Weekend Reading – Vanguard’s Guide to Wellness & Sound Ways to invest Sustainably

Weekend Reading is a periodic collection of Investment Research and Lifestyle topics from all corners of the Web.

We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process.

Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance.

As usual, everything is to be used at your own risk.

TYPE OF CONTENT

- Recommended Reading

- Youtube

- Podcast

- Academic Research

- Twitter Thread

This Week's Quote

You don't have to be brilliant, only a little bit wiser than the other guys, on average, for a long, long time

Charlie Munger

INVEST WISELY

This section is dedicated to research on how to invest for the Long Run using Passive Investment Strategies. Read Topics related to (i) Portfolio Construction and Asset Allocation (ii) Acting wisely by avoiding behavioural traps and also (iii) publications that help understand how financial markets work.

CONSTRUCT YOUR PORTFOLIO

- Should You be 100% in Stocks? (A Wealth of Common Sense)

- The Ultimate Checklist for what goes in your portfolio and what doesn't (Pension Craft)

- Balanced portfolios will continue to prove the naysayers wrong (Vanguard)

- Questioning the illiquidity premium (Fiduciary Wealth Partners)

- Personal identity matters more than an established (Yale) model (Institutional Investor)

HOW TO INVEST

- Does your personality impact your investment decision making? (Joachim Klement)

- Losses in the markets are inevitable plus 4 other lessons (A Wealth of Common Sense)

- Avoiding FOMO could be the best investing trait to have (Collab Fund)

- Should you listen to outperforming fund managers? (Behavioural Investment)

- In conversation with a guy who Sues Financial Advisors for a living (Rational Reminder - 1 hr 10 min)

UNDERSTAND FINANCIAL MARKETS

Prof. Robert C. Merton: ICAPM, Retirement, and Models in Finance (Rational Reminder - 2 hrs)

Professor Robert C. Merton is the Distinguished Professor of Finance at The Massachusetts Institute of Technology (MIT) Sloan School of Management and Professor Emeritus at Harvard University. He also created the Intertemporal Capital Asset Pricing Model (ICAPM), a popular tool to help advisors make informed financial decisions and understand market trends. In the conversation, RR covers portfolio theory, moving from Capital Asset Pricing Model (CAPM) to the Intertemporal Capital Asset Pricing Model (ICAPM), and how financial models work.

This section relates to improving your knowledge about active investing. If you decide to sin, then sin only a little. Given ample evidence, combined active bets should be ideally a relatively small fraction of your portfolio.

FACTOR & Thematic investing

STOCKS

A data-driven approach to picking growth stocks and thematic baskets (Flirting With Models - 14 Min )

It’s no secret that high flying growth stocks were hammered in 2022, so here is a revisit of a conversation with Jason Thomson.

Jason is a portfolio manager at O’Neil Global Advisors, where he manages highly concentrated portfolios of growth stocks.

SUSTAINABLE investing

This section is about Sustainable Investing. You can invest in a Socially Responsible way but there are many ESG traps. Learn how to invest sustainably, and what it means for expected returns, with the our definitve guide to sustainable investing.

