Year-End Reading – Wise Money Got It Right. Again.

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist:

The content of your character is your choice. Day by day, what you choose, what you think and what you do is who you become.

Heraclitus

INVEST WISELY

CONSTRUCT YOUR PORTFOLIO

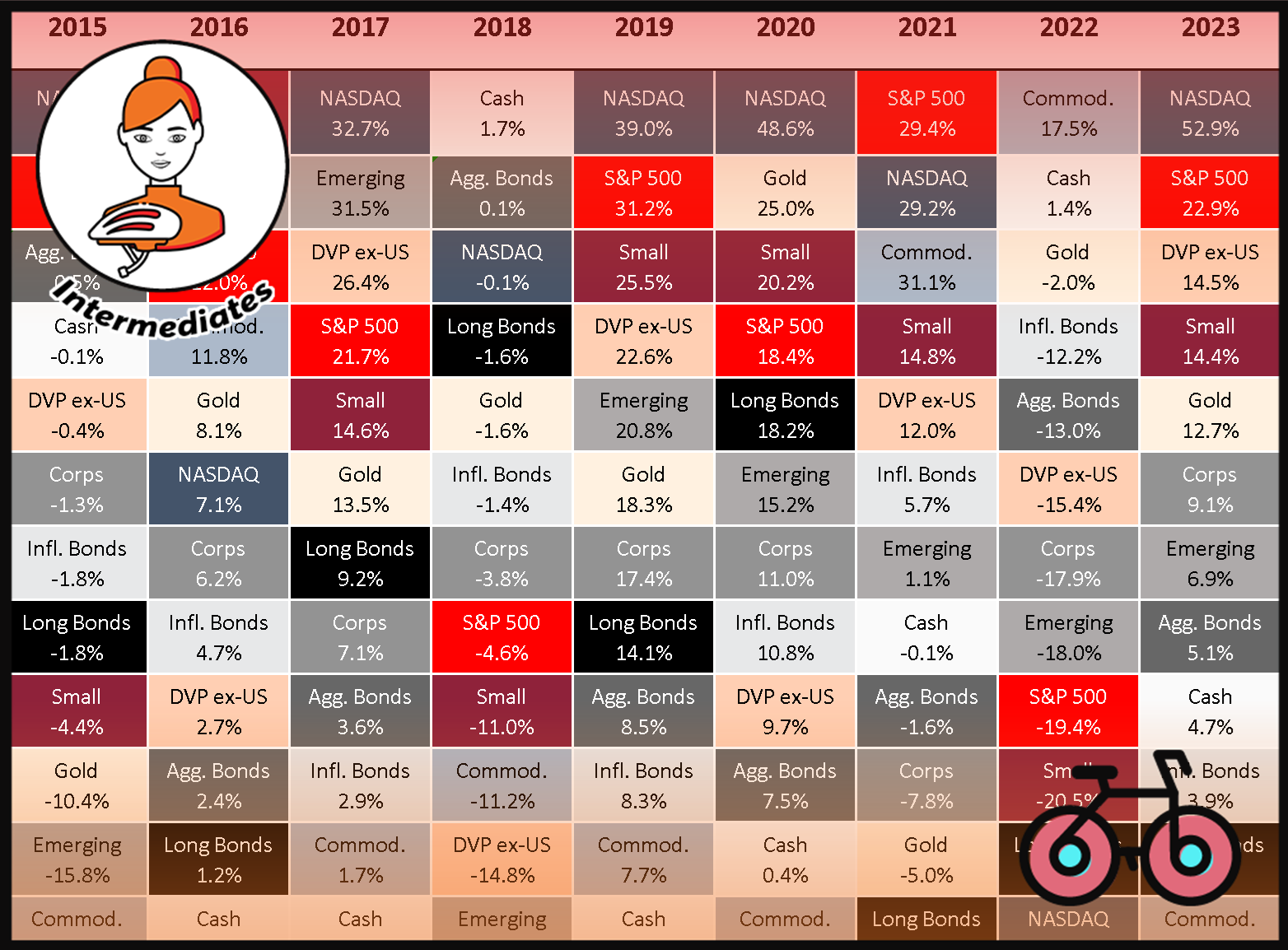

2022 losses meant 2023 gains. The past decade has been great for investors accumulating for the future, but also those consuming their portfolios. It’s also fairly representative of longer time horizons. Global Equities have gained over 215% and returned 7.9% annually. Wise Money Beat Smart Money. Once Again.

