Weekend Reading – What Worked? Returns Of Popular Portfolios.

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist:

If you put the government in charge of the Sahara Desert, in five years there’d be a shortage of sand

Milton Friedman

Portfolio Construction

Asset Allocation

As we prepare our pipeline of articles and ideas for 2024 it’s time to summarise what you liked in the prior 12 months.

Here are some of our most-read posts of 2023, and some of your favourites.

Did you catch them all?

- 2023 Performance of Popular Portfolios (Portfolio Charts)

- UBS - Global Family Office Report (Asset Allocation) (UBS)

- Visualizing 60 Years of Stock Market Cycles (Visual Capitalist)

- Corey Hoffstein talks with Nick Baltas, at Goldman Sachs about multi-strategy portfolios (Flirting With Models - 1 hr 8 min)

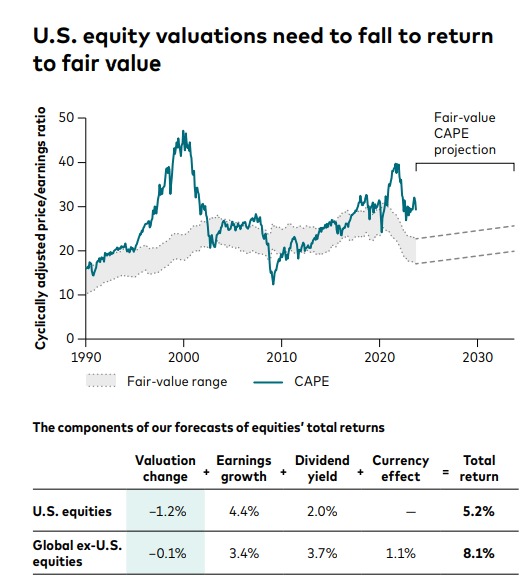

Vanguard: We’re looking back at some of our more popular and enduring investing topics of 2023. The 60/40 portfolio sparked a lot of conversation, as did the impact of rising bond yields on retirement portfolios. The 60/40 portfolio is not a one-size-fits-all approach, Vanguard researchers say. It’s also not so rigid that it can’t be customized to suit individual needs and preferences. And investors who use the 60/40 strategy should review their portfolio periodically to make sure the allocation is still right for their circumstances. Our approach to securities lending also resonated with readers.

