Commission-Free Brokers: Are You Trading Or Being Traded?

Definitive guide to choosing a stock broker - Part 6

This is part 6 of Bankeronwheels.com Definitive Guide to choosing a Stock Broker.

‘Free trading’ often advertised by Brokers may not be as free as you think it is. Often, a shadow transaction you might not know about comes with it – Payment for Order Flow.

Your trades are sold, and matched in a ‘Dark Pool’ (in the US) or on an exchange that may have a single market-maker (in the EU). It often results in worse prices. So, the EU stepped in. But what does it mean for you when choosing a broker?

Even as these payments are banned, single market maker exchanges may still be around. Be sure you understand the implications of trading through them.

KEY TAKEAWAYS

- PFOF is controversial – PFOF are commissions (aka legal bribes or ‘kickbacks’) paid by financial firms to brokers. They may impact transparency and add conflict of interest.

- PFOF is beneficial to everyone. But only in theory. Buyers pay a lower price, sellers get a higher price, the third party gets a commission, and brokers get a payment without paying the exchange fee. Sounds too good to be true? It is. In practice, numerous studies show that investors lose out in 68% to 86% of cases.

- Are Small Investors an exception? A BaFin study shows that single market maker venues may be fine, as long as you are only dealing on the German market or your transaction value is below €500.

- In the EU, PFOF will be banned from 2026. The UK already banned it in 2012. The ban will impact broker business models. Today, some brokers like Trade Republic heavily rely on it. They may continue until 2026. After that, they may continue using PFOF exchanges, but without explicit payment.

- But single market-maker Stock Exchanges may remain. Brokers may still put them forward as the cheapest to trade on. Be aware – prices may not always be advantageous.

Here is the full analysis

How do brokers make money on my Trades?

What is Payment-for-order-flow?

