The Long Game - Historical Market Returns and 2022 Expectations

It’s the humbling time of the year to acknowledge the limits of our ability to predict markets.

For the first time in decades, inflation needs to be properly accounted for when looking at asset class returns but also our plans.

If you remained invested in Stocks your objectives may be closer than ever.

Over the past decade, World Equities gained over 320% and returned 12.4% annually.

It’s probably also time to rebalance your portfolio. Sell some of the winners, buy some losers.

In fact, this is what Vanguard’s model implies (more on that below). While this is great for learning with some small allocation do not forget the rules of the game and try to remain forecast-free.

While timing any sectorial rotation is tricky, Vanguard’s model can be more helpful in another key aspect – setting the right returns expectations in achieving your financial freedom goals.

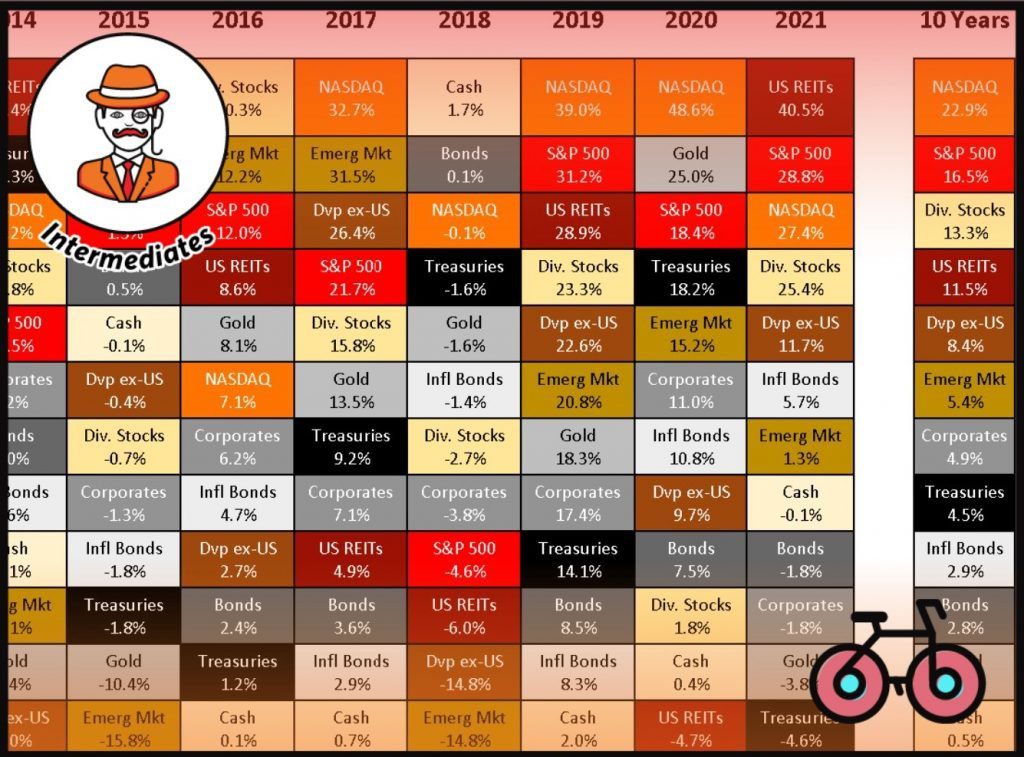

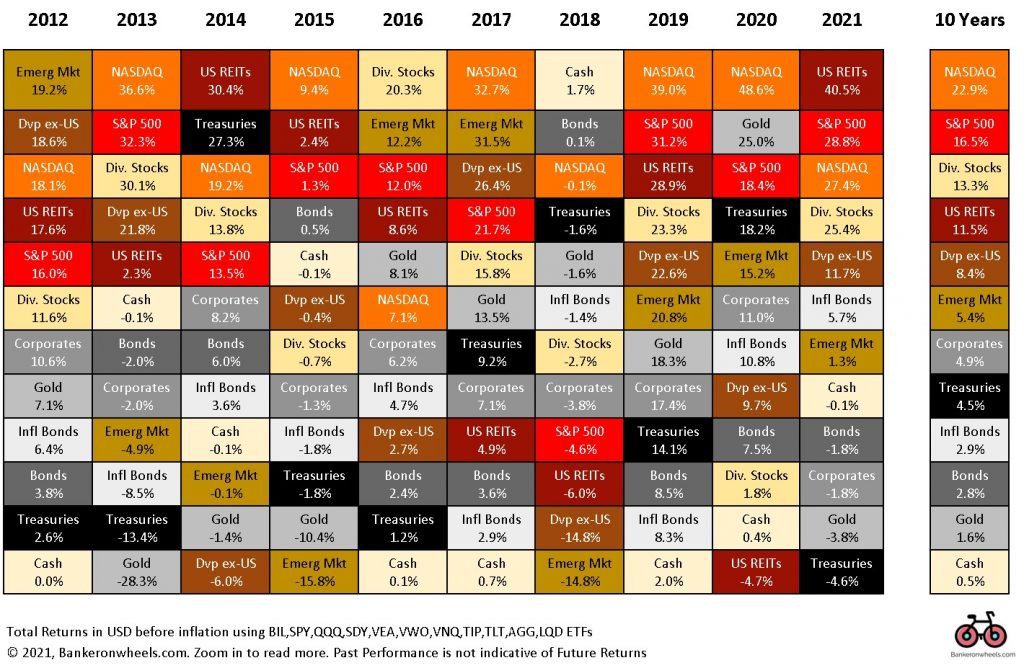

BEST PERFORMERS OF THE PAST DECADE

Asset Classes sorted by performance and 10-year average

- In 2021, the S&P 500 hit 71x a record high. The most in 26 years. The second most ever after 1995 (77x)

- The largest peak-to-trough drawdown was only 5.1%. It’s placing 2021 in the Top 10 Best years over a 94-year period

- World Equities gained 18.9% in USD. From the UK investors’ perspective Vanguard’s FTSE All-World ETF is up 20.3%. European investors recorded 28.5% gains.

- EUR is down 7% this year while GBP lost 1.5% (both versus the USD)

