An Apolitical, Data-driven Guide To Sustainable Investing.

PART 1 - INTRODUCTION

This guide to sustainable investing is Bankeronwheels.com’s exclusive deep dive into Sustainable Investing.

Sustainable Investing is trendy. But let’s face it, hardly anyone understands the topic.

The vast majority of institutional investors and even some academics don’t understand the nuances either.

Unsurprisingly, you probably haven’t found any comprehensive guide on this topic that didn’t create even greater confusion.

So here is where we step in.

Our readers kept asking, so we went on a few-month journey to understand what was happening behind the scenes.

We also bust two myths around ESG. What may surprise you is that:

- ESG Ratings in most Equity ETFs are not designed to protect the planet

- On a Risk-adjusted basis, ESG ETFs will, in the long run, inevitably underperform

How to use this guide

Why is our guide Different?

To our knowledge, this is a unique guide on the web that addresses Sustainable Investing taking into account the financial nature of ESG Ratings, that today is absent from the ESG debate.

Understanding ESG Ratings’ flaws significantly impacts investment decisions.

- This guide takes the political aspect of ESG out of the analysis.

- It focuses only on the investment and planet impact aspects.

- We went through hundreds of academic papers to remove the noise and only provide you with the signals.

Target Audience

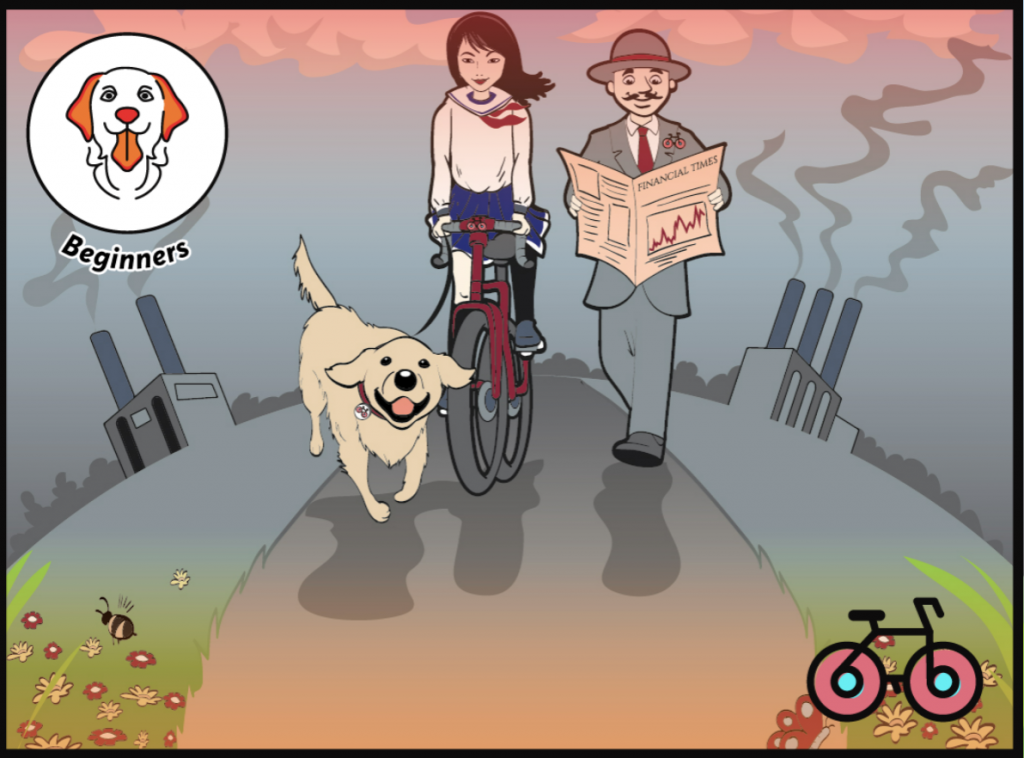

This guide can benefit Bankeronwheels.com’s three core audiences.

We highlight what sections you may find particularly helpful, depending on your profile:

- The Golden Retriever, aka Wise Passive Investor – A hands-off Investor, typically using a single ETF, may benefit from understanding what it means to have a World ETF with ESG characteristics and whether it’s worth it. Perhaps our insights about the ways to make the planet a better place can help, too.

- The Cyclist, aka Semi-Passive DIY Investor – A DIY Investor willing to customise her portfolio can probably benefit the most from our SRI & ESG Investing Sections. Understanding how to incorporate ethical value screens while avoiding ESG traps and what’s really inside an ESG ETF may provide a great starting point. We also cover the price for excluding sin stocks from a portfolio.

- The Banker, aka Evidence-Based Investor – For Advanced Investors, the future of Sustainable Ratings can also provide an introduction to materiality maps, the landscape of financial, impact and double-materiality scores or taxonomy resources to leverage for all asset classes, including private debt.

The Golden Retriever, aka Wise Passive Investor – A hands-off Investor, typically using a single ETF, may benefit from understanding what it means to have a World ETF with ESG characteristics and whether it’s worth it. Our insights about the ways to make the planet a better place can help, too.

