Weekend Reading – Who Should NOT Invest in Total Market Index Funds?

- Recommeded Reading

- Youtube (Required watch time)

- Podcast (Listening Time)

- Academic Research - May require intermediate/advanced knowledge

- Noteworthy Twitter Thread

Someone is sitting in the shade today because someone planted a tree a long time ago

Warren Buffett

INVEST WISELY

This section is dedicated to research on how to invest for the Long Run using Passive Investment Strategies. Read Topics related to (i) Portfolio Construction and Asset Allocation (ii) Acting wisely by avoiding behavioural traps and also (iii) publications that help understand how financial markets work.

CONSTRUCT YOUR PORTFOLIO

Compounding is a powerful wealth-creation tool. But taxes and fees can sabotage your plan. Typically, up to 2-3% of the 7% average annual total return from Global Stocks comes in the form of dividends. But what happens to compounding if we distribute them? We take a look at how to optimise your ETF selection for the compounding magic to work without leaking too much in unnecessary taxes.

- Beware of These Fund Red Flags (Morningstar)

- Making the case for international equity allocations (Vanguard)

- Dividends matter, but they don't keep up with inflation (Joachim Klement)

- Vanguard vs BlackRock: The case for and against a 60/40 portfolio (Trust Net)

- Diversification or Di-worse-ification? How many stocks are required for a diversified portfolio? (Verdad)

