The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Definitive guide to choosing a stock broker - Part 4

This is part 4 of Bankeronwheels.com Definitive Guide to choosing a Stock Broker.

In part 3 of our ultimate guide to choosing a Stock Broker, we explained why in the EU, Broker protections are inadequate. Certain brokers subscribe to a private insurance to provide a higher protection level.

Today, let’s look at what these protections are really worth.

KEY TAKEAWAYS

- Investment Protection Schemes Are Inadequate. In most of the EU, they cover up to €20k in a case of broker bankruptcy combined with a fraud. Policymakers should revise these limits to allow Europeans to invest with more confidence.

- In Theory, A Private Insurance May Look Like A Solution. In the meantime, certain brokers subscribe to an insurance to cover losses for a much higher amount. This is typically the case for unlisted Tier 2 and Tier 3 Brokers. Tier 1 Brokers typically have longer track record are often listed and have better transparency, and thus less need for such insurance policies.

- Broker Disclosures Are Inadequate. Certain brokers advertise such insurance policies as a key safety feature with up to €1 million insurance per client on their homepages. Brokers typically link it to a one-pager ‘evidence of cover’ from a leading UK Insurer – Lloyd’s. However, these one-pagers omit key policy limitations.

- Aggregate Caps Are Very Low. We investigated these policies and found that aggregate limits (for all broker clients) are typically very low. We urge brokers to fully disclose caps, thus reflecting the true nature of these guarantees.

Here is the full analysis

Why do brokers want to take insurance policies?

Investment protection schemes in the EU are problematic

In Europe, they typically cover up to €20k

In an unlikely scenario of fraud combined with a Broker bankruptcy, there is a likelihood that you may not recover your shares. We have a dedicated guide explaining how broker safety works. Some countries have created compensation schemes for these specific instances. Unfortunately, for most of Europe the coverage levels are very low. Below are the levels from our broker safety guide.

What is defined as fraud? Technically it’s defined as Misconduct and includes ‘the loss of cash or securities belonging to a broker’s customer as a result of theft, misplacement, robbery, hold-up, burglary, embezzlement, wrongful abstraction, larceny, false pretences’. Importantly, it also includes ‘fraud by the broker or any of its employees, agents, or any other person’.

Summary of Compensation Schemes

| Country | Investment Guarantee | Coverage Level | Cash Guarantee | Guarantor |

|---|---|---|---|---|

| US | $500k | 100% | Combined up to 250k | SIPC |

| UK | £85k | 100% | Additional £85k | FSCS |

| Spain | €100k | 100% | Combined | FOGAIN |

| Hungary | €100k | 100% | Combined | BVA |

| France | €70k | 100% | Combined | FGD |

| Portugal | €25k | 100% | Combined | SII |

| Poland | €22k | up to €3k - 100%, €3-22k - 90% | Combined | KDPW |

| Netherlands | €20k | 100% | Combined | ICS |

| Belgium | €20k | 100% | Combined | GF |

| Italy | €20k | 100% | Combined | FNG |

| Denmark | DKK 150,000 | 100% | Combined | FS |

| Germany | €20k | 90% | Combined | EDW |

| Ireland | €20k | 90% | Combined | ICC |

Can an insurance be the remedy?

In theory, an insurance could protect customers to a higher amount

For a broker, a solution would then be to take an insurance on a much higher amount to protect its customers. This is especially relevant for Tier 2 or Tier 3 brokers that are not rated, listed or have a strong parent group.

We found such policies common across jurisdictions (including the UK, Australia or Cyprus) for CFD or FX brokers – which we call Tier 3 Brokers and we recommend investors to stay away from – including:

- eToro

- ThinkMarkets

- Infinox and similar;

Example of Trading 212: insurance of €1 Million per customer

However, it also applies to Tier 2 brokers. Tier 2 brokers are getting popular amongst long-term investors and investors typically put less faith in their operations than in Tier 1 or Bank-backed Brokers, due to their shorter track record, lower transparency, sometimes lack of profitability or a Tier 2 regulator.

