What Are UCITS Equivalents Of Popular Vanguard Funds?

The Definitive Guide to Equity Index Investing - PART 7

This article is Part 7 of our definitive guide to Equity Index Investing.

While Vanguard is a relatively small Asset Manager in Europe, you can still build a 100% Vanguard Index Fund Portfolio.

And there are lots of reasons to back Vanguard, including excellent reputation and unique ownership structure with low conflicts of interest.

As a European or UK Investor, you would have to slightly adjust the way to construct a typical two, three or four Fund Portfolio using UCITS ETFs.

Here are some questions, that European and UK Investors frequently ask.

KEY TAKEAWAYS

- US Investors can invest in either Vanguard’s ETFs or Index Mutual Funds. In Europe, investing through ETFs is easier, but UK Investors can also opt for Index Mutual Funds.

- UK and German Investors can also open an account directly with Vanguard. Other European investors would need a minimum of €500,000 to access Vanguard directly.

- So, as most Europeans, you will most likely need to find a European broker that gives access to Vanguard UCITS ETFs.

- But you can still access the same funds as US Investors. Vanguard Total World Stock (VT) has an equivalent Mutual Fund for UK Investors, and a correlated UCITS ETF for Europeans. Other ETFs, including VTI, VOO, VXUS also have UCITS equivalents.

- Some European countries, like Switzerland, allow Investors to invest in Non-UCITS ETF, so an equivalent UCITS Fund may not be needed.

Here is the full analysis

How To Access Vanguard Funds Outside Of the US?

Can I open an account with Vanguard?

Most individual investors in Europe do not have the option to open a direct account with Vanguard and need to invest in Vanguard ETFs through their brokers.

However, the following types of Investors have direct access to Vanguard:

- Investors in the UK, with a minimum initial investment of £500.

- Investors in Germany, with a minimum initial investment of €5,000.

- Non-Professional Europeans that may be treated as elective professionals, usually requiring a minimum of €500,000.

Do I Need a UCITS ETF?

Most Individual Investors in Europe and the UK are bound by UCITS, a regulatory framework for investment funds in the European Union.

However, there are a couple of exceptions, when as an Investor you may directly invest in US ETFs:

- Investors from countries like Switzerland.

- Non-Professional Europeans that may be treated as elective professionals, usually requiring a minimum of €500,000.

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Vanguard Equity Funds

Vanguard Total World Stock Index Fund (VT & VTWAX)

What is UCITS equivalent of Vanguard Total World Stock Index Fund (VT ETF)?

Vanguard Total World Stock Index Fund, as ETF (VT) or Mutual Fund (VTWAX), gives you access to all Global markets:

- Developed and Emerging Markets

- Large, Mid and Small Caps

It tracks the FTSE Global All Cap Index, as illustrated below.

The closest European equivalent is the Vanguard FTSE ALL-World UCITS ETF, with accumulating share classes in GBP and EUR and distributing share classes in GBP, EUR and CHF. It tracks the FTSE All-World Index.

The FTSE All World Index excludes Small Caps, but performance is very closely correlated.

Vanguard Uses FTSE Benchmarks for its global ETFs

| INDEX | MARKET | COMPANY SIZE | |||

|---|---|---|---|---|---|

| Series | DM | EM | Large | Mid | Small |

| FTSE Global All Cap | ✓ | ✓ | ✓ | ✓ | ✓ |

| FTSE All World | ✓ | ✓ | ✓ | ✓ | |

| FTSE Developed All Cap | ✓ | ✓ | ✓ | ✓ | |

| FTSE Developed | ✓ | ✓ | ✓ | ||

| FTSE Emerging All Cap | ✓ | ✓ | ✓ | ✓ | |

| FTSE Emerging | ✓ | ✓ | ✓ | ||

In the table above, DM = Developed Markets, EM = Emerging Markets

Are there are Non-Vanguard Equivalents of Vanguard Total World Stock Index Fund (VT & VTWAX)?

Vanguard competes with other Asset Managers that provide you with similar access to all Developed and Emerging Markets. Below is what these cover. Read our guide to International Equity Markets to learn more.