Today, it’s time to rebalance your portfolio – maybe buy some losers (I look at you – Bonds and Value Stocks), and revisit your plans for 2024 and beyond.

- Why Investors Benefit From the Return Of Sound Money (Vanguard)

- Growth Investors: You Probably Need to Rebalance Your Portfolio (Morningstar)

- The Advantage for Stocks When Inflation Rises (Morningstar)

- The case for greater portfolio diversification (Goldman Sachs - 33 Min)

- The case for International Stocks from the lens of JP Morgan (Meb Faber - 51 Min)

UNDERSTAND FINANCIAL MARKETS

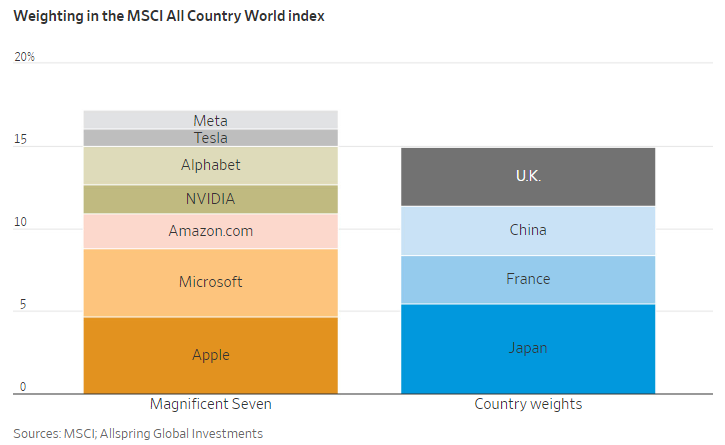

These seven stocks combined are bigger than the stock markets of the United Kingdom, China, France and Japan put together. Apple is roughly the same size as Japan. Microsoft is bigger than the UK. Google is nearly the size of the entire French stock market. As much publicity as these companies get, I feel like we almost don’t spend enough time talking about how insane these numbers are.

Read more on A Wealth of Common Sense

- The 2024 Vanguard Economic & Markets Outlook - hosted by Rick Ferri (Bogleheads on Investing - 58 Min)

- At The Very Least, AI is a Force for Disinflation (Morningstar)

- Markets are becoming less efficient, not more, says AQR's Cliff Asnes (FT)

- How is the financial services sector, often seen as a bellwether for the economy, coping with inflation, interest rates, and greater regulatory pressures? (Goldman Sachs - 28 min)

The world economy has already had a difficult two years, with inflation sparking a cost of living crisis across many countries.

Now, ships diverted from the Suez Canal will be forced to go around the Cape of Good Hope, much like trade did before the Suez Canal existed.

This longer journey increases fuel costs, reduces shipping efficiencies. The price of Brent Crude has already climbed 8% in the last week.