PFOF are commissions paid by financial firms to Your broker

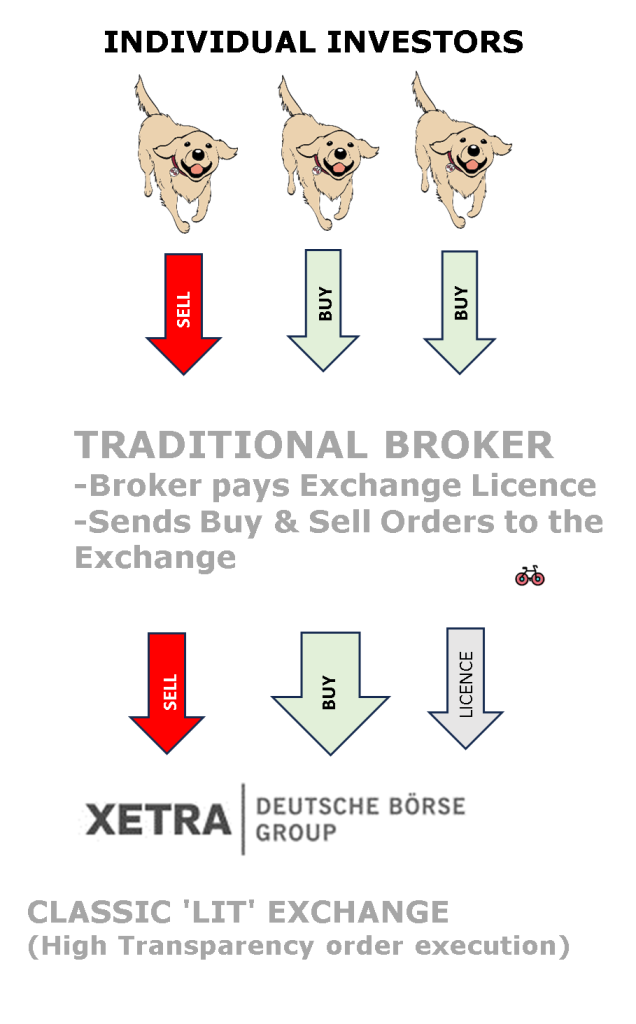

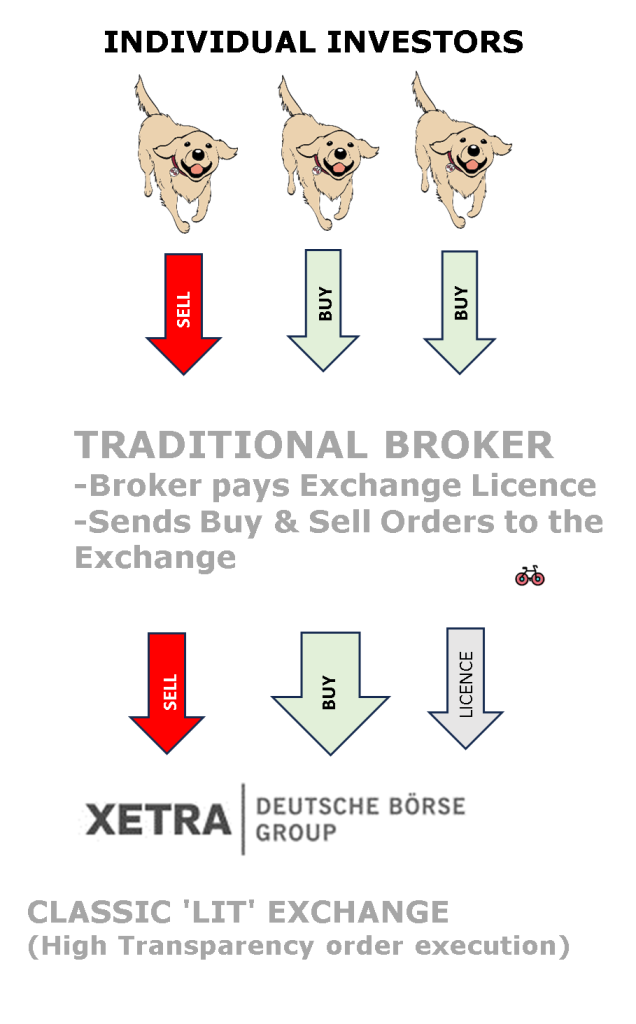

TRADITIONAL BROKER

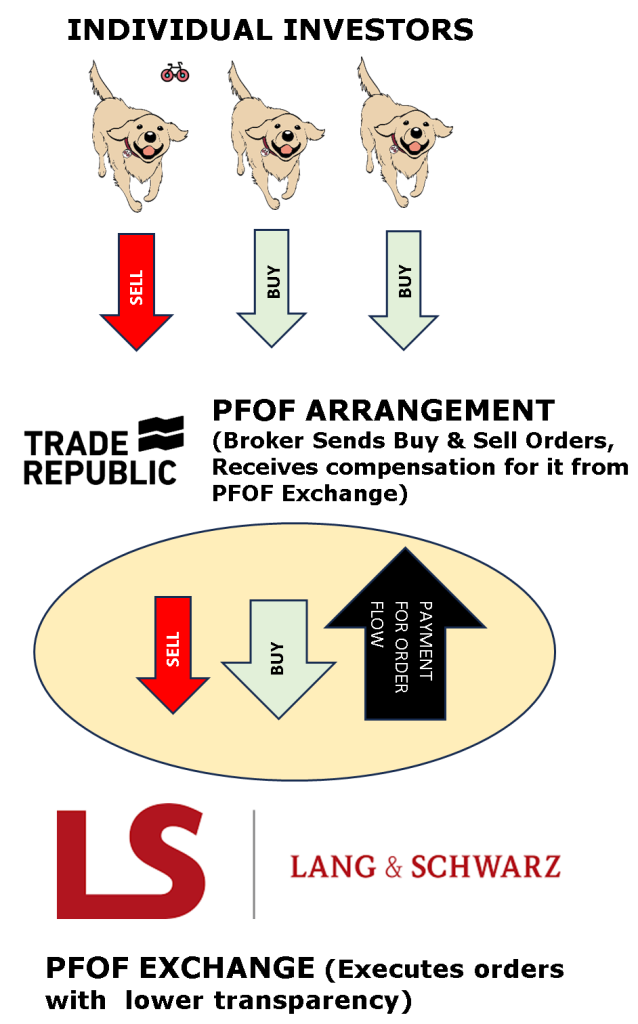

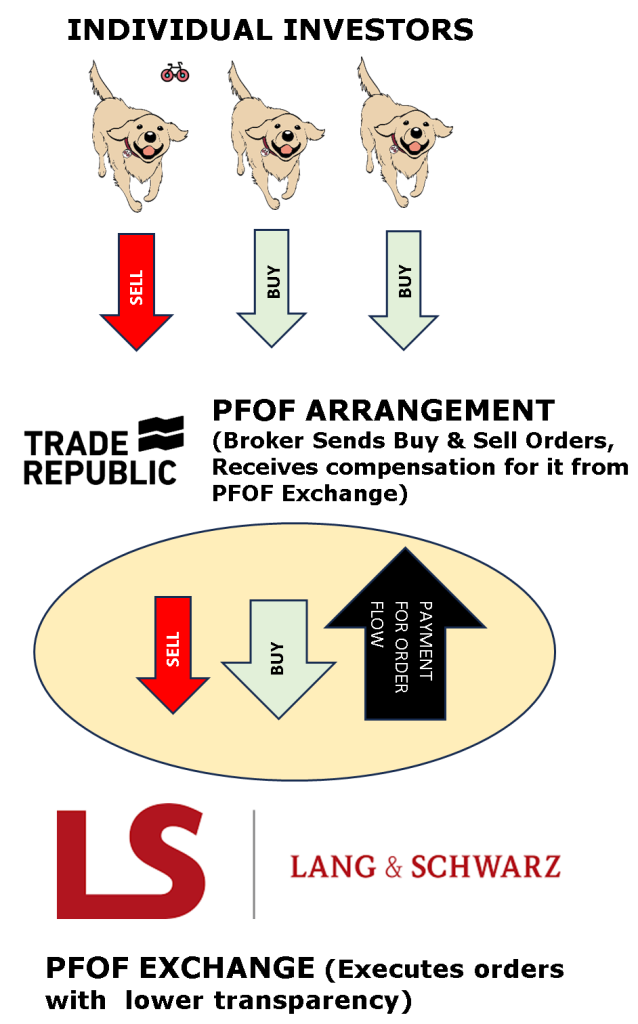

PFOF BROKER

TRADITIONAL BROKER

PFOF BROKER

There are two brokerage revenue models

- Regular Model – The broker earns from client commissions, fees, or spreads, provides more transparent order execution through various market venues, and generally holds a lower conflict of interest risk.

- PFOF Model – It relies on payments – called Payment-for-order-flow (PFOF) from third parties for directing orders, often offering lower or zero commission trades but facing transparency issues and higher conflict of interest potential, and is scrutinized in regions like the EU and UK.

With PFOF, not only the Broker doesn’t pay a fee, but it also receives a commission. So, it’s easier for the Broker to offer zero-commission trades to you.

Select aspects of Broker Business models

| Feature | PFOF Broker | Regular Broker |

|---|---|---|

| Revenue Model | Earns some revenue from directing orders to market makers in exchange for payments. | Primarily earns through commissions, spreads, or fees directly from clients. |

| Commission Charges | Often offers zero or lower commission trades. | Typically charges commissions or fees per trade, but can also offer zero commissions. |

| Order Execution | Orders are routed to market makers or third parties who pay for the order flow. | Orders are executed through a variety of market venues. |

| Conflict of Interest Potential | Higher, due to financial incentives from market makers. | Lower, as revenue is primarily client-focused. |

