Do I need Bonds in my Portfolio?

Yes, if you need your money in the next few years

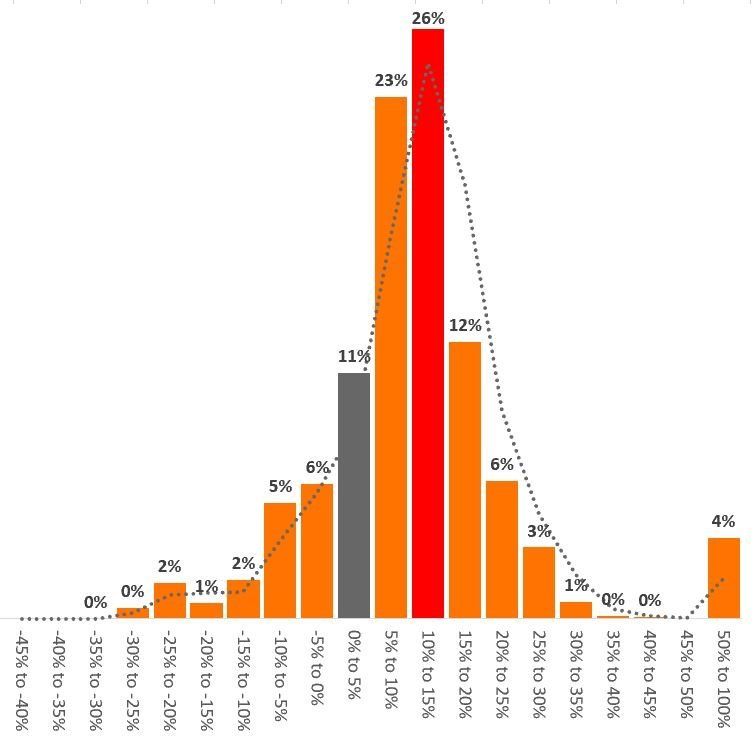

Look at the chart below:

- These are S&P 500 annual returns from June 1990 to June 2020

- The higher the bar the more likely the outcome

- The outcome is on the horizontal axis e.g. an annual return between 10% and 15% occurred in 16% of cases

- The best annual return was 81% and the worst was 46% annual loss

- All the bars on the right from grey bar are positive returns

Why? In c. 15% of cases the S&P 500 experienced annual losses - sometimes, quite steep

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Bonds improve positive returns

The chart below includes a mix of 40% Bonds (iShares AGG ETF Benchmark) and 60% S&P 500 which is by far the most popular asset allocation strategy these days:

- These S&P 500 annual returns include monthly re-balancing so that the 40% allocation to Bonds remains constant

- Your chances of positive outcome are over 90% based on historical data

- The best is c. 71% annual return and the worst a 29% annual loss (from 46% without Bonds)

- Notice the loss bands below -30% are not relevant anymore

Conclusion: Do I need Bonds in my Portfolio?

- Unless, you’re investing for very long term (10+ years), you need bonds in your portfolio because your risk is vastly reduced and chances of higher returns increased

- Also, you may want to hold Bonds that are very high quality and “pop” during a crisis (i.e. increase in price given a flight to quality)

- Holding high quality Bonds would further allow you to benefit from a Crisis and buy cheaper Equities because for a 1% drop in Yield Bond ETF prices may rally in the double digits (assuming long duration Bonds)

- Bonds will give you flexibility to re-balance your portfolio at the moment when you need it most, but otherwise will still generate 1-2% yield (assuming your Bond ETF is not only Treasuries that have low yield)

- Higher Yielding Bonds e.g. Corporates may seem attractive (since you buy alongside the FED) but they don’t provide the same security – see how they behaved during the Coronavirus Sell-off and which ones the FED currently holds

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

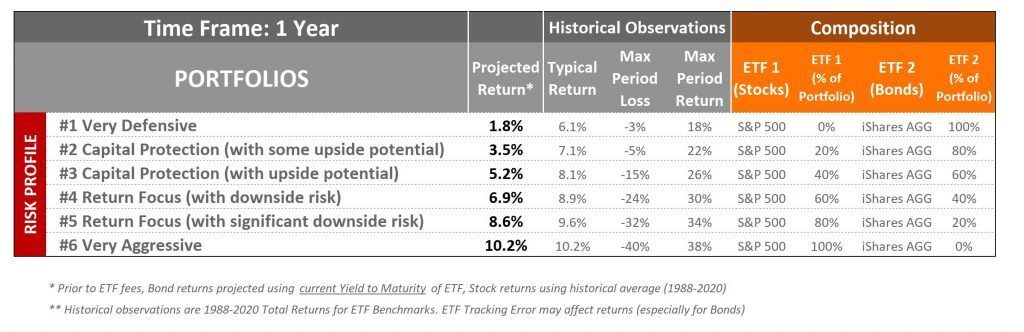

What percentage of Bonds do I need to hold?

- This is an excellent question and it depends on your time horizon and risk tolerance

- A further analysis will be performed – subscribe to the Research Newsletter below to be posted

- If you want to see what percentage of your portfolio should be invested in Bonds and you invest for the short term e.g. year or two check this simple 2 ETF Portfolio

DISCLAIMER

The views expressed here are my own personal views. The above is a simplistic generic scenario analysis. The information provided is general in nature only and does not constitute personal financial advice. You should consider the appropriateness of the information having regard to your objectives. You should consider your financial situation and needs. Seek professional advice where appropriate. This website is not affiliated with any of the investment firms for which products are described here.

These are meant to be illustrative investments. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. There can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to in this article, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.