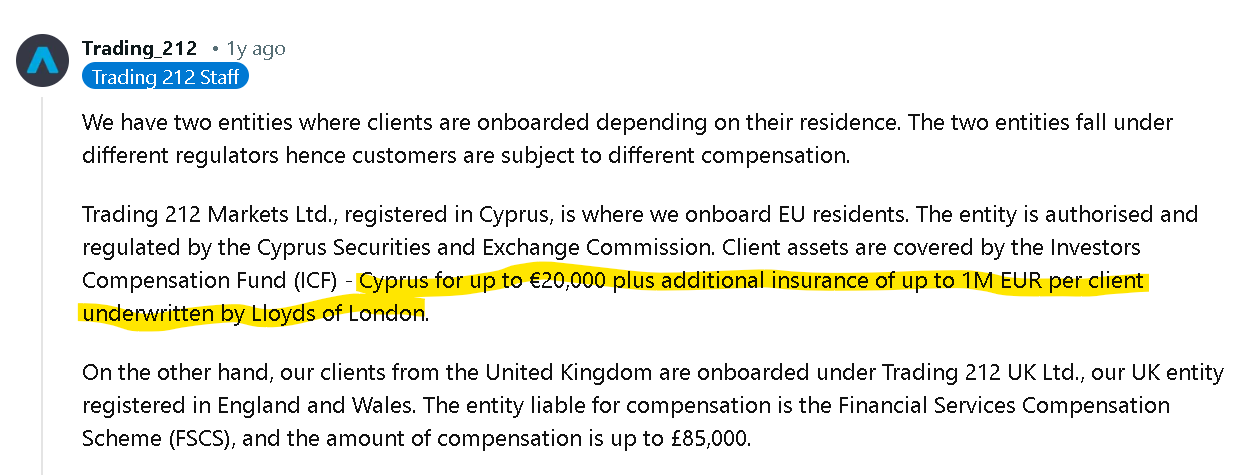

But even more profitable Tier 2 brokers advertise insurances of up to €1 Million per customer for their EU operations. XTB or Trading 212 are some examples, with Trading 212 being the most vocal about this protection.

Trading 212 Homepage - Safety section

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

What Is Often undisclosed?

disclosures are insufficient or even misleading

Certain Tier 2 Brokers omit essential policy details

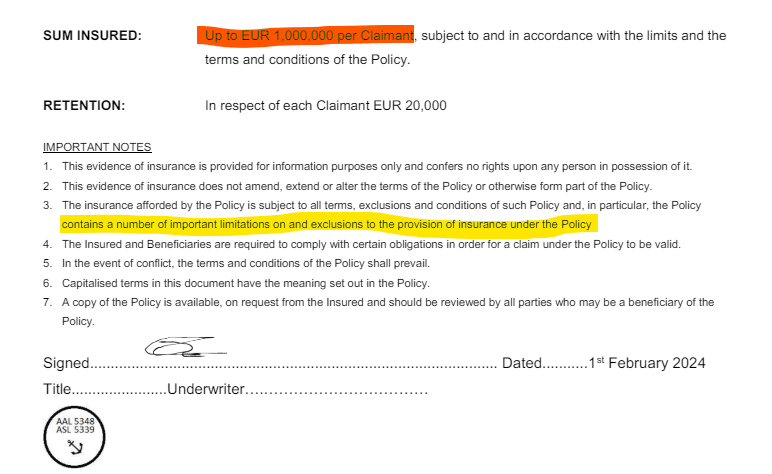

When you dig into the relevant Trading 212 documentation you will find a one-pager ‘Evidence of Cover’ from Lloyd’s below. Lloyd’s is the main coverage provider for these types of insurances. As with all financial products, the devil is in the details. One of them is the aggregate cap. And here, you won’t find it.

Trading 212 Insurance - Evidence of Cover (Lloyd's)

On forums, Brokers' Staff doesn't stress that caps exist

While most investors may not be aware of the nature of these contracts we find that these clarifications should be disclosed when asked about the insurance.

Aggregate Caps are part of these insurance contracts.

Lack of full disclosure

We find it unfair towards clients and other brokers that such details are omitted. We also think that putting safety guarantees as one of the main features on the frontpage without providing the details is a serious omission.

