Weekend Reading – Don’t Buy ETFs When The Market Opens

- Recommeded Reading

- Youtube (Required watch time)

- Podcast (Listening Time)

- Academic Research - May require intermediate/advanced knowledge

- Noteworthy Twitter Thread

There are people who have money and people who are rich

Coco Chanel

INVEST WISELY

This section is dedicated to research on how to invest for the Long Run using Passive Investment Strategies. Read Topics related to (i) Portfolio Construction and Asset Allocation (ii) Acting wisely by avoiding behavioural traps and also (iii) publications that help understand how financial markets work.

CONSTRUCT YOUR PORTFOLIO

HOW TO INVEST

UNDERSTAND FINANCIAL MARKETS

ACTIVE INVESTING

This section relates to improving your knowledge about active investing. If you decide to sin, then sin only a little. Given ample evidence, combined active bets should be ideally a relatively small fraction of your portfolio. This section also includes Sustainable Investing. You can invest in a Socially Responsible way, but there are many ESG traps. Learn how to invest sustainably, and what it means for expected returns, with our definitive guide to sustainable investing.

FACTOR & Thematic investing

STOCKS

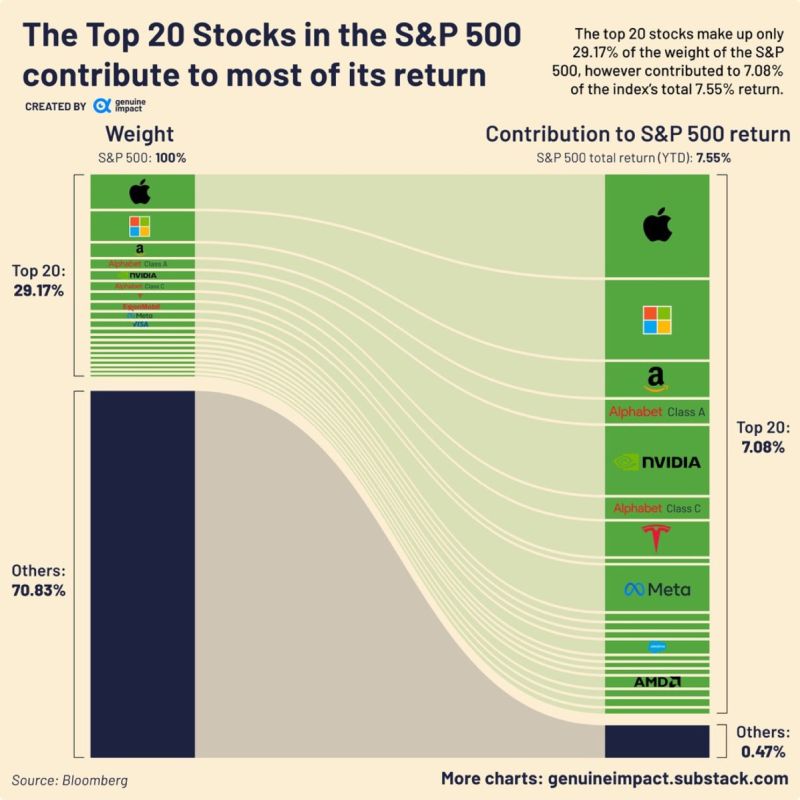

The total return of the S&P 500 YTD is 7.55%, and the top 20 stocks have contributed to 7.08% of that! This is despite the fact that they are under 30% of the weight of the S&P 500. Of the top 20, particular heavy lifters include Apple, Microsoft and NVIDIA, contributing 1.49%, 1.15%, and 1.00% respectively.

Despite difficulties the tech industry has recently been facing, with highly publicised layoffs, these companies still clearly dominate in the S&P 500 both by weight and contributions to return. In fact, looking at the top 20, only 4 are not a part of the information technology sector.