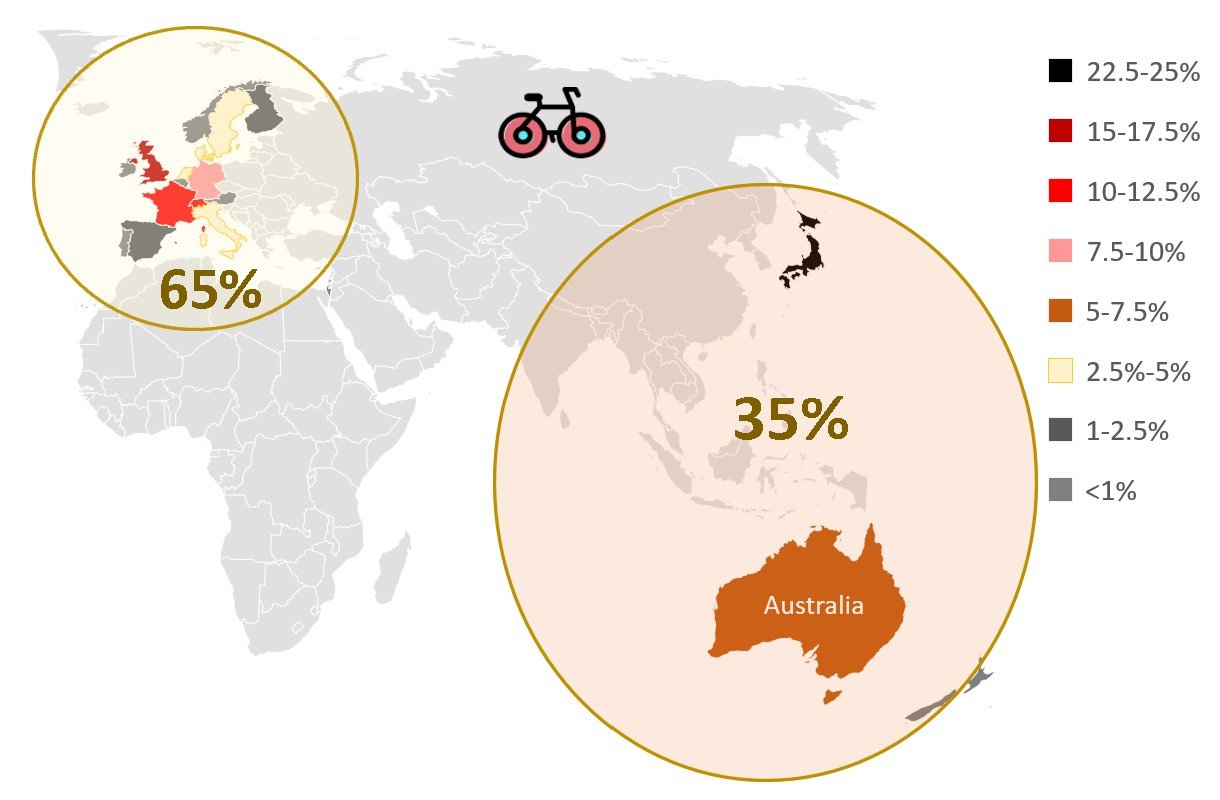

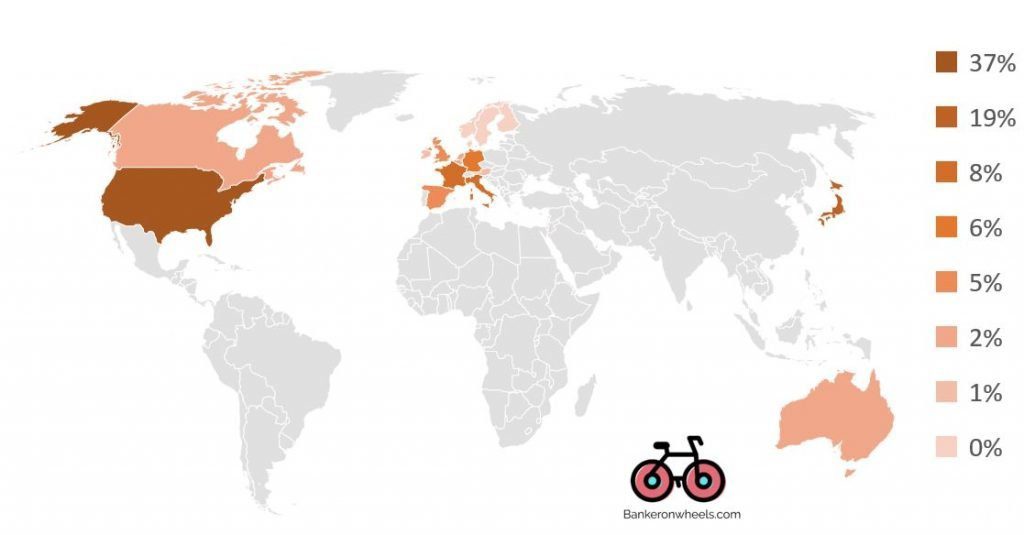

Total World STock ANIMATION - 23 Developed & 26 Emerging Markets

So, you can also pick an iShares or SPDR equivalent instead of Vanguard.

I have done an extensive comparison of the below World ETFs that give you all the convenience of investing through a single Index Fund.

Similar, Highly Correlated UCITS Funds

| Rank | Global(World) ETF | 3Y TD | TER | Acc. | Dist. | Replication | Size | Inception | Domicile | Benchmark | Acc ISIN | Dist ISIN | Rank Category |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Vanguard FTSE ALL-World UCITS ETF | 0.0% | 0.22% | ✓ | ✓ | Physical | 13.9 | 05/2012 | Ireland | FTSE All World Net Total Return Index | IE00BK5BQT80 | IE00B3RBWM25 | Large & Mid Caps |

| 2 | iShares MSCI ACWI UCITS ETF | -0.1% | 0.20% | ✓ | ✘ | Physical | 6.3 | 10/2011 | Ireland | MSCI All Country World Net Total Return Index | IE00B6R52259 | ✘ | Large & Mid Caps |

| 3 | SPDR MSCI ACWI IMI ETF UCITS ETF | 0.1% | 0.17% | ✓ | ✘ | Physical | 0.5 | 05/2011 | Ireland | MSCI ACWI IMI Net Total Return Index | IE00B3YLTY66 | ✘ | With Small Caps |

Vanguard TOtal Stock Market Index Fund (VTI & VTSAX)

What is the UCITS equivalent of Vanguard Total Stock Market Index Fund (VTI ETF)?

