Weekend Reading – Saving On Dividend Taxes with S&P 500 ETFs

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist:

Bulls make money, bears make money, pigs get slaughtered.

Old Wall Street saying that warns investors against excessive greed.

INVEST WISELY

CONSTRUCT YOUR PORTFOLIO

Over the past years Synthetic ETFs got safer. Why do investors choose them? French Investors get around restrictions to invest in companies outside Europe within the PEA tax wrapper. Other Europeans use them to avoid being taxed on US Dividends. But how competitive are they today compared to the cheapest physical ETFs like the $5.5bn SPDR S&P 500 UCITS ETF that will see its TER cut from 0.09% to 0.03% in November 2023? Let’s Find Out.

Dr. William (Bill) Bernstein research is in the field of modern portfolio theory and economic history. Bill has published extensively on investing and economic history, including eight books and numerous articles. In this episode, the discussion revolves around Treasury Inflation Protected Securities (TIPS), asset allocation in today’s uncertain world, four deep risks, and the cost of income inequality.

UNDERSTAND FINANCIAL MARKETS

Aswath is a Professor of Finance at NYU’s Stern School of Business and is often referred to as the Dean of Valuation for his clarity of thought on the subject. This conversation covers a wide range of topics from macro risks to Nvidia and the process of crafting a personal investment philosophy.

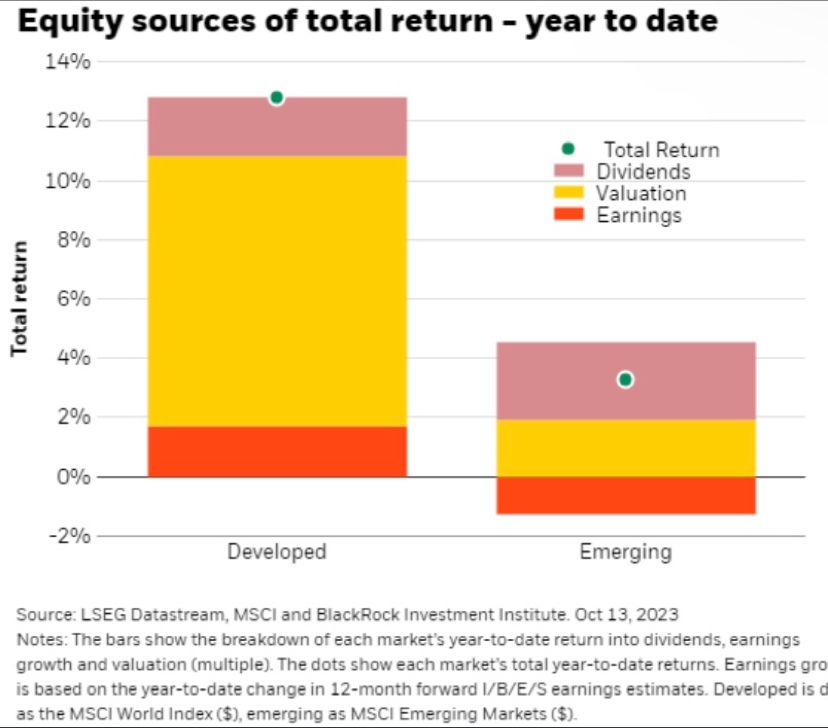

Sources of YTD Total Returns (Blackrock)

With the AI rally, valuation continues to drive total equity market return this year, having dethroned earnings.

Earnings (red) will need to come through for equities to stablise at these levels, especially in the face of elevated rate vol. The AI theme continues to stand out – driving recent earnings estimate upward revision and accounting for half of circa. 10% earnings growth expectations next year.

