Weekend Reading – Visualising 90 years of stock & bond performance

Men, it has been well said, think in herds. It will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.”

Charles Mackay

HOW IT WORKS

- Recommeded Reading

- Youtube (Required watch time)

- Podcast (Listening Time)

- Academic Research - May require intermediate/advanced knowledge

- Noteworthy Twitter Thread

INVEST WISELY

This section is dedicated to research on how to invest for the Long Run using Passive Investment Strategies. Read Topics related to (i) Portfolio Construction and Asset Allocation (ii) Acting wisely by avoiding behavioural traps and also (iii) publications that help understand how financial markets work.

CONSTRUCT YOUR PORTFOLIO

Over the past 50 years, the US Market outperformed the Rest of the World by 1% annually. But all of it came in the last 8 years. Compared to the S&P 500, a more diversified Global Portfolio has lower volatility and increases the likelihood of financing your projects. Look beyond Global Markets’ correlations, which don’t capture the magnitude of returns.

- On Retirement Planning - The 4% rule vs Monte Carlo (Bogleheads Live - 38 min)

- 4 bond strategies that matter (Vanguard)

- Why Do Equally Weighted Portfolios Beat Value-Weighted Ones? (Journal of Portfolio Management)

- Tax-efficient investing in the UK (Monevator)

- Does time in the market beat market timing? (Ben Felix)

- Is Leverage Too Expensive Right Now? (Italian Leather Sofa)

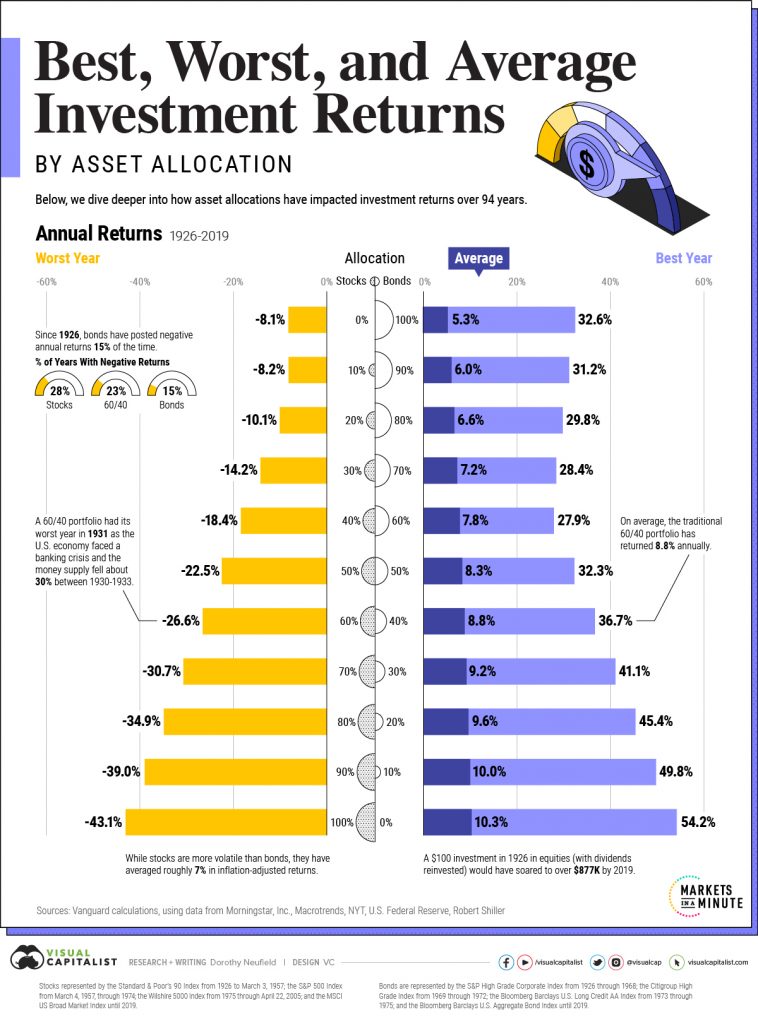

“Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard. We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

Read more on VisualCapitalist.com

HOW TO INVEST

- Advice for Anxious Investors- Control What You Can (Vanguard - 3 min)

- In conversation with Dr Daniel Crosby on the behavioural investor (Bogleheads on Investing - 57 min)

- Risk less at age 104 (Advisor Perspectives)

- Controlling your behavior amid uncertainty can be hard enough (Collab Fund)

- 100 years of data really only tells us one thing about stock market volatility: it is persistent (Fortunes & Frictions)

- Why Investment Complexity Is Not Your Friend (Morningstar)

UNDERSTAND FINANCIAL MARKETS

- Vanguard's investment and economic outlook, March 2023 (Vanguard)

