CAN YOU MAKE 10x WITH CRYPTO TOKENS? I TRIED FOR YOU.

You haven’t seen me writing a lot about crypto since I was initially a Crypto Skeptic.

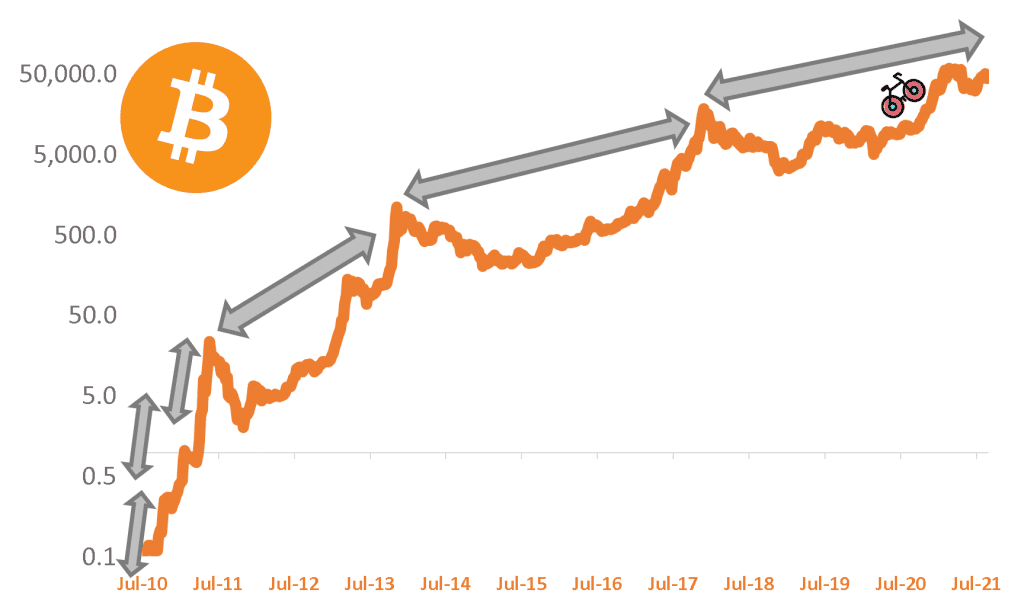

Over the past decade, crypto has grown into a $2 trillion market cap industry and it has been through a few booms and busts.

Chances are it isn’t going away.

It remains a highly speculative asset class but as you can see by looking at each grey arrow below, it now takes longer for Bitcoin to increase 10x in value.

Bitcoin is a (somewhat) maturing asset

putting out the fire with gasoline

THE PREFERRED WAY

If you are new to Crypto you need to know that there are safer ways to getting marginal passive exposure to this asset class than tokens.

This includes Crypto ETFs, certain Equities, or outright exposure to some of the largest cryptocurrencies through centralized exchanges.

I will certainly write about those in due course. If you are interested, here is how to get added to my newsletter.

Also Safer doesn’t mean less volatile.

In the context of crypto, it refers to direct operational risks.

THE NEW WILD WEST

That said, some of the most speculative crypto tokens have received a lot of attention recently and promises of high gains.

For instance, one of the most speculative corners of the web has whitelisted trading in crypto tokens which could add 10 million self-proclaimed ‘retards’ fuel to the fire at a time when Robinhood in the US is also launching crypto wallets.

Can you make a 10x on tokens? If so, at what potential cost?

Given that I spotted a very interesting asymmetric trade, I thought I would dive into the actual trade process, and take you along for a wild ride.

But most importantly warn you of some of the highest risks I’ve seen in my career.

MAKING A KILLING IN CRYPTO

Be First, Be Smarter or Cheat

As with any active trade, there are only three ways of making a killing – be first, be smarter, or cheat.

There is a reason why I didn’t venture into Crypto Tokens until now.

The market is overcrowded, extremely risky and I have no edge – I am not smarter than experienced crypto speculators.

But very peculiar circumstances made me first with one of the newly launched ‘real-world utility’ tokens.

Active investing or speculative opportunities where you have a real edge over the market are extremely rare.

They present themselves to you once every 5-10 years.

And that’s provided your mind is trained to spot them.

But even if you do spot an opportunity, what I discovered is that, outside of speculation, most people in crypto are in this space to cheat.

And this may have massive implications for you.

Here is why you should think 5 times before considering buying any speculative crypto tokens.

