Weekend Reading – Escape the Tax Man: Tax-Free Compounding & Top 12 Countries with Zero Taxes!

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist:

A rising tide lifts all boats.

Old Wall Street Adage

INVEST WISELY

CONSTRUCT YOUR PORTFOLIO

Compounding is a money-making machine. But taxes and fees can sabotage your plan.

Typically, up to 2-3% of the 7% average annual total return from Global Stocks comes in the form of dividends. But what happens to compounding if your ETF distributes them?

- How Time Horizon Affects the Odds of Equity Investing (Morningstar)

- Multi Asset Class 5 Year Sharpe Ratios (Fidelty Investments)

- Asset Allocation Isn’t Magic (Oblivious Investor)

- The Cash Wedge + The four D's of tax planning (Rational Reminder - 49 min)

- Buy when there is blood on the street (but be invested all the time) (Italian Leather Sofa)

Listen in on this episode for an in depth look at the credit market with Asterozoa Capital CIO Joe Hegener. Coverage of the basics of the credit market, the current state of the market, the potential upcoming refinancing wall and the most important fundamental criteria Joe looks at when evaluating companies are some of the key highlights.

UNDERSTAND FINANCIAL MARKETS

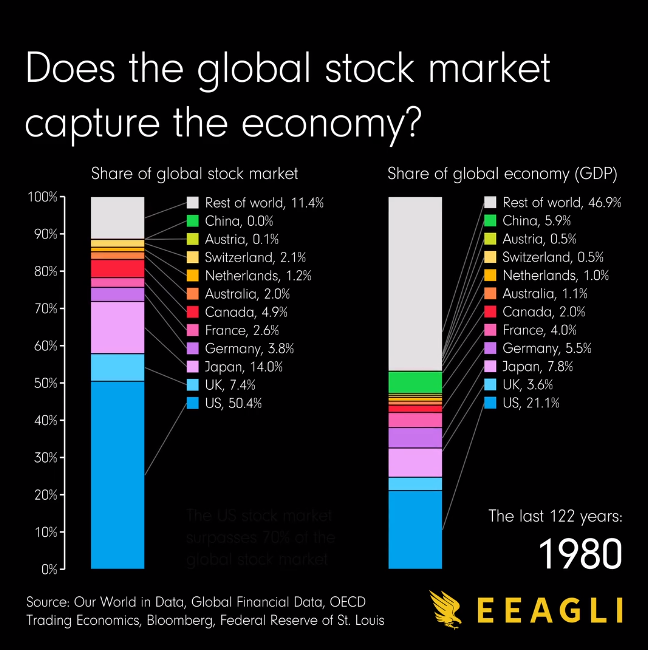

While the distribution of global GDP has diversified over time, the global stock market remains dominated by a few developed financial markets. In 2022, the U.S. accounted for 59% of global stock market capitalization, with a 21% share of global GDP. To put that into context, China makes up just 4% of the global stock market despite accounting for 16% of global GDP. To explore the roots of this disconnect, this animated bar chart from James Eagle compares countries’ share of the global stock market and global GDP over 122 years from 1900 to 2022.

Read more on Visual Capitalist

- High Rates Don’t Put the Brakes on Stocks (Dimensional Funds)

- Vanguard leaders on CNBC provide perspective (Vanguard - 6 min)

- Charted: U.S. Retail Investor Inflows (2014–2023 (Visual Capitalist)

- The impending gas supply shock on Europe (Joachim Klement)

- Top Middle East Exports By Country (Visual Capitalist)

HOW TO INVEST

- Forecasting follies, getting lost in predictions & things that never change with Morgan Housel (Peter Lazaroff - 42 min)

- Emotions & Market Timing are likely to be costly (The financial bodyguard)

- You don’t become a great investor by reading about great investors. But it's Friday. Why not indulge a little? (The alchemy of money)

No one is immune to errors, including the best investors in the world.

Fortunately, investing mistakes can provide valuable lessons over time, providing investors an opportunity to gain insights on investing—and build more resilient portfolios.

This TOP 20 includes: Not Knowing Your Performance – Often, investors don’t actually know the performance of their investments. Review your returns to track if you are meeting your investment goals factoring in fees and inflation. Reacting to the Media – Negative news in the short-term can trigger fear, but remember to focus on the long run. Working – With the Wrong Advisor Taking the time to find the right advisor is worth it. Vet your advisor carefully to ensure your goals are aligned.

