Weekend Reading – Vanguard’s Outlook For 2024 And Beyond

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist:

People calculate too much and think too little

Charlie Munger

INVEST WISELY

CONSTRUCT YOUR PORTFOLIO

With a wave of U.S. Spot Bitcoin ETFs on the horizon, and a potential SEC approval, Bitcoin may take a place in some portfolios.

This article looks at the limited data – only a decade long – and tries to make sense of this asset from a portfolio perspective, if you decide to give it a go.

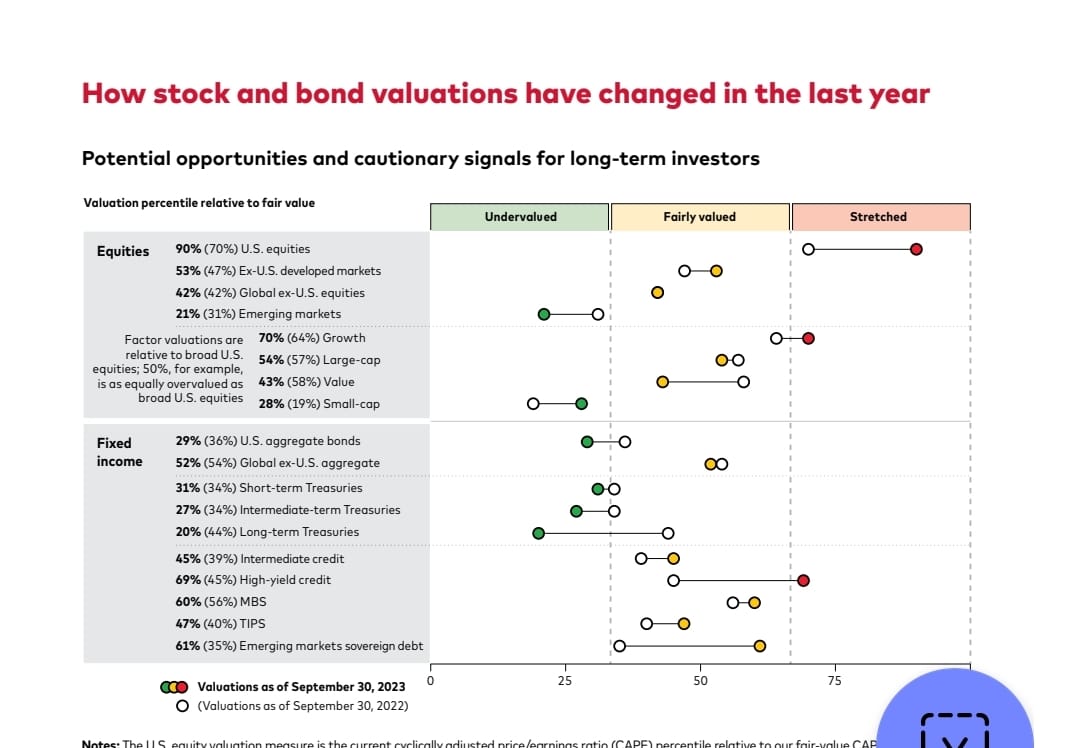

Vanguard has said for more than a year that a return to sound money was underway. In the meantime, the transition to a higher interest rate environment no doubt has challenged investors, who have endured historical losses in bonds and high volatility in stocks. They believe that this structural shift, which will endure beyond the next business cycle, is the single best economic and financial development in the last 20 years.

Read more on Vanguard

UNDERSTAND FINANCIAL MARKETS

HOW TO INVEST

Active Investing

FACTOR investing

One of the best pieces about Factor Investing in a while.

Available for free on Financial Times.

Read more on Ft.com

- Navigating the factor zoo (Excess Returns - 46 Min)

- Assessing Alternative Quality Metrics (Dimensional Funds)

- New study says factors are barely a factor in returns (Ria Intel)

- The Illusion of the Small-Cap Premium (Finominal, Paywall)

- Factor Investing & Investor Behavior (Sound Investing - 38 Min)

- Navigating the Factor Zoo with Matthias Hanauer (Excess Returns - 46 Min)

discretionary investing

The Difference Makers: Key Person Value (Aswath Damodaran - 42 min)

In small businesses, it is common to apply what is called a “key person” discount to appraised value. Aswath looks at the variety of people who can be key to an organization’s value (from founder/CEOs to celebrity spokesperson), before creating value and pricing frameworks for valuing/pricing their presence. He also looks at how businesses can manage key person risk, why it can vary across businesses and implications for employee compensation.

ALTERNATIVE ASSET CLASSES

A long-time Vanguard investor received an email encouraging him to consider opening a margin account. The email included a link to a 20-page paper that explains both the workings of a margin account and the dangers entailed. I am pleased to report that the document thoroughly reflects Vanguard’s tradition of communications: detailed, sober, somewhat dull, and complete.The author does, however, have three questions.

