How To Choose A Cheap Stock Broker?

Definitive guide to choosing a stock broker - Part 5

This is part 5 of Bankeronwheels.com Definitive Guide to choosing a Stock Broker.

Over the past months, as we developed our Broker Fee Comparison Tool, we looked into the different fees in Europe and the UK. You probably won’t be surprised to hear that the fee structures are almost designed not to be easily comparable!

But, the portfolios of our readers are often relatively simple, so coming up with a lifetime accumulation phase simulation of all fee components to choose the cheapest broker is not only feasible, but necessary. Certain fees – like custody fees – eat into investors’ wealth in the same dramatic way as high Total Expense Ratios charged by Fund Managers.

Ready to choose the cheapest broker for your portfolio? Let’s dive in!

KEY TAKEAWAYS

- The Cheapest Broker Is Not The Same For Everyone – the results depend on the invested amounts, time horizon or country where you’re based.

- Four Key Explicit Fee Types – relevant to ETF investors. They include platform fees, trading commissions, inactivity charges and currency conversion fees.

- Other Important Charges – that ETF investors may encounter include deposit and/or withdrawal fees, share transfer fees, data access fees or margin fees.

- Like-for-Like Comparisons – the cheapest Exchange in our tool only includes the explicit costs charged by the broker. You should also consider if the exchange is the best from an ETF liquidity perspective. Spreads are not part of this guide – and will be explained in another article – but a rule of thumb is that you can use LSE, Xetra or EuroNext for your comparisons.

Here is the full analysis

Safety First. In the first part of our guide, we looked at Broker Safety.

You must be relatively comfortable with your broker from a transparency, capital strength or regulatory oversight perspective before looking at the fees. Low Investor Compensation Schemes in Europe are one reason, why a lot of our readers have multiple Brokers.

Once these checkboxes are ticked, you can look at the type of fees your broker may charge. There are four key charges.

- platform fees - may impact you the most.

- trading commissions - The fee attractiveness depends on the amounts and frequency of your trades.

- inactivity fees - can bite if you stop buying ETFs.

- Currency conversion Charges - May matter for large trades.

Four Key charges

1. Platform Fees

Also Called Account Fees, Custody Fees, Annual Fees or Maintenance Fees.

In Europe and the UK, platform fee structures vary widely. They can include:

- Percentage-based Fees – calculated as a percentage of your investments. These can be particularly costly in the long run, as there are no caps.

- Fixed Fees – annual or monthly fees, irrespective of portfolio size. Usually, a very beneficial structure.

- Tiered Structures – where fees decrease as the size of your investments increases, often with a minimum or maximum. The attractiveness varies a lot, depending on the structure.

- No Fees – certain brokers do not charge platform fees.

- Mixed Structures – There are platforms offering a combination of fixed and percentage-based fees or offering fee waivers under certain conditions. Caps on variable fees are very welcome for long-term investors.

Fee Example Section 🤓

Here are a few examples of how it works:

- Percentage-based fee (SAXO Bank): If we assume that you hold ETFs with a market value of €100,000, the SAXO Bank custody fee is 0.15% of that amount, per annum. You will pay a €150 custody fee annually.

- Fixed fee (IG ISA UK) – IG ISA charge is £24 per quarter, irrespective of the portfolio size. You will pay £96 custody fee annually. There are discounts if you trade more (see Inactivity section below).

- Tiered structure (Swissquote Switzerland) – The fixed amount depends on the bucket you fall into. The first buckets are: 0-50k: 20 CHF per quarter; 50-100k: 25 CHF per quarter; 100-150k: 37.5 CHF per quarter. For a 100k portfolio, you will pay a 100 CHF custody fee annually.

- No fee (DEGIRO) – DEGIRO does not charge any platform fees.

- Mixed structure (Vanguard UK) – The rate is 0.15% per year up to £250k, at which point it becomes capped at £375. For a £100k portfolio, you will pay £150 custody fee annually.

2. Trading CommissionS

Platforms’ trading commission structures also vary:

- Flat Fee per Trade – A set amount charged for each trade, regardless of trade size. Common with Neo Brokers.

- Percentage-Based Fee – Commission calculated as a percentage of the trade value, sometimes with variable minimum or maximum amount. Very common.

- Mixed Structures – these have flat and/or percentage fees depending on the trade size, sometimes with an overall minimum or/and maximum. It is quite common.

- Tiered Pricing – Based on the value and/or the number of trades you make. Fees drop as you increases the value/volume over a certain period (monthly, quarterly etc.)

- Commission-Free Trades – No charge for trading certain assets like stocks or ETFs.