Read more on Visual Capitalist

Active Investing

FACTOR investing

discretionary investing

Elon is the biggest business story of our times. Listen in on an engaging conversation as host David Papadopoulos and a panel of guests including Businessweek’s Max Chafkin, Tesla reporter Dana Hull & Big Tech editor Sarah Frier break down the most important stories on Musk and his empire.

ALTERNATIVE ASSET CLASSES

WALL STREET

Over dinner at his Los Angeles home, Charlie reflects on his own career and his nearly 50-year partnership at Berkshire Hathaway with Warren Buffett. He tops it off with lessons and advice for investors today, and of course the virtues of Costco (among other favorite investments) are once again (among other favorite investments). Listen in and enjoy the singular wit and wisdom of Charlie Munger.

SUSTAINABLE investing

crypto

BAD BETS

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

ETFs

State Street Global Advisors (SSGA) is set to offer the cheapest ETF in Europe after slashing the fees on its S&P 500 product by two-thirds.

Effective 1 November, the $5.5bn SPDR S&P 500 UCITS ETF (SPY5) will see its total expense ratio (TER) cut from 0.09% to 0.03%, the cheapest S&P 500 ETF on the European market, undercutting the Invesco S&P 500 UCITS ETF (SPXS) and its 0.05% TER.

Read more on ETF Stream

Robeco is stepping into the European ETF market with a focus on active funds. The Dutch asset manager, which has €181bn assets under management, is planning to launch its first UCITS ETFs in Q2 2024. [FT.com]

Xetra has seen the launch of 3 new fixed income ETFs by the German asset management group DWS. The ETFs provide ultra-short-duration exposure to bonds from issuers of Eurozone sovereigns. All the ETFs have a 0.07% fee. [ETFStrategy.com]

US ETFs

BlackRock is set to launch ten ETFs focused on Treasury inflation-protected securities (TIPS). Ranging in maturity from 2024 to 2033, these ETFs will seek to provide inflation protection to investors concerned with erosion of purchasing power. The new TIPS-defined maturity bond ETFs will carry an expense ratio of 0.1%. [ETF.com]

Personal Finance

- Conflicted Financial Advisors: Restricted Advisors & Their Disclaimers (Banker on Wheels)

- The impact of inflation traverses everything (Indeedably)

- Index Funds, How To Build Wealth & Financial Independence Wisdom (Journey to Launch - 52 min)

- Used wisely, carefully: A bit of a bad thing can be good. (Mr. Stingy)

- Dollars Are For Spending & Investing, Not Saving (Ritholtz)

Early Retirement

When it comes to planning for retirement, one crucial aspect that often takes center stage is taxation. Retirees seek tax-friendly destinations where their hard-earned savings and pensions can stretch further. Fortunately, numerous countries around the world offer the enticing prospect of tax-free living in retirement. These nations, through a combination of tax incentives, exemptions, and strategic financial policies, provide retirees with the opportunity to enjoy their golden years with minimal tax burdens.

Read more on The Frugal Expat

FINANCIAL PRODUCTS

COST OF LIVING

OUR Community

Question of the week

DESIGN YOUR LIFESTYLE

Personal Development

- A Practical Guide to Controlling Addiction & Dopamine (The Knowledge Project - 1 hr 5 min)

- How Anti Obesity drugs are reshaping health care & Consumer behaviour (Goldman Sachs - 27 min)

- How to avoid death by comfort (Art of Manliness - 56 min)

- Workers in Valencia’s 4-day week trial report less stress and more socialising (Yahoo Finance)

CAREERS

- 5 Tactics to Combat a Culture of False Urgency at Work (Harvard Business Review, paywall)

- Digital nomads: rising number of people choose to work remotely (Guardian)

- The UKs graduate wage premium is shrinking (FT)

- I just lost the fear’: why more older people are founding start-ups (FT.com, click on the first link)

TECH AND SCIENCE

Elon Musk & UK Prime Minister Discuss AI’s Global Risk (Farzad Meshabi - 40 min)

Watch a special encounter as Rishi Sunak, the British Prime Minister, puts questions around AI’s viability and acceptability as a new technological force including burning questions around the legal & policy side.

