What proportion of Bonds do I need in my Portfolio?

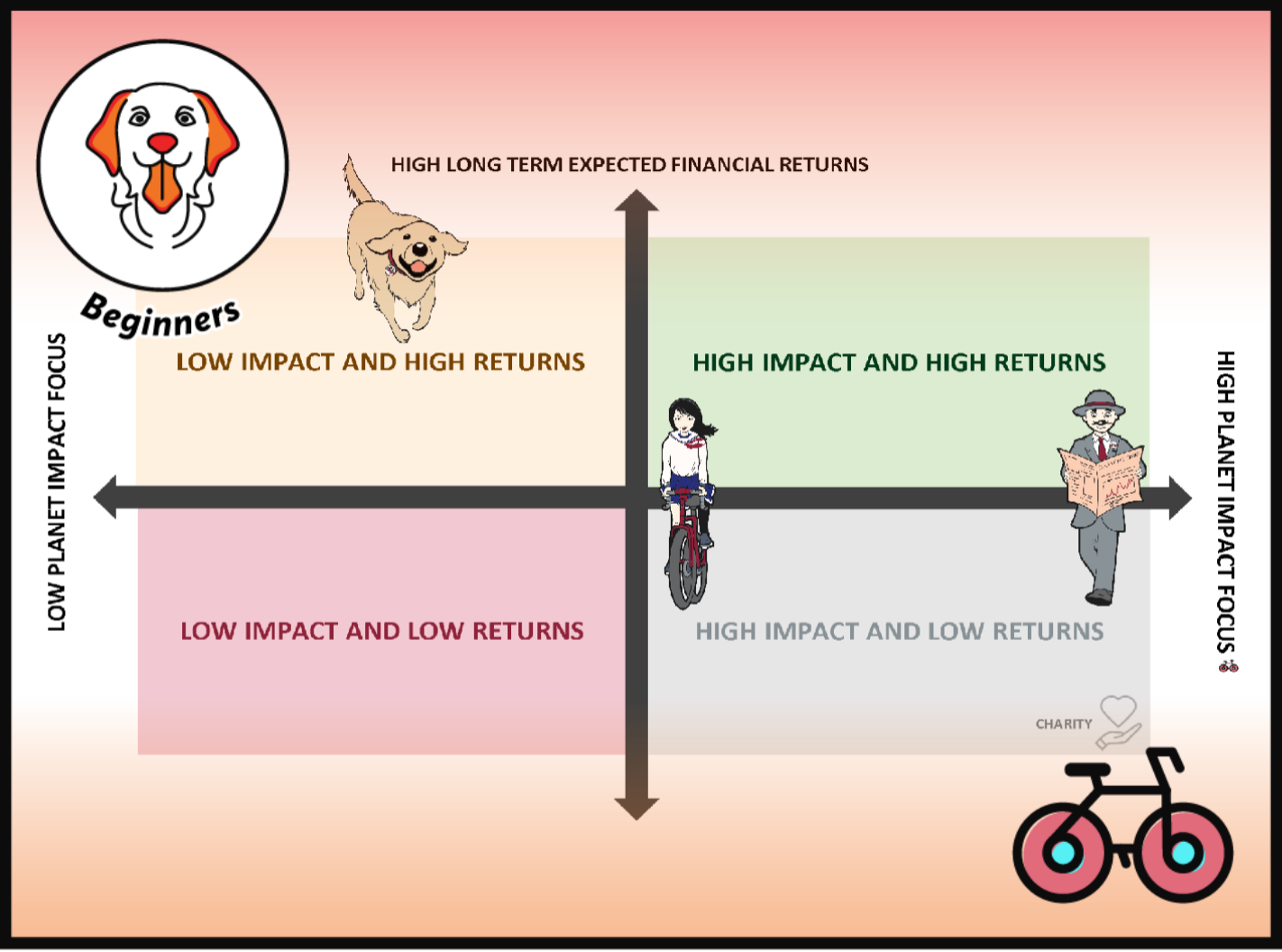

Your asset allocation—that is, how you divide your money among stocks, bonds, and short-term reserves—may be the most important factor in determining your portfolio’s short- and long-term risks and returns. That’s why we recommend that you select specific mutual funds and ETFs (exchange-traded funds) only after you’ve determined the right asset allocation for you.

For convenience below is a reproduced Vanguard questionnaire as described in the Book “The Bogleheads’ Guide to Investing”

The investor questionnaire suggests an asset allocation based on your answers to questions about your investment objectives and experience, time horizon, risk tolerance, and financial situation. As your financial circumstances or goals change, it may be helpful to complete the questionnaire again and reallocate the investments in your portfolio

Source: The Vanguard Group.

Keep in mind that the suggested allocation is based on limited information. You should conduct additional research or consult a professional advisor for more detailed recommendations.

*For U.S. stock market returns, we use the S&P 90 Index from 1926 through March 3, 1957; the S&P 500 Index from March 4, 1957, through 1974; the Dow Jones U.S. Total Stock Market Index (formerly known as the Dow Jones Wilshire 5000 Index) from 1975 through April 22, 2005; the MSCI US Broad Market Index from April 23, 2005, through June 2, 2013; and the CRSP US Total Market Index thereafter.

**For U.S. bond market returns, we use the S&P High Grade Corporate Index from 1926 through 1968; the Citigroup High Grade Index from 1969 through 1972; the Lehman Brothers U.S. Long Credit AA Index from 1973 through 1975; the Bloomberg Barclays U.S. Aggregate Bond Index from 1976 through 2009; and the Bloomberg Barclays U.S. Aggregate Float Adjusted Index thereafter.

***For U.S. short-term reserves, we use the Ibbotson U.S. 30-Day Treasury Bill Index from 1926 through 1977 and the FTSE 3-Month U.S. Treasury Bill Index thereafter.

Past performance is not a guarantee or prediction of future results.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

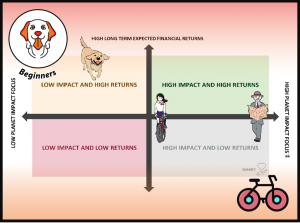

Three Sustainable Investing Strategies That Actually Work

ETF Fees – How They Work & How to Minimise Them!

How Much Should You Pay For An ETF?

4 Things I Learned In 4 Years Of Running A Finance Blog

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.