Weekend Reading – FAT FIRE: Guide To A Luxurious Early Retirement

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web.We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist.

Invest Wisely section is dedicated to research on how to invest for the Long Run using Passive Investment Strategies. Read Topics related to (i) Portfolio Construction and Asset Allocation (ii) Acting wisely by avoiding behavioural traps and also (iii) publications that help understand how financial markets work.

Active Investing section relates to improving your knowledge about active investing. If you decide to sin, then sin only a little. Given ample evidence, combined active bets should be ideally a relatively small fraction of your portfolio. This section also includes Sustainable Investing. You can invest in a Socially Responsible way, but there are many ESG traps. Learn how to invest sustainably, and what it means for expected returns, with our definitive guide to sustainable investing.

Personal Finance section is dedicated to UK and European Products. It can also touch on other European jurisdictions outside the Euro-zone.

- Recommeded Reading

- Youtube (Required watch time)

- Podcast (Listening Time)

- Academic Research - May require intermediate/advanced knowledge

- Noteworthy Twitter Thread

Quiet quitting has a polar opposite: The FatFIRE movement of people working hard to retire early on a 'massive stash'

Sophie Mellor

INVEST WISELY

CONSTRUCT YOUR PORTFOLIO

In this latest episode, Buckingham Strategic Wealth’s Larry Swedroe talks about how he takes his evidence-based approach to investing and translates it into managing his personal portfolio. The conversation extends to his approach to incorporating uncorrelated return streams into his overall approach, his unique use of assets outside of those traditionally used by investors, how he approaches equities and bonds, how his approach has changed over time and a lot more.

- What exactly is your problem with stock index concentration (FT.com, click on the first link)

- Risk is as important as return when investing, and it’s wise to learn this lesson before a market crash happens (Pension Craft - 17 min)

- Andrew Lo: Finding the Perfect Portfolio--a ‘Never-Ending Journey’ (Morningstar - 52 min)

UNDERSTAND FINANCIAL MARKETS

- How America Saves? Vangaurd's in-depth analysis (Vanguard)

- Revalidating the case for international bonds (Vanguard)

- Why Corporate Profits Keep Going Up? (Bloomberg - 40 min)

- Why "everything aligns" for Japanese stocks (Goldman Sachs - 17 min)

- The reality is that nothing in fixed-income markets is ever risk-free (FT.com, click on the first link)

HOW TO INVEST

You may not know, but Harry Markowitz, a Nobel Prize-winning economist, helped shape Index Investing as you know it by showing that diversification could reduce investment risk while maximizing returns. He recently passed away, aged 95. Robin Wigglesworth has written an excellent book about the Indexing Revolution, including how Markowitz contributed to it. We highly recommend it if you haven’t read it already.

Active Investing

FACTOR investing

Craving an edge with more diversification and potential for higher-than-average returns?Berkin and Swedroe’s “Your Complete Guide to Factor-Based Investing” is a great place to start. This book navigates you through the ‘zoo’ of factors, retaining only the most pertinent and investable factors influencing returns, including the ones that accounted for most of Warren Buffett’s outperformance. But beware, it’s not all smooth sailing. Risks and costs lurk around the corner, demanding knowledge and patience.

discretionary investing

ALTERNATIVE ASSET CLASSES

WALL STREET

Classics Revisited: Joel Greenblatt & Howard Marks Discuss Value Investing (Wharton School - 33 Min )

As part of the Howard Marks Investor Series, Howard Marks, Co-Chairman, Oaktree Capital and Joel Greenblatt, Managing Partner and Co-CIO, Gotham Asset Management, discuss value investing.

SUSTAINABLE investing

crypto

BAD BETS

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

PERSONAL FINANCE

Wealth Management

Early Retirement

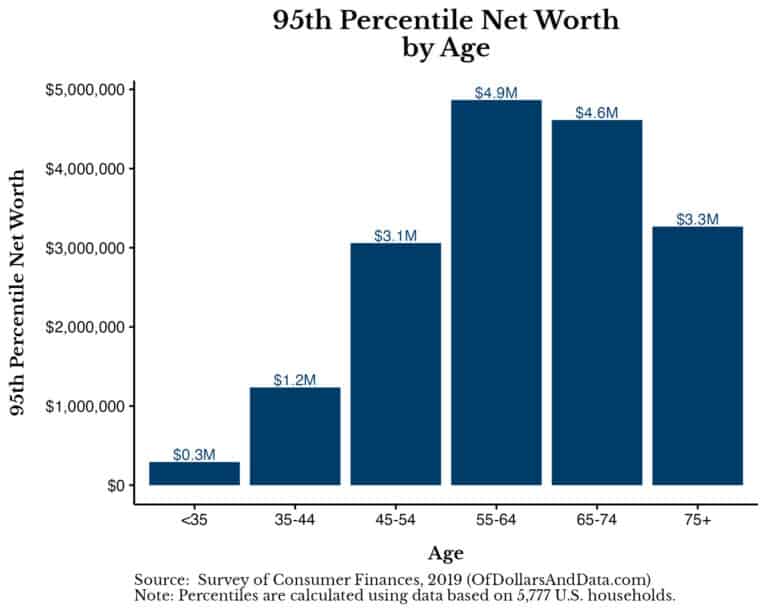

Over the past few years, more and more people are looking to achieve financial independence and retire early. Among the many different ways to achieve FIRE, one stands above the rest—Fat FIRE. Fat FIRE is an early retirement strategy that allows you to live life on your own terms. It’s much more than just escaping the rat race and leaving the corporate world behind—it’s about achieving a level of financial independence that gives you the retirement you’ve always dreamed of. But what exactly does Fat FIRE entail? What are its advantages and disadvantages? And what does it take to achieve?

Read more on Of Dollars and Data

FINANCIAL PRODUCTS

COST OF LIVING

OUR Community

Question of the week

Personal Development

Richard’s book were translated into roughly 40 languages, and became business classics. Richard’s latest book is Unreasonable Success and How to Achieve It. He has two upcoming books: 80/20 Beliefs, which identifies the very few beliefs in our lives that strongly influence what we do, and, therefore, the results we get, as well as 80/20 Daily, a collection of 365 short daily readings using the 80/20 philosophy to achieve the good life.

Health & Wellness

CAREERS

- AI: Don’t Forget to Swim Now and Then (Raptitude)

- ChatGPT and generative AI will change how we work, but how different is this to all the other waves of automation of the last 200 years? (Benedict Evans)

- Lessons From the Catastrophic Failure of the Metaverse (The Nation)

- Charting the changing sentiment to AI in the workplace (Visual Capitalist)

- Meet the competing apps vying for Twitter's market share (Visual Capitalist)

Travel

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

miscellaneous

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – Global Shocks: How Do Stocks Perform?

Trading 212 Review: Pros & Cons

Cash Is Not Enough: Why Hold Bond ETFs Despite Price Rollercoasters.

The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Halifax Share Dealing Review – Similar To Lloyds With SIPP On Top

Lloyds Share Dealing Review – Old School But Ticks The Boxes For Golden Retrievers

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.