- How can two index trackers generate different returns? (The Evidence Based Investor)

- A deep dive into custom and direct indexing (Excess Returns - 49 min)

- Tech Investing & How SVB Failed Banking 101 (Bloomberg - 41 min)

- In conversation with Morgan Stanley's Mike Wilson on the earnings recession in the S&P 500 (Meb Faber - 47 min)

- Understanding the Banking panic of 2023 (Three Minute Macro - 4 min)

- It’s been rough getting here, but the future looks brighter for bonds. (Morningstar)

- Debunking the Myth of Market Efficiency (CFA Institute)

- On expected returns with Anttii IImanen (CFA Society Chicago - 51 min)

This section relates to improving your knowledge about active investing. If you decide to sin, then sin only a little. Given ample evidence, combined active bets should be ideally a relatively small fraction of your portfolio. This section also includes Sustainable Investing. You can invest in a Socially Responsible way, but there are many ESG traps. Learn how to invest sustainably, and what it means for expected returns, with our definitive guide to sustainable investing.

FACTOR & Thematic investing

This episode is with Jeremy Schwartz, Global Chief Investment Officer at WisdomTree. Prior to joining WisdomTree in 2005, Jeremy was a head research assistant for Professor Jeremy Siegel and, in 2022, became Professor Siegel’s co-author on the sixth edition of the book Stocks for the Long Run. Listen now and learn: Why you should want to own stocks right now, How to manage cash in the current yield environment.

STOCKS

SUSTAINABLE investing

ALTERNATIVE ASSET CLASSES

FROM WALL STREET

crypto & blockchain

REMINDERS TO PUNT RESPONSIBLY

In the Book review section we rate some of the most relevant resources related to Financial Independence, Personal Finance and Investing. Browse All Book and Video Reviews.

The 2023 Netflix docuseries Madoff: The Monster of Wall Street dives into the largest Ponzi scheme in history, worth $64.8 billion.

Although the Madoff madness stopped in late 2008, today’s investors still fall for the very same tricks.

What exactly can we learn from this series?

Let’s have a closer look.

PERSONAL FINANCE

This section is dedicated to UK and European Products. It can also touch on other European jurisdictions outside the Euro-zone.

FINANCIAL PRODUCTS

COST OF LIVING

Question of the week

DESIGN YOUR LIFESTYLE

This section is dedicated to the ‘Why’ of Investing, trends or career choices.

LIFESTYLE

- Status games: Absurd or necessary? (Rad Reads)

- How to build generational wealth (Of Dollars and Data)

- You Don't Need to Do a Cleanse Diet (GQ)

- The Digestive Power of an After-Dinner Walk (Art of Manliness)

- How Loneliness Reshapes the Brain (Qaunta)

- How relationships impact long-term health and long-term wealth (On Money & Meaning)

- In conversation with Dominique Mielle on Luck & Resilience in Finance (Bloomberg - 1 hr 10 min)

- How to better understand the past & passing on the need to impress (The daily stoic - 9 min)

- Rather than feel defeated, allow the setbacks to act as momentum to charge ahead (ChooseFi - 53 min)

David Deutsch is a visiting professor of physics at the Centre for Quantum Computation, a part of the Clarendon Laboratory at Oxford University. Naval Ravikant is the co-founder Airchat of and Angelist. He has invested in more than 100 companies, including many mega-successes, such as Twitter, Uber, Notion, Opendoor, Postmates, and Wish.

EARLY RETIREMENT

- Ministers reportedly scrap plan to bring forward rise in UK state pension age (Guardian)

- Less than a tenth of retired over-50s would be tempted to return by Hunt's Budget pension giveaway (This is money)

- Why retirees still require rainy day funds (Investment News)

- Retirement forces you into decisions you've never taken before (Humble Dollar)

- In conversation with Brad Barrett on FI, Safe Withdrawal Rates, Travel Tips & Hacks (Morningstar - 56 min)

Goal-setting is essential for personal and professional growth, helping individuals clarify their priorities, stay focused, and achieve success. Samantha Lamas and Danielle Labotka help us unpack the topic of goal-setting and how it relates to finance. Samantha Lamas is a Senior Behavioural Researcher at Morningstar and a recipient of the Montgomery-Warschauer Award for her research in financial planning.

CAREERS

TECH & ECONOMY

Sam Altman on GPT 4 & the future of AI (2 hr 23 Minutes - Lex Fridman Podcast)

Sam Altman is the CEO of OpenAI, the company behind GPT-4, ChatGPT, DALL-E, Codex, and many other state-of-the-art AI technologies.

