Weekend Reading – The Portfolio To Live Longer

- Recommeded Reading

- Youtube (Required watch time)

- Podcast (Listening Time)

- Academic Research - May require intermediate/advanced knowledge

- Noteworthy Twitter Thread

You miss 100% of the shots you don’t take.

Wayne Gretzky

INVEST WISELY

This section is dedicated to research on how to invest for the Long Run using Passive Investment Strategies. Read Topics related to (i) Portfolio Construction and Asset Allocation (ii) Acting wisely by avoiding behavioural traps and also (iii) publications that help understand how financial markets work.

CONSTRUCT YOUR PORTFOLIO

According to Vanguard research, investing through an ETF that is 0.6% more expensive than the lowest available can lower the likelihood of a successful early retirement by more than half. But how exactly should you assess an ETF’s cost? Especially when one ETF has a better historical performance and another ETF has a better forward-looking Total Expense Ratio. Here are some questions that European and UK Investors frequently ask.

HOW TO INVEST

As behavioral finance has moved into the mainstream, one thing has become clear. It’s great to know there’s a way to explain a client’s sub-optimal behavior. But, it’s an entirely different challenge to know what to do about it. In other words, behavioral finance has done a great job of providing advisors with a list of diagnoses. There are over 20+ biases to pick from. But, we need less diagnosis and more prescription.

- Would You Rather Outperform During Bull Markets or Bear Markets? (A Wealth of Common Sense)

- Investors are still their worst enemy (IFA)

- Why to focus on long-term market results (Vanguard)

- The four questions an investor must ask (Behavioural Investment)

- Worry About the Right Things (Irrelevant Investor)

- The business of risk (Humble Dollar)

- Lessons from the Fund Manager Whisperer - getting people to listen and change (Decision Nerds - 54 Min)

