Weekend Reading – How Much Are You Losing? The Hidden Costs Of Commission-Free Trading.

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist:

Acquire worldly wisdom and adjust your behavior accordingly. If your new behavior gives you a little temporary unpopularity with your peer group…then to hell with them.

Charlie Munger

INVEST WISELY

CONSTRUCT YOUR PORTFOLIO

‘Free trading’ often advertised by Brokers may not be as free as you think it is. Often, a shadow transaction you might not know about comes with it – Payment for Order Flow.Your trades are sold, and matched in a ‘Dark Pool’ (in the US) or on an exchange that may have a single market-maker (in the EU). It often results in worse prices. So, the EU stepped in. But what does it mean for you when choosing a broker?Even as these payments are banned, single market maker exchanges may still be around. Be sure you understand the implications of trading through them.

How Popular Market Indexes Are Constructed (Excess Returns - 55 min)

Most investors reference the returns of popular indexes frequently. But most also do not understand the details of how those indexes are constructed. This episode takes a deep dive into index construction with Bloomberg’s Athanasios Psarofagis starting with basic indexes like the S&P 500 and NASDAQ and move to more complex ones like the Russell and S&P value and growth indexes.

UNDERSTAND FINANCIAL MARKETS

- Country Debt & Stock Returns (Dimensional Funds)

- The Debt Reaper (Bond Vigilantes)

- How Banks really manage rate risk? (Bloomberg - 39 min)

- What China's Struggling property sector means for the global economy and markets (Goldman Sachs - 28 min)

- Visualizing U.S. GDP by Industry in 2023 (Visual Capitalist)

The last 30 years of globalization have benefited Asia greatly. As a result of deepening trade relations and access to other markets, Asian companies have grown in output and prominence. Unsurprisingly, among the top 3,000 companies globally, Asian companies are most prevalent in the manufacturing sector. Specifically, the region’s strength is in industries like consumer electronics, industrial electronics, electric vehicles, and semiconductors. For many Asian countries, manufacturing is the bulwark of the economy. In Asia’s largest economy, China, the manufacturing sector accounts for nearly one-third of economic output. In Asia’s 13th largest economy, Vietnam, it accounts for almost one-fourth of gross domestic product.

Read more on Visual Capitalist

HOW TO INVEST

Active Investing

FACTOR investing

Wes Crill, Senior Investment Director & VP at Dimensional Fund Advisors answers questions about factor investing: pursuing the small and value risk premiums for the chance to earn a higher investment return.

discretionary investing

Joel Tillinghast, who will retire as the manager of the Fidelity Low-Priced Stock Fund at the end of this year, has managed the fund for over 30 years and built an impressive track record, substantially outperforming the S&P 500 over his tenure. The conversation focuses on the biggest lessons from his career, his approach to finding undervalued stocks, what he learned from Peter Lynch, the most important advice he will give his successors and a lot more.

ALTERNATIVE ASSET CLASSES

WALL STREET

The twisted history of Morgan Stanley (FinAIus - 44 min)

Unveil the tale of money, power, and war as this documentary charts the epic journey of the Investment Bank Morgan Stanley, through its rise, fall, and rise again in the brutal jungle of finance.

SUSTAINABLE investing

crypto

BAD BETS

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

ETFs

UCITS ETFs

Return Stacked ETFs, are innovative financial products that have recently become available in Europe. These ETFs operate on the principle of “Return Stacking,” which involves layering one investment return on top of another to achieve more than $1.00 of exposure for each $1.00 invested. While you may find the concept intriguing and potentially more capital efficient, it’s crucial to understand that these are complex, leveraged products not suitable for the majority of investors.

Read more on Italian Leather Sofa

Robeco is stepping into the European ETF market with a focus on active funds. The Dutch asset manager, which has €181bn assets under management, is planning to launch its first UCITS ETFs in Q2 2024. [FT.com]

Xetra has seen the launch of 3 new fixed income ETFs by the German asset management group DWS. The ETFs provide ultra-short-duration exposure to bonds from issuers of Eurozone sovereigns. All the ETFs have a 0.07% fee. [ETFStrategy.com]

US ETFs

BlackRock is set to launch ten ETFs focused on Treasury inflation-protected securities (TIPS). Ranging in maturity from 2024 to 2033, these ETFs will seek to provide inflation protection to investors concerned with erosion of purchasing power. The new TIPS-defined maturity bond ETFs will carry an expense ratio of 0.1%. [ETF.com]

Personal Finance

- Victor Haghani and James White, ”The Missing Billionaires”, host Rick Ferri (Bogleheads - 57 min)

- Millennials say they need $525,000 a year to be happy. A Nobel prize winner's research shows they're not wrong. (Business Insider)

- The rich person’s guide to pension contributions (UK) (Monevator)

- Autumn Statement 2023: what it means for your money (UK) (Which?)

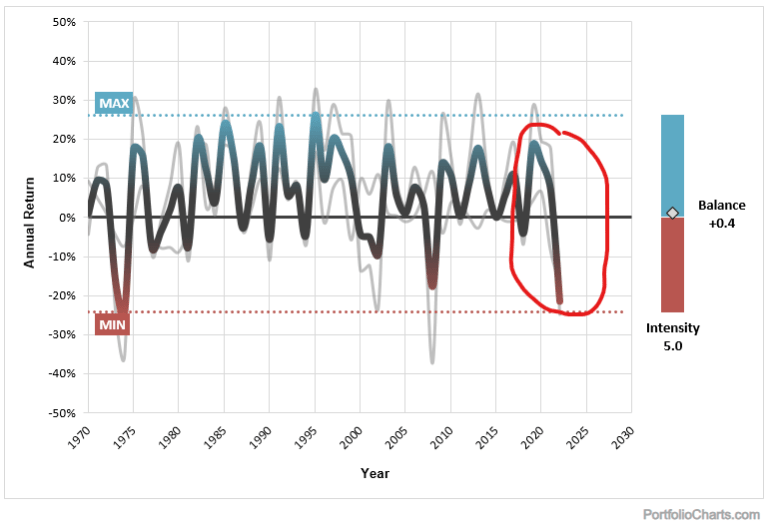

Early Retirement

FINANCIAL PRODUCTS

COST OF LIVING

OUR Community

Question of the week

DESIGN YOUR LIFESTYLE

Personal Development

- Andrew McAfee on the Geek Way (Econ Talk - 1 hr 14 min)

- Upside Down Economics & Priceless Value of a Great Question (ChooseFi - 1 hr)

- The Full Reset (Collab Fund)

- You Can Retire Early, But Never Stop Being Useful (Abandoned Cubicle)

- Six ways to make your life easier and more peaceful – by using stoic principles (Guardian)

Delve into the complexity of navigating life’s challenges, taking risks, fostering self-confidence, and honing problem-solving skills. Shane Parrish, a best-selling author, helps unpack this nuanced topic through the lens of his new book, Clear Thinking.

CAREERS

TECH AND SCIENCE

Travel

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

miscellaneous

Steve Jang is the founder and managing partner at Kindred Ventures, an early-stage venture capital fund based in San Francisco. The conversation focuses on Korea’s exploding “soft power,” the poverty to power playbook, K-Pop & more.

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – Global Shocks: How Do Stocks Perform?

Trading 212 Review: Pros & Cons

Cash Is Not Enough: Why Hold Bond ETFs Despite Price Rollercoasters.

The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Halifax Share Dealing Review – Similar To Lloyds With SIPP On Top

Lloyds Share Dealing Review – Old School But Ticks The Boxes For Golden Retrievers

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.