Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist:

The function of economic forecasting is to make astrology look respectable.

John Kenneth Galbraith

Featured

When I launched Bankeronwheels.com four years ago, my ambition was to spread knowledge to a diverse audience. But over the years, I’ve noticed that we inevitably also attract like-minded people. Part of our audience are wealth management firms, aspiring financial planners, investment bloggers, and entrepreneurial spirits alike. If that’s you, this article is dedicated to you. Here are the four takeaways from four years of blogging.

Portfolio Construction

Asset Allocation

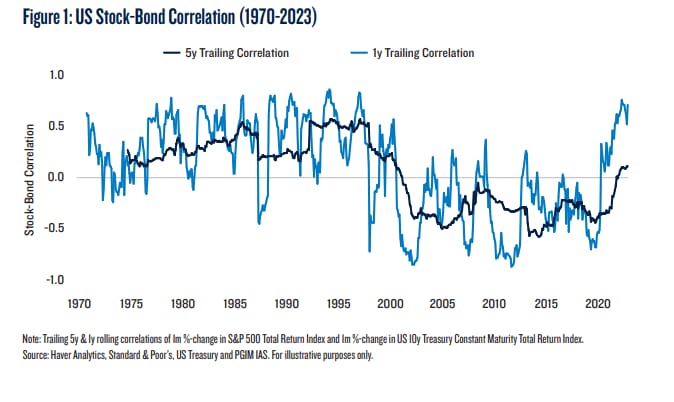

As part of PGIM IAS’s ongoing research on strategic portfolio construction, we have explored the macro drivers, global linkages, and portfolio construction implications of stock-bond correlation.This paper builds on our previous research and addresses what elements of the current economic landscape we think ought to be top of mind for asset allocators and risk managers.

Read more on PGIM

UNDERSTAND FINANCIAL MARKETS

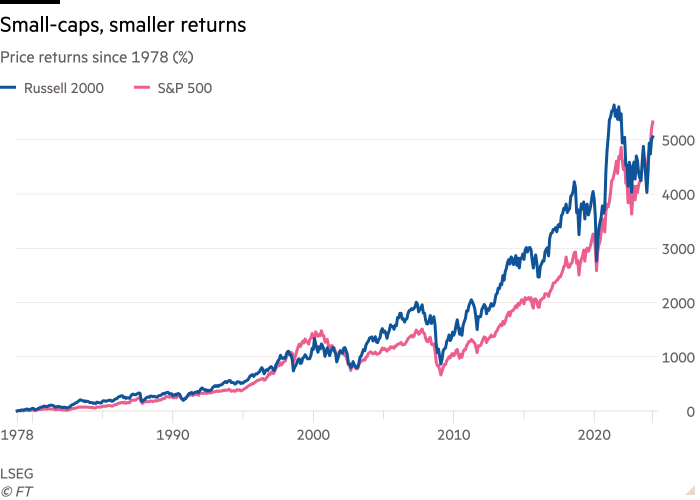

A truism of finance is that risk and returns are correlated. The stocks of smaller companies therefore do better than bigger ones in the long run. This is a foundation stone of both investment theory and practice. Sure, they are more volatile and they can suffer long stretches of dismal performance — such as in the 1960s and late 1990s. But, over time, “small-capitalisation” stocks trump larger stocks in every single major market studied by academics over the decades. Across the world there are hundreds of billions of dollar invested purely on this basis.

Read more on FT.Com, Click On First Link

HOW TO INVEST

Today’s guest is Professor Ken French, the Roth Family Distinguished Professor of Finance at the Tuck School of Business at Dartmouth College. He’s written some of the most influential papers in finance alongside former podcast guest, Professor Eugene Fama. In today’s episode, Ken shares what topic he and Professor Fama disagree on.