Source: BlackRock

- Why Aren’t Stocks Down More? (Irrelevant Investor)

- Why the stock market usually goes up? (Heritage Financial - 38 min)

- Dissecting the Idiosyncratic Volatility Puzzle (Alpha Architect)

- Charted: Comparing the GDP of BRICS and the G7 Countries (Visual Capitalist)

- Aging Population Affects Economic Growth but Not Stock Returns (Morningstar)

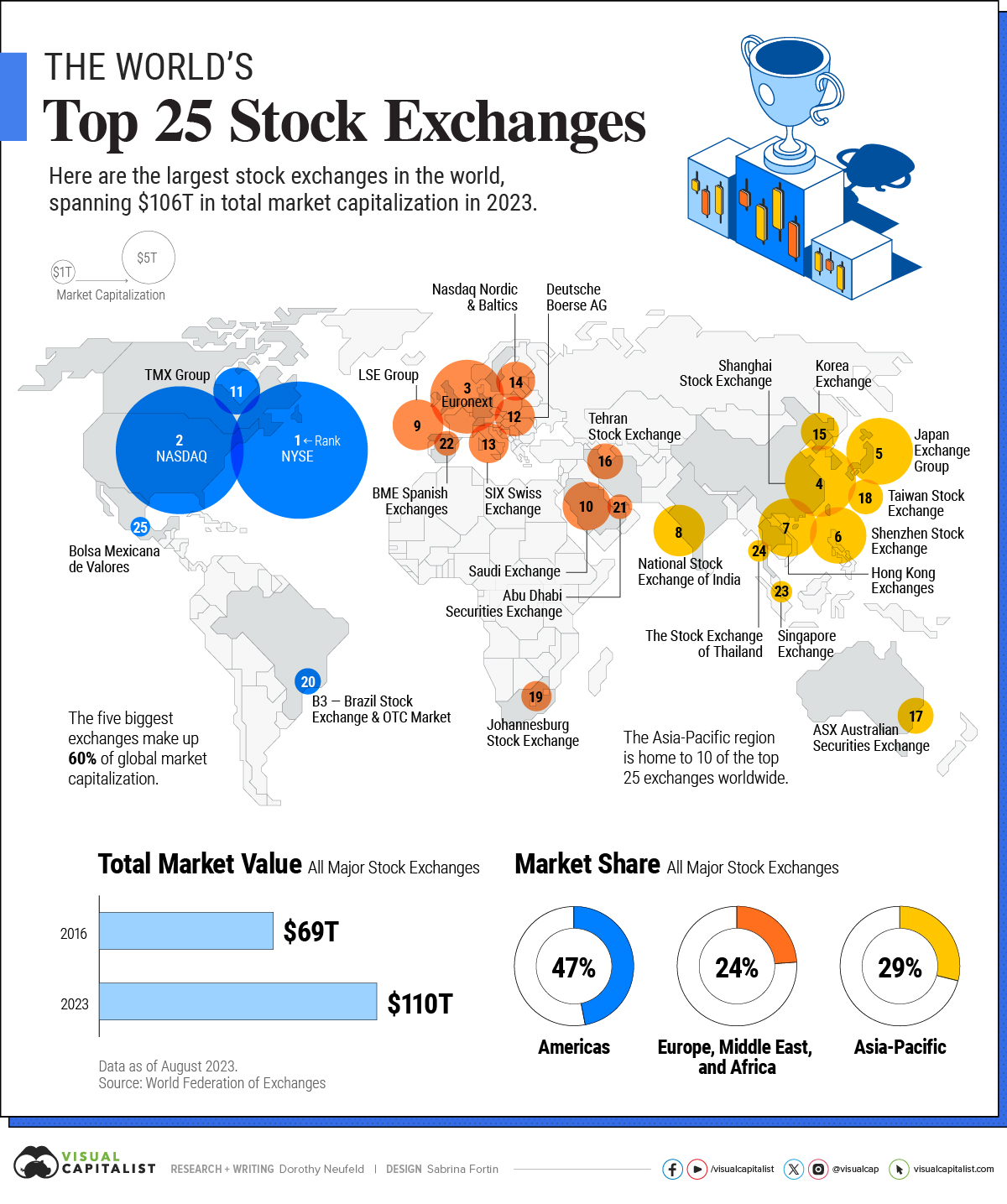

Today, there are roughly 80 major stock exchanges worth a combined $110.2 trillion in value.

The world’s top two exchanges, the New York Stock Exchange (NYSE) and the Nasdaq, command 42.4% of global market capitalization. Despite the rapid growth of emerging economies, the U.S. continues to lead capital markets by a wide margin—even as countries such as India see considerable growth, surpassing the UK in 2023.