Read more on Morningstar

WALL STREET

SUSTAINABLE investing

crypto

BAD BETS

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

ETFs

UCITS ETFs

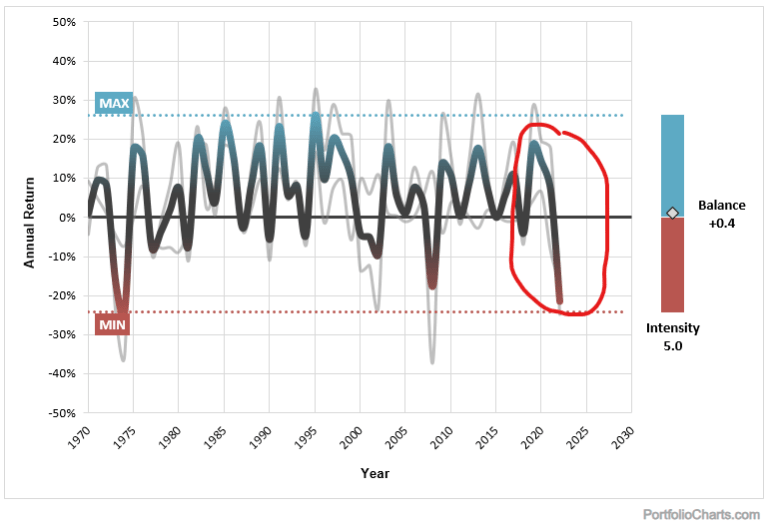

Return Stacked ETFs, are innovative financial products that have recently become available in Europe. These ETFs operate on the principle of “Return Stacking,” which involves layering one investment return on top of another to achieve more than $1.00 of exposure for each $1.00 invested. While you may find the concept intriguing and potentially more capital efficient, it’s crucial to understand that these are complex, leveraged products not suitable for the majority of investors.

Read more on Italian Leather Sofa

Robeco is stepping into the European ETF market with a focus on active funds. The Dutch asset manager, which has €181bn assets under management, is planning to launch its first UCITS ETFs in Q2 2024. [FT.com]

Xetra has seen the launch of 3 new fixed income ETFs by the German asset management group DWS. The ETFs provide ultra-short-duration exposure to bonds from issuers of Eurozone sovereigns. All the ETFs have a 0.07% fee. [ETFStrategy.com]

US ETFs

BlackRock is set to launch ten ETFs focused on Treasury inflation-protected securities (TIPS). Ranging in maturity from 2024 to 2033, these ETFs will seek to provide inflation protection to investors concerned with erosion of purchasing power. The new TIPS-defined maturity bond ETFs will carry an expense ratio of 0.1%. [ETF.com]

Personal Finance

Early Retirement

A U.K.-based financial advisor discusses why people over 50 are often underserved by the financial-services industry, ways to ease into retirement, and what it means to be a ‘retirement rebel.’

FINANCIAL PRODUCTS

COST OF LIVING

OUR Community

Question of the week

DESIGN YOUR LIFESTYLE

Personal Development

In this episode, Ryan outlines the Stoic strategies that you can use in your daily life to stop caring about what other people are thinking. Epictetus liked to joke that when someone unfairly criticizes you, feel grateful that they didn’t point out your real flaws. Trying to control other people’s opinions was like trying to control the weather—and public life guarantees public scrutiny.

CAREERS

TECH AND SCIENCE

An Introduction to AI for everyone (Andrej Karpathy - 1 hr)

This is a 1 hour general-audience introduction to Large Language Models: the core technical component behind systems like ChatGPT, Claude, and Bard. What they are, where they are headed, comparisons and analogies to present-day operating systems, and some of the security-related challenges of this new computing paradigm.

Travel

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

miscellaneous

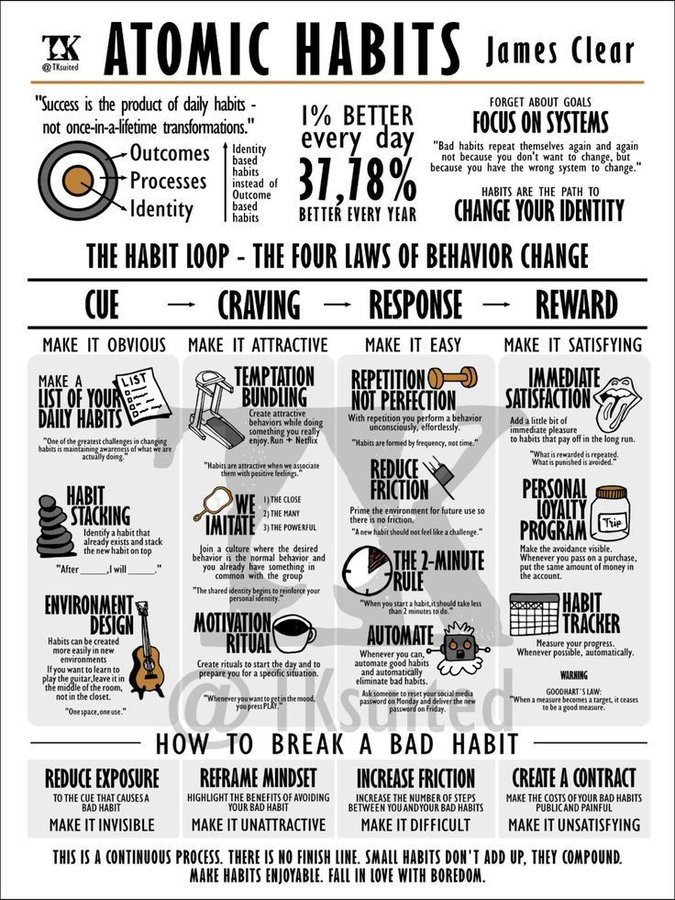

From Atomic Habits to Think Twice, explore the key lessons across 9 books through bite sized visual summaries

Read more on Investment Books (Dhaval)

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – Global Shocks: How Do Stocks Perform?

Trading 212 Review: Pros & Cons

Cash Is Not Enough: Why Hold Bond ETFs Despite Price Rollercoasters.

The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Halifax Share Dealing Review – Similar To Lloyds With SIPP On Top

Lloyds Share Dealing Review – Old School But Ticks The Boxes For Golden Retrievers

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.