- Alphabet, Tesla or Microsoft’s 50-60% rallies drove Tech Stocks but some names started disappointing including Amazon ending the year close to flat

- This bull run hasn’t been easy for Small and Mid Growth Stocks. 66% of Tech stocks were in Bear Market and at least 35% have lost more than 50% since hitting their records As predicted in 2020, ARK ETFs ended up underperforming (ARKK down 25%)

- Bitcoin price growth ‘slowed down’ to 65% after rallying 300% last year. Volatility remains very high as BTC plunged over 50% in July before recovering roughly half of the losses

- Crypto Industry grew to c. $2.3 Trillion Market Cap. Bitcoin is 10% of Gold Market Cap

- While Inflation is up, the expectation that it will subside (expected to average 2.5% over the next 10 Years in the US) didn’t lift Gold price. Yes, Investing is hard

- Value Stocks underperformed the S&P 500 by c. 5% while REITs gained 40.5%.

- Emerging Markets continued their relative underperformance driven by crackdowns and Real Estate bankruptcies in China

BEST RISK-ADJUSTED PERFORMERS

Risk and Returns when looking at last 20-Year period

- US large Caps that represent over 50% of World Stocks, remained the best risk-adjusted asset class. Most back-testing tools frequently overweight it in portfolios and it’s one of the reasons why some US Investors are reluctant to invest internationally. Optimization for future returns using a rear-view mirror is a tricky game, though.

- Developed Markets ex-US have a higher dividend yield than US Stocks and if the reversion of Price to Earning ratios materializes as described below, this dividend yield could contribute to higher returns vs. US Stocks.