The Cyclist, aka Semi-Passive DIY Investor – A DIY Investor willing to customize her portfolio can probably benefit the most from our SRI Investing Sections. Understanding how to incorporate ethical value screens while avoiding ESG traps and what’s really inside popular Sustainable ETFs may provide a great starting point. We also cover the price for excluding sin stocks from a portfolio.

The Banker, aka Evidence-Based Investor – For Advanced Investors, the future of Sustainable Ratings can also provide an introduction to materiality maps, the landscape of financial, impact and double-materiality scores or taxonomy resources to leverage for all asset classes, including private debt.

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

What's in thIS Guide?

Table of Content (Click on the Title Below)

You are reading this introduction.

This article is golden-retriever (beginner) friendly.

We start the guide with the most shocking truth. ESG Ratings in most Equity ETFs are almost the exact opposite of what you think they are.

This article is golden-retriever (beginner) friendly. It is one of the 3 highlights of the series.

When investors mention Sustainable Investing, confusion and relativism reign. That’s because hardly anyone uses a consistent framework of thinking about this topic. We created our own, inspired by the most authoritative academic research.

Here is how to apply our B.S. Meter to ETF Selection. Pure SRI Funds are the most intuitive choice for an Investor willing to exclude investments based on moral grounds. Filtering out ESG Ratings from your portfolio can avoid giving undue influence to index providers.

We look at what investments you will be exposed to when investing in a Sustainable ETF. Funds based on ESG Ratings are composed of companies you wouldn’t suspect. SRI is more intuitive. But when buying an ETF, you need to pay special attention because ETF providers want you to be confused about the funds’ names, too.

Over the past few years, Sustainable investments have, sometimes significantly, outperformed. But this outperformance won’t last. On a risk-adjusted basis, ESG is guaranteed to underperform due to taste for sustainability that has inflated valuations and reduced expected returns.

This article is one of the 3 highlights of the series.

Despite the expected underperformance, some investors may still want to express their Sustainability views in their portfolios. How can you have an impact on the planet? We look at three ways to invest sustainably.

This article is golden-retriever-friendly. It is one of the 3 highlights of the series.

8. Light at the end of the Tunnel? The Future of Sustainable Ratings

This article is only for advanced investors.

[Coming Soon – Subscribe 📧 to get posted when it’s available]

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Sources and limitations

Academica and Our Professional Experience

We relied on two sources:

- Our Professional experience – is related to how Institutional Investors approach Sustainable Investing. In particular, our investigation into rating materialities.

- Academic research – helped shed light on the performance of ESG Funds. We have reviewed dozens of academic papers. Part 6 of our guide uses some references from Larry Swedroe and Samuel Adams that compiled academic papers in their book – Your Essential Guide to Sustainable Investing: How to live your values and achieve your financial goals with ESG, SRI, and Impact Investing.

Why BlackRock and Vanguard

For our benchmark and ETF selection articles, we have prioritised the largest managers:

- BlackRock – given (i) its declared strategic focus on Sustainability and (ii) the fact that it manages 6 out of 10 of the largest Sustainable ETFs.

- Vanguard – given that it’s a popular choice amongst individual investors.

Vanguard

- What is Vanguard ESG Global All Cap UCITS ETF?

- What is Vanguard ESG International Stock ETF? [Coming Shortly]

- What is Vanguard ESG US Stock ETF? [Coming Shortly]

iShares

- What is iShares MSCI World ESG Enhanced UCITS ETF?

- What is iShares MSCI USA SRI UCITS ETF?

- What is iShares MSCI USA ESG Enhanced UCITS ETF? [Coming Shortly]

- What is iShares MSCI Europe SRI UCITS ETF? [Coming Shortly]

- What is iShares MSCI USA ESG Screened UCITS ETF? [Coming Shortly]

- What is iShares MSCI EM SRI UCITS ETF? [Coming Shortly]

- What is iShares MSCI EM IMI ESG Screened UCITS ETF? [Coming Shortly]

- What is iShares ESG MSCI USA Leaders ETF? [Coming Shortly]

- iShares ESG Aware MSCI USA ETF [Coming Shortly]

- What is iShares Global Clean Energy ETF? [Coming Shortly]

- What is iShares ESG Advanced MSCI USA ETF? [Coming Shortly]

- What is iShares ESG Advanced MSCI EAFE ETF? [Coming Shortly]

- What is iShares ESG Advanced MSCI EM ETF? [Coming Shortly]

Other Providers

- What is Xtrackers MSCI USA ESG UCITS ETF? [Coming Shortly]

- What is AMUNDI S&P 500 ESG UCITS ETF? [Coming Shortly]

- What is Invesco Water Resources ETF? [Coming Shortly]

But remember, our framework of thinking and conclusions can be applied to any sustainable fund.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

4 Things I Learned In 4 Years Of Running A Finance Blog

Weekend Reading – JP Morgan Guide To Retirement

Surviving The Next Bear – Strategies To Profit From The Next Market Crash

Weekend Reading – Asset Class Returns since 1970 & Trend Following Strategies

Cracking the Code: Decoding ETF Names & Discovering Tools To Find Them

Broker Review Methodology

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.