| Transparency | May have less transparency in how orders are routed and executed. | Generally more transparent about order execution and routing. |

| Regulatory Stance | Subject to scrutiny and bans in some regions (e.g., EU, UK). | Typically standard and widely accepted brokerage model. |

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Who else makes money off my trade?

If it looks like a duck and swims like a duck...

In the US, Your order may be executed by Hedge Funds

In the US, your order may land in a Dark Pool of a High Frequency Trading Firm like Citadel, which will profit from the transaction.

In Europe, a single market maker May have full control

In Europe, your order may be sold to a Multilateral Exchange. In theory, that’s probably better than an opaque Hedge Fund, you may say. Except, in practice, these exchanges only include one market maker. So while in theory it’s different, If it looks like a duck, swims like a duck, and quacks like a duck… then probably it is a duck!

hold on. Shouldn't PFOF benefit individual investors?

Yes, In theory Everyone should benefit.

To paraphrase Matt Levine, PFOF should be beneficial to everyone. Here is a situation:

- A million people come to a broker to trade GameStop Stock. Half of them want to buy, half of them want to sell. All using market orders, all at precisely the same time.

- Normally, the broker would pay the exchange a small fee for executing orders. The exchange has half a million shares of GameStop for sale at $58.25, and a million shares for buy at $58. The broker can send orders to the exchange, where the buy orders would be filled at $58.25 and the sell orders would be filled at $58.