HOW TO INVEST

UNDERSTAND FINANCIAL MARKETS

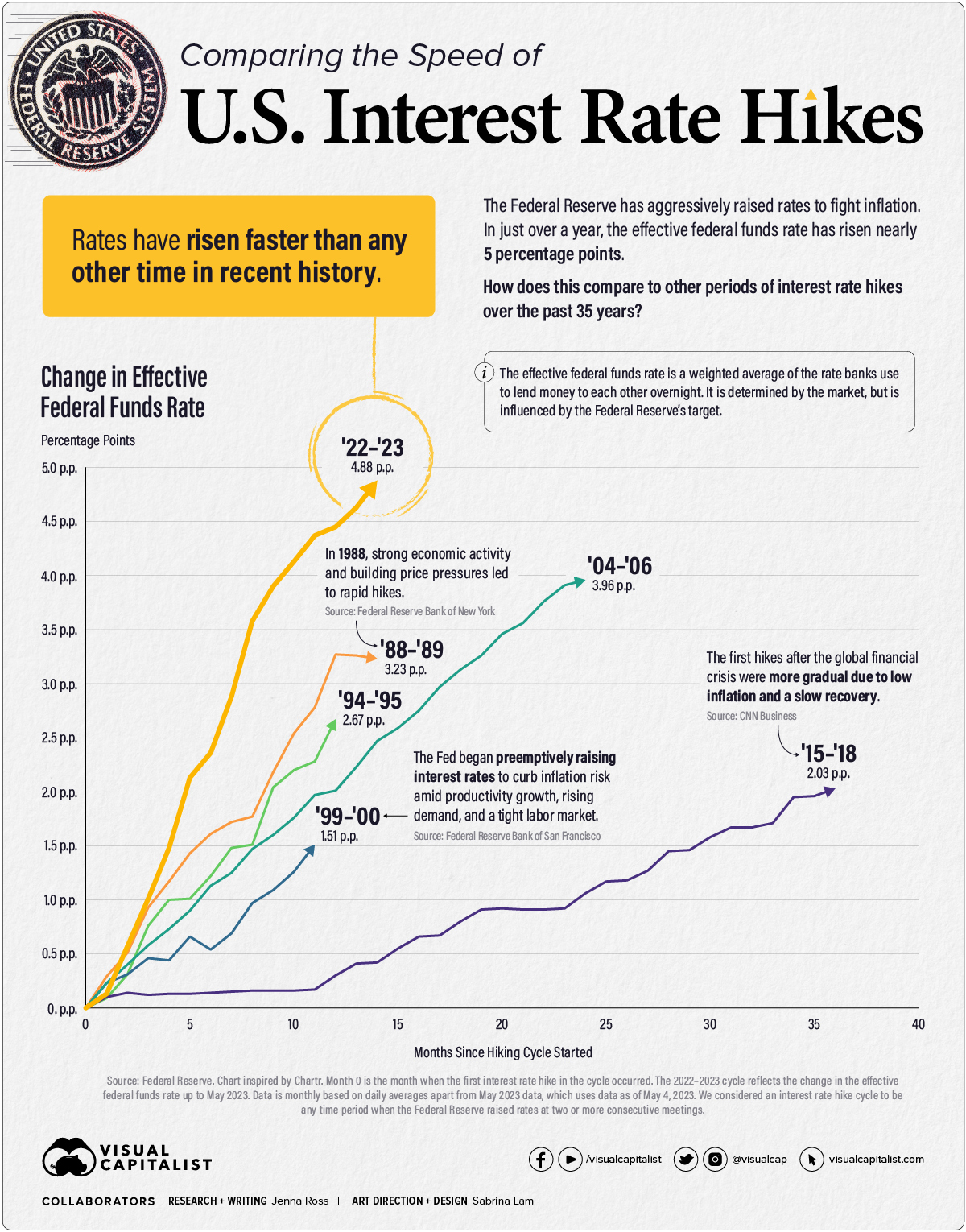

After the latest rate hike on May 3rd, U.S. interest rates have reached levels not seen since 2007. The Federal Reserve has been aggressive with its interest rate hikes as it tries to combat sticky inflation. In fact, rates have risen nearly five percentage points (p.p.) in just 14 months. This graphic explores both the speed and severity of current interest rate hikes to other periods of monetary tightening over the past 35 years. When we last compared the speed of interest rate hikes in September 2022, the current cycle was the fastest but not the most severe. In the months since, the total rate change of 4.88 p.p. has surpassed that of the ‘04-‘06 rate hike cycle. During the ‘04-‘06 cycle, the Federal Reserve eventually decided to pause hikes due to moderate economic growth and contained inflation expectations.

Read more on Visual Capitalist

- Should we be starting to think more about deflation than inflation next year? (Bond Vigilantes)

- The World is Awash With Debt, So How Do I Invest? (Morningstar)

- In America and Europe, higher rates for longer (Vanguard)

- When narratives take over (Joachim Klement)

- Why liquidity matters more than anything else (Real Vision)

ACTIVE INVESTING

This section relates to improving your knowledge about active investing. If you decide to sin, then sin only a little. Given ample evidence, combined active bets should be ideally a relatively small fraction of your portfolio. This section also includes Sustainable Investing. You can invest in a Socially Responsible way, but there are many ESG traps. Learn how to invest sustainably, and what it means for expected returns, with our definitive guide to sustainable investing.

FACTOR & Thematic investing

Who Should NOT Invest in Total Market Index Funds? (Ben Felix - 9 Min)

I have told you in many of my videos that low-cost total market index funds are the most sensible investments for most people – just own the market. I stand by that statement, but as true as it is, there is a lot more nuance to making good asset allocation decisions. How do you know if you’re like most people? And if you’re not like most people, how should your portfolio be different from the market?

STOCKS

Nobody knows for sure who is going to make all the money when it comes to artificial intelligence. One thing is clear though — AI requires a lot of computing power and that means demand for semiconductors. Right now, Nvidia has been a huge winner in the space, with their chips powering both the training of AI models (like ChatGPT) and the inference (the results of a query.) But others want in on the action as well. So how big will this market be?

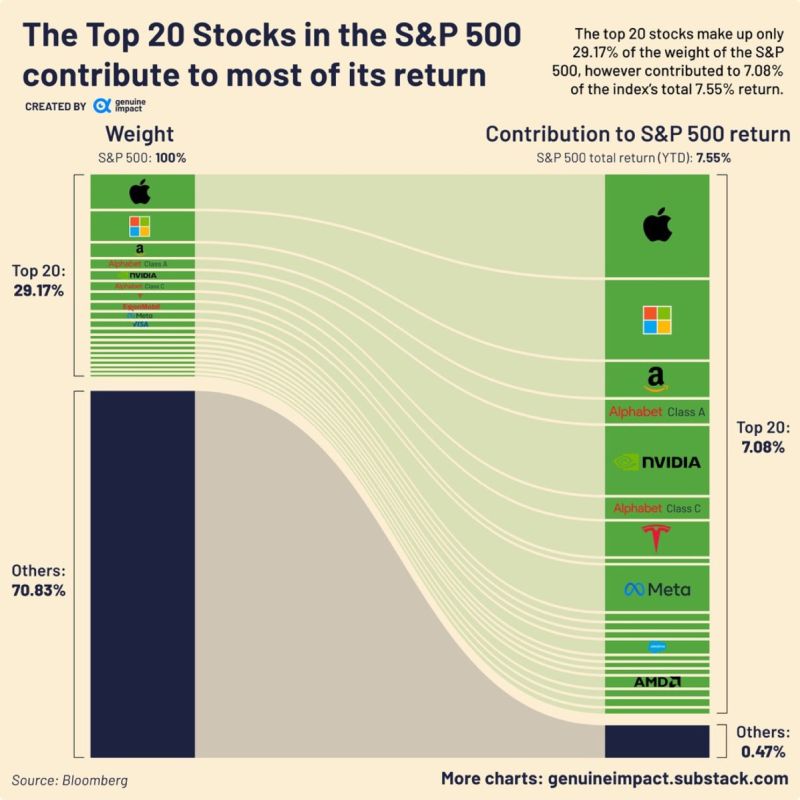

The total return of the S&P 500 YTD is 7.55%, and the top 20 stocks have contributed to 7.08% of that! This is despite the fact that they are under 30% of the weight of the S&P 500. Of the top 20, particular heavy lifters include Apple, Microsoft and NVIDIA, contributing 1.49%, 1.15%, and 1.00% respectively.

