Weekend Reading – Safe Withdrawal Rates Based On Inflation & Valuations

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist:

My partner Charlie says there is only three ways a smart person can go broke: liquor, ladies and leverage,

Now the truth is — the first two he just added because they started with L — it’s leverage.Warren Buffett

INVEST WISELY

CONSTRUCT YOUR PORTFOLIO

Over the past two decades, Index Investing became attractive, partly due to low ETF fees.

While you can’t avoid fees altogether, minimizing them is vital for maximizing your long-term returns. What are the different fees, when and how should you trade ETFs? Who is pocketing your fees?

Ready to safeguard your returns from unexpected fees? Let’s dive in!

UNDERSTAND FINANCIAL MARKETS

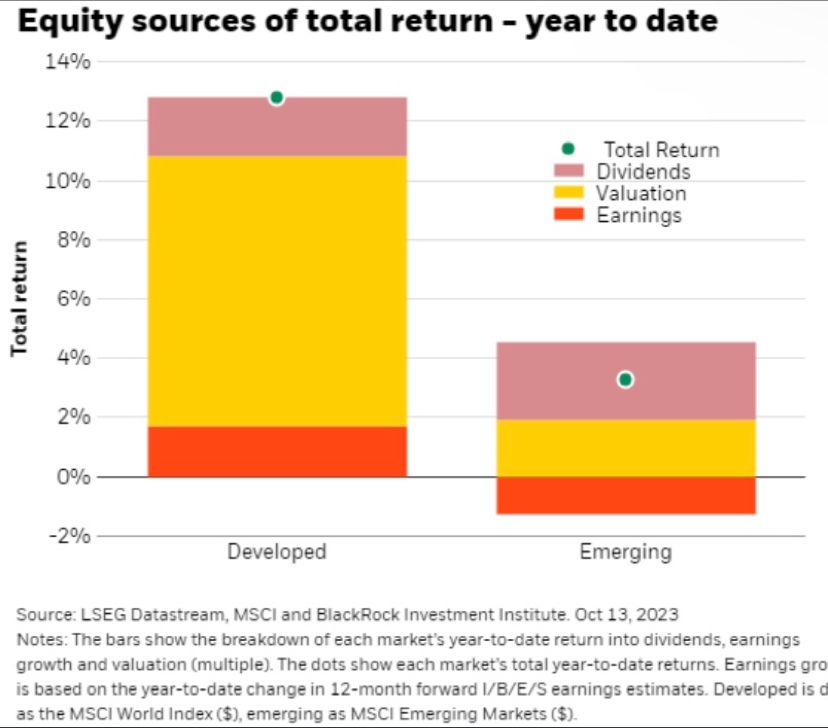

Sources of YTD Total Returns (Blackrock)

With the AI rally, valuation continues to drive total equity market return this year, having dethroned earnings.

Earnings (red) will need to come through for equities to stablise at these levels, especially in the face of elevated rate vol. The AI theme continues to stand out – driving recent earnings estimate upward revision and accounting for half of circa. 10% earnings growth expectations next year.

Source: BlackRock

- Argentina vs Austria, the smackdown of the century (bonds) (FT.com, click on the first link)

- Default rates, defined broadly, are spiking, just in new ways and new places (Verdad)

- How An Old Regulation May Have Driven Inflation in the 1970s. What now? (Bloomberg - 48 min)

- Europe is the new Japan (Italian Leather Sofa)

- Japan: The land of the rising profits (GMO)

HOW TO INVEST

Active Investing

FACTOR investing

discretionary investing

Market Bipolarity: Exuberance versus Exhaustion! (Aswath Damodaran - 22 min)

In this session, Aswath uses the end of the third quarter of 2023 as an opportunity to look at economic and market movements during the quarter, and to try to make judgments about what the last quarter has in store. While the market looks close to fairly valued, given consensus earnings estimates and interest rates today, your judgment will change based on whether you think inflation will remain stubbornly high (subside) and on whether you think the economy is headed for a recession (soft landing).

ALTERNATIVE ASSET CLASSES

WALL STREET

SUSTAINABLE investing

crypto

Michael Lewis authored “Going Infinite: The Rise and Fall of a New Tycoon” which aptly describes the tale of SBF & FTX. This conversation gives us background on his relationship with SBF & his fallen empire, why he wrote the book & what he thinks you should think about Sam’s guilt or innocence.