UNDERSTAND FINANCIAL MARKETS

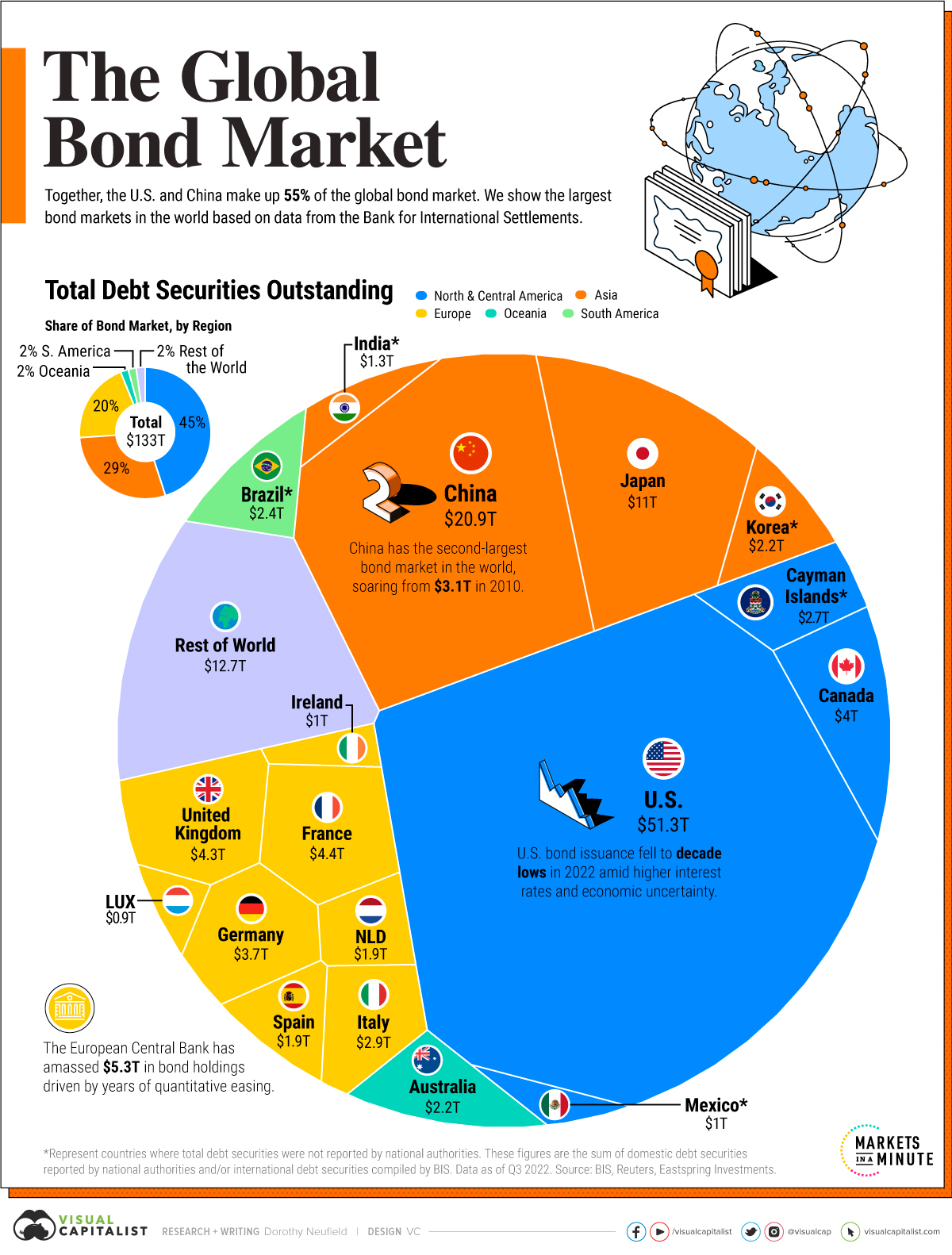

Mapped: The Global Bond Market

Valued at over $51 trillion, the U.S. has the largest bond market globally. Government bonds made up the majority of its debt market, with over $26 trillion in securities outstanding.

In 2022, the Federal government paid $534 billion in interest on this debt. China is second, at 16% of the global total. Local commercial banks hold the greatest share of its outstanding bonds, while foreign ownership remains fairly low. Foreign interest in China’s bonds slowed in 2022 amid geopolitical tensions in Ukraine and lower yields.

Read more on VisualCapitalist.com

ACTIVE INVESTING

This section relates to improving your knowledge about active investing. If you decide to sin, then sin only a little. Given ample evidence, combined active bets should be ideally a relatively small fraction of your portfolio. This section also includes Sustainable Investing. You can invest in a Socially Responsible way, but there are many ESG traps. Learn how to invest sustainably, and what it means for expected returns, with our definitive guide to sustainable investing.

FACTOR & Thematic investing

- Booming but be Wary: Your guide to Thematic Funds (Morningstar)

- Portfolio Tilts versus Overlays: It’s Long/Short Portfolios All the Way Down (Flirting With Models)

- Valuation metrics in emerging debt - Q1 2023 (GMO)

- How factor exposures change over time - A study into Information Decay (Alpha Architect)

- Here’s Where Market Timing Works (Institutional Investor)