Travel

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

miscellaneous

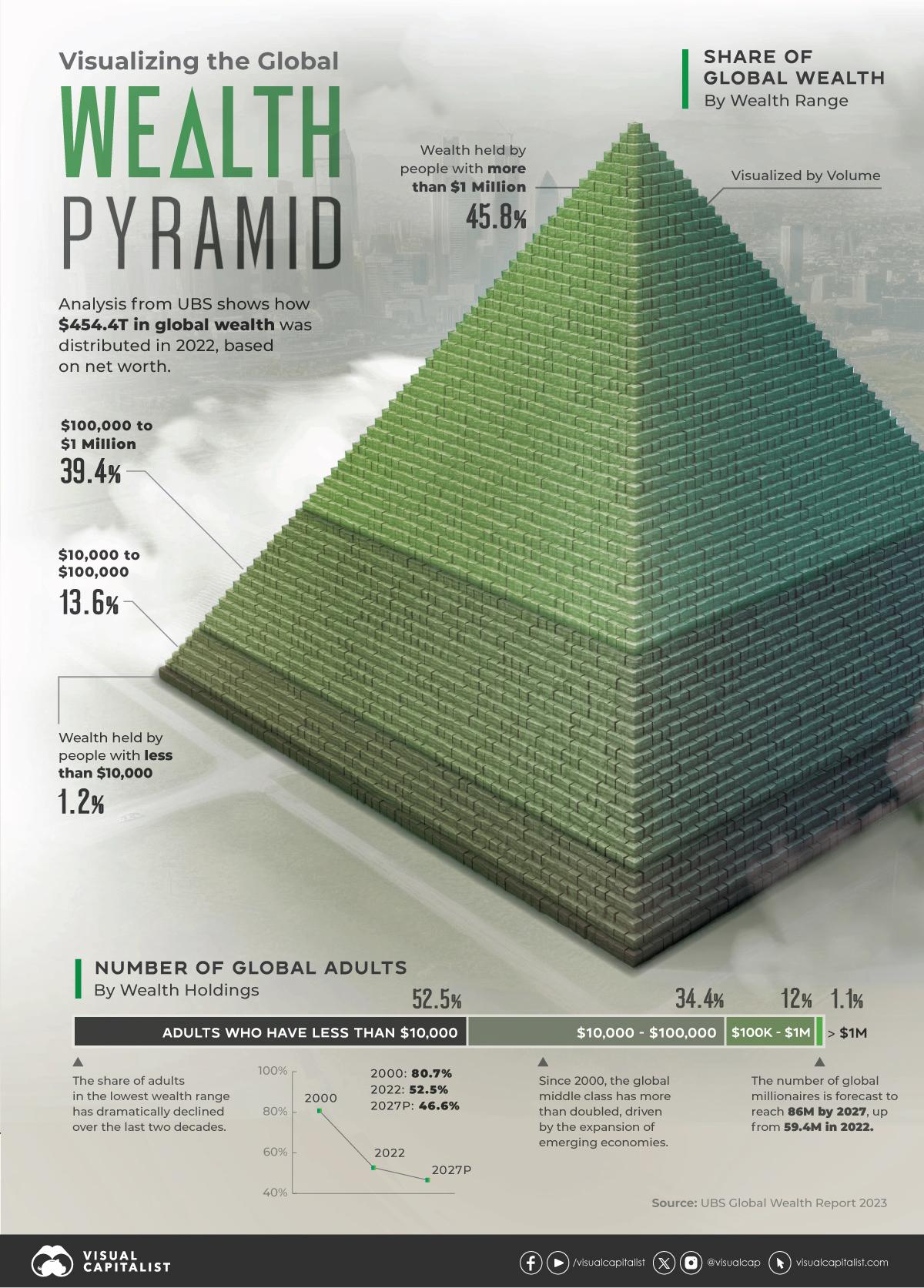

Who controls global wealth?

In 2022, the world’s millionaires held nearly half of net household wealth. Decades of low interest rates led equities and real estate values to soar, and these assets are disproportionately held among the world’s wealthiest.

While a steep rise in interest rates decreased these fortunes in 2022, the share of wealth controlled by the global millionaire population remains substantial.

Read more on Visual Capitalist

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – Global Shocks: How Do Stocks Perform?

Trading 212 Review: Pros & Cons

Cash Is Not Enough: Why Hold Bond ETFs Despite Price Rollercoasters.

The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Halifax Share Dealing Review – Similar To Lloyds With SIPP On Top

Lloyds Share Dealing Review – Old School But Ticks The Boxes For Golden Retrievers

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.