Weekend Reading – Vanguard’s Strategies to Live Off Your Portfolio Without Draining It

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist:

You want a strategy that accomplishes 2 often-competing goals: 1) having enough money to support your desired lifestyle, and 2) ensuring there's enough left for the future. We've got a strategy that can help you with both.

Vanguard

INVEST WISELY

CONSTRUCT YOUR PORTFOLIO

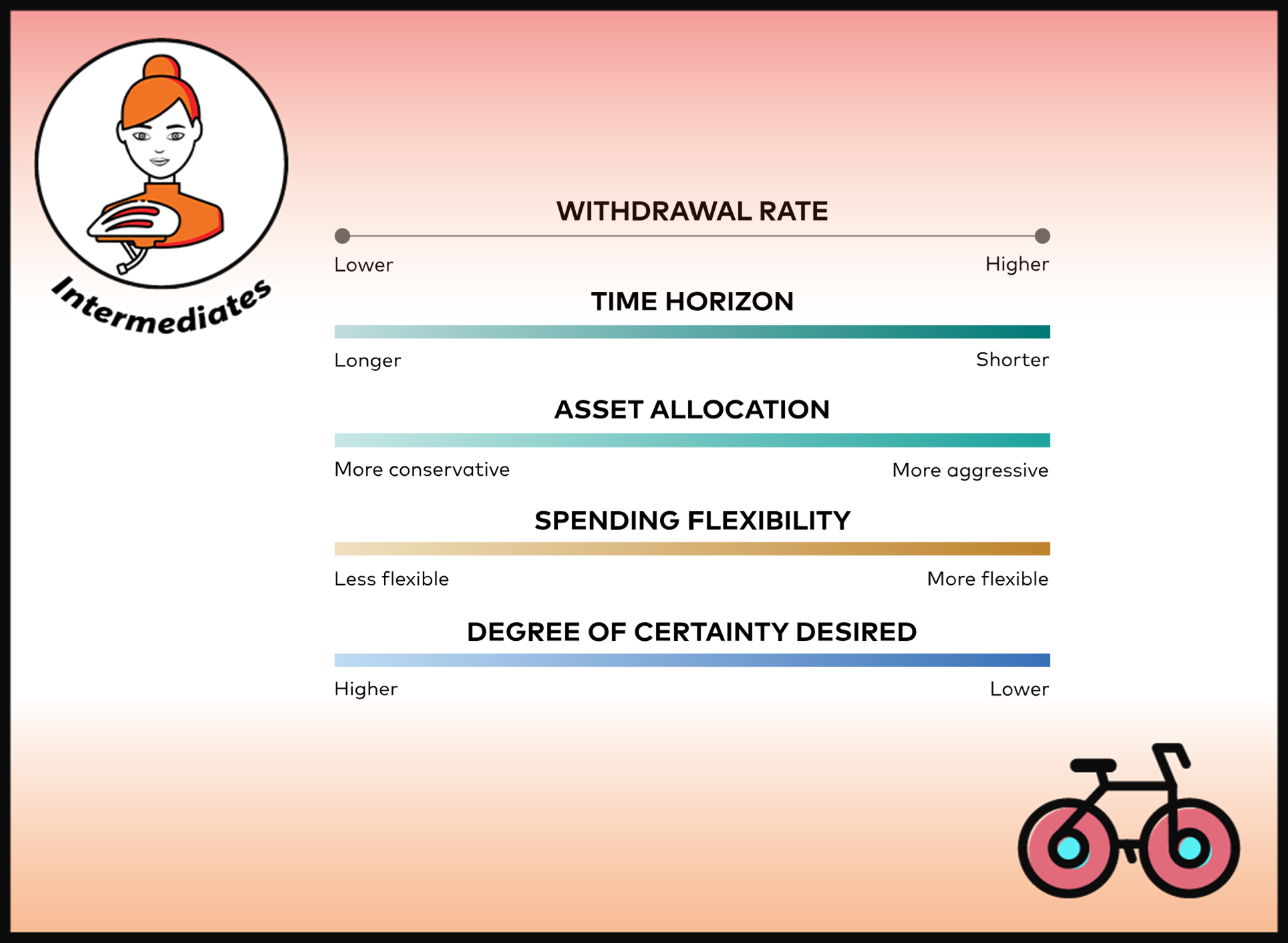

With lots of talk about withdrawal rates this week, let’s go back to basics. What options do you have? Vanguards provides a deep dive into:

- Percentage-of-portfolio strategy

- Fixed-dollar withdrawal strategy

- Fixed-percentage withdrawal strategy

Ignore the noise, look at serious research.