The Vanguard Total Stock Market Index Fund, as ETF (VTI) or Mutual Fund (VTSAX), gives access to the entire US Market – Large, Mid and Small Caps. The ETF Tracks the CRSP US Total Market Index and includes about 3,500 companies. It is a popular choice, given a larger coverage than the S&P 500, that only tracks Large Caps.

Vanguard S&P 500 Vanguard excludes Small and some Mid-Caps. However, since both indices are weighted by market size, the performance is very similar. As a European or UK Investor, you don’t necessarily need to control the allocation to US Large Caps Stocks.

A more efficient way may be to split your portfolio into Developed and Emerging Markets ETFs. You can learn more about how the ETF World is divided through my analysis of ETF Benchmarks from two leading providers – MSCI and FTSE.

VanguaRd S&p 500 ETF (VOO)

What is the UCITS equivalent of Vanguard S&P 500 (VOO & VFIAX)?

The European and UK UCITS Equivalent to VOO ETF or VFIAX Mutual Fund is Vanguard S&P 500 UCITS ETF, with accumulating share classes in GBP and EUR, and distributing share classes in GBP, EUR and CHF.

Vanguard Total International Stock Index Fund (VXUS & VGTSX)

What is the European equivalent of VXUS ETF (Vanguard Total International Stock Index Fund ETF)?

Vanguard Total International Stock Index Fund, VXUS as ETF and VGTSX as Mutual Fund, are used by American Investors that want to control exposure to all International markets ex-US.

