Weekend Reading – Vanguard: Invest now or temporarily hold your cash?

Many investors hold too much cash as a result of indefinitely deferring the decision about how and when to invest. Whether this cash-hoarding is a result of indecision, risk aversion, or simply disengagement, we know that over long time horizons, investors will achieve superior outcomes by being fully invested according to their prescribed asset allocation"

Vanguard Research

HOW IT WORKS

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist.

- Recommeded Reading

- Youtube (Required watch time)

- Podcast (Listening Time)

- Academic Research - May require intermediate/advanced knowledge

- Noteworthy Twitter Thread

INVEST WISELY

This section is dedicated to research on how to invest for the Long Run using Passive Investment Strategies. Read Topics related to (i) Portfolio Construction and

CONSTRUCT YOUR PORTFOLIO

For someone who is unfamiliar with ETF benchmarks and criteria, selecting an ETF has become a headache. Comparison websites generally list thousands of ETFs. Here is where we step in. Investing should be simple. While we may have a marginal preference for some ETFs, we list suitable alternatives to account for investors’ tax situations, and preferences. Let’s dive into the Best Equity ETFs.

The Wrong Arguments Against International Diversification (11 Minutes - Ben Felix)

International stocks have trailed US stocks for more than 100 years. Performance aside, the US market is well diversified across industries, makes up more than 50% of the global stock market, and lots of US companies have international revenue exposure. Additionally, international diversification has gotten less effective over time as correlations across markets have increased.

HOW TO INVEST

- Statistically Speaking, You Are The Patsy (Neckar)

- What Does the Demise of SVB Tell Us About Our Behaviour During Market Shocks? (Behavioural Investment)

- Staying Invested - It's easier said than done (Spilled Coffee)

- Why You Always Sell Your Stocks at the Bottom (and How to Stop) (Darius Foroux)

- investing is not only about the rate of return but also about what you are investing for and why. (Rational Reminder - 1 hr 7 min)

With inflation returning after being dormant for decades, many investors have had a renewed interest in adding inflation fighting assets to their portfolios. But figuring out how to do that can be challenging. In this episode, VanEck’s Head of Quantitative Solutions Dave Schassler gives insights about how to attack the problem.

UNDERSTAND FINANCIAL MARKETS

- Uncertain but navigable conditions (Vanguard)

- How to explain to your kid what a bank run is? (Finance Nerd)

- Does The Wisdom of Crowds Mean Equity Markets Are Efficient? (Behavioural Investment)

- What the UK budget means for the economy & investors? (Pension Craft)

- What are CoCos and why are Credit Suisse's now worth zero? (Morningstar)

- How many banks are in danger? (The Grumpy Economist)

Whenever a major financial institution collapses and needs a bailout, it’s easy to say, “Where were the regulators?” But that’s only a useful question if you can pinpoint the specific regulatory choices that led to any particular situation. So what caused Silicon Valley Bank to implode?

This section relates to improving your knowledge about active investing. If you decide to sin, then sin only a little. Given ample evidence, combined active bets should be ideally a relatively small fraction of your portfolio. This section also includes Sustainable Investing. You can invest in a Socially Responsible way, but there are many ESG traps. Learn how to invest sustainably, and what it means for expected returns, with our definitive guide to sustainable investing.

FACTOR & Thematic investing

- In conversation with Dr Maria Vassalou on the small cap effect (Bloomberg)

- Trend following: The proof is in the track record (RCM Alternatives - 1 hr)

- Bonfire of the CTAs (FT.com - click on the first link)

- What to Look for in Actively-Managed Bond Funds Right Now (Morningstar)

- Are defined outcome ETFs worth it? (Italian Leather Sofa)

- Merger Arbitrage - Do risky deals pay? (Verdad)

Bloomberg Radio host Barry Ritholtz speaks with Cliff Asness, who cofounded AQR Capital Management — which has $100 billion in assets under management — and serves as its chief investment officer.

STOCKS

SUSTAINABLE investing

ALTERNATIVE ASSET CLASSES

FROM WALL STREET

crypto & blockchain

REMINDERS TO PUNT RESPONSIBLY

In the Book review section we rate some of the most relevant resources related to Financial Independence, Personal Finance and Investing. Browse All Book and Video Reviews.

The 2023 Netflix docuseries Madoff: The Monster of Wall Street dives into the largest Ponzi scheme in history, worth $64.8 billion.

Although the Madoff madness stopped in late 2008, today’s investors still fall for the very same tricks.

What exactly can we learn from this series?

Let’s have a closer look.

PERSONAL FINANCE

This section is dedicated to UK and European Products. It can also touch on other European jurisdictions outside the Euro-zone.

FINANCIAL PRODUCTS

COST OF LIVING

Question of the week

DESIGN YOUR LIFESTYLE

This section is dedicated to the ‘Why’ of Investing, trends or career choices.