STOCKS

SUSTAINABLE investing

ALTERNATIVE ASSET CLASSES

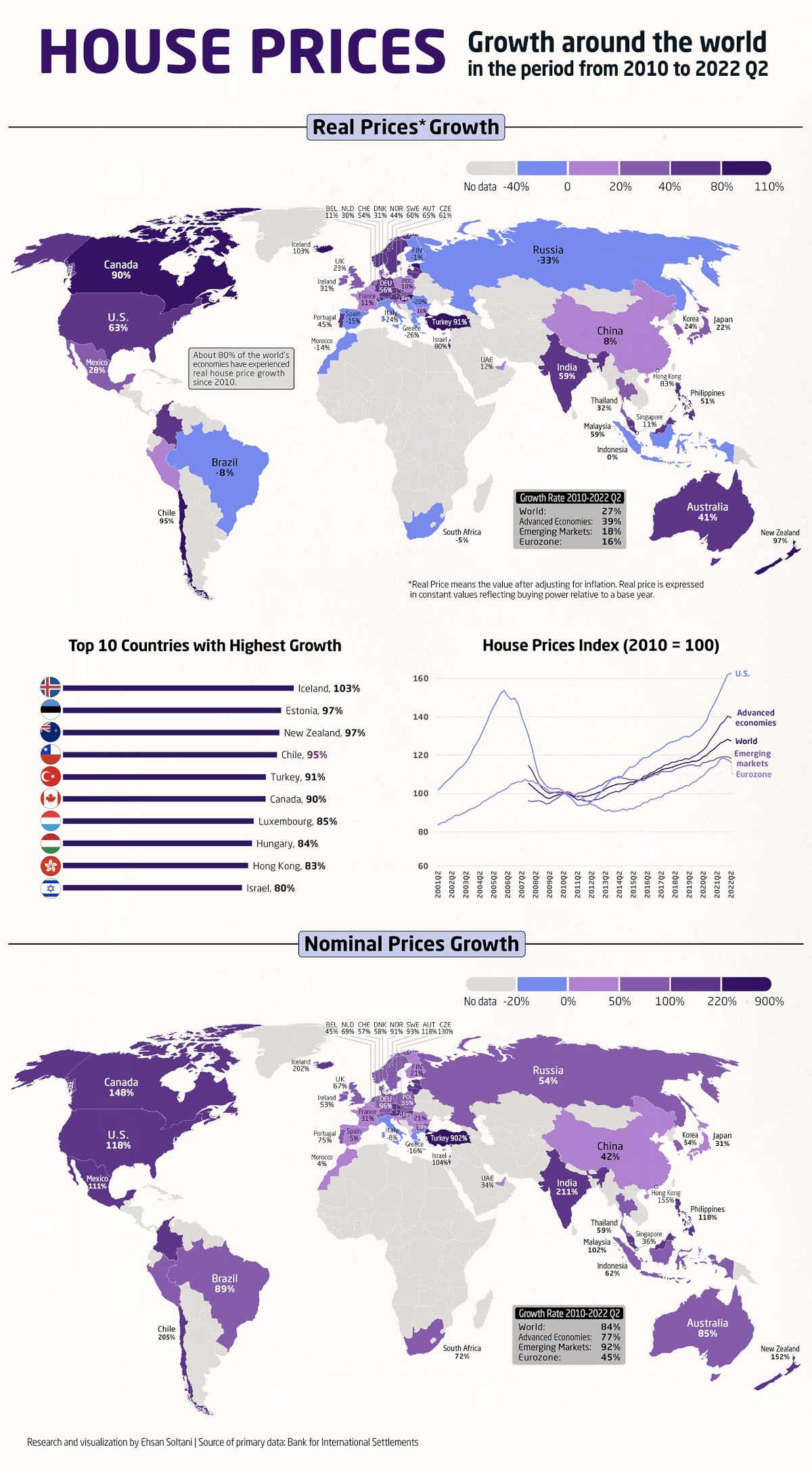

Mapped: House price growth around the world

In many countries around the world, it seems like house prices have been constantly climbing.

Houses fulfill a rare mix of necessity, utility, sentimentality, and for many, also act as a primary investment to build wealth. And it’s that last angle, combined with increasing demand in many countries, that is driving housing prices skyward.

Using data from the Bank of International Settlements, Ehsan Soltani has ranked the change in real residential property prices for 57 countries from 2010 to 2022.

Read more on VisualCapitalist.com

WALL STREET

crypto

BAD BETS

The 2023 Netflix docuseries Madoff: The Monster of Wall Street dives into the largest Ponzi scheme in history, worth $64.8 billion.

Although the Madoff madness stopped in late 2008, today’s investors still fall for the very same tricks.

What exactly can we learn from this series?

Let’s have a closer look.

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

PERSONAL FINANCE

This section is dedicated to UK and European Products. It can also touch on other European jurisdictions outside the Euro-zone.

Wealth Management

FINANCIAL PRODUCTS

COST OF LIVING

Life is getting more expensive for all of us at the minute, and rising living costs are a concern for households across the country. The cost of living has surged at its fastest pace in almost 40 years, with inflation – the rate at which prices are rising – hitting 10.4% in March. With interest rates also being increased, record fuel prices and a host of household bill hikes coming into force in April, a team of Which? experts have answered 17 key questions on how you can cut your household expenses.

Read more on which.co.uk

OUR Community

Question of the week

Personal Development

Creating and maintaining habits are an important part of the FI journey. Not only does it require you to prioritize what you value, but it can lead to success in many areas of your life. However, while we talk about the success that habits can lead to, sometimes we overlook that starting a habit can be stressful or overwhelming

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Health & Wellness

CAREERS & REMOTE WORK

Over the past year, Raph and I worked remotely from Digital Nomad places in Asia and Europe. Sometimes illusionary in a corporate environment, work-life balance can also be tricky on the move. We tested different coworking spaces, but sometimes adapted a work-from-home style when options were limited. Time off while travelling can be incredibly rewarding. We wanted to bring out unique activities each place offers to make your choice easier.

EARLY RETIREMENT

- Considering the universe of financial choice - Savings Vs Long Term Investment for Retirement (Vanguard - 20 min)

- A personal-finance blogger quit being a landlord, sold her rental properties, and still plans to retire early. Here's how. (Business Insider)

- Ultimately, a plan for retirement that does not account for the “where” and “why” is not a complete strategy. (Think Advisor)

- Will you have “retirement regret?” (Rad Reads)

Travel

TECH

miscellaneous

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Broker Safety: Should You Rely On Broker Insurance?

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

Money Market Funds: Are ETFs The Best Bang For Your Buck Or A Risky Ride?

4 Things I Learned In 4 Years Of Running A Finance Blog

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.