Read more on Visual Capitalist

HOW TO INVEST

- Confessions of an Analyst: My Five Investing Mistakes (Morningstar)

- What coming face-to-face with a grizzly bear can teach you about managing your money (Market Watch)

- If you’ve been fighting the recovery the whole way up, it’s time to change who’s influencing the way you think about the market. (Irrelevant Investor)

- 2023: Another miserable year for market forecasters (Mathematical Investor)

Active Investing

FACTOR investing

discretionary investing

- The four 4s behind the compelling opportunity in Japanese Equities (GMO)

- Can Japan's legendary savers spark a stock market boom? (FT.com, click on the first link)

- 5 Drivers Behind the Growth of the GPU Cloud Computing Market (Visual Capitalist)

- Dr. Yield Curve, Neighbour Tracking Error & The Emerging Markets Decade (Meb Faber - 1 Hr 12 Min)

- 7 Predictions (plus 1) for 2024 (Italian Leather Sofa)

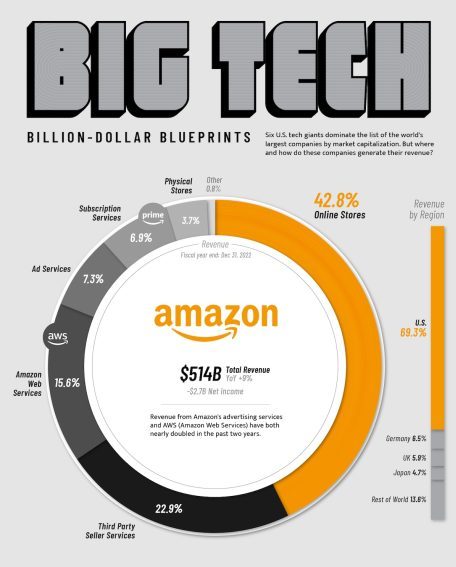

Alphabet made slightly north of $280 billion in 2022, nearly 60% of that coming from monetizing Google Search and other related activities. Apple’s 25% net profit margin is the second-highest amongst the Big Tech companies.

Nevertheless, even Apple has less-than-stellar years on occasion. Sales for all Apple products declined year-on year, pulling revenue down 5%. The iPhone continues to be the company’s chief moneymaker, contributing 52% of total revenue. Microsoft earned nearly $212 billion for its financial year ending July 2023, led by gains in their cloud and server segment, which CEO Satya Nadella prioritized back in 2014.

Read more on Visual Capitalist

ALTERNATIVE ASSET CLASSES

WALL STREET

SUSTAINABLE investing

crypto

BAD BETS

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

ETFs

UCITS ETFs

Return Stacked ETFs, are innovative financial products that have recently become available in Europe. These ETFs operate on the principle of “Return Stacking,” which involves layering one investment return on top of another to achieve more than $1.00 of exposure for each $1.00 invested. While you may find the concept intriguing and potentially more capital efficient, it’s crucial to understand that these are complex, leveraged products not suitable for the majority of investors.

Read more on Italian Leather Sofa

Robeco is stepping into the European ETF market with a focus on active funds. The Dutch asset manager, which has €181bn assets under management, is planning to launch its first UCITS ETFs in Q2 2024. [FT.com]

Xetra has seen the launch of 3 new fixed income ETFs by the German asset management group DWS. The ETFs provide ultra-short-duration exposure to bonds from issuers of Eurozone sovereigns. All the ETFs have a 0.07% fee. [ETFStrategy.com]

US ETFs

BlackRock is set to launch ten ETFs focused on Treasury inflation-protected securities (TIPS). Ranging in maturity from 2024 to 2033, these ETFs will seek to provide inflation protection to investors concerned with erosion of purchasing power. The new TIPS-defined maturity bond ETFs will carry an expense ratio of 0.1%. [ETF.com]

Personal Finance

Gain profound insights into the significance of inflation-protected bonds, target date funds, and an all-equity strategy. Comparing his latest paper with prior research on withdrawal rates, Professor Cederburg highlights surprising aspects of the results and provides invaluable takeaways. Discover how this pioneering work challenges conventional wisdom, reshaping the landscape of retirement planning and investment strategies in this illuminating conversation with Professor Scott Cederburg.