- Treasuries exhibited high volatility but hedged well during both GFC and COVID-19 downturns (Standard Deviation doesn’t tell the whole story for Bonds).

Bogle's Framework for Stocks

In 1991, John Bogle presented a model to estimate long-run stock returns in the United States in the Journal of Portfolio Management.

Bogle noted that you could (reasonably) predict stock market returns with three inputs:

- The initial dividend yield on the stock market

- The predicted change of Price/Earnings (P/E) ratio

- An estimate of earnings growth

Let’s focus on the last two drivers of the Stock Market Equation in 2021.

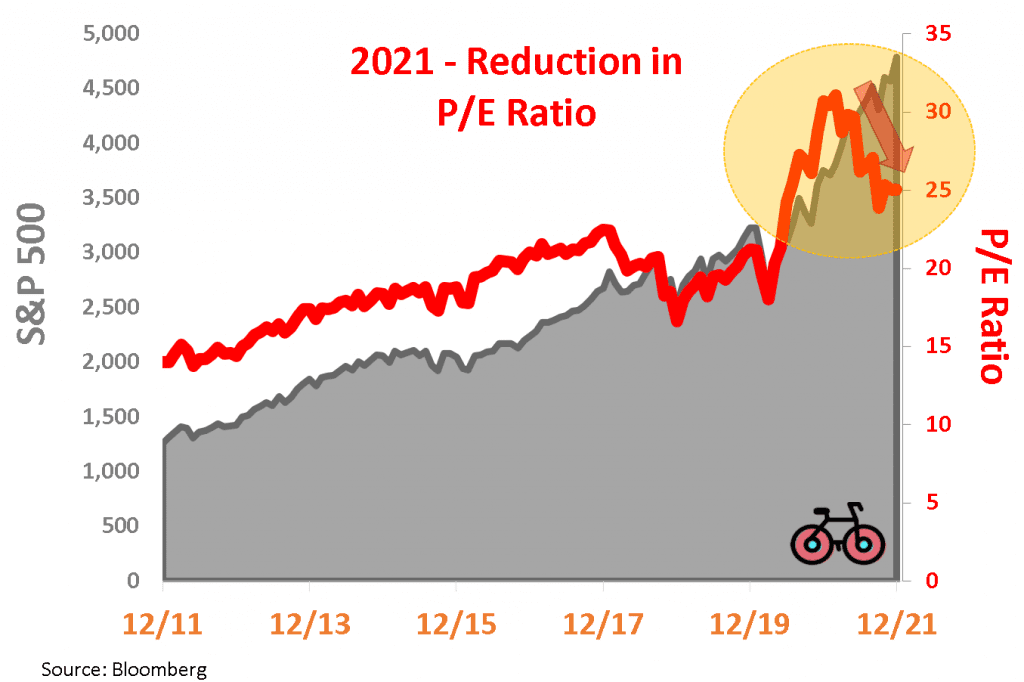

'Money Printing' didn't inflate Equities

Ask around you what drove asset prices higher in 2021. Chances are, that similarly to Real Estate, Bitcoin and other assets the answer for Stocks will be that these were directly ‘inflated’ by the Fed. Through P/E multiple expansion. Was that really the case? Well, not quite.

- P/E Ratios actually compressed. The ratio of Price/Earning for the S&P 500 fell from over 30 to around 25 on a trailing basis. The same trend applies to forward-looking earnings

- As such, assets were priced at a lower P/E ratio despite ‘Money Printing’

