Our 2023 Unmissable TOP 10 – Did You Catch Them All?

As we prepare our pipeline of articles and ideas for 2024 it’s time to summarise what you liked in the prior 12 months.

Here are some of our most-read posts of the past 12 months.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Our 2023 Classics To help you manage your portfolio

1. Beyond The Hype – Bitcoin’s Potential Role In A Portfolio

With a wave of U.S. Spot Bitcoin ETFs on the horizon, and a potential SEC approval, Bitcoin may take a bigger place in investors’ portfolios. The topic is contentious amongst our readers – according to our survey, only half of you have an allocation. Let’s look at the limited data – only a decade long – and try to make sense of this asset from a portfolio perspective, if you decide to give it a go.

2. Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

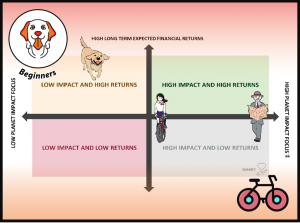

Two very well-diversified portfolios can have very different returns. On the face of it, it’s complex. It is impossible to pinpoint the exact economic reasons that drive this performance difference. But, high-level ETF characteristics, including whether the portfolio is full of small, ‘cheap’, or ‘good quality’ stocks, may explain 95% of the return difference.

3. ETF Fees – How They Work & How to Minimise Them!

Over the past two decades, Index Investing became attractive, partly due to low ETF fees. While you can’t avoid fees altogether, minimizing them is vital for maximizing your long-term returns. What are the different costs, and how do they compare to single Stocks or old school Mutual Funds? Ready to safeguard your returns from unexpected fees?

4. UCITS vs U.S. ETFs – Pros and Cons for Non-US Investors

ETF Domicile is not very glamour. While fees and index tracking frequently steal the spotlight, the domicile’s pivotal role in portfolio performance cannot be overstated. Some of our readers from Latin America, Asia and the Middle East know how to optimise their tax bill. But here is what most investors ignore, and may pay a heavy price for it.

5. Live and Let Buy: Which Bonds For Your Objectives?

6. How To Construct a Bond Ladder with iBonds

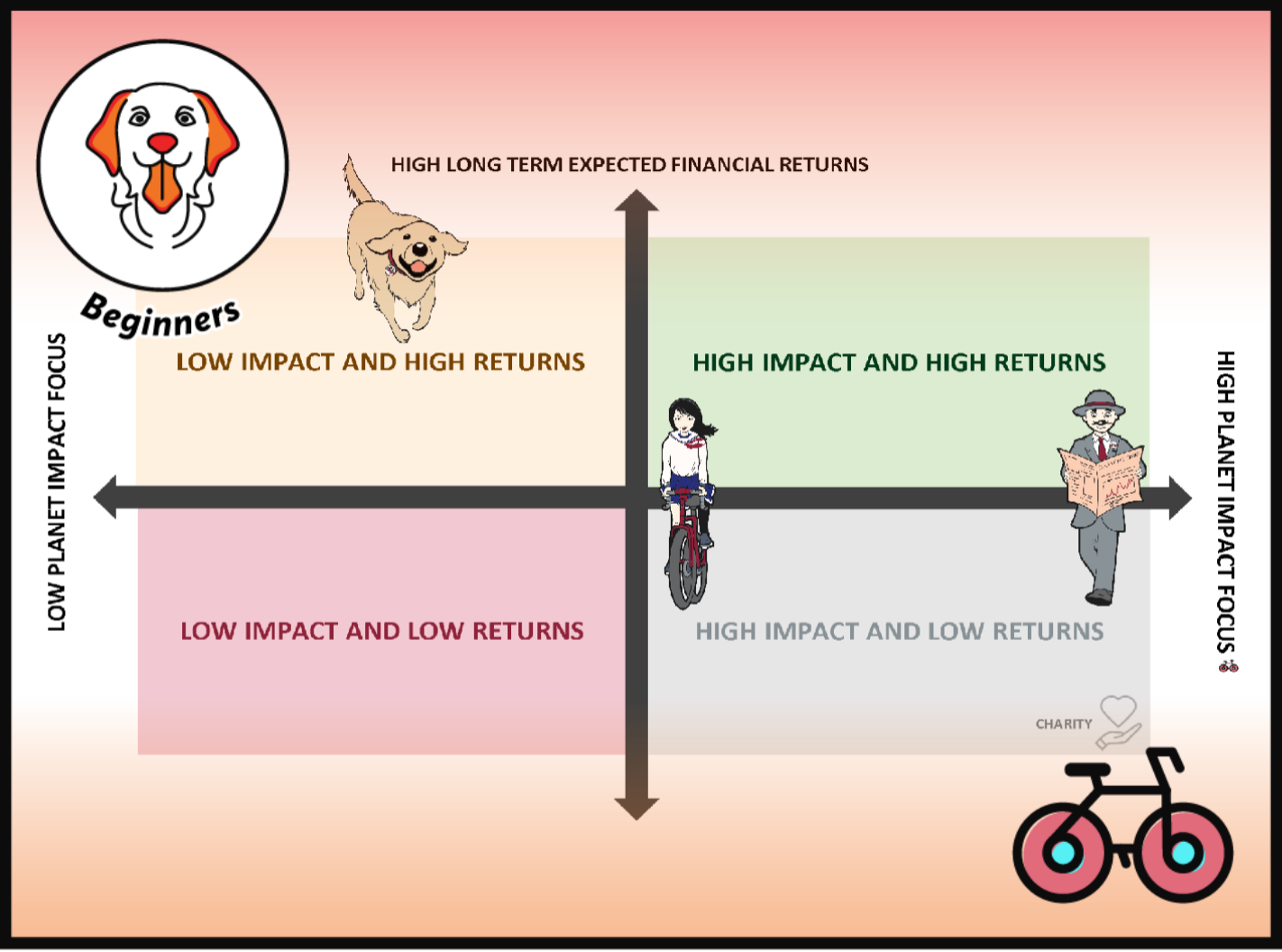

7. Vanguard LifeStrategy – A Retriever In A Babushka Doll

8. Currency Royale – Should You Hedge Your Bonds?

Navigating the world of bonds can be a treacherous journey, especially when it comes to currency hedging. Can your strategy change based on your home currency? Does it matter if you invest in Euros, or Swiss Francs? Is the British Pound any different? What about other currencies? Is the decision to hedge impacted by your life situation and goals?

9. COMMISSION-FREE BROKERS: ARE YOU TRADING OR BEING TRADED?

‘Free trading’ often advertised by Brokers may not be as free as you think it is. Often, a shadow transaction you might not know about comes with it – Payment for Order Flow. The EU has banned it. But what does it mean to you when choosing a broker? Even as these payments are banned, single market maker exchanges may still be around.

10. Should You Invest In Gold In 2024?

Gold is a controversial topic, and there are a lot of misconceptions about it and facts that may surprise you. Some investors avoid it, since it does not generate any yield. But, portfolio managers and traders, including prominent ones, allocate personal savings to Gold. If we don’t subscribe to the doom predictions of gold bugs and take emotions out of the equation, is buying Gold a wise choice?

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

Three Sustainable Investing Strategies That Actually Work

ETF Fees – How They Work & How to Minimise Them!

How Much Should You Pay For An ETF?

4 Things I Learned In 4 Years Of Running A Finance Blog

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.