- But, the broker realises shares could be matched up. They don’t have to pay a fee to the exchange, the buyers don’t have to pay $58.25, and the sellers don’t have to get $58. The buyers could pay $58.15 and save 10 cents, the sellers could get $58.10 and make an extra 10 cents, and a broker keeps 5 cents (and avoids an exchange fee). This is called “internalizing”. Here is how IBKR does it.

- In practice, less sophisticated brokers don’t have the ability to do this. They subcontract it and send orders to a “wholesaler”. The wholesaler pays the sellers more, charges the buyers less, and keeps a margin for itself. But, instead of keeping 3 cents for itself, it sends 2 cents back to the retail broker, for example Trade Republic, who sent it the trade (that’s the PFOF Commission).

but Do investors really benefit?

in practice, with a lawful bribe, There is an incentive to hide the price.

The problem is, the execution is not transparent once the order hits the wholesaler. As the FT.com notes “By allowing market makers to attract order flow with a lawful bribe, PFOF gives them every incentive to hide the true price at which they are willing to trade, probably leading to poorer executions for retail traders.”

Independent Studies into quality of Execution

| Study | Country | PFOF Execution | Worse Execution |

|---|---|---|---|

| Authority for the Financial Markets | Netherlands | Worse | 68% to 83% Cases |

| Comision Nacional Del Mercado de Valores | Spain | Worse | 86.4% Cases |

| CFA Institute - execution post 2012 Ban | UK | Worse | 65% vs 90% Best prices |

| Bafin | Germany | Mixed | Better only for Small volume trades on DAX securities¹ |

Most EU countries have no doubt

Numerous NCA and CFAI studies confirm it:

- A Dutch study reveals that orders executed through PFOF fare worse than non-PFOF venues, with price deteriorations between €1.44 to €3.46 in 68%-83% of cases for €3,000 transactions.

- A Spanish study found 86.4% of trades in PFOF trading venues underperforming, resulting in a 0.14%-0.16% price deterioration.

- A CFAI Study, post 2012 ban in the UK, observed best execution in 90% cases vs 65% prior to the ban.

Even in the german study, larger transactions are executed poorly

Mixed result came from a Bafin study, where DAX and non-DAX securities for different trade sizes were compared.

Any non-DAX security above €500 and any DAX security above €2,000 had worse execution on PFOF venues.

How do I know which stock exchange to choose?

How do I know where I'm trading?

The largest PFOF exchanges are in Germany

There are primarily two types of exchanges for ETFs in Europe – Traditional and Quote:

- Traditional Exchanges (or Lit Pools) – like XETRA in Frankfurt, operate in a transparent environment where trade orders and prices are visible to all market participants. This transparency ensures price discovery and fairness in trading. These exchanges have a central order book – you can see the best bid and offer prices, including volumes requested or offered. There is also insight into the depth of the order book.

- Quote-driven markets – like Gettex in Munich or Tradegate Exchange in Berlin. There is no depth of the order book. These Exchanges only show the “best” bid and ask price. L&S Exchange and Tradegate show how many shares are available or in demand at those prices, at Gettex even that is not transparent.

Select German Traditional and Pfof Exchanges

| Exchange | City | Country | Type |

|---|---|---|---|

| XETRA | Frankfurt | Germany | LIT |

| Gettex | Munich | Germany | Quote |

| Tradegate Exchange | Berlin | Germany | Quote |

| Lang & Schwarz Exchange | Hamburg | Germany | Quote |

| Quotrix | Düsseldorf | Germany | Quote |

| Börse Stuttgart | Stuttgart | Germany | Quote |

Are gettex, L&S or Tradegate Exchange competitive?

There is only one market maker.

Now, in theory, your trade goes to a Quote Driven Market that should be competitive.

After all, it’s called a multilateral exchange. But, provisions within the exchanges’ rules make it almost impossible for non-affiliated firms to participate.

If we look closer:

- Gettex? Only one market maker for shares, funds, ETPs and bonds (Baader Bank).

- Lang & Schwarz? One market maker for all orders executed by Lang & Schwarz TradeCenter AG & Co. KG.

- Tradegate Exchange? One market maker. Tradegate AG which owns 42.84% of the exchange is the only party responsible for completing orders in equities and ETFs.

IS pfof allowed in the USA?

PFOF is legal in the U.S.

In the US, this practice is still in place. Although US regulators considered an outright ban of PFOF, they stopped short of doing so. Instead, the Securities and Exchange Commission (SEC) made a raft of proposals to reform the market structure, some of which directly targeted the practice. Here is what the CEO of IBKR said about it after the GME Saga.