Fee Example Section 🤓

Here are a few examples of how it works:

- Flat Fee per Trade (DEGIRO) – DEGIRO charges €3 for trades on Euronext, Xetra, LSE or Milan Exchange.

- Percentage-Based Fee (Swissquote Luxembourg) – The broker charges 0.1% on all major European and UK Exchanges with a minimum of €14.95.

- Mixed Structures (Scalable Capital) – On Xetra, the broker charges €3.99 per trade plus 0.01% with a minimum of €1.5.

- Tiered Pricing (Interactive Brokers or IG UK) – For its Tiered plan, Interactive Brokers charges from 0.015% to 0.05% depending on trade value. IG UK charges £8 the first two transactions in a given month, and then £3 for any further trade.

- Commission-Free Trades (Trading 212) – No charges for ETFs.

3. Inactivity Charges

Inactivity fees apply to accounts with low activity over a specified period. A platform may impose:

- No Inactivity Fee

- A Monthly or Annual Fee – on accounts that haven’t executed any trades or haven’t met a minimum trading volume within a certain timeframe.

- An Implicit Fee – Unless you remain active. These platforms don’t have explicit inactivity fees, but reduce other charges if you trade often.

Fee Example Section 🤓

Here are a few examples of how it works.

- No Inactivity fee (Interactive Brokers) – No fee is charged.

- A monthly or annual fee (SAXO Bank) – Saxobank charges $100 for every 6 months during which you do not trade.

- An implicit fee (IG UK) – IG charges £24 per quarter of platform fees. However, once you execute 3 trades, there will be no charge for that quarter. In a way, the platform fee is an implicit inactivity fee.

4. Currency conversion Fees

Why Multi-Currency Accounts May Avoid Them

Foreign Exchange (FX) fees are charges applied for currency conversion. For ETFs, you incur currency conversion charges :

- Once – When you buy/sell an ETF share class denominated in a currency that is different to the currency in which you have available funds.

- Regularly – When the ETF base currency is different to yours, and you hold an ETF Distributing Share Class that regularly pays dividends.

We explained before how it works in our dedicated guide to ETF currency fees.

FX fees are typically charged as a percentage of the transaction, often with a minimum. Pay attention to these, as they can have a considerable impact.

⚠️ Brokers that offer Multi-Currency Accounts have the advantage of not automatically converting all your transactions. This can be very advantageous.

Note: FX fees are currently not simulated in our fee comparison tool – we will add the functionality in the coming weeks.

Fee Example Section 🤓

Here are a few examples of how FX fees work:

- Low Variable Fee with Multi-Currency Accounts (Interactive Brokers) – Tiered pricing from 0.08 bps to 0.2 bps. Minimum for most clients is set at $2.

- High Variable Fee without Multi-Currency Accounts (iWeb) – Charges 1.5%.

Other fees

Other fees that you need to look at are:

- Deposit Fees – charged for certain types of deposits (e.g. Debit Cards), or conversion fees on deposits that are not in your currency.

- Withdrawal Fees – charged for withdrawals (e.g. if frequent).

- Exchange Data Fees – Brokers may charge access to real-time ETF prices monthly, or ad hoc when you trade.

- Share Transfer Fees – some brokers may charge you if decide to switch to another broker.

- Interest On Cash Fees – brokers may take a cut on the interest that is being paid on the cash in your account.

- Margin Rates – if you use leverage for ETFs.

- Security Lending Fees – as mentioned in our Broker Safety Guide, brokers may offer security lending. Some will take a substantial cut on the generated revenues.

- Non-ETF Commissions – While we focus primarily on ETFs, you may also consider other securities you intend to buy, including Mutual Funds (particularly useful in the UK), Bonds or Derivatives.

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Perform your own simulation

STEP 1: your BUY & HOLD Assumptions

How Much And For How Long?

The cheapest overall broker for your cousin may not be the best one for you.

That’s why our Broker charges comparison tool uses your specific inputs:

- Country – The tool filters available brokers in your country. Let’s assume we’re domiciled in Belgium.

- Initial Investment – It is the lump sum you invest today. Let’s assume we have €100k to invest.

- Monthly Investment – How much do you want to save with ETFs monthly, on top of the initial lump sum? After ongoing living expenses, let’s set aside €1k per month.

- Time Horizon – For how long do you want to keep injecting monthly? We plan to invest in this way for the next 25 years.

- Estimated Portfolio Return – Depending on the asset allocation, this can vary from low single figures to double digits. Let’s assume we have a 100% Equity Portfolio (and we are a bit optimistic!).

- Investment Inactivity – Some brokers penalise you when you don’t trade. Assume you may have some time when you will not contribute. Let’s assume we will take a 12-month sabbatical at some point during those 25 years.

