Weekend Reading – What’s the best long-term investment?

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web.We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist.

Invest Wisely section is dedicated to research on how to invest for the Long Run using Passive Investment Strategies. Read Topics related to (i) Portfolio Construction and Asset Allocation (ii) Acting wisely by avoiding behavioural traps and also (iii) publications that help understand how financial markets work.

Active Investing section relates to improving your knowledge about active investing. If you decide to sin, then sin only a little. Given ample evidence, combined active bets should be ideally a relatively small fraction of your portfolio. This section also includes Sustainable Investing. You can invest in a Socially Responsible way, but there are many ESG traps. Learn how to invest sustainably, and what it means for expected returns, with our definitive guide to sustainable investing.

Personal Finance section is dedicated to UK and European Products. It can also touch on other European jurisdictions outside the Euro-zone.

- Recommeded Reading

- Youtube (Required watch time)

- Podcast (Listening Time)

- Academic Research - May require intermediate/advanced knowledge

- Noteworthy Twitter Thread

Chains of habit are too light to be felt until they are too heavy to be broken.

Warren Buffet

INVEST WISELY

CONSTRUCT YOUR PORTFOLIO

One of the most confusing aspects of UCITS ETFs is currencies. Pay special attention. Not only can they affect the long term performance of the Stocks and Bonds, but they also impact the FX conversion fees you pay your Broker.

This article looks at the best practices and what you can do to reduce FX fees.

- Effects of 5-10% Allocation to Gold (Alpha Architect)

- What's the best long term investment? (A Wealth of Common Sense)

- What is the optimal level of duration - and does it even matter? (Verdad)

- The Problem With Investing In Bond Indexes (Peter Lazaroff - 8 min)

- Starting Valuation Matters - The Case of US High Yeild & US Equities (FTSE Russell)

- The case for international diversification (A Wealth of Common Sense)

HOW TO INVEST

UNDERSTAND FINANCIAL MARKETS

The Future of Investing - with legendary investor Stanley Druckenmiller (Sohn Conference Foundation - 1 hr 3 Min )

At the 2023 Sohn Investment Conference on May 9, 2023, 13D Research & Strategy Founder Kiril Sokoloff spoke with Duquesne Family Office CEO Stanley Druckenmiller about the future of investing.

Druckenmiller is one of all-time most successful investors. Duquesne Capital Management posted an average annual return of 30 percent without any money-losing year.

- Macro Trends & Recent Bank Failures - with Bridgewater CIO Karen Karniol (Sohn Conference Foundation - 36 min)

- What needs to happen for the Remnibi to seriously compete with the dollar (Bloomberg - 46 min)