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Active Investing

FACTOR investing

discretionary investing

- International Intangible Value (Sparkline Capital)

- Taleb’s Barbell Portfolio (Italian Leather Sofa)

- Japan: Have S&P 500 constituents actually outperformed global peers? (Verdad)

- Time to Look at Chinese Stocks Again? (Morningstar)

- Evaluating the Macro Landscape and Finding Great Companies with Jeff Muhlenkamp (Excess Returns - 1 Hr 9 Min)

ALTERNATIVE ASSET CLASSES

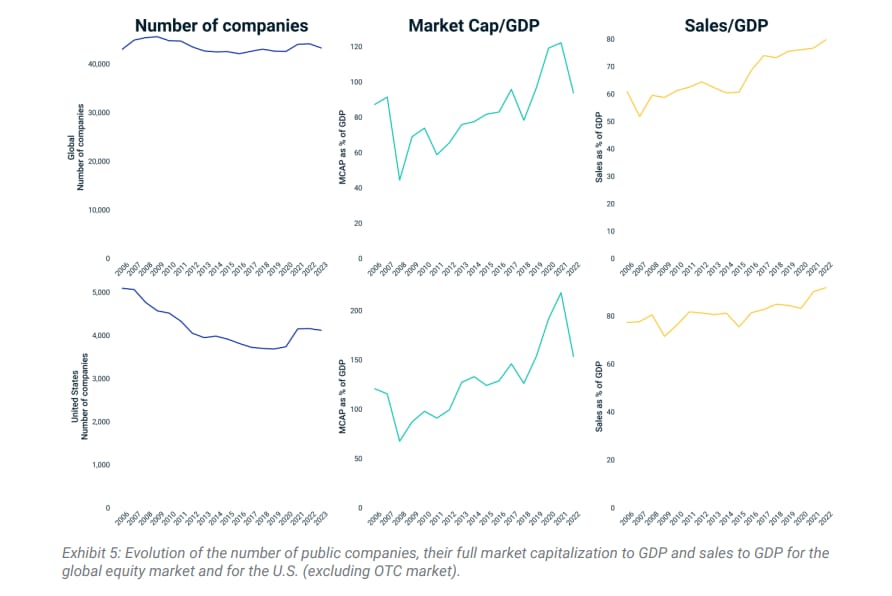

In Section I of this paper, we describe the evolution of the global market portfolio, a theoretical portfolio that includes investment assets worldwide, weighted according to their market values. In Sections II and III we zoom in on two sub-categories of the global market portfolio: private-equity markets and Chinese public-equity markets, respectively. We discuss the main characteristics of those markets

through our equity and private-capital solutions.

Read more on MSCI

WALL STREET

Visa Inc. - World’s Largest Credit Card Company | A Finance Documentary (FinAIus - 39 Min)

Meet The King of Credit Cards – the world’s largest credit card company! This is the story of Visa’s ascent to global dominance in the financial world. Exploring its origins, innovations, and controversies, we will have an insightful look into the power dynamics and challenges within the credit card industry, highlighting Visa’s unparalleled influence and impact.

SUSTAINABLE investing

BAD BETS

- Truong My Lan: Vietnamese billionaire sentenced to death for $44bn fraud (BBC)

- The biggest bank heist in history (and why you've never heard of it) (The Economist - 19 Min)

- 15 Stocks That Have Destroyed the Most Wealth Over the Past Decade (Morningstar)

- Dave Portnoy: A journey of investing starting in 2019 until now. (unusal whales)

Money, Ego and Deception at FTX (Bloomberg - 1 Hr 48 Min)

RUIN is a feature documentary about Sam Bankman-Fried and the stunning collapse of his cryptocurrency exchange, FTX, as narrated by Bloomberg journalists and some of the central players in the rise of digital assets.

On Nov. 2, 2023, Sam Bankman-Fried was found guilty in Manhattan federal court of seven counts of fraud and conspiracy.

On March 28, 2024, Bankman-Fried was sentenced to 25 years in prison. He plans to appeal.

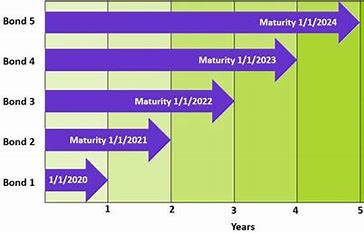

UCITS ETFS

BlackRock has expanded its fixed-maturity iBonds range with the launch of US and Italian government bond ETFs. The iShares iBonds Dec 2027 Term $ Treasury UCITS ETF (27IT) and the iShares iBonds Dec 2029 Term $ Treasury UCITS ETF (29IT) are listed on Euronext Amsterdam with total expense ratios (TERs) of 0.10%. 27IT and 29IT track the respective 2027 and 2029 maturities of the ICE Maturity US Treasury UCITS indices which offer exposure to US Treasuries that mature on a defined date.