In an extreme scenario - a very misleading marketing

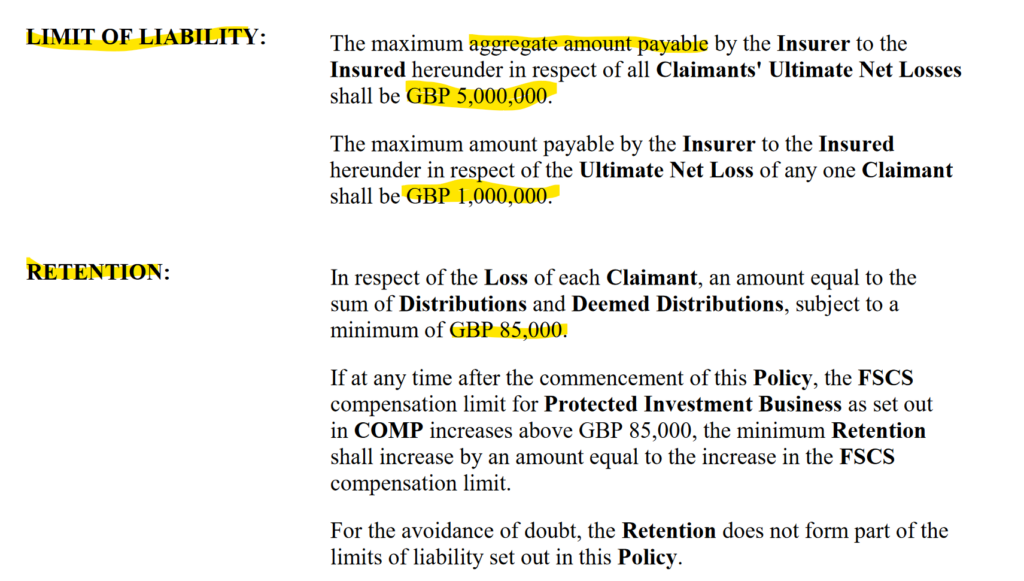

We sourced a full contract where this level was €1 million per customer with an aggregate Cap of €5 million

While these policies are private in nature, we investigated this issue and sourced full 25-page-long contracts from a couple of peers. We find that levels are extremely low. The most extreme case of a UK entity states:

- A £1 million per customer coverage.

- A total cap of £5 million for all customers.

Full Insurance Policy - extract from peer broker

The Trading 212 Cap is €20 Million

We have requested the full insurance contract from Trading 212 which wasn’t able to disclose it.

However, post initial publication of this article, we have received an email from a reader that had access to the 2023/24 Trading 212 Insurance contract. Our suspicion based on our investigation was correct. The amounts are very low indeed and in the same ballpark as the peer contracts we reviewed.

Full Insurance Policy - Extract from Trading 212 contract

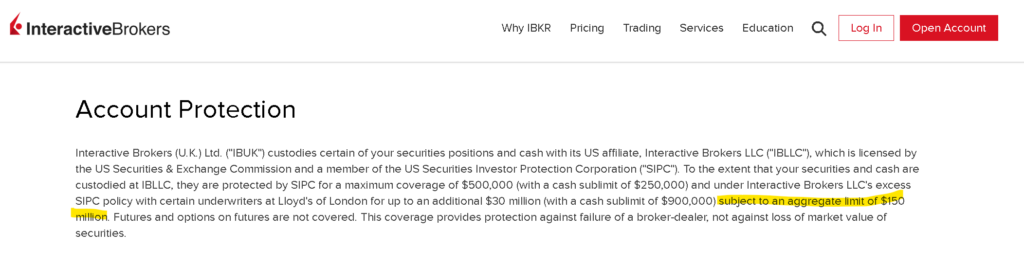

Even in the case of interactive brokers the limits are low

IBKR has $430 Billion of assets, against a $150 million cap.

Interactive Brokers – one of the industry leaders – has an aggregate cap of $150 million for assets that are $430 billion. Tiny, and fairly irrelevant for IBKR that similar to other Tier 1 brokers relies more on its reputation, transparency/listing and debt rating to convince investors. But, that’s probably as high as any brokerage would get from Lloyd’s.

Based on this benchmark and our investigation, we have reasons to believe that any Tier 2 Brokers will have much lower levels.

example of Proper disclosure (Interactive brokers)

our request to brokers

🚨 what needs to change

full disclosure & investor education is the absolute minimum

We understand that the environment is tough for innovating Tier 2 brokers and policymakers in the EU don’t make enough to promote safe investing by increasing the coverage levels.

However, we think that there should be a level playing field between the market participants and transparency.

We think that brokers should at the minimum:

👉 Clearly disclose the aggregate caps on the website

👉 Properly explain the policy limits to investors when asked about the insurance

⚠️ How we incorporate insurance in our broker reviews

We give no credit to the insurance policies

Unless the insurance levels are fully disclosed and adequate we do not give credit to such contracts and recommend investors to remain cautious.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

What else should you consider?

Beyond safety, considerations come into play including (i) type of products (ii) fees (iii) country/language or (iv) convenience, like tax reporting. In the next article, let’s have a look at Broker fee structures.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – Global Shocks: How Do Stocks Perform?

Trading 212 Review: Pros & Cons

Cash Is Not Enough: Why Hold Bond ETFs Despite Price Rollercoasters.

The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Halifax Share Dealing Review – Similar To Lloyds With SIPP On Top

Lloyds Share Dealing Review – Old School But Ticks The Boxes For Golden Retrievers

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.