Early Retirement

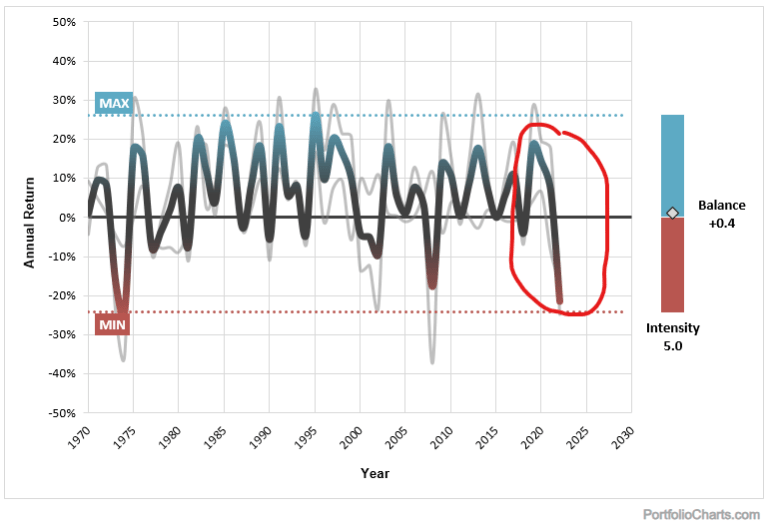

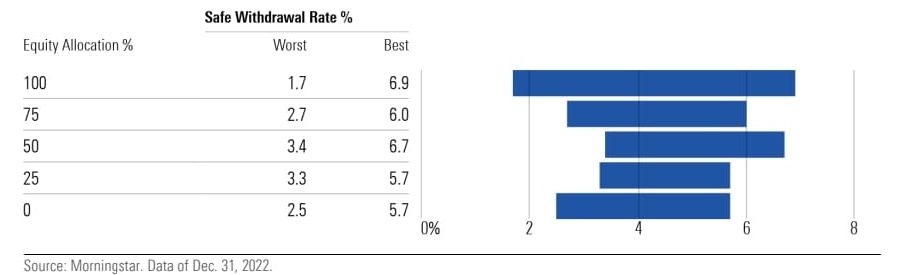

Morningstar’s 2023 research suggests that 4.0% is the highest safe starting withdrawal rate for retirees. The highest starting safe withdrawal rate for a 30-year horizon with a 90% probability of success was 3.3% in 2021 and 3.8% in 2022.

Read more on Morningstar

FINANCIAL PRODUCTS

COST OF LIVING

OUR Community

Question of the week

DESIGN YOUR LIFESTYLE

Personal Development

Dwight Eisenhower gave himself the order. Quit smoking.

It had become a 4-pack-a-day habit. It had been part of his life for nearly 40 years. It was comfortable. So, after nearly four decades of smoking, he made the decision to quit, cold turkey.

“The only way to stop is to stop,” Eisenhower would tell an aide, “and I stopped.”