LIFESTYLE

- 6 simple stoic lessons to feel more peace (The daily stoic - 8 min)

- FI Frugal Hobbies (ChooseFi - 1 hr 24 min)

- How to make better decisions (Good Life Project - 54 min)

- Why “Everyone Has the Same 24 Hours” Is Not a Good Way to Think About Time Management (GQ)

- There’s a reason some of us find it easier to change than others (Psyche)

- New Neuroscience Reveals 6 Secrets That Will Increase Your Attention Span (Barking Up The Wrong Tree)

There are only a handful of financial rules, ideas, and observations that really move the needle — and explain the majority of what you need to know to do better with your money. Here are Morgan Housel’s top 30 rules of the money game.

EARLY RETIREMENT

CAREERS

TECH & ECONOMY

Travel

miscellaneous

- What YouTube hustle gurus are really selling you (VOX)

- Currency & The Collapse of The Roman Empire (Visual Capitalist)

- How did a reclusive electrician living in a modest bungalow amass the largest unclaimed estate in American history? (Chicago)

- A Brief History of Time is ‘wrong’, Stephen Hawking told collaborator (Guardian)

- Tokyo citizens hand in record ¥3.99bn of lost cash (Guardian)

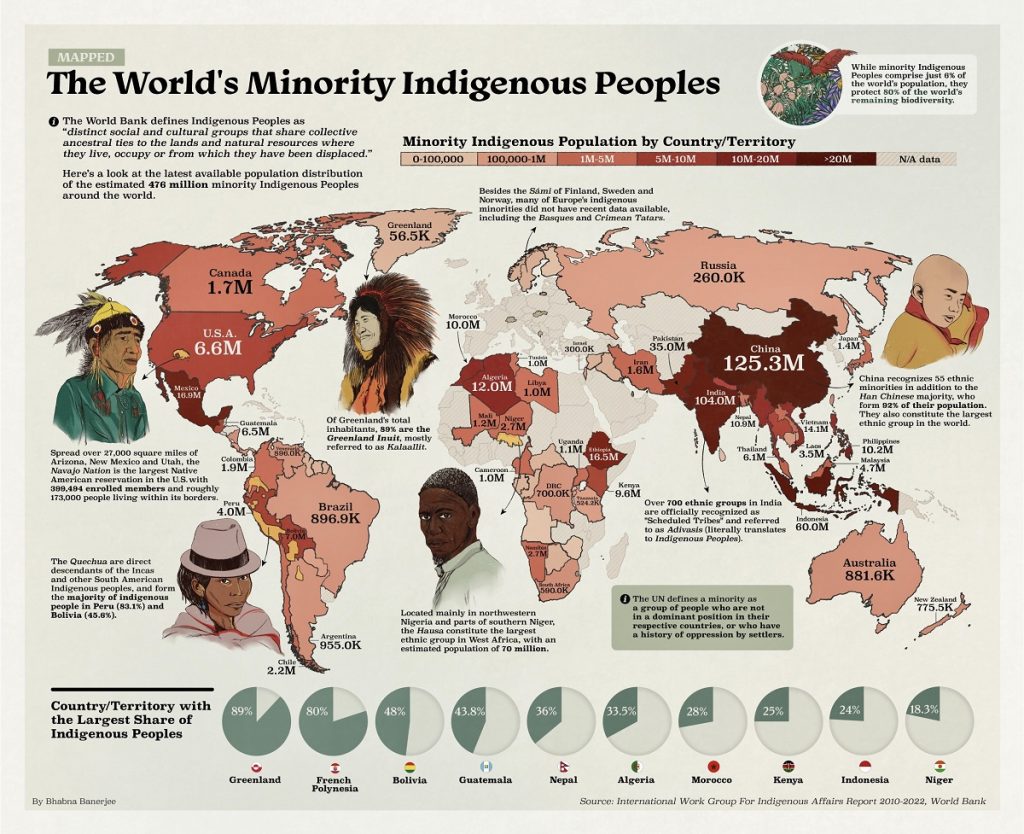

“Research by the UN’s International Labour Organization found that, while minority Indigenous peoples make up only 6% of the world’s total population, they account for nearly 20% of the world’s extreme poor. In addition, Indigenous peoples also have much lower average life expectancies than non-Indigenous people, according to a report by the United Nations. Some countries and governments around the world are starting to implement laws and policies to support and recognize Indigenous communities, but there’s still work to be done”. Read more on VisualCapitalist.com

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – JP Morgan Guide To Retirement

Surviving The Next Bear – Strategies To Profit From The Next Market Crash

Weekend Reading – Asset Class Returns since 1970 & Trend Following Strategies

Cracking the Code: Decoding ETF Names & Discovering Tools To Find Them

Broker Review Methodology

iWeb Share Dealing Review – Great For Inactive Investors

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🎁 Taking advantage of our affiliate links when setting up a broker account. This doesn’t increase your costs, and we often secure exclusive bonuses for our audience.

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.