STEP 1: Broker Cost Calculator (BETA VERSION) - Assumptions

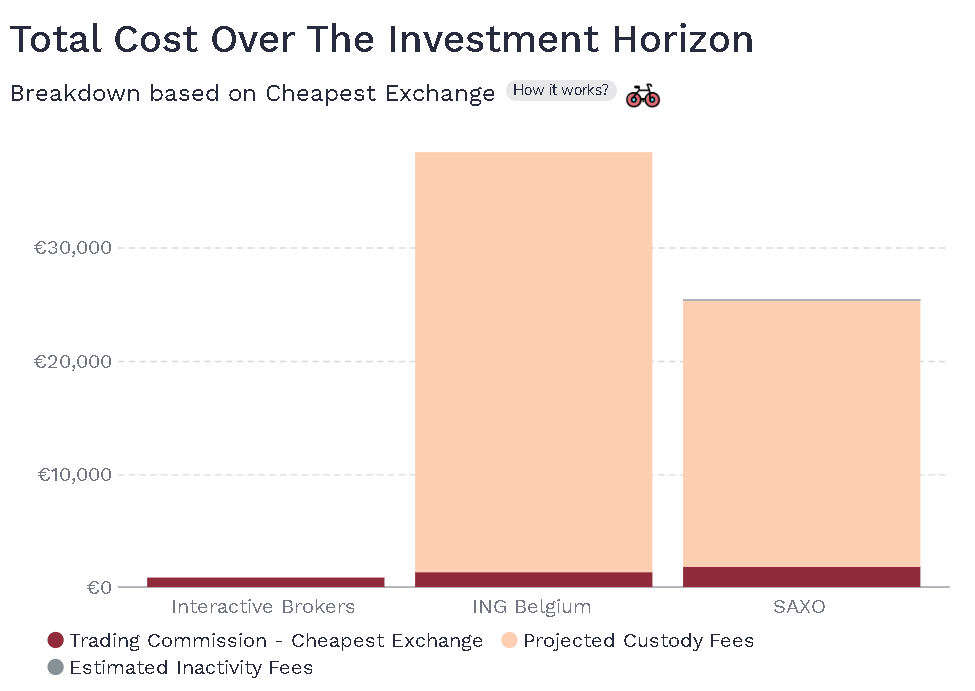

In this case, we compared three brokers for a Belgian investor:

- Interactive Brokers – a sophisticated and relatively cheap International Broker (Fixed IB SmartRouting Plan). It is available to all Europeans.

- ING Belgium – a local Bank that has a brokerage business, but is also affiliated with a big financial institution with c. €50 bn Market Cap. It is available to Belgian Investors.

- SAXO Bank – another popular International Broker. It is available to all Europeans.

STEP 2: Simulation results

What are the Overall Fee components?

All Brokers give you access to main European Exchanges including the London Stock Exchange (LSE), Xetra or EuroNext. You will have the option to choose an Exchange when trading an ETF.

Overall, trading on Xetra (for IBKR and SAXO) or EuroNext (for all three) is a bit cheaper than LSE or Six Swiss, if you’re an investor in the Eurozone, in addition to saving on FX fees.

STEP 2: Cost Comparison Breakdown (TABLE)

How do these broker differ in fees:

- Interactive Brokers does not charge inactivity fees or custody fees. It comes out by far the cheapest. If you’re trading an ETF in EUR, Euronext, Xetra or Milan have equivalent fees (although spreads may vary).

- ING Belgium – from a trading commission perspective, e.g. on Euronext, ING looks more competitive compared to Saxo. But that’s before you dig into their fee structure further and understand the long-term consequences of the 0.02% (plus VAT) custody fee each month. Over 25 years, it adds up to over €37k in total fees!

- SAXO – comes out second, but is also very expensive due to a 0.0125% monthly custody fee. On top of that, we assumed that the investor stops investing for 12 months ($200 charge), which converted to EUR gives an additional €188 fee.

STEP 2: Cost Comparison Breakdown (GRAPH)

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

WHat else you need to consider

What if the broker doesn't charge any fees?

It may work, unless they restrict the exchanges you use.

In the next parts of our guide, we will look at other considerations, that include broker interfaces, ETF availability, or tax reporting.

But before that, let’s look at some of the new kids on the block – Neo Brokers that charge no fees. Should you consider them? It depends. First, consider Broker safety. Then, for very small transactions – it could make sense. But, once your portfolio increases, dealing on a single market-maker Exchange is usually not the cheapest. And those brokers may need to alter their business model given the recent EU PFOF ban. Finally, consider other aspects like share transfers. It could be key if you want to move away one day.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.