This visualization shows the largest stock exchanges in the world, with data from the World Federation of Exchanges

Read more on Visual Capitalist

HOW TO INVEST

Active Investing

FACTOR investing

The GMO small cap quality strategy was launched a year ago as the long term advantages of small cap value investing had aligned with a tactical opportunity given small cap quality stocks were trading at attractive valuations. A year on, the results of this foray have been good to say the least.

Read more on GMO

discretionary investing

Crash course on valuation - Tesla (Aswath Damodaran - 40 min)

If valuation is a craft, there is no better company to hone that craft on than Tesla. Aswath has valued Tesla almost every year since 2013, and by his own admission, has been woefully wrong on occasion. Here he takes a stab at it again by returning to the scene of the crime.

ALTERNATIVE ASSET CLASSES

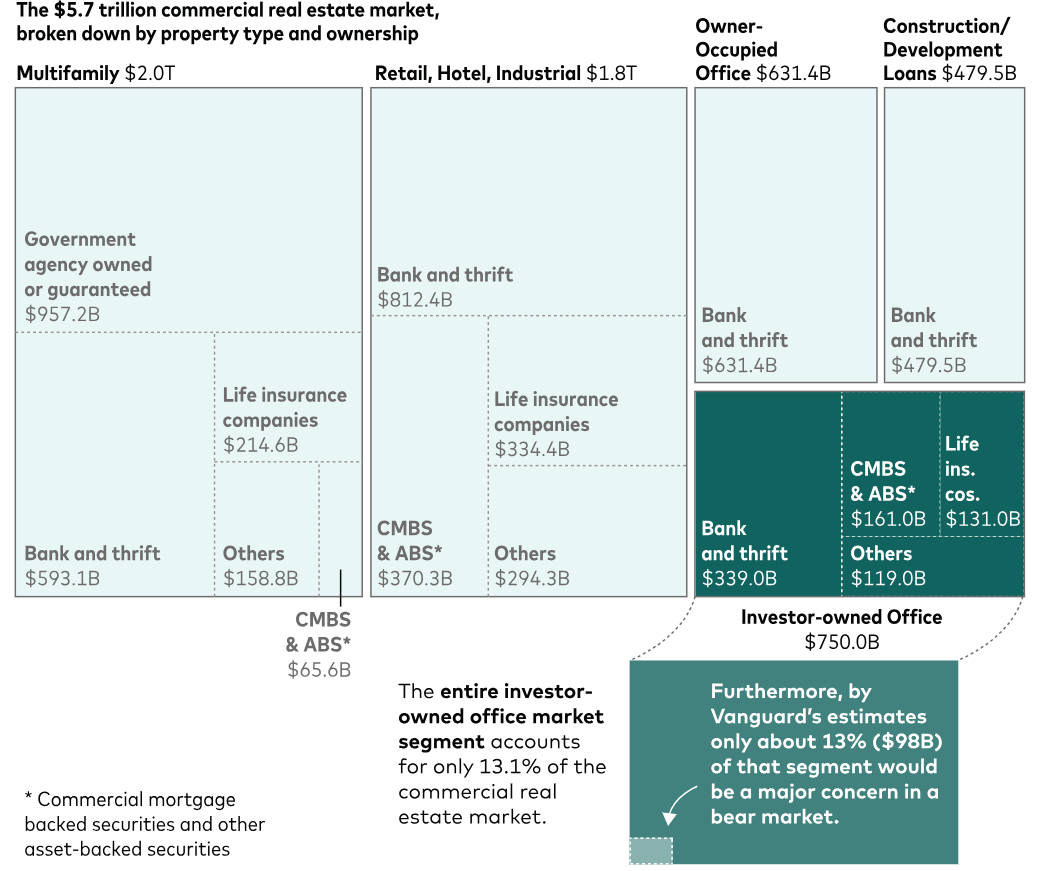

The shift to remote work and the rise in interest rates have raised alarm bells about the health of the $5.7 trillion commercial real estate lending market. Although the analysis shows some stress in the office sector, a systemic financial risk to this lending market is not expected. Hence, the beliefnis that investors should be able to sidestep meaningful impact to fixed income portfolios through careful security selection.

