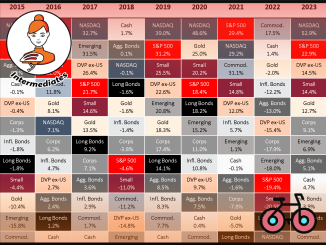

Articles for Intermediate Investors looking to trade individual ETFs and potentially express some views in their portfolios. The benefit of more knowledge about Index Investing comes with the benefit of higher returns.

It may take a week to get fully up to speed.

Examples of such approaches are the Golden Retriever Portfolio or the Cyclist Portfolio.