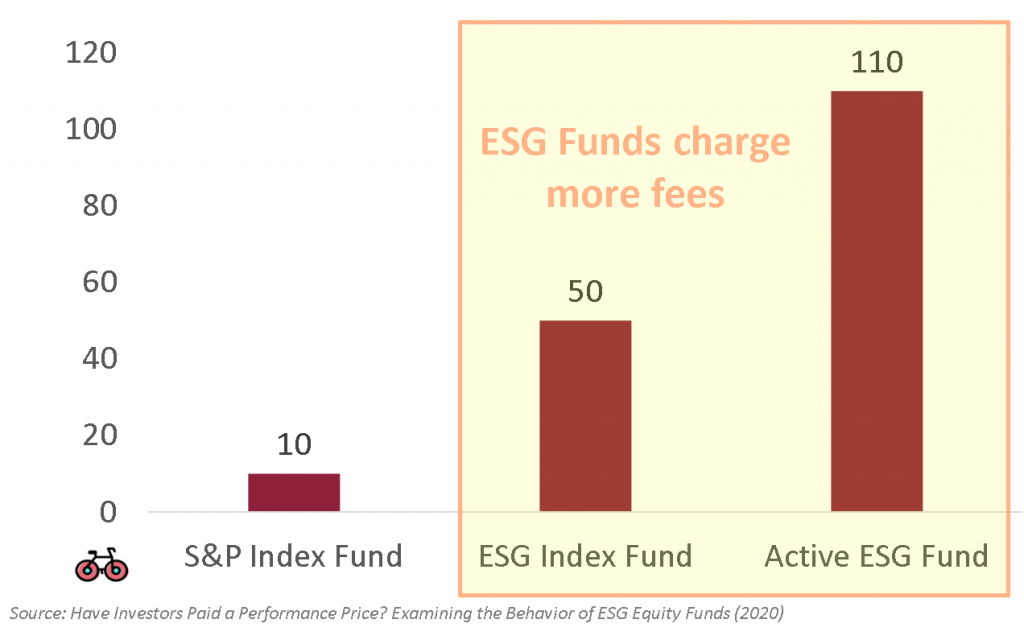

OVERPAYING IN FEES, TOO

According to a 2020 study, the average management fees for ESG Index Funds were five times higher than plain vanilla passive funds and over ten times higher for Active ESG Funds. While SRI screening is relatively vanilla, you do need to pay for those ESG Ratings. You probably don’t need a calculator to understand the long-term impact on portfolio performance.

Average Management Costs of investing in ESG Funds (in bps)

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

So How Can You Impact the World?

In summary, most Equity ETFs that use financially material ESG Ratings are not impacting the planet but are poised to underperform in the long run on a risk-adjusted basis. So, what can you do to make an impact? Let’s have a look at 3 potential strategies.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Surviving The Next Bear – Strategies To Profit From The Next Market Crash

Weekend Reading – Asset Class Returns since 1970 & Trend Following Strategies

Cracking the Code: Decoding ETF Names & Discovering Tools To Find Them

Broker Review Methodology

iWeb Share Dealing Review – Great For Inactive Investors

AJBell Review – Leading Broker & Low-Fee SIPP Provider

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🎁 Taking advantage of our affiliate links when setting up a broker account. This doesn’t increase your costs, and we often secure exclusive bonuses for our audience.

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.