Read more on Vanguard

- How Crazy is Dave Ramsey’s 8% Withdrawal Rate Recommendation? (Early Retirement Now)

- Would a Cash Buffer Improve Your Retirement Income Success? (Investment Moats)

- Not All Total Returns Are Created Equal (Morningstar)

- ‘T-bill and chill’: Why Jack Bogle’s strategy of ‘lazy’ investing is making a comeback (CNBC)

Country credit ratings assess the likelihood that a country will default on its debts, and are determined by international rating agencies like Standard & Poor’s (S&P), Moody’s, and Fitch Ratings.

Generally speaking, a higher rating results in lower borrowing costs for the country, while lower ratings can increase costs or even limit access to capital.

This graphic from The Hinrich Foundation shows the credit worthiness of 28 major economies, using an index of ratings from the three agencies mentioned above

Read more on Visual Capitalist

UNDERSTAND FINANCIAL MARKETS

Goldman Sachs’ Jan Hatzius, the firm’s chief economist and head of Goldman Sachs Research, and Dominic Wilson, senior advisor in the Global Markets Research Group, discuss their outlook and the findings from their recently published 2024 macro outlook entitled, The Hard Part is Over.

HOW TO INVEST

To many cycling enthusiasts, the bicycle embodies freedom and equality. Similarly, the art of wise investing resonates with freedom, simplicity, and accessibility. With the democratisation of knowledge, the possibility of attaining financial freedom is within reach of many. Establishing a portfolio is swifter than learning to cycle. The challenge, however, lies in tailoring your portfolio to suit your unique financial journey. This is where Lorenzo Biagi’s new book could be of help.

Active Investing

FACTOR investing

Jeff Burton at Furey Research recently published a piece titled “The Death of Small Cap Equities,” highlighting the underperformance of small-cap stocks and the deterioration in the quality of the Russell 2000 index over the last 40 years. Here’s Verdad’s take