Some of the topics include:

GPT-4, Political bias, AI safety, Neural network size, AGI,Elon Musk

Travel

miscellaneous

- What YouTube hustle gurus are really selling you (VOX)

- Currency & The Collapse of The Roman Empire (Visual Capitalist)

- How did a reclusive electrician living in a modest bungalow amass the largest unclaimed estate in American history? (Chicago)

- A Brief History of Time is ‘wrong’, Stephen Hawking told collaborator (Guardian)

- Tokyo citizens hand in record ¥3.99bn of lost cash (Guardian)

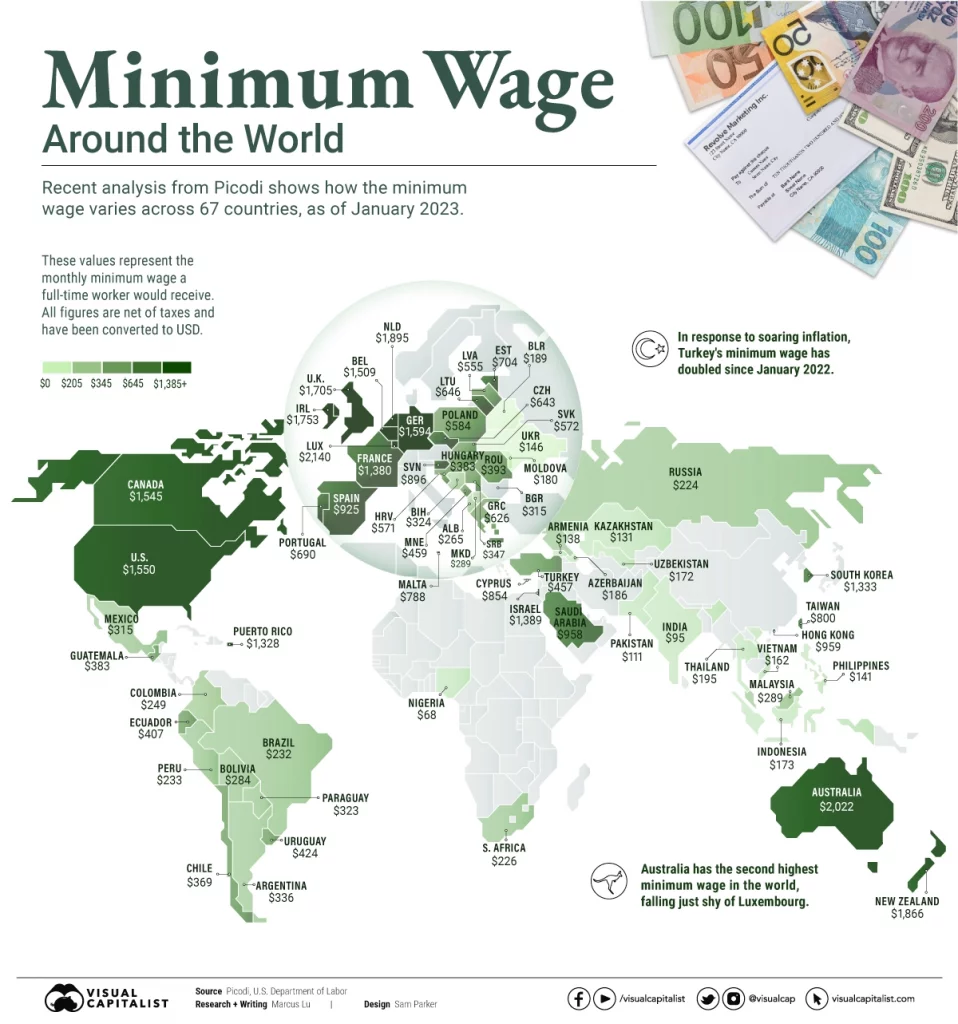

“The purpose of a minimum wage is to establish a baseline income level for workers in a given jurisdiction. Ideally it’s enough to cover basic needs like food and housing, but this isn’t always a guarantee. Generally speaking, developed countries have a higher cost of living, and thus require a higher minimum wage. Two outliers in this dataset are Argentina and Turkey, which have increased their minimum wages by 100% or more from January 2022 levels. Turkey is suffering from an ongoing currency crisis, with the lira losing over 40% of its value in 2021. Prices of basic goods have increased considerably as the Turkish lira continues to plummet.“

Read more on VisualCapitalist.com

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – JP Morgan Guide To Retirement

Surviving The Next Bear – Strategies To Profit From The Next Market Crash

Weekend Reading – Asset Class Returns since 1970 & Trend Following Strategies

Cracking the Code: Decoding ETF Names & Discovering Tools To Find Them

Broker Review Methodology

iWeb Share Dealing Review – Great For Inactive Investors

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🎁 Taking advantage of our affiliate links when setting up a broker account. This doesn’t increase your costs, and we often secure exclusive bonuses for our audience.

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.