S&P 500 Index and Price/Earnings Ratio

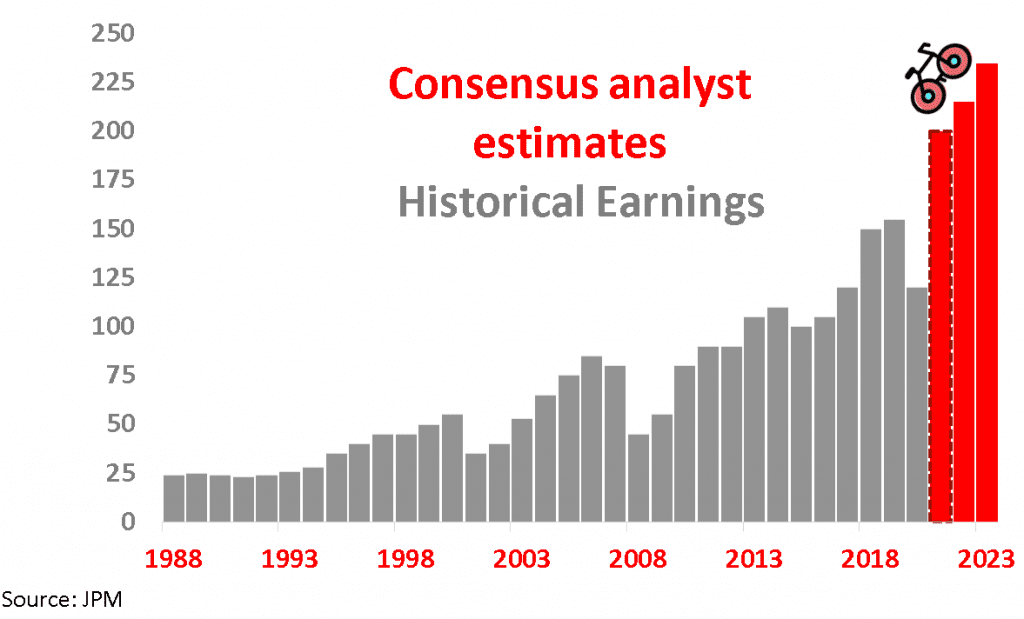

Markets rewarded Profitability

- Company Earnings weren’t really flat in 2021. Quite the contrary, they were off the charts.

- Wall Street Analysts expect earnings for 2021 to be 50-60% higher than in 2020

- By taking into account higher earnings and removing the negative effect of 10-15% compression of the P/E Ratio you can explain most of the S&P 500 performance in 2021

- That said, government policies inflated earnings growth which won’t be repeated in the near future

- You can understand why, unsurprisingly, the markets punished a number of growth companies that are unprofitable

S&P 500 Earnings per Share

Can't have a High CAPE and Eat it too

- Over the course of the pandemic, P/Es expanded 15-20% with another 25-30% coming from earnings growth explaining most of the S&P 500 rally