BAD BETS

The fake genius: a $30b fraud (James Jani - 1 hr 5 min)

Sam Bankman-Fried was supposed to be a billionaire genius running the world’s largest Crypto exchange: FTX. In only a few weeks, his $32B empire crumbled, leading to his arrest. In this video, we unravel one of the decade’s most significant cases of financial fraud.

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

ETFs

Robeco is stepping into the European ETF market with a focus on active funds. The Dutch asset manager, which has €181bn assets under management, is planning to launch its first UCITS ETFs in Q2 2024. [FT.com]

Xetra has seen the launch of 3 new fixed income ETFs by the German asset management group DWS. The ETFs provide ultra-short-duration exposure to bonds from issuers of Eurozone sovereigns. All the ETFs have a 0.07% fee. [ETFStrategy.com]

US ETFs

BlackRock is set to launch ten ETFs focused on Treasury inflation-protected securities (TIPS). Ranging in maturity from 2024 to 2033, these ETFs will seek to provide inflation protection to investors concerned with erosion of purchasing power. The new TIPS-defined maturity bond ETFs will carry an expense ratio of 0.1%. [ETF.com]

Personal Finance

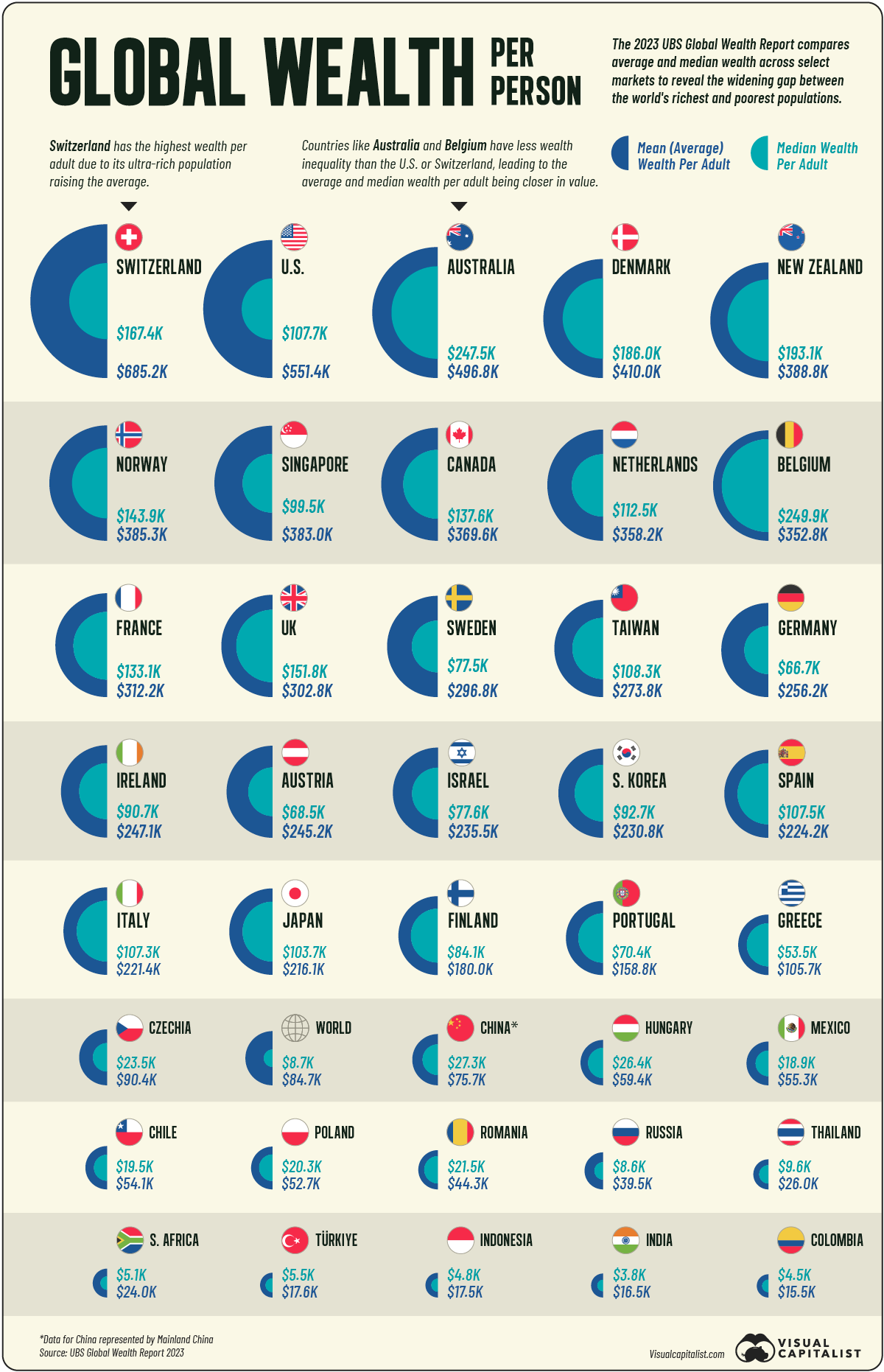

When looking at wealth per person on a country-by-country basis, is it more important to look at median wealth or average wealth?