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

#1 FINDING THE needle in a SH*Tstack

It so happens, that the guy that was launching this token has a traditional business background.

His venture is somewhat tied to the physical world and as he discovered crypto and launched his project, he posted guidance on how to get exposure to it.

As you can imagine, this was very convenient for me, as a first-time crypto buyer.

But being able to trust a founder because you have followed him for half a decade is extremely rare.

Crypto Trap #1 - Sh*tcoins

Having had a look at the number of tokens out there, I guesstimate that about 99% of the tokens in crypto will be ultimately worthless.

Having trust in their founder(s) or their marketing engine is the first way of losing money.

The crypto sphere revolves around a couple of social networks, mainly Telegram and Discord.

Once the project was launched, an official group on Telegram followed.

I wasn’t alone to discover that these communities are full of landmines.

Since the founder was new to crypto, it was also mindblowing for him to realize the number of scammers trying to sink his project (he was pretty transparent about his experiences – a rare situation).

In a few days, the official project group was inundated with 20k+ members posting links and setting up traps for members that were new to this space.

New unofficial groups were launched with tens of thousands of fake members, all with one objective – steal your money (first), before someone else does it.

Crypto Trap #2 - Unlimited ways of getting scammed

Even if you do find a decent project (and that’s a big if, since <1% of projects are legit) and you want to speculate on its token price, it is very likely that you will lose your money along the way.

Especially as a newcomer to the crypto space.

Finally, there are now organized groups of hundred of thousands of people practicing pump and dump schemes (ironically, some of them get scammed in their own way).

#3 YOU ONLY TRADE ONCE, OR SO IT SEEMED

In crypto, you only get one shot at each transaction.

You get it wrong you, you lose it all.

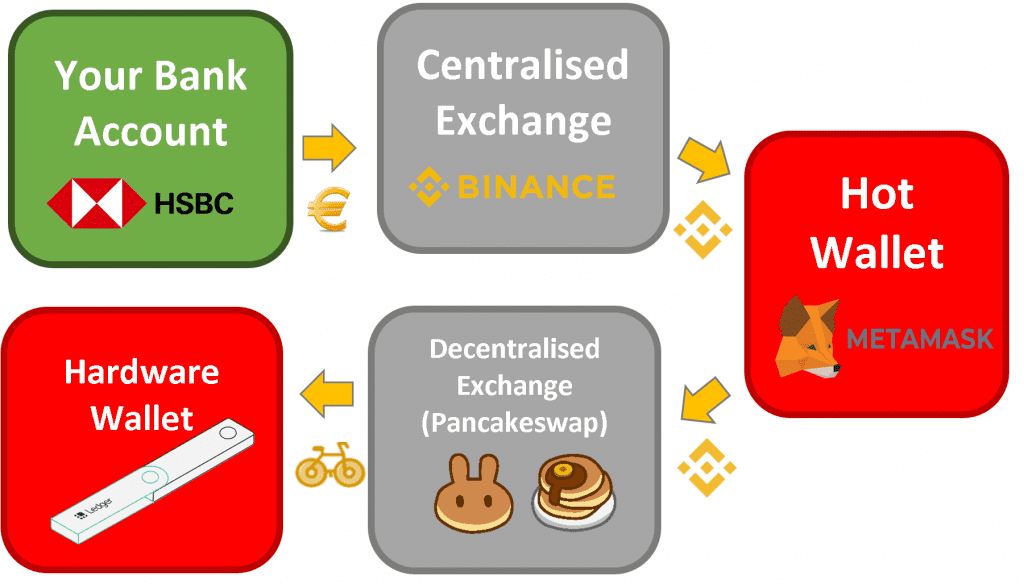

But to get one trade done, you need to channel your money through the entire ecosystem, which involves multiple transfers.

The issue with being first in any crypto project is that you need to get exposure to a coin that is highly illiquid, not traded on centralized exchanges (like Binance or Coinbase), and probably manipulated by a few insiders along the way.

Now, from what I understand the bulk of projects are currently launched on the Binance platform.

Anatomy of a Crypto Trade (Buying a Token in 5 steps)

To buy the token (let’s call this quality token, a BoW Token), you need to:

- Deposit your fiat currency into Binance

- Exchange it for a Binance Smart Chain (BNB) Token

- Transfer BNB into a Hot Wallet like Metamask

- Swap BNB via a Decentralized Exchange like Pancakeswap for BoW Token

- Store BoW Token in your Wallet like Ledger

Ring of Fire

As a Banker, I have seen a lot of strategies and products with high operational risks.