Read more on ETF Stream

New UCITS ETF launches

| # | ETF | TER | ISIN |

|---|---|---|---|

| 1 | Amundi Prime All Country World UCITS ETF | 0.07% | IE0009HF1MK9 |

| 2 | Xtrackers MSCI World ex USA UCITS ETF 1C | 0,16% | IE0006WW1TQ4 |

| 3 | AMUNDI PRIME USA UCITS ETF Acc | 0,05% | IE000FSN19U2 |

| 4 | AMUNDI PRIME USA UCITS ETF Dist | TBC | IE000IEGVMH6 |

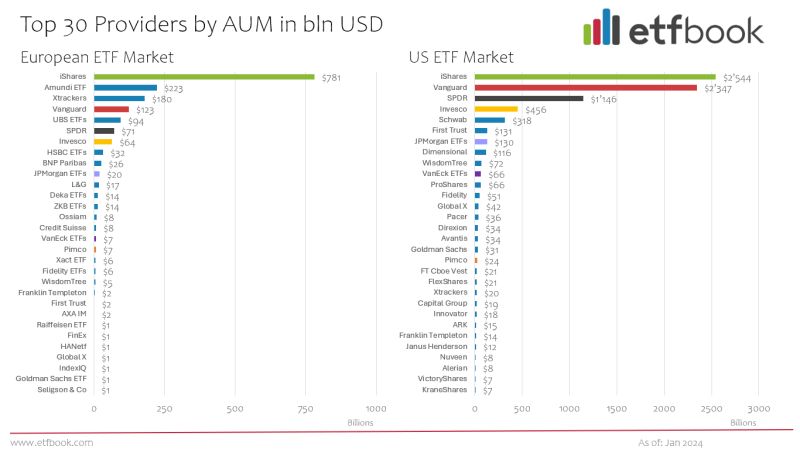

ETF Book Provided an updated overview of the US and European ETF markets by leading Issuers. US ETF market: AUM $7.96 trillion – European ETF market: AUM $1.81 trillion. iShares is leading in the US, but Vanguard is closing the gap. In Europe, iShares is much more dominant.

US ETFs

BlackRock is set to launch ten ETFs focused on Treasury inflation-protected securities (TIPS). Ranging in maturity from 2024 to 2033, these ETFs will seek to provide inflation protection to investors concerned with erosion of purchasing power. The new TIPS-defined maturity bond ETFs will carry an expense ratio of 0.1%. [ETF.com]

Wealth Management

Personal Finance

This is part 4 of Bankeronwheels.com Definitive Guide to choosing a Stock Broker.

In part 3 of our ultimate guide to choosing a Stock Broker, we explained why in the EU, Broker protections are inadequate. Certain brokers subscribe to a private insurance to provide a higher protection level.

Today, let’s look at what these protections are really worth.

Broker REVIEWS

Our take: If you’re just starting to pedal into the world of investing with small stakes, Dodl could be your ride partner, all while drafting behind its big bro, the Tier 1 brokerage powerhouse, AJBell. But while AJBell rides a well-marked route, Dodl seems a bit lost, like a cyclist without a GPS. And let’s be real—no other broker in the peloton charges a 0.15% custody fee. That’s like breaking away from the pack, but in the wrong direction!

Early Retirement

DESIGN YOUR LIFESTYLE

Travel

Tristan Bogaard’s latest video is a meditative tribute to the beautiful new 600-kilometer Of Resilience and Hope bikepacking route in rural Spain and the challenges and opportunities designer Ernesto Pastor aimed to bring to light in creating it. Find the calming six-minute video with an introduction by Tristan here…

Words, photos, and video by Tristan Boggard.

Read more on Bikepacking.com

Personal Development

Live 10th Anniversary Random Show with Kevin Rose. As many listeners know, Kevin was my very first guest for episode 1, way back in April 2014.

We explore What’s Next, Testing Ozempic, Modern Dating, New Breakthrough Treatments for Anxiety, Bitcoin ETFs, Mike Tyson vs. Jake Paul, and Engineering More Awe in Your Life

Tech & Economy

economy

TECH AND SCIENCE

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

And finally

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – Global Shocks: How Do Stocks Perform?

Trading 212 Review: Pros & Cons

Cash Is Not Enough: Why Hold Bond ETFs Despite Price Rollercoasters.

The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Halifax Share Dealing Review – Similar To Lloyds With SIPP On Top

Lloyds Share Dealing Review – Old School But Ticks The Boxes For Golden Retrievers

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.