ESG Ratings Uncovered – What Wall Street Doesn’t Want You To Know

THE DEFINITIVE GUIDE TO SUSTAINABLE INVESTING - PART 2

This article is part of Bankeronwheels.com definitive guide to Sustainable Investing.

We spent a few months trying to understand what was going on behind the scenes. In this series, we decode how the ESG Industry tricked investors into believing they invest in Greener Companies. Greenwashing by companies, you may think? No, there is a more fundamental issue. ESG Ratings are almost the exact opposite of what you think they are.

KEY TAKEAWAYS

- Financially material ESG ratings impact the vast majority of ESG Equity ETFs.

- But these ESG ratings are NOT about protecting the planet.

- ESG ratings are about protecting the companies’ profits and enterprise value.

- For example, protecting companies’ Real Estate from Environmental risks like floods or hurricanes has a high impact on their ESG ratings.

- Failing to protect communities and biodiversity or releasing toxins that are not subject to regulations or fines may not negatively impact ESG ratings.

- A company that harms the Environment but is financially protected against it, for example, by taking insurance, may still have high ESG Ratings.

Here is the full analysis

Be alarmed when Unregulated Rating Companies Assign ESG Ratings

There is one and only one social responsibility of a business—to use its resources and engage in activities designed to increase its profits.

This unpopular today view from Milton Friedman - who won the 1976 Nobel Prize in Economics - has surprisingly a lot in common with how a company can obtain a high ESG Rating

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

HOW TO TRICK MILLEnNIALS

Millennials want to invest ethically

A new trend emerged after the Global Financial Crisis. Millennials wanted to invest ethically. You see, Ethical investing isn’t something new. For example, Judaism prevented followers from investing in immoral companies, and Islam – alcohol or pork products. It used to be a niche sector. Less than half of the broader population was interested in Sustainable Investing. Today, over 70% of Millennials care about the planet.

Wall Street makes them think they do

With Millennials, Wall Street – akin to a chameleon – smelled opportunity and blended in. In a way to extract fees, Index and ETF Providers created a myriad of products and labels. Each new is more confusing than the last – ESG, SRI, Sustainable Investing or Green Funds. But to create dedicated investment funds, there was a need to define what goes into them. Here is where things went terribly wrong.

Trash in, Trash out

In the late 1990s and early 2000s, several NGOs were founded to define reporting of sustainable information. The incentive was to make firms disclose as many ESG metrics as possible. As you can imagine, it was messy. There was no link between data, financial outcomes and impact on the planet.

Re-focus. but not on the planet.

In the last decade, there was a first effort to clean up the mess. Harvard’s published an important paper that made the industry pivot. Instead of disclosing all ESG metrics in a disorganised way, why don’t companies disclose only material ESG issues in an organised fashion?

The Sustainability Accounting Standards Board, or SASB, was founded. Think of the effort like the standardisation of accounting (IFRS) back in the day. But now for ESG. SASB spoke to market participants to understand what matters. However, it took a few years to define norms on what is material for companies to report. But material to whom? To the Investors, of course.

But not in the way you think. The worst part? It served as the basis for ESG Ratings.

THE SHOCKING TRUTH BEHIND ESG RATINGS

You see, it took a decade to get the ball rolling. But it was somewhat of a lost decade. Because it created even more confusion. Yes – companies started disclosing ESG metrics in a more standardised way. But it had nothing to do with how most ESG-conscious investors wanted to invest. To make the matter more problematic, players like MSCI – one of the leaders in Equity Indices that ETFs track – created ESG Ratings based on these disclosures.

One Concept that no One Talks about.

Now, if you understand the concept below, you will be ahead in understanding ESG better than most investors. Including institutional investors. Wall Street came up with the concept of Financial Materiality. What does it mean, exactly?

