How I Lost Money in Real Estate Before it Was Fashionable (Book Review)

How I Lost Money in Real Estate Before it Was Fashionable by JL Collins tells the story of his disastrous condo purchase in the 1970s and 80s.

The short book demonstrates how, contrary to popular opinion, real estate isn’t always an amazing investment and that potential homeowners should be critical before buying.

As such, it is applicable for investors around the world who are thinking of purchasing a property.

With Collins’ helpful list of tips, you will be better equipped to make sound financial decisions when it comes to real estate.

KEY TAKEAWAYS

- If you are not familiar with Collins, we previously covered the author’s “Simple Path to Wealth that sold over 400,000 copies worldwide.

- Collins doesn’t aim to educate you on the details of real estate investing; he also doesn’t dissuade you from ever buying property. He states it can be a good lifestyle choice or even a sound investment.

- The brief story and the subsequent helpful tips are meant for young or new investors wondering whether the property is an excellent idea for them.

- They might be under some pressure from family and friends to get on the housing ladder ASAP, which may or may not be a good choice for them at the time.

- Collins offers a more balanced view and demonstrates how blindly buying property can be dangerous in the hopes that it will always go up.

Here is the full analysis

There is a rather common misconception that real estate is a sure-fire winner all the time. It’s not. JL’s tale of condo woe is a prime example of just how wrong it can go when you jump in blindly with both feet. This story should be required reading for everyone before they buy their first property.

Mindy Jensen

JL Collins’ Story

At the heart of How I Lost Money in Real Estate Before it Was Fashionable is the author’s own story about buying a condo in his youth.

He describes in detail how he purchased the first place that was shown to him without doing much research.

The apartment was not finished, but the contractors promised to have it done by his desired move-in date.

Unfortunately, Collins failed to inspect the work, and nothing was done several months in.

However, he didn’t take the developer up on his offer of a refund because he had already invested time and energy into the place.

Eventually, he signed the contract and moved in, only to find that the mortgage and building fees were significantly more expensive than his rent used to be.

Some years later, he moved into a bigger place with his new partner, but the rent he could charge for the condo didn’t cover the mortgage and fees, which meant that he was still losing money.

By the time he sold the place, it was worth significantly less than he paid for it.

With taxes, he lost a total of $26,480 on a $40,000 unit.

Be More Critical

The first lesson we can take from Collins’ experience is that you should always be critical about any deals you enter into and the info that is given to you.

Before you even start your real estate journey, read extensively about the kind of transaction you hope to make and the local market.

When you’re speaking to agents or other professionals, always examine their advice critically. Is it accurate and appropriate for your situation? Are they trying to sell you something?

If in doubt, you should get a second opinion.

Similarly, always inspect the work being done on your property.

For the developers and construction workers, you are just another job, so they won’t advocate for you or make an extra effort if you don’t monitor the situation.

Over the next several months, as I shared the good news with friends and colleagues, I received wise and consistent advice. Visit the work site often. Monitor the progress. Stay on top of it. This, of course, I failed to do. I didn’t have time. I didn’t have the expertise. I didn’t have the inclination. They were the experts. I had effectively hired them to do a job, why would I want to get in the way? Why indeed.

JL Collins

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Be More Analytical

Most people you meet will tell you that buying a property is always better than renting because you’re building equity.

However, this isn’t always true.

JL Collins spent less than $200 per month on his rental place, while his condo cost him over $500 due to a large mortgage and high maintenance fees.

What’s more, it didn’t appreciate because of the market crash, so he lost money on it in the end.

He calls this type of investment an alligator because it eats you alive, financially speaking.

It’s better to rent than to own such a property.

Before you dive in, run the numbers and check that you are not at risk of making a mistake.

While renting can be expensive, it is sometimes a better deal, and it is also advantageous because you don’t have to worry about maintenance work.

Collins has included one of his most popular blog posts in the book, which explains why real estate is often a terrible investment.

It’s illiquid, tied to the fortunes of one location, expensive to buy and sell, and hard to maintain.