Read more on Vanguard

UNDERSTAND FINANCIAL MARKETS

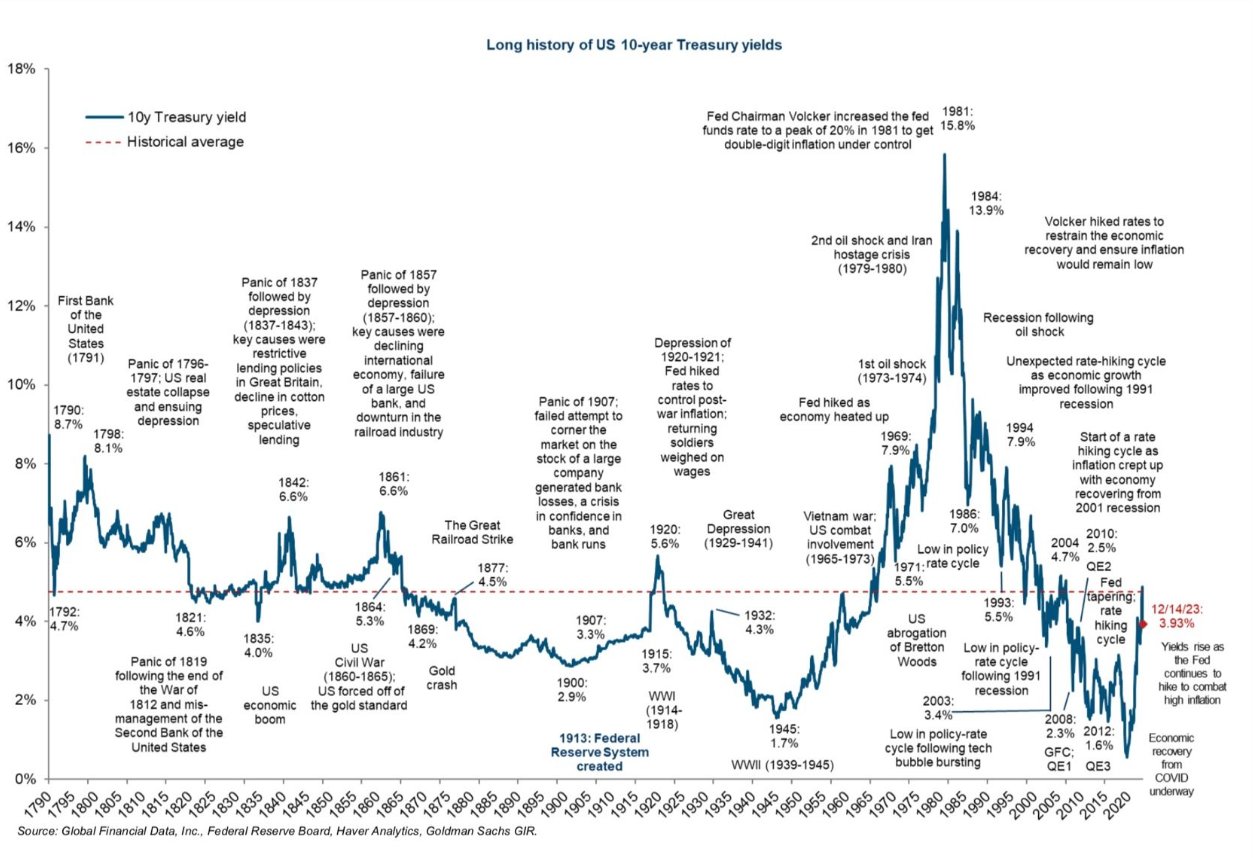

Yields have stabilised and dropped c. 1% from recent highs.

Where are we looking at the history of the 10-year Treasuries?

Read more on Goldman Sachs

HOW TO INVEST

Active Investing

FACTOR investing

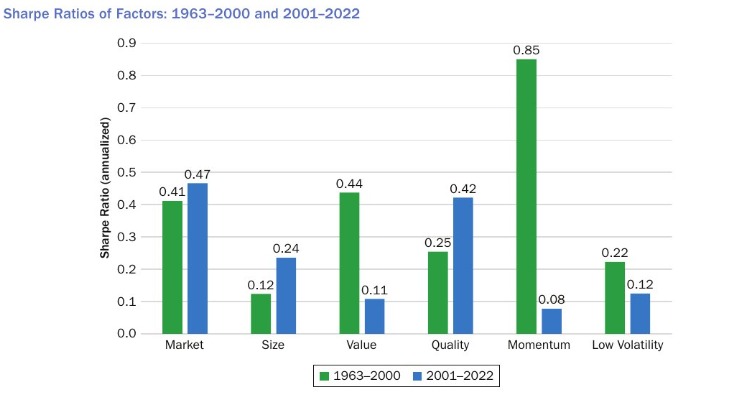

The recent weaker performance of value in the 21st century, including the value drawdown over 2017 to 2022 which is the worst value drawdown ever experienced, can be attributed to both a decreasing trend component and downturns in cyclical components. Momentum performance has also declined in the post-2001 period due to decreasing trends, while the trends of the quality and size factors have increased.

Read more on BlackRock

discretionary investing

ALTERNATIVE ASSET CLASSES

WALL STREET

SUSTAINABLE investing

BAD BETS

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

ETFs

UCITS ETFS

US ETFs

BlackRock is set to launch ten ETFs focused on Treasury inflation-protected securities (TIPS). Ranging in maturity from 2024 to 2033, these ETFs will seek to provide inflation protection to investors concerned with erosion of purchasing power. The new TIPS-defined maturity bond ETFs will carry an expense ratio of 0.1%. [ETF.com]

Personal Finance

The annual UBS Wealth report is here. Belgium has the highest median wealth per adult. Denmark and Switzerland are not far off. North America and Europe account for 56% of total global household wealth, but contain only 16% of the world adult population. The U.S. accounts for 38% of the world’s millionaires, well-ahead of China in 2nd place with 10%.

Read more on UBS

Early Retirement

DESIGN YOUR LIFESTYLE

Personal Development

Mullenweg is co-founder of the open-source publishing platform WordPress, which now powers over 40 percent of all sites on the web. Additionally, Matt runs Audrey Capital, an investment and research company. In his spare time, Matt is an avid photographer. He currently splits his time between Houston and San Francisco.

CAREERS & Entrepreneurship

Travel

The Future of Tech & Economy

economy

Something Terrible Is Happening in Italy (Economics Explained - 18 min)

Italy is in trouble… but this doesn’t seem to be a new thing. With mountainous protection from the north and great trade connections through the Mediterranean sea, Italy has been in an ideal geographic position that has benefitted the country economically for millennia. After a decade of stagnation, can Italy boom like it has in the past, or is this time different?

TECH AND SCIENCE

An Introduction to AI for everyone (Andrej Karpathy - 1 hr)

This is a 1 hour general-audience introduction to Large Language Models: the core technical component behind systems like ChatGPT, Claude, and Bard. What they are, where they are headed, comparisons and analogies to present-day operating systems, and some of the security-related challenges of this new computing paradigm.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

And finally

What The Prisoner's Dilemma Reveals About Life, The Universe, and Everything (Veritasium - 28 min)

The video “What The Prisoner’s Dilemma Reveals About Life, The Universe, and Everything” focuses on the Prisoner’s Dilemma, a well-known problem in Game Theory. It features insights and expertise from notable figures such as Prof. Robert Axelrod and Prof. Steven Strogatz, with references to various resources related to the topic, such as Axelrod’s work, TED-Ed content on outsmarting the Prisoner’s Dilemma.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – Global Shocks: How Do Stocks Perform?

Trading 212 Review: Pros & Cons

Cash Is Not Enough: Why Hold Bond ETFs Despite Price Rollercoasters.

The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Halifax Share Dealing Review – Similar To Lloyds With SIPP On Top

Lloyds Share Dealing Review – Old School But Ticks The Boxes For Golden Retrievers

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.