Despite difficulties the tech industry has recently been facing, with highly publicised layoffs, these companies still clearly dominate in the S&P 500 both by weight and contributions to return. In fact, looking at the top 20, only 4 are not a part of the information technology sector.

Read more on Geniune Impact

SUSTAINABLE investing

ALTERNATIVE ASSET CLASSES

WALL STREET

crypto

BAD BETS

We all have different levels of risk tolerance. But how is that risk measured for complex investment strategies like covered calls? And how can you be sure it’s an accurate reflection of reality?

Later, Jonathan Hollow and Robin Powell discuss their new book How to Fund the Life You Want: What everyone needs to know about savings, pensions and investments.

This section is dedicated to UK and European Products. It can also touch on other European jurisdictions outside the Euro-zone.

Wealth Management

Interest rates play a crucial role in the economy because they affect consumers, businesses, and investors alike.

They can have significant implications for people’s ability to access credit, manage debts, and buy more expensive goods such as cars and houses.

This graphic uses data from Infinity Asset Management to visualize the real interest rates (ex ante) of 40 major world economies, by subtracting projected inflation over the next 12 months from current nominal rates.

Read more on Visual Capitalist

- The Simple Path to Wealth (Book Review -Banker on Wheels)

- Negotiation in the age of the dual-career couple (Ft.Com- Click on the first link)

- The Beatles famously sang, "Money can't buy me love," but married couples who manage their finances together may love each other longer (Science Daily)

- Why Do I Need a Credit Card? (Morningstar)

- Do rising interest rates spell dark days ahead for our portfolios? (Monevator)

- Banking is a Relationship Business (Italian Leather Sofa)

FINANCIAL PRODUCTS

- Vanguard UK retail platform hits 500,000 users amid low-cost passive boom (ETF Stream)

- UK: Investors swell money market funds (FT.com - click on the first link)

- UK: Thinking of switching bank account? HSBC brings back £200 cash offer for new joiners as it looks to entice more customers (This is money)

COST OF LIVING

OUR Community

Question of the week

Personal Development

Health & Wellness

CAREERS & REMOTE WORK

Should You Quit Your Job? (The Outcome - 12 Min )

Over the past year, Raph and I worked remotely from Digital Nomad places in Asia and Europe. Sometimes illusionary in a corporate environment, work-life balance can also be tricky on the move. We tested different coworking spaces, but sometimes adapted a work-from-home style when options were limited. Time off while travelling can be incredibly rewarding. We wanted to bring out unique activities each place offers to make your choice easier.

EARLY RETIREMENT

- Should You Save More to Retire Earlier? (Of Dollars and Data)

- Financial Samurai going back to work & other Early retirement devotees rethink assumptions (Yahoo Finance)

- Back from Early Retirement? An Experiment With Work. (Fire & Wide)

- The Road Trip – What Almost Everyone Gets Wrong On the Journey to FI (Money Flamingo)

- Whether it's wanting to pay off your debts or get yourself set up for your future, there are many motivations for wanting to begin the path towards FI. (ChooseFi )

Travel

The Inside Story of ChatGPT’s Astonishing Potential (Greg Brockman - 30 Min )

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

miscellaneous

Technologist, serial entrepreneur, world-class investor & self-experimenter Kevin Rose joins Tim for another episode of The Random Show. In this one, they discuss affordable luxuries for priceless lives, suiting up for a visit to the Magic Castle, Eliza Ivanova’s art, Tim’s secret for supple skin, 19th-century Nintendo, Balaji’s bet, the science of hangover remedies, Moonbirds over Tokyo, an unexpected Sanbo Zen inquisition, Japanese death poems, escape rooms, high-fidelity immersive sound, Nanoblocks, and much more!

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – JP Morgan Guide To Retirement

Surviving The Next Bear – Strategies To Profit From The Next Market Crash

Weekend Reading – Asset Class Returns since 1970 & Trend Following Strategies

Cracking the Code: Decoding ETF Names & Discovering Tools To Find Them

Broker Review Methodology

iWeb Share Dealing Review – Great For Inactive Investors

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🎁 Taking advantage of our affiliate links when setting up a broker account. This doesn’t increase your costs, and we often secure exclusive bonuses for our audience.

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.