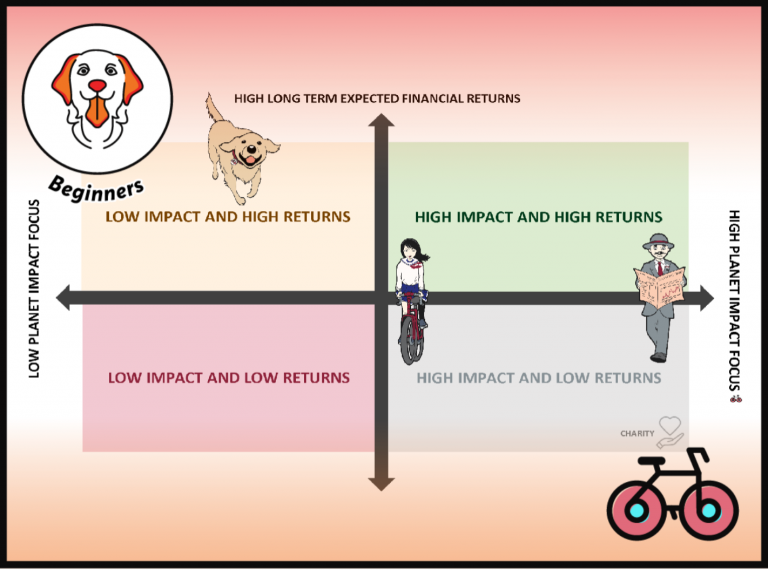

There are at least three proven sustainable investing strategies.

To keep it simple, you may hold a non-screened portfolio and, use the incremental profits for philanthropy.

If you want to avoid investing in certain types of industries, e.g. Tobacco companies, you may select cost-efficient and well-diversified SRI Funds. The most active sustainable strategy is Impact Investing.

ALTERNATIVE ASSET CLASSES

FROM WALL STREET

crypto & blockchain

- The Sad Tale of a Crypto Lender Who Promised Safety & High Returns (Coppola Comment)

- What Does The Genesis bankruptcy mean for GBTC? (ETF.com)

- The Price of Bitcoin - fairly, under or over valued? (Fortunes & Frictions)

- In conversation with Ram Ahulwalia on the Greyscale Bitcoin Trust (Bloomberg - 37 min)

REMINDERS TO PUNT RESPONSIBLY

In the Book review section we rate some of the most relevant resources related to Financial Independence, Personal Finance and Investing. Browse All Book and Video Reviews.

The 2023 Netflix docuseries Madoff: The Monster of Wall Street dives into the largest Ponzi scheme in history, worth $64.8 billion.

Although the Madoff madness stopped in late 2008, today’s investors still fall for the very same tricks.

What exactly can we learn from this series?

Let’s have a closer look.

PERSONAL FINANCE

This section is dedicated to UK and European Products. It can also touch on other European jurisdictions outside the Euro-zone.

FINANCIAL PRODUCTS

COST OF LIVING

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

DESIGN YOUR LIFESTYLE

This section is dedicated to the ‘Why’ of Investing, trends or career choices.

LIFESTYLE

- Vanguard's guide to designing your life for financial wellness (Vanguard)

- Financial Planning at an early age is all about building habits (Oblivious Investor)

- On Balance (Italian Leather Sofa)

- How to Make Small Life Changes That Develop Into Atomic Habits (Entrepreneur)

- In conversation with Adam Grant on the Perfectionism & Procastination (In conversation with Adam Grant on the Perfectionism & Procastination - 1 hr 8 min)

In conversation with Dr. Matthew Walker on sleep (The Tim Ferris Show - 3 hr 10 min)

EARLY RETIREMENT

How Much You Can Spend In Retirement (Bogleheads - 34 Min)

Christine Benz answers the question, “how much can I spend in retirement?”

CAREERS

TECH & ECONOMY

James Clear, Atomic Habits — Mastering Habits, Growing an Email List to 2M+ People (2hrs)

James Clear (@JamesClear) is a writer and speaker focused on habits and continuous improvement. He is the author of the #1 New York Times bestseller Atomic Habits, which covers easy and proven ways to build good habits and break bad ones.

miscellaneous

NEW! SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Surviving The Next Bear – Strategies To Profit From The Next Market Crash

Weekend Reading – Asset Class Returns since 1970 & Trend Following Strategies

Cracking the Code: Decoding ETF Names & Discovering Tools To Find Them

Broker Review Methodology

iWeb Share Dealing Review – Great For Inactive Investors

AJBell Review – Leading Broker & Low-Fee SIPP Provider

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🎁 Taking advantage of our affiliate links when setting up a broker account. This doesn’t increase your costs, and we often secure exclusive bonuses for our audience.

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.