What Do Tour De France Winners and Your Portfolio Have In Common?

KEY TAKEAWAYS

- Larry and RC have collected 77 investing mistakes that investors commonly fall prey to. Each mistake and the evidence behind it is briefly presented in its own chapter, sometimes using personal stories, along with tips on how to avoid it.

- Even though chapters are relatively short, they are informationally very dense. An effective way for readers to digest the material is to focus on one mistake per day to let the material sink in.

- The mistakes can also be used as prompts for interesting finance-related discussions amongst families, friends, or investing groups.

- There are four parts in this book dealing with mistakes that fall into the same broad theme, which we briefly summarize below.

- This book does not put a particular focus on personal finance, but touches upon how to think about the opportunity cost of spending, how to think about withdrawal rates in retirement, and the importance of saving money early to let compounding work its magic.

Here is the full analysis

Ah, compounding, the eighth wonder of the world, the solution to all problems, and the hidden secret of life. But is it really all it is touted to be, or like all cure-alls, something that sounds great only on paper? But first things first, let us understand what compounding (in the financial sense) is. There have been reams after reams written about it, but at its very crux, it is not that complicated. A simple example should illustrate it very well.

Let's Start With A Simple Example

Suppose you start with $100, and earn 10% on it every year.

A simple calculation will give you an interest of $10 in the first year, making the total sum of your money $110.

What about the interest earned in the year after that though?

Well, this time, you will be making 10% on the $10 you earned, as well as on your original $100, giving you $11 as interest, which is (slightly, but still) higher than what you earned in the first year.

Next year, along with your original $100, and the $10 interest for the first year, even this $11 will earn interest.

Do you see where we are going with this?

As the years go by, not only will you be earning interest on each previous year’s interest, each year’s interest will be higher than the one before it. Although in the few initial years, the difference will be minuscule, the interest keeps snowballing exponentially.

This is why your $100 will become $250 in ten years, $670 in twenty, and a whopping $1700 in thirty, with absolutely no help from your end!

The Surprising Power of Atomic Habits changed the fate of British Cycling one day in 2003. At the time, professional cyclists in Great Britain had endured nearly one hundred years of mediocrity.Since 1908, British riders had won just a single gold medal at the Olympic Games, and they had fared even worse in cycling’s biggest race, the Tour de France. In 110 years, no British cyclist had ever won the event (...)

Then, during the ten-year span from 2007 to 2017, British cyclists won 178 world championships and sixty-six Olympic or Paralympic gold medals and captured five Tour de France victories in what is widely regarded as the most successful run in cycling history.James Clear, Atomic Habits

Using Compounding as a Way of Life

But compounding is much more than ‘interest on interest’, which is what it has been reduced to by personal finance gurus.

In fact, it is a way of life.

For example, if you accomplish one extra work task every day, you may not notice any difference for a few months or even years.

However, over the course of a career, it could very well be the difference between stagnating in middle management or being picked as the occupant of one of the C-suites.

Compounding Atomic Habits

In his book ‘Atomic Habits’, James Clear, our generation’s authority on habit-building, has cited a very interesting example on how compounding can lead to huge wins, seemingly out of nowhere.

After a drought of almost a century in which they collectively won one single Olympic medal, the fate of the British cycling team flipped 180 degrees, winning a whopping 60 per cent of the gold medals at the Beijing Olympics and five Tour de France.

The success was due to the almost strange efforts of their coach, Dave Brailsford, who believed in tiny changes that built up over time.

While other coaches might have focused on the team’s fitness and the cycles’ technology, Brailsford was more worried about whether the team was washing their hands in the manner which best prevented them from catching colds.

They redesigned the bike seats to make them more comfortable and rubbed alcohol on the tires for a better grip. They determined the type of pillow and mattress that led to the

best night’s sleep for each rider.

They even painted the inside of the team truck white, which helped them spot little bits of dust that would normally slip by unnoticed but could degrade the performance of the finely tuned bikes.

The overnight success of the British team meant only one thing – Brailsford was right; slow as it was, compounding was the secret to massive success.

But coming back to finance, if compounding is actually such a miracle, why don’t we all use it to get wealthy?

There are two reasons for this.

One is psychological, while the other is purely practical.