Crypto is topping my list.

Not only are there numerous transfers involved and you can easily mess it up at any point during that process (e.g. choosing the wrong BNB network) but also you are relying on several counterparties.

These are unregulated entities, some are even prohibited to operate in certain countries you may be a resident of.

They often face operational issues, especially when everyone wants to get out at the same time.

And finally, some of the exchanges like Pancakeswap look more like toys for kids and may be used by bots to affect your trades.

Even experienced crypto traders don’t quite understand how the DEX ‘dark pools’ match trades.

Crypto will get easier as the industry matures but for now, the process rings a familiar bell from the 90s.

Crypto Trap #3 - You rely on the entire Ecosystem to work

There are many ways of getting trapped inside the system.

If e.g. the Binance network doesn’t work or is hacked and there is no way of swapping your BNB token into a Stablecoin or Bitcoin, let alone fiat currency.

Some of the entities may also be banned in your country, effectively locking your funds.

If you think you can’t trust Banks, try to be one.

There are a few ways of storing crypto and all of them have flaws.

You have a choice between:

- Leaving your crypto on an exchange, that can potentially get hacked

- On your device’s hot wallet (E.g. Metamask or Trust Wallet)

- Getting a hardware wallet (E.g. Ledger or Trezor)

Now think of all the ways transfers or storing it on your device can fail – viruses, trojan horses, various keyloggers, or screen recorders are just some of the risks.

Are you sure your WIFI is secure? What about your hard drive or other hardware issues?

Crypto Trap #4 - As any Security Guard you need training

Finally, are you one of those people that can’t even back up files regularly?

What makes you think you can keep your seed phrase secure from other people, fire, or other unexpected events?

Who can you trust to share it with?

Your crypto is as safe as the weakest link of the plan you have in place.

#5 you are about to be ripped off!

If you are a cost-conscious investor paying no more than 0.2% per year here on earth, you need to prepare for up to 100x more in cumulative fees to go to the moon (or, most likely, crash in that expensive, designed for kids, rocket)

Layer 1 – Exchange Fees

Exchange fees – to buy certain coins, a centralized exchange like Coinbase may charge you up to 4% for direct credit card purchase (Coinbase Pro is cheaper). Withdrawals can be onerous as well.

Layer 2 – Transaction fees

As you can visualize on my graph above, each transaction in the ecosystems means you incurring additional costs. Each depends on the network but can be quite high (few percentage points) e.g. for low amount transferred. Here is a good take on Ethereum and its ‘gas’ fees, if you want to dig deeper.

Layer 3 – Built-in token fees

Or… the invisible part! Tokens using sh*tcoin tokenomics have built-in fees. The project I bought had a 5% in/out fee e.g. you swap equivalent of $100 in BNB and receive only $95 worth of project token. If you transfer between two of your wallets you lose 10% of value!

Layer 4 – Keeping it safe fees

Similar to Gold, keeping crypto may have some storage costs. At least, this is the case for hardware wallets that you need to purchase.

Crypto Trap #5 - Breaking even

Aiming for 20% returns on any asset just to break even and before even taking into account all risks is a bold move.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Conclusion: I WON't DO IT AGAIN ANYTIME SOON

In finance, there is this concept of the required rate of return.

It’s the minimum return an investor will accept for owning an asset, as compensation for a given level of risk associated with holding it.

For crypto tokens, the required rate of return should be a multiple of the initial stake.

A friend of mine recently asked me what rate of return I generated.

My highly speculatory bet has generated a 10x return in a couple of months (yes, it was one of the best trades I ever made) but on a risk-adjusted basis I think I’m just breaking even (so, in a sense I got lucky).

That’s because (in theory, I think) 9 out of 10 times I would lose all my money in such a project, assuming a macro event doesn’t wipe it out beforehand:

- Regulators are just getting started with a fresh round of crackdowns and lawsuits against exchanges

- Other key parts of the ecosystem, including a $60 bn stablecoin are ticking timebombs

- Events like Evergrande, demonstrated again a very high correlation to Equities

While fresh capital is encouraging growth in this space, for now, outside of gambling, there are still limited signs of potential mainstream adoption.

That said, I will keep a marginal exposure through some of the common ways that I will write about in the coming weeks, since these are I think the best ways of getting (passive) exposure to crypto and sleep well.

Unless you can get…. a crypto-hamster!

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.