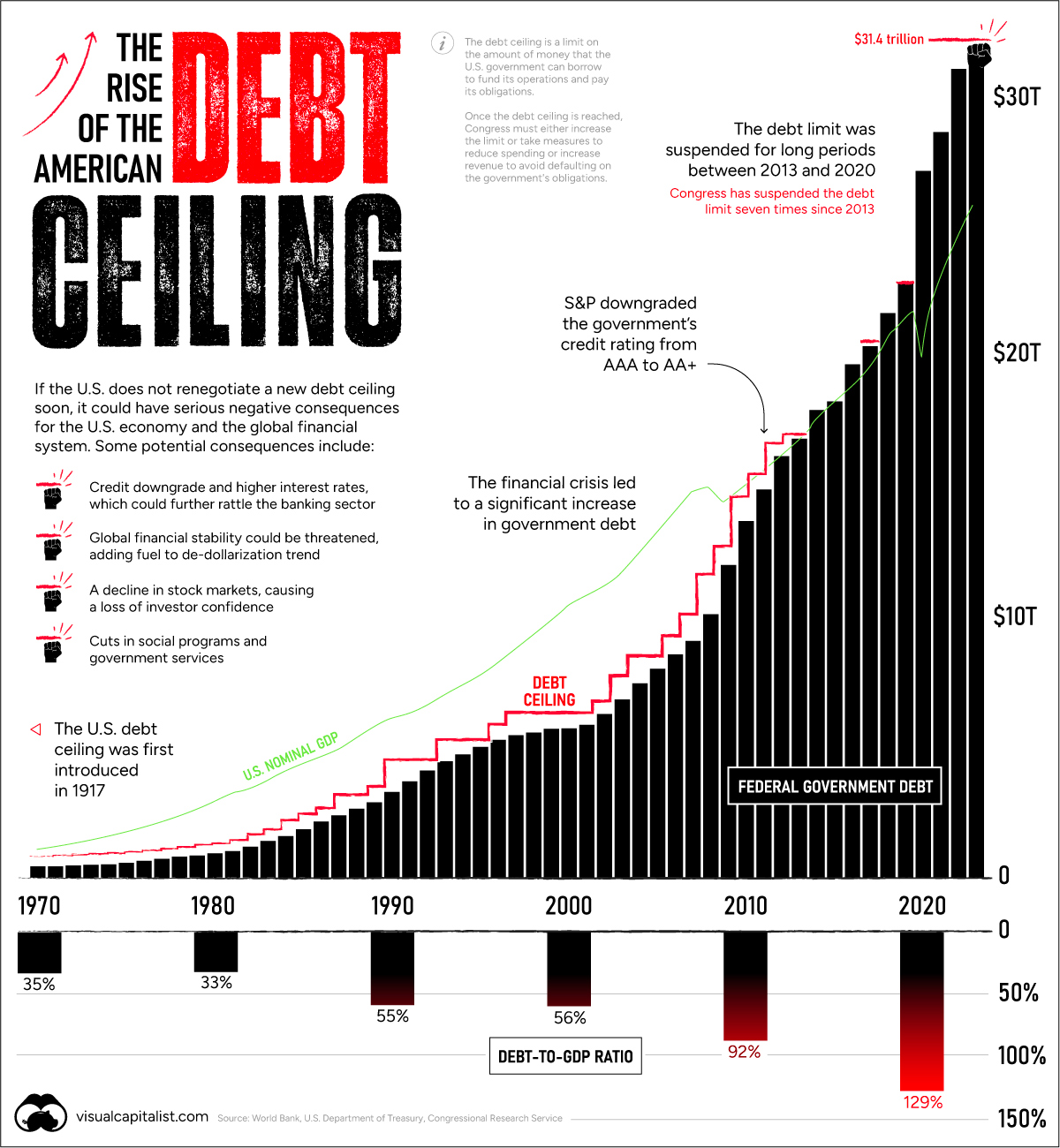

- What investors should know about the debt ceiling (Vanguard)

- Traditionally, bonds are seen as 'safe' and equities as 'risky', but this is a rather simplistic view of the world (Morningstar)

Every few years, the debt ceiling stand-off puts the credit of the U.S. at risk. In January, the $31.4 trillion debt limit—the amount of debt the U.S. government can hold—was reached. That means U.S. cash reserves could be exhausted by June 1 according to Treasury Secretary Janet Yellen. Should Republicans and Democrats fail to act, the U.S. could default on its debt, causing harmful effects across the financial system.

This graphic shows the sharp rise in the debt ceiling in recent years, pulling data from various sources including the World Bank, U.S. Department of Treasury, and Congressional Research Service.

Read more on Visual Capitalist

ACTIVE INVESTING

FACTOR & Thematic investing

- On Factor Investing- Needles in Haystacks (Humble Dollar)

- Perhaps dividends aren't as safe as they sometimes look. (Morningstar)

- Dont blindly chase high dividend yield - the risks with generous companies (Morningstar)

- Beating the S&P 500 at Its Own Game - The triumph of the equally weighted index. (Morningstar)

Roni Israelov, CIO of NDVR, discusses global asset risk models & the application of high frequency signals to tail risk hedging. While there are insights to glean in each of these topics, the conversation helps paint an insightful picture about how Roni thinks about research in general.

STOCKS

Everything you need to know about investing and finance in under an hour (Big Think - 44 Min )

Bill Ackman is one of the top investors in the world He learned the basics of investing in his early 20s. This Big Think video is aimed at young professionals just starting out, as well as those who are more experienced but lack a financial background.

ALTERNATIVE ASSET CLASSES

WALL STREET

SUSTAINABLE investing

Wall Street didn’t want you to know that ESG Ratings are not about protecting the planet. And yet, over the past few years, ESG investments have, sometimes significantly, outperformed. This outperformance is due to two reasons. First, they are over-exposed to large-cap and growth risk factors. Second, ESG was, until recently, very trendy. Investors developed a taste for sustainability that inflated valuations. This taste is the very reason why ESG ETFs are poised to underperform on a risk-adjusted basis.

crypto

BAD BETS

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

PERSONAL FINANCE

Wealth Management

FINANCIAL PRODUCTS

COST OF LIVING

OUR Community

Question of the week

Personal Development

Health & Wellness

CAREERS & REMOTE WORK

EARLY RETIREMENT

Travel

In conversation with Sam Altman on the recent developments in AI and future expectations (Sohn Conference Foundation - 53 Min )

At the 2023 Sohn Investment Conference on May 9, 2023, Stripe CEO Patrick Collison spoke with OpenAI CEO Sam Altman about the future of AI and more.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

miscellaneous

OUR Community

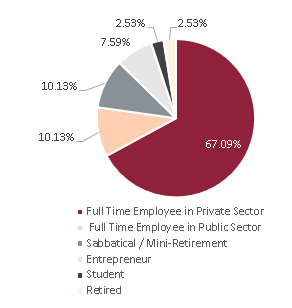

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Broker Safety: Should You Rely On Broker Insurance?

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

Money Market Funds: Are ETFs The Best Bang For Your Buck Or A Risky Ride?

4 Things I Learned In 4 Years Of Running A Finance Blog

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.