CAREERS

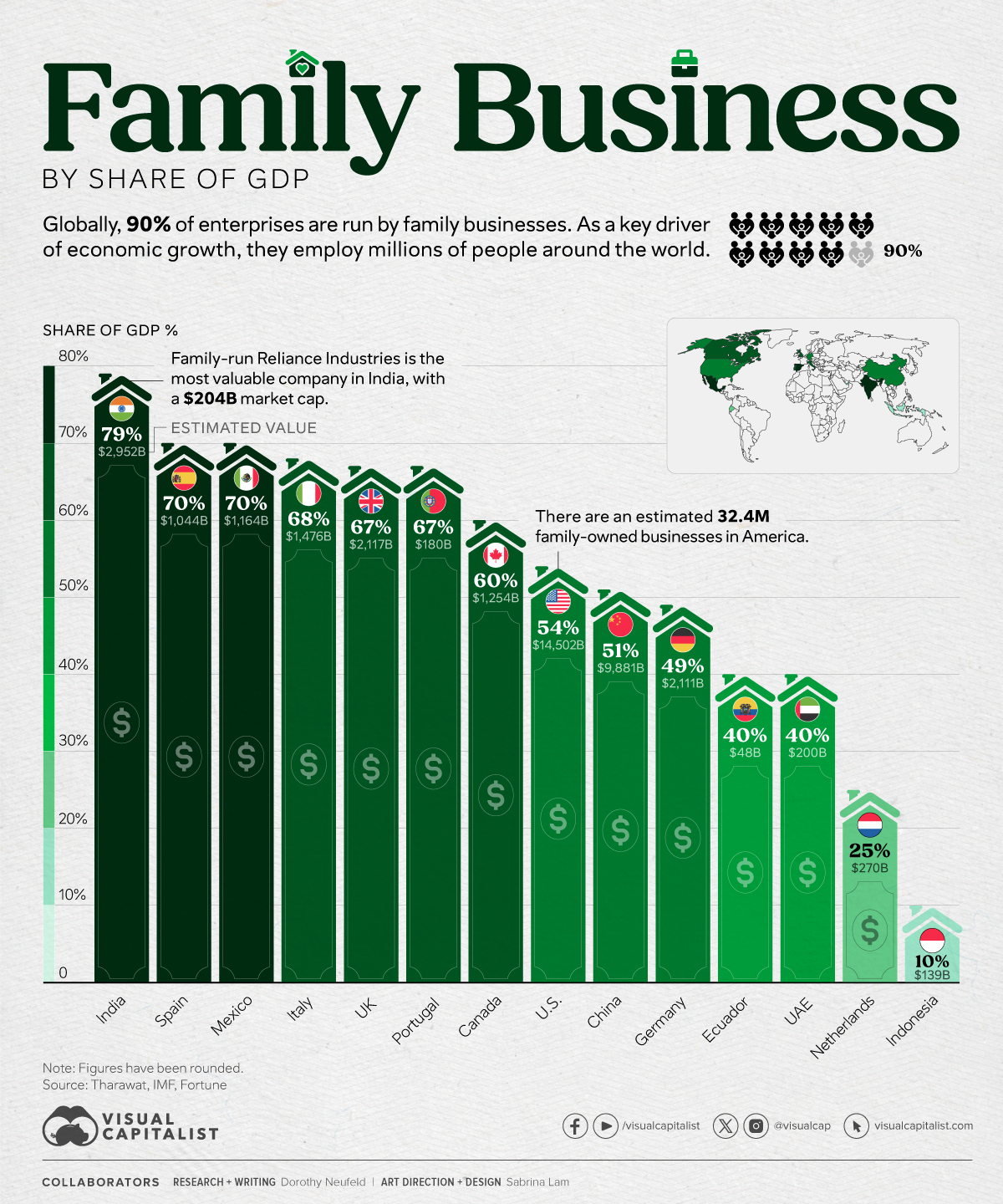

79% of India’s economic output is fueled by family-owned businesses, the highest across the dataset. Following India are Spain and Mexico, with family businesses making up 70% of GDP and contributing over $1 trillion to these economies each year. In the U.S., an estimated 32.4 million businesses are family-owned that collectively generate $14.5 trillion in GDP. Just as family businesses have significant influence over global GDP, family offices also own a large portion of global assets.

Read more on Visual Capitalist

TECH AND SCIENCE

An Introduction to AI for everyone (Andrej Karpathy - 1 hr)

This is a 1 hour general-audience introduction to Large Language Models: the core technical component behind systems like ChatGPT, Claude, and Bard. What they are, where they are headed, comparisons and analogies to present-day operating systems, and some of the security-related challenges of this new computing paradigm.

Travel

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

miscellaneous

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – Global Shocks: How Do Stocks Perform?

Trading 212 Review: Pros & Cons

Cash Is Not Enough: Why Hold Bond ETFs Despite Price Rollercoasters.

The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Halifax Share Dealing Review – Similar To Lloyds With SIPP On Top

Lloyds Share Dealing Review – Old School But Ticks The Boxes For Golden Retrievers

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.