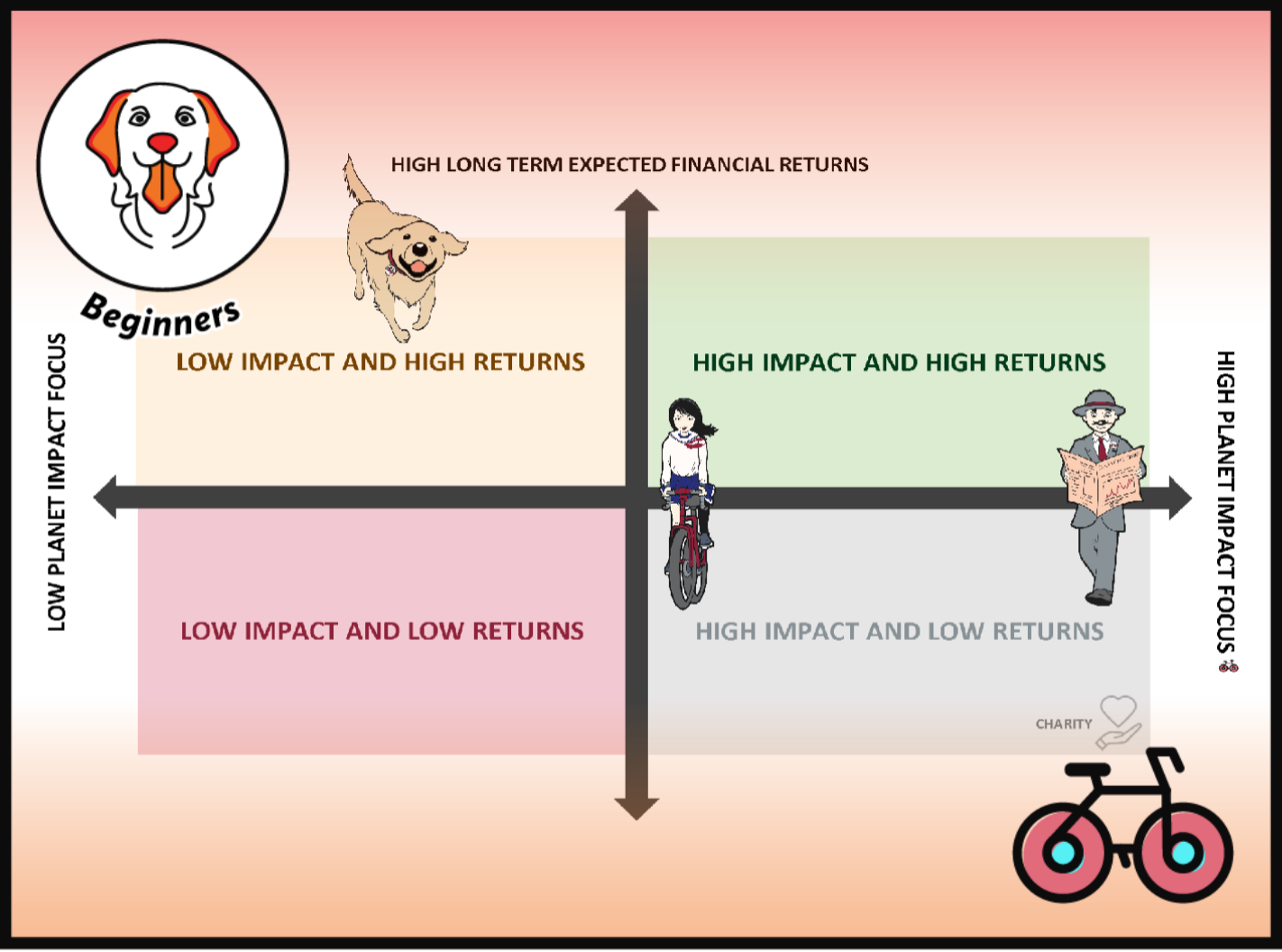

But that doesn’t mean you should always avoid it.

You might still decide to purchase a house or flat after evaluating all the pros and cons, especially because it can create stability for you and your family.

If you do so, you should be clear on whether you will live in the place or rent it out.

The home you buy for yourself is rarely good as a buy-to-let, and it can easily turn into an alligator.

You don’t want to be backed into becoming a landlord due to circumstances out of your control.

For this reason, you should always make sure you will be able to sell your property on before you purchase it – unless you know that you will want to live there for the rest of your life.

Be More Friendly

Finally, Collins emphasizes how much it can pay off to be friendly and build up connections to the people you are interacting with.

If you have good tenants that pay the rent on time and don’t destroy your property, be

accommodating and make sure they want to stay with you as long as possible.

If you are renting, be a good tenant.

You are likely to get better deals, and your landlord might even help you out if your circumstances change or you have an issue.

When you buy your property, make friends with the professionals you deal with and the other people in your neighborhood.

You never know when you will need their help, and good relationships can really pay off in tough situations.

For example,

Collins believes that he wouldn’t have been able to sell his condo if he hadn’t been friendly with the condo association president.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

SHOULD YOU BUY THIS BOOK?

How we rated the book

Our overall rating comprises five key considerations, including suitability for beginners and European and UK readers.

1. Beginner-Friendly

2. Investing Concepts

3. Investing How-to (Europe)

4. Financial Freedom Principles

5. Personal Finance Know-how

1. Beginner-Friendly

2. Investing Concepts

3.Investing How-to (Europe)

4. Financial Freedom Principles

5. Personal Finance Know-how

Rating justification

How I Lost Money in Real Estate Before it Was Fashionable is an important book because it counters the common misconception that buying property is always a good decision.

It is appropriate for beginners, although the author assumes that readers have enough financial resources for a property purchase.

His tips are applicable to people around the world because they are broad and general, and they don’t rely on a specific location or housing market.

I enjoyed reading this book because I am a renter and am often challenged about it.

Collins offers some valuable advice for people who are ready to make an investment but not sure property is for them.

However, the book is not a guide to buying real estate, so you will have to do a lot more research before you can dive in.

It is quite short, and you can read it in one afternoon.

While I would have liked to see some more detailed content, it is well worth reading and will appeal to a diverse audience.

By implementing Collins’ sound advice, you can save you a lot of money and hassle.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Lloyds Share Dealing Review – Old School But Ticks The Boxes For Golden Retrievers

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

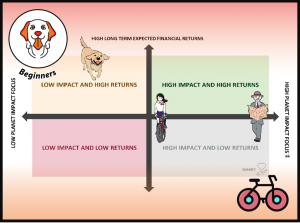

Three Sustainable Investing Strategies That Actually Work

ETF Fees – How They Work & How to Minimise Them!

How Much Should You Pay For An ETF?

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.