Read more on Verdad

discretionary investing

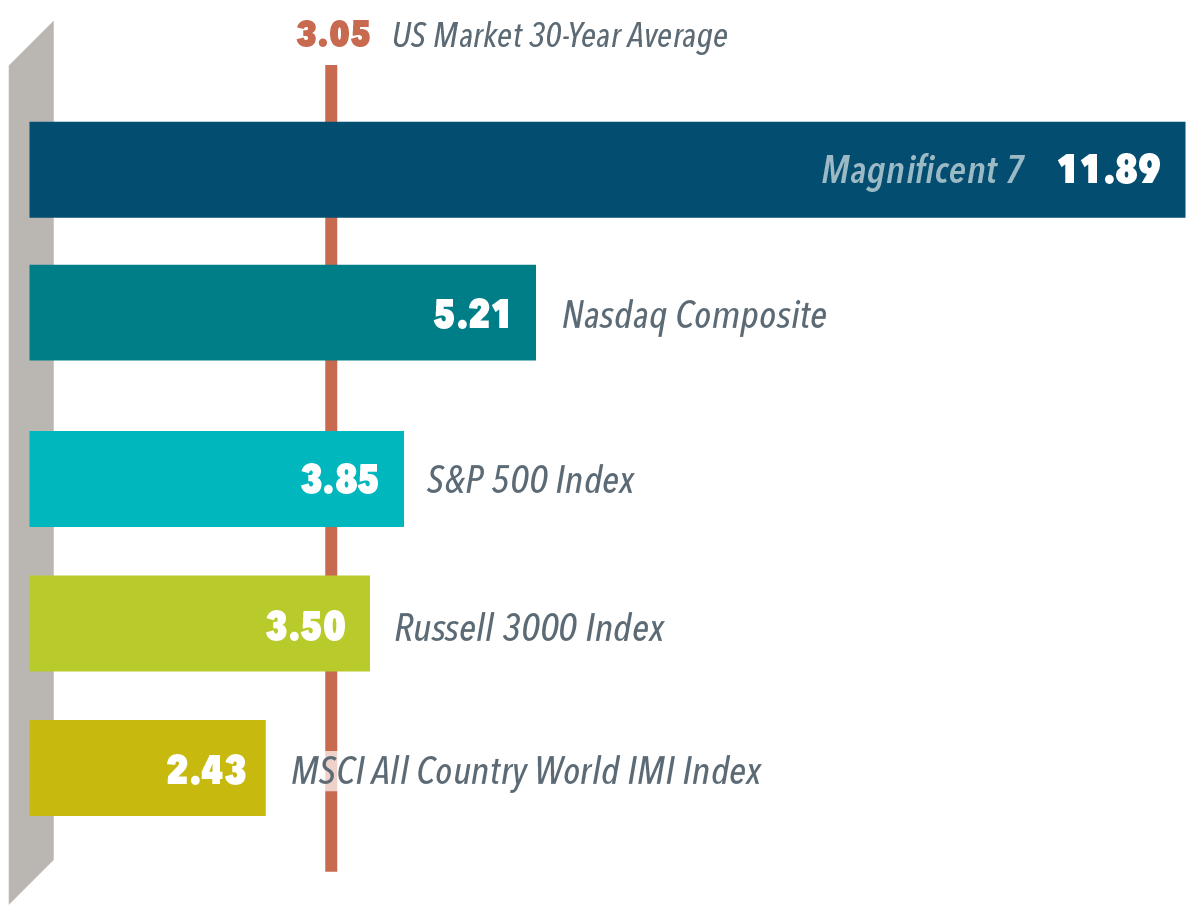

Aggregate stock market valuation ratios have not been strong predictors of broad market returns. And yet, high stock valuations sit near the top of concerns cited by investors about the state of equity markets. However, this perception stems from a subset of stocks, and investors should be careful not to throw the baby out with the bathwater by ascribing this characteristic to the global stock market.

Read more on Dimensional Funds

ALTERNATIVE ASSET CLASSES

WALL STREET

Stanley Druckenmiller: The Government Needs To Stop Spending Like Drunken Sailors (CNBC - 7 min)

Stanley Druckenmiller, Duquesne Family Office chairman and CEO, joins ‘Squawk Box’ to discuss the state of the U.S. economy, Treasury Secretary Janet Yellen’s ‘big blunder’ of not issuing more long-dated Treasurys when interest rates were low, government spending and the impact on the national debt, market outlook, the Fed’s inflation fight, and more.

SUSTAINABLE investing

crypto

BAD BETS

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

ETFs

State Street Global Advisors (SSGA) is set to offer the cheapest ETF in Europe after slashing the fees on its S&P 500 product by two-thirds.

Effective 1 November, the $5.5bn SPDR S&P 500 UCITS ETF (SPY5) will see its total expense ratio (TER) cut from 0.09% to 0.03%, the cheapest S&P 500 ETF on the European market, undercutting the Invesco S&P 500 UCITS ETF (SPXS) and its 0.05% TER.

Read more on ETF Stream

Robeco is stepping into the European ETF market with a focus on active funds. The Dutch asset manager, which has €181bn assets under management, is planning to launch its first UCITS ETFs in Q2 2024. [FT.com]

Xetra has seen the launch of 3 new fixed income ETFs by the German asset management group DWS. The ETFs provide ultra-short-duration exposure to bonds from issuers of Eurozone sovereigns. All the ETFs have a 0.07% fee. [ETFStrategy.com]

US ETFs

BlackRock is set to launch ten ETFs focused on Treasury inflation-protected securities (TIPS). Ranging in maturity from 2024 to 2033, these ETFs will seek to provide inflation protection to investors concerned with erosion of purchasing power. The new TIPS-defined maturity bond ETFs will carry an expense ratio of 0.1%. [ETF.com]

Personal Finance

- What is financial planning & why does it matter? (Morningstar)

- Financial Advisors vs Financial Planners (Morningstar)

- How I Handled an Unexpected Inheritance (Morningstar)

- Wealth, Actually: current and legacy wealth, retirement planning vs. estate planning. (Talking Billions - 1 hr 4 min)

- Visualizing America’s $1 Trillion Credit Card Debt (Visual Capitalist)

- What's your personal Inflation Rate? (Charlie Billelo)

- Financial advisors & the cross-section of returns (Rational Reminder - 58 min)

Early Retirement

FINANCIAL PRODUCTS

COST OF LIVING

OUR Community

Question of the week

DESIGN YOUR LIFESTYLE

Personal Development

Sheila Heen has spent the last three decades working to understand how people can better navigate conflict, with a particular specialty in difficult conversations. She is a founder of Triad Consulting Group, a professor at Harvard Law School, and a co-author of Thanks for the Feedback: The Science and Art of Receiving Feedback Well (even when it’s off base, unfair, poorly delivered, and, frankly, you’re not in the mood).