ESG Ratings are the opposite of what you think they are

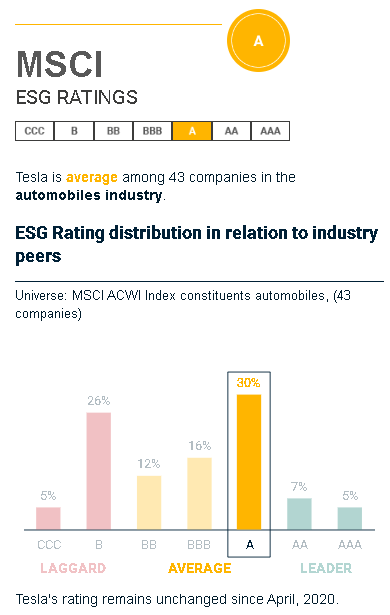

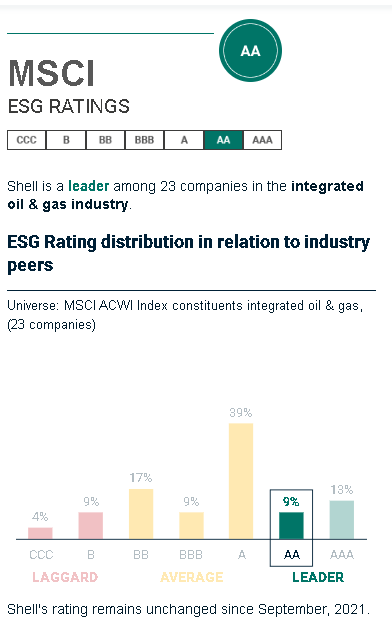

When MSCI assigns a rating, it measures a company’s resilience to financially material environmental, societal and governance risks to its profits and enterprise value. Yes, you read that right. ESG topics are only relevant to the rating if they help protect the company’s profits. For example, protecting its real estate from flood risk. For instance, Shell has a relative ‘AA’ Rating within its sector. The ‘A’ Rating makes Tesla an average player in the automobile industry. MSCI Ratings are not meant to be compared against each other, since these ratings are relative to their industry (for other providers ratings are absolute).

Our ESG ratings are NOT a general measure of corporate “goodness,” a barometer on any single issue or a synonym for sustainable investing.

Source: "What ESG Ratings are and are not" MSCI FAQ Document

Examples of ESG Ratings Assigned By MSCI

We asked - do you think ordinary investors have any idea that the entire lens of the current system is the impact of the world on the company and not the company on the world? He said - no they don't have any idea. In fact, even investment managers who are putting together these funds, don't grasp it.

Buried Bloomberg interview with MSCI's CEO Henry A. Fernandez

Leaders in Protecting Their Bottom-Lines

Shell being a leader in its industry is a fair assessment. But a leader in what exactly? MSCI1 or Morningstar’s Sustainalytics2 definitions are clear. The higher the score the better it protects its profits and enterprise value. For example, for Energy companies:

- It relates to how well companies protect their profits by avoiding fines associated to pollution regulations or safeguard their infrastructure from hurricanes

- What about the impact on the planet and society? The impact on communities or consumer health and safety won’t have a material (if any) impact on ESG Ratings

A similar reasoning applies to Car Manufacturers:

- Tesla’s ESG Rating focuses on the way it protects itself from e.g. customer health and safety litigations

- It doesn’t tell us at all about its impact on the planet to biodiversity or resource use

Yes, sometimes protecting profits incidentally also saves the planet. But as you can imagine in lots of cases, it doesn’t. And it gets even worse. Suppose an industry tends taking insurance policies against certain environmental risks it causes. In that case, these may not even be relevant to the rating because it won’t have any financial consequence for the company.

After reading this, you may not be surprised anymore to find out that an ESG ETF, like Vanguard ESG Global All Cap UCITS ETF can have a lower MSCI ESG Rating than its non-ESG version

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

ESG RATINGS ARE IRRELEVANT. WHAT IS?

Now, some ethically-minded investors may be surprised to learn that ESG funds have lower MSCI ratings than their non-ESG versions. Absurd, they may think. They are right, but you are among the rare investors to know why it’s the case. Unfortunately, today the financial materiality of ESG Ratings is absent in the whole ESG debate3, including from prominent sources.

Next time you read that ESG academic paper, pay attention. Some authors make the wrong assumptions. But what does it mean for your investments? Can you still invest ethically, and if so, at what financial cost, if any? First, let’s have a look at an intellectually robust framework of thinking about Sustainable Investing.

1 MSCI definition – MSCI ESG Ratings aim to measure a company’s resilience to long term, financially relevant ESG risks. Of the negative externalities that companies in an industry generate, which issues may turn into unanticipated costs for companies in the medium to long-term? Conversely, which ESG issues affecting an industry may turn into opportunities for companies in the medium to long term?

2 Morningstar’s Sustainalytics definition – (based on IFRS) an issue is a material within the ESG Risk Rating if its presence or absence in financial reporting is likely to influence the decisions made by an investor. To be selected as a material ESG issue (MEI) an issue must have a potentially substantial impact on the economic value of a company and, hence, the financial risk and return profile of an investor investing in the company.

3 MSCI or Morningstar’s Sustainalytics have different definitions of ratings but both assess companies based on Financial Materiality and not impact on the planet. Other rating companies may add some impact elements, but their top-line double-materiality ratings are even more problematic given data issues and the aggregations that ESG Rating providers operate. While this is not very relevant for Investors given MSCI’s market share in Equity ETFs, we discuss later in this series their nuances, correlations and the future of Sustainability-related Ratings.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

The Truth About €1 Million Broker Guarantees

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

Money Market Funds: Are ETFs The Best Bang For Your Buck Or A Risky Ride?

4 Things I Learned In 4 Years Of Running A Finance Blog

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.