Read more on Geniune Impact

SUSTAINABLE investing

ALTERNATIVE ASSET CLASSES

WALL STREET

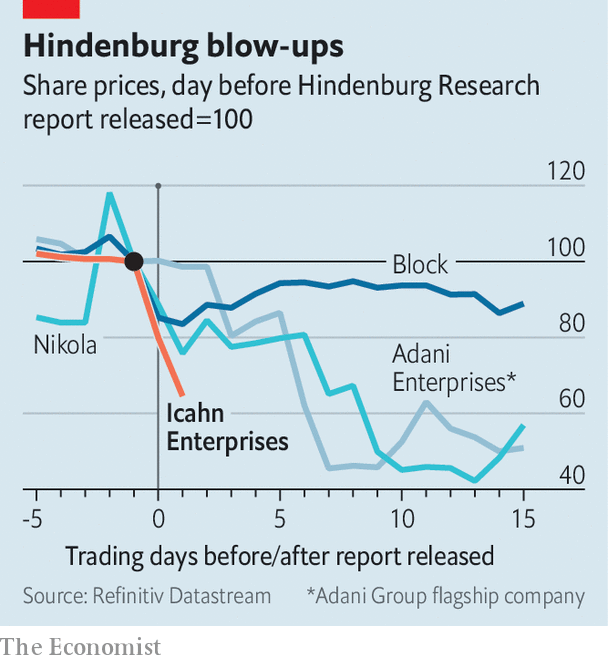

Until this week Icahn Enterprises had a market capitalisation of around $18bn, more than triple the reported net value of its assets. These include majority ownership of energy and car companies, in addition to an activist-investment portfolio. On May 2nd Hindenburg Research, a short-selling outfit founded in 2017 by Nathan Anderson, accused Icahn Enterprises of operating a “Ponzi-like” structure. Icahn Enterprises has shed more than a third of its market value since Hindenburg released its report.

Read more on Hindenburg Research

crypto

BAD BETS

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

PERSONAL FINANCE

This section is dedicated to UK and European Products. It can also touch on other European jurisdictions outside the Euro-zone.

Wealth Management

In Personal Finance, what one would consider Common Sense Is relatively Uncommon. The Netflix Series “How to Get Rich” is based on Ramit Sethi’s work, including the New York Times Best Seller Book “I Will Teach You To Be Rich”. Today, we look at why most people are so bad at managing their finances and where you and your loved ones can start to change it. With this series, we are also glad to see Index Investing hitting Netflix in a big way.

- Taking control of your finances while being in a variable income Job (ChooseFI)

- Q and A with Mr. Money Mustache

- 40% of people regret buying their car. Find out why (Rachael Camp)

- When it comes to money, there are always more than 2 choices (Advisor Perspectives)

- How to avoid the inheritance disasters seen in US drama Succession (Trust Net)

FINANCIAL PRODUCTS

- Vanguard UK retail platform hits 500,000 users amid low-cost passive boom (ETF Stream)

- UK: Investors swell money market funds (FT.com - click on the first link)

- UK: Thinking of switching bank account? HSBC brings back £200 cash offer for new joiners as it looks to entice more customers (This is money)

COST OF LIVING

OUR Community

Question of the week

Personal Development

Kevin Kelly is the author of the new book Excellent Advice for Living: Wisdom I Wish I’d Known Earlier. Other books by Kevin Kelly include Out of Control, the 1994 classic book on decentralized emergent systems; The Silver Cord, a graphic novel about robots and angels; What Technology Wants, a robust theory of technology; Vanishing Asia, his 50-year project to photograph the disappearing cultures of Asia, and The Inevitable: Understanding the 12 Technological Forces That Will Shape Our Future, a New York Times bestseller.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Health & Wellness