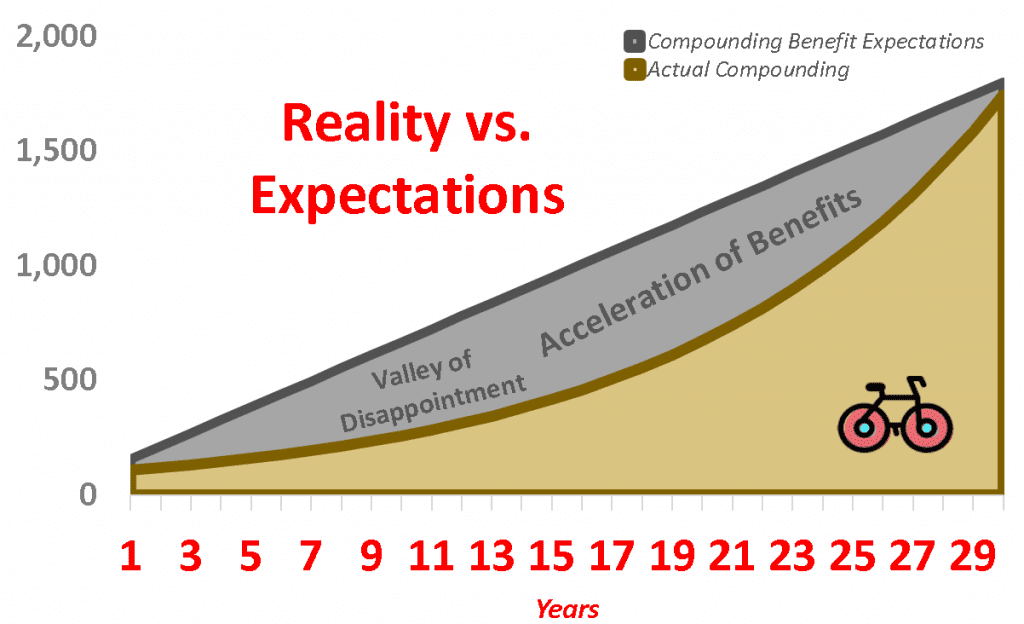

The Psychological Stumbling Block – the Valley of Disappointment

When we start building tiny habits or putting aside tiny sums of money, we expect the results immediately.

It is always a big change to unlearn past behaviour and do something that is ‘right’, and immediate results following a change boost dopamine in our bodies.

But that’s not how compounding works – meaning that it is a system set up for initial disappointment.

However, if one is able to get past this initial ‘valley of disappointment’, the results will surpass what one would expect otherwise.

Theory - Compounding Benefits Are Not Linear

The Practical Challenge

The second and more practical reason for most of us losing out the ‘golden years’ of compounding, is because it is pretty much next to impossible to save and invest when you are in your teens or early 20s, which is when you need to, in order to retire at a reasonable age and enjoy the fruits of your labor.

Instead, we end up beginning to invest sometime in our late 20s or early 30s, meaning that the lion’s share of the benefits of compounding come about at the fag end of our lives.

Compounding may be easy on paper, but it takes a bit of creativity to make it work for your actual life.

Just ask Buffett – out of his worth, which is pegged at $81 billion as of 2020, $70 billion came after he turned 65.

Nevertheless, the one place where we all wish and hope that the magic of compounding takes us to the moon, is in the stock market.

Ironically, that is the one place where compounding, in the sense of money begetting money, doesn’t work.

The other kind of compounding, of building a habit of saving and investing, of course, does.

This is because compounding works on the basis of a small but fixed return every so often, which builds on itself to give you a spectacular outcome.

Stock markets, on the other hand, are known for their volatility (in the short term) – the very antithesis of a small, fixed return.