Many experts believe that median wealth provides the most accurate picture of wealth since it identifies the middle point of a dataset, with half of the data points above this number, and half falling below it. In this way, it is less impacted by extreme values, and gives a good representation of the “middle of the pack”.

With that said, average wealth gives you a true average, even though it may get distorted by outliers, like the fortunes held by billionaires.

Either way, today’s graphic compares both average and median wealth across select countries, using data from the 2023 UBS Global Wealth Report.

Read more on Visual Capitalist

Early Retirement

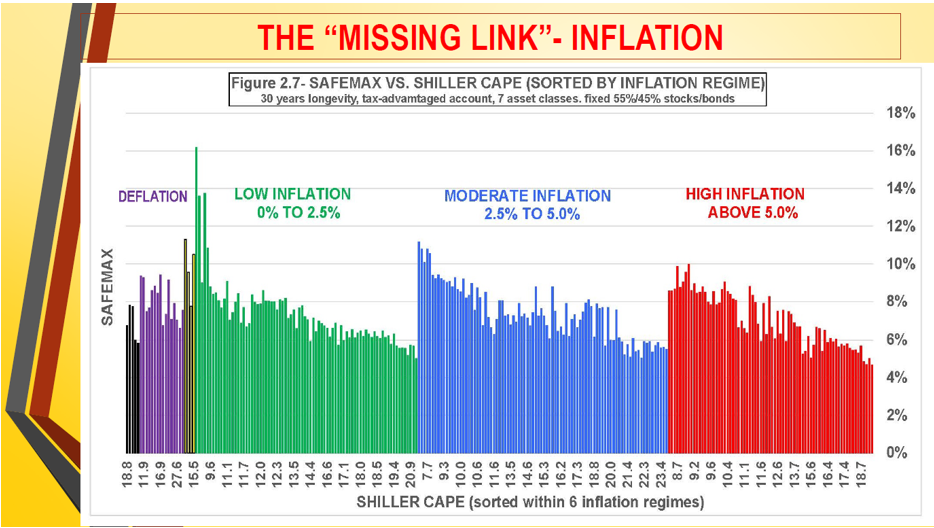

Bill Bengen has continued his groundbreaking research into retirement strategies. He has developed a framework for retirees to monitor and adjust withdrawals based on inflation and market performance, what he calls ‘the missing link’. SAFEMAX is subdivided into inflation regimes and CAPE ratios. What does it mean for you today?

Read more on Advisor Perspectives

FINANCIAL PRODUCTS

COST OF LIVING

OUR Community

Question of the week

DESIGN YOUR LIFESTYLE

Personal Development

Longevity: can ageing be reversed? (The Economist - 16 min)

Ageing has always been inevitable but fasting, epigenetic reprogramming and parabiosis are just some of the scientific techniques that seem to help people stay young. Might the Peter Pan dream become real?