Read more on Vanguard

WALL STREET

Robin Hood NYC 2023 Fireside Chat Stan Druckenmiller and Paul Tudor Jones (Heller House - 33 min)

Stan Druckenmiller & Paul Tudor are household names if you’re into finance. Catch them here on an enthralling perspective that has Wall Street insider vibes on the economy, markets & where we are headed

SUSTAINABLE investing

crypto

BAD BETS

If you’re in the world of finance, you’d know this episode’s guest from YouTube — but you’ve probably never heard his real name. However, on this episode and for the first time, he chooses to associate his actual identity with his YouTube channel! Presenting Mr. How Money Works himself, Darin Soat.

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

ETFs

State Street Global Advisors (SSGA) is set to offer the cheapest ETF in Europe after slashing the fees on its S&P 500 product by two-thirds.

Effective 1 November, the $5.5bn SPDR S&P 500 UCITS ETF (SPY5) will see its total expense ratio (TER) cut from 0.09% to 0.03%, the cheapest S&P 500 ETF on the European market, undercutting the Invesco S&P 500 UCITS ETF (SPXS) and its 0.05% TER.

Read more on ETF Stream

Robeco is stepping into the European ETF market with a focus on active funds. The Dutch asset manager, which has €181bn assets under management, is planning to launch its first UCITS ETFs in Q2 2024. [FT.com]

Xetra has seen the launch of 3 new fixed income ETFs by the German asset management group DWS. The ETFs provide ultra-short-duration exposure to bonds from issuers of Eurozone sovereigns. All the ETFs have a 0.07% fee. [ETFStrategy.com]

US ETFs

BlackRock is set to launch ten ETFs focused on Treasury inflation-protected securities (TIPS). Ranging in maturity from 2024 to 2033, these ETFs will seek to provide inflation protection to investors concerned with erosion of purchasing power. The new TIPS-defined maturity bond ETFs will carry an expense ratio of 0.1%. [ETF.com]

Personal Finance

- Conflicted Financial Advisors: Restricted Advisors & Their Disclaimers (Banker on Wheels)

- The impact of inflation traverses everything (Indeedably)

- Index Funds, How To Build Wealth & Financial Independence Wisdom (Journey to Launch - 52 min)

- Used wisely, carefully: A bit of a bad thing can be good. (Mr. Stingy)

- Dollars Are For Spending & Investing, Not Saving (Ritholtz)

Early Retirement

FINANCIAL PRODUCTS

COST OF LIVING

OUR Community

Question of the week

DESIGN YOUR LIFESTYLE

Personal Development

- The Power of Purpose (The daily stoic - 16 min)

- The three types of failure and how to deal with each of them (Art of Manliness - 44 min)

- The Science of Achievement, With Adam Grant (The Ringer - 42 min)

- Changing Minds in a Polarized World (Alliance for decision education - 43 min)

- The 5-Minute To-Do List (The Art of Non Conformity)

- A Better Way to Ask for Advice (Behavioural Scientest)

Morgan Housel is a partner at The Collaborative Fund. His book The Psychology of Money has sold more than three million copies and has been translated into 53 languages. He is a two-time winner of the Best in Business Award from the Society of American Business Editors and Writers and winner of the New York Times Sidney Award. In 2022, MarketWatch named him one of the 50 most influential people in markets. He serves on the board of directors at Markel. Listen in for an engaging conversation!

Longevity: can ageing be reversed? (The Economist - 16 min)

Ageing has always been inevitable but fasting, epigenetic reprogramming and parabiosis are just some of the scientific techniques that seem to help people stay young. Might the Peter Pan dream become real?