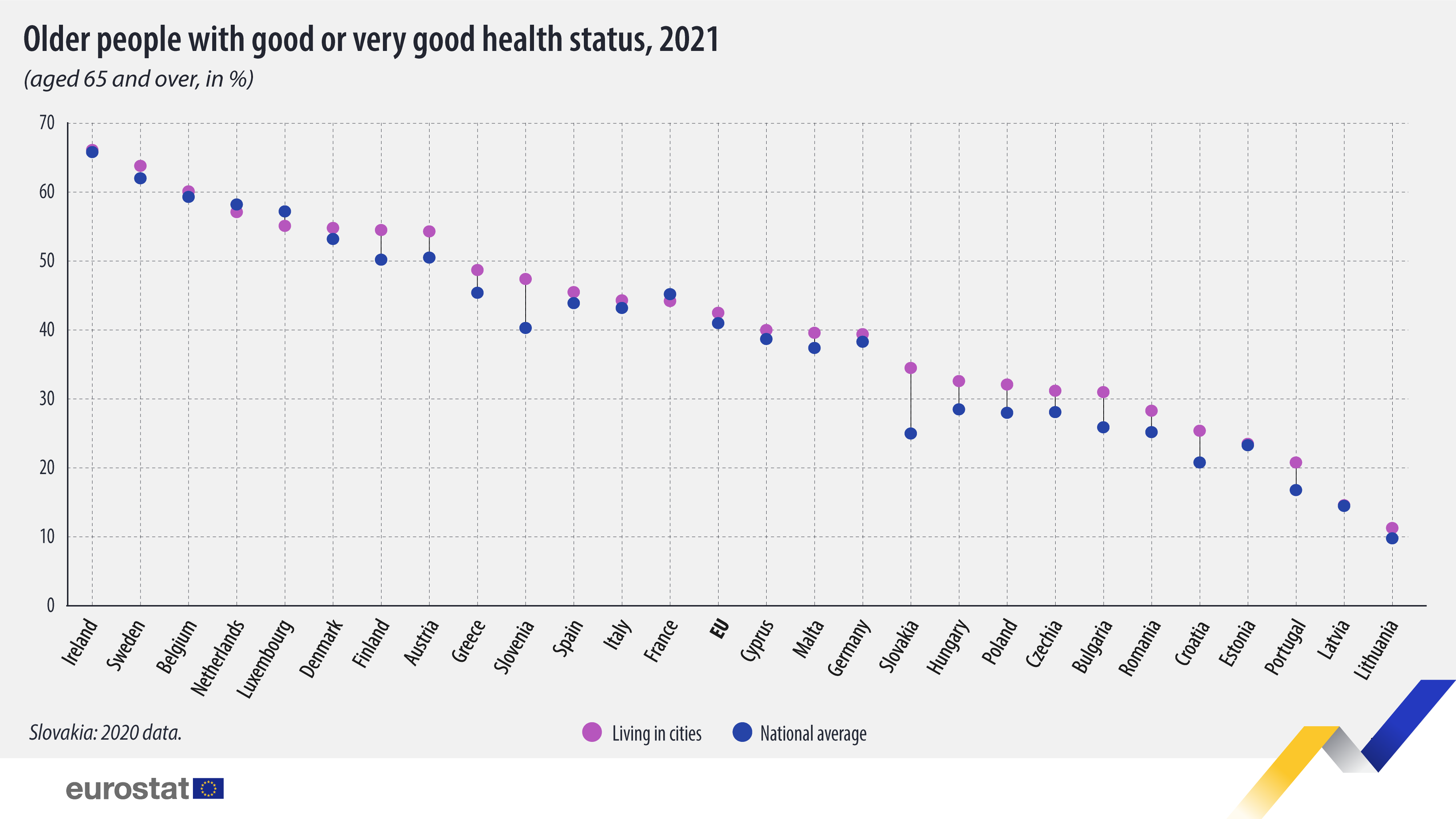

In 2021, at EU level, 43% of people aged 65 and over living in cities reported that they had a good or very good health status; Eight EU members reported shares above 50% of people aged 65 and over living in cities with good or very good health status. The highest proportions were recorded in Ireland (66%), Sweden (64%) and Belgium (60%). On the other hand, the lowest proportions were recorded in Lithuania (11%), Latvia (15%) and Portugal (21%).

Read more on Euro Stat

CAREERS & REMOTE WORK

Should You Quit Your Job? (The Outcome - 12 Min )

Over the past year, Raph and I worked remotely from Digital Nomad places in Asia and Europe. Sometimes illusionary in a corporate environment, work-life balance can also be tricky on the move. We tested different coworking spaces, but sometimes adapted a work-from-home style when options were limited. Time off while travelling can be incredibly rewarding. We wanted to bring out unique activities each place offers to make your choice easier.

EARLY RETIREMENT

Travel

TECH

- How to stop AI going rouge? (The Economist)

- As technology tilts power towards capital, individuals must adapt by investing in diverse assets (Dror Pleg)

- AI is taking the jobs of Kenyans who write essays for U.S. college students (AI is taking the jobs of Kenyans who write essays for U.S. (Rest of World)

The Inside Story of ChatGPT’s Astonishing Potential (Greg Brockman - 30 Min )

miscellaneous

Community

How Would You Improve This Series?

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

The Truth About €1 Million Broker Guarantees

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

Money Market Funds: Are ETFs The Best Bang For Your Buck Or A Risky Ride?

4 Things I Learned In 4 Years Of Running A Finance Blog

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.