IBKR CEO - in the us, PFOF is unlikely to be banned

IS pfof allowed in the uK?

PFOF has been banned in the UK for over a decade

The Payment for Order Flow has been effectively banned in the United Kingdom since 2012. This move was spearheaded by the UK’s Financial Services Authority (FSA), which is now known as the Financial Conduct Authority (FCA). A study following the ban indicated that the UK markets became more liquid and pricing for retail investors improved without PFOF.

IS pfof allowed in the EU?

Even before the ban, some EU countries didn't like this practice

While Germany was defending this practice, given some of its biggest fintech players rely on it, other regulators in Europe were opposed. The Dutch authorities have banned the practice, and the French NCAs were also opposed. But until 2023, a EU harmonisation was not in place.

In 2026, PFOF will be banned in the EU

The European Council reached an agreement imposing a general ban on PFOF in the EU.

Until 2026, we're in A transitory period

What if a french customer uses a German Broker?

Our interpretation of this agreement is that e.g. German Brokers that have German customers may direct them to PFOF venues until 2026, but French customers shouldn’t have it executed through PFOF.

Which Brokers currently rely on PFOF?

For Most brokers the ban has marginal impact

Interactive Brokers, DEGIRO or Trading212

- DEGIRO (8% of orders) – execute their trades through a mix of venues including XETRA (35%), Euronext Amsterdam (34%) or Euronext Paris (22%) with 8% executed through PFOF (Tradegate Exchange) in 2022.

- Interactive Brokers (3% of orders) only marginally relied on PFOF in 2022.

- Trading 212 (likely marginal) – and other brokers using IBKR for execution will likely not be highly impacted.

Unclear or negative impact

Scalable Capital, Comdirect, ING Germany, Smartbroker, Finanzen.net

Other German businesses, including Scalable Capital, Comdirect, ING Germany, Smartbroker and Finanzen.Net execute part of their trades through PFOF venues. Scalable Capital for instance, produced a sponsored study on the merits of PFOF Venues.

Depending on the broker, the impact is likely marginal to medium.

Trade Republic is heavily intertwined with a PFOF Exchange

Trade Republic is the most impacted broker.

In 2022, 99% of its ETF orders were directed through the Hamburg Stock Exchange (Lang & Schwarz Exchange), with minor contribution of Tradegate Exchange.

Until recently, some of its Managing Directors also were also involved with Lang & Schwarz Exchange, which may have potentially led to conflicts of interest.

ExampleS of high and low PFOF reliance

| Allocation | Ending Balance | Annual Return | Risk | Return-to-Risk | Drawdown |

|---|---|---|---|---|---|

| 0/70/30 | 22,685 | 8.61% | 11.15% | 0.69 | -21% |

| 1/69/30 | 26,053 | 10.14% | 11.50% | 0.8 | -21% |

| 5/65/30 | 41,439 | 15.41% | 14.30% | 0.99 | -23% |

| 10/60/30 | 65,061 | 20.79% | 19.00% | 1.04 | -26% |

| 20/50/30 | 126,700 | 29.20% | 27.00% | 1.03 | -33% |

Before & After 2026: What does it mean for you?

Before 2026

First - some brokers will be vulnerable to the new ban

The Brokerage landscape in the EU is currently being reshaped, and some brokers have to adapt their business models to this new reality.

Individual investors should be aware that some of them are more vulnerable to these changes than others. For instance, today Trade Republic derives over a third of its income from PFOF, according to the company.

Also, it remains to be seen how quote-driven Exchanges can incentivise brokers to send them business, without PFOF.

Today, in some instances we see that:

- Brokers offer investors the choice of exchanges, but a legacy-PFOF venue may still be given preference in the user interface (cheaper visible fees for investors)

- Clearing, trading or custody fees may be covered by the operator of the Exchange.

We will publish more on brokers exposure to this practice in the coming weeks. 🔎

Before & After 2026

Second - Unless your Transactions are small, You may get a worse price when trading on a quote-driven market

You should also be aware that, when passing an order on one of the Quote-driven markets, the quality of execution you get may not the same as with a traditional exchange, especially if you trade amounts higher than €500, as indicated in the Bafin Study. And that may be the case even after explicit PFOF payments are banned in 2026.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

What else should you consider?

In the next part of this guide, we will look at Broker ETF availability. Which ones give you the most options?

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.