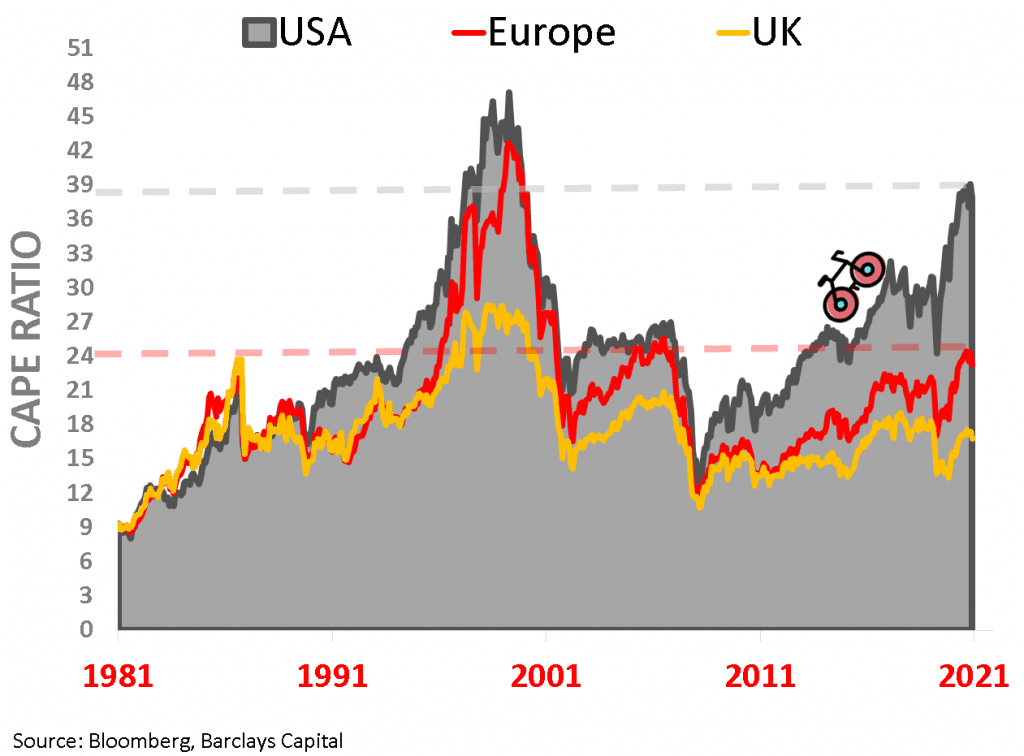

- Despite the recent fall in 1-Year P/E ratios, equity valuations are very high in America, as measured by the cyclically adjusted price-earnings (Cape) ratio, which compares share prices with inflation-adjusted average corporate earnings of the past 10 years

- The current Cape ratio is 38, a level that was only higher during the peak of the dotcom bubble of 2000

- In the Stock Market, you either have high valuations or high future returns, not both

- The CAPE ratio has not been a useful predictor of future price levels but could be an indication that future returns will be much lower

- Be cautious about comparing countries on that basis, though. Indices e.g. have very different sectorial exposure with America driven by Big Tech

Historic CAPE Ratio by Economy

Bogle's Observation for Bonds

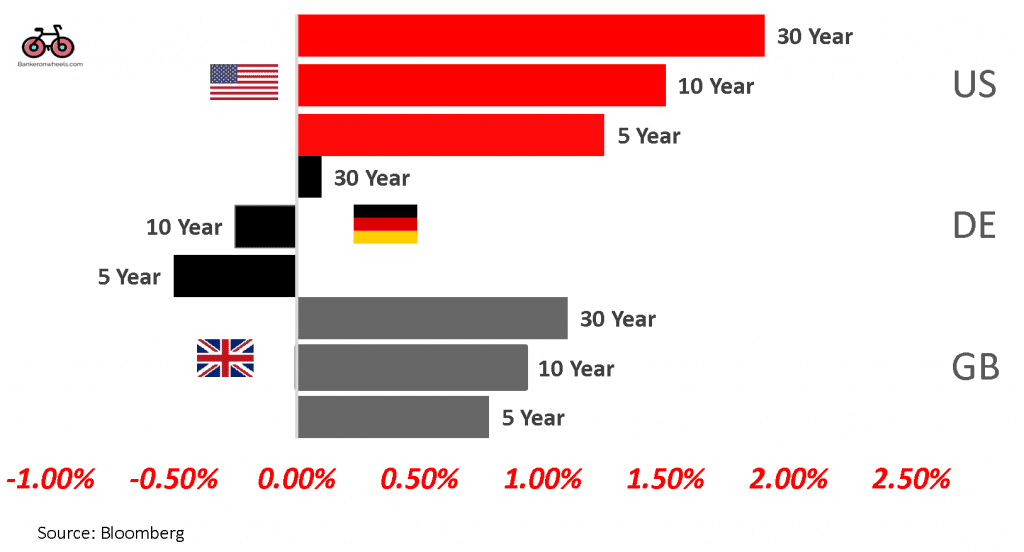

As John C. Bogle noted, since 1926, the entry yield on the 10-year Treasury explained 92% of the annualized return an investor would have earned over the subsequent decade had he or she held the bond to maturity and reinvested the coupon payments at prevailing rates.