- A Practical Guide to Controlling Addiction & Dopamine (The Knowledge Project - 1 hr 5 min)

- How Anti Obesity drugs are reshaping health care & Consumer behaviour (Goldman Sachs - 27 min)

- How to avoid death by comfort (Art of Manliness - 56 min)

- Workers in Valencia’s 4-day week trial report less stress and more socialising (Yahoo Finance)

CAREERS

TECH AND SCIENCE

In conversation with Elon (Lex Fridman Podcast - 2 hr 17 min)

Elon Musk on War, AI, Aliens, Politics, Physics & Humanity

Travel

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

miscellaneous

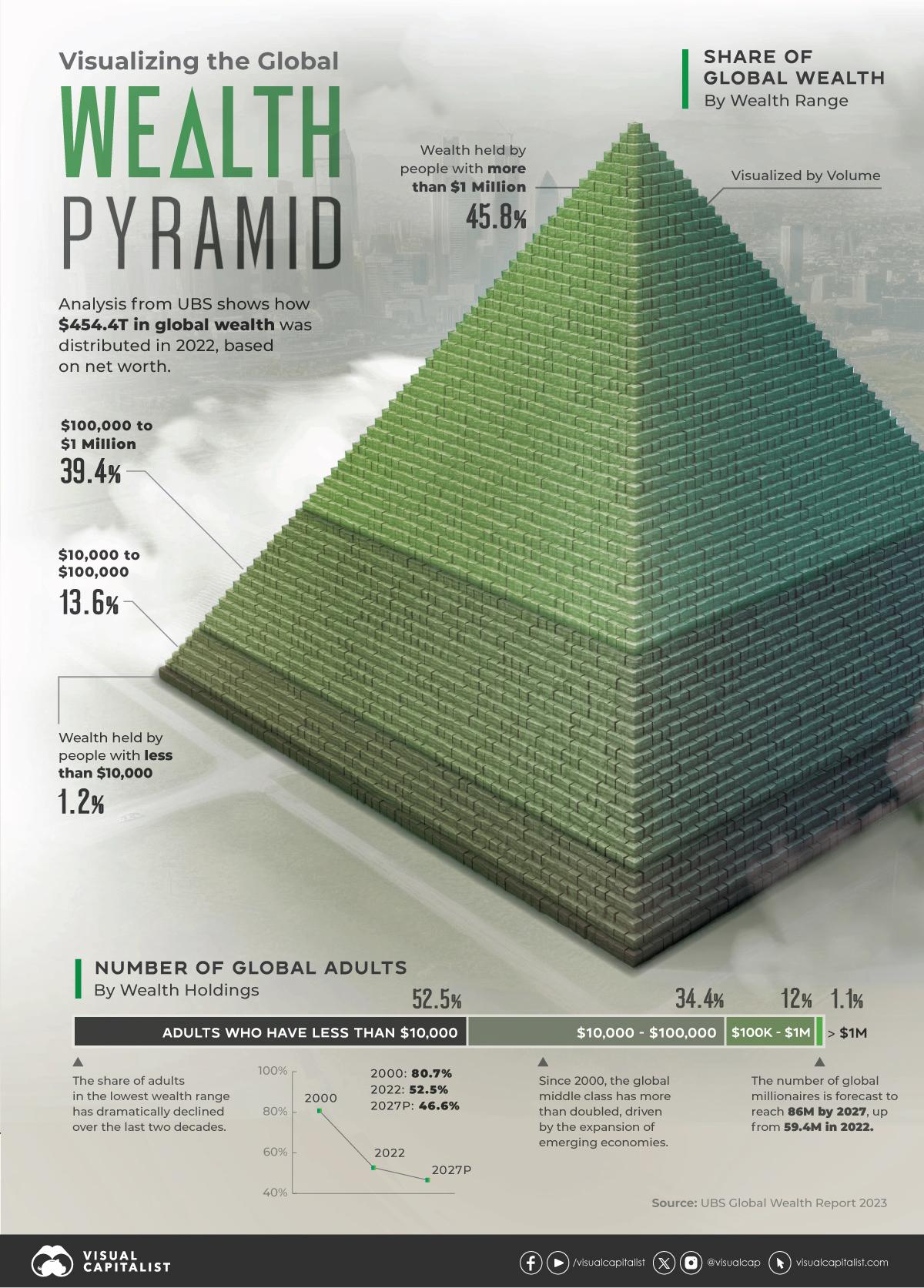

Who controls global wealth?

In 2022, the world’s millionaires held nearly half of net household wealth. Decades of low interest rates led equities and real estate values to soar, and these assets are disproportionately held among the world’s wealthiest.

While a steep rise in interest rates decreased these fortunes in 2022, the share of wealth controlled by the global millionaire population remains substantial.

Read more on Visual Capitalist

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – Global Shocks: How Do Stocks Perform?

Trading 212 Review: Pros & Cons

Cash Is Not Enough: Why Hold Bond ETFs Despite Price Rollercoasters.

The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Halifax Share Dealing Review – Similar To Lloyds With SIPP On Top

Lloyds Share Dealing Review – Old School But Ticks The Boxes For Golden Retrievers

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.