Weekend Reading – 15 Investment Books Wall Street Doesn’t Want You to Read This Christmas

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist:

A lot of people think that if they have a hundred stocks they’re investing more professionally than they are if they have four or five. I regard this as insanity.

Charlie Munger

INVEST WISELY

CONSTRUCT YOUR PORTFOLIO

The holiday season is just around the corner, and with it comes the challenge of finding a great gift for your loved ones. Why not opt for a personal finance book this year?

Given that most of them teach you how to achieve high returns without trading, we know some that won’t be happy with your gifts – Wall Street & Financial Media.

Let’s dive into 15 book gift ideas!

In the end, any investment outcome comes from two sources: (1) savings, or the amount contributed toward a goal over time and (2) investment returns, which affect the growth (or the decline) of invested savings. Asset managers focus heavily on the latter. The navigation of market swings, along with asset allocation recommendations, are the bread and butter of the industry. But that’s not the most meaningful part of the story.

Read more on Vanguard

UNDERSTAND FINANCIAL MARKETS

- What’s Really Driving Inflation and Bond Yields? (Morningstar)

- Visualizing $97 Trillion of Global Debt in 2023 (Visual Capitalist)

- Long Periods of Boredom (Research Affiliates)

- The forces shaping the real estate industry (Goldman Sachs - 52 min)

- Why Argentina's problems persist & what options it has going forward (Bloomberg - 32 min)

- How Target-Date Funds Stabilize Markets (Morningstar)

HOW TO INVEST

Active Investing

FACTOR investing

Andrew Beer is a managing member at DBi, which manages ETFs and mutual funds that seek to outperform hedge funds with low fees.

Their two ETF’s – DBMF & DBEH bring alternative strategies to public, liquid markets in ETF format with comparatively low fees.

But the most interesting part of the podcast are the first 30 minutes about Value Investing Back in the days vs. Today.

discretionary investing

The Magnificent 7 stocks1 continue to capture the focus of investors as these large growth names have outpaced the bulk of global equities. Their outperformance is notable because eye-popping returns for top stocks tend to occur before they reach the top of the market. Once there, subsequent returns tend to lag the market. This is a cautionary tale for investors expecting continued outperformance from the Magnificent 7.

Read more on Dimensional Funds

If you ask a large enough number of people to repeatedly flip a coin, someone will flip 10 heads in a row. Similarly, we should expect some strategies to generate outstanding results just by chance if we try enough parameter combinations. Indeed, the best-performing strategy is only one out of 720 strategies we simulated. As shown, the vast majority of these timing strategies underperformed. And this is before considering any trading and tax costs.

Read more on Dimensional Funds

ALTERNATIVE ASSET CLASSES

WALL STREET

Read the Almanack in an interactive format.

Poor Charlie’s Almanack – The Essential Wit and Wisdom

of Charles T. Munger

Read more on Stripe Press

Video About Charlie Munger - The man who built Berkshire Hathaway (FinAIus - 22 min)

Charlie Munger perhaps is the man most instrumental to Berkshire Hathaway’s success. This mini-documentary tells the story of life and how he went through the great depression, made millions in real estate, and helped Warren Buffett build Berkshire Hathaway.

SUSTAINABLE investing

crypto

BAD BETS

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

ETFs

UCITS ETFs

Return Stacked ETFs, are innovative financial products that have recently become available in Europe. These ETFs operate on the principle of “Return Stacking,” which involves layering one investment return on top of another to achieve more than $1.00 of exposure for each $1.00 invested. While you may find the concept intriguing and potentially more capital efficient, it’s crucial to understand that these are complex, leveraged products not suitable for the majority of investors.