For Europeans this means:

- If investing for 10 Years, the UK Investor can expect about 1% annual nominal return. After accounting for expected inflation the yield is -3%.

- Similarly, for the same time horizon, German Investors can expect to lose 0.3% and get a return of -2.1% after inflation.

Government Bonds' Yields (before Inflation)

Potential upsides

Are further price gains on Bonds possible that can be harvested during a market crash by rebalancing?

There are unlikely but possible. Should there be another exogenous shock it’s not unreasonable to expect rates to go even lower (in which case Bond ETF prices may rally).

It is also a hedge against future deflationary recessions. While this may sound unreasonable in this market, this is the broader trend.

Learn more about how Bond ETFs can lose value or rally using the Bond ETF Calculator.

HOW TO INVEST IN 2022 (AND BEYOND)

Overvaluations were driven by 'Investor Psychology'

One of our diligent readers, Roberto pointed out the over-valuation of US Markets.

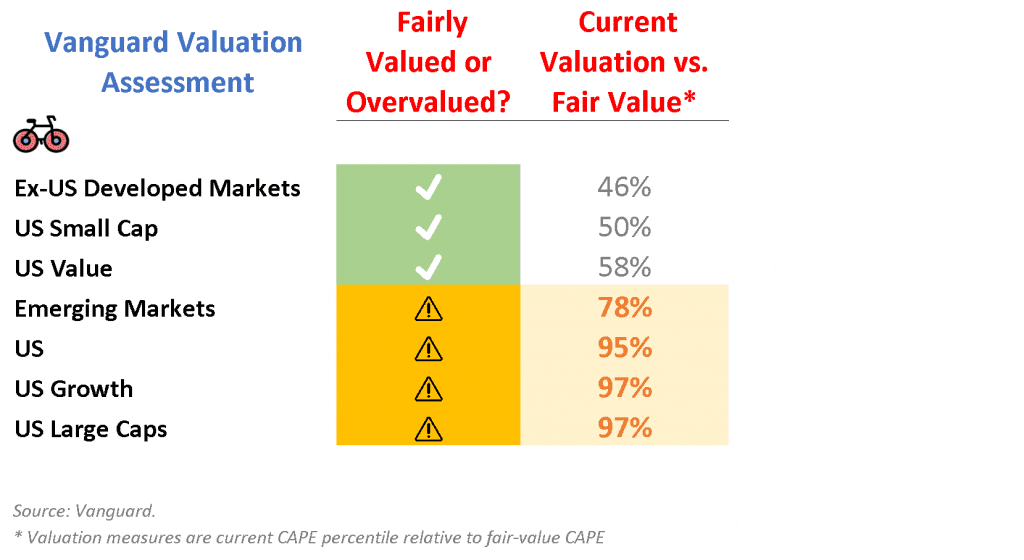

Vanguard’s Model uses the same Bogle Equation comprising (i) Dividend yield (ii) P/E Ratio aka Valuation Multiple and (iii) Earnings growth to predict future 10-year Market Returns.

According to their simulations Investor behaviour (P/E ratio) is to ‘blame’ for US Equities being largely outside of the expected ranges over the last decade (in the table above the expected range is 25%-75%).

Vanguard predicted an average c. 9% 10-year return for US Stocks against the current 10-year performance of 16.8%.

Emerging Markets are on the cusp of that range.