But if you do opt for it, you will need a few ETFs:

- A couple of ETFs to get access to Developed Markets ex-North America, as explained in this guide and illustrated below.

- An ETF with exposure to Emerging Markets, like illustrated in this guide.

- An ETF with exposure to Canadian Market.

DEveloped Markets ex-North America

Vanguard Total Bond Market Index Fund (BND & VBTLX)

What is UCITS equivalent of Vanguard Total Bond Market (BND & VBTLX)?

The Vanguard Stock Bond Index Fund, BND as ETF or VBTLX as Index Fund, gives access to the US Bond Market. It is a one-stop solution to give you exposure to the entire Bond Market including Government Bonds, highly rated corporate Bonds and Mortgage Bonds.

The BND ETF Tracks the Bloomberg Barclays US Aggregate Index. Vanguard does not have a UCITS-equivalent tracker. However, BlackRock’s iShares and State Street SPDR have a direct equivalent.

Are there are Non-Vanguard Equivalents of Vanguard Total Bond Market Index Fund (BND ETF)?

- iShares US Aggregate Bond UCITS ETF, with accumulating share classes available in EUR,USD and CHF and distributing share classes in EUR,USD and GBP.

- SPDR Bloomberg US Aggregate Bond UCITS ETF, with distributing share classes in EUR and USD.

Are there are Vanguard's Bond ETFs designed for European and UK Investors?

The UCITS diverified Bond Fund is Vanguard Global Aggregate Bond UCITS ETF with accumulating share classes in GBP and EUR, and distributing classes is GBP and EUR.

This ETF tracks the Bloomberg Barclays Global Aggregate Bond Index.

As a European or UK Investor, you want access to High Quality Bonds available in your currency.

Developed BOnd Markets

That’s why tracking a Global Aggregate Benchmark hedged to your currency is the best practice when building your portfolio.

Alternatively, you can also invest in your local Government/High Quality corporates, but this provides lower diversification while not necessarily higher returns. If you want to learn more about the different Bond ETFs and how to make it fit into your portfolio, have a look at my analysisrelated to International Bond ETFs

Vanguard FUND OF Funds

Vanguard Lifestrategy FUnds

What are UCITS equivalents of Vanguard Lifestrategy Funds?

Should you want to choose the efficient and simple way without splitting your portfolio into multiple ETFs, Vanguard Lifestrategy Funds are a great choice. It combines exposure to all global equity markets and bonds.

These products are structured as funds-of-fund. In a nutshell, it is a one ETF solution to gives you exposure to both Equities and Bonds.

The LifeStrategy Funds differ by the asset allocation and risk profile.

The European and UK Equivalents are Vanguard LifeStrategy UCITS ETFs. The Equity proportion varies from 20% to 80% and the ETFs are either accumulating or distributing. Note that in the UK these are structured as mutual Index Funds and have some biases, while the European ETFs maintain market allocations.

If you want to learn more about the Lifestrategy range, I have included a dedicated section on them.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Cost comparison

US Funds have Lower explicit costs

For the most liquid asset classes (S&P 500) differences are minimal, while Bonds may have larger discrepancies (difference of 0.22%).

Even if you do have access to US Funds, Taxes are another consideration that, depending on your situation, may outweigh expense ratios. Here is why.

Fund Total Expense ratio comparison

| ETF Tickers | Asset Class | Coverage | US TER | UCITS TER |

|---|---|---|---|---|

| VT/VWCE | Equities | Global | 0.05% | 0.22% |

| VOO/VUSA | Equities | S&P 500 | 0.03% | 0.07% |

| BND/SUAG | Bonds | US Bonds | 0.03% | 0.25% |

| VASGX/V80A | Fund of Funds | Equities & Bonds | 0.14% | 0.25% |

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Broker Safety: Should You Rely On Broker Insurance?

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

Money Market Funds: Are ETFs The Best Bang For Your Buck Or A Risky Ride?

4 Things I Learned In 4 Years Of Running A Finance Blog

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.