Read more on Italian Leather Sofa

Robeco is stepping into the European ETF market with a focus on active funds. The Dutch asset manager, which has €181bn assets under management, is planning to launch its first UCITS ETFs in Q2 2024. [FT.com]

Xetra has seen the launch of 3 new fixed income ETFs by the German asset management group DWS. The ETFs provide ultra-short-duration exposure to bonds from issuers of Eurozone sovereigns. All the ETFs have a 0.07% fee. [ETFStrategy.com]

US ETFs

BlackRock is set to launch ten ETFs focused on Treasury inflation-protected securities (TIPS). Ranging in maturity from 2024 to 2033, these ETFs will seek to provide inflation protection to investors concerned with erosion of purchasing power. The new TIPS-defined maturity bond ETFs will carry an expense ratio of 0.1%. [ETF.com]

Personal Finance

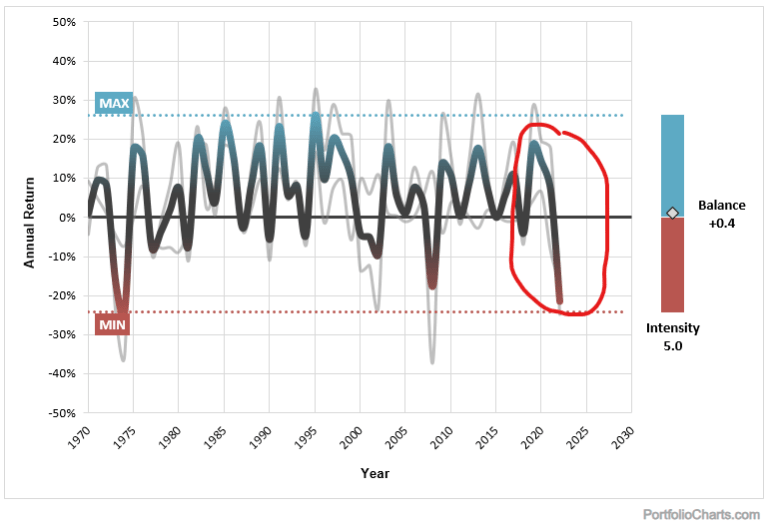

Early Retirement

FINANCIAL PRODUCTS

COST OF LIVING

OUR Community

Question of the week

DESIGN YOUR LIFESTYLE

Personal Development

- Unpacking the emotion no one wants to talk about (Art of Manliness - 1 Hr 1 Min)

- Be Stingy With Time (The daily stoic - 11 Min)

- The what I don't want list (Mr. Stingy)

- Solving the Wrong Problem (Of Dollars and Data)

- Marshmallow Mind tricks us into believing that the rewards for delayed gratification compound forever. (The alchemy of money)

Andrew Huberman, is a neuroscientist and professor in the Department of Neurobiology at Stanford University’s School of Medicine. He has made numerous important contributions to the fields of brain development, brain function, and neural plasticity.

Andrew is the host of the podcast Huberman Lab, which is often ranked as one of the top five podcasts in the world/

CAREERS

TECH AND SCIENCE

An Introduction to AI for everyone (Andrej Karpathy - 1 hr)

This is a 1 hour general-audience introduction to Large Language Models: the core technical component behind systems like ChatGPT, Claude, and Bard. What they are, where they are headed, comparisons and analogies to present-day operating systems, and some of the security-related challenges of this new computing paradigm.

Travel

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

miscellaneous

- Visualizing the Rise of the U.S. Dollar Since the 19th Century (Visual Capitalist)

- Germans don’t care that much about beauty; Italians, meanwhile… (Joachim Klement)

- Wall Street banker pays $2 million sight unseen for coal mine then discovers it's filled with $37 billion worth of rare Earth elements (Yahoo Finance)

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – Global Shocks: How Do Stocks Perform?

Trading 212 Review: Pros & Cons

Cash Is Not Enough: Why Hold Bond ETFs Despite Price Rollercoasters.

The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Halifax Share Dealing Review – Similar To Lloyds With SIPP On Top

Lloyds Share Dealing Review – Old School But Ticks The Boxes For Golden Retrievers

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.