Setting The Right Expectations

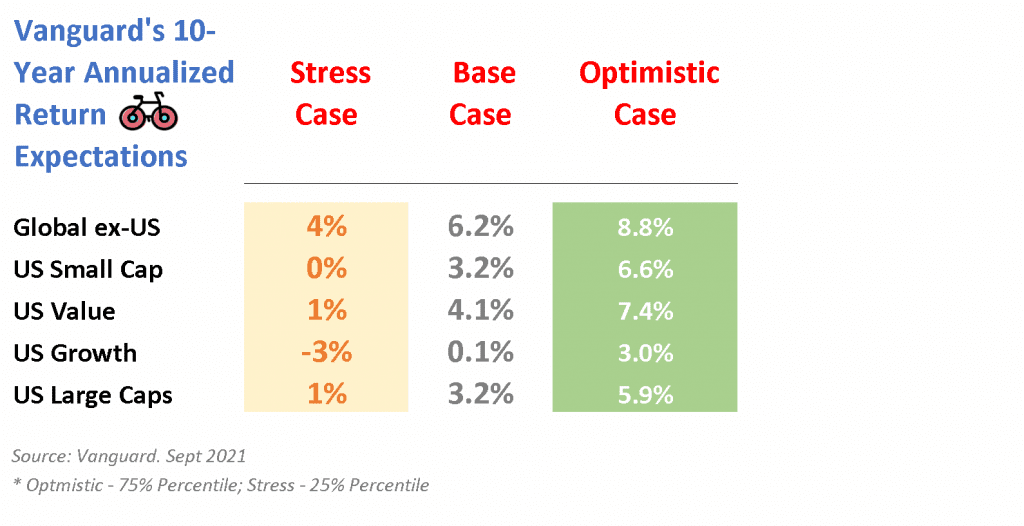

Vanguard's 10-year Return Projections (before Inflation)

Over the next 10 years, ex-US Equities are expected to outperform the US by c. 3% annually, according to the same model:

- The strongest assumption is the relative P/E compression (1.5% annually over the next 10 years).

- European or Japanese Stocks that are more Value-oriented are expected to maintain a higher dividend yield of 3% (explaining another 1.5% difference in return vs. the US).

A ‘long-awaited’ growth to value rotation is also implied by Vanguard with US Value Stocks generating 4.1% return while US Growth Stocks are expected to be flat over the next decade.

CONCLUSIONS

While you can’t control market returns you may still think of small adjustments:

- A more practical take-away from Vanguard’s analysis would be to keep your lazy World ETF and perhaps remove that Nasdaq bet that you may have (and worked so well during the pandemic!)

- An ex-US cyclist portfolio adjustment could be implemented. But we may also be assisting to a (P/E) regime shift with low interest rates despite higher inflation justifying paying a higher price for long-dated cash flows from Big Tech

In a low return environment controlling what you can is even more important:

- Adjust your expectations

- Set the right risk in your portfolio

- Implement ways to benefit from the next market crash

- Control fees

- Optimize your portfolio for a tax perspective to squeeze out higher returns

- Most importantly, stick to your strategy

Thank you for reading. I wish you a Happy New Year and a great start to 2022,

Raph

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

APPENDIX

Equities

- S&P 500 and NASDAQ need no introduction and are cornerstone of most portfolios

- Dividend Stocks are favored by some investors but can be less diversified and tilted towards certain sectors / styles (e.g. value)

- Developed Markets ex-US are important part of the Global Stock Market and include Japan, Europe or Australia

- Emerging Markets is a volatile asset class but usually held for diversification and optionality should there was a shift of capital in global Economy towards these countries

Bonds

- Long Term Treasuries provided the best downside protection in recessions

- Bonds are Aggregate Funds for those seeking low volatility and some income

- Corporates are high quality US corporate bonds (Investment Grade Rating) that are primarily held for income. LQD ETF was used here and was the #1 ETF bought by the FED in 2020

- Inflation Linked Bonds are US Government issued Bonds that are adjusted for Inflation

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – JP Morgan Guide To Retirement

Surviving The Next Bear – Strategies To Profit From The Next Market Crash

Weekend Reading – Asset Class Returns since 1970 & Trend Following Strategies

Cracking the Code: Decoding ETF Names & Discovering Tools To Find Them

Broker Review Methodology

iWeb Share Dealing Review – Great For Inactive Investors

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🎁 Taking advantage of our affiliate links when setting up a broker account. This doesn’t increase your costs, and we often secure exclusive bonuses for our audience.

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.