CAREERS

TECH AND SCIENCE

Travel

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

miscellaneous

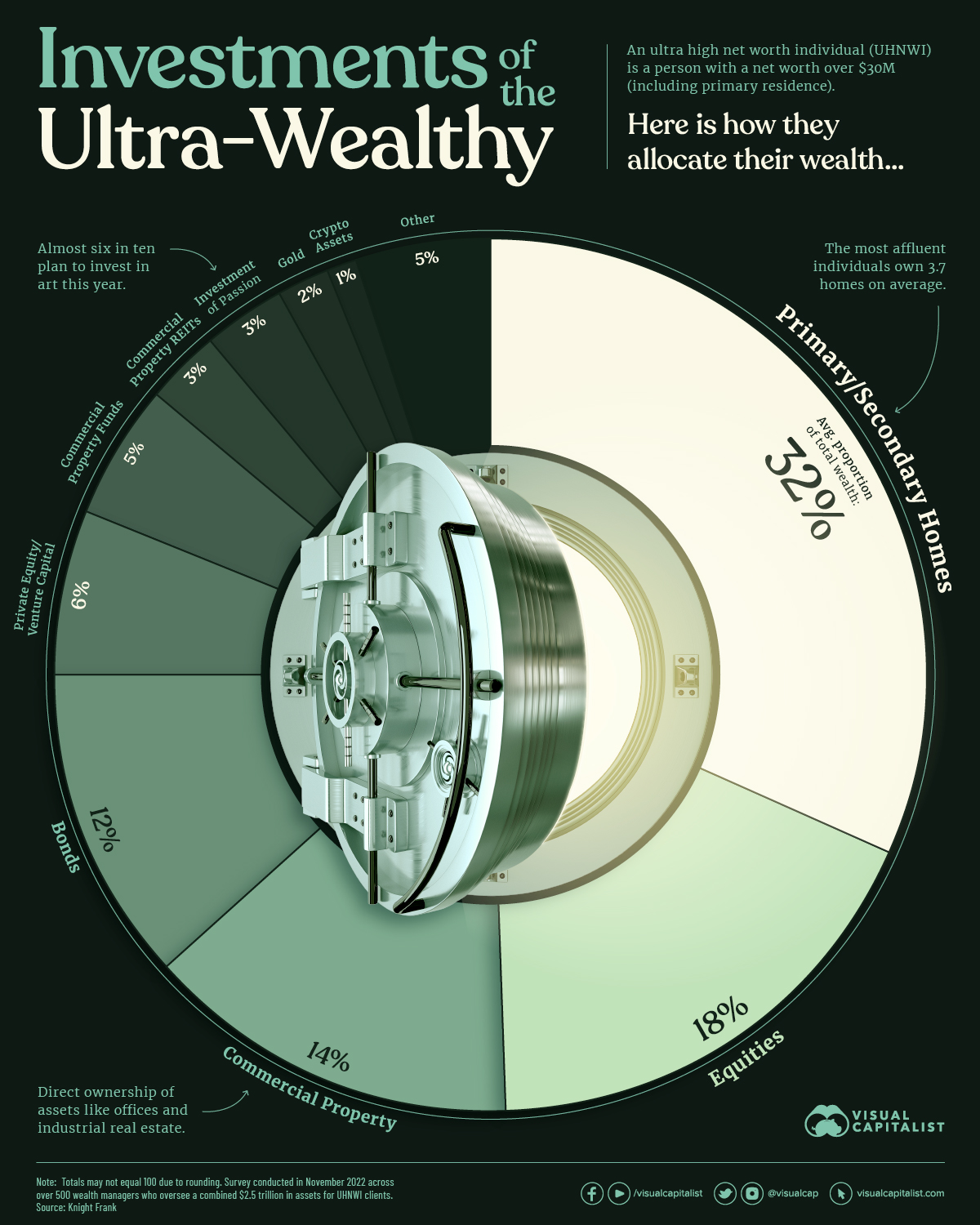

How do the world’s richest people invest their money?

This graphic shows how ultra high net worth individuals (UHNWIs)—people with a net worth of $30 million or more including their primary residence—allocate their wealth based on data from Knight Frank’s 2023 Wealth Report.

Read more on Visual Capitalist

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – Global Shocks: How Do Stocks Perform?

Trading 212 Review: Pros & Cons

Cash Is Not Enough: Why Hold Bond ETFs Despite Price Rollercoasters.

The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Halifax Share Dealing Review – Similar To Lloyds With SIPP On Top

Lloyds Share Dealing Review – Old School But Ticks The Boxes For Golden Retrievers

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.