CAREERS

TECH AND SCIENCE

Travel

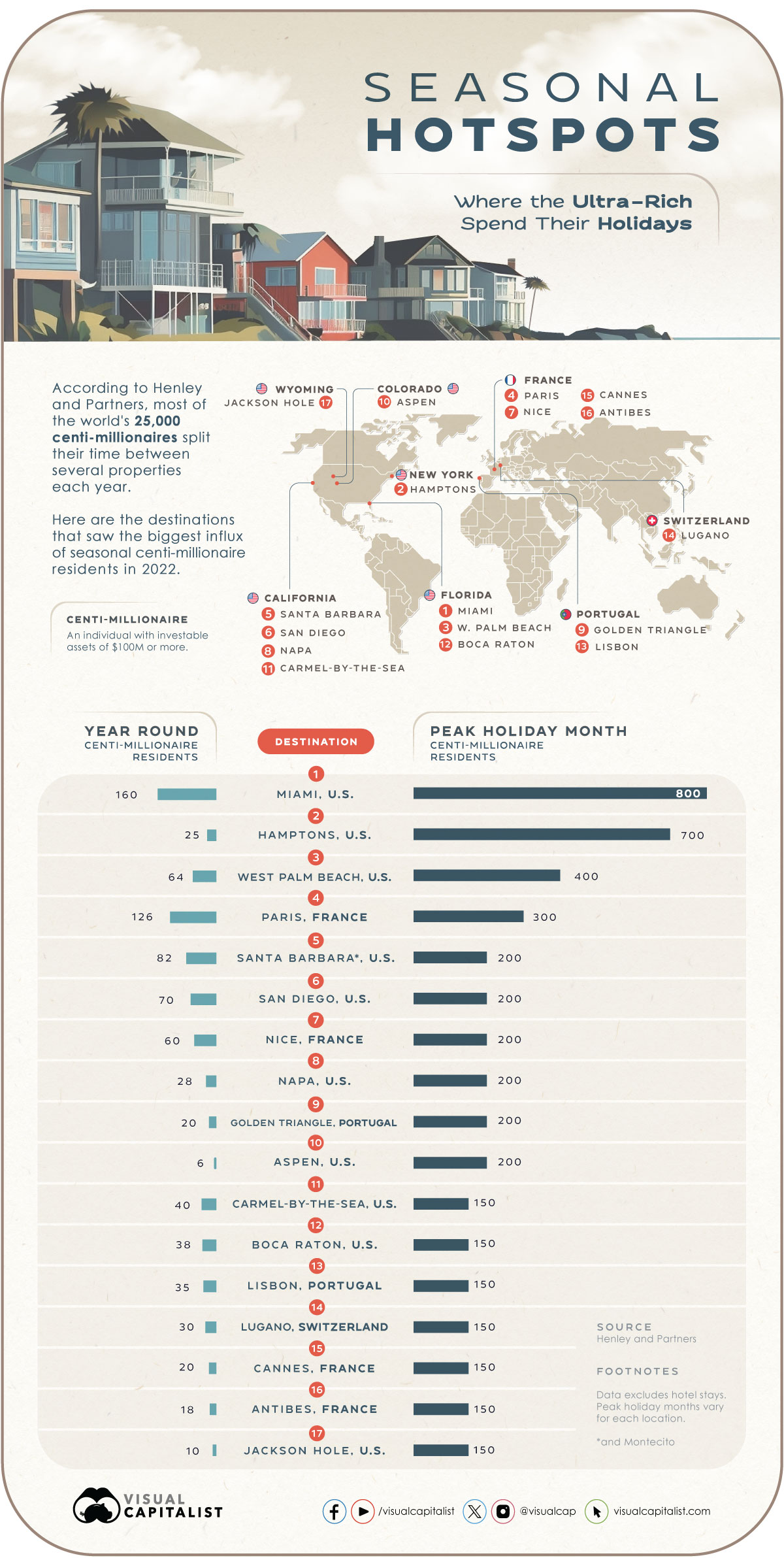

There are more than 25,000 centi-millionaires around the world today, forming an elite club composed primarily of founders and heirs of family fortunes. According to Henley & Partners, most of these individuals—who have more than $100 million in investable assets by definition—split their time between several properties each year. Much of this growth is expected to be seen in countries such as China, India, and Saudi Arabia. China’s Hangzhou and Shenzhen, specifically, are expected to see the highest percentage growth in centi-millionaire populations through 2033, growing by 95% and 88%, respectively. Despite the rapid growth of the wealthy in the global East, however, it’s notable that many centi-millionaires are still graduating from American universities. More than half of the top 20 universities with the most centi-millionaire alumni are in the United States, with Harvard, Stanford, and the University of Pennsylvania making up the top three spots. The top three seasonal vacation hotspots of the ultra-rich are found in the United States: Miami, the Hamptons, and Florida’s West Palm Beach.

Read more on Visual Capitalist

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

miscellaneous

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – Global Shocks: How Do Stocks Perform?

Trading 212 Review: Pros & Cons

Cash Is Not Enough: Why Hold Bond ETFs Despite Price Rollercoasters.

The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Halifax Share Dealing Review – Similar To Lloyds With SIPP On Top

Lloyds Share Dealing Review – Old School But Ticks The Boxes For Golden Retrievers

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.