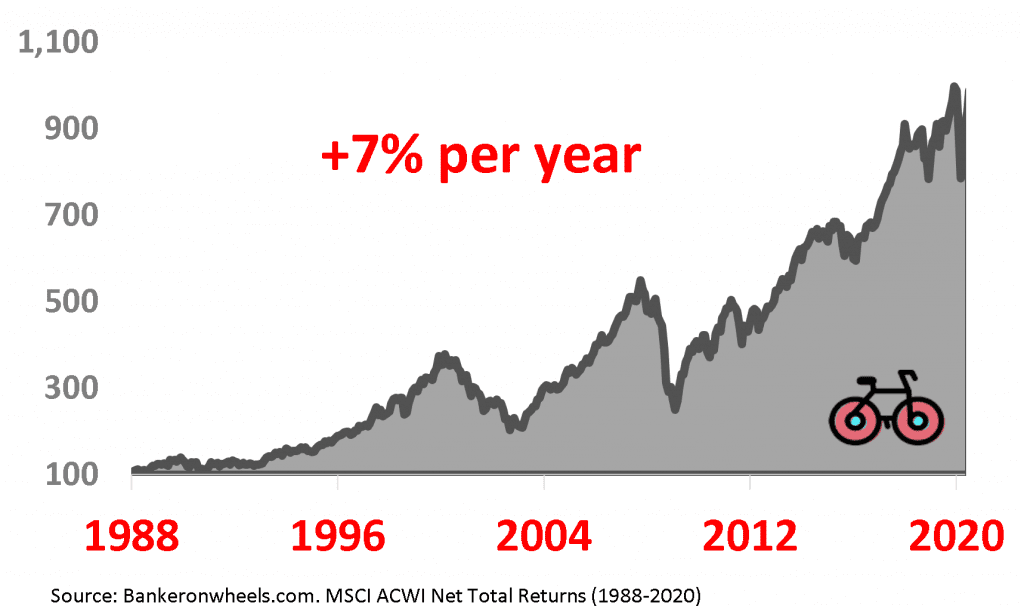

Over a longer time horizon, though, a stock market replicates compound interest.

For example, the S&P 500 gave a massive 21.83% in 2017, but a negative 4.38% in 2018.

However, over a long period, a World ETF averages out to c. 7% compounded return a year – despite the dot-com crash as well as the 2008 financial crisis.

In short, for all intents and purposes, the stock market also compounds, as long as you’re in it through the highs and the lows.

Practice - Compounding In Action (World Stock Market ETF)

Stress compounds. The frustration of a traffic jam. The weight of parenting responsibilities. The worry of making ends meet. The strain of slightly high blood pressure. By themselves, these common causes of stress are manageable. But when they persist for years, little stresses compound into serious health issues.

James Clear, Atomic Habits

The Dangers of Compounding

In Life

So compounding is the next best thing after sliced bread.

Or is it?

The danger of compounding is its very nature – it magnifies both risks and rewards.

If your credit card is overdue, the interest will compound.

The inflation in prices of goods and services is compounding.

Atomic Habits, again, explains this with a wonderful real-world example.

If a plane, intending to fly from Los Angeles to New York City, heads just 3.5 degrees south as compared to where it is supposed to be heading, it will land in Washington, D.C.

An imperceptible change, magnified across the breadth of the United States, means you end up hundreds of miles apart.

Small undesirable habits, built up over time, are taking you farther and farther from your ultimate goals every day, without you even realizing.

The trick according to research is to deviate from good habits (if needed) and sin once, but never twice. If you repeat it twice, you start building a new, bad habit.

And when it comes to your portfolio, the danger is real and quantifiable.

For Your Portfolio

When your portfolio has a negative return, it takes you much more than the corresponding positive return to even break even.

A negative 10% cannot be countered by a positive 10%.

And the higher the negative return, the more exponentially the required positive number grows.

The only way out of the quagmire is to use the positive power of compounding to counter its negatives. Remember, World Stock Market (as a whole) always recovers in the long run. Individual Stocks may not.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Calculate Your Own Power of Compounding

Still a little unsure of how exactly your savings will compound?

Here’s a simple calculator to play around with.

Whether you want to invest at a go, or chip away every month, the calculator can throw light on how bright your future will be.

In a sense, it can help you overcome the lethargy that we (very humanly) feel, to invest in something that will only reward you a couple of decades from now, by helping you picture the outcome of your actions today.

Use it, and use it well, to tell you where you stand when it comes to the one financial phenomenon you want to be on the right side of – the magic of compounding.

Compounding Simulator

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Surviving The Next Bear – Strategies To Profit From The Next Market Crash

Weekend Reading – Asset Class Returns since 1970 & Trend Following Strategies

Cracking the Code: Decoding ETF Names & Discovering Tools To Find Them

Broker Review Methodology

iWeb Share Dealing Review – Great For Inactive Investors

AJBell Review – Leading Broker & Low-Fee SIPP Provider

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🎁 Taking advantage of our affiliate links when setting up a broker account. This doesn’t increase